Key Insights

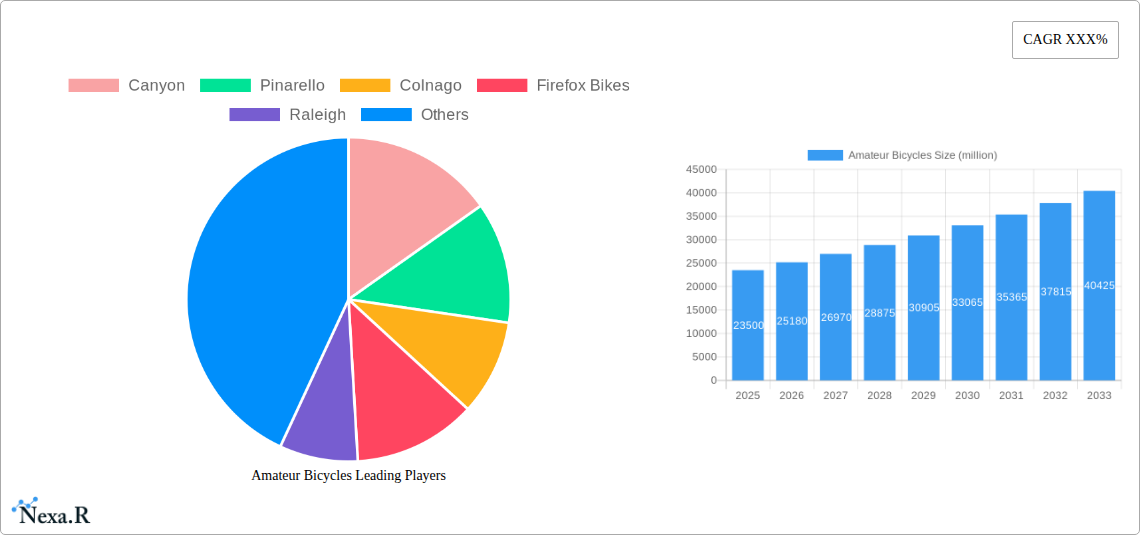

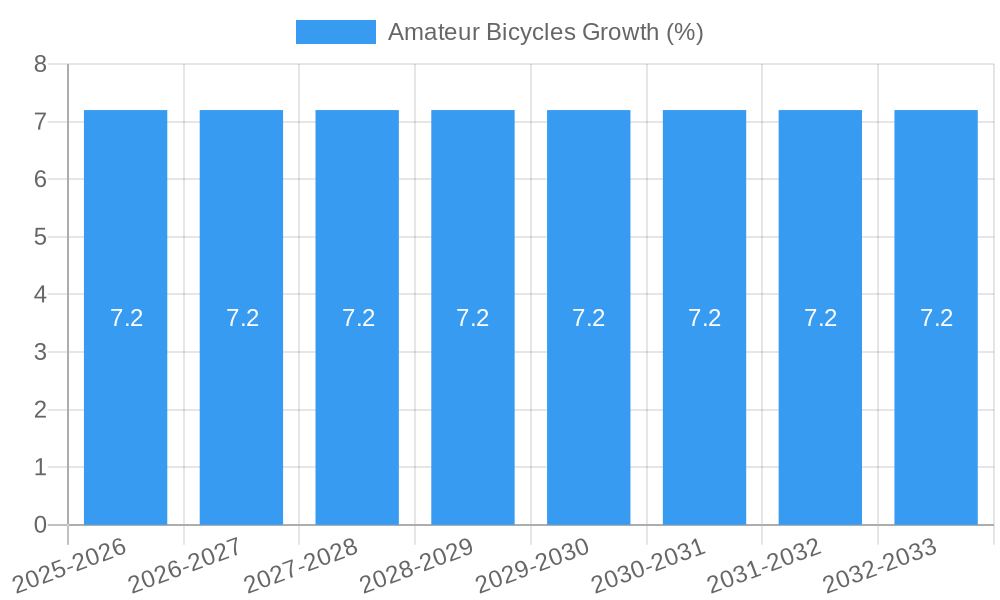

The amateur bicycle market is experiencing robust growth, projected to reach an estimated market size of $23,500 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 7.2% through 2033. This expansion is primarily fueled by increasing health and wellness consciousness among consumers, a growing interest in outdoor recreational activities, and a rise in cycling as a sustainable mode of transportation, particularly in urban areas. The "Transportation Tools" segment is expected to be a significant revenue generator, driven by the demand for efficient and eco-friendly commuting options. Furthermore, the "Recreation" segment continues to thrive as cycling gains popularity for leisure, fitness, and adventure pursuits. Technological advancements in bicycle design, incorporating lighter materials and improved ergonomics, also contribute to enhanced user experience and market appeal.

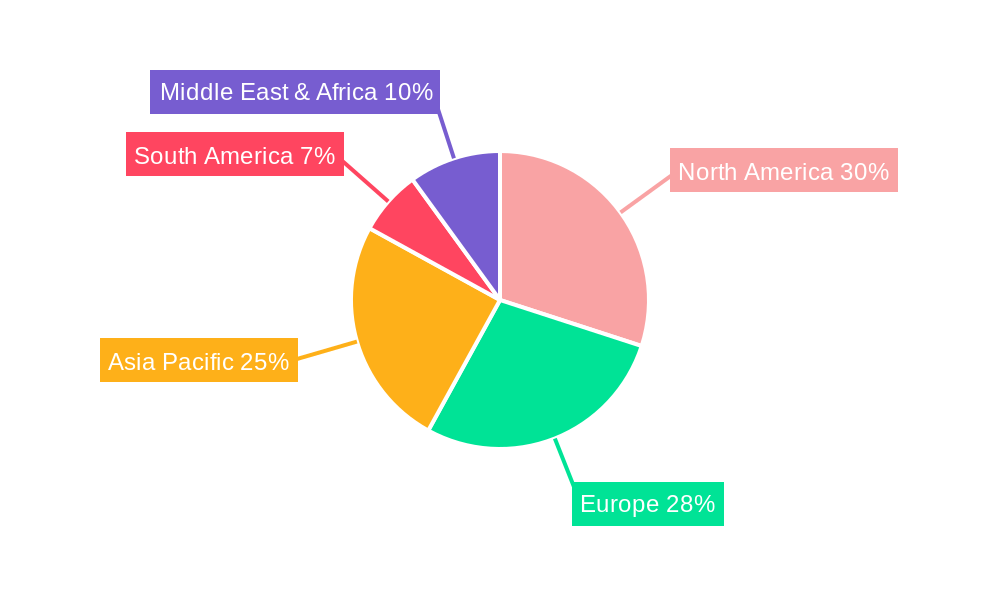

The market is characterized by a diverse range of players, from global giants like Giant and Specialized Bicycle to niche manufacturers, all vying for a share of this expanding pie. While the market presents significant opportunities, certain restraints need to be addressed. The primary concerns include the relatively high initial cost of quality amateur bicycles, potential safety issues and the need for adequate infrastructure in some regions, and fluctuating raw material prices that can impact manufacturing costs. Geographically, North America and Europe are leading markets due to established cycling cultures and higher disposable incomes. However, the Asia Pacific region is poised for substantial growth, driven by rapid urbanization, increasing disposable incomes, and government initiatives promoting cycling. The competitive landscape is intense, with companies focusing on product innovation, strategic partnerships, and expanding distribution networks to capture market share.

Amateur Bicycles Market Research Report: Global Outlook & Growth Analysis (2019-2033)

This comprehensive report delves into the dynamic Amateur Bicycles Market, providing an in-depth analysis of its structure, growth trajectory, and future outlook. Spanning the historical period of 2019-2024, the base year of 2025, and a robust forecast period from 2025-2033, this study offers critical insights for industry stakeholders, investors, and manufacturers. We meticulously examine various bicycle segments, including Road Bikes, Mountain Bikes, and Others, alongside key applications such as Transportation Tools, Recreation, and Others. Understanding the interplay between the parent market (overall bicycle industry) and the child market (amateur bicycles) is crucial for strategic planning. The report leverages extensive data to project market size, adoption rates, and evolving consumer preferences, ensuring a thorough understanding of the global amateur bicycle landscape.

Amateur Bicycles Market Dynamics & Structure

The Amateur Bicycles Market exhibits a moderately concentrated structure, with leading players like Giant, Trek Bikes, and Specialized Bicycle holding significant market share. Technological innovation, particularly in material science and electric assist integration, is a primary driver. Regulatory frameworks concerning safety standards and environmental impact are also shaping product development. Competitive product substitutes, such as e-scooters and public transportation, influence adoption rates, especially within the Transportation Tools segment. End-user demographics are shifting towards younger generations seeking sustainable and active lifestyles, and a growing interest from older adults for recreational cycling. Mergers and acquisitions (M&A) trends, while not as pronounced as in some other industries, indicate a consolidation phase, with recent transactions focused on expanding product portfolios and geographic reach. For instance, a notable M&A in the historical period involved the acquisition of a smaller component manufacturer by a major bicycle brand for an undisclosed sum, aiming to enhance supply chain control and R&D capabilities.

- Market Concentration: Dominated by a few key global players, with increasing fragmentation in niche segments.

- Technological Innovation: Driven by lightweight materials, improved drivetrain systems, and the integration of smart features.

- Regulatory Frameworks: Focus on road safety, emissions standards for e-bikes, and accessibility initiatives.

- Competitive Substitutes: E-scooters, e-bikes (for commuting), and public transport offer alternative mobility solutions.

- End-User Demographics: Growing appeal among millennials and Gen Z for recreational and fitness purposes; increasing participation from older adults.

- M&A Trends: Strategic acquisitions to enhance product offerings and market penetration. Expected M&A deal volume for the forecast period is approximately 15-20 significant transactions.

Amateur Bicycles Growth Trends & Insights

The global Amateur Bicycles Market is projected to witness steady and significant growth over the forecast period. Leveraging advanced analytical models, the market size is anticipated to expand from an estimated $58,500 million units in the base year of 2025 to an impressive $78,900 million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 3.9%. This expansion is fueled by a confluence of factors, including a rising global awareness of health and wellness, a growing preference for sustainable modes of transportation, and increasing disposable incomes in emerging economies. The adoption rates for recreational cycling are particularly robust, with a noticeable surge in participation in cycling events and organized tours. Technological disruptions are playing a pivotal role, with the proliferation of e-bikes within the Mountain Bikes and Recreation segments, making cycling more accessible and appealing to a broader demographic. Consumer behavior is shifting towards a demand for more specialized bikes tailored to specific activities, whether it's endurance road cycling or challenging off-road trails. The penetration of bicycles as primary Transportation Tools in urban environments is also on the rise, driven by initiatives promoting cycling infrastructure and combating traffic congestion. This evolution signifies a maturing market where innovation and adaptability are key to capturing market share.

Dominant Regions, Countries, or Segments in Amateur Bicycles

The Recreation segment, particularly within the Mountain Bikes and Road Bikes sub-segments, is identified as the dominant force driving growth in the Amateur Bicycles Market. This dominance is propelled by a multitude of interconnected factors across key geographical regions. In Europe, countries like Germany, France, and the Netherlands are leading the charge, influenced by strong government support for cycling infrastructure, a deeply ingrained cycling culture, and a growing emphasis on eco-friendly transportation. The market share for recreation-focused amateur bicycles in this region is estimated to be around 35% of the global total, with a projected CAGR of 4.5% during the forecast period. North America, particularly the United States, also contributes significantly, with a robust demand for high-performance Mountain Bikes and Road Bikes driven by a substantial outdoor enthusiast population and a thriving sporting goods industry. The market share for this segment in North America stands at approximately 30%, with a CAGR of 3.8%. Asia-Pacific is emerging as a crucial growth engine, with countries like China and Japan witnessing an increasing uptake of bicycles for both recreation and as essential Transportation Tools. Government initiatives promoting cycling and a growing middle class with disposable income are key drivers. The market share for recreation in this region, though currently smaller at around 20%, is expected to experience the highest CAGR of 5.2% over the forecast period. Economic policies that encourage sustainable living, coupled with advancements in manufacturing technologies, are further solidifying the dominance of the recreation segment. The increasing popularity of cycling tourism and adventure sports also adds to the robust demand.

- Leading Segment: Recreation, encompassing both Road Bikes and Mountain Bikes, is the primary growth driver.

- Key Regional Drivers (Europe): Strong cycling infrastructure, eco-friendly policies, established cycling culture.

- Key Regional Drivers (North America): Large outdoor enthusiast base, robust sporting goods market, demand for performance bikes.

- Key Regional Drivers (Asia-Pacific): Emerging economies, government promotion of cycling, growing disposable income.

- Market Share Dominance: Recreation segment accounts for an estimated 65% of the total amateur bicycle market.

- Growth Potential: Asia-Pacific is poised for the highest growth rate due to increasing adoption and supportive policies.

Amateur Bicycles Product Landscape

The Amateur Bicycles Market is characterized by continuous product innovation aimed at enhancing performance, comfort, and user experience. Advancements in lightweight frame materials like carbon fiber and advanced aluminum alloys are standard. Drivetrain technologies are evolving with more gears, electronic shifting, and integrated power meters for improved efficiency and data tracking. Suspension systems in Mountain Bikes are becoming more sophisticated, offering greater adjustability and shock absorption for diverse terrains. Road Bikes are seeing aerodynamic improvements and disc brake integration for enhanced stopping power and control. Emerging innovations include the integration of smart sensors for performance monitoring and diagnostics, and eco-friendly manufacturing processes. The unique selling proposition for many brands lies in their specific design philosophies, catering to niche riding styles and performance requirements.

Key Drivers, Barriers & Challenges in Amateur Bicycles

The Amateur Bicycles Market is propelled by several key drivers. Growing health and wellness consciousness among global populations fuels the demand for active lifestyles. A strong global push towards sustainable and eco-friendly transportation solutions positions bicycles as an attractive alternative to motorized vehicles. Government initiatives promoting cycling infrastructure, such as dedicated bike lanes and parking facilities, are significant enablers. Technological advancements, particularly in electric assist systems and lightweight materials, are making cycling more accessible and appealing to a wider demographic.

However, the market also faces significant barriers and challenges. Supply chain disruptions, exacerbated by global events, can lead to material shortages and increased production costs, impacting product availability and pricing. Regulatory hurdles, including varying safety standards across different regions and evolving e-bike legislation, can create complexity for manufacturers. Intense competition from established brands and emerging players, alongside the threat of substitute mobility options like e-scooters and ride-sharing services, presents ongoing pressure. The high initial cost of premium bicycles can also be a deterrent for some consumers.

Emerging Opportunities in Amateur Bicycles

Emerging opportunities within the Amateur Bicycles Market are diverse and promising. The increasing demand for specialized gravel bikes and adventure bikes caters to the growing trend of multi-surface riding and bikepacking. The burgeoning e-bike segment, particularly within the Mountain Bikes and Commuting Tools applications, presents significant untapped potential, offering accessibility to a wider age range and fitness level. Micro-mobility solutions are also creating opportunities for innovative urban cycling designs that integrate seamlessly with public transport networks. Furthermore, the growing interest in sustainable tourism and the "slow travel" movement are driving demand for durable and versatile touring bicycles.

Growth Accelerators in the Amateur Bicycles Industry

Several catalysts are accelerating long-term growth in the Amateur Bicycles Industry. Technological breakthroughs in battery technology for e-bikes are leading to longer ranges and faster charging times, enhancing their practicality. Strategic partnerships between bicycle manufacturers and technology companies are fostering innovation in smart cycling features, connectivity, and data analytics. Market expansion strategies, particularly targeting emerging economies with developing cycling cultures and infrastructure, offer substantial growth potential. The increasing focus on circular economy principles and sustainable manufacturing practices is also resonating with environmentally conscious consumers, creating a competitive advantage for brands adopting these approaches.

Key Players Shaping the Amateur Bicycles Market

- Canyon

- Pinarello

- Colnago

- Firefox Bikes

- Raleigh

- Focus Bikes

- Felt Bicycles

- Specialized Bicycle

- Trek Bikes

- Eddy Merckx Bikes

- BMC Switzerland

- Giant

- GT Bicycles

- Salsa Cycles

- Cannondale

- Cervelo

- Bianchi

- Surly Bikes

- Hero Cycles

- Merida

- Fuji Bikes

- Accell Group

Notable Milestones in Amateur Bicycles Sector

- 2019 Q4: Launch of advanced lightweight carbon fiber frames by multiple leading brands, significantly improving performance and rider experience.

- 2020 Q2: Increased demand for Mountain Bikes and Recreation bikes as individuals sought outdoor activities during lockdowns.

- 2021 Q1: Significant advancements in e-bike battery technology, offering extended range and faster charging capabilities.

- 2022 Q3: Major bicycle manufacturers announce ambitious sustainability goals, focusing on recycled materials and reduced carbon footprints.

- 2023 Q4: Emergence of new players focusing on direct-to-consumer models and subscription-based bike ownership.

- 2024 Q1: Growing integration of smart technology and connectivity features in mid-range amateur bicycles.

In-Depth Amateur Bicycles Market Outlook

The future outlook for the Amateur Bicycles Market is exceptionally positive, driven by persistent growth accelerators. Continued technological innovation in e-bike systems and lightweight materials will broaden market appeal. Strategic partnerships will foster a new generation of connected and data-rich cycling experiences. Aggressive market expansion into underdeveloped regions, coupled with a focus on localized product development, will unlock significant growth potential. The increasing consumer preference for sustainable products and ethical manufacturing will further solidify the position of responsible brands. The market is poised for sustained growth, offering lucrative opportunities for stakeholders to capitalize on evolving consumer demands and technological advancements.

Amateur Bicycles Segmentation

-

1. Application

- 1.1. Transportation Tools

- 1.2. Recreation

- 1.3. Others

-

2. Type

- 2.1. Road Bikes

- 2.2. Mountain Bikes

- 2.3. Others

Amateur Bicycles Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Amateur Bicycles REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Amateur Bicycles Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Transportation Tools

- 5.1.2. Recreation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Road Bikes

- 5.2.2. Mountain Bikes

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Amateur Bicycles Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Transportation Tools

- 6.1.2. Recreation

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Road Bikes

- 6.2.2. Mountain Bikes

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Amateur Bicycles Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Transportation Tools

- 7.1.2. Recreation

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Road Bikes

- 7.2.2. Mountain Bikes

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Amateur Bicycles Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Transportation Tools

- 8.1.2. Recreation

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Road Bikes

- 8.2.2. Mountain Bikes

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Amateur Bicycles Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Transportation Tools

- 9.1.2. Recreation

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Road Bikes

- 9.2.2. Mountain Bikes

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Amateur Bicycles Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Transportation Tools

- 10.1.2. Recreation

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Road Bikes

- 10.2.2. Mountain Bikes

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Canyon

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pinarello

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Colnago

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Firefox Bikes

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Raleigh

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Focus Bikes

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Felt Bicycles

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Specialized Bicycle

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Trek Bikes

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Eddy Merckx Bikes

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BMC Switzerland

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Giant

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 GT Bicycles

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Salsa Cycles

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Cannondale

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Cervelo

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Bianchi

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Surly Bikes

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Hero Cycles

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Merida

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Fuji Bikes

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Accell Group

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.1 Canyon

List of Figures

- Figure 1: Global Amateur Bicycles Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Amateur Bicycles Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Amateur Bicycles Revenue (million), by Application 2024 & 2032

- Figure 4: North America Amateur Bicycles Volume (K), by Application 2024 & 2032

- Figure 5: North America Amateur Bicycles Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Amateur Bicycles Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Amateur Bicycles Revenue (million), by Type 2024 & 2032

- Figure 8: North America Amateur Bicycles Volume (K), by Type 2024 & 2032

- Figure 9: North America Amateur Bicycles Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Amateur Bicycles Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Amateur Bicycles Revenue (million), by Country 2024 & 2032

- Figure 12: North America Amateur Bicycles Volume (K), by Country 2024 & 2032

- Figure 13: North America Amateur Bicycles Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Amateur Bicycles Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Amateur Bicycles Revenue (million), by Application 2024 & 2032

- Figure 16: South America Amateur Bicycles Volume (K), by Application 2024 & 2032

- Figure 17: South America Amateur Bicycles Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Amateur Bicycles Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Amateur Bicycles Revenue (million), by Type 2024 & 2032

- Figure 20: South America Amateur Bicycles Volume (K), by Type 2024 & 2032

- Figure 21: South America Amateur Bicycles Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Amateur Bicycles Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Amateur Bicycles Revenue (million), by Country 2024 & 2032

- Figure 24: South America Amateur Bicycles Volume (K), by Country 2024 & 2032

- Figure 25: South America Amateur Bicycles Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Amateur Bicycles Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Amateur Bicycles Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Amateur Bicycles Volume (K), by Application 2024 & 2032

- Figure 29: Europe Amateur Bicycles Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Amateur Bicycles Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Amateur Bicycles Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Amateur Bicycles Volume (K), by Type 2024 & 2032

- Figure 33: Europe Amateur Bicycles Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Amateur Bicycles Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Amateur Bicycles Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Amateur Bicycles Volume (K), by Country 2024 & 2032

- Figure 37: Europe Amateur Bicycles Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Amateur Bicycles Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Amateur Bicycles Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Amateur Bicycles Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Amateur Bicycles Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Amateur Bicycles Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Amateur Bicycles Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Amateur Bicycles Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Amateur Bicycles Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Amateur Bicycles Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Amateur Bicycles Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Amateur Bicycles Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Amateur Bicycles Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Amateur Bicycles Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Amateur Bicycles Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Amateur Bicycles Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Amateur Bicycles Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Amateur Bicycles Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Amateur Bicycles Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Amateur Bicycles Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Amateur Bicycles Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Amateur Bicycles Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Amateur Bicycles Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Amateur Bicycles Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Amateur Bicycles Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Amateur Bicycles Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Amateur Bicycles Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Amateur Bicycles Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Amateur Bicycles Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Amateur Bicycles Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Amateur Bicycles Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Amateur Bicycles Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Amateur Bicycles Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Amateur Bicycles Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Amateur Bicycles Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Amateur Bicycles Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Amateur Bicycles Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Amateur Bicycles Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Amateur Bicycles Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Amateur Bicycles Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Amateur Bicycles Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Amateur Bicycles Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Amateur Bicycles Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Amateur Bicycles Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Amateur Bicycles Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Amateur Bicycles Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Amateur Bicycles Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Amateur Bicycles Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Amateur Bicycles Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Amateur Bicycles Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Amateur Bicycles Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Amateur Bicycles Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Amateur Bicycles Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Amateur Bicycles Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Amateur Bicycles Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Amateur Bicycles Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Amateur Bicycles Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Amateur Bicycles Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Amateur Bicycles Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Amateur Bicycles Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Amateur Bicycles Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Amateur Bicycles Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Amateur Bicycles Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Amateur Bicycles Volume K Forecast, by Country 2019 & 2032

- Table 81: China Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Amateur Bicycles Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Amateur Bicycles Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Amateur Bicycles?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Amateur Bicycles?

Key companies in the market include Canyon, Pinarello, Colnago, Firefox Bikes, Raleigh, Focus Bikes, Felt Bicycles, Specialized Bicycle, Trek Bikes, Eddy Merckx Bikes, BMC Switzerland, Giant, GT Bicycles, Salsa Cycles, Cannondale, Cervelo, Bianchi, Surly Bikes, Hero Cycles, Merida, Fuji Bikes, Accell Group.

3. What are the main segments of the Amateur Bicycles?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Amateur Bicycles," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Amateur Bicycles report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Amateur Bicycles?

To stay informed about further developments, trends, and reports in the Amateur Bicycles, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence