Key Insights

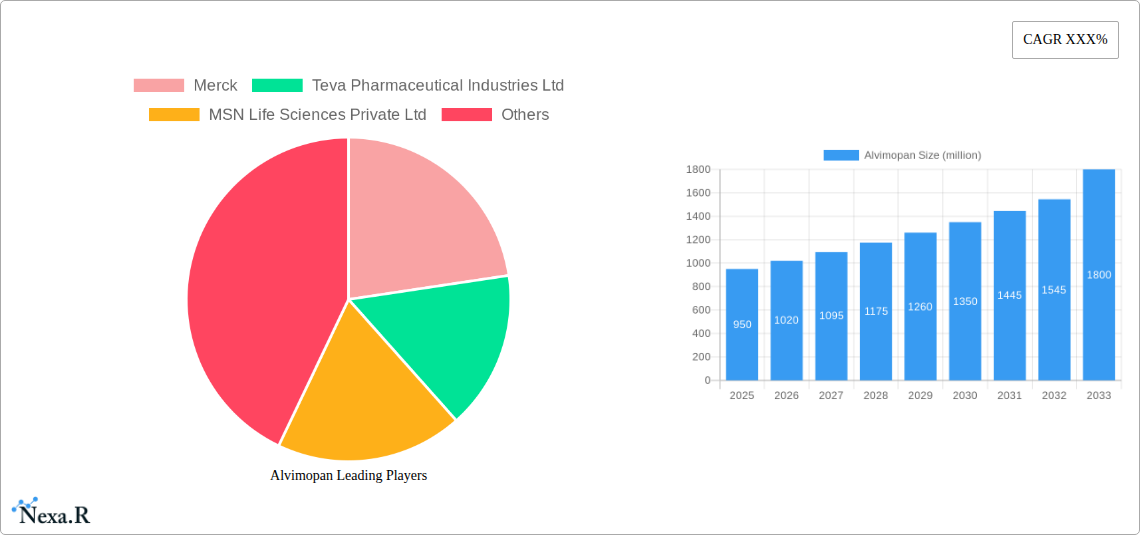

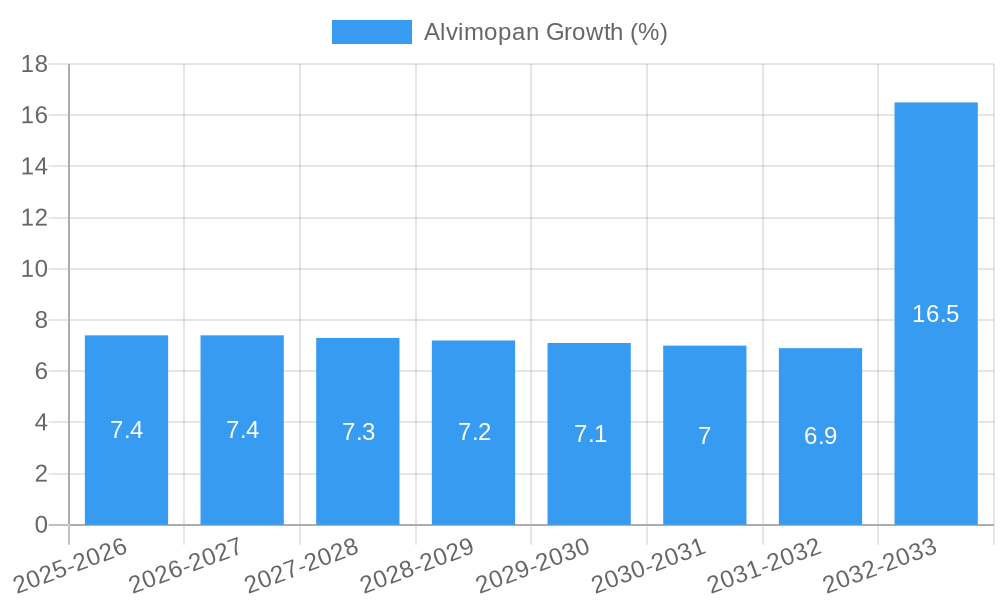

The Alvimopan market is poised for significant expansion, projected to reach approximately $1,800 million by 2033. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of around 7.5% from 2025 to 2033. The increasing prevalence of gastrointestinal disorders, particularly post-operative ileus (POI), is a primary driver. Alvimopan's efficacy in accelerating gastrointestinal recovery and reducing hospital stays makes it an indispensable therapeutic option for surgical patients. The pharmaceutical segment, specifically within the pharmaceutical grade type, is anticipated to dominate the market, reflecting the drug's critical role in patient care and hospital protocols. The growing adoption of enhanced recovery after surgery (ERAS) programs further fuels demand for Alvimopan, as these protocols emphasize minimizing opioid use and improving patient outcomes, areas where Alvimopan excels.

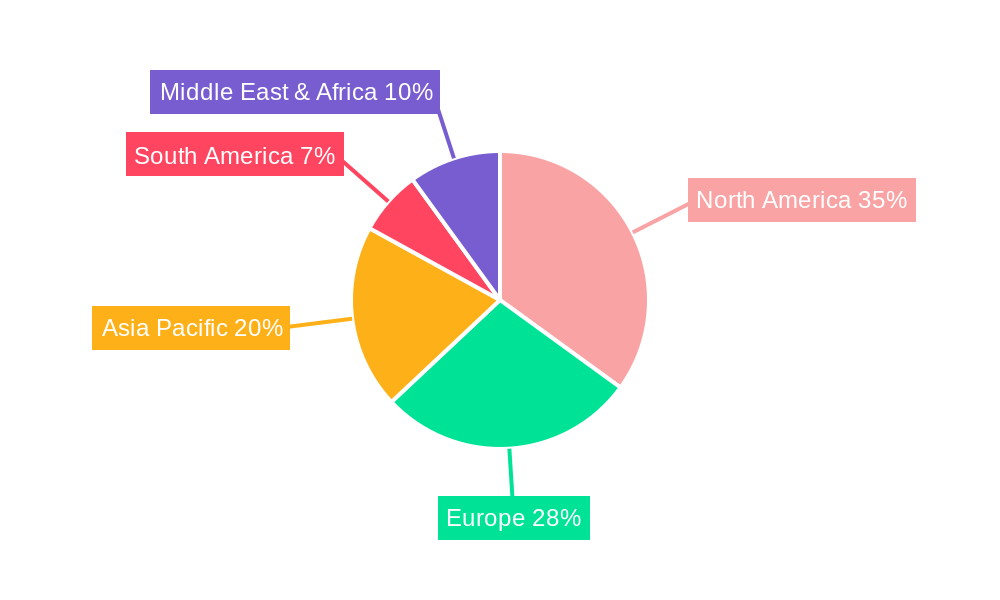

The market's expansion is further bolstered by increasing healthcare expenditure and advancements in diagnostic capabilities, leading to earlier and more accurate identification of conditions requiring Alvimopan. Key players like Merck and Teva Pharmaceutical Industries Ltd are actively investing in research and development, as well as expanding their manufacturing capacities to meet this burgeoning demand. Geographically, North America is expected to lead the market, driven by a well-established healthcare infrastructure and high rates of surgical procedures. Asia Pacific, with its rapidly growing economies and increasing access to advanced medical treatments, presents a substantial opportunity for market penetration. While the market shows immense promise, potential regulatory hurdles and the development of alternative therapies could pose challenges, necessitating continuous innovation and strategic market positioning by industry stakeholders.

Here is a comprehensive, SEO-optimized report description for Alvimopan, designed to maximize visibility and engagement with industry professionals, incorporating high-traffic keywords, parent and child market concepts, and presenting values in million units.

Alvimopan Market Dynamics & Structure

The Alvimopan market is characterized by a moderate to highly concentrated structure, driven by a limited number of key pharmaceutical manufacturers. Technological innovation plays a pivotal role, particularly in the development of enhanced drug delivery systems and novel therapeutic applications within the gastrointestinal segment. Regulatory frameworks, governed by bodies like the FDA and EMA, significantly influence market entry and product lifecycle management, demanding stringent efficacy and safety data. Competitive product substitutes, primarily other peripherally acting mu-opioid receptor antagonists, exert pressure, necessitating continuous R&D for differentiation. End-user demographics are primarily focused on post-operative patients experiencing opioid-induced bowel dysfunction. Merger and acquisition (M&A) trends, while not overly frequent, are strategic, often aimed at acquiring novel IP or expanding market reach for existing Alvimopan formulations.

- Market Concentration: Dominated by established pharmaceutical players, with a few leading companies holding substantial market share.

- Technological Innovation Drivers: Focus on improved bioavailability, reduced side effects, and expanded indications.

- Regulatory Frameworks: Strict adherence to clinical trial protocols and post-market surveillance.

- Competitive Product Substitutes: Other opioid antagonists, dietary interventions, and non-pharmacological approaches.

- End-User Demographics: Primarily hospitals and surgical centers catering to patients undergoing major abdominal surgery.

- M&A Trends: Strategic acquisitions for pipeline enhancement and geographic expansion.

Alvimopan Growth Trends & Insights

The global Alvimopan market is poised for robust growth, projected to reach approximately $850 million in market size by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period (2025-2033). This expansion is fueled by an increasing number of surgical procedures worldwide, coupled with a growing awareness and diagnosis of opioid-induced bowel dysfunction (OIBD). The base year of 2025 saw an estimated market value of $500 million, underscoring the substantial growth trajectory. Adoption rates are steadily climbing as healthcare providers recognize the benefits of Alvimopan in accelerating post-operative recovery, reducing hospital stays, and improving patient quality of life. Technological disruptions are primarily centered on optimizing existing Alvimopan formulations for enhanced efficacy and potentially exploring new therapeutic avenues beyond post-operative ileus. Consumer behavior shifts are evident in the growing patient demand for effective pain management solutions that mitigate adverse gastrointestinal effects. The market penetration of Alvimopan is expected to rise significantly as its efficacy and safety profile become more widely understood and accepted by both clinicians and patients. The pharmaceutical grade segment is the dominant type, accounting for over 95% of the market value, reflecting the critical need for high-purity, regulated therapeutic agents. The "Other" segment, while nascent, may explore applications in preclinical research or novel drug development platforms.

Dominant Regions, Countries, or Segments in Alvimopan

North America is currently the dominant region in the Alvimopan market, driven by a confluence of factors including a high volume of surgical procedures, advanced healthcare infrastructure, and significant investment in pharmaceutical research and development. The United States, in particular, is a leading country, accounting for an estimated 60% of the global Alvimopan market share. This dominance is further bolstered by favorable reimbursement policies for post-operative care and a proactive approach to managing OIBD.

- Key Drivers in North America:

- High prevalence of surgical procedures, especially abdominal surgeries.

- Advanced healthcare systems and widespread adoption of innovative treatments.

- Strong emphasis on patient recovery and reducing hospital readmission rates.

- Active pharmaceutical market with robust R&D investment.

- Favorable regulatory environment and reimbursement landscape.

Within the Application segment, Pharmaceutical applications overwhelmingly drive market growth, representing over 98% of the market value. This is directly attributable to Alvimopan's established role in clinical settings for managing post-operative gastrointestinal complications. The "Other" application segment, while currently minimal, could see potential future development in research settings or as a component in investigational therapies.

Regarding Type, Pharmaceutical Grade Alvimopan is the sole significant market segment, accounting for virtually 100% of the market. The stringent quality and purity requirements for therapeutic drugs preclude the widespread use of "Others" in direct patient care. This highlights the critical need for regulated manufacturing processes and rigorous quality control within the Alvimopan industry.

Alvimopan Product Landscape

The Alvimopan product landscape is characterized by a singular focus on its established therapeutic application as a peripherally acting mu-opioid receptor antagonist. Its primary innovation lies in its ability to reverse opioid-induced constipation and restore gastrointestinal motility without interfering with central analgesia. Performance metrics are consistently measured by its efficacy in reducing the time to bowel movement post-surgery and improving patient comfort. Unique selling propositions revolve around its targeted mechanism of action, offering a specialized solution for a significant post-operative complication. Technological advancements are primarily directed at optimizing formulation and delivery, ensuring consistent therapeutic outcomes.

Key Drivers, Barriers & Challenges in Alvimopan

Key Drivers: The Alvimopan market is propelled by the ever-increasing volume of surgical procedures, particularly abdominal surgeries, which directly correlate with the incidence of opioid-induced bowel dysfunction (OIBD). The growing recognition of OIBD as a significant cause of patient discomfort and prolonged hospital stays is a major driver, pushing healthcare providers to adopt effective management strategies. Advancements in pain management protocols, which often involve opioids, paradoxically increase the demand for agents like Alvimopan to mitigate their gastrointestinal side effects. Furthermore, an aging global population, prone to a higher incidence of surgical interventions, contributes to market expansion.

Barriers & Challenges: Despite its therapeutic benefits, the Alvimopan market faces several barriers and challenges. High manufacturing costs and the need for stringent regulatory approvals present significant hurdles for new entrants. The development of generic alternatives, while not yet widespread, poses a future challenge to market exclusivity and pricing power. Post-market surveillance requirements and the potential for rare adverse events necessitate ongoing vigilance and can impact physician prescribing habits. Moreover, the competitive landscape includes other pharmacological interventions and evolving non-pharmacological approaches, requiring continuous demonstration of Alvimopan's superior efficacy and cost-effectiveness.

Emerging Opportunities in Alvimopan

Emerging opportunities in the Alvimopan market lie in exploring novel therapeutic indications beyond its current post-operative use. Research into its potential efficacy in managing chronic opioid-induced constipation in non-surgical patient populations presents a significant untapped market. Additionally, the development of extended-release formulations or combination therapies could enhance patient compliance and therapeutic outcomes. Geographic expansion into emerging markets with growing surgical volumes and improving healthcare infrastructure also represents a substantial growth avenue.

Growth Accelerators in the Alvimopan Industry

Catalysts driving long-term growth in the Alvimopan industry include ongoing clinical research into expanded indications, particularly for chronic pain management patients reliant on opioids. Strategic partnerships between Alvimopan manufacturers and surgical device companies or anesthesia providers can foster integrated care pathways, enhancing Alvimopan's adoption. Market expansion strategies targeting regions with a rising number of elective surgeries and increasing healthcare expenditure will also accelerate growth. The continuous pursuit of improved pharmacokinetic profiles and reduced side effects through formulation advancements will further solidify its market position.

Key Players Shaping the Alvimopan Market

- Merck

- Teva Pharmaceutical Industries Ltd

- MSN Life Sciences Private Ltd

Notable Milestones in Alvimopan Sector

- 2019: Continued clinical evaluation for expanded indications.

- 2020: Increased awareness and adoption driven by enhanced post-operative recovery protocols.

- 2021: Focus on post-market surveillance and real-world evidence generation.

- 2022: Intensified research into alternative formulations and delivery systems.

- 2023: Growth in market penetration across key geographical regions.

- 2024: Ongoing patent landscape analysis and potential for generic entry discussions.

- 2025: Expected market growth fueled by increased surgical volumes.

- 2026-2033: Projected sustained growth driven by established efficacy and evolving healthcare needs.

In-Depth Alvimopan Market Outlook

The future outlook for the Alvimopan market is highly optimistic, underpinned by a consistent upward trend in surgical procedures and a growing understanding of OIBD management. Growth accelerators, including the exploration of new therapeutic areas and enhanced formulations, will continue to drive market expansion. Strategic partnerships and a focus on emerging markets will be crucial for maximizing future potential. The industry is well-positioned to capitalize on the ongoing need for effective post-operative recovery solutions, ensuring sustained market relevance and value.

Alvimopan Segmentation

-

1. Application

- 1.1. Pharmaceutical

- 1.2. Other

-

2. Type

- 2.1. Pharmaceutical Grade

- 2.2. Others

Alvimopan Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Alvimopan REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Alvimopan Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pharmaceutical

- 5.1.2. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Pharmaceutical Grade

- 5.2.2. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Alvimopan Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pharmaceutical

- 6.1.2. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Pharmaceutical Grade

- 6.2.2. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Alvimopan Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pharmaceutical

- 7.1.2. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Pharmaceutical Grade

- 7.2.2. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Alvimopan Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pharmaceutical

- 8.1.2. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Pharmaceutical Grade

- 8.2.2. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Alvimopan Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pharmaceutical

- 9.1.2. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Pharmaceutical Grade

- 9.2.2. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Alvimopan Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pharmaceutical

- 10.1.2. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Pharmaceutical Grade

- 10.2.2. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Merck

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Teva Pharmaceutical Industries Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MSN Life Sciences Private Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.1 Merck

List of Figures

- Figure 1: Global Alvimopan Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Alvimopan Revenue (million), by Application 2024 & 2032

- Figure 3: North America Alvimopan Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Alvimopan Revenue (million), by Type 2024 & 2032

- Figure 5: North America Alvimopan Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Alvimopan Revenue (million), by Country 2024 & 2032

- Figure 7: North America Alvimopan Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Alvimopan Revenue (million), by Application 2024 & 2032

- Figure 9: South America Alvimopan Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Alvimopan Revenue (million), by Type 2024 & 2032

- Figure 11: South America Alvimopan Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Alvimopan Revenue (million), by Country 2024 & 2032

- Figure 13: South America Alvimopan Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Alvimopan Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Alvimopan Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Alvimopan Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Alvimopan Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Alvimopan Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Alvimopan Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Alvimopan Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Alvimopan Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Alvimopan Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Alvimopan Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Alvimopan Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Alvimopan Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Alvimopan Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Alvimopan Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Alvimopan Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Alvimopan Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Alvimopan Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Alvimopan Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Alvimopan Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Alvimopan Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Alvimopan Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Alvimopan Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Alvimopan Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Alvimopan Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Alvimopan Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Alvimopan Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Alvimopan Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Alvimopan Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Alvimopan Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Alvimopan Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Alvimopan Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Alvimopan Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Alvimopan Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Alvimopan Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Alvimopan Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Alvimopan Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Alvimopan Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Alvimopan Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Alvimopan?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Alvimopan?

Key companies in the market include Merck, Teva Pharmaceutical Industries Ltd, MSN Life Sciences Private Ltd.

3. What are the main segments of the Alvimopan?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5900.00, USD 8850.00, and USD 11800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Alvimopan," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Alvimopan report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Alvimopan?

To stay informed about further developments, trends, and reports in the Alvimopan, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence