Key Insights

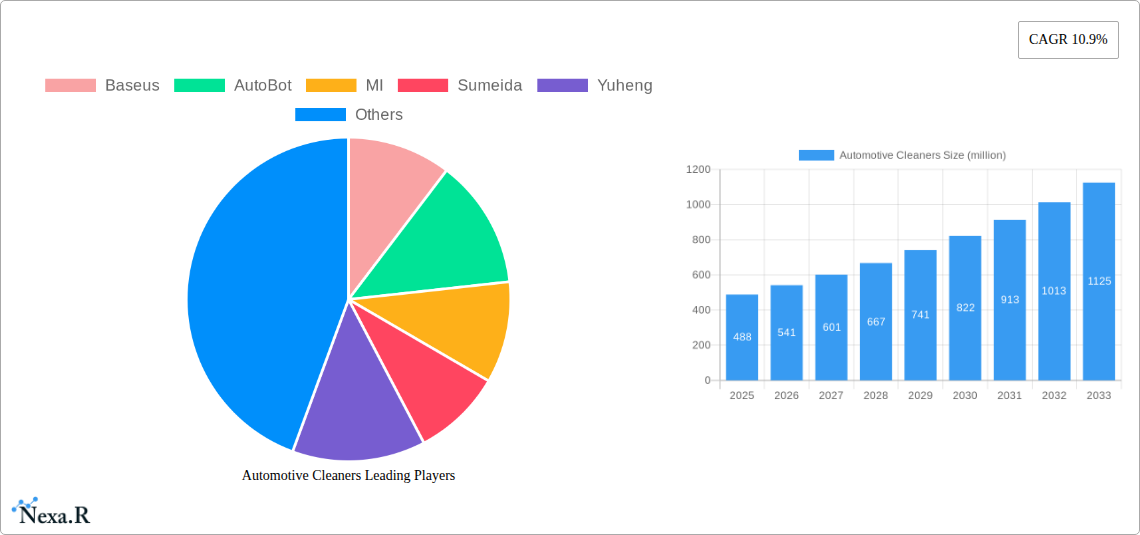

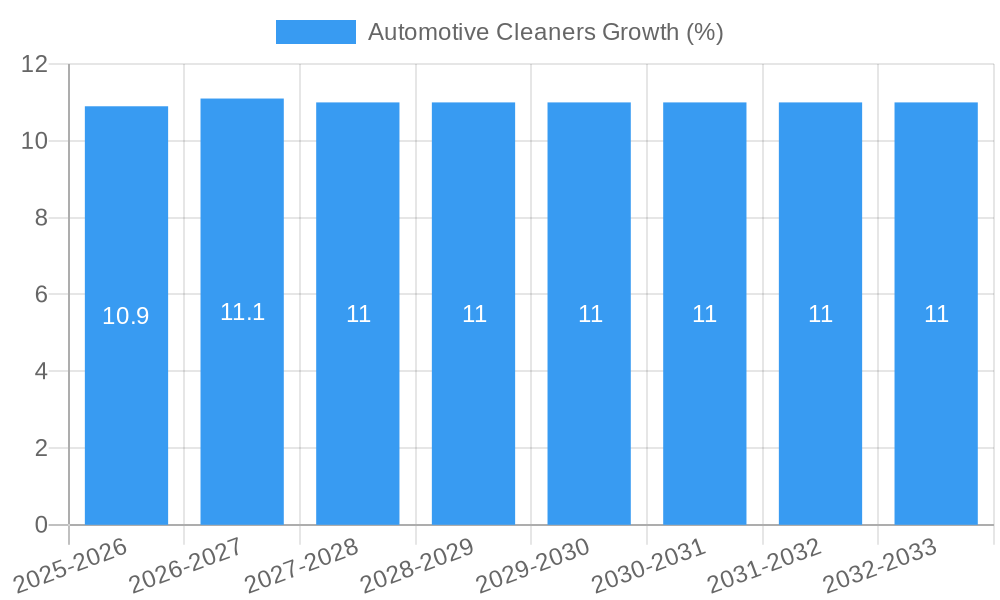

The global automotive cleaners market is poised for robust expansion, projected to reach \$488 million in value by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 10.9%. This significant growth is primarily fueled by the increasing demand for maintaining vehicle aesthetics and hygiene, driven by rising disposable incomes and a growing awareness among consumers about the importance of regular car care. The burgeoning automotive sector, particularly the surge in passenger car ownership and the continuous demand for commercial vehicles, also acts as a key accelerator for this market. Furthermore, advancements in cleaning technology, including the introduction of eco-friendly and multi-functional cleaning solutions, are attracting a wider consumer base and encouraging repeat purchases. The market is segmented into applications such as commercial vehicles and passenger cars, with types encompassing both wireless and wired cleaning devices, catering to diverse consumer needs and preferences.

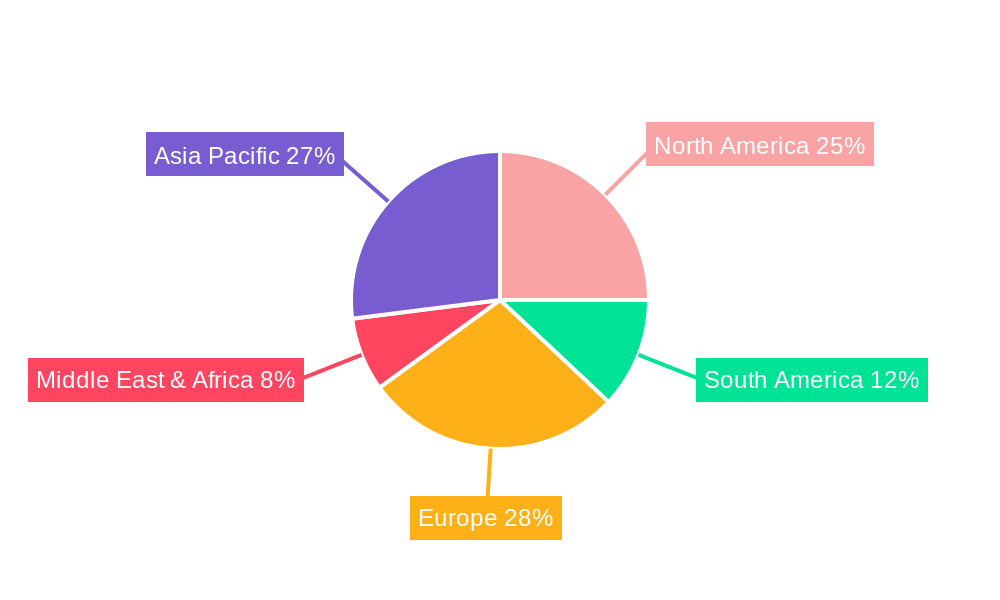

Emerging trends like the rise of the DIY car care culture, coupled with the convenience offered by portable and rechargeable cleaning devices, are reshaping the market landscape. The increasing adoption of smart and automated cleaning solutions further contributes to market dynamism. However, the market faces certain restraints, including the relatively high initial cost of some advanced cleaning equipment and the availability of lower-priced, less sophisticated alternatives. Intense competition among established and emerging players, such as Baseus, AutoBot, MI, Dyson, and Haier, is also a notable factor, driving innovation and price competitiveness. Geographically, Asia Pacific is expected to emerge as a dominant region, owing to its large automotive manufacturing base and rapidly growing consumer market, followed by North America and Europe. The forecast period, 2025-2033, is anticipated to witness sustained growth as consumers increasingly prioritize vehicle maintenance and appearance.

Automotive Cleaners Market: Comprehensive Analysis and Future Outlook (2019-2033)

This report delivers an in-depth analysis of the global Automotive Cleaners market, encompassing a comprehensive study from 2019 to 2033, with a detailed focus on the Base Year 2025 and the Forecast Period 2025-2033. We provide critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, and emerging opportunities, all designed to equip industry professionals with actionable intelligence. The report leverages high-traffic keywords for optimal SEO visibility, including "automotive cleaning solutions," "car interior cleaner," "car exterior cleaner," "auto detailing products," "wireless car vacuum," "wired car vacuum," and "commercial vehicle cleaning." It also analyzes the parent market (Automotive Aftermarket) and child markets (e.g., specific cleaner types) for a holistic view. All quantitative values are presented in million units.

Automotive Cleaners Market Dynamics & Structure

The automotive cleaners market exhibits a moderate concentration, with a blend of established global players and emerging regional manufacturers. Technological innovation is a primary driver, fueled by advancements in chemical formulations for enhanced cleaning efficacy, eco-friendliness, and ease of use. The development of specialized cleaners for various vehicle surfaces and applications, alongside the increasing demand for sustainable and biodegradable products, is shaping product roadmaps. Regulatory frameworks, particularly concerning environmental impact and chemical safety, are becoming more stringent, influencing product development and market entry strategies. Competitive product substitutes, such as DIY cleaning methods and multi-purpose cleaners, pose a continuous challenge, necessitating manufacturers to emphasize product performance, brand reputation, and unique selling propositions. End-user demographics are shifting, with a growing segment of younger, tech-savvy consumers prioritizing convenience and specialized cleaning solutions, while commercial fleet operators focus on cost-effectiveness and bulk purchasing. Mergers and acquisitions (M&A) trends are moderately active, with larger entities acquiring innovative startups to expand their product portfolios and market reach.

- Market Concentration: Moderate, with key players holding significant shares but room for niche market penetration.

- Technological Innovation Drivers: Development of eco-friendly formulas, advanced application technologies (e.g., foaming agents, nanotechnology), and smart cleaning devices.

- Regulatory Frameworks: Increasing focus on VOC reduction, biodegradable ingredients, and enhanced safety standards.

- Competitive Product Substitutes: DIY cleaning solutions, multi-purpose household cleaners, and professional detailing services.

- End-User Demographics: Growing demand for premium, specialized cleaners from discerning car owners and eco-conscious consumers.

- M&A Trends: Strategic acquisitions to gain market share, access new technologies, and expand product offerings.

- Innovation Barriers: High R&D costs for novel formulations and the need for extensive product testing and certification.

Automotive Cleaners Growth Trends & Insights

The global automotive cleaners market is experiencing robust growth, projected to expand significantly from 2019 to 2033. The Base Year 2025 is anticipated to witness a market size of approximately USD 12,500 million units, driven by increasing vehicle ownership and the growing emphasis on vehicle aesthetics and maintenance. The Forecast Period 2025–2033 is expected to see a Compound Annual Growth Rate (CAGR) of around 5.8%, pushing the market value to an estimated USD 19,500 million units by 2033. This expansion is underpinned by a combination of factors. Rising disposable incomes in emerging economies have led to a surge in passenger car sales, consequently increasing the demand for aftermarket cleaning products. Furthermore, the growing popularity of car detailing as a hobby and a professional service contributes substantially to market volume. Technological disruptions, such as the advent of advanced cleaning formulations and the integration of smart features in cleaning devices (like wireless car vacuums with advanced filtration), are revolutionizing consumer preferences and driving adoption. Consumer behavior is shifting towards a greater appreciation for long-term vehicle care and preservation, leading to increased spending on specialized cleaners for both interior and exterior applications. The convenience offered by wireless cleaning solutions is particularly appealing to younger demographics, while commercial vehicle operators are seeking efficient and cost-effective cleaning solutions to maintain fleet appearance and longevity. The market penetration of advanced cleaning technologies is expected to deepen, with consumers becoming more aware of the benefits of high-performance and eco-friendly products. The historical data from 2019–2024 indicates a steady upward trajectory, demonstrating the resilience and consistent demand within the automotive cleaners sector. The increasing global vehicle parc, coupled with a growing trend towards vehicle personalization and maintenance, acts as a powerful catalyst for sustained market expansion.

Dominant Regions, Countries, or Segments in Automotive Cleaners

The global automotive cleaners market is significantly influenced by a confluence of regional economic strengths, consumer behaviors, and the dominant vehicle types. North America and Europe currently lead market growth, driven by high disposable incomes, a mature automotive aftermarket, and a strong culture of vehicle maintenance and care. Within these regions, the Passenger Car segment is the dominant application, accounting for an estimated 75% of the market share in 2025. This dominance is fueled by the sheer volume of passenger vehicles on the road and the widespread consumer interest in maintaining vehicle aesthetics and interior comfort. The Wireless type of automotive cleaners is emerging as a particularly strong growth driver, projected to capture 55% of the market share by 2025, due to its unparalleled convenience and increasing technological sophistication.

- Leading Region: North America, followed closely by Europe.

- Key Country Drivers (North America): United States (high vehicle ownership, strong aftermarket infrastructure, consumer preference for premium products), Canada (growing demand for car care services and products).

- Key Country Drivers (Europe): Germany (strong automotive manufacturing base, high-quality standards, consumer focus on vehicle longevity), UK (vibrant car care culture, increasing adoption of detailing services).

- Dominant Application Segment: Passenger Car, driven by the extensive global passenger vehicle parc and a consumer focus on interior and exterior aesthetics.

- Dominant Type Segment: Wireless Automotive Cleaners, propelled by technological advancements, convenience, and a growing demand for portable cleaning solutions.

- Market Share (Passenger Car Application - 2025): Approximately 75% of the total automotive cleaners market.

- Market Share (Wireless Type - 2025): Approximately 55% of the total automotive cleaners market.

- Growth Potential (Commercial Vehicle Application): Significant, with increasing fleet sizes and a focus on operational efficiency and vehicle presentation.

- Growth Potential (Wired Type): Stable, catering to users requiring continuous power and higher capacity for professional detailing.

Automotive Cleaners Product Landscape

The automotive cleaners product landscape is characterized by continuous innovation, with manufacturers focusing on developing high-performance, user-friendly, and environmentally conscious solutions. Key product categories include interior cleaners, exterior cleaners, wheel cleaners, glass cleaners, and specialized surface treatments. Advanced formulations now incorporate features like pH-neutral compositions, streak-free performance, UV protection, and odor elimination. The emergence of cordless and portable cleaning devices, such as powerful wireless car vacuums and compact steam cleaners, is a significant trend, offering unprecedented convenience for both DIY enthusiasts and professional detailers. Product performance metrics are increasingly scrutinized, with consumers seeking quick-drying formulas, long-lasting protection, and minimal effort for maximum results. Unique selling propositions often revolve around eco-friendliness, with plant-derived ingredients and biodegradable packaging gaining traction. Technological advancements in applicator systems, such as micro-mist sprayers and specialized microfiber cloths, further enhance product effectiveness and user experience.

Key Drivers, Barriers & Challenges in Automotive Cleaners

Key Drivers:

The automotive cleaners market is propelled by several key drivers. Increasing vehicle ownership globally directly translates to a larger consumer base for cleaning and maintenance products. The growing emphasis on vehicle aesthetics and resale value encourages owners to invest in regular cleaning and detailing. Technological advancements in cleaning formulations and devices, such as eco-friendly ingredients and efficient wireless vacuums, are enhancing product appeal. Furthermore, the expansion of the automotive aftermarket and the rise of professional car detailing services create sustained demand.

Barriers & Challenges:

Despite the growth, the market faces several barriers and challenges. Price sensitivity among some consumer segments, particularly in emerging economies, can limit the adoption of premium products. Intense competition from both established brands and private label manufacturers exerts downward pressure on prices. Supply chain disruptions and raw material price volatility can impact production costs and product availability. Stringent environmental regulations and the need for product certifications add complexity and cost to product development. Additionally, consumer perception and education regarding the benefits of specialized automotive cleaners versus general-purpose alternatives remain a hurdle.

Emerging Opportunities in Automotive Cleaners

Emerging opportunities within the automotive cleaners market are diverse and promising. The rapid growth of electric vehicles (EVs) presents a unique segment with evolving cleaning needs, particularly for interior surfaces and battery component protection. The increasing demand for sustainable and biodegradable cleaning solutions is creating a niche for eco-conscious brands that can leverage natural ingredients and reduced chemical footprints. The integration of smart technology in automotive cleaning devices, such as AI-powered self-cleaning systems or app-controlled detailing tools, represents a significant frontier. Furthermore, untapped markets in developing regions with a burgeoning middle class and increasing vehicle ownership offer substantial growth potential for accessible and effective cleaning products.

Growth Accelerators in the Automotive Cleaners Industry

Several factors are accelerating growth in the automotive cleaners industry. The relentless pursuit of product innovation, focusing on enhanced efficacy, convenience, and environmental sustainability, is a key accelerator. Strategic partnerships between chemical manufacturers and automotive OEMs or aftermarket service providers can drive product integration and brand visibility. The expansion of e-commerce platforms has significantly broadened market reach, allowing manufacturers to connect directly with consumers and offer specialized products globally. Furthermore, the increasing trend towards vehicle personalization and customization drives demand for a wide array of specialized cleaning and maintenance products.

Key Players Shaping the Automotive Cleaners Market

- Baseus

- AutoBot

- MI

- Sumeida

- Yuheng

- Dyson

- Midea

- Yantu

- Unit

- Lingcheng

- Haier

- Ozio

- Westinghouse

- Worx

Notable Milestones in Automotive Cleaners Sector

- 2019: Launch of advanced, eco-friendly interior detailing kits by multiple manufacturers, responding to growing environmental concerns.

- 2020: Significant surge in demand for DIY car cleaning products as lockdowns restrict access to professional services.

- 2021: Introduction of highly efficient, HEPA-filtered wireless car vacuums, enhancing air quality within vehicles.

- 2022: Increased investment in R&D for biodegradable and plant-based cleaning formulations across the industry.

- 2023: Strategic collaborations between automotive parts retailers and cleaning product brands to offer bundled solutions.

- 2024: Emerging trend of smart cleaning devices with app connectivity for enhanced user experience and product tracking.

In-Depth Automotive Cleaners Market Outlook

The future outlook for the automotive cleaners market remains exceptionally strong, driven by persistent growth accelerators. The continued evolution of vehicle technology and the increasing lifespan of automobiles will necessitate advanced cleaning and maintenance solutions. Emerging opportunities in the EV sector and the sustained demand for sustainable products will shape innovation trajectories. Strategic market expansions into developing economies, coupled with a greater focus on direct-to-consumer sales channels, will unlock new revenue streams. Industry players are poised to capitalize on these trends by prioritizing research and development, fostering strategic alliances, and adapting to evolving consumer preferences for convenience, performance, and environmental responsibility. The market is expected to witness sustained growth, driven by innovation and a deepening consumer commitment to vehicle care.

Automotive Cleaners Segmentation

-

1. Application

- 1.1. Commercial Vehicle

- 1.2. Passenger Car

-

2. Types

- 2.1. Wireless

- 2.2. Wired

Automotive Cleaners Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Automotive Cleaners REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.9% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Cleaners Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Vehicle

- 5.1.2. Passenger Car

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Wireless

- 5.2.2. Wired

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Automotive Cleaners Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Vehicle

- 6.1.2. Passenger Car

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Wireless

- 6.2.2. Wired

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Automotive Cleaners Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Vehicle

- 7.1.2. Passenger Car

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Wireless

- 7.2.2. Wired

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Automotive Cleaners Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Vehicle

- 8.1.2. Passenger Car

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Wireless

- 8.2.2. Wired

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Automotive Cleaners Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Vehicle

- 9.1.2. Passenger Car

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Wireless

- 9.2.2. Wired

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Automotive Cleaners Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Vehicle

- 10.1.2. Passenger Car

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Wireless

- 10.2.2. Wired

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Baseus

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AutoBot

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MI

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sumeida

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yuheng

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dyson

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Midea

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Yantu

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Unit

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lingcheng

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Haier

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ozio

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Westinghouse

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Worx

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Baseus

List of Figures

- Figure 1: Global Automotive Cleaners Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Cleaners Revenue (million), by Application 2024 & 2032

- Figure 3: North America Automotive Cleaners Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Automotive Cleaners Revenue (million), by Types 2024 & 2032

- Figure 5: North America Automotive Cleaners Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Automotive Cleaners Revenue (million), by Country 2024 & 2032

- Figure 7: North America Automotive Cleaners Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Automotive Cleaners Revenue (million), by Application 2024 & 2032

- Figure 9: South America Automotive Cleaners Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Automotive Cleaners Revenue (million), by Types 2024 & 2032

- Figure 11: South America Automotive Cleaners Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Automotive Cleaners Revenue (million), by Country 2024 & 2032

- Figure 13: South America Automotive Cleaners Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Automotive Cleaners Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Automotive Cleaners Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Automotive Cleaners Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Automotive Cleaners Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Automotive Cleaners Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Automotive Cleaners Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Automotive Cleaners Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Automotive Cleaners Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Automotive Cleaners Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Automotive Cleaners Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Automotive Cleaners Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Automotive Cleaners Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Automotive Cleaners Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Automotive Cleaners Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Automotive Cleaners Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Automotive Cleaners Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Automotive Cleaners Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Automotive Cleaners Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Cleaners Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Cleaners Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Automotive Cleaners Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Automotive Cleaners Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Automotive Cleaners Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Automotive Cleaners Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Automotive Cleaners Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Automotive Cleaners Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Automotive Cleaners Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Automotive Cleaners Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Automotive Cleaners Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Automotive Cleaners Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Automotive Cleaners Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Automotive Cleaners Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Automotive Cleaners Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Automotive Cleaners Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Automotive Cleaners Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Automotive Cleaners Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Automotive Cleaners Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Automotive Cleaners Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Cleaners?

The projected CAGR is approximately 10.9%.

2. Which companies are prominent players in the Automotive Cleaners?

Key companies in the market include Baseus, AutoBot, MI, Sumeida, Yuheng, Dyson, Midea, Yantu, Unit, Lingcheng, Haier, Ozio, Westinghouse, Worx.

3. What are the main segments of the Automotive Cleaners?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 488 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Cleaners," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Cleaners report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Cleaners?

To stay informed about further developments, trends, and reports in the Automotive Cleaners, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence