Key Insights

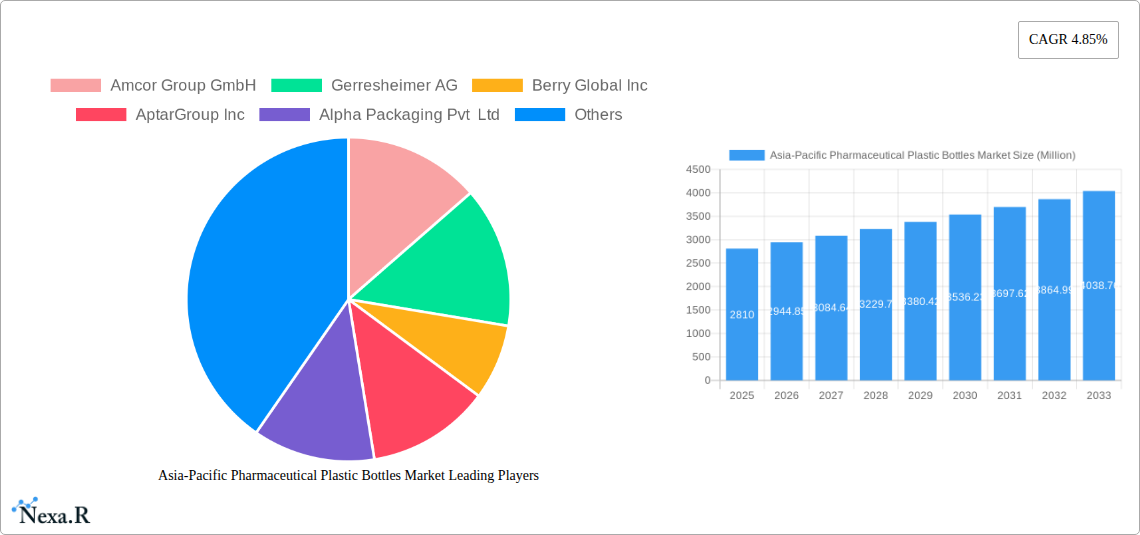

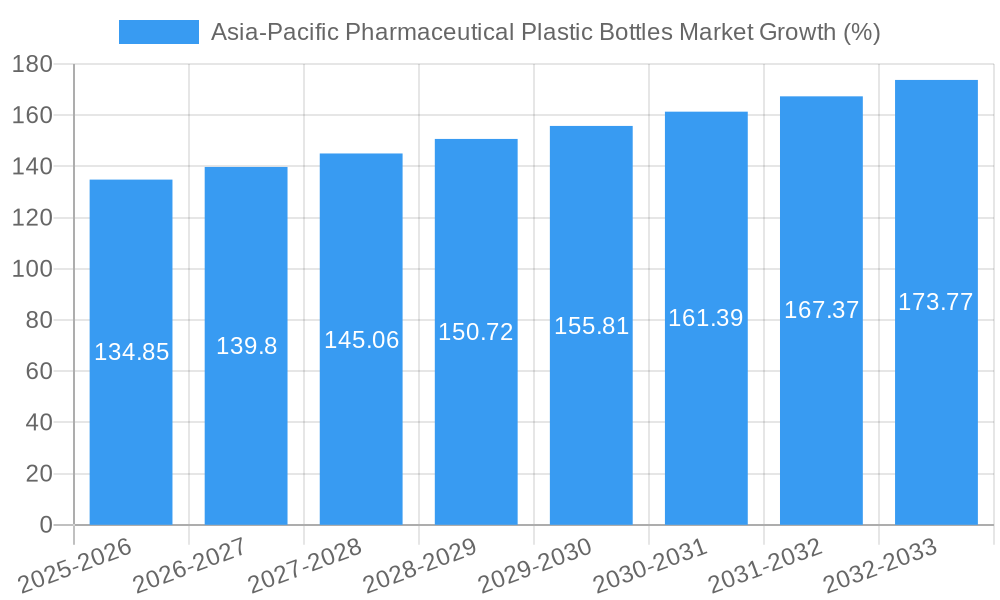

The Asia-Pacific pharmaceutical plastic bottles market is experiencing robust growth, projected to reach a value of $2.81 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 4.85% from 2019 to 2033. This expansion is fueled by several key factors. The rising prevalence of chronic diseases across the region necessitates increased pharmaceutical production and packaging, driving demand for plastic bottles. Furthermore, the increasing adoption of single-dose and multi-dose packaging formats, preferred for their convenience, hygiene, and cost-effectiveness, significantly contributes to market growth. Technological advancements in plastic bottle manufacturing, including the development of lighter-weight, more durable, and tamper-evident containers, further enhance market appeal. Stringent regulatory frameworks regarding pharmaceutical packaging, ensuring product safety and integrity, also play a crucial role. However, growing environmental concerns regarding plastic waste and the increasing adoption of alternative packaging materials present a challenge to market growth. Competitive landscape analysis reveals major players such as Amcor, Gerresheimer, Berry Global, and AptarGroup are actively innovating and expanding their product portfolios to cater to the evolving needs of the pharmaceutical industry.

The forecast period of 2025-2033 is poised for continued growth, driven by rising healthcare expenditure, expanding pharmaceutical manufacturing capacity, and increased focus on supply chain optimization within the pharmaceutical sector. The market segmentation reveals a strong preference for specific bottle types depending on the pharmaceutical application. Regional variations are also apparent, with countries experiencing rapid economic development and rising healthcare infrastructure investments showcasing the highest growth potential. This underscores the importance of targeted marketing and distribution strategies for companies operating in this dynamic market. Continued innovation in sustainable packaging materials and manufacturing processes will be essential for maintaining market share and addressing environmental concerns. The ongoing shift toward personalized medicine will further shape the market as demand for specialized and customized plastic packaging solutions increases.

Asia-Pacific Pharmaceutical Plastic Bottles Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific Pharmaceutical Plastic Bottles Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously examines the parent market of pharmaceutical packaging and the child market of plastic bottles within the Asia-Pacific region, offering invaluable insights for industry professionals. The market size is projected in Million units.

Asia-Pacific Pharmaceutical Plastic Bottles Market Dynamics & Structure

This section delves into the intricate structure and dynamics of the Asia-Pacific Pharmaceutical Plastic Bottles Market. We analyze market concentration, revealing the market share held by leading players like Amcor Group GmbH, Gerresheimer AG, and Berry Global Inc. The report also examines the influence of technological innovation, specifically advancements in sustainable and recyclable materials, on market growth. Regulatory frameworks impacting plastic usage in pharmaceuticals across different Asia-Pacific nations are scrutinized, along with the presence and impact of competitive product substitutes (e.g., glass, alternative materials). End-user demographics, including hospital preferences, pharmaceutical companies' needs, and consumer demand for specific bottle types are detailed. Finally, the report includes a quantitative and qualitative analysis of mergers and acquisitions (M&A) activity within the sector, assessing deal volumes and identifying trends in consolidation.

- Market Concentration: xx% of the market is controlled by the top 5 players (predicted value)

- Technological Innovation: Focus on sustainable materials (PET, recycled PET) is a major driver.

- Regulatory Landscape: Varying regulations across countries influence material choices and production processes.

- Competitive Substitutes: Glass containers remain a significant competitor, but plastic offers cost and lightweight advantages.

- M&A Activity: xx deals recorded in the last 5 years (predicted value), indicating industry consolidation.

- Innovation Barriers: High initial investment for sustainable material adoption, regulatory complexities.

Asia-Pacific Pharmaceutical Plastic Bottles Market Growth Trends & Insights

This section leverages extensive data analysis to present a comprehensive overview of market size evolution, adoption rates of different bottle types, technological disruptions impacting manufacturing processes, and consumer behavior shifts concerning pharmaceutical packaging preferences. The report utilizes a robust methodology to determine the Compound Annual Growth Rate (CAGR) and market penetration rates for various segments within the Asia-Pacific region.

- Market Size Evolution (Million units): 2019 (xx), 2024 (xx), 2025 (xx), 2033 (xx) (predicted values)

- CAGR (2025-2033): xx% (predicted value)

- Market Penetration: xx% in 2025 (predicted value), projected to increase to xx% by 2033 (predicted value).

- Technological Disruptions: Automation in manufacturing, 3D printing for customized bottles are reshaping production.

- Consumer Behavior Shifts: Increasing demand for sustainable and convenient packaging.

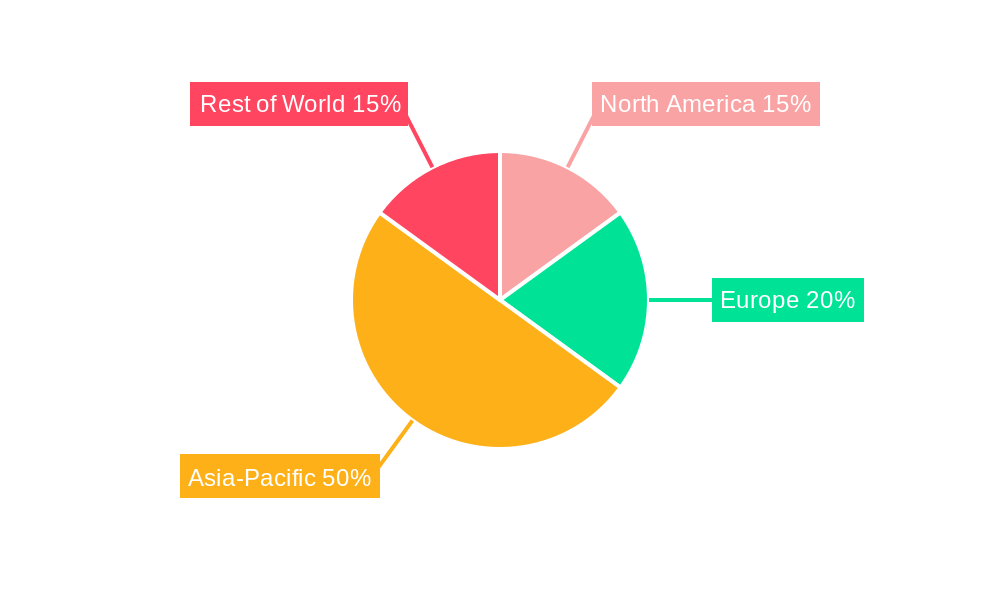

Dominant Regions, Countries, or Segments in Asia-Pacific Pharmaceutical Plastic Bottles Market

This section identifies the leading regions, countries, and segments driving market growth within the Asia-Pacific Pharmaceutical Plastic Bottles Market. Key drivers such as economic policies promoting domestic manufacturing, investments in healthcare infrastructure, and stringent regulatory frameworks are highlighted using bullet points. Paragraphs analyze the dominance of specific regions and countries, considering factors like market share, growth potential, and consumer demand.

- Leading Region/Country: China is expected to hold the largest market share, driven by its massive pharmaceutical industry and expanding healthcare infrastructure. India exhibits significant growth potential.

- Key Drivers: Increasing government healthcare spending in several countries, rising prevalence of chronic diseases.

- Dominance Factors: Strong domestic pharmaceutical manufacturing capabilities, rising disposable income, increasing awareness regarding healthcare.

- Growth Potential: Southeast Asia is expected to witness significant growth due to increasing healthcare investments and rising population.

Asia-Pacific Pharmaceutical Plastic Bottles Market Product Landscape

This section offers a concise overview of the product landscape, including innovative bottle designs, various applications in pharmaceutical packaging (e.g., liquid, solid, powder), and performance metrics like barrier properties, sterility, and ease of use. The unique selling propositions (USPs) of various plastic bottle types and recent technological advancements are highlighted.

Key Drivers, Barriers & Challenges in Asia-Pacific Pharmaceutical Plastic Bottles Market

This section analyzes the key factors driving market growth and the significant challenges faced by stakeholders.

Key Drivers:

- Increasing demand for pharmaceutical products in the region

- Growing focus on sustainable and eco-friendly packaging

- Technological advancements in plastic bottle manufacturing

Key Challenges & Restraints:

- Fluctuations in raw material prices (e.g., PET resin)

- Stringent environmental regulations concerning plastic waste

- Intense competition among existing players

Emerging Opportunities in Asia-Pacific Pharmaceutical Plastic Bottles Market

This section explores the exciting potential of untapped markets, innovative applications, and shifts in consumer preferences. The focus is on identifying opportunities for growth and expansion in the Asia-Pacific pharmaceutical plastic bottle market.

Growth Accelerators in the Asia-Pacific Pharmaceutical Plastic Bottles Market Industry

Technological breakthroughs in material science, leading to more sustainable and efficient packaging solutions, are significant growth catalysts. Strategic partnerships and collaborations between plastic manufacturers and pharmaceutical companies, along with expansion strategies into new markets within the Asia-Pacific region, will further accelerate growth.

Key Players Shaping the Asia-Pacific Pharmaceutical Plastic Bottles Market Market

- Amcor Group GmbH

- Gerresheimer AG

- Berry Global Inc

- AptarGroup Inc

- Alpha Packaging Pvt Ltd

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Silgan Holdings Inc

- Chemco Group

- Supple Pack (India) Private Limited

- LOG Pharma Packaging

- Dongguan Fukang Plastic Products Co Lt

Notable Milestones in Asia-Pacific Pharmaceutical Plastic Bottles Market Sector

- January 2024: Bormioli Pharma and Loop Industries launch a pharmaceutical bottle made from 100% recycled Loop PET resin. This marks a significant advancement towards a circular economy for pharmaceutical packaging.

- July 2023: Otsuka Pharmaceutical and Tokushima Prefecture collaborate to advance "bottle-to-bottle" recycling for PET bottles, promoting sustainability.

In-Depth Asia-Pacific Pharmaceutical Plastic Bottles Market Market Outlook

The Asia-Pacific Pharmaceutical Plastic Bottles Market is poised for robust growth, driven by increasing healthcare spending, technological advancements in sustainable packaging, and a growing focus on reducing environmental impact. Strategic partnerships and investments in innovative packaging solutions will be crucial for companies to capitalize on the substantial market potential. The market is expected to show strong growth in the coming years.

Asia-Pacific Pharmaceutical Plastic Bottles Market Segmentation

-

1. Raw Material

- 1.1. Polyethylene Terephthalate (PET)

- 1.2. Polypropylene (PP)

- 1.3. Low-density Polyethylene (LDPE)

- 1.4. High-density Polyethylene (HDPE)

-

2. Type

- 2.1. Dropper Bottles

- 2.2. Nasal Spray Bottles

- 2.3. Liquid Bottles

- 2.4. Oral Care

- 2.5. Other Types

Asia-Pacific Pharmaceutical Plastic Bottles Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Pharmaceutical Plastic Bottles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.85% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Pharmaceutical Packaging Adoption Fuels Growth of the Market; Rising Demand for Child-Resistant Packaging

- 3.3. Market Restrains

- 3.3.1. Expanding Pharmaceutical Packaging Adoption Fuels Growth of the Market; Rising Demand for Child-Resistant Packaging

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET) is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Polyethylene Terephthalate (PET)

- 5.1.2. Polypropylene (PP)

- 5.1.3. Low-density Polyethylene (LDPE)

- 5.1.4. High-density Polyethylene (HDPE)

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Dropper Bottles

- 5.2.2. Nasal Spray Bottles

- 5.2.3. Liquid Bottles

- 5.2.4. Oral Care

- 5.2.5. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Amcor Group GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gerresheimer AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Berry Global Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AptarGroup Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alpha Packaging Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ALPLA Werke Alwin Lehner GmbH & Co KG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Silgan Holdings Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Chemco Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Supple Pack (India) Private Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LOG Pharma Packaging

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dongguan Fukang Plastic Products Co Lt

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Amcor Group GmbH

List of Figures

- Figure 1: Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Pharmaceutical Plastic Bottles Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Pharmaceutical Plastic Bottles Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 4: Asia-Pacific Pharmaceutical Plastic Bottles Market Volume Billion Forecast, by Raw Material 2019 & 2032

- Table 5: Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Asia-Pacific Pharmaceutical Plastic Bottles Market Volume Billion Forecast, by Type 2019 & 2032

- Table 7: Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia-Pacific Pharmaceutical Plastic Bottles Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 10: Asia-Pacific Pharmaceutical Plastic Bottles Market Volume Billion Forecast, by Raw Material 2019 & 2032

- Table 11: Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Asia-Pacific Pharmaceutical Plastic Bottles Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Asia-Pacific Pharmaceutical Plastic Bottles Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: China Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: China Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: South Korea Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: India Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Australia Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Australia Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: New Zealand Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: New Zealand Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Malaysia Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Malaysia Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Singapore Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Singapore Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Thailand Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Thailand Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Vietnam Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Vietnam Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Philippines Asia-Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Philippines Asia-Pacific Pharmaceutical Plastic Bottles Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Pharmaceutical Plastic Bottles Market?

The projected CAGR is approximately 4.85%.

2. Which companies are prominent players in the Asia-Pacific Pharmaceutical Plastic Bottles Market?

Key companies in the market include Amcor Group GmbH, Gerresheimer AG, Berry Global Inc, AptarGroup Inc, Alpha Packaging Pvt Ltd, ALPLA Werke Alwin Lehner GmbH & Co KG, Silgan Holdings Inc, Chemco Group, Supple Pack (India) Private Limited, LOG Pharma Packaging, Dongguan Fukang Plastic Products Co Lt.

3. What are the main segments of the Asia-Pacific Pharmaceutical Plastic Bottles Market?

The market segments include Raw Material, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Pharmaceutical Packaging Adoption Fuels Growth of the Market; Rising Demand for Child-Resistant Packaging.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET) is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Expanding Pharmaceutical Packaging Adoption Fuels Growth of the Market; Rising Demand for Child-Resistant Packaging.

8. Can you provide examples of recent developments in the market?

January 2024: Bormioli Pharma, a player in pharmaceutical packaging and medical devices in China, and Loop Industries Inc., a pioneer in clean technology, introduced a pharmaceutical packaging bottle. This bottle is crafted entirely from 100% recycled, virgin-quality Loop PET resin, marking a significant step toward a circular plastics economy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Pharmaceutical Plastic Bottles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Pharmaceutical Plastic Bottles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Pharmaceutical Plastic Bottles Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Pharmaceutical Plastic Bottles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence