Key Insights

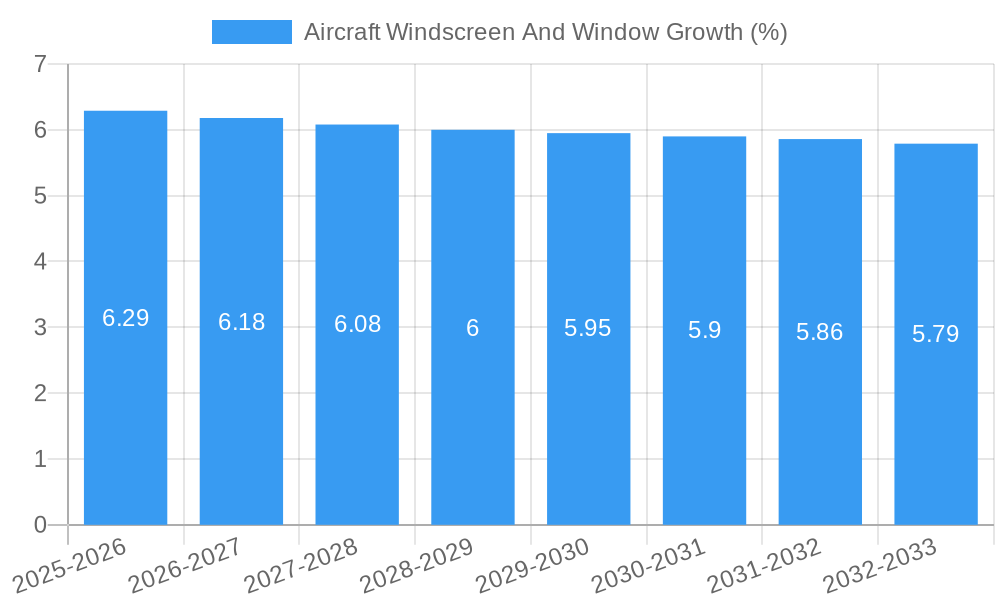

The global Aircraft Windscreen and Window market is poised for robust expansion, projected to reach approximately USD 3.5 billion by 2025, with a significant Compound Annual Growth Rate (CAGR) of around 6.5% anticipated throughout the forecast period of 2025-2033. This growth is primarily propelled by the escalating demand for new aircraft across both commercial and defense sectors, coupled with the continuous need for retrofitting and replacement of existing aircraft windows. The burgeoning air travel industry, particularly in emerging economies, is a major catalyst, driving fleet expansion and consequently, the market for sophisticated aircraft glazing solutions. Furthermore, advancements in material science, leading to the development of lighter, stronger, and more durable materials like advanced acrylics and composites, are enhancing performance and safety, thereby stimulating market demand. The increasing focus on fuel efficiency also necessitates the use of lighter window materials, further contributing to market expansion.

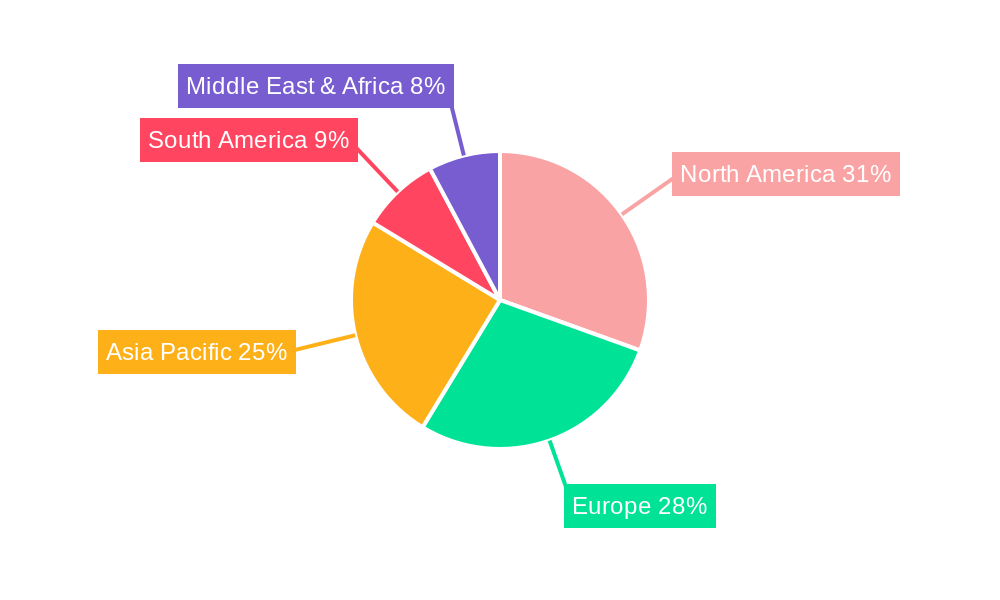

Key market segments are showcasing distinct growth trajectories. The 'Jet Aircraft' application segment is expected to dominate due to the sheer volume of production and operational hours. Within the 'Type' segment, 'Acrylic' materials are likely to hold a significant market share owing to their cost-effectiveness, impact resistance, and ease of manufacturing. However, the growing demand for enhanced optical clarity, UV protection, and scratch resistance is driving innovation and adoption of advanced polycarbonate and even mineral glass alternatives in high-end applications and specialized aircraft. Geographically, North America and Europe are leading markets, benefiting from established aviation industries and a high concentration of aircraft manufacturers and MRO (Maintenance, Repair, and Overhaul) services. The Asia Pacific region, however, presents the most substantial growth potential, fueled by rapid industrialization, expanding aviation infrastructure, and increasing air passenger traffic, leading to significant investments in new aircraft and related components.

This comprehensive report offers an in-depth analysis of the global aircraft windscreen and window market, providing critical insights for stakeholders across the aerospace industry. Covering the historical period of 2019-2024 and a forecast period extending from 2025 to 2033, with a base year of 2025, this study details market dynamics, growth trends, regional dominance, product landscapes, key drivers, barriers, and emerging opportunities. With a focus on high-traffic keywords like "aircraft windows," "aerospace glazing," "aviation windscreens," and "aircraft cockpit windows," this report is optimized for maximum search engine visibility and engagement among industry professionals. We explore both parent and child markets to provide a holistic view of market evolution and potential.

Aircraft Windscreen And Window Market Dynamics & Structure

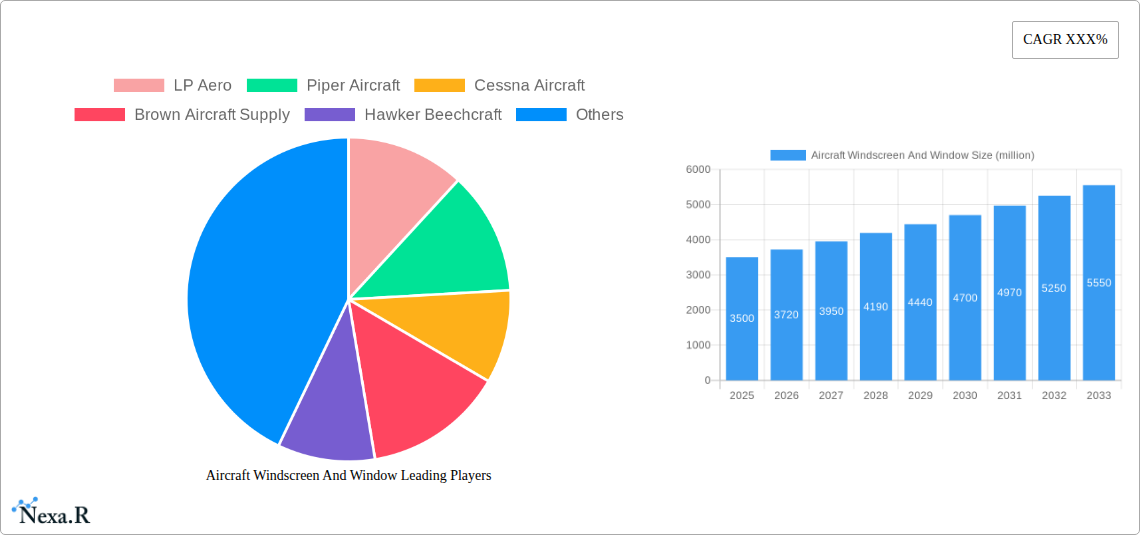

The global aircraft windscreen and window market exhibits a moderately concentrated structure, characterized by the presence of established aerospace manufacturers and specialized glazing suppliers. Technological innovation remains a primary driver, with advancements in material science, anti-reflective coatings, and enhanced optical clarity continually pushing the boundaries of performance. Stringent regulatory frameworks, including those set by the FAA and EASA, dictate rigorous safety and performance standards, influencing product development and market entry. Competitive product substitutes are limited, with advancements in materials like advanced acrylics and polycarbonates offering superior alternatives to traditional mineral glass for specific applications. End-user demographics are diverse, spanning commercial aviation, business jets, military aircraft, and general aviation sectors, each with unique demands for durability, weight, and visibility. Mergers and acquisitions (M&A) trends are present, driven by the desire for vertical integration and expanded product portfolios. For instance, recent years have seen a handful of strategic acquisitions aimed at consolidating manufacturing capabilities and R&D expertise, with an estimated 3-5 significant M&A deals annually within the broader aerospace components sector impacting this niche. Barriers to innovation include high R&D costs, lengthy certification processes, and the need for specialized manufacturing infrastructure. The market share of leading players, such as GKN AEROSPACE and PPG COATINGS S.A, is estimated to collectively account for over 40% of the total market value.

Aircraft Windscreen And Window Growth Trends & Insights

The global aircraft windscreen and window market is poised for significant expansion over the forecast period. The market size, valued at approximately $2,800 million in the base year of 2025, is projected to reach an estimated $4,200 million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 5.2%. This growth is fueled by increasing global air travel demand, the continuous introduction of new aircraft models across all segments (Propeller Aircraft, Jet Aircraft, Rotorcraft), and the growing emphasis on passenger comfort and safety. Adoption rates for advanced glazing solutions, particularly those offering enhanced UV protection, impact resistance, and weight reduction, are steadily increasing as airlines and aircraft manufacturers seek to improve operational efficiency and passenger experience. Technological disruptions, such as the development of electrochromic windows that can dynamically adjust tint and heated windscreens for improved de-icing capabilities, are beginning to shape the market. Consumer behavior shifts, driven by a greater awareness of cabin aesthetics and the desire for enhanced panoramic views, are also influencing design and material choices. The market penetration of lightweight and durable polycarbonate windscreens in newer aircraft designs is a notable trend, contributing to fuel efficiency gains. The projected growth trajectory indicates a robust and evolving market, driven by both incremental improvements and significant technological leaps in aerospace glazing. The increasing average age of the global commercial aircraft fleet, necessitating component upgrades and replacements, also contributes to consistent demand for new and improved windscreens and windows.

Dominant Regions, Countries, or Segments in Aircraft Windscreen And Window

The Jet Aircraft application segment, representing an estimated 60% of the total market value in 2025, is the dominant force driving growth in the global aircraft windscreen and window market. This dominance is attributed to the high volume of commercial jet aircraft production and the increasing demand for long-haul flights, which necessitate robust, high-performance glazing solutions. Within this segment, North America stands out as the leading region, accounting for approximately 35% of the global market share in 2025. This leadership is underpinned by the presence of major aircraft manufacturers like Cessna Aircraft and Piper Aircraft, a highly developed aerospace manufacturing ecosystem, and a significant market for business and general aviation. Key drivers in North America include favorable economic policies supporting aviation, substantial investment in aerospace research and development, and a well-established MRO (Maintenance, Repair, and Overhaul) infrastructure for aircraft windows.

In terms of Type, Acrylic materials are expected to hold the largest market share, estimated at over 50% in 2025, due to their excellent optical clarity, impact resistance, and cost-effectiveness for a wide range of aircraft applications. However, the Polycarbonate segment is experiencing robust growth, driven by its superior impact resistance and lighter weight, making it increasingly attractive for newer generation aircraft designs.

The Propeller Aircraft segment, while smaller, exhibits steady growth, particularly in the general aviation and regional transport sectors. The Rotorcraft segment, crucial for defense and specialized civilian applications, also presents consistent demand for durable and reliable glazing solutions. The continued expansion of air travel, coupled with ongoing fleet modernization programs across all aircraft types, ensures sustained demand for advanced aircraft windscreens and windows globally.

Aircraft Windscreen And Window Product Landscape

Innovations in the aircraft windscreen and window sector are primarily focused on enhancing performance, durability, and passenger experience. Companies are developing lightweight yet robust acrylic and polycarbonate solutions with advanced anti-glare and anti-reflective coatings, significantly improving pilot visibility and reducing eye strain. Heated windscreen technology is gaining traction to combat icing conditions effectively, ensuring safe operations in extreme weather. Furthermore, the integration of smart materials, such as electrochromic glass, allows for dynamic tint control, enhancing cabin comfort and privacy. Performance metrics are constantly being pushed, with manufacturers demonstrating improvements in impact resistance (exceeding XXX g), UV filtration (over 99.9%), and optical distortion (less than X%). The unique selling proposition lies in providing solutions that reduce aircraft weight, improve fuel efficiency, and elevate the overall flying experience, while adhering to stringent aerospace safety certifications.

Key Drivers, Barriers & Challenges in Aircraft Windscreen And Window

Key Drivers:

- Growing global air travel demand: Increased passenger numbers necessitate fleet expansion and replacement, driving demand for new aircraft components.

- Technological advancements: Development of lighter, stronger, and more durable materials like advanced polycarbonates and specialized coatings.

- Emphasis on passenger safety and comfort: Improved visibility, de-icing capabilities, and cabin aesthetics are becoming critical differentiators.

- Fleet modernization and upgrades: Aging aircraft fleets require replacement parts and upgrades, creating a steady MRO market.

- Government initiatives and infrastructure development: Investments in aviation infrastructure and supportive policies in emerging economies.

Key Barriers & Challenges:

- Stringent regulatory approvals: Lengthy and expensive certification processes for new materials and designs can hinder innovation.

- High R&D and manufacturing costs: The specialized nature of aerospace components requires significant capital investment.

- Supply chain volatility: Disruptions in raw material availability and logistics can impact production timelines and costs, with an estimated impact of 5-10% on production delays during periods of high volatility.

- Intense competition: While consolidated, the market faces pressure from existing players and potential new entrants in niche segments.

- Economic downturns and geopolitical instability: These factors can significantly impact airline profitability and aircraft order backlogs.

Emerging Opportunities in Aircraft Windscreen And Window

Emerging opportunities in the aircraft windscreen and window market lie in the development of next-generation smart glazing solutions. This includes advancements in self-healing materials to repair minor scratches, further development of electrochromic technology for enhanced passenger control, and the integration of augmented reality (AR) displays directly onto windscreens for pilots. The growing demand for sustainable aviation solutions presents an opportunity for lightweight glazing materials that contribute to fuel efficiency. Furthermore, the expansion of urban air mobility (UAM) and eVTOL aircraft creates a new, albeit niche, market for specialized, highly durable, and aesthetically pleasing windows and windscreens. The aftermarket segment for retrofitting older aircraft with upgraded glazing also represents a significant untapped potential.

Growth Accelerators in the Aircraft Windscreen And Window Industry

The long-term growth of the aircraft windscreen and window industry is being accelerated by several key factors. Technological breakthroughs in polymer science are enabling the creation of materials that are lighter, more impact-resistant, and offer superior optical properties than ever before. Strategic partnerships and collaborations between material manufacturers, aircraft OEMs, and R&D institutions are fostering rapid innovation and faster product development cycles. For instance, collaborations between GKN AEROSPACE and leading polymer research centers have led to the development of novel composite materials. Market expansion strategies, including targeting emerging aviation markets in Asia-Pacific and Africa, are also contributing to sustained growth. The increasing focus on enhanced pilot situational awareness and cabin experience acts as a significant pull factor for advanced glazing solutions.

Key Players Shaping the Aircraft Windscreen And Window Market

- LP Aero

- Piper Aircraft

- Cessna Aircraft

- Brown Aircraft Supply

- Hawker Beechcraft

- Cee Bailey's

- Control Logistics Inc

- GKN AEROSPACE

- Lee Aerospace, Inc

- MECAPLEX LTD

- PPG COATINGS S.A

Notable Milestones in Aircraft Windscreen And Window Sector

- 2019: Introduction of advanced anti-reflective coatings by PPG COATINGS S.A, improving pilot visibility.

- 2020: Lee Aerospace, Inc. launches enhanced impact-resistant polycarbonate windows for business jets.

- 2021: GKN AEROSPACE announces significant investment in research for lightweight composite glazing solutions.

- 2022: MECAPLEX LTD develops innovative heated windscreen technology for severe weather operations.

- 2023: Cee Bailey's expands its product line to include customizable windows for experimental aircraft.

- 2024: Control Logistics Inc. strengthens its supply chain for critical aviation glazing components.

In-Depth Aircraft Windscreen And Window Market Outlook

- 2019: Introduction of advanced anti-reflective coatings by PPG COATINGS S.A, improving pilot visibility.

- 2020: Lee Aerospace, Inc. launches enhanced impact-resistant polycarbonate windows for business jets.

- 2021: GKN AEROSPACE announces significant investment in research for lightweight composite glazing solutions.

- 2022: MECAPLEX LTD develops innovative heated windscreen technology for severe weather operations.

- 2023: Cee Bailey's expands its product line to include customizable windows for experimental aircraft.

- 2024: Control Logistics Inc. strengthens its supply chain for critical aviation glazing components.

In-Depth Aircraft Windscreen And Window Market Outlook

The future outlook for the aircraft windscreen and window market is exceptionally promising, driven by the synergistic forces of technological innovation and expanding global aviation. Growth accelerators such as cutting-edge material science, including self-healing polymers and lightweight composites, are poised to revolutionize aircraft design and performance. Strategic alliances and robust R&D investments by key players like GKN AEROSPACE and Lee Aerospace, Inc. will continue to push the boundaries of what's possible in aerospace glazing. The increasing demand for enhanced passenger comfort and pilot efficiency, coupled with the sustained growth in air travel, will fuel the adoption of advanced solutions. The burgeoning market for new aircraft types, from eVTOLs to supersonic jets, presents significant untapped potential, ensuring a dynamic and evolving landscape for years to come.

Aircraft Windscreen And Window Segmentation

-

1. Application

- 1.1. Propeller Aircraft

- 1.2. Jet Aircraft

- 1.3. Rotorcraft

- 1.4. Others

-

2. Type

- 2.1. Acrylic

- 2.2. Polycarbonate

- 2.3. Mineral Glass

- 2.4. Others

Aircraft Windscreen And Window Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aircraft Windscreen And Window REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aircraft Windscreen And Window Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Propeller Aircraft

- 5.1.2. Jet Aircraft

- 5.1.3. Rotorcraft

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Acrylic

- 5.2.2. Polycarbonate

- 5.2.3. Mineral Glass

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Aircraft Windscreen And Window Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Propeller Aircraft

- 6.1.2. Jet Aircraft

- 6.1.3. Rotorcraft

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Acrylic

- 6.2.2. Polycarbonate

- 6.2.3. Mineral Glass

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Aircraft Windscreen And Window Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Propeller Aircraft

- 7.1.2. Jet Aircraft

- 7.1.3. Rotorcraft

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Acrylic

- 7.2.2. Polycarbonate

- 7.2.3. Mineral Glass

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Aircraft Windscreen And Window Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Propeller Aircraft

- 8.1.2. Jet Aircraft

- 8.1.3. Rotorcraft

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Acrylic

- 8.2.2. Polycarbonate

- 8.2.3. Mineral Glass

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Aircraft Windscreen And Window Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Propeller Aircraft

- 9.1.2. Jet Aircraft

- 9.1.3. Rotorcraft

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Acrylic

- 9.2.2. Polycarbonate

- 9.2.3. Mineral Glass

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Aircraft Windscreen And Window Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Propeller Aircraft

- 10.1.2. Jet Aircraft

- 10.1.3. Rotorcraft

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Acrylic

- 10.2.2. Polycarbonate

- 10.2.3. Mineral Glass

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 LP Aero

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Piper Aircraft

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cessna Aircraft

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Brown Aircraft Supply

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hawker Beechcraft

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cee Bailey's

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Control Logistics Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 GKN AEROSPACE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Lee Aerospace

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 MECAPLEX LTD

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 PPG COATINGS S.A

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 LP Aero

List of Figures

- Figure 1: Global Aircraft Windscreen And Window Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Aircraft Windscreen And Window Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Aircraft Windscreen And Window Revenue (million), by Application 2024 & 2032

- Figure 4: North America Aircraft Windscreen And Window Volume (K), by Application 2024 & 2032

- Figure 5: North America Aircraft Windscreen And Window Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Aircraft Windscreen And Window Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Aircraft Windscreen And Window Revenue (million), by Type 2024 & 2032

- Figure 8: North America Aircraft Windscreen And Window Volume (K), by Type 2024 & 2032

- Figure 9: North America Aircraft Windscreen And Window Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Aircraft Windscreen And Window Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Aircraft Windscreen And Window Revenue (million), by Country 2024 & 2032

- Figure 12: North America Aircraft Windscreen And Window Volume (K), by Country 2024 & 2032

- Figure 13: North America Aircraft Windscreen And Window Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Aircraft Windscreen And Window Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Aircraft Windscreen And Window Revenue (million), by Application 2024 & 2032

- Figure 16: South America Aircraft Windscreen And Window Volume (K), by Application 2024 & 2032

- Figure 17: South America Aircraft Windscreen And Window Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Aircraft Windscreen And Window Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Aircraft Windscreen And Window Revenue (million), by Type 2024 & 2032

- Figure 20: South America Aircraft Windscreen And Window Volume (K), by Type 2024 & 2032

- Figure 21: South America Aircraft Windscreen And Window Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Aircraft Windscreen And Window Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Aircraft Windscreen And Window Revenue (million), by Country 2024 & 2032

- Figure 24: South America Aircraft Windscreen And Window Volume (K), by Country 2024 & 2032

- Figure 25: South America Aircraft Windscreen And Window Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Aircraft Windscreen And Window Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Aircraft Windscreen And Window Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Aircraft Windscreen And Window Volume (K), by Application 2024 & 2032

- Figure 29: Europe Aircraft Windscreen And Window Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Aircraft Windscreen And Window Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Aircraft Windscreen And Window Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Aircraft Windscreen And Window Volume (K), by Type 2024 & 2032

- Figure 33: Europe Aircraft Windscreen And Window Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Aircraft Windscreen And Window Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Aircraft Windscreen And Window Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Aircraft Windscreen And Window Volume (K), by Country 2024 & 2032

- Figure 37: Europe Aircraft Windscreen And Window Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Aircraft Windscreen And Window Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Aircraft Windscreen And Window Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Aircraft Windscreen And Window Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Aircraft Windscreen And Window Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Aircraft Windscreen And Window Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Aircraft Windscreen And Window Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Aircraft Windscreen And Window Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Aircraft Windscreen And Window Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Aircraft Windscreen And Window Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Aircraft Windscreen And Window Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Aircraft Windscreen And Window Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Aircraft Windscreen And Window Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Aircraft Windscreen And Window Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Aircraft Windscreen And Window Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Aircraft Windscreen And Window Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Aircraft Windscreen And Window Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Aircraft Windscreen And Window Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Aircraft Windscreen And Window Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Aircraft Windscreen And Window Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Aircraft Windscreen And Window Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Aircraft Windscreen And Window Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Aircraft Windscreen And Window Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Aircraft Windscreen And Window Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Aircraft Windscreen And Window Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Aircraft Windscreen And Window Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Aircraft Windscreen And Window Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Aircraft Windscreen And Window Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Aircraft Windscreen And Window Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Aircraft Windscreen And Window Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Aircraft Windscreen And Window Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Aircraft Windscreen And Window Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Aircraft Windscreen And Window Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Aircraft Windscreen And Window Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Aircraft Windscreen And Window Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Aircraft Windscreen And Window Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Aircraft Windscreen And Window Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Aircraft Windscreen And Window Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Aircraft Windscreen And Window Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Aircraft Windscreen And Window Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Aircraft Windscreen And Window Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Aircraft Windscreen And Window Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Aircraft Windscreen And Window Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Aircraft Windscreen And Window Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Aircraft Windscreen And Window Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Aircraft Windscreen And Window Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Aircraft Windscreen And Window Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Aircraft Windscreen And Window Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Aircraft Windscreen And Window Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Aircraft Windscreen And Window Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Aircraft Windscreen And Window Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Aircraft Windscreen And Window Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Aircraft Windscreen And Window Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Aircraft Windscreen And Window Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Aircraft Windscreen And Window Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Aircraft Windscreen And Window Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Aircraft Windscreen And Window Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Aircraft Windscreen And Window Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Aircraft Windscreen And Window Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Aircraft Windscreen And Window Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Aircraft Windscreen And Window Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Aircraft Windscreen And Window Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Aircraft Windscreen And Window Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Aircraft Windscreen And Window Volume K Forecast, by Country 2019 & 2032

- Table 81: China Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Aircraft Windscreen And Window Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Aircraft Windscreen And Window Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aircraft Windscreen And Window?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Aircraft Windscreen And Window?

Key companies in the market include LP Aero, Piper Aircraft, Cessna Aircraft, Brown Aircraft Supply, Hawker Beechcraft, Cee Bailey's, Control Logistics Inc, GKN AEROSPACE, Lee Aerospace, Inc, MECAPLEX LTD, PPG COATINGS S.A.

3. What are the main segments of the Aircraft Windscreen And Window?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aircraft Windscreen And Window," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aircraft Windscreen And Window report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aircraft Windscreen And Window?

To stay informed about further developments, trends, and reports in the Aircraft Windscreen And Window, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence