Key Insights

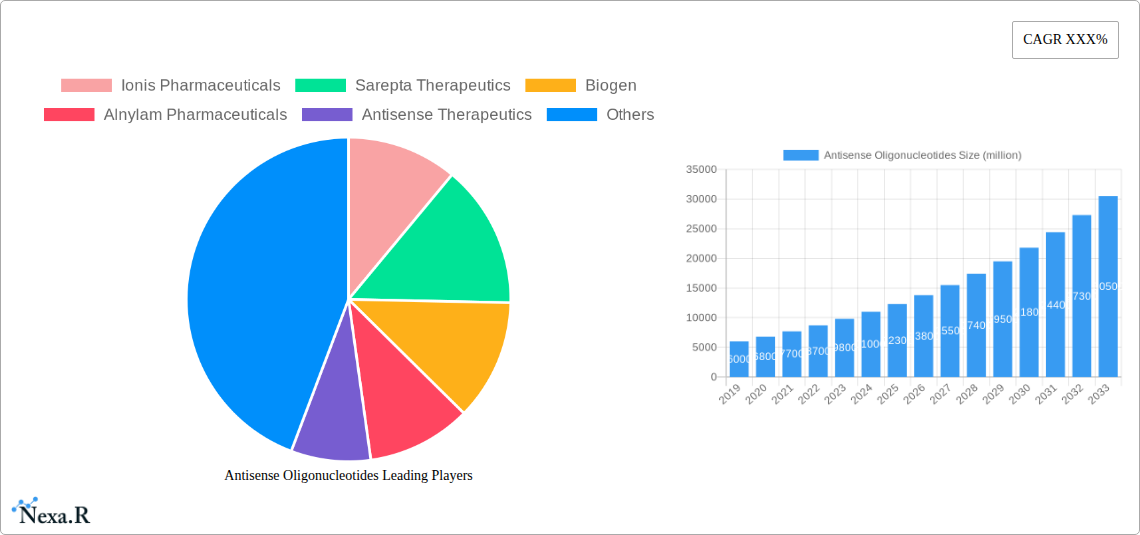

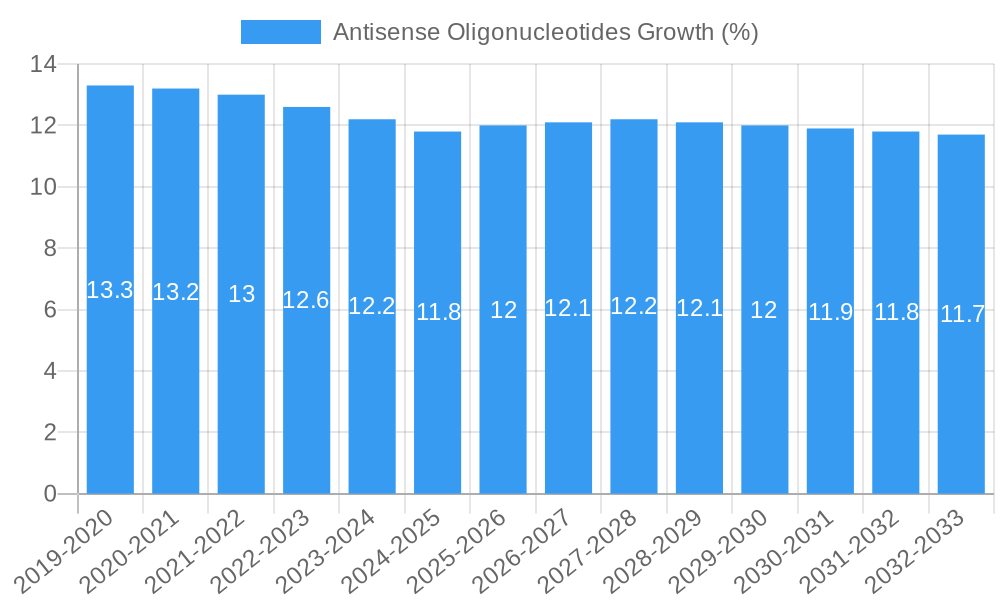

The global Antisense Oligonucleotides market is poised for substantial expansion, projected to reach a market size of approximately $12,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 12%, and further growing to an estimated $20,000 million by 2033. This significant market trajectory is primarily driven by the increasing prevalence of genetic disorders, the growing demand for targeted therapies, and advancements in nucleic acid-based drug development. The therapeutic potential of antisense oligonucleotides in treating a wide range of conditions, from rare genetic diseases like Spinal Muscular Atrophy (SMA) and Huntington's disease to more common ailments such as cardiovascular diseases and certain cancers, is a key catalyst for market growth. Moreover, substantial investments in research and development by leading pharmaceutical and biotechnology companies, coupled with favorable regulatory pathways for orphan drugs, are further propelling market expansion. The market's growth is also bolstered by a deepening understanding of molecular biology and the increasing efficacy and safety profiles of oligonucleotide-based therapeutics.

The market is segmented into various applications, with Hospitals emerging as the dominant segment due to their comprehensive infrastructure for advanced treatment and diagnosis. Clinics also represent a significant application area, especially for specialized treatments. In terms of type, RNA Antisense Oligonucleotides are leading the market, owing to their broader therapeutic applicability and the success of several FDA-approved drugs in this category. DNA Antisense Oligonucleotides, while holding a smaller share, are also witnessing increasing research and development efforts. Key restraints to market growth include the high cost of development and manufacturing, potential off-target effects, and the complexity of drug delivery. However, ongoing technological innovations in chemical modifications and delivery systems are actively addressing these challenges. The competitive landscape is characterized by the presence of major players like Ionis Pharmaceuticals, Sarepta Therapeutics, Biogen, and Alnylam Pharmaceuticals, who are continually innovating and expanding their product pipelines, thereby shaping the future of this dynamic market.

Antisense Oligonucleotides Market Dynamics & Structure

The global Antisense Oligonucleotides (ASO) market is characterized by a dynamic interplay of technological innovation, stringent regulatory frameworks, and evolving end-user demands. Market concentration is moderately fragmented, with a few key players dominating while a host of emerging companies vie for market share. Technological innovation is a primary driver, fueled by advancements in ASO design, delivery systems, and therapeutic targeting, enabling the development of novel treatments for a wide range of genetic and acquired diseases. The regulatory landscape, particularly in developed nations, presents both opportunities and challenges, with a focus on efficacy, safety, and manufacturing standards. Competitive product substitutes, primarily gene therapies and small molecule drugs, pose a constant threat, necessitating continuous product differentiation and pipeline development. End-user demographics are shifting, with an increasing prevalence of rare genetic disorders and chronic diseases driving demand for targeted ASO therapies. Mergers and acquisitions (M&A) trends are significant, with larger pharmaceutical companies acquiring or partnering with smaller biotech firms to bolster their ASO portfolios and gain access to cutting-edge technologies.

- Market Concentration: Moderately fragmented, with a mix of large pharmaceutical companies and specialized ASO developers.

- Technological Innovation: Key drivers include improved ASO design, novel delivery mechanisms (e.g., conjugation, liposomes), and enhanced targeting capabilities.

- Regulatory Frameworks: Strict FDA and EMA guidelines for drug approval, influencing R&D and manufacturing processes.

- Competitive Substitutes: Gene therapy, RNA interference (RNAi) therapeutics, and small molecule drugs are key alternatives.

- End-User Demographics: Growing demand for treatments for rare genetic diseases (e.g., Spinal Muscular Atrophy), neurological disorders, cardiovascular diseases, and oncology.

- M&A Trends: Strategic acquisitions and partnerships are prevalent as companies seek to expand their ASO pipelines and technological expertise.

Antisense Oligonucleotides Growth Trends & Insights

The Antisense Oligonucleotides (ASO) market is poised for substantial growth, driven by a convergence of scientific breakthroughs, increasing clinical validation, and a growing unmet medical need for targeted therapies. The market size is projected to expand significantly over the forecast period, underpinned by a rising CAGR of approximately 15-20%. Adoption rates for ASO therapies are steadily increasing as regulatory bodies approve more novel compounds and payers recognize their therapeutic value, particularly for orphan diseases where conventional treatments are limited. Technological disruptions are at the forefront of this growth, with continuous improvements in ASO chemistry, such as the development of 2'-O-methoxyethyl (MOE) and locked nucleic acid (LNA) modifications, enhancing their stability, potency, and reducing off-target effects. Furthermore, advancements in delivery technologies, including novel nanoparticle formulations and conjugation strategies, are improving tissue-specific delivery and cellular uptake, broadening the therapeutic potential of ASOs.

Consumer behavior shifts are also playing a crucial role. Patients and healthcare providers are increasingly seeking personalized and targeted treatment options, a paradigm that ASOs excel at fulfilling by directly addressing the root cause of genetic diseases at the molecular level. The growing understanding of disease pathogenesis at the genetic level has opened new avenues for ASO intervention. For instance, the successful application of ASOs in treating conditions like Spinal Muscular Atrophy (SMA) and Huntington's disease has paved the way for their exploration in a multitude of other neurological disorders, cardiovascular conditions, and even certain types of cancer. The expanding pipeline of ASO candidates in various stages of clinical trials, coupled with the robust investment in ASO research and development, signals a strong future outlook for the market. The ability of ASOs to modulate gene expression with high specificity offers a unique therapeutic modality that complements and, in some cases, surpasses existing treatment options. The increasing number of clinical trials demonstrating positive outcomes is further bolstering confidence among clinicians and patients, driving higher market penetration.

Dominant Regions, Countries, or Segments in Antisense Oligonucleotides

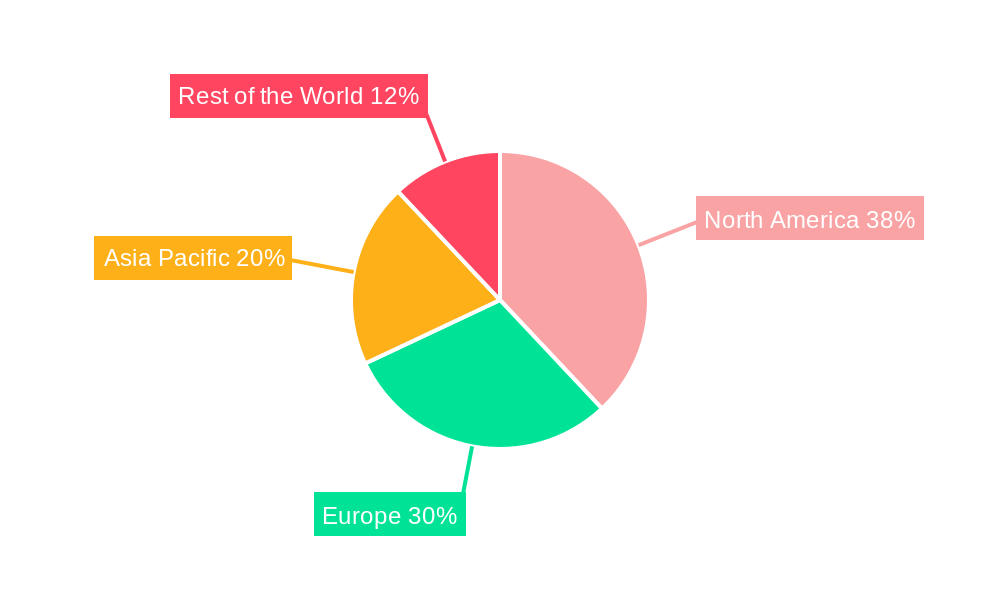

The global Antisense Oligonucleotides (ASO) market exhibits significant regional variations in dominance, largely driven by established pharmaceutical infrastructure, robust R&D investments, favorable regulatory environments, and the prevalence of specific genetic disorders. North America, particularly the United States, currently stands as the leading region, accounting for a substantial market share estimated at over 45% in 2025. This dominance is attributed to the presence of major ASO developers like Ionis Pharmaceuticals, Sarepta Therapeutics, and Biogen, which have a rich history of innovation and successful product launches. The region also benefits from a well-established healthcare system, high patient awareness, and significant venture capital funding for biotechnology research.

Within the Application segment, Hospitals emerge as the dominant end-user, driven by the complex treatment requirements of severe genetic disorders and the need for specialized administration and monitoring of ASO therapies. Hospitals are equipped with the necessary infrastructure and trained personnel to manage patients receiving these advanced treatments, leading to a higher consumption of ASO products. The Type segment is overwhelmingly dominated by RNA Antisense Oligonucleotides. This is due to the direct targeting of messenger RNA (mRNA) which allows for modulation of protein synthesis. RNA ASOs have demonstrated remarkable success in clinical trials and subsequent market approvals, particularly in treating neurological and rare genetic diseases. The ability to silence or modify the expression of specific genes at the post-transcriptional level provides a powerful therapeutic avenue.

- Dominant Region: North America (primarily the United States) due to strong R&D, major players, and market access.

- Dominant Application: Hospitals, reflecting the complexity of ASO therapy and patient management.

- Dominant Type: RNA Antisense Oligonucleotides, due to their proven efficacy and broad therapeutic applications.

- Key Drivers in North America: High R&D expenditure, presence of key pharmaceutical companies, favorable reimbursement policies, and high incidence of target diseases.

- Growth Potential in Hospitals: Increasing adoption of advanced therapies for genetic disorders and chronic conditions requiring specialized care.

- Market Share of RNA ASOs: Estimated to be over 85% of the total ASO market due to their wider applicability and therapeutic success.

Antisense Oligonucleotides Product Landscape

The Antisense Oligonucleotides (ASOs) product landscape is characterized by highly specialized therapeutics targeting specific genetic mutations. Innovations focus on enhancing ASO stability, reducing immunogenicity, and improving targeted delivery to affected tissues. Key product applications span rare genetic diseases such as Spinal Muscular Atrophy (SMA), Huntington's disease, and Duchenne Muscular Dystrophy (DMD), as well as emerging applications in neurological disorders, cardiovascular diseases, and oncology. Performance metrics emphasize increased therapeutic efficacy, extended dosing intervals, and improved safety profiles compared to previous generations of ASOs. Unique selling propositions lie in their ability to directly address the root cause of disease by modulating gene expression at the RNA level, offering a highly personalized and potentially curative approach.

Key Drivers, Barriers & Challenges in Antisense Oligonucleotides

Key Drivers:

- Targeted Gene Modulation: The ability to precisely target specific genes and modify their expression offers novel therapeutic avenues for diseases with limited treatment options.

- Advancements in Chemistry and Delivery: Continuous innovation in ASO chemistry (e.g., 2'-MOE, LNA) and delivery systems (e.g., nanoparticles) enhances efficacy, stability, and reduces side effects.

- Growing Incidence of Genetic and Rare Diseases: The increasing diagnosis and understanding of genetic disorders fuels demand for targeted ASO therapies.

- Robust Clinical Pipeline: A significant number of ASO candidates in various stages of clinical trials demonstrate strong potential for future market growth.

Barriers & Challenges:

- High Development and Manufacturing Costs: The intricate nature of ASO development and manufacturing leads to substantial costs, impacting accessibility.

- Delivery to Specific Tissues: Efficient and targeted delivery of ASOs to specific organs or tissues, particularly the central nervous system, remains a significant challenge.

- Immunogenicity and Off-Target Effects: Potential for immune responses and unintended effects on other genes necessitates careful design and rigorous testing.

- Regulatory Hurdles and Reimbursement Policies: Navigating complex regulatory pathways and securing favorable reimbursement from payers can be challenging.

- Competition from Alternative Therapies: Emerging gene therapies and other advanced treatment modalities present competitive pressures.

- Supply Chain Disruptions: Ensuring a consistent and reliable supply of specialized raw materials and finished products can be complex.

Emerging Opportunities in Antisense Oligonucleotides

Emerging opportunities in the Antisense Oligonucleotides (ASO) sector lie in expanding therapeutic indications beyond rare genetic diseases into more prevalent conditions. The development of ASOs for neurodegenerative disorders like Alzheimer's and Parkinson's disease, as well as cardiovascular diseases and metabolic disorders, represents a significant untapped market. Further innovation in delivery technologies, such as orally administered ASOs or advanced targeted delivery mechanisms to specific cell types, could revolutionize patient compliance and broaden accessibility. Furthermore, the application of ASOs in oncology, particularly for targeting specific oncogenic pathways or overcoming drug resistance, presents a promising frontier. The growing understanding of the human microbiome and its role in various diseases also opens avenues for ASO-based interventions.

Growth Accelerators in the Antisense Oligonucleotides Industry

Growth in the Antisense Oligonucleotides industry is being significantly accelerated by groundbreaking technological advancements that enhance the precision and efficacy of these therapies. The continuous refinement of ASO chemistry, leading to improved binding affinity, increased stability in vivo, and reduced off-target effects, is a key catalyst. Furthermore, the development of innovative delivery systems, such as targeted nanoparticles and novel conjugation strategies, is crucial for overcoming biological barriers and achieving effective drug distribution. Strategic partnerships between established pharmaceutical giants and agile biotechnology firms are also driving rapid progress by pooling resources, expertise, and research capabilities. Market expansion is further fueled by the increasing number of successful clinical trial outcomes for a wider range of diseases, building confidence among clinicians, patients, and investors, and subsequently leading to greater market penetration and adoption.

Key Players Shaping the Antisense Oligonucleotides Market

- Ionis Pharmaceuticals

- Sarepta Therapeutics

- Biogen

- Alnylam Pharmaceuticals

- Antisense Therapeutics

- Isarna Therapeutics

- Arrowhead Pharmaceuticals

- Atlantic Pharmaceuticals

- Enzon Pharmaceuticals

- Bio-Path Holdings

- GlaxoSmithKline

- Geron

- ICO Therapeutics

- Marina Biotech

- RXi Pharmaceuticals

Notable Milestones in Antisense Oligonucleotides Sector

- 2019: Approval of Spinraza (nusinersen) by Biogen for Spinal Muscular Atrophy, a landmark in ASO therapy.

- 2020: FDA approval of Waylivra (volanesorsen) by Ionis Pharmaceuticals for Familial Chylomicronemia Syndrome.

- 2021: Sarepta Therapeutics announces positive Phase 3 data for its ASO therapy targeting Duchenne Muscular Dystrophy.

- 2022: Alnylam Pharmaceuticals' siRNA therapy, ONPATTRO, demonstrates significant impact in treating hereditary transthyretin-mediated amyloidosis.

- 2023: Numerous preclinical and early-stage clinical trials initiated for ASOs targeting neurological disorders, cardiovascular diseases, and oncology.

- 2024: Increased investment in research and development of next-generation ASO technologies focusing on improved delivery and reduced immunogenicity.

In-Depth Antisense Oligonucleotides Market Outlook

The future of the Antisense Oligonucleotides market is exceptionally promising, driven by a confluence of sustained innovation and expanding therapeutic applications. Growth accelerators include the ongoing evolution of ASO chemistry for enhanced efficacy and safety, alongside breakthroughs in targeted delivery systems that promise to unlock treatment for a broader range of diseases. Strategic collaborations and acquisitions will continue to consolidate market leadership and foster pipeline development. The increasing recognition of ASOs as a viable and effective therapeutic modality for previously untreatable conditions, coupled with positive clinical outcomes and expanding regulatory approvals, will propel significant market penetration. The outlook suggests a robust expansion, with ASOs poised to become an integral part of precision medicine, addressing unmet medical needs across diverse patient populations.

Antisense Oligonucleotides Segmentation

-

1. Application

- 1.1. Hospitals

- 1.2. Clinic

- 1.3. Others

-

2. Type

- 2.1. RNA Antisense Oligonucleotides

- 2.2. DNA Antisense Oligonucleotides

Antisense Oligonucleotides Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Antisense Oligonucleotides REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Antisense Oligonucleotides Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospitals

- 5.1.2. Clinic

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. RNA Antisense Oligonucleotides

- 5.2.2. DNA Antisense Oligonucleotides

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Antisense Oligonucleotides Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospitals

- 6.1.2. Clinic

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. RNA Antisense Oligonucleotides

- 6.2.2. DNA Antisense Oligonucleotides

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Antisense Oligonucleotides Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospitals

- 7.1.2. Clinic

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. RNA Antisense Oligonucleotides

- 7.2.2. DNA Antisense Oligonucleotides

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Antisense Oligonucleotides Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospitals

- 8.1.2. Clinic

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. RNA Antisense Oligonucleotides

- 8.2.2. DNA Antisense Oligonucleotides

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Antisense Oligonucleotides Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospitals

- 9.1.2. Clinic

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. RNA Antisense Oligonucleotides

- 9.2.2. DNA Antisense Oligonucleotides

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Antisense Oligonucleotides Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospitals

- 10.1.2. Clinic

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. RNA Antisense Oligonucleotides

- 10.2.2. DNA Antisense Oligonucleotides

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ionis Pharmaceuticals

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sarepta Therapeutics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Biogen

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Alnylam Pharmaceuticals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Antisense Therapeutics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Isarna Therapeutics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Arrowhead Pharmaceuticals

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Atlantic Pharmaceuticals

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Enzon Pharmaceuticals

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bio-Path Holdings

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 GlaxoSmithKline

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Geron

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 ICO Therapeutics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Marina Biotech

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 RXi Pharmaceuticals

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Ionis Pharmaceuticals

List of Figures

- Figure 1: Global Antisense Oligonucleotides Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Antisense Oligonucleotides Revenue (million), by Application 2024 & 2032

- Figure 3: North America Antisense Oligonucleotides Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Antisense Oligonucleotides Revenue (million), by Type 2024 & 2032

- Figure 5: North America Antisense Oligonucleotides Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Antisense Oligonucleotides Revenue (million), by Country 2024 & 2032

- Figure 7: North America Antisense Oligonucleotides Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Antisense Oligonucleotides Revenue (million), by Application 2024 & 2032

- Figure 9: South America Antisense Oligonucleotides Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Antisense Oligonucleotides Revenue (million), by Type 2024 & 2032

- Figure 11: South America Antisense Oligonucleotides Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Antisense Oligonucleotides Revenue (million), by Country 2024 & 2032

- Figure 13: South America Antisense Oligonucleotides Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Antisense Oligonucleotides Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Antisense Oligonucleotides Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Antisense Oligonucleotides Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Antisense Oligonucleotides Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Antisense Oligonucleotides Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Antisense Oligonucleotides Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Antisense Oligonucleotides Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Antisense Oligonucleotides Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Antisense Oligonucleotides Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Antisense Oligonucleotides Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Antisense Oligonucleotides Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Antisense Oligonucleotides Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Antisense Oligonucleotides Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Antisense Oligonucleotides Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Antisense Oligonucleotides Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Antisense Oligonucleotides Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Antisense Oligonucleotides Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Antisense Oligonucleotides Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Antisense Oligonucleotides Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Antisense Oligonucleotides Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Antisense Oligonucleotides Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Antisense Oligonucleotides Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Antisense Oligonucleotides Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Antisense Oligonucleotides Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Antisense Oligonucleotides Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Antisense Oligonucleotides Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Antisense Oligonucleotides Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Antisense Oligonucleotides Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Antisense Oligonucleotides Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Antisense Oligonucleotides Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Antisense Oligonucleotides Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Antisense Oligonucleotides Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Antisense Oligonucleotides Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Antisense Oligonucleotides Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Antisense Oligonucleotides Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Antisense Oligonucleotides Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Antisense Oligonucleotides Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Antisense Oligonucleotides Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Antisense Oligonucleotides?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Antisense Oligonucleotides?

Key companies in the market include Ionis Pharmaceuticals, Sarepta Therapeutics, Biogen, Alnylam Pharmaceuticals, Antisense Therapeutics, Isarna Therapeutics, Arrowhead Pharmaceuticals, Atlantic Pharmaceuticals, Enzon Pharmaceuticals, Bio-Path Holdings, GlaxoSmithKline, Geron, ICO Therapeutics, Marina Biotech, RXi Pharmaceuticals.

3. What are the main segments of the Antisense Oligonucleotides?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Antisense Oligonucleotides," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Antisense Oligonucleotides report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Antisense Oligonucleotides?

To stay informed about further developments, trends, and reports in the Antisense Oligonucleotides, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence