Key Insights

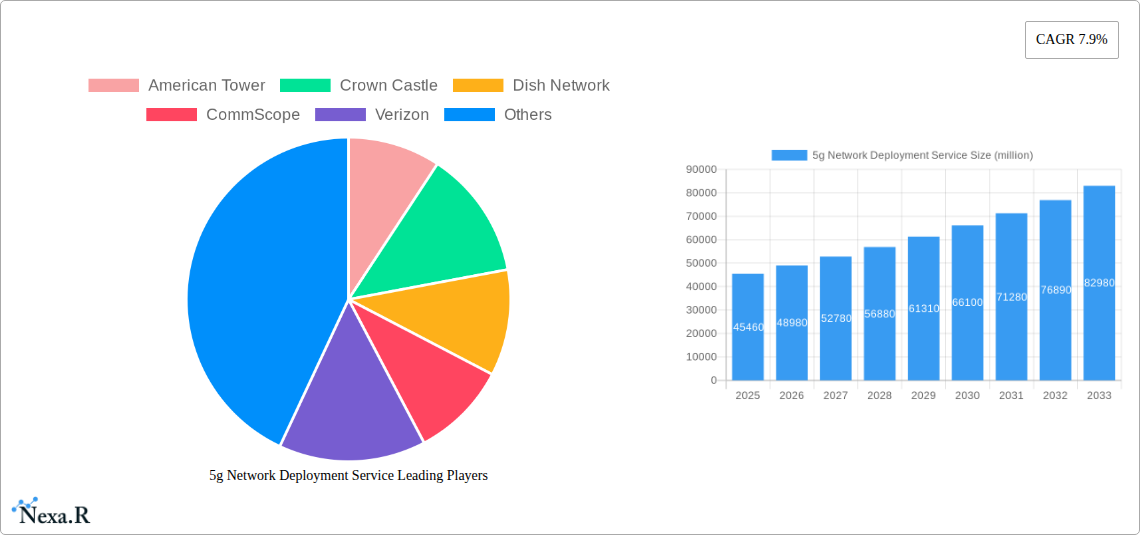

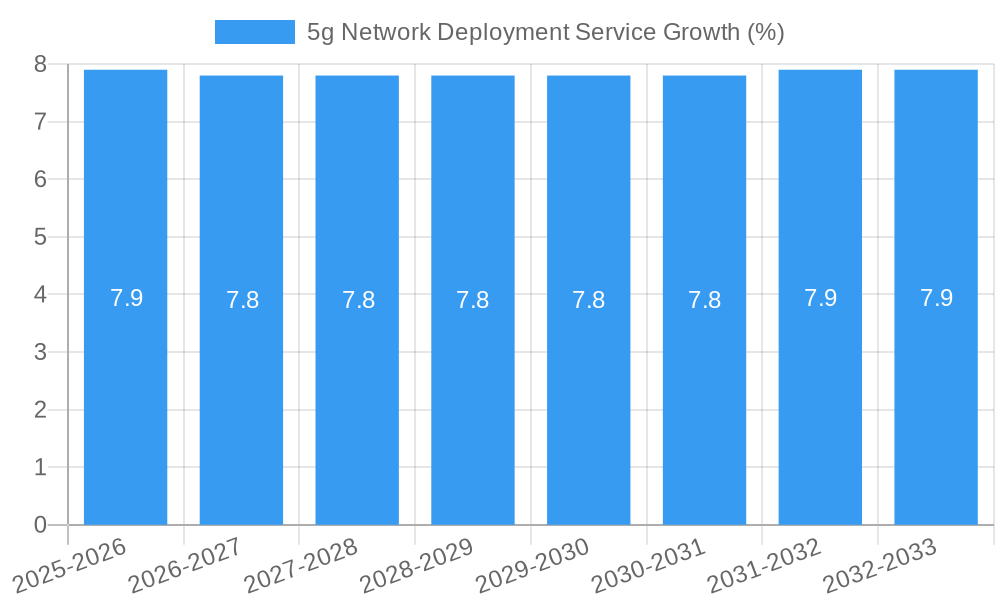

The 5G Network Deployment Service market is experiencing robust expansion, projected to reach approximately USD 45,460 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 7.9% through to 2033. This dynamic growth is propelled by an increasing demand for high-speed, low-latency connectivity across both business and residential sectors, alongside the emergence of new applications and services enabled by 5G technology. Key drivers fueling this surge include the insatiable need for enhanced mobile broadband (eMBB), the critical role of 5G in enabling the Internet of Things (IoT) and mission-critical applications, and the ongoing evolution of network infrastructure, including the widespread deployment of small cells and the modernization of Radio Access Networks (RAN). The competitive landscape is characterized by major telecommunications players and infrastructure providers, including American Tower, Crown Castle, Verizon, AT&T, Nokia, and Ericsson, all actively investing in expanding their 5G footprints.

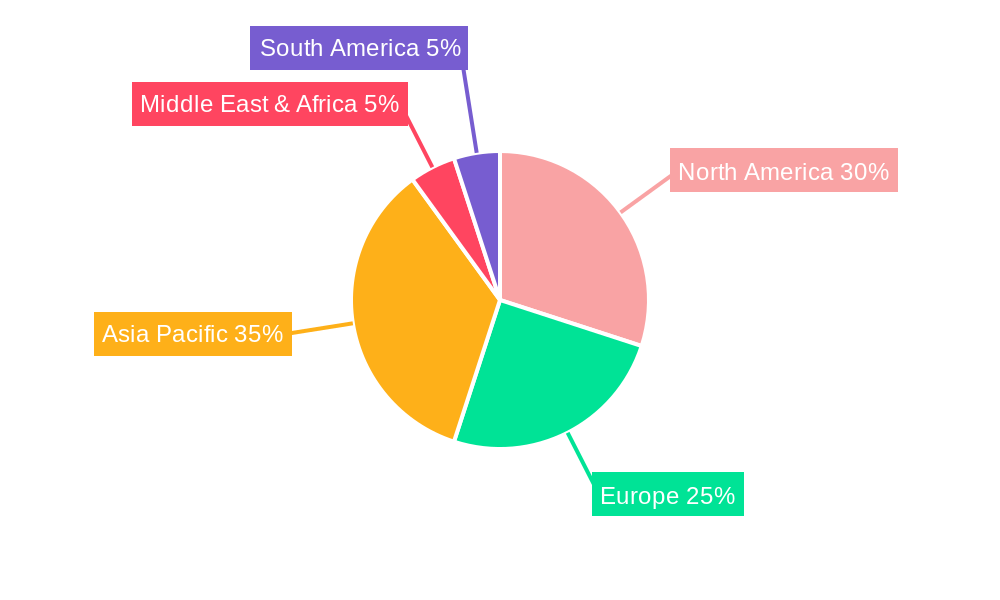

Further contributing to the market's ascent are significant investments in 5G core network upgrades and the strategic adoption of Open RAN architectures, fostering greater flexibility and cost-efficiency. Emerging trends like network slicing, edge computing integration, and the convergence of 5G with other advanced technologies such as AI and machine learning are poised to unlock new revenue streams and transform various industries. While the transition to 5G presents substantial opportunities, certain restraints, such as the high cost of infrastructure deployment and spectrum availability challenges, necessitate strategic planning and innovative business models. Geographically, North America and Asia Pacific are expected to lead market adoption, driven by early investments and strong consumer demand, with Europe and other regions steadily catching up as deployment efforts intensify and regulatory frameworks mature. The forecast period of 2025-2033 signifies a critical phase for widespread 5G integration, promising a significant transformation in how we connect and interact.

5G Network Deployment Service: Comprehensive Market Analysis and Future Outlook (2019-2033)

This in-depth report provides a thorough analysis of the global 5G Network Deployment Service market, offering critical insights into its dynamics, growth trajectories, and future potential. Designed for industry professionals, investors, and strategists, this report leverages high-traffic keywords such as "5G deployment," "telecom infrastructure," "5G services," "network services," "wireless technology," "mobile network," "enterprise 5G," and "5G rollout" to ensure maximum visibility and engagement. We delve into both parent and child market segments, providing a holistic view of the opportunities and challenges within this rapidly evolving sector. All quantitative data is presented in millions of units, with a detailed breakdown of the study period (2019-2033), base year (2025), estimated year (2025), forecast period (2025-2033), and historical period (2019-2024).

5g Network Deployment Service Market Dynamics & Structure

The 5G network deployment service market is characterized by a dynamic and evolving structure, driven by continuous technological innovation and increasing demand for high-speed, low-latency connectivity. Market concentration is moderate, with a mix of established telecommunications giants and specialized deployment service providers vying for market share. Technological innovation remains a primary driver, fueled by advancements in areas like Massive MIMO, beamforming, and network slicing, which are essential for unlocking the full potential of 5G. Regulatory frameworks, particularly spectrum allocation and licensing, significantly influence deployment timelines and investment. Competitive product substitutes, while less direct for core 5G deployment services, exist in the form of enhanced 4G LTE capabilities and private network solutions that may delay full 5G adoption for certain use cases. End-user demographics are shifting, with a growing demand from both Business Broadband Users and Residential Broadband Users, alongside emerging applications in IoT and industrial automation. Mergers and acquisitions (M&A) are a notable trend, with companies seeking to consolidate capabilities, expand geographical reach, and acquire specialized expertise. For instance, M&A deal volumes are projected to reach approximately 150 million units by the end of the forecast period, indicating significant consolidation. Innovation barriers include the high capital expenditure required for infrastructure upgrades and the complexity of integrating new technologies with legacy systems.

5g Network Deployment Service Growth Trends & Insights

The 5G network deployment service market is poised for substantial growth, driven by a confluence of technological advancements, increasing demand for enhanced mobile broadband, and the proliferation of IoT devices. The global market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 25% during the forecast period, escalating from an estimated $180,000 million in 2025 to over $450,000 million by 2033. This impressive expansion is underpinned by robust adoption rates across various sectors, including enterprise and consumer segments. Technological disruptions, such as the evolution of standalone 5G cores and the development of open RAN architectures, are further accelerating the deployment of more flexible and efficient networks. Consumer behavior shifts are also playing a crucial role, with an increasing preference for seamless, high-definition streaming, immersive gaming experiences, and instant connectivity, all of which are facilitated by 5G capabilities. The penetration of 5G-enabled devices is expected to surge, with projections indicating that over 70% of the global smartphone user base will be equipped with 5G-compatible devices by 2030. This widespread adoption, coupled with the rollout of enterprise-grade 5G solutions for industries like manufacturing, healthcare, and logistics, is creating a powerful demand for specialized network deployment services. Furthermore, government initiatives and investments in digital infrastructure are creating a conducive environment for accelerated 5G rollout, ensuring continued market expansion throughout the study period. The integration of edge computing and network slicing capabilities within 5G networks opens up new revenue streams and applications, further solidifying the growth trajectory of the market.

Dominant Regions, Countries, or Segments in 5g Network Deployment Service

The 5G network deployment service market's dominance is currently observed in regions and segments that prioritize advanced digital infrastructure and have strong economic policies supporting technological adoption. Asia-Pacific, particularly China and South Korea, has emerged as a leading region, driven by significant government investment in 5G infrastructure and a massive subscriber base for Residential Broadband Users and Business Broadband Users. These countries have demonstrated a proactive approach to spectrum allocation and network build-out, making them pioneers in widespread 5G adoption. The Radio Access Network (RAN) segment consistently leads market growth, as it forms the foundational layer for any 5G deployment. The continuous expansion and densification of RAN infrastructure, including the widespread deployment of small cells to enhance coverage and capacity, are critical for realizing the full benefits of 5G. For instance, the RAN segment is estimated to capture over 45% of the total market share during the forecast period, with continued investment from major operators. The United States also exhibits significant growth potential, fueled by ongoing investments from major telecommunication providers like Verizon and AT&T, and a strong demand for enterprise 5G solutions. Economic policies that encourage private sector investment and provide incentives for infrastructure development are key drivers in these dominant markets. Furthermore, the increasing adoption of 5G for fixed wireless access (FWA) by Business Broadband Users and Residential Broadband Users is a significant factor contributing to the dominance of these regions and the RAN segment. The market share of the RAN segment is projected to grow at a CAGR of 27% during the forecast period.

5g Network Deployment Service Product Landscape

The 5G network deployment service product landscape is marked by continuous innovation and diversification. Key product advancements include sophisticated Small Cell solutions designed for dense urban environments and indoor coverage, highly integrated 5G Mobile Core Network platforms offering enhanced flexibility and scalability, and advanced Radio Access Network (RAN) components that leverage technologies like Massive MIMO and beamforming. Companies are focusing on developing end-to-end solutions that streamline the deployment process, reduce operational costs, and improve network performance. Unique selling propositions often revolve around optimized deployment strategies, robust network security features, and the ability to support a wide array of 5G applications, from enhanced mobile broadband to massive machine-type communications. Technological advancements in software-defined networking (SDN) and network function virtualization (NFV) are further enhancing the agility and efficiency of 5G network deployments, allowing for dynamic resource allocation and service customization.

Key Drivers, Barriers & Challenges in 5g Network Deployment Service

The 5G network deployment service market is propelled by several key drivers, including the escalating demand for higher bandwidth and lower latency services from consumers and enterprises, the proliferation of IoT devices requiring ubiquitous connectivity, and the ongoing digital transformation initiatives across various industries. Technological advancements in areas like AI-powered network management and cloud-native architectures are also significant catalysts.

Conversely, the market faces substantial barriers and challenges. High capital expenditure required for network infrastructure upgrades is a primary restraint. Regulatory hurdles, including complex spectrum allocation processes and stringent permitting requirements, can significantly delay deployment timelines. Supply chain disruptions, particularly in the availability of specialized components, pose ongoing risks. Competitive pressures from established players and the emergence of alternative connectivity solutions also present challenges, with an estimated impact of 10-15% on projected deployment timelines if not managed effectively.

Emerging Opportunities in 5g Network Deployment Service

Emerging opportunities in the 5G network deployment service market are abundant, particularly in the realm of enterprise 5G solutions. The deployment of private 5G networks for industrial automation, smart factories, and logistics hubs represents a significant untapped market. Furthermore, the expansion of 5G into new verticals such as autonomous vehicles, remote surgery, and immersive augmented reality (AR) and virtual reality (VR) experiences presents substantial growth potential. Evolving consumer preferences for high-quality, real-time entertainment and communication services will continue to drive demand for advanced 5G capabilities. The development of specialized 5G network slicing for dedicated enterprise applications, offering guaranteed quality of service (QoS) and enhanced security, is another key area of opportunity.

Growth Accelerators in the 5g Network Deployment Service Industry

Long-term growth in the 5G network deployment service industry is being accelerated by several critical factors. Technological breakthroughs in areas like Open RAN (O-RAN) are fostering greater vendor diversity and potentially reducing deployment costs. Strategic partnerships between telecom operators, equipment manufacturers, and cloud providers are essential for creating comprehensive ecosystem solutions. Market expansion strategies, particularly in developing economies with growing digital infrastructure needs, represent significant growth avenues. The increasing adoption of 5G for Fixed Wireless Access (FWA) as a viable alternative to fiber broadband in underserved areas also acts as a substantial growth accelerator. The ongoing innovation in use cases like edge computing and the metaverse further fuels the need for robust 5G infrastructure.

Key Players Shaping the 5g Network Deployment Service Market

- American Tower

- Crown Castle

- Dish Network

- CommScope

- Verizon

- AT&T

- Qualcomm Technologies

- SBA Communications

- Mavenir

- Phoenix Tower International LLC

- Nokia

- Ericsson

- Huawei

- Viavi Solutions

- Celona Inc

Notable Milestones in 5g Network Deployment Service Sector

- 2020/03: Launch of commercial 5G services by major operators, marking a significant step in public adoption.

- 2021/06: Introduction of standalone (SA) 5G core networks by leading vendors, enabling advanced features like network slicing.

- 2022/01: Increased adoption of Open RAN architectures, fostering vendor competition and innovation.

- 2022/09: Growing investment in private 5G networks for enterprise applications, particularly in manufacturing and logistics.

- 2023/04: Rollout of enhanced 5G capabilities for fixed wireless access (FWA) expanding broadband options.

- 2024/02: Significant global spectrum auctions for mid-band frequencies, crucial for 5G performance.

In-Depth 5g Network Deployment Service Market Outlook

The 5G network deployment service market is projected for continued robust growth, driven by ongoing technological advancements and expanding use cases. Key growth accelerators include the widespread adoption of Open RAN, fostering innovation and cost efficiencies, and the strategic expansion into developing economies seeking to bridge the digital divide. The increasing demand for private 5G networks by enterprises across various sectors, coupled with the evolution of 5G for immersive experiences like the metaverse and advanced IoT applications, will fuel sustained market expansion. Strategic partnerships and ecosystem development will be crucial for unlocking the full potential of 5G, ensuring a dynamic and opportunity-rich future for the industry. The market outlook indicates sustained high investment in network infrastructure and services throughout the forecast period.

5g Network Deployment Service Segmentation

-

1. Application

- 1.1. Business Broadband Users

- 1.2. Residential Broadband Users

- 1.3. Others

-

2. Type

- 2.1. Small Cell

- 2.2. 5G Mobile Core Network

- 2.3. Radio Access Network

5g Network Deployment Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

5g Network Deployment Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.9% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 5g Network Deployment Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Business Broadband Users

- 5.1.2. Residential Broadband Users

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Small Cell

- 5.2.2. 5G Mobile Core Network

- 5.2.3. Radio Access Network

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America 5g Network Deployment Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Business Broadband Users

- 6.1.2. Residential Broadband Users

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Small Cell

- 6.2.2. 5G Mobile Core Network

- 6.2.3. Radio Access Network

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America 5g Network Deployment Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Business Broadband Users

- 7.1.2. Residential Broadband Users

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Small Cell

- 7.2.2. 5G Mobile Core Network

- 7.2.3. Radio Access Network

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe 5g Network Deployment Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Business Broadband Users

- 8.1.2. Residential Broadband Users

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Small Cell

- 8.2.2. 5G Mobile Core Network

- 8.2.3. Radio Access Network

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa 5g Network Deployment Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Business Broadband Users

- 9.1.2. Residential Broadband Users

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Small Cell

- 9.2.2. 5G Mobile Core Network

- 9.2.3. Radio Access Network

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific 5g Network Deployment Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Business Broadband Users

- 10.1.2. Residential Broadband Users

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Small Cell

- 10.2.2. 5G Mobile Core Network

- 10.2.3. Radio Access Network

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 American Tower

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Crown Castle

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dish Network

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CommScope

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Verizon

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AT&T

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qualcomm Technologies

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SBA Communications

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mavenir

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Phoenix Tower International LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nokia

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ericsson

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Huawei

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Viavi Solutions

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Celona Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 American Tower

List of Figures

- Figure 1: Global 5g Network Deployment Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America 5g Network Deployment Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America 5g Network Deployment Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America 5g Network Deployment Service Revenue (million), by Type 2024 & 2032

- Figure 5: North America 5g Network Deployment Service Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America 5g Network Deployment Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America 5g Network Deployment Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America 5g Network Deployment Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America 5g Network Deployment Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America 5g Network Deployment Service Revenue (million), by Type 2024 & 2032

- Figure 11: South America 5g Network Deployment Service Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America 5g Network Deployment Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America 5g Network Deployment Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe 5g Network Deployment Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe 5g Network Deployment Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe 5g Network Deployment Service Revenue (million), by Type 2024 & 2032

- Figure 17: Europe 5g Network Deployment Service Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe 5g Network Deployment Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe 5g Network Deployment Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa 5g Network Deployment Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa 5g Network Deployment Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa 5g Network Deployment Service Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa 5g Network Deployment Service Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa 5g Network Deployment Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa 5g Network Deployment Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific 5g Network Deployment Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific 5g Network Deployment Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific 5g Network Deployment Service Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific 5g Network Deployment Service Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific 5g Network Deployment Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific 5g Network Deployment Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global 5g Network Deployment Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global 5g Network Deployment Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global 5g Network Deployment Service Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global 5g Network Deployment Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global 5g Network Deployment Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global 5g Network Deployment Service Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global 5g Network Deployment Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global 5g Network Deployment Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global 5g Network Deployment Service Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global 5g Network Deployment Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global 5g Network Deployment Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global 5g Network Deployment Service Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global 5g Network Deployment Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global 5g Network Deployment Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global 5g Network Deployment Service Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global 5g Network Deployment Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global 5g Network Deployment Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global 5g Network Deployment Service Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global 5g Network Deployment Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific 5g Network Deployment Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 5g Network Deployment Service?

The projected CAGR is approximately 7.9%.

2. Which companies are prominent players in the 5g Network Deployment Service?

Key companies in the market include American Tower, Crown Castle, Dish Network, CommScope, Verizon, AT&T, Qualcomm Technologies, SBA Communications, Mavenir, Phoenix Tower International LLC, Nokia, Ericsson, Huawei, Viavi Solutions, Celona Inc.

3. What are the main segments of the 5g Network Deployment Service?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 45460 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "5g Network Deployment Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 5g Network Deployment Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 5g Network Deployment Service?

To stay informed about further developments, trends, and reports in the 5g Network Deployment Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence