Key Insights

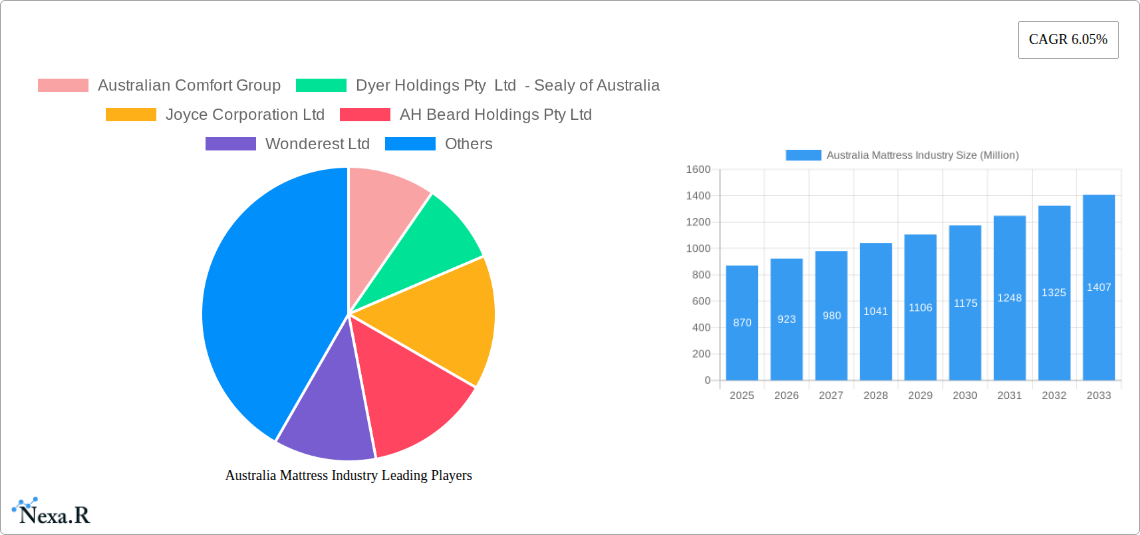

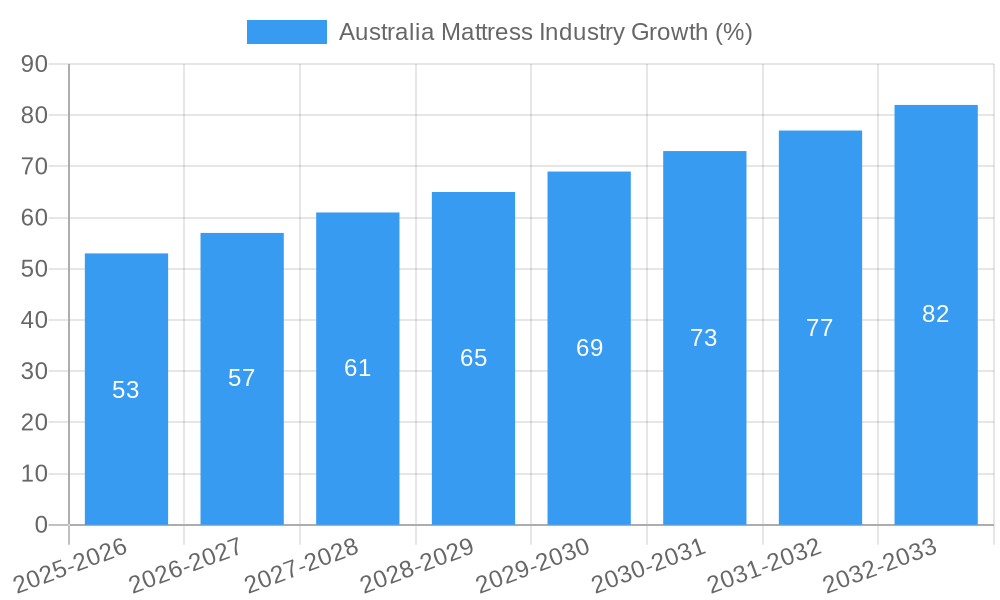

The Australian mattress industry, valued at $0.87 billion in 2025, is projected to experience robust growth, driven by several key factors. Rising disposable incomes, coupled with increased awareness of the importance of sleep quality and its impact on overall health and wellbeing, are fueling demand for higher-quality mattresses. The industry is witnessing a shift towards technologically advanced mattresses incorporating features like memory foam, cooling technologies, and adjustable bases, catering to diverse consumer preferences and needs. Furthermore, the growth of online retail channels and the increasing popularity of direct-to-consumer brands are disrupting traditional retail models, offering consumers greater convenience and choice. Key players like Australian Comfort Group, Sealy, and Koala Sleep are strategically navigating this evolving landscape through product innovation, targeted marketing campaigns, and expansion into new distribution channels.

However, the industry also faces challenges. Fluctuations in raw material prices, particularly those related to foam and other components, can impact profitability. The competitive landscape is intensifying, with both established players and new entrants vying for market share. Maintaining sustainable supply chains and managing environmental concerns, particularly regarding mattress disposal and material sourcing, are also emerging as critical considerations for industry participants. The industry's future growth will depend on its ability to innovate, adapt to changing consumer preferences, and address these challenges effectively. Considering a 6.05% CAGR, we can project a market size exceeding $1.2 billion by 2033, assuming consistent economic growth and no significant disruptions. This projection incorporates a moderate growth rate, acknowledging the potential for market fluctuations.

Australia Mattress Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Australian mattress industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is an invaluable resource for industry professionals, investors, and anyone seeking to understand this dynamic market. The report is segmented by product type (e.g., innerspring, memory foam, latex), price point (budget, mid-range, premium), and distribution channel (online, retail).

Australia Mattress Industry Market Dynamics & Structure

The Australian mattress market is a moderately consolidated industry, with several key players holding significant market share. Market concentration is moderate, with the top five companies estimated to hold approximately XX% of the market in 2025 (Million Units). Technological innovation, particularly in materials science and sleep technology, is a key driver of growth. Stringent regulatory frameworks concerning flammability and safety standards influence manufacturing processes. The market also faces competition from substitute products like air mattresses and futons. The end-user demographic is diverse, catering to various age groups, income levels, and lifestyle preferences. M&A activity has been relatively low in recent years, with only XX deals recorded between 2019 and 2024.

- Market Concentration: Top 5 players hold approximately XX% market share in 2025 (Million Units).

- Technological Innovation: Focus on advanced materials (e.g., graphene-infused foams), smart sleep technology, and personalized comfort features.

- Regulatory Framework: Strict compliance with Australian Standards regarding flammability and safety.

- Competitive Substitutes: Increasing competition from air mattresses, sofa beds, and other sleep solutions.

- End-User Demographics: Diverse market encompassing various age groups, income levels, and lifestyle preferences (Millennials, Gen Z, etc.).

- M&A Trends: Low M&A activity in recent years (XX deals between 2019 and 2024).

Australia Mattress Industry Growth Trends & Insights

The Australian mattress market experienced steady growth during the historical period (2019-2024), with an estimated CAGR of XX% in Million Units. This growth is attributed to factors such as rising disposable incomes, increasing awareness of sleep hygiene, and the growing popularity of online mattress retailers. The market is expected to continue its growth trajectory during the forecast period (2025-2033), driven by technological advancements, evolving consumer preferences, and the expansion of online sales channels. Market penetration of premium mattress segments is increasing, reflecting the growing demand for high-quality sleep products. Technological disruptions, such as the rise of smart mattresses and sleep-tracking devices, are reshaping the industry landscape.

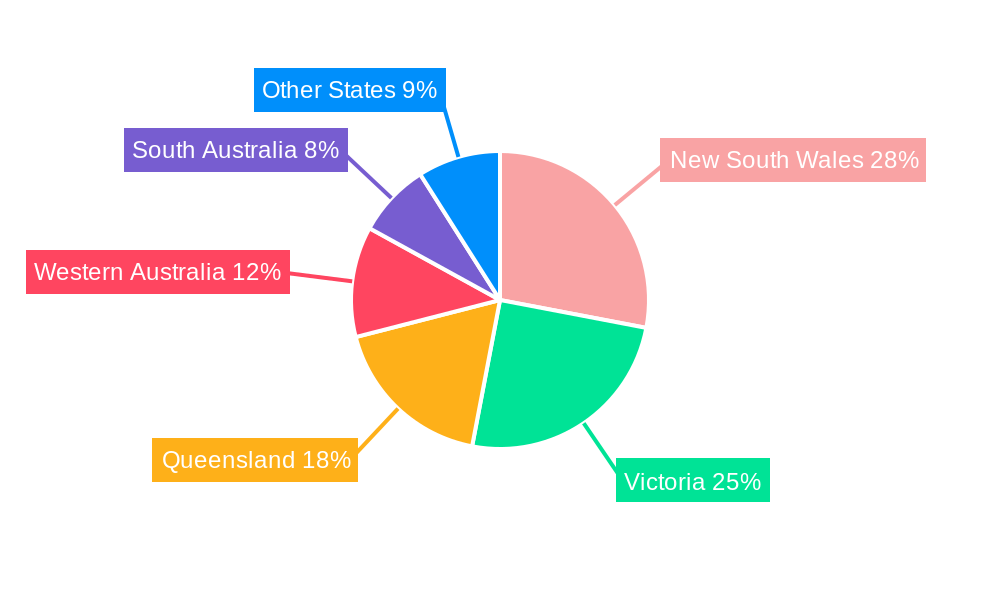

Dominant Regions, Countries, or Segments in Australia Mattress Industry

The major metropolitan areas of Sydney, Melbourne, and Brisbane are leading the Australian mattress market, accounting for approximately XX% of total sales in 2025 (Million Units). This dominance is driven by higher population density, increased disposable incomes, and greater awareness of sleep health in urban centers. The online segment is experiencing the fastest growth, fueled by e-commerce platforms' accessibility and convenience.

- Key Drivers:

- High population density in major cities.

- Higher disposable incomes in urban centers.

- Growing awareness of sleep hygiene.

- Convenience and accessibility of online shopping.

- Dominance Factors:

- Strong established retail presence in major cities.

- Higher consumer spending power.

- Significant online sales growth.

- Established supply chains and distribution networks.

Australia Mattress Industry Product Landscape

The Australian mattress market offers a diverse range of products, including innerspring, memory foam, latex, and hybrid mattresses. Product innovation focuses on enhancing comfort, support, and durability, incorporating advanced materials and technologies. Unique selling propositions include personalized comfort features, advanced cooling technologies, and eco-friendly materials. Technological advancements include the integration of smart sleep sensors and app connectivity.

Key Drivers, Barriers & Challenges in Australia Mattress Industry

Key Drivers:

- Rising disposable incomes and improved living standards.

- Increased awareness of sleep health and its impact on overall well-being.

- Technological advancements in mattress materials and design.

- Growth of e-commerce and online sales channels.

Challenges & Restraints:

- Intense competition from established and new entrants.

- Fluctuating raw material prices impacting manufacturing costs.

- Supply chain disruptions and logistical challenges.

- Stringent regulatory requirements and compliance costs.

Emerging Opportunities in Australia Mattress Industry

- Growing demand for specialized mattresses catering to specific needs (e.g., adjustable bases, anti-allergy mattresses).

- Expansion into underserved regional markets.

- Increased adoption of subscription models and rental options.

- Development of sustainable and eco-friendly mattress materials.

Growth Accelerators in the Australia Mattress Industry

Technological breakthroughs in materials science and sleep technology continue to drive market growth. Strategic partnerships between mattress manufacturers and technology companies are creating innovative products and services. Expansion into new market segments, such as the hospitality industry, offers significant growth potential. The increasing adoption of personalized comfort solutions through customizable mattresses also fuels market expansion.

Key Players Shaping the Australia Mattress Industry Market

- Australian Comfort Group

- Dyer Holdings Pty Ltd - Sealy of Australia

- Joyce Corporation Ltd

- AH Beard Holdings Pty Ltd

- Wonderest Ltd

- Koala Sleep Pty Ltd

- Sleeping Duck Mattress

- Ecosa Mattress

- Tontine Pty Ltd

- Tempur Australia Pty Ltd

List Not Exhaustive

Notable Milestones in Australia Mattress Industry Sector

- December 2022: Koala launches the "Bed Sofa," a new hybrid sofa-bed design.

- May 2023: Koala expands its product line to include three new sofa bed models.

In-Depth Australia Mattress Industry Market Outlook

The Australian mattress market is poised for continued growth driven by technological innovation, evolving consumer preferences, and expansion into new segments. Strategic partnerships, focus on sustainability, and personalized comfort solutions are key to unlocking long-term market potential. Opportunities exist in developing eco-friendly products, smart sleep technology, and tailored solutions for specific needs. The market’s growth trajectory indicates a promising future for companies that can adapt to evolving consumer preferences and leverage technological advancements.

Australia Mattress Industry Segmentation

-

1. Type

- 1.1. Spring Mattresses

- 1.2. Memory Foam Mattresses

- 1.3. Latex Mattresses

- 1.4. Other Mattresses

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

-

3. End Users

- 3.1. Residential

- 3.2. Commercial

Australia Mattress Industry Segmentation By Geography

- 1. Australia

Australia Mattress Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.05% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Residential Construction; Increase In Tourism Contributing To The Growth Of The Mattress Market

- 3.3. Market Restrains

- 3.3.1. Growing Residential Construction; Increase In Tourism Contributing To The Growth Of The Mattress Market

- 3.4. Market Trends

- 3.4.1. Hotel Industry is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Mattress Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Spring Mattresses

- 5.1.2. Memory Foam Mattresses

- 5.1.3. Latex Mattresses

- 5.1.4. Other Mattresses

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Australian Comfort Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dyer Holdings Pty Ltd - Sealy of Australia

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Joyce Corporation Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AH Beard Holdings Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wonderest Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Koala Sleep Pty Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sleeping Duck Mattress

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ecosa Mattress

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tontine Pty Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tempur Australia Pty Ltd **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Australian Comfort Group

List of Figures

- Figure 1: Australia Mattress Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Mattress Industry Share (%) by Company 2024

List of Tables

- Table 1: Australia Mattress Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Mattress Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Australia Mattress Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Australia Mattress Industry Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Australia Mattress Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Australia Mattress Industry Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 7: Australia Mattress Industry Revenue Million Forecast, by End Users 2019 & 2032

- Table 8: Australia Mattress Industry Volume Billion Forecast, by End Users 2019 & 2032

- Table 9: Australia Mattress Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Australia Mattress Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Australia Mattress Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Australia Mattress Industry Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Australia Mattress Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Australia Mattress Industry Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 15: Australia Mattress Industry Revenue Million Forecast, by End Users 2019 & 2032

- Table 16: Australia Mattress Industry Volume Billion Forecast, by End Users 2019 & 2032

- Table 17: Australia Mattress Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Australia Mattress Industry Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Mattress Industry?

The projected CAGR is approximately 6.05%.

2. Which companies are prominent players in the Australia Mattress Industry?

Key companies in the market include Australian Comfort Group, Dyer Holdings Pty Ltd - Sealy of Australia, Joyce Corporation Ltd, AH Beard Holdings Pty Ltd, Wonderest Ltd, Koala Sleep Pty Ltd, Sleeping Duck Mattress, Ecosa Mattress, Tontine Pty Ltd, Tempur Australia Pty Ltd **List Not Exhaustive.

3. What are the main segments of the Australia Mattress Industry?

The market segments include Type, Distribution Channel, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Residential Construction; Increase In Tourism Contributing To The Growth Of The Mattress Market.

6. What are the notable trends driving market growth?

Hotel Industry is Driving the Market Growth.

7. Are there any restraints impacting market growth?

Growing Residential Construction; Increase In Tourism Contributing To The Growth Of The Mattress Market.

8. Can you provide examples of recent developments in the market?

In May 2023, Koala launched a new venture into sofa beds. The well-known firm has now introduced three gorgeous sofa bed designs, each of which has already gained a tonne of traction with consumers searching for comfort, style, and most importantly, functionality in their living rooms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Mattress Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Mattress Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Mattress Industry?

To stay informed about further developments, trends, and reports in the Australia Mattress Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence