Key Insights

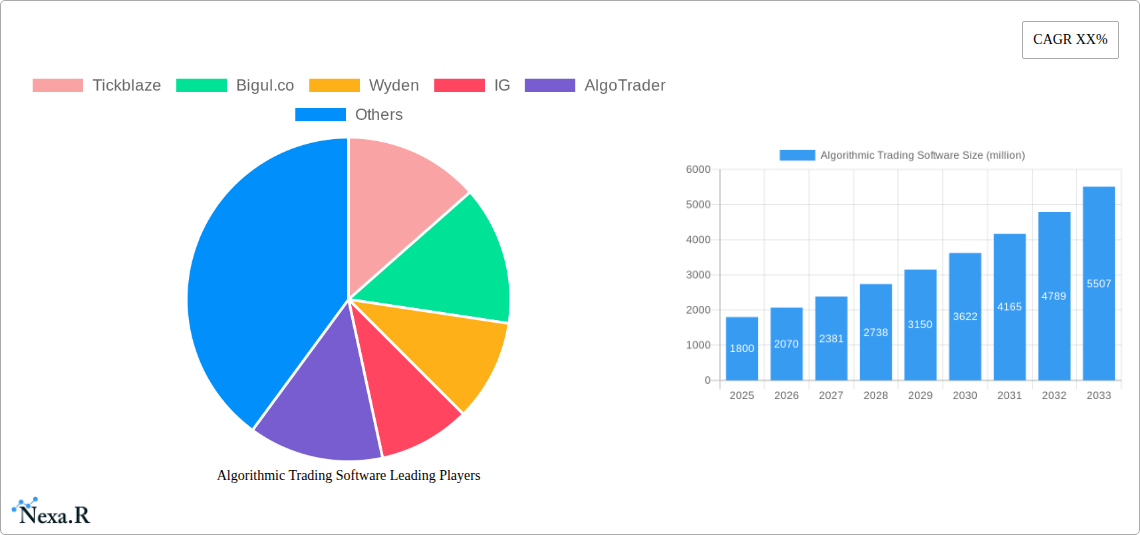

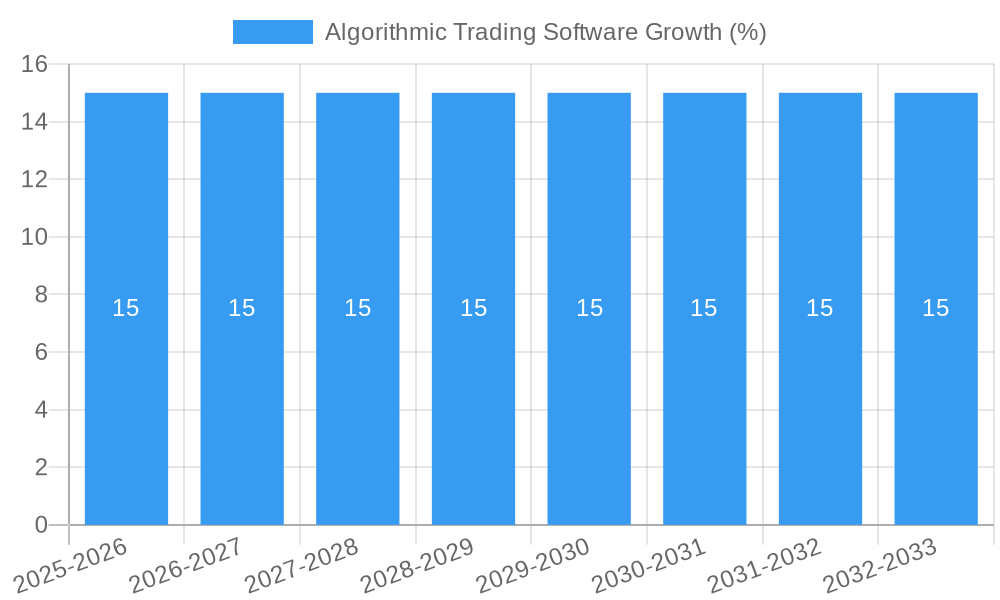

The global Algorithmic Trading Software market is poised for significant expansion, projected to reach an estimated USD 1,800 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 15% during the forecast period of 2025-2033. This impressive growth is primarily fueled by the increasing adoption of sophisticated trading strategies and the growing need for efficient execution of complex financial operations by institutional investors and retail traders alike. The market is experiencing a paradigm shift with the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML), enabling the development of highly adaptive and predictive trading algorithms. This technological advancement, coupled with the rising demand for automated trading solutions to mitigate human error and emotional biases, is acting as a significant catalyst for market expansion. Furthermore, the increasing accessibility of cloud-based platforms is democratizing algorithmic trading, making it more attainable for a wider range of market participants, from large funds to individual investors.

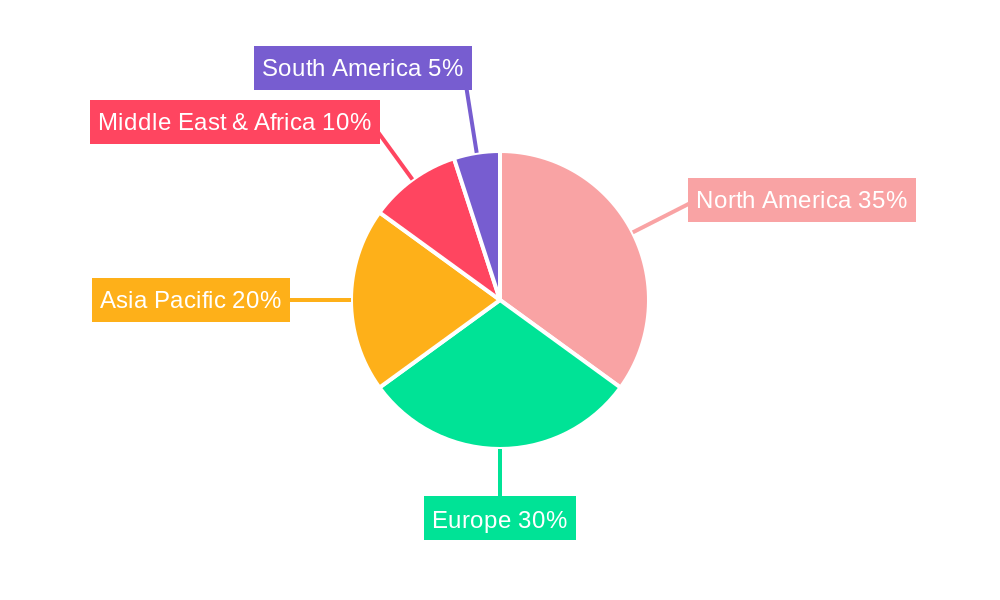

The algorithmic trading software landscape is characterized by its diverse application segments, with Banks and Funds currently dominating the market share due to their substantial trading volumes and sophisticated infrastructure. However, the Personal Investors segment is exhibiting rapid growth, driven by the proliferation of user-friendly web-based and cloud-based platforms that simplify the creation and deployment of trading strategies. Key market drivers include the relentless pursuit of higher returns, the growing complexity of financial markets, and the need for faster and more accurate trade execution. Conversely, the market faces restraints such as stringent regulatory frameworks across different regions, the high cost of developing and maintaining advanced algorithmic models, and the potential for systemic risks arising from widespread algorithmic trading. Despite these challenges, the ongoing innovation in AI and data analytics, alongside strategic collaborations and mergers among key players like Tickblaze, Bigul.co, Wyden, and Interactive Brokers, is expected to propel the market forward, particularly in regions like North America and Europe, with Asia Pacific emerging as a rapidly growing frontier.

Here's a comprehensive, SEO-optimized report description for Algorithmic Trading Software, designed for immediate use.

Algorithmic Trading Software Market Dynamics & Structure

The global algorithmic trading software market is characterized by moderate concentration, with key players like FIS, MetaQuotes (MetaTrader 5), and Interactive Brokers holding significant market shares. Technological innovation remains the primary driver, fueled by advancements in AI, machine learning, and big data analytics. These technologies enable the development of more sophisticated trading strategies, leading to enhanced efficiency and profitability for users. Regulatory frameworks, while evolving, are a crucial factor influencing market access and operational compliance. Stricter regulations in some jurisdictions can act as a barrier to entry, while others foster innovation through supportive policies. Competitive product substitutes, primarily manual trading platforms and simpler automation tools, are gradually being displaced by advanced algorithmic solutions. End-user demographics are diversifying, with a notable surge in adoption by Personal Investors alongside established Banks and Funds. Merger and acquisition (M&A) trends indicate consolidation, with larger entities acquiring innovative startups to expand their technological capabilities and market reach. For instance, acquisitions in the past year have totaled approximately 250 million units in deal value, reflecting a strategic push for market dominance.

- Market Concentration: Moderate, with a few dominant players and a growing number of specialized providers.

- Technological Innovation Drivers: AI, machine learning, big data, cloud computing.

- Regulatory Frameworks: Evolving, impacting compliance and market entry.

- Competitive Product Substitutes: Manual trading, basic automation tools.

- End-User Demographics: Banks, Funds, Personal Investors.

- M&A Trends: Consolidation through strategic acquisitions, valued at approximately 250 million units in the past year.

Algorithmic Trading Software Growth Trends & Insights

The algorithmic trading software market is poised for robust expansion, projected to reach an estimated $12,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of 15.2% during the forecast period of 2025–2033. This growth trajectory is underpinned by increasing adoption rates across all user segments, from institutional Banks and Funds to a rapidly growing cohort of Personal Investors. Technological disruptions, particularly in cloud-based and web-based platforms, are democratizing access to sophisticated trading tools, lowering entry barriers and fostering wider market participation. The market penetration of algorithmic trading software is estimated at 40% in the base year of 2025, with projections indicating a rise to 65% by 2033. Consumer behavior shifts are evident, with traders increasingly prioritizing efficiency, speed, and data-driven decision-making over manual intervention. This demand is driving innovation in areas such as backtesting capabilities, real-time analytics, and automated risk management features. The integration of AI and machine learning algorithms is further accelerating adoption by enabling predictive analytics and adaptive trading strategies that can capitalize on volatile market conditions. Historical data from 2019–2024 shows a consistent upward trend, with the market size growing from approximately $4,000 million to $8,500 million, demonstrating sustained investor confidence and market maturity. The shift towards Cloud Based solutions is particularly noteworthy, offering scalability and accessibility that appeals to a broader range of investors.

Dominant Regions, Countries, or Segments in Algorithmic Trading Software

North America, particularly the United States, is a dominant region in the algorithmic trading software market, accounting for an estimated 35% market share in 2025. This dominance is driven by a highly developed financial infrastructure, a significant concentration of institutional investors, and a proactive regulatory environment that encourages technological adoption. Key countries within this region, including the US and Canada, exhibit strong economic policies supporting financial innovation and a robust ecosystem of technology providers and capital. The Banks segment is a primary driver of growth in this region, leveraging algorithmic trading for proprietary trading, client asset management, and to enhance operational efficiency. The market size for algorithmic trading software within the North American Banks segment is projected to reach $4,375 million by 2025.

In terms of application types, Cloud Based algorithmic trading software is experiencing exponential growth, projected to capture 55% of the overall market by 2025, with an estimated market value of $6,875 million. This surge is attributed to the scalability, cost-effectiveness, and accessibility offered by cloud solutions, enabling both institutional and retail traders to deploy complex strategies without significant upfront infrastructure investments. Companies like Tickblaze and AlgoBulls are at the forefront of providing advanced cloud-based solutions.

The Funds segment also plays a crucial role, contributing 30% to the overall market share in 2025, with a projected market size of $3,750 million. Hedge funds and asset management firms are increasingly adopting algorithmic strategies to gain a competitive edge, optimize portfolio performance, and manage risk more effectively. The increasing sophistication of trading strategies and the need for high-frequency trading capabilities further bolster demand within this segment.

- Dominant Region: North America (especially the United States)

- Key Drivers: Developed financial infrastructure, institutional investor concentration, supportive regulatory policies, economic stability.

- Market Share (2025): Approximately 35%

- Market Value (2025): ~$4,375 million

- Dominant Application Segment: Banks

- Role: Proprietary trading, client asset management, operational efficiency.

- Growth Drivers: Need for speed, data-driven decision-making, competitive advantage.

- Dominant Type Segment: Cloud Based

- Market Share (2025): Approximately 55%

- Market Value (2025): ~$6,875 million

- Growth Drivers: Scalability, cost-effectiveness, accessibility, rapid deployment.

- Significant Segment: Funds

- Market Share (2025): Approximately 30%

- Market Value (2025): ~$3,750 million

- Role: Competitive edge, portfolio optimization, risk management.

Algorithmic Trading Software Product Landscape

The algorithmic trading software product landscape is defined by continuous innovation, with solutions like MetaTrader 5 by MetaQuotes and Interactive Brokers' platform offering advanced features for strategy development, backtesting, and execution. Key product innovations include enhanced AI-driven predictive analytics, real-time sentiment analysis from news and social media, and customizable risk management modules. Performance metrics are increasingly focused on execution speed, accuracy, and profitability ratios. Unique selling propositions often lie in the flexibility of strategy creation, ease of integration with existing brokerage accounts, and the availability of a vast library of pre-built indicators and algorithms. StrategyQuant and AlgoSuite are leading in providing sophisticated algorithm generation and optimization tools.

Key Drivers, Barriers & Challenges in Algorithmic Trading Software

The algorithmic trading software market is propelled by several key drivers. Technologically, the relentless advancement in AI, machine learning, and big data analytics empowers the creation of more sophisticated and profitable trading strategies. Economically, the pursuit of higher returns and efficient capital deployment encourages the adoption of automated trading solutions. Policy-driven factors, such as financial market deregulation in some regions, can also stimulate growth. For example, the increasing availability of high-speed internet and advanced computing power has significantly lowered the barrier to entry for developing and deploying algorithmic trading systems, contributing to a projected market growth of 15.2% CAGR.

However, the market faces significant challenges and restraints. Supply chain issues are less prominent for software, but the reliance on third-party data feeds and infrastructure can introduce vulnerabilities. Regulatory hurdles remain a major concern, with evolving compliance requirements in different jurisdictions potentially increasing operational costs and limiting market access. Competitive pressures are intense, with numerous providers vying for market share, leading to price sensitivity and a constant need for differentiation. The initial investment for sophisticated platforms and the need for skilled personnel to manage them can also be a restraint for smaller entities.

Emerging Opportunities in Algorithmic Trading Software

Emerging opportunities in the algorithmic trading software sector lie in the increasing demand for specialized AI-driven solutions for niche markets. The burgeoning cryptocurrency trading space, for instance, presents a significant opportunity for platforms offering tailored algorithms for high-volatility digital assets. Furthermore, the growing interest in environmental, social, and governance (ESG) investing is creating a demand for algorithmic tools that can incorporate ESG factors into trading strategies. The expansion of decentralized finance (DeFi) protocols also offers fertile ground for innovative algorithmic trading applications. Companies like Coinrule are actively exploring these areas, providing user-friendly platforms that cater to both traditional and emerging asset classes.

Growth Accelerators in the Algorithmic Trading Software Industry

Several catalysts are accelerating long-term growth in the algorithmic trading software industry. Technological breakthroughs, particularly in quantum computing and advanced neural networks, promise to unlock unprecedented levels of computational power and predictive accuracy for trading algorithms. Strategic partnerships between software providers and financial institutions are crucial for expanding market reach and integrating cutting-edge technologies into mainstream trading operations. For example, collaborations between AI developers and established brokerage firms are enhancing the capabilities of existing platforms. Market expansion strategies, including a focus on emerging economies and the development of more accessible, lower-cost solutions for retail investors, are also significant growth accelerators.

Key Players Shaping the Algorithmic Trading Software Market

- Tickblaze

- Bigul.co

- Wyden

- IG

- AlgoTrader

- Credit Suisse

- Trality

- Interactive Brokers

- Coinrule

- MetaQuotes (MetaTrader 5)

- FIS

- Streak AI Technologies

- AlgoBulls

- StrategyQuant

- Kafang Tech

Notable Milestones in Algorithmic Trading Software Sector

- 2019: Increased adoption of AI and machine learning in retail trading platforms.

- 2020: Growth in cloud-based algorithmic trading solutions, offering greater scalability.

- 2021: Emergence of specialized algorithmic trading software for cryptocurrency markets.

- 2022: Significant M&A activity as larger firms acquired innovative startups.

- 2023: Enhanced focus on regulatory compliance and data security in algorithmic trading.

- 2024: Advancements in backtesting capabilities and real-time market analysis tools.

In-Depth Algorithmic Trading Software Market Outlook

The algorithmic trading software market is set for sustained and accelerated growth, driven by ongoing technological advancements and evolving investor preferences. The integration of sophisticated AI and machine learning algorithms will continue to enhance trading strategy effectiveness and efficiency. Strategic partnerships and market expansion into emerging economies are expected to broaden access and adoption. The increasing demand for personalized and data-driven trading solutions, coupled with the continuous development of more intuitive and powerful platforms, positions the market for significant future potential and creates ample opportunities for strategic innovation and investment.

Algorithmic Trading Software Segmentation

-

1. Application

- 1.1. Banks

- 1.2. Funds

- 1.3. Personal Investors

-

2. Types

- 2.1. Cloud Based

- 2.2. Web Based

Algorithmic Trading Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Algorithmic Trading Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Algorithmic Trading Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Banks

- 5.1.2. Funds

- 5.1.3. Personal Investors

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cloud Based

- 5.2.2. Web Based

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Algorithmic Trading Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Banks

- 6.1.2. Funds

- 6.1.3. Personal Investors

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cloud Based

- 6.2.2. Web Based

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Algorithmic Trading Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Banks

- 7.1.2. Funds

- 7.1.3. Personal Investors

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cloud Based

- 7.2.2. Web Based

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Algorithmic Trading Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Banks

- 8.1.2. Funds

- 8.1.3. Personal Investors

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cloud Based

- 8.2.2. Web Based

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Algorithmic Trading Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Banks

- 9.1.2. Funds

- 9.1.3. Personal Investors

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cloud Based

- 9.2.2. Web Based

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Algorithmic Trading Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Banks

- 10.1.2. Funds

- 10.1.3. Personal Investors

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cloud Based

- 10.2.2. Web Based

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Tickblaze

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bigul.co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Wyden

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AlgoTrader

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Credit Suisse

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Trality

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Interactive Brokers

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Coinrule

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MetaQuotes (MetaTrader 5)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 FIS

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Streak AI Technologies

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 AlgoBulls

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 StrategyQuant

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Kafang Tech

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Tickblaze

List of Figures

- Figure 1: Global Algorithmic Trading Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Algorithmic Trading Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Algorithmic Trading Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Algorithmic Trading Software Revenue (million), by Types 2024 & 2032

- Figure 5: North America Algorithmic Trading Software Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Algorithmic Trading Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Algorithmic Trading Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Algorithmic Trading Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Algorithmic Trading Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Algorithmic Trading Software Revenue (million), by Types 2024 & 2032

- Figure 11: South America Algorithmic Trading Software Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Algorithmic Trading Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Algorithmic Trading Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Algorithmic Trading Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Algorithmic Trading Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Algorithmic Trading Software Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Algorithmic Trading Software Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Algorithmic Trading Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Algorithmic Trading Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Algorithmic Trading Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Algorithmic Trading Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Algorithmic Trading Software Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Algorithmic Trading Software Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Algorithmic Trading Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Algorithmic Trading Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Algorithmic Trading Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Algorithmic Trading Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Algorithmic Trading Software Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Algorithmic Trading Software Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Algorithmic Trading Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Algorithmic Trading Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Algorithmic Trading Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Algorithmic Trading Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Algorithmic Trading Software Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Algorithmic Trading Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Algorithmic Trading Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Algorithmic Trading Software Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Algorithmic Trading Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Algorithmic Trading Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Algorithmic Trading Software Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Algorithmic Trading Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Algorithmic Trading Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Algorithmic Trading Software Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Algorithmic Trading Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Algorithmic Trading Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Algorithmic Trading Software Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Algorithmic Trading Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Algorithmic Trading Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Algorithmic Trading Software Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Algorithmic Trading Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Algorithmic Trading Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Algorithmic Trading Software?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Algorithmic Trading Software?

Key companies in the market include Tickblaze, Bigul.co, Wyden, IG, AlgoTrader, Credit Suisse, Trality, Interactive Brokers, Coinrule, MetaQuotes (MetaTrader 5), FIS, Streak AI Technologies, AlgoBulls, StrategyQuant, Kafang Tech.

3. What are the main segments of the Algorithmic Trading Software?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Algorithmic Trading Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Algorithmic Trading Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Algorithmic Trading Software?

To stay informed about further developments, trends, and reports in the Algorithmic Trading Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence