Key Insights

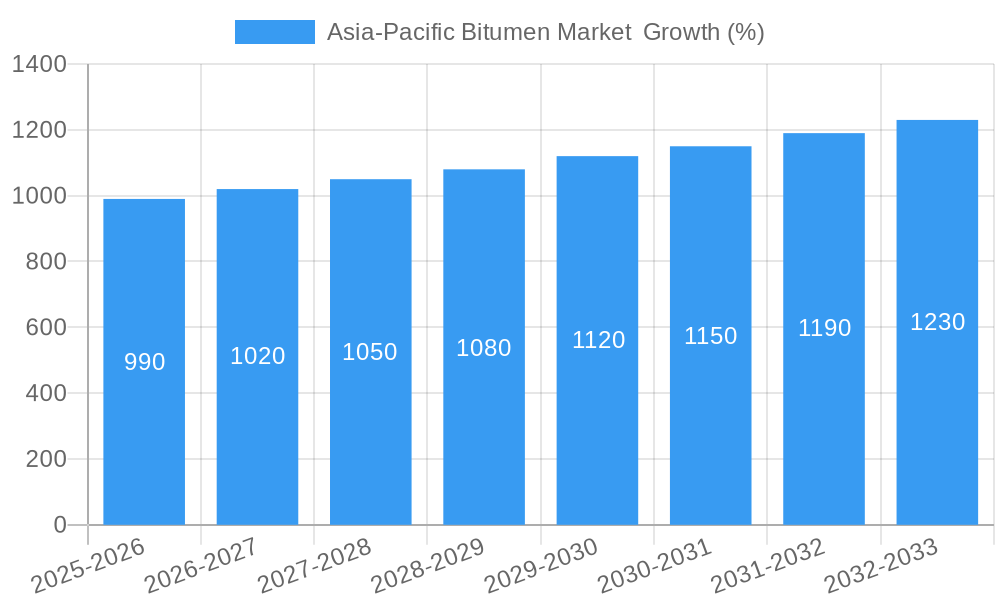

The Asia-Pacific bitumen market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 4.90% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, significant infrastructure development projects across the region, particularly in rapidly developing economies like India and China, are creating substantial demand for bitumen in road construction. The burgeoning urbanization and increasing vehicle ownership are further accelerating this demand. Secondly, the growing adoption of bitumen in waterproofing applications, particularly in the construction of commercial and residential buildings, is contributing to market growth. Furthermore, the increasing use of polymer-modified bitumen, offering enhanced performance characteristics like durability and flexibility, is driving market expansion within the paving and waterproofing segments. While challenges such as fluctuating crude oil prices and environmental concerns regarding bitumen's carbon footprint exist, the overall market outlook remains positive, particularly given the sustained focus on infrastructure development across the Asia-Pacific region.

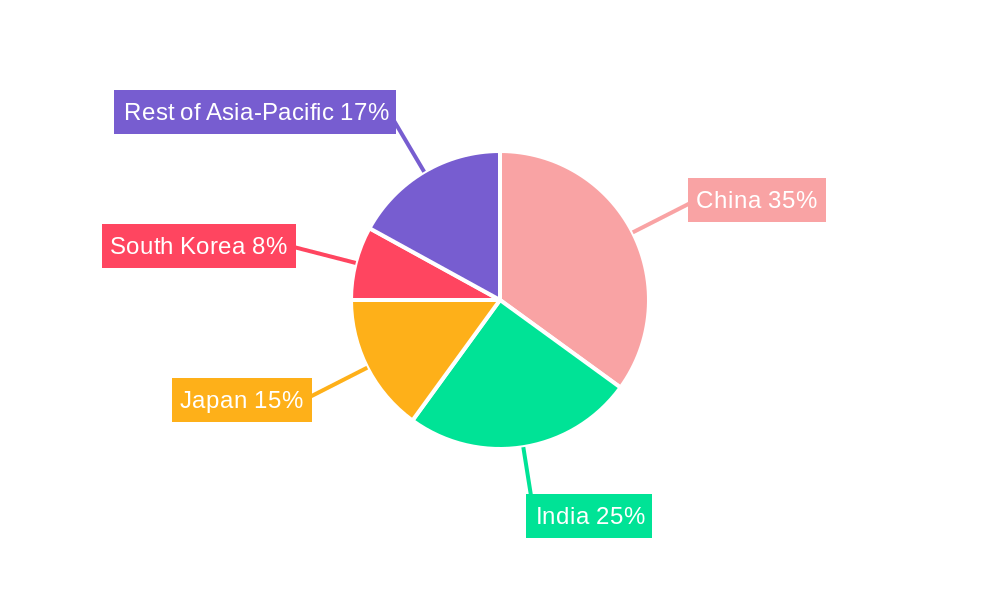

Despite potential restraints like fluctuating crude oil prices and environmental regulations, the Asia-Pacific bitumen market's growth trajectory remains strong. The market segmentation reveals a diverse landscape, with paving-grade bitumen holding the largest market share, reflecting the dominant role of road construction. However, other segments like polymer-modified bitumen are witnessing rapid growth due to their enhanced performance properties. Key players, including Marathon Oil Company, ExxonMobil Corporation, and China Petroleum & Chemical Corporation, are actively shaping the market dynamics through investments in production capacity and technological advancements. The regional breakdown shows China, India, and Japan as major contributors to market revenue, reflecting their extensive infrastructure development initiatives. The continued focus on sustainable infrastructure solutions and advancements in bitumen technology will likely further propel market growth throughout the forecast period.

Asia-Pacific Bitumen Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific bitumen market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with 2025 as the base year and a forecast period of 2025-2033. The study examines various segments within the market, including product types (Paving Grade, Hard Grade, Oxidized Grade, Bitumen Emulsions, Polymer Modified Bitumen, and Other Product Types) and applications (Road Construction, Waterproofing, Adhesives, and Other Applications). This report is essential for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on the growth opportunities within this dynamic market.

Asia-Pacific Bitumen Market Market Dynamics & Structure

The Asia-Pacific bitumen market is characterized by a moderately concentrated structure, with several major players holding significant market share. Market concentration is influenced by factors such as economies of scale, technological capabilities, and access to raw materials. Technological innovation, particularly in modified bitumen products, is a key driver, improving performance and expanding application possibilities. Stringent regulatory frameworks related to environmental sustainability and road construction standards shape industry practices. The market faces competition from substitute materials such as asphalt concrete and recycled materials; however, bitumen's advantages in certain applications maintain its market position. End-user demographics, particularly rapid urbanization and infrastructure development in several Asian countries, significantly influence market demand. M&A activity in the sector is moderate, with strategic acquisitions focused on expanding geographical reach and product portfolios.

- Market Concentration: xx% held by top 5 players (2024).

- Technological Innovation: Focus on polymer-modified bitumen and sustainable solutions.

- Regulatory Landscape: Stringent environmental regulations impacting production and usage.

- Competitive Substitutes: Asphalt concrete and recycled materials pose competitive challenges.

- M&A Activity: xx deals recorded between 2019-2024, primarily focused on consolidation.

- Innovation Barriers: High R&D costs and regulatory approvals hinder innovation.

Asia-Pacific Bitumen Market Growth Trends & Insights

The Asia-Pacific bitumen market experienced robust growth during the historical period (2019-2024), driven by burgeoning infrastructure development across the region. Significant investments in road construction projects, particularly in rapidly developing economies, fueled demand for bitumen. The market's growth trajectory reflects a strong correlation between infrastructure spending and bitumen consumption. Adoption rates for high-performance bitumen products, such as polymer-modified bitumen, are increasing due to their enhanced durability and performance characteristics. Technological disruptions, such as the development of sustainable and eco-friendly bitumen alternatives, are gradually shaping market dynamics. Consumer behavior shifts toward environmentally conscious construction practices present both challenges and opportunities for market players. The market is anticipated to register a CAGR of xx% during the forecast period (2025-2033), driven by continued infrastructure development, particularly in Southeast Asia and India. Market penetration for polymer-modified bitumen is projected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Asia-Pacific Bitumen Market

China and India represent the largest national markets within the Asia-Pacific bitumen sector, accounting for xx% and xx% of the total market volume in 2024 respectively. These countries’ extensive road construction programs and rapid urbanization drive significant bitumen demand. Southeast Asian nations are also experiencing substantial growth, driven by expanding infrastructure projects and economic development. Within product types, paving-grade bitumen holds the largest market share, owing to its widespread use in road construction. Road construction remains the dominant application segment, significantly contributing to overall bitumen consumption.

Key Growth Drivers:

- Massive infrastructure development projects (roads, highways, airports).

- Rapid urbanization and population growth.

- Government initiatives promoting infrastructure spending.

- Increasing adoption of polymer-modified bitumen.

Dominance Factors:

- Extensive road networks under development in China and India.

- High construction activity in Southeast Asia.

- Favorable government policies supporting infrastructure projects.

- Cost-effectiveness and performance advantages of paving-grade bitumen.

Asia-Pacific Bitumen Market Product Landscape

The Asia-Pacific bitumen market offers a diverse range of products, including paving-grade, hard-grade, oxidized-grade bitumen, bitumen emulsions, and polymer-modified bitumen. Recent innovations have focused on enhancing performance characteristics, such as improved durability, flexibility, and resistance to environmental factors. Polymer-modified bitumen is gaining traction due to its superior properties, extending the lifespan of road infrastructure. Product development is driven by the need for sustainable and environmentally friendly alternatives, aligning with global sustainability goals. The market also sees specialized products for applications like waterproofing and adhesives.

Key Drivers, Barriers & Challenges in Asia-Pacific Bitumen Market

Key Drivers: The primary drivers of market growth are the ongoing expansion of road infrastructure across the region, coupled with rapid urbanization and industrialization. Government initiatives promoting infrastructure development, coupled with increasing investments in transportation networks, significantly bolster demand. The growing adoption of polymer-modified bitumen, offering superior performance, also fuels market growth.

Key Challenges: Fluctuations in crude oil prices directly impact bitumen pricing and profitability. Environmental regulations related to bitumen production and disposal present challenges for manufacturers. Intense competition among various bitumen producers can also create price pressures. Supply chain disruptions, particularly regarding raw material availability, can affect production and delivery.

Emerging Opportunities in Asia-Pacific Bitumen Market

The Asia-Pacific bitumen market presents several promising opportunities. The increasing focus on sustainable infrastructure development creates demand for environmentally friendly bitumen alternatives. Expansion into new applications, such as waterproofing and industrial construction, offers untapped potential. The growing adoption of advanced technologies in bitumen production and application further fuels growth. Moreover, leveraging digital technologies to improve supply chain efficiency and enhance customer relationships presents significant opportunities.

Growth Accelerators in the Asia-Pacific Bitumen Market Industry

Long-term growth in the Asia-Pacific bitumen market will be driven by sustained investment in infrastructure development, particularly in emerging economies. Technological advancements in bitumen modification and production processes, enhancing performance and sustainability, will continue to drive market expansion. Strategic partnerships between bitumen producers and construction companies can further optimize production and distribution. Expansion into new geographical markets and diversification into adjacent industries will create additional growth opportunities.

Key Players Shaping the Asia-Pacific Bitumen Market Market

- Marathon Oil Company

- Richmond Group

- Exxon Mobil Corporation

- ASIA Bitumen

- China Petroleum & Chemical Corporation

- Bouygues

- JXTG Nippon Oil & Energy Corporation

- KRATON CORPORATION

- BP PLC

- Indian Oil Corporation Ltd

- RAHA Bitumen Inc

- Icopal ApS

- Shell Plc

- *List Not Exhaustive

Notable Milestones in Asia-Pacific Bitumen Market Sector

- April 2023: Downer Group launched a new Ammann plant in Australia, capable of processing up to three granular and three liquid additives, with a storage capacity of 6,000 tonnes of aggregate and 720 cubic meters of bitumen. This signifies advancements in bitumen processing and additive integration.

- February 2023: Porner Group announced plans to construct three new bitumen production plants for IOCL in India, utilizing its Biturox process. The Barauni plant (300 KTPA) and Paradip plant (500 KTPA) will significantly enhance bitumen production capacity in Eastern and Western India respectively.

In-Depth Asia-Pacific Bitumen Market Market Outlook

The Asia-Pacific bitumen market is poised for sustained growth driven by ongoing infrastructure development, technological advancements, and increasing demand for high-performance bitumen products. Strategic investments in research and development, coupled with innovative product offerings and expansion into new applications, will shape the future landscape. The focus on sustainable and environmentally friendly solutions will be critical for long-term success in this dynamic market. The market's future potential is significant, presenting attractive opportunities for both established players and new entrants.

Asia-Pacific Bitumen Market Segmentation

-

1. Product Type

- 1.1. Paving Grade

- 1.2. Hard Grade

- 1.3. Oxidized Grade

- 1.4. Bitumen Emulsions

- 1.5. Polymer Modified Bitumen

- 1.6. Other Pr

-

2. Application

- 2.1. Road Construction

- 2.2. Waterproofing

- 2.3. Adhesives

- 2.4. Other Applications (Coating and Canal Lining)

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. ASEAN Countries

- 3.6. Rest of Asia-Pacific

Asia-Pacific Bitumen Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. ASEAN Countries

- 6. Rest of Asia Pacific

Asia-Pacific Bitumen Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Roadways Network in China and India; Increasing Demand for Waterproofing Applications; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Environmental Concerns Regarding the Usage of Bitumen; Concrete as a Substitute for Bitumen in Road Construction

- 3.4. Market Trends

- 3.4.1. Road Construction Application to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Paving Grade

- 5.1.2. Hard Grade

- 5.1.3. Oxidized Grade

- 5.1.4. Bitumen Emulsions

- 5.1.5. Polymer Modified Bitumen

- 5.1.6. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Road Construction

- 5.2.2. Waterproofing

- 5.2.3. Adhesives

- 5.2.4. Other Applications (Coating and Canal Lining)

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. ASEAN Countries

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. ASEAN Countries

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Paving Grade

- 6.1.2. Hard Grade

- 6.1.3. Oxidized Grade

- 6.1.4. Bitumen Emulsions

- 6.1.5. Polymer Modified Bitumen

- 6.1.6. Other Pr

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Road Construction

- 6.2.2. Waterproofing

- 6.2.3. Adhesives

- 6.2.4. Other Applications (Coating and Canal Lining)

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. ASEAN Countries

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. India Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Paving Grade

- 7.1.2. Hard Grade

- 7.1.3. Oxidized Grade

- 7.1.4. Bitumen Emulsions

- 7.1.5. Polymer Modified Bitumen

- 7.1.6. Other Pr

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Road Construction

- 7.2.2. Waterproofing

- 7.2.3. Adhesives

- 7.2.4. Other Applications (Coating and Canal Lining)

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. ASEAN Countries

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Japan Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Paving Grade

- 8.1.2. Hard Grade

- 8.1.3. Oxidized Grade

- 8.1.4. Bitumen Emulsions

- 8.1.5. Polymer Modified Bitumen

- 8.1.6. Other Pr

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Road Construction

- 8.2.2. Waterproofing

- 8.2.3. Adhesives

- 8.2.4. Other Applications (Coating and Canal Lining)

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. ASEAN Countries

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South Korea Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Paving Grade

- 9.1.2. Hard Grade

- 9.1.3. Oxidized Grade

- 9.1.4. Bitumen Emulsions

- 9.1.5. Polymer Modified Bitumen

- 9.1.6. Other Pr

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Road Construction

- 9.2.2. Waterproofing

- 9.2.3. Adhesives

- 9.2.4. Other Applications (Coating and Canal Lining)

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. ASEAN Countries

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. ASEAN Countries Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Paving Grade

- 10.1.2. Hard Grade

- 10.1.3. Oxidized Grade

- 10.1.4. Bitumen Emulsions

- 10.1.5. Polymer Modified Bitumen

- 10.1.6. Other Pr

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Road Construction

- 10.2.2. Waterproofing

- 10.2.3. Adhesives

- 10.2.4. Other Applications (Coating and Canal Lining)

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. ASEAN Countries

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Asia Pacific Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Paving Grade

- 11.1.2. Hard Grade

- 11.1.3. Oxidized Grade

- 11.1.4. Bitumen Emulsions

- 11.1.5. Polymer Modified Bitumen

- 11.1.6. Other Pr

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Road Construction

- 11.2.2. Waterproofing

- 11.2.3. Adhesives

- 11.2.4. Other Applications (Coating and Canal Lining)

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. South Korea

- 11.3.5. ASEAN Countries

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. China Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 13. Japan Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 14. India Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 15. South Korea Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 16. Taiwan Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 17. Australia Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Asia-Pacific Asia-Pacific Bitumen Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Marathon Oil Company

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Richmond Group

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Exxon Mobil Corporation

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 ASIA Bitumen

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 China Petroleum & Chemical Corporation

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Bouygues

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 JXTG Nippon Oil & Energy Corporation

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 KRATON CORPORATION

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 BP PLC

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Indian Oil Corporation Ltd

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.11 RAHA Bitumen Inc

- 19.2.11.1. Overview

- 19.2.11.2. Products

- 19.2.11.3. SWOT Analysis

- 19.2.11.4. Recent Developments

- 19.2.11.5. Financials (Based on Availability)

- 19.2.12 Icopal ApS

- 19.2.12.1. Overview

- 19.2.12.2. Products

- 19.2.12.3. SWOT Analysis

- 19.2.12.4. Recent Developments

- 19.2.12.5. Financials (Based on Availability)

- 19.2.13 Shell Plc*List Not Exhaustive

- 19.2.13.1. Overview

- 19.2.13.2. Products

- 19.2.13.3. SWOT Analysis

- 19.2.13.4. Recent Developments

- 19.2.13.5. Financials (Based on Availability)

- 19.2.1 Marathon Oil Company

List of Figures

- Figure 1: Asia-Pacific Bitumen Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Bitumen Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Bitumen Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Bitumen Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Asia-Pacific Bitumen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Asia-Pacific Bitumen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Asia-Pacific Bitumen Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Bitumen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia-Pacific Bitumen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia-Pacific Bitumen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia-Pacific Bitumen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Bitumen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia-Pacific Bitumen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Bitumen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia-Pacific Bitumen Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia-Pacific Bitumen Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Asia-Pacific Bitumen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Asia-Pacific Bitumen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Asia-Pacific Bitumen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Asia-Pacific Bitumen Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Asia-Pacific Bitumen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Asia-Pacific Bitumen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia-Pacific Bitumen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia-Pacific Bitumen Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Asia-Pacific Bitumen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Asia-Pacific Bitumen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Asia-Pacific Bitumen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Asia-Pacific Bitumen Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 27: Asia-Pacific Bitumen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Asia-Pacific Bitumen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Asia-Pacific Bitumen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Bitumen Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Asia-Pacific Bitumen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Asia-Pacific Bitumen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Asia-Pacific Bitumen Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Asia-Pacific Bitumen Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 35: Asia-Pacific Bitumen Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Asia-Pacific Bitumen Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 37: Asia-Pacific Bitumen Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Bitumen Market ?

The projected CAGR is approximately 4.90%.

2. Which companies are prominent players in the Asia-Pacific Bitumen Market ?

Key companies in the market include Marathon Oil Company, Richmond Group, Exxon Mobil Corporation, ASIA Bitumen, China Petroleum & Chemical Corporation, Bouygues, JXTG Nippon Oil & Energy Corporation, KRATON CORPORATION, BP PLC, Indian Oil Corporation Ltd, RAHA Bitumen Inc, Icopal ApS, Shell Plc*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Bitumen Market ?

The market segments include Product Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Roadways Network in China and India; Increasing Demand for Waterproofing Applications; Other Drivers.

6. What are the notable trends driving market growth?

Road Construction Application to Dominate the Market.

7. Are there any restraints impacting market growth?

Environmental Concerns Regarding the Usage of Bitumen; Concrete as a Substitute for Bitumen in Road Construction.

8. Can you provide examples of recent developments in the market?

April 2023: Downer Group commenced an Ammann plant based on the success of its other Ammann plants in Australia. Downer can include up to three different granular additive types in a mix and up to three liquid additives. The facility can vertically store 6,000 tonnes of aggregate and 720 cubic meters of bitumen.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Bitumen Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Bitumen Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Bitumen Market ?

To stay informed about further developments, trends, and reports in the Asia-Pacific Bitumen Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence