Key Insights

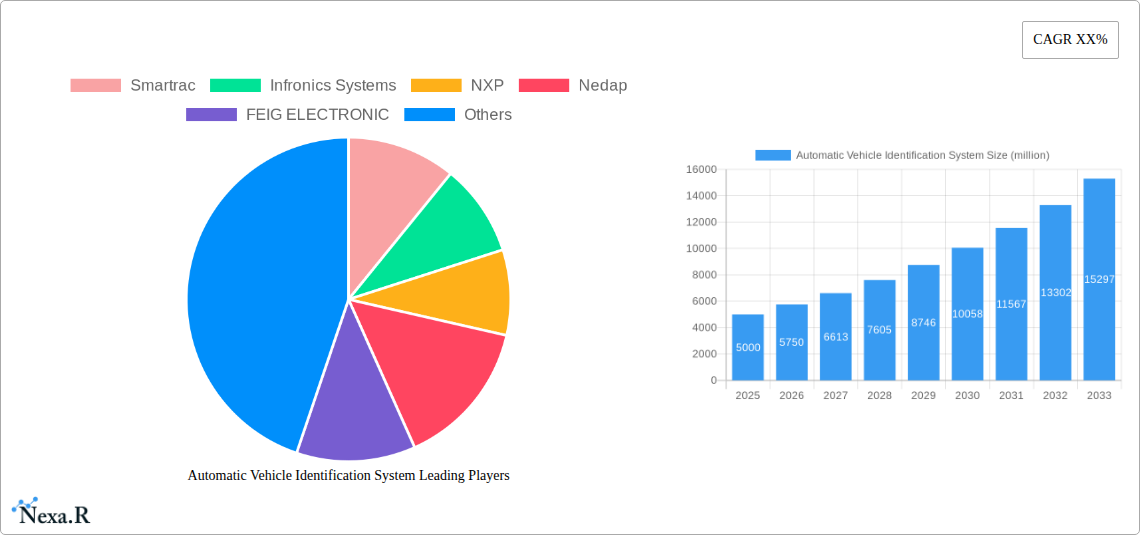

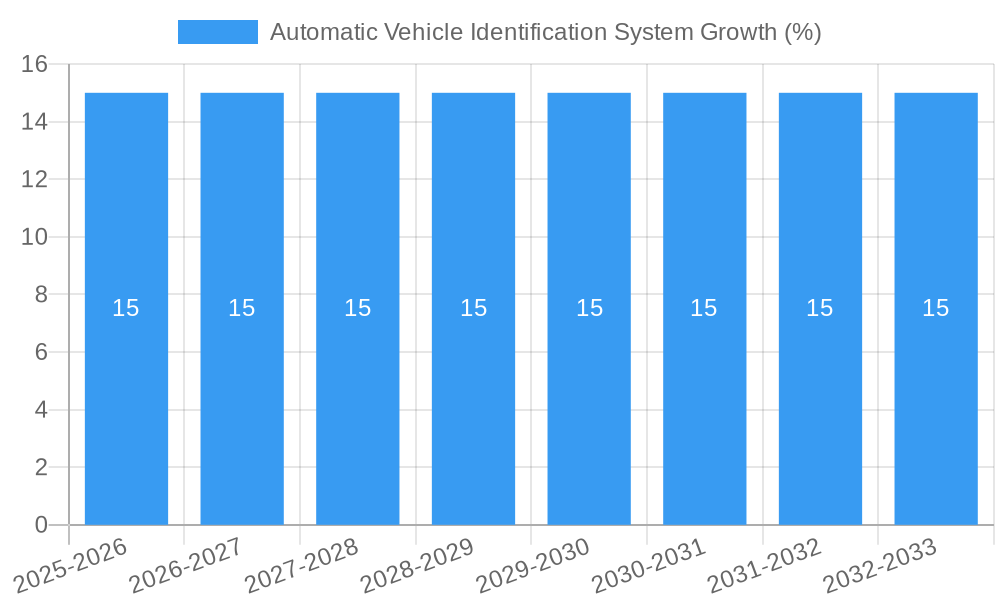

The global Automatic Vehicle Identification (AVI) system market is poised for robust expansion, projected to reach a substantial market size of approximately $5,000 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 15% through 2033. This significant growth is primarily fueled by the escalating need for enhanced traffic management, toll collection efficiency, and security across various sectors. The increasing adoption of smart city initiatives and the proliferation of connected vehicles are key drivers, fostering a demand for seamless and automated vehicle tracking and identification solutions. Furthermore, the drive towards contactless and efficient payment systems in parking and tolling applications significantly contributes to market momentum. The AVI system market encompasses a diverse range of applications, with residential gated communities and commercial/municipal lots leading the adoption due to their direct impact on convenience and security. Corporate campuses and educational facilities are also increasingly investing in these systems for streamlined access control and asset management. The market is segmented into hardware, software, and services, with hardware components like RFID tags and readers forming the foundational elements, while sophisticated software platforms enable data analysis and integration.

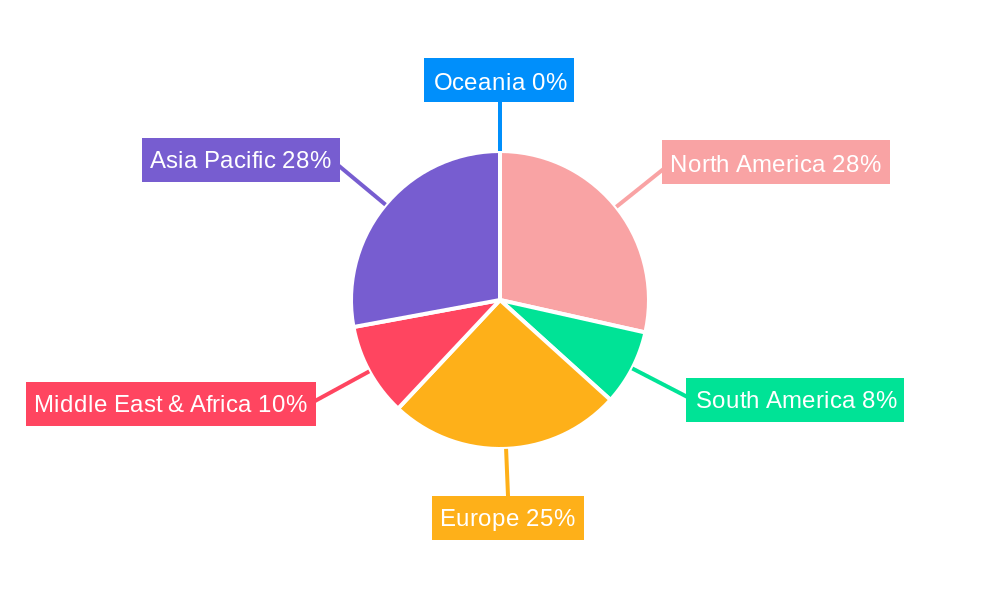

The market dynamics are further shaped by a combination of technological advancements and evolving regulatory landscapes. Innovations in long-range RFID, AI-powered analytics, and integrated payment solutions are enhancing the capabilities and appeal of AVI systems. However, certain restraints, such as the initial high implementation costs for some organizations and concerns regarding data privacy and security, could temper rapid adoption in specific segments. Despite these challenges, the inherent benefits of AVI systems – improved operational efficiency, enhanced security, and better data collection for urban planning – are expected to outweigh these limitations. Leading companies such as Smartrac, NXP, and Nedap are at the forefront of innovation, driving market competition and introducing advanced solutions. The Asia Pacific region, particularly China and India, is anticipated to witness the fastest growth due to rapid urbanization, infrastructure development, and a burgeoning vehicle parc. North America and Europe, with their mature markets and early adoption of smart technologies, will continue to hold significant market share, driven by stringent traffic management regulations and the widespread use of electronic toll collection.

Automatic Vehicle Identification System Market Dynamics & Structure

The Automatic Vehicle Identification (AVI) system market is characterized by a moderately concentrated structure, with key players like Smartrac, Infronics Systems, NXP, Nedap, and FEIG ELECTRONIC holding significant market share. Technological innovation is a primary driver, fueled by advancements in RFID, GPS, and AI for enhanced accuracy and speed. Regulatory frameworks surrounding data privacy and security are also shaping market development, influencing deployment strategies. Competitive product substitutes, such as manual toll collection and manual access control, are gradually being phased out due to their inherent inefficiencies. End-user demographics are diverse, spanning residential, commercial, and municipal sectors, each with unique adoption drivers. Mergers and acquisitions (M&A) are a notable trend, with companies seeking to expand their product portfolios and geographic reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately 60% of the market share.

- Technological Innovation Drivers: Miniaturization of sensors, increased processing power, AI integration for pattern recognition, and development of low-power, long-range communication protocols.

- Regulatory Frameworks: Evolving data privacy laws (e.g., GDPR, CCPA), national security standards for critical infrastructure, and open road tolling mandates.

- Competitive Product Substitutes: Manual gate operations, barcode-based systems, and basic proximity card access.

- End-User Demographics: Growing demand from urban centers for smart city initiatives, increased adoption in multi-tenant residential buildings, and the need for efficient access control in large corporate and educational campuses.

- M&A Trends: Consolidation for economies of scale, acquisition of specialized technology firms, and strategic partnerships to enter new application segments.

Automatic Vehicle Identification System Growth Trends & Insights

The Automatic Vehicle Identification (AVI) system market is poised for robust growth, driven by an escalating demand for efficient traffic management, enhanced security, and streamlined access control across various sectors. The market size is projected to witness a significant expansion from an estimated $2,500 million in 2025 to a projected $4,800 million by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 8.5% during the forecast period (2025–2033). This substantial growth is underpinned by increasing urbanization, a surge in vehicle ownership, and the imperative for smarter infrastructure solutions.

Adoption rates for AVI systems are accelerating across both developed and emerging economies. In the historical period (2019–2024), the market saw steady adoption driven by initial deployments in toll collection and parking management. The base year (2025) marks a pivotal point, with widespread recognition of AVI's benefits in corporate campuses, residential gated communities, and educational facilities. The estimated year (2025) further solidifies this trend, with the market penetrating deeper into these segments.

Technological disruptions are continuously reshaping the AVI landscape. The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is enhancing the accuracy and efficiency of vehicle recognition, enabling advanced features like driver behavior analysis and predictive maintenance for access control systems. The evolution of communication technologies, such as 5G and advanced RFID, is facilitating real-time data processing and seamless integration with existing smart city infrastructure. Cloud-based AVI solutions are also gaining traction, offering scalability, cost-effectiveness, and enhanced data management capabilities for businesses of all sizes.

Consumer behavior shifts are also playing a crucial role. Individuals and organizations are increasingly prioritizing convenience, security, and efficiency. For instance, in residential gated communities, residents expect frictionless entry and exit. Similarly, commercial and municipal lots are looking for automated payment and parking management to improve user experience and operational efficiency. The growing emphasis on contactless solutions, accelerated by recent global health concerns, further bolsters the demand for AVI systems that minimize human interaction.

The market penetration of AVI systems is expected to deepen significantly in the coming years. While tolling and parking remain dominant applications, the growth in corporate campuses, universities, and medical centers is particularly noteworthy. These segments are recognizing the value of AVI in managing large volumes of traffic, enhancing security, and optimizing resource allocation. The increasing adoption of smart city initiatives globally is a powerful catalyst, creating a fertile ground for widespread AVI deployment. The shift from standalone AVI solutions to integrated mobility platforms that leverage AVI data for broader urban planning and management is another key trend to watch, promising sustained and accelerated market expansion.

Dominant Regions, Countries, or Segments in Automatic Vehicle Identification System

The Automatic Vehicle Identification (AVI) system market exhibits distinct regional and segment-specific dominance, driven by a confluence of economic policies, infrastructure development, and technological adoption rates. Globally, North America consistently emerges as a dominant region, closely followed by Europe. This leadership is attributed to a mature technological ecosystem, significant investments in smart infrastructure, and a strong regulatory push towards intelligent transportation systems. The United States, in particular, plays a pivotal role due to its extensive highway networks, the early adoption of electronic toll collection, and a high concentration of commercial and corporate entities prioritizing advanced security and access management.

Within North America, the Commercial and Municipal Lots application segment is a significant growth engine, accounting for an estimated 35% of the total market share in 2025. This dominance is fueled by the need for efficient parking management in bustling urban centers, the implementation of smart city initiatives, and the growing demand for automated payment and access solutions in commercial complexes. The United States' robust economy and substantial investment in public infrastructure have further propelled the adoption of AVI systems in this segment.

In Europe, countries like Germany, the UK, and France are leading the charge, with a strong emphasis on integrated traffic management solutions and stricter environmental regulations that indirectly favor efficient vehicle flow. The Services type within AVI systems is experiencing remarkable growth across both regions, encompassing installation, maintenance, and data analytics. This is driven by the increasing complexity of AVI deployments and the demand for specialized expertise to manage and optimize these systems. The market penetration of services is projected to reach 30% of the total market by 2025, indicating a shift towards comprehensive solutions rather than just hardware.

Looking at specific countries, the United States is expected to hold approximately 28% of the global market share by 2025, driven by extensive highway systems, advanced tolling infrastructure, and a proactive approach to smart city development. Germany follows closely, with a strong focus on industrial applications and smart logistics.

The Hardware segment, encompassing RFID tags, readers, and antennas, still holds the largest market share, estimated at 45% in 2025, reflecting the foundational nature of these components. However, the Software segment, including data processing, analytics, and integration platforms, is witnessing the fastest growth, with an estimated CAGR of 10%. This rapid expansion is a direct result of the increasing need to derive actionable insights from AVI data for traffic optimization, security enhancement, and operational efficiency. The Services segment is expected to capture 30% of the market by 2025, reflecting a growing trend towards outsourced management and maintenance of complex AVI systems.

The dominance of these regions and segments is further solidified by several key drivers:

- Economic Policies: Government initiatives promoting smart city development, public-private partnerships for infrastructure projects, and incentives for adopting advanced technology.

- Infrastructure Development: Extensive road networks, the modernization of existing toll plazas, and the development of smart parking facilities.

- Technological Advancements: Continuous innovation in RFID, AI, and IoT technologies, leading to more accurate, faster, and cost-effective AVI solutions.

- Security Concerns: Increasing need for robust access control in high-security areas like corporate campuses, government facilities, and residential communities.

- Urbanization Trends: Growing population density in urban areas, leading to increased traffic congestion and a demand for efficient traffic management solutions.

The Corporate or Business Campuses application segment is also projected to witness significant growth, driven by the need for streamlined employee and visitor access, enhanced security, and efficient management of large vehicle volumes. This segment is expected to contribute approximately 20% to the market share by 2025.

Automatic Vehicle Identification System Product Landscape

The Automatic Vehicle Identification (AVI) system product landscape is rapidly evolving, with a focus on enhanced performance, greater accuracy, and seamless integration. Key innovations include the development of advanced RFID tags with extended read ranges and improved anti-collision capabilities, enabling faster and more reliable identification of multiple vehicles simultaneously. High-resolution cameras integrated with AI-powered Optical Character Recognition (OCR) and Automatic Number Plate Recognition (ANPR) technologies offer superior accuracy even in challenging environmental conditions. Software solutions are increasingly incorporating machine learning algorithms for predictive analytics, traffic flow optimization, and anomaly detection, providing actionable insights to system administrators. The integration of cloud-based platforms is central to the current product strategy, offering scalability, remote management, and real-time data processing for a comprehensive and connected user experience.

Key Drivers, Barriers & Challenges in Automatic Vehicle Identification System

The Automatic Vehicle Identification (AVI) system market is propelled by several key drivers, including the increasing global vehicle population, the growing need for efficient traffic management in congested urban areas, and the rising demand for enhanced security and access control in various applications like residential communities and corporate campuses. Technological advancements in RFID, ANPR, and AI are making AVI systems more accurate, faster, and cost-effective. Government initiatives promoting smart city development and intelligent transportation systems are also significant accelerators.

However, the market faces several barriers and challenges. High initial implementation costs for comprehensive AVI systems can deter smaller organizations and municipalities. Concerns surrounding data privacy and security, including the potential for unauthorized access or misuse of vehicle data, remain a significant hurdle. Regulatory complexities and the need for standardization across different jurisdictions can also impede widespread adoption. Furthermore, the integration of new AVI systems with existing legacy infrastructure can be technically challenging and time-consuming. Supply chain disruptions for critical components can also impact deployment timelines and costs.

Emerging Opportunities in Automatic Vehicle Identification System

Emerging opportunities in the Automatic Vehicle Identification (AVI) system sector are centered around the integration of AVI with broader smart city ecosystems and the development of more specialized, data-driven applications. The expansion of electric vehicle (EV) charging infrastructure presents a significant opportunity for AVI systems to manage charging station access and billing. Furthermore, the growing adoption of autonomous vehicles will necessitate advanced AVI capabilities for seamless interaction and identification. The use of AVI data for real-time traffic incident detection, emergency response coordination, and personalized urban mobility services represents another significant growth avenue. The development of interoperable AVI standards will unlock opportunities for cross-sectoral data sharing and create a more connected and efficient urban environment.

Growth Accelerators in the Automatic Vehicle Identification System Industry

Growth in the Automatic Vehicle Identification (AVI) System industry is significantly accelerated by ongoing technological breakthroughs, particularly in the realm of AI and IoT. The continuous miniaturization and cost reduction of RFID and sensor technologies are making AVI solutions more accessible across a wider range of applications. Strategic partnerships between hardware manufacturers, software developers, and system integrators are crucial for delivering comprehensive, end-to-end solutions. Furthermore, the global push towards smart city initiatives and the increasing investment in intelligent transportation infrastructure by governments worldwide are creating fertile ground for market expansion and driving higher adoption rates for AVI systems.

Key Players Shaping the Automatic Vehicle Identification System Market

- Smartrac

- Infronics Systems

- NXP

- Nedap

- FEIG ELECTRONIC

- Litum

- Avante

- deister electronic UK Ltd.

- Coselec Pte Ltd

Notable Milestones in Automatic Vehicle Identification System Sector

- 2021: Launch of advanced AI-powered ANPR cameras with enhanced accuracy in low-light conditions by major players.

- 2022: Increased adoption of cloud-based AVI platforms for scalability and remote management.

- 2023: Significant advancements in long-range RFID technology enabling faster throughput in high-traffic areas.

- 2024: Emergence of integrated AVI solutions for smart parking and EV charging management.

- 2025: Increased focus on cybersecurity measures within AVI systems due to rising data privacy concerns.

In-Depth Automatic Vehicle Identification System Market Outlook

The future outlook for the Automatic Vehicle Identification (AVI) system market is exceptionally bright, driven by sustained technological innovation and increasing global demand for intelligent infrastructure. The integration of AVI with emerging technologies like 5G, edge computing, and blockchain will unlock new levels of efficiency, security, and data integrity. Strategic collaborations and the development of interoperable standards will foster a more cohesive and expansive market. The continued evolution of smart city projects and the imperative for seamless urban mobility will ensure robust growth, making AVI systems an indispensable component of modern infrastructure.

Automatic Vehicle Identification System Segmentation

-

1. Application

- 1.1. Residential Gated Communities

- 1.2. Commercial and Municipal Lots

- 1.3. Corporate or Business Campuses

- 1.4. Colleges and Universities Facilities

- 1.5. Medical Centers and Hospitals

-

2. Types

- 2.1. Hardware

- 2.2. Software

- 2.3. Services

Automatic Vehicle Identification System Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Automatic Vehicle Identification System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automatic Vehicle Identification System Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential Gated Communities

- 5.1.2. Commercial and Municipal Lots

- 5.1.3. Corporate or Business Campuses

- 5.1.4. Colleges and Universities Facilities

- 5.1.5. Medical Centers and Hospitals

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Hardware

- 5.2.2. Software

- 5.2.3. Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automatic Vehicle Identification System Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential Gated Communities

- 6.1.2. Commercial and Municipal Lots

- 6.1.3. Corporate or Business Campuses

- 6.1.4. Colleges and Universities Facilities

- 6.1.5. Medical Centers and Hospitals

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Hardware

- 6.2.2. Software

- 6.2.3. Services

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Automatic Vehicle Identification System Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential Gated Communities

- 7.1.2. Commercial and Municipal Lots

- 7.1.3. Corporate or Business Campuses

- 7.1.4. Colleges and Universities Facilities

- 7.1.5. Medical Centers and Hospitals

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Hardware

- 7.2.2. Software

- 7.2.3. Services

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Automatic Vehicle Identification System Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential Gated Communities

- 8.1.2. Commercial and Municipal Lots

- 8.1.3. Corporate or Business Campuses

- 8.1.4. Colleges and Universities Facilities

- 8.1.5. Medical Centers and Hospitals

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Hardware

- 8.2.2. Software

- 8.2.3. Services

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Automatic Vehicle Identification System Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential Gated Communities

- 9.1.2. Commercial and Municipal Lots

- 9.1.3. Corporate or Business Campuses

- 9.1.4. Colleges and Universities Facilities

- 9.1.5. Medical Centers and Hospitals

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Hardware

- 9.2.2. Software

- 9.2.3. Services

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Automatic Vehicle Identification System Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential Gated Communities

- 10.1.2. Commercial and Municipal Lots

- 10.1.3. Corporate or Business Campuses

- 10.1.4. Colleges and Universities Facilities

- 10.1.5. Medical Centers and Hospitals

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Hardware

- 10.2.2. Software

- 10.2.3. Services

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Smartrac

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Infronics Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NXP

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nedap

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FEIG ELECTRONIC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Litum

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Avante

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 deister electronic UK Ltd.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Coselec Pte Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Smartrac

List of Figures

- Figure 1: Global Automatic Vehicle Identification System Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Automatic Vehicle Identification System Revenue (million), by Application 2024 & 2032

- Figure 3: North America Automatic Vehicle Identification System Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Automatic Vehicle Identification System Revenue (million), by Types 2024 & 2032

- Figure 5: North America Automatic Vehicle Identification System Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Automatic Vehicle Identification System Revenue (million), by Country 2024 & 2032

- Figure 7: North America Automatic Vehicle Identification System Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Automatic Vehicle Identification System Revenue (million), by Application 2024 & 2032

- Figure 9: South America Automatic Vehicle Identification System Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Automatic Vehicle Identification System Revenue (million), by Types 2024 & 2032

- Figure 11: South America Automatic Vehicle Identification System Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Automatic Vehicle Identification System Revenue (million), by Country 2024 & 2032

- Figure 13: South America Automatic Vehicle Identification System Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Automatic Vehicle Identification System Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Automatic Vehicle Identification System Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Automatic Vehicle Identification System Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Automatic Vehicle Identification System Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Automatic Vehicle Identification System Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Automatic Vehicle Identification System Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Automatic Vehicle Identification System Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Automatic Vehicle Identification System Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Automatic Vehicle Identification System Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Automatic Vehicle Identification System Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Automatic Vehicle Identification System Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Automatic Vehicle Identification System Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Automatic Vehicle Identification System Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Automatic Vehicle Identification System Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Automatic Vehicle Identification System Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Automatic Vehicle Identification System Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Automatic Vehicle Identification System Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Automatic Vehicle Identification System Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automatic Vehicle Identification System Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Automatic Vehicle Identification System Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Automatic Vehicle Identification System Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Automatic Vehicle Identification System Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Automatic Vehicle Identification System Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Automatic Vehicle Identification System Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Automatic Vehicle Identification System Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Automatic Vehicle Identification System Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Automatic Vehicle Identification System Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Automatic Vehicle Identification System Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Automatic Vehicle Identification System Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Automatic Vehicle Identification System Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Automatic Vehicle Identification System Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Automatic Vehicle Identification System Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Automatic Vehicle Identification System Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Automatic Vehicle Identification System Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Automatic Vehicle Identification System Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Automatic Vehicle Identification System Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Automatic Vehicle Identification System Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Automatic Vehicle Identification System Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automatic Vehicle Identification System?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Automatic Vehicle Identification System?

Key companies in the market include Smartrac, Infronics Systems, NXP, Nedap, FEIG ELECTRONIC, Litum, Avante, deister electronic UK Ltd., Coselec Pte Ltd.

3. What are the main segments of the Automatic Vehicle Identification System?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automatic Vehicle Identification System," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automatic Vehicle Identification System report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automatic Vehicle Identification System?

To stay informed about further developments, trends, and reports in the Automatic Vehicle Identification System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence