Key Insights

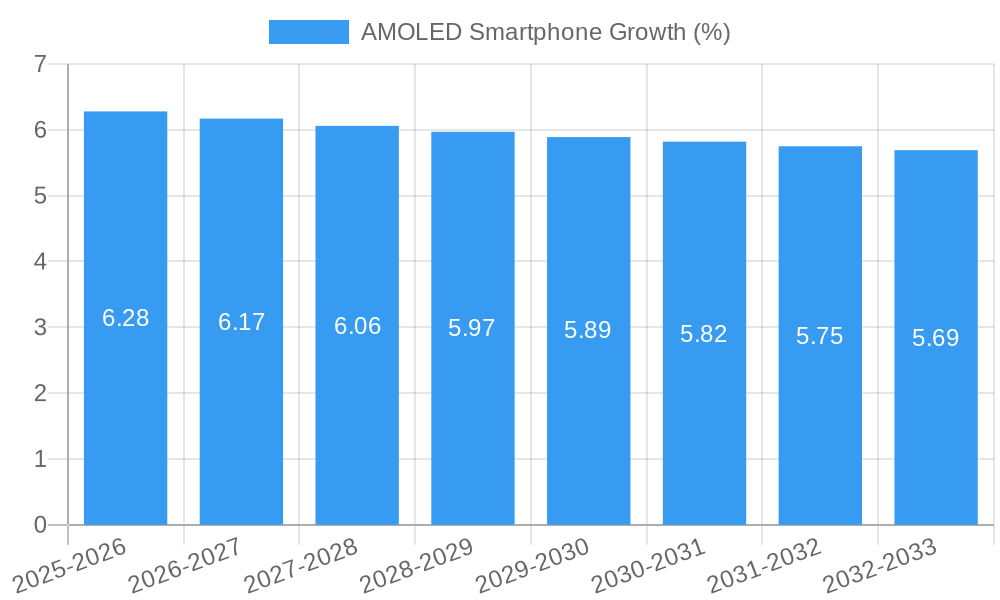

The global AMOLED smartphone market is poised for significant expansion, projected to reach a valuation of USD 6026.7 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 6.1% over the forecast period extending to 2033. This impressive growth is largely fueled by the increasing consumer demand for premium smartphone features, particularly superior display quality characterized by vibrant colors, deep blacks, and enhanced energy efficiency. The proliferation of foldable screen smartphones, a segment that inherently relies on advanced AMOLED technology for its flexibility and durability, is a major catalyst. As manufacturers continue to innovate in this area, the adoption of foldable devices is expected to accelerate, further bolstering the AMOLED market. Furthermore, the ever-present desire for visually immersive experiences in mobile gaming, high-definition video streaming, and augmented reality applications directly translates to a higher demand for the advanced display capabilities offered by AMOLED technology.

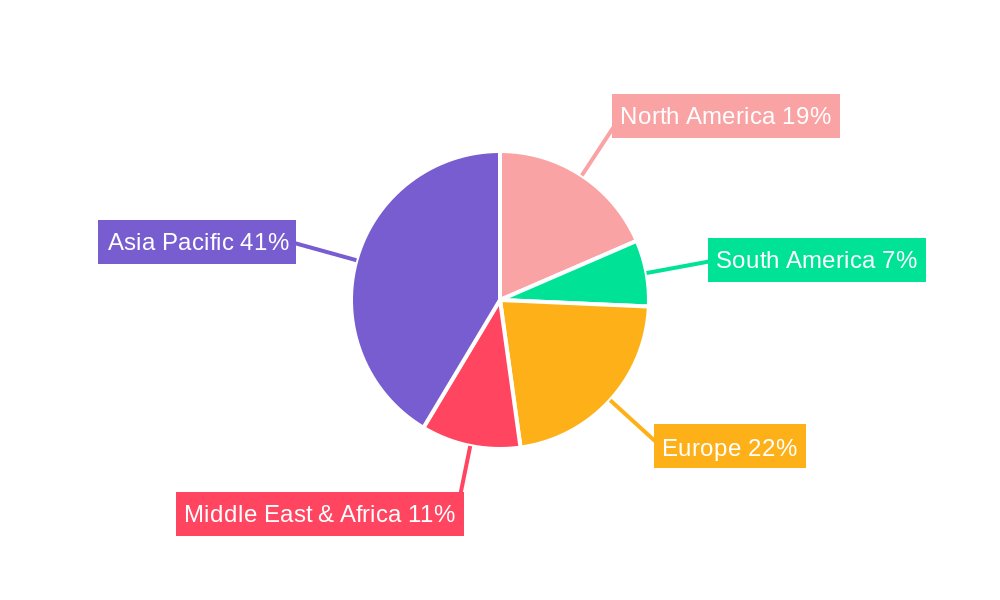

The market's trajectory is also shaped by the continuous technological advancements in AMOLED panel production, leading to improved performance, reduced costs, and enhanced power efficiency. While the market enjoys strong growth, certain restraints may emerge, such as the high manufacturing costs associated with cutting-edge AMOLED displays and the intense competition from other display technologies like advanced LCD. However, the overwhelming advantages of AMOLED in terms of visual fidelity and form factor flexibility, especially for emerging device types, are expected to outweigh these challenges. Key players like Samsung, Apple, OPPO, HONOR, and XIAOMI are at the forefront of this innovation, investing heavily in research and development to capture market share. The Asia Pacific region, led by China and India, is anticipated to be a dominant force, owing to its vast consumer base and the concentration of smartphone manufacturing hubs.

This report offers an in-depth analysis of the global AMOLED smartphone market, examining its current dynamics, growth trajectory, and future potential. Covering the period from 2019 to 2033, with a base year of 2025, this report provides critical insights for industry stakeholders, investors, and strategic planners. It integrates high-traffic SEO keywords to maximize visibility and engagement, focusing on key segments, technological advancements, and competitive landscapes.

AMOLED Smartphone Market Dynamics & Structure

The AMOLED smartphone market exhibits a moderately concentrated structure, largely dominated by a few key players who control significant market share and drive technological innovation. Samsung remains the leading entity, consistently investing in R&D to enhance display technology and production capacity. Apple, while not a direct AMOLED panel manufacturer, exerts considerable influence through its substantial demand and premium product positioning. Other prominent players like OPPO, HONOR, XIAOMI, vivo, and Realme are increasingly investing in AMOLED technology to differentiate their mid-range and flagship offerings. Technological innovation, particularly in panel efficiency, brightness, and refresh rates, acts as a primary driver, influencing consumer purchasing decisions and pushing competitors to innovate. Regulatory frameworks, primarily concerning display manufacturing standards and import/export policies, play a role in shaping market entry and operational costs. Competitive product substitutes, though limited in the high-end AMOLED segment, include advanced LCD technologies, but the superior contrast ratios, color accuracy, and energy efficiency of AMOLED continue to solidify its dominance. End-user demographics are shifting towards younger, tech-savvy consumers who prioritize visual experience and device aesthetics. Mergers and acquisitions (M&A) trends are relatively subdued, with consolidation primarily seen among component suppliers rather than major smartphone brands directly acquiring AMOLED manufacturers, though strategic partnerships are abundant.

- Market Concentration: Moderate, with Samsung and Apple holding substantial sway.

- Technological Innovation Drivers: Enhanced display quality, power efficiency, and flexible screen technologies.

- Regulatory Frameworks: Influence on manufacturing standards and market access.

- Competitive Product Substitutes: Advanced LCDs, though AMOLED offers superior features.

- End-User Demographics: Growing demand from tech-savvy, younger consumers.

- M&A Trends: Limited direct consolidation, but frequent strategic alliances.

AMOLED Smartphone Growth Trends & Insights

The global AMOLED smartphone market has witnessed robust growth throughout the historical period (2019-2024), a trend projected to accelerate significantly during the forecast period (2025-2033). The estimated market size for AMOLED smartphones in 2025 is projected to reach approximately 750 million units, driven by increasing adoption rates across various price segments. This expansion is fueled by continuous technological disruptions, including advancements in foldable screen technology, higher refresh rate panels, and improved power efficiency, making AMOLED displays an increasingly attractive proposition even in mid-tier devices. Consumer behavior has demonstrably shifted towards prioritizing visual fidelity and immersive viewing experiences, directly benefiting the adoption of AMOLED technology. The market penetration of AMOLED displays in smartphones is expected to surpass 70% by 2030, indicating a substantial increase from its historical levels. The Compound Annual Growth Rate (CAGR) for the AMOLED smartphone market is estimated to be in the range of 12-15% over the forecast period, a testament to its sustained momentum. This growth is also supported by the decreasing manufacturing costs of AMOLED panels, making them more accessible for integration into a wider range of smartphone models. Furthermore, the introduction of new form factors, such as rollable and stretchable displays, while still nascent, holds the potential to unlock new market segments and drive future expansion. The increasing demand for 5G-enabled smartphones, which often feature higher-end displays to complement their capabilities, also indirectly contributes to the growth of the AMOLED segment. The shift from traditional offline sales to a more dominant online sales channel for smartphones also influences how consumers discover and purchase devices, often leading to greater emphasis on detailed product specifications, including display technology. The ability of AMOLED to offer deeper blacks, vibrant colors, and faster response times makes it a key selling point in the competitive smartphone arena. The continuous improvement in display resolution and pixel density further enhances the user experience, making AMOLED smartphones a preferred choice for media consumption, gaming, and productivity. This sustained technological advancement and evolving consumer preferences are the bedrock of the projected market expansion.

Dominant Regions, Countries, or Segments in AMOLED Smartphone

The Non-foldable Screen Smartphone segment is currently the dominant driver of growth within the global AMOLED smartphone market, accounting for an estimated 92% of the total market share in 2025, translating to approximately 690 million units. This segment’s dominance is attributed to its widespread adoption across all price tiers, from budget-friendly to premium devices. The sheer volume of non-foldable smartphones manufactured and sold globally ensures that this segment continues to be the primary consumer of AMOLED displays. The Online Sales application segment is rapidly gaining prominence and is projected to represent approximately 55% of the total AMOLED smartphone sales by 2025, amounting to over 412 million units. This shift is driven by the convenience, competitive pricing, and wider selection offered by e-commerce platforms, particularly in Asia-Pacific and North America.

Asia-Pacific is the leading region for AMOLED smartphone market growth, driven by a combination of factors including a large and growing smartphone user base, strong domestic manufacturing capabilities, and a burgeoning middle class with increasing disposable income. Countries like China, South Korea, and India are significant contributors to this regional dominance. The presence of major AMOLED panel manufacturers and smartphone brands within the region, including Samsung, HONOR, XIAOMI, vivo, and Realme, further solidifies its leadership. Government initiatives promoting technological adoption and digital infrastructure development also play a crucial role. The economic policies in these countries often favor local manufacturing and R&D, leading to competitive pricing and rapid product innovation. The infrastructure development supporting online sales and logistics further enhances market penetration. The demand for high-quality displays for multimedia consumption and gaming, prevalent among the younger demographics in these countries, also fuels the adoption of AMOLED technology.

- Dominant Segment (Type): Non-foldable Screen Smartphone (approx. 92% market share in 2025).

- Dominant Segment (Application): Online Sales (projected to reach 55% of sales by 2025).

- Leading Region: Asia-Pacific, driven by China, South Korea, and India.

- Key Drivers in Asia-Pacific: Large user base, strong manufacturing, economic growth, government support for technology.

- Market Share (Non-foldable): Approximately 690 million units in 2025.

- Market Share (Online Sales): Approximately 412 million units in 2025.

AMOLED Smartphone Product Landscape

The AMOLED smartphone product landscape is characterized by continuous innovation in display technology, focusing on enhanced visual experiences and novel form factors. Manufacturers are pushing the boundaries with higher refresh rates (120Hz and above) for smoother scrolling and gaming, improved peak brightness for better outdoor visibility, and wider color gamuts for more vibrant and accurate color reproduction. The integration of under-display camera technology is a significant advancement, leading to truly bezel-less displays. Foldable screen smartphones, while still a niche segment, represent a major area of innovation, offering unique user experiences and compact designs. Infinix Mobile and Tecno are also increasingly incorporating AMOLED displays in their mid-range offerings, democratizing access to premium display technology. Asus continues to cater to the gaming segment with high-performance AMOLED displays.

Key Drivers, Barriers & Challenges in AMOLED Smartphone

Key Drivers:

- Superior Display Quality: AMOLED's unparalleled contrast, true blacks, and vibrant colors are primary consumer demand drivers.

- Energy Efficiency: Per-pixel illumination leads to significant power savings, especially with dark mode.

- Technological Advancements: Continuous improvements in refresh rates, brightness, and new form factors like foldable displays.

- Growing Demand for Premium Experiences: Consumers are willing to pay more for enhanced visual content consumption and gaming.

- Decreasing Manufacturing Costs: Making AMOLED accessible to a broader range of smartphone price points.

Barriers & Challenges:

- Manufacturing Complexity and Cost: High initial investment and complex production processes can limit entry for smaller manufacturers.

- Burn-in Concerns: Although mitigated by technological advancements, residual image retention remains a perception challenge.

- Supply Chain Dependencies: Reliance on a limited number of panel suppliers can lead to price volatility and potential shortages.

- Competition from Advanced LCDs: While AMOLED leads in premium segments, advanced LCDs offer competitive alternatives in lower price tiers.

- Environmental Impact: Production processes for AMOLED panels can have environmental implications, requiring sustainable manufacturing practices.

- Intellectual Property Disputes: The highly competitive nature of display technology can lead to patent disputes and licensing challenges.

Emerging Opportunities in AMOLED Smartphone

Emerging opportunities in the AMOLED smartphone market lie in the continued miniaturization and cost reduction of foldable display technology, making it more accessible for mainstream adoption. The development of under-display camera technology that is truly imperceptible to the user will further enhance the appeal of all-screen designs. Furthermore, the integration of AMOLED displays in emerging smartphone form factors like rollable and stretchable devices presents a significant untapped market. The growing demand for personalized and immersive augmented reality (AR) and virtual reality (VR) experiences on smartphones also opens avenues for AMOLED's superior display capabilities. The expansion of AMOLED adoption in emerging markets, particularly in Africa and Latin America, represents a substantial growth frontier as these regions' smartphone penetration increases.

Growth Accelerators in the AMOLED Smartphone Industry

The AMOLED smartphone industry's long-term growth is significantly accelerated by breakthroughs in quantum dot enhancement films and microLED technology, which promise even greater color accuracy, brightness, and energy efficiency. Strategic partnerships between panel manufacturers and smartphone brands, such as those involving SAMSUNG Display and various OEMs, are crucial for co-developing next-generation display solutions tailored to specific device needs. Market expansion strategies, including aggressive pricing to penetrate mid-range and budget segments, are also key accelerators. The increasing adoption of AMOLED in gaming-centric smartphones and the growing demand for high-resolution content consumption further propel this growth. Huawei, despite facing geopolitical challenges, continues to innovate in display technology, albeit with a more focused product strategy. ZTE also plays a role in offering AMOLED solutions across different market segments.

Key Players Shaping the AMOLED Smartphone Market

- Samsung

- Apple

- OPPO

- HONOR

- XIAOMI

- vivo

- Infinix Mobile

- ZTE

- Realme

- Asus

- Tecno

- Huawei

Notable Milestones in AMOLED Smartphone Sector

- 2019: Widespread adoption of 90Hz refresh rate AMOLED displays in flagship smartphones.

- 2020: Samsung introduces its first foldable smartphone with an Infinity-O AMOLED display, pioneering the foldable segment.

- 2021: Increased integration of LTPO AMOLED technology for variable refresh rates, significantly improving power efficiency.

- 2022: Advancement in under-display camera technology, leading to more seamless full-screen experiences.

- 2023: Significant price reductions in AMOLED panel manufacturing, enabling their inclusion in more mid-range devices.

- Q1 2024: Emergence of higher refresh rate foldable displays with improved durability.

- Q3 2024: Enhanced brightness levels and color accuracy in new AMOLED panel generations, improving outdoor visibility.

In-Depth AMOLED Smartphone Market Outlook

- 2019: Widespread adoption of 90Hz refresh rate AMOLED displays in flagship smartphones.

- 2020: Samsung introduces its first foldable smartphone with an Infinity-O AMOLED display, pioneering the foldable segment.

- 2021: Increased integration of LTPO AMOLED technology for variable refresh rates, significantly improving power efficiency.

- 2022: Advancement in under-display camera technology, leading to more seamless full-screen experiences.

- 2023: Significant price reductions in AMOLED panel manufacturing, enabling their inclusion in more mid-range devices.

- Q1 2024: Emergence of higher refresh rate foldable displays with improved durability.

- Q3 2024: Enhanced brightness levels and color accuracy in new AMOLED panel generations, improving outdoor visibility.

In-Depth AMOLED Smartphone Market Outlook

The future outlook for the AMOLED smartphone market is exceptionally promising, with sustained growth driven by ongoing technological innovation and expanding market reach. The projected evolution of foldable and other flexible display technologies, coupled with continuous improvements in energy efficiency and visual quality, will solidify AMOLED's position as the dominant display technology in the premium smartphone segment. The strategic expansion of AMOLED adoption into mid-range and potentially budget-friendly devices will unlock significant new consumer bases. Opportunities arising from emerging markets and the increasing demand for immersive mobile experiences will act as potent growth accelerators. Industry players are poised to capitalize on these trends through continued R&D investment, strategic collaborations, and a focus on cost optimization, ensuring a robust and dynamic market for AMOLED smartphones in the coming years.

AMOLED Smartphone Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Foldable Screen Smartphone

- 2.2. Non-foldable Screen Smartphone

AMOLED Smartphone Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

AMOLED Smartphone REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global AMOLED Smartphone Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Foldable Screen Smartphone

- 5.2.2. Non-foldable Screen Smartphone

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America AMOLED Smartphone Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Foldable Screen Smartphone

- 6.2.2. Non-foldable Screen Smartphone

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America AMOLED Smartphone Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Foldable Screen Smartphone

- 7.2.2. Non-foldable Screen Smartphone

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe AMOLED Smartphone Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Foldable Screen Smartphone

- 8.2.2. Non-foldable Screen Smartphone

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa AMOLED Smartphone Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Foldable Screen Smartphone

- 9.2.2. Non-foldable Screen Smartphone

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific AMOLED Smartphone Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Foldable Screen Smartphone

- 10.2.2. Non-foldable Screen Smartphone

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Samsung

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Apple

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 OPPO

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HONOR

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 XIAOMI

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 vivo

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Infinix Mobile

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ZTE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Realme

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Asus

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tecno

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Huawei

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Samsung

List of Figures

- Figure 1: Global AMOLED Smartphone Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America AMOLED Smartphone Revenue (million), by Application 2024 & 2032

- Figure 3: North America AMOLED Smartphone Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America AMOLED Smartphone Revenue (million), by Types 2024 & 2032

- Figure 5: North America AMOLED Smartphone Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America AMOLED Smartphone Revenue (million), by Country 2024 & 2032

- Figure 7: North America AMOLED Smartphone Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America AMOLED Smartphone Revenue (million), by Application 2024 & 2032

- Figure 9: South America AMOLED Smartphone Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America AMOLED Smartphone Revenue (million), by Types 2024 & 2032

- Figure 11: South America AMOLED Smartphone Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America AMOLED Smartphone Revenue (million), by Country 2024 & 2032

- Figure 13: South America AMOLED Smartphone Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe AMOLED Smartphone Revenue (million), by Application 2024 & 2032

- Figure 15: Europe AMOLED Smartphone Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe AMOLED Smartphone Revenue (million), by Types 2024 & 2032

- Figure 17: Europe AMOLED Smartphone Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe AMOLED Smartphone Revenue (million), by Country 2024 & 2032

- Figure 19: Europe AMOLED Smartphone Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa AMOLED Smartphone Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa AMOLED Smartphone Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa AMOLED Smartphone Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa AMOLED Smartphone Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa AMOLED Smartphone Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa AMOLED Smartphone Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific AMOLED Smartphone Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific AMOLED Smartphone Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific AMOLED Smartphone Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific AMOLED Smartphone Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific AMOLED Smartphone Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific AMOLED Smartphone Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global AMOLED Smartphone Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global AMOLED Smartphone Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global AMOLED Smartphone Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global AMOLED Smartphone Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global AMOLED Smartphone Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global AMOLED Smartphone Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global AMOLED Smartphone Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global AMOLED Smartphone Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global AMOLED Smartphone Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global AMOLED Smartphone Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global AMOLED Smartphone Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global AMOLED Smartphone Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global AMOLED Smartphone Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global AMOLED Smartphone Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global AMOLED Smartphone Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global AMOLED Smartphone Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global AMOLED Smartphone Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global AMOLED Smartphone Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global AMOLED Smartphone Revenue million Forecast, by Country 2019 & 2032

- Table 41: China AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific AMOLED Smartphone Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the AMOLED Smartphone?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the AMOLED Smartphone?

Key companies in the market include Samsung, Apple, OPPO, HONOR, XIAOMI, vivo, Infinix Mobile, ZTE, Realme, Asus, Tecno, Huawei.

3. What are the main segments of the AMOLED Smartphone?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 6026.7 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "AMOLED Smartphone," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the AMOLED Smartphone report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the AMOLED Smartphone?

To stay informed about further developments, trends, and reports in the AMOLED Smartphone, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence