Key Insights

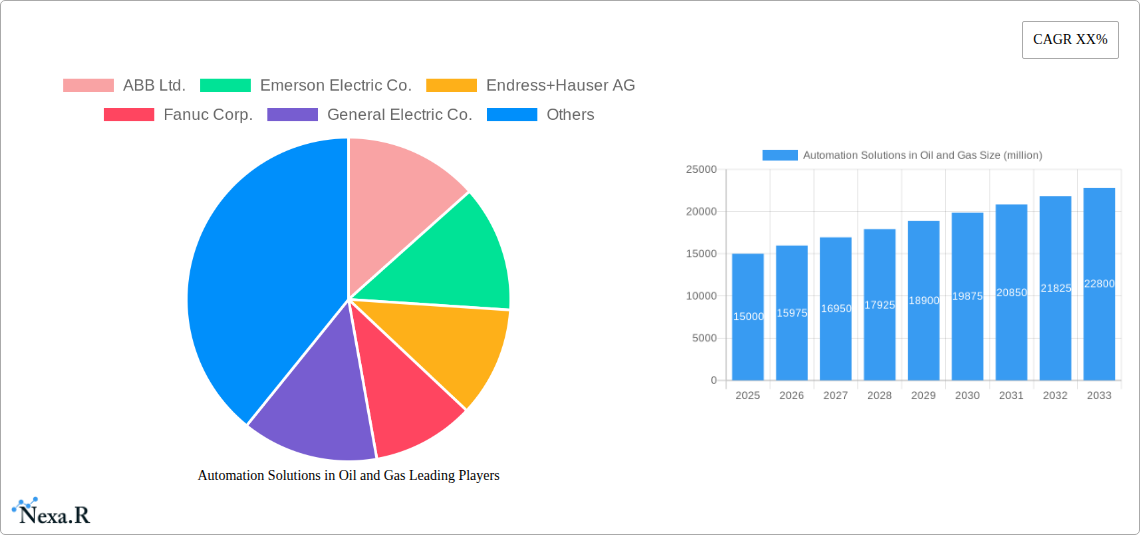

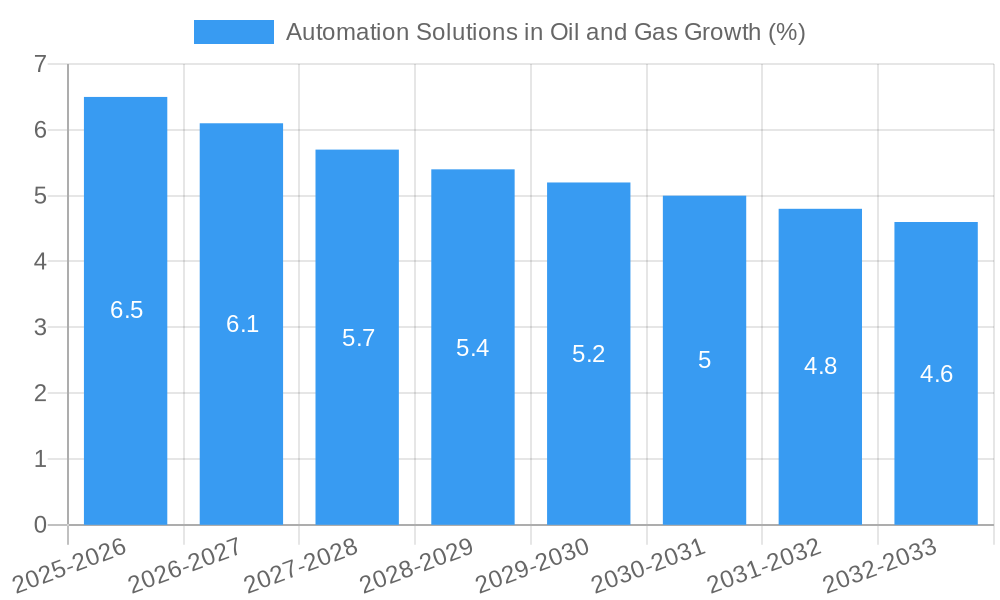

The global market for Automation Solutions in the Oil and Gas sector is experiencing robust growth, estimated at a market size of approximately USD 15,000 million in 2025, and projected to expand at a Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This significant expansion is primarily fueled by the escalating demand for enhanced operational efficiency, stringent safety regulations, and the increasing complexity of exploration and production activities. Automation solutions, encompassing SCADA, PLC, DCS, MES, and SIS, are critical for optimizing processes, minimizing downtime, and ensuring the safe handling of volatile substances across upstream, midstream, and downstream segments of the industry. The drive towards digital transformation and the adoption of Industry 4.0 technologies are further accelerating the integration of advanced automation, including AI-powered analytics and IoT integration, to predict equipment failures, optimize resource allocation, and improve overall yield.

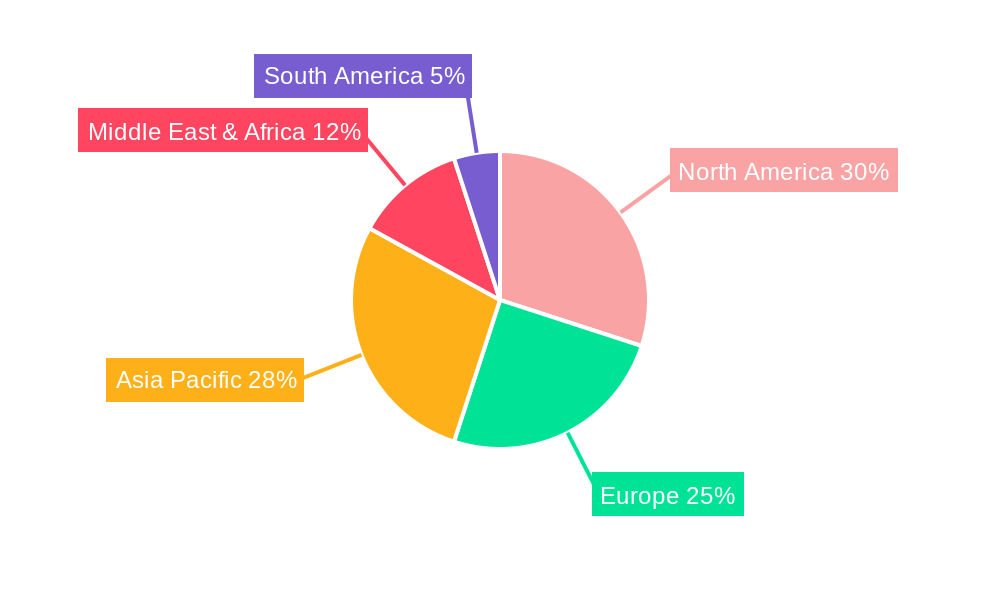

The market's trajectory is further supported by ongoing investments in digital transformation initiatives and the need to address aging infrastructure with modernized automation systems. Key market drivers include the pursuit of reduced operational costs through automated processes, the imperative for real-time data monitoring and analysis for informed decision-making, and the global push towards sustainable practices which automation can facilitate through optimized energy consumption and reduced emissions. Despite the strong growth potential, certain restraints, such as the high initial investment costs for implementing sophisticated automation systems and the ongoing need for skilled workforce training, could pose challenges. Geographically, North America and the Asia Pacific region are anticipated to lead market adoption due to their significant oil and gas production activities and a strong inclination towards technological innovation.

Dive deep into the transformative landscape of the global Automation Solutions in Oil and Gas market. This comprehensive report provides an unparalleled analysis of market dynamics, growth trajectories, and key strategic imperatives for stakeholders navigating the complexities of oil and gas operations. From upstream exploration to downstream refining, discover how advanced automation is revolutionizing safety, productivity, and sustainability.

Automation Solutions in Oil and Gas Market Dynamics & Structure

The Automation Solutions in Oil and Gas market is characterized by a moderate to high concentration, with major players like Siemens AG, Honeywell International Inc., and ABB Ltd. holding significant influence. Technological innovation is a primary driver, fueled by the continuous pursuit of enhanced operational efficiency, stringent safety standards, and the increasing need for real-time data analytics. The industry is shaped by a complex web of regulatory frameworks, particularly concerning environmental protection and worker safety, which mandates the adoption of advanced automation systems. Competitive product substitutes are emerging, primarily from interconnected digital solutions and advanced analytics platforms that complement traditional automation hardware. End-user demographics are shifting towards a greater demand for integrated, intelligent automation solutions that offer predictive maintenance capabilities and optimize resource utilization. Mergers and acquisitions (M&A) remain a consistent feature, as larger companies seek to expand their portfolios and technological capabilities, with an estimated 50+ M&A deals recorded in the historical period (2019-2024) to bolster market presence and innovation. Barriers to innovation include the long lifecycle of existing infrastructure, the high initial investment costs for new technologies, and the need for specialized workforce training.

- Market Concentration: Moderate to high, dominated by global automation giants.

- Key Innovation Drivers: Efficiency enhancement, safety improvements, data analytics, digital transformation.

- Regulatory Influence: Environmental regulations (e.g., emissions control) and safety standards significantly shape solution adoption.

- Competitive Landscape: Increasing competition from software and data analytics providers alongside traditional hardware vendors.

- End-User Demand: Growing preference for intelligent, integrated, and predictive automation systems.

- M&A Activity: Consistent deal flow aimed at strategic acquisitions and technology integration.

- Innovation Barriers: High capital expenditure, infrastructure inertia, and workforce skill gaps.

Automation Solutions in Oil and Gas Growth Trends & Insights

The global Automation Solutions in Oil and Gas market is poised for robust expansion, projected to grow from an estimated $12.5 billion in 2025 to reach approximately $18.2 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 4.8% during the forecast period (2025-2033). This growth is underpinned by the persistent need to optimize operations, reduce costs, and enhance safety across the entire oil and gas value chain. Adoption rates of advanced automation technologies like Artificial Intelligence (AI) and Machine Learning (ML) are accelerating, particularly in areas such as predictive maintenance and process optimization. Technological disruptions, including the integration of Industrial Internet of Things (IIoT) devices and cloud-based platforms, are enabling unprecedented levels of connectivity and data utilization, driving a paradigm shift towards smart oilfield operations. Consumer behavior shifts are evident in the increasing demand for solutions that offer greater transparency, real-time visibility into production processes, and enhanced environmental performance monitoring. The market penetration of digital twin technology and advanced analytics platforms is expected to surge, transforming decision-making and operational strategies. The estimated market size in the base year of 2025 stands at $12.5 billion, reflecting a significant uplift from the historical period, which saw steady, albeit slower, growth driven by foundational automation deployments.

Dominant Regions, Countries, or Segments in Automation Solutions in Oil and Gas

The Oil segment is currently the dominant force within the Automation Solutions in Oil and Gas market, accounting for an estimated 65% of the market share in 2025, primarily driven by the vast scale of exploration, extraction, and refining operations globally. Within this segment, Distributed Control Systems (DCS) are a cornerstone technology, representing approximately 30% of the total market value for automation solutions in 2025, due to their critical role in managing complex industrial processes across upstream, midstream, and downstream sectors. North America, particularly the United States, is a leading region, projected to hold a 35% market share in 2025, propelled by extensive shale oil and gas production, significant investments in modernizing aging infrastructure, and a robust regulatory environment that encourages the adoption of advanced safety and efficiency technologies. Key drivers in this region include favorable economic policies supporting domestic energy production, substantial investments in digital transformation initiatives by major oil and gas companies, and the presence of a highly developed technological ecosystem.

The dominance of the Oil segment is further amplified by the critical need for sophisticated automation in challenging environments, from offshore platforms to remote onshore fields. DCS solutions are indispensable for precise control of drilling operations, pipeline management, and refinery processes, ensuring operational stability and maximizing yield. The market share of DCS is expected to remain strong, supplemented by the growing integration of SCADA and Safety Instrumented Systems (SIS) for enhanced monitoring and hazard mitigation.

In terms of geographical dominance, North America's leadership is attributable to its significant proven reserves and its proactive approach to adopting cutting-edge automation technologies. The region benefits from a mature market that readily embraces innovations in AI, IIoT, and advanced analytics to enhance production efficiency and reduce operational expenditure. Furthermore, the strategic investments by major oil and gas corporations in digitalizing their operations are a significant growth catalyst.

- Dominant Application Segment: Oil (Estimated 65% market share in 2025).

- Dominant System Type: Distributed Control Systems (DCS) (Estimated 30% market share in 2025).

- Leading Region: North America (Estimated 35% market share in 2025).

- Key Drivers in North America: Shale production, infrastructure modernization, technological adoption, supportive policies.

- Growth Potential in Oil Segment: Continuous demand for efficiency and safety in exploration, extraction, and refining.

- SCADA and SIS Integration: Increasing importance for real-time monitoring and risk management.

Automation Solutions in Oil and Gas Product Landscape

The product landscape for Automation Solutions in Oil and Gas is defined by sophisticated, integrated systems designed for harsh environments and critical operations. Innovations are focused on enhancing reliability, scalability, and data-driven insights. Supervisory Control and Data Acquisition (SCADA) systems are evolving with advanced cybersecurity features and cloud connectivity, enabling remote monitoring and control of dispersed assets. Programmable Logic Controllers (PLCs) are becoming more powerful and compact, offering greater processing capabilities for intricate control tasks. Distributed Control Systems (DCS) continue to be central, with a strong emphasis on intuitive human-machine interfaces (HMIs) and seamless integration with enterprise resource planning (ERP) systems. Manufacturing Execution Systems (MES) are crucial for optimizing production workflows and improving asset utilization. Safety Instrumented Systems (SIS) are paramount, featuring advanced diagnostics and fail-safe mechanisms to prevent catastrophic events. The unique selling proposition of leading vendors lies in their ability to offer end-to-end solutions that ensure interoperability, robust performance, and compliance with industry standards, thereby maximizing uptime and minimizing operational risks. Technological advancements are also pushing towards more modular and flexible architectures, allowing for easier upgrades and customization to meet specific project requirements.

Key Drivers, Barriers & Challenges in Automation Solutions in Oil and Gas

The Key Drivers propelling the Automation Solutions in Oil and Gas market are the relentless pursuit of operational efficiency and cost reduction, the paramount need for enhanced safety and environmental compliance, and the growing adoption of digital transformation initiatives like IIoT and AI for predictive maintenance and process optimization. The demand for real-time data analytics to improve decision-making is also a significant catalyst, enabling better resource management and proactive problem-solving.

- Efficiency & Cost Reduction: Automating complex processes reduces manual intervention and minimizes errors, leading to significant cost savings.

- Safety & Compliance: Stringent regulations and the hazardous nature of operations necessitate advanced safety systems to prevent accidents and environmental spills.

- Digital Transformation: IIoT, AI, and cloud computing enable smart operations, remote monitoring, and data-driven insights.

- Data Analytics: Real-time data empowers informed decision-making, optimizing production and resource allocation.

The Key Challenges and Restraints faced by the market include the substantial upfront capital investment required for implementing advanced automation systems, the long lifecycle of existing infrastructure, which can hinder rapid adoption, and the inherent risks associated with cybersecurity threats to interconnected operational technology (OT) systems. Supply chain disruptions, particularly for specialized components, can also impact project timelines and costs. Furthermore, the shortage of skilled personnel capable of operating and maintaining these sophisticated systems poses a significant hurdle to widespread implementation. The projected market impact of these challenges could lead to a 5-10% slower adoption rate in regions with less developed technological infrastructure.

- High Capital Expenditure: Significant initial investment is a barrier for smaller players and during economic downturns.

- Legacy Infrastructure: The long lifespan of existing equipment necessitates gradual upgrades rather than complete overhauls.

- Cybersecurity Risks: Increased connectivity exposes critical infrastructure to cyberattacks, demanding robust security measures.

- Supply Chain Volatility: Disruptions in component availability can delay projects and increase costs.

- Skilled Workforce Shortage: A lack of trained professionals to manage and maintain advanced automation systems.

Emerging Opportunities in Automation Solutions in Oil and Gas

Emerging opportunities in the Automation Solutions in Oil and Gas market are abundant, driven by the growing demand for sustainable and intelligent operations. The digitalization of upstream operations, including remote monitoring of wellheads and the use of drones for inspection, presents a significant growth avenue. The midstream sector offers opportunities in smart pipeline monitoring and leak detection systems, enhanced by AI for predictive analytics. Downstream, opportunities lie in optimizing refinery processes through advanced simulation and control, alongside the integration of renewable energy sources for power generation within facilities. Furthermore, the development of robust cybersecurity solutions tailored for OT environments is a critical and rapidly expanding niche. The growing emphasis on reducing greenhouse gas emissions also opens doors for automation solutions that optimize energy consumption and monitor environmental impact. The potential market value in these emerging areas is estimated to be over $2 billion by 2030.

Growth Accelerators in the Automation Solutions in Oil and Gas Industry

Several key catalysts are accelerating the growth of the Automation Solutions in Oil and Gas industry. The increasing global energy demand, coupled with the imperative to extract resources more efficiently and safely, provides a fundamental impetus. Technological breakthroughs in areas such as AI, machine learning, and edge computing are enabling more sophisticated and autonomous operations. Strategic partnerships between automation providers and oil and gas majors are fostering innovation and facilitating the deployment of integrated solutions. Furthermore, market expansion strategies, including the development of solutions for emerging energy sectors like hydrogen and carbon capture, are opening new revenue streams. The drive towards Industry 4.0 principles and the adoption of digital twins for simulation and optimization are also significant growth accelerators, promising to redefine operational paradigms.

Key Players Shaping the Automation Solutions in Oil and Gas Market

- ABB Ltd.

- Emerson Electric Co.

- Endress+Hauser AG

- Fanuc Corp.

- General Electric Co.

- Hitachi, Ltd.

- Honeywell International Inc.

- Mitsubishi Electric Corp.

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corporation

Notable Milestones in Automation Solutions in Oil and Gas Sector

- 2019: Siemens AG launches its enhanced Industrial Edge platform, strengthening its IIoT capabilities for the oil and gas sector.

- 2020: Honeywell International Inc. announces a significant expansion of its Experion PKS distributed control system portfolio to address evolving industrial needs.

- 2021: Emerson Electric Co. acquires a leading provider of digital oilfield technologies, enhancing its integrated solutions offering.

- 2022: Rockwell Automation Inc. partners with a major oilfield services company to develop AI-powered solutions for production optimization.

- 2023: ABB Ltd. introduces new advanced sensor technologies designed for extreme environments in oil and gas exploration.

- 2024: Schneider Electric SE announces a strategic collaboration to advance digital transformation and cybersecurity in the energy sector.

- 2025 (Projected): Increased focus on AI-driven predictive maintenance solutions and fully integrated SCADA-DCS platforms.

In-Depth Automation Solutions in Oil and Gas Market Outlook

- 2019: Siemens AG launches its enhanced Industrial Edge platform, strengthening its IIoT capabilities for the oil and gas sector.

- 2020: Honeywell International Inc. announces a significant expansion of its Experion PKS distributed control system portfolio to address evolving industrial needs.

- 2021: Emerson Electric Co. acquires a leading provider of digital oilfield technologies, enhancing its integrated solutions offering.

- 2022: Rockwell Automation Inc. partners with a major oilfield services company to develop AI-powered solutions for production optimization.

- 2023: ABB Ltd. introduces new advanced sensor technologies designed for extreme environments in oil and gas exploration.

- 2024: Schneider Electric SE announces a strategic collaboration to advance digital transformation and cybersecurity in the energy sector.

- 2025 (Projected): Increased focus on AI-driven predictive maintenance solutions and fully integrated SCADA-DCS platforms.

In-Depth Automation Solutions in Oil and Gas Market Outlook

The future outlook for the Automation Solutions in Oil and Gas market is exceptionally promising, driven by a confluence of technological advancements and persistent industry demands. Growth accelerators such as the widespread adoption of AI for autonomous operations, the expansion of IIoT connectivity across the value chain, and the increasing emphasis on sustainability and decarbonization will shape the market trajectory. Strategic opportunities lie in providing integrated digital solutions that enhance operational resilience, optimize resource utilization, and ensure stringent safety and environmental compliance. The market is expected to witness continued innovation in areas like advanced analytics, cybersecurity for OT systems, and the development of solutions for emerging energy technologies, positioning automation as a cornerstone of future energy infrastructure. The estimated market size by 2033 is projected to reach $18.2 billion, signifying substantial growth and innovation.

Automation Solutions in Oil and Gas Segmentation

-

1. Application

- 1.1. Oil

- 1.2. Gas

-

2. Types

- 2.1. Supervisory Control and Data Acquisition (SCADA)

- 2.2. Programmable Logic Controller (PLC)

- 2.3. Distributed Control Systems (DCS)

- 2.4. Manufacturing Execution System (MES)

- 2.5. Safety Instrumented System (SIS)

- 2.6. Other Systems

Automation Solutions in Oil and Gas Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Automation Solutions in Oil and Gas REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automation Solutions in Oil and Gas Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Oil

- 5.1.2. Gas

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Supervisory Control and Data Acquisition (SCADA)

- 5.2.2. Programmable Logic Controller (PLC)

- 5.2.3. Distributed Control Systems (DCS)

- 5.2.4. Manufacturing Execution System (MES)

- 5.2.5. Safety Instrumented System (SIS)

- 5.2.6. Other Systems

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automation Solutions in Oil and Gas Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Oil

- 6.1.2. Gas

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Supervisory Control and Data Acquisition (SCADA)

- 6.2.2. Programmable Logic Controller (PLC)

- 6.2.3. Distributed Control Systems (DCS)

- 6.2.4. Manufacturing Execution System (MES)

- 6.2.5. Safety Instrumented System (SIS)

- 6.2.6. Other Systems

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Automation Solutions in Oil and Gas Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Oil

- 7.1.2. Gas

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Supervisory Control and Data Acquisition (SCADA)

- 7.2.2. Programmable Logic Controller (PLC)

- 7.2.3. Distributed Control Systems (DCS)

- 7.2.4. Manufacturing Execution System (MES)

- 7.2.5. Safety Instrumented System (SIS)

- 7.2.6. Other Systems

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Automation Solutions in Oil and Gas Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Oil

- 8.1.2. Gas

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Supervisory Control and Data Acquisition (SCADA)

- 8.2.2. Programmable Logic Controller (PLC)

- 8.2.3. Distributed Control Systems (DCS)

- 8.2.4. Manufacturing Execution System (MES)

- 8.2.5. Safety Instrumented System (SIS)

- 8.2.6. Other Systems

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Automation Solutions in Oil and Gas Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Oil

- 9.1.2. Gas

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Supervisory Control and Data Acquisition (SCADA)

- 9.2.2. Programmable Logic Controller (PLC)

- 9.2.3. Distributed Control Systems (DCS)

- 9.2.4. Manufacturing Execution System (MES)

- 9.2.5. Safety Instrumented System (SIS)

- 9.2.6. Other Systems

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Automation Solutions in Oil and Gas Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Oil

- 10.1.2. Gas

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Supervisory Control and Data Acquisition (SCADA)

- 10.2.2. Programmable Logic Controller (PLC)

- 10.2.3. Distributed Control Systems (DCS)

- 10.2.4. Manufacturing Execution System (MES)

- 10.2.5. Safety Instrumented System (SIS)

- 10.2.6. Other Systems

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ABB Ltd.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Emerson Electric Co.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Endress+Hauser AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fanuc Corp.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 General Electric Co.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hitachi

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ltd.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Honeywell International Inc.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mitsubishi Electric Corp.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rockwell Automation Inc.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Schneider Electric SE

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Siemens AG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Yokogawa Electric Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 ABB Ltd.

List of Figures

- Figure 1: Global Automation Solutions in Oil and Gas Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Automation Solutions in Oil and Gas Revenue (million), by Application 2024 & 2032

- Figure 3: North America Automation Solutions in Oil and Gas Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Automation Solutions in Oil and Gas Revenue (million), by Types 2024 & 2032

- Figure 5: North America Automation Solutions in Oil and Gas Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Automation Solutions in Oil and Gas Revenue (million), by Country 2024 & 2032

- Figure 7: North America Automation Solutions in Oil and Gas Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Automation Solutions in Oil and Gas Revenue (million), by Application 2024 & 2032

- Figure 9: South America Automation Solutions in Oil and Gas Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Automation Solutions in Oil and Gas Revenue (million), by Types 2024 & 2032

- Figure 11: South America Automation Solutions in Oil and Gas Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Automation Solutions in Oil and Gas Revenue (million), by Country 2024 & 2032

- Figure 13: South America Automation Solutions in Oil and Gas Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Automation Solutions in Oil and Gas Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Automation Solutions in Oil and Gas Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Automation Solutions in Oil and Gas Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Automation Solutions in Oil and Gas Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Automation Solutions in Oil and Gas Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Automation Solutions in Oil and Gas Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Automation Solutions in Oil and Gas Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Automation Solutions in Oil and Gas Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Automation Solutions in Oil and Gas Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Automation Solutions in Oil and Gas Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Automation Solutions in Oil and Gas Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Automation Solutions in Oil and Gas Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Automation Solutions in Oil and Gas Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Automation Solutions in Oil and Gas Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Automation Solutions in Oil and Gas Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Automation Solutions in Oil and Gas Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Automation Solutions in Oil and Gas Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Automation Solutions in Oil and Gas Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automation Solutions in Oil and Gas Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Automation Solutions in Oil and Gas Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Automation Solutions in Oil and Gas Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Automation Solutions in Oil and Gas Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Automation Solutions in Oil and Gas Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Automation Solutions in Oil and Gas Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Automation Solutions in Oil and Gas Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Automation Solutions in Oil and Gas Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Automation Solutions in Oil and Gas Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Automation Solutions in Oil and Gas Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Automation Solutions in Oil and Gas Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Automation Solutions in Oil and Gas Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Automation Solutions in Oil and Gas Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Automation Solutions in Oil and Gas Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Automation Solutions in Oil and Gas Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Automation Solutions in Oil and Gas Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Automation Solutions in Oil and Gas Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Automation Solutions in Oil and Gas Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Automation Solutions in Oil and Gas Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Automation Solutions in Oil and Gas Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automation Solutions in Oil and Gas?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Automation Solutions in Oil and Gas?

Key companies in the market include ABB Ltd., Emerson Electric Co., Endress+Hauser AG, Fanuc Corp., General Electric Co., Hitachi, Ltd., Honeywell International Inc., Mitsubishi Electric Corp., Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Yokogawa Electric Corporation.

3. What are the main segments of the Automation Solutions in Oil and Gas?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automation Solutions in Oil and Gas," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automation Solutions in Oil and Gas report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automation Solutions in Oil and Gas?

To stay informed about further developments, trends, and reports in the Automation Solutions in Oil and Gas, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence