Key Insights

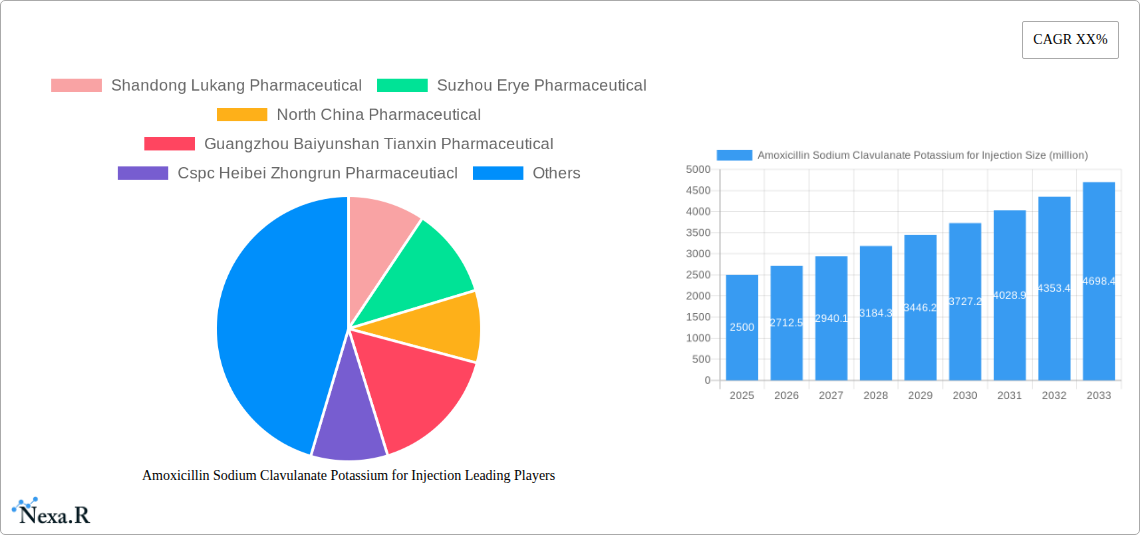

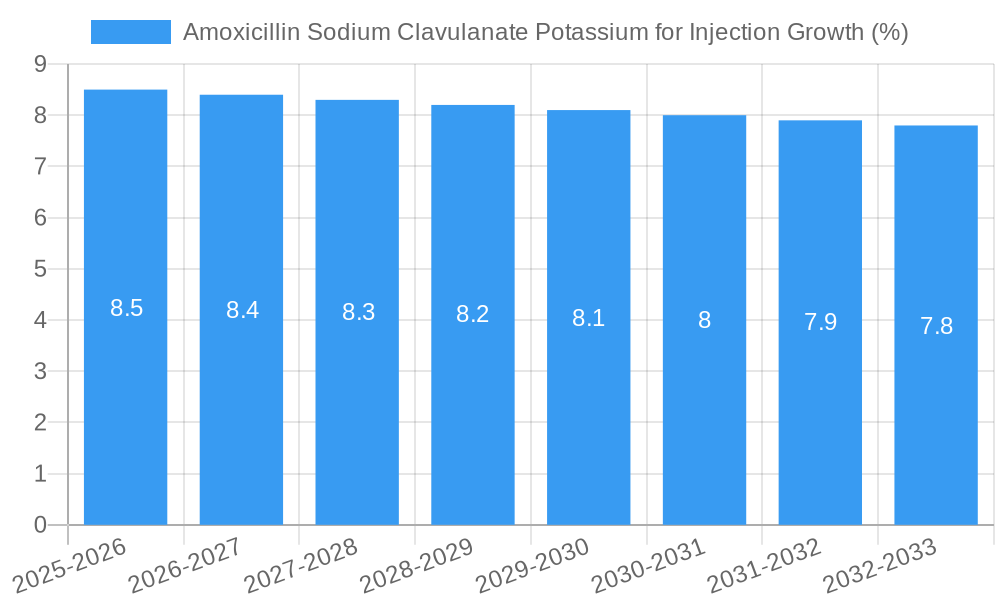

The Amoxicillin Sodium Clavulanate Potassium for Injection market is poised for significant expansion, projected to reach a substantial market size of approximately $2,500 million by 2025. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of around 8.5% during the forecast period of 2025-2033. The market's dynamism is driven by several key factors, including the increasing global prevalence of bacterial infections that require potent antibiotic treatment and the growing demand for injectable formulations due to their faster onset of action and higher bioavailability. Furthermore, advancements in pharmaceutical manufacturing and a continuous focus on research and development to enhance drug efficacy and address antibiotic resistance are contributing positively. The increasing healthcare expenditure, particularly in emerging economies, and the expansion of healthcare infrastructure also play a crucial role in driving market penetration for this essential antimicrobial.

The market segmentation reveals a healthy distribution across various applications and product types. Hospital pharmacies are expected to hold a dominant share, reflecting the critical need for injectable antibiotics in inpatient settings for severe infections. Retail pharmacies also present a significant segment, catering to outpatient prescriptions and physician-administered treatments. In terms of product types, both 0.6g/Bottle and 1.2g/Bottle formulations are anticipated to witness steady demand, driven by varied dosage requirements based on patient age, weight, and infection severity. Despite the strong growth potential, the market faces certain restraints, primarily the escalating concern over antibiotic resistance, which necessitates judicious use and drives the demand for newer therapeutic alternatives. Regulatory hurdles in drug approval processes and stringent quality control measures, while essential for patient safety, can also impact the pace of market entry and expansion for new manufacturers. Nevertheless, the strategic initiatives undertaken by leading players like Shandong Lukang Pharmaceutical, Suzhou Erye Pharmaceutical, and North China Pharmaceutical are expected to further fuel market growth and innovation in the coming years.

This in-depth market report provides a strategic overview of the global Amoxicillin Sodium Clavulanate Potassium for Injection market, encompassing historical performance, current dynamics, and future projections. Leveraging extensive research and granular data from 2019 to 2033, with a base year of 2025, this report is essential for pharmaceutical manufacturers, distributors, investors, and healthcare stakeholders seeking to understand market evolution and capitalize on emerging opportunities in the antibiotic market, injectable antibiotics market, and beta-lactamase inhibitor market.

Amoxicillin Sodium Clavulanate Potassium for Injection Market Dynamics & Structure

The Amoxicillin Sodium Clavulanate Potassium for Injection market is characterized by a moderately consolidated structure, with leading players focusing on technological advancements and expanded production capacities. Key drivers include the rising global burden of bacterial infections and the increasing need for effective antibiotic therapies. Regulatory frameworks, particularly those related to drug approval and manufacturing standards by entities like the FDA and EMA, play a significant role in shaping market entry and product lifecycles. Competitive product substitutes, such as alternative antibiotic combinations and novel antibacterial agents, present ongoing challenges. End-user demographics, primarily hospitals and clinics, influence demand patterns based on infection prevalence and treatment protocols. Mergers and acquisitions (M&A) are a notable trend, with companies strategically acquiring smaller players or forming alliances to enhance their market presence and diversify product portfolios. For instance, the historical period from 2019-2024 saw an estimated 15 M&A deals valued at over $50 million each within the broader antimicrobial sector.

- Market Concentration: Moderately consolidated, with key players holding significant market share.

- Technological Innovation Drivers: Development of improved formulations, enhanced stability, and extended shelf-life for injectable antibiotics.

- Regulatory Frameworks: Stringent approval processes and quality control standards are paramount.

- Competitive Product Substitutes: Emergence of new antibiotic classes and resistance management strategies.

- End-User Demographics: Primarily driven by hospital pharmacies and institutional healthcare settings.

- M&A Trends: Strategic acquisitions to gain market share and expand product offerings, with an estimated 10-12% of market players involved in M&A activities in the past five years.

Amoxicillin Sodium Clavulanate Potassium for Injection Growth Trends & Insights

The global Amoxicillin Sodium Clavulanate Potassium for Injection market has witnessed steady growth driven by the escalating prevalence of bacterial infections and the critical role of this combination therapy in combating antibiotic resistance. From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of approximately 4.8%, reaching an estimated market size of $1,800 million units in the base year of 2025. This growth is fueled by an increasing demand in both hospital pharmacy settings for treating severe infections and in retail pharmacy for outpatient management of common bacterial illnesses. Technological disruptions, such as advancements in lyophilization techniques for improved drug stability and longer shelf-life, are enhancing product accessibility and efficacy. Consumer behavior shifts, including a greater awareness of antibiotic stewardship and the demand for potent, broad-spectrum treatments, also contribute to market expansion. The market penetration of Amoxicillin Sodium Clavulanate Potassium for Injection is projected to reach 75% in developed economies by 2028, with developing regions showing accelerated adoption rates due to improving healthcare infrastructure and increased access to essential medicines. The market size is forecasted to reach $2,500 million units by the end of the forecast period in 2033, exhibiting a projected CAGR of 5.1%.

Dominant Regions, Countries, or Segments in Amoxicillin Sodium Clavulanate Potassium for Injection

The Hospital Pharmacy segment is the dominant force within the Amoxicillin Sodium Clavulanate Potassium for Injection market, accounting for an estimated 65% of the global market share in 2025. This dominance is attributable to the critical role of injectable antibiotics in treating severe, life-threatening bacterial infections that necessitate inpatient care. Hospitals are equipped to administer intravenous therapies and manage potential side effects, making them the primary setting for utilizing Amoxicillin Sodium Clavulanate Potassium for Injection for conditions such as severe pneumonia, sepsis, and complicated skin and soft tissue infections. Economic policies that prioritize robust healthcare infrastructure and the availability of essential medicines further bolster demand in these settings.

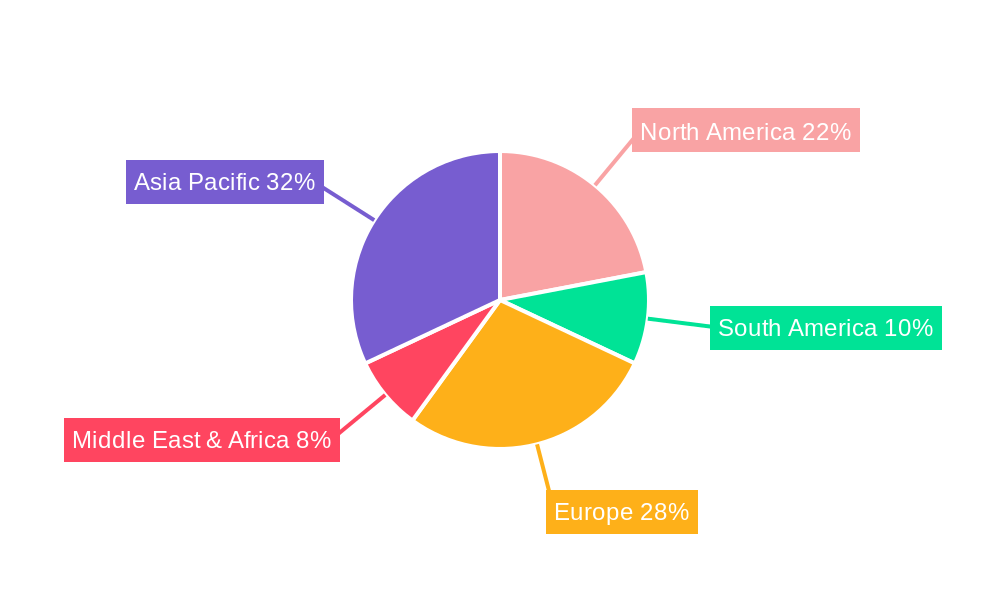

North America and Europe currently lead in market share due to well-established healthcare systems, high prevalence of antibiotic-resistant bacteria, and significant R&D investments in pharmaceutical innovation. However, the Asia-Pacific region is exhibiting the fastest growth trajectory, driven by a burgeoning population, increasing healthcare expenditure, and a rising incidence of infectious diseases. Countries like China and India are emerging as significant markets due to their large patient pools and expanding pharmaceutical manufacturing capabilities.

Within the Types segment, the 1.2g/Bottle formulation holds a larger market share due to its suitability for treating more severe infections and its cost-effectiveness in hospital settings compared to multiple administrations of lower dosage forms. However, the 0.6g/Bottle formulation is gaining traction for pediatric applications and less severe outpatient infections managed through hospital outpatient departments.

- Dominant Segment (Application): Hospital Pharmacy (estimated 65% market share in 2025).

- Drivers: Treatment of severe infections, availability of IV administration facilities, hospital procurement policies.

- Growth Potential: Continued demand due to persistent infectious disease burden.

- Leading Regions: North America, Europe, and the rapidly growing Asia-Pacific.

- Asia-Pacific Growth Drivers: Increasing healthcare access, large population, rising infectious disease rates, and expanding manufacturing bases in China and India.

- Dominant Type: 1.2g/Bottle (due to efficacy in severe infections and cost-effectiveness in hospital settings).

- Emerging Trend: Increased adoption of 0.6g/Bottle for specific patient populations and outpatient care.

Amoxicillin Sodium Clavulanate Potassium for Injection Product Landscape

The Amoxicillin Sodium Clavulanate Potassium for Injection product landscape is characterized by the focus on ensuring high efficacy, stability, and ease of administration. Manufacturers are continually optimizing formulations to enhance solubility, reduce reconstitution time, and improve patient tolerance. Key product innovations revolve around sterile powder for injection, ready-to-use reconstituted solutions, and advanced packaging that preserves drug integrity. Performance metrics such as antibacterial spectrum, pharmacokinetic profile, and minimal adverse event rates are crucial differentiators in this competitive market. For instance, advanced manufacturing techniques ensure a sterile product with a guaranteed shelf-life of at least 24 months under specified storage conditions, crucial for hospital inventory management.

Key Drivers, Barriers & Challenges in Amoxicillin Sodium Clavulanate Potassium for Injection

Key Drivers:

- Rising Incidence of Bacterial Infections: A persistent global health concern demanding effective antibiotic solutions.

- Growing Awareness of Antibiotic Stewardship: This encourages the use of proven combinations like amoxicillin-clavulanate for appropriate indications, reducing reliance on newer, more expensive agents.

- Advancements in Pharmaceutical Manufacturing: Improved lyophilization and sterile processing technologies ensure product quality and stability.

- Expanding Healthcare Infrastructure: Particularly in emerging economies, leading to increased access to injectable medications.

- Favorable Reimbursement Policies: In many regions, this combination therapy is well-covered by healthcare insurance.

Barriers & Challenges:

- Antibiotic Resistance: The ongoing evolution of bacterial resistance necessitates continuous innovation and judicious use of existing therapies.

- Stringent Regulatory Hurdles: Obtaining and maintaining drug approvals requires significant investment and adherence to strict quality standards.

- Supply Chain Disruptions: Global events can impact the availability of raw materials and finished products, leading to potential shortages.

- Competition from Novel Antibiotics: The development of entirely new classes of antibiotics poses a long-term competitive threat.

- Cost Pressures: Healthcare systems are often under pressure to manage costs, which can influence prescribing patterns.

Emerging Opportunities in Amoxicillin Sodium Clavulanate Potassium for Injection

Emerging opportunities lie in the development of novel drug delivery systems that enhance patient convenience and reduce the frequency of administration, such as extended-release formulations or depot injections. There is also a significant untapped market in developing countries with improving healthcare access where awareness and availability of essential antibiotics are growing. Furthermore, exploring strategic partnerships with generic drug manufacturers in emerging markets can unlock significant growth potential. The increasing focus on combating multidrug-resistant organisms (MDROs) presents an opportunity for advanced formulations or combination therapies that can overcome resistance mechanisms, although this is a complex R&D endeavor.

Growth Accelerators in the Amoxicillin Sodium Clavulanate Potassium for Injection Industry

The long-term growth of the Amoxicillin Sodium Clavulanate Potassium for Injection industry will be significantly accelerated by ongoing technological breakthroughs in antibiotic formulation and manufacturing. Strategic partnerships between established pharmaceutical giants and agile biotech firms specializing in infectious disease research are crucial for developing next-generation antibiotic solutions. Market expansion strategies, particularly focusing on underserved regions with a growing demand for accessible and effective treatments, will be a key growth catalyst. Furthermore, increased government initiatives and funding for antibiotic research and development, aimed at combating the growing threat of antimicrobial resistance, will provide a supportive ecosystem for sustained market expansion.

Key Players Shaping the Amoxicillin Sodium Clavulanate Potassium for Injection Market

- Shandong Lukang Pharmaceutical

- Suzhou Erye Pharmaceutical

- North China Pharmaceutical

- Guangzhou Baiyunshan Tianxin Pharmaceutical

- Cspc Heibei Zhongrun Pharmaceutical

- Reyoung Pharmaceutical

- Lunan BETTER Pharmaceutical

- Tianjin Huajin Pharmaceutical

- Chengdu Brilliant Pharmaceutical

- Hainan Weikang Pharmaceutical

- Shanghai SPH New ASIA Pharmaceutical

- Jiangxi Dongfeng Pharmaceutical

- Haikou Qili Pharmaceutical

- Hunan Kelun Pharmaceutical

- Youcare Pharmaceutical

Notable Milestones in Amoxicillin Sodium Clavulanate Potassium for Injection Sector

- 2019: Launch of novel sterile production facility by a major Chinese manufacturer, increasing production capacity by 20%.

- 2020: Introduction of a more stable lyophilized formulation by a European player, extending product shelf-life by 6 months.

- 2021: Key regulatory approval for a new indication in pediatric infectious diseases in a major emerging market.

- 2022: Strategic acquisition of a smaller competitor by a leading global pharmaceutical company to consolidate market share.

- 2023: Major outbreak of a specific bacterial infection leading to a surge in demand for effective injectable antibiotics.

- 2024: Significant investment in R&D for advanced antibiotic resistance solutions by a consortium of key players.

In-Depth Amoxicillin Sodium Clavulanate Potassium for Injection Market Outlook

The future market outlook for Amoxicillin Sodium Clavulanate Potassium for Injection remains positive, driven by consistent demand from hospital pharmacies and the increasing penetration into emerging markets. Growth accelerators such as advancements in drug delivery, strategic collaborations for R&D into combating antibiotic resistance, and targeted market expansion will continue to fuel the industry. Pharmaceutical companies are poised to capitalize on these opportunities by focusing on product quality, supply chain resilience, and the development of value-added formulations. The global fight against infectious diseases ensures a sustained and evolving role for this essential antibiotic combination.

Amoxicillin Sodium Clavulanate Potassium for Injection Segmentation

-

1. Application

- 1.1. Hospital Pharmacy

- 1.2. Retail Pharmacy

-

2. Types

- 2.1. 0.6g/Bottle

- 2.2. 1.2g/Bottle

Amoxicillin Sodium Clavulanate Potassium for Injection Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Amoxicillin Sodium Clavulanate Potassium for Injection REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Amoxicillin Sodium Clavulanate Potassium for Injection Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital Pharmacy

- 5.1.2. Retail Pharmacy

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 0.6g/Bottle

- 5.2.2. 1.2g/Bottle

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Amoxicillin Sodium Clavulanate Potassium for Injection Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital Pharmacy

- 6.1.2. Retail Pharmacy

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 0.6g/Bottle

- 6.2.2. 1.2g/Bottle

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Amoxicillin Sodium Clavulanate Potassium for Injection Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital Pharmacy

- 7.1.2. Retail Pharmacy

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 0.6g/Bottle

- 7.2.2. 1.2g/Bottle

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Amoxicillin Sodium Clavulanate Potassium for Injection Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital Pharmacy

- 8.1.2. Retail Pharmacy

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 0.6g/Bottle

- 8.2.2. 1.2g/Bottle

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Amoxicillin Sodium Clavulanate Potassium for Injection Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital Pharmacy

- 9.1.2. Retail Pharmacy

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 0.6g/Bottle

- 9.2.2. 1.2g/Bottle

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Amoxicillin Sodium Clavulanate Potassium for Injection Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital Pharmacy

- 10.1.2. Retail Pharmacy

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 0.6g/Bottle

- 10.2.2. 1.2g/Bottle

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Shandong Lukang Pharmaceutical

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Suzhou Erye Pharmaceutical

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 North China Pharmaceutical

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Guangzhou Baiyunshan Tianxin Pharmaceutical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cspc Heibei Zhongrun Pharmaceutiacl

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Reyoung Pharmaceutical

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Lunan BETTER Pharmaceutical

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tianjin Huajin Pharmaceutcial

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Chengdu Brilliant Pharmaceutical

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hainan Weikang Pharmaceutical

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shanghai SPH New ASIA Pharmaceutical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Jiangxi Dongfeng Pharmaceutical

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Haikou Qili Pharmaceutical

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Hunan Kelun Pharmaceutical

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Youcare Pharmaceutical

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Shandong Lukang Pharmaceutical

List of Figures

- Figure 1: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million), by Application 2024 & 2032

- Figure 3: North America Amoxicillin Sodium Clavulanate Potassium for Injection Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million), by Types 2024 & 2032

- Figure 5: North America Amoxicillin Sodium Clavulanate Potassium for Injection Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million), by Country 2024 & 2032

- Figure 7: North America Amoxicillin Sodium Clavulanate Potassium for Injection Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million), by Application 2024 & 2032

- Figure 9: South America Amoxicillin Sodium Clavulanate Potassium for Injection Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million), by Types 2024 & 2032

- Figure 11: South America Amoxicillin Sodium Clavulanate Potassium for Injection Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million), by Country 2024 & 2032

- Figure 13: South America Amoxicillin Sodium Clavulanate Potassium for Injection Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Amoxicillin Sodium Clavulanate Potassium for Injection Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Amoxicillin Sodium Clavulanate Potassium for Injection Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Amoxicillin Sodium Clavulanate Potassium for Injection Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Amoxicillin Sodium Clavulanate Potassium for Injection Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Amoxicillin Sodium Clavulanate Potassium for Injection Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Amoxicillin Sodium Clavulanate Potassium for Injection Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Amoxicillin Sodium Clavulanate Potassium for Injection Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Amoxicillin Sodium Clavulanate Potassium for Injection Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Amoxicillin Sodium Clavulanate Potassium for Injection Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Amoxicillin Sodium Clavulanate Potassium for Injection Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Amoxicillin Sodium Clavulanate Potassium for Injection Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Amoxicillin Sodium Clavulanate Potassium for Injection?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Amoxicillin Sodium Clavulanate Potassium for Injection?

Key companies in the market include Shandong Lukang Pharmaceutical, Suzhou Erye Pharmaceutical, North China Pharmaceutical, Guangzhou Baiyunshan Tianxin Pharmaceutical, Cspc Heibei Zhongrun Pharmaceutiacl, Reyoung Pharmaceutical, Lunan BETTER Pharmaceutical, Tianjin Huajin Pharmaceutcial, Chengdu Brilliant Pharmaceutical, Hainan Weikang Pharmaceutical, Shanghai SPH New ASIA Pharmaceutical, Jiangxi Dongfeng Pharmaceutical, Haikou Qili Pharmaceutical, Hunan Kelun Pharmaceutical, Youcare Pharmaceutical.

3. What are the main segments of the Amoxicillin Sodium Clavulanate Potassium for Injection?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Amoxicillin Sodium Clavulanate Potassium for Injection," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Amoxicillin Sodium Clavulanate Potassium for Injection report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Amoxicillin Sodium Clavulanate Potassium for Injection?

To stay informed about further developments, trends, and reports in the Amoxicillin Sodium Clavulanate Potassium for Injection, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence