Key Insights

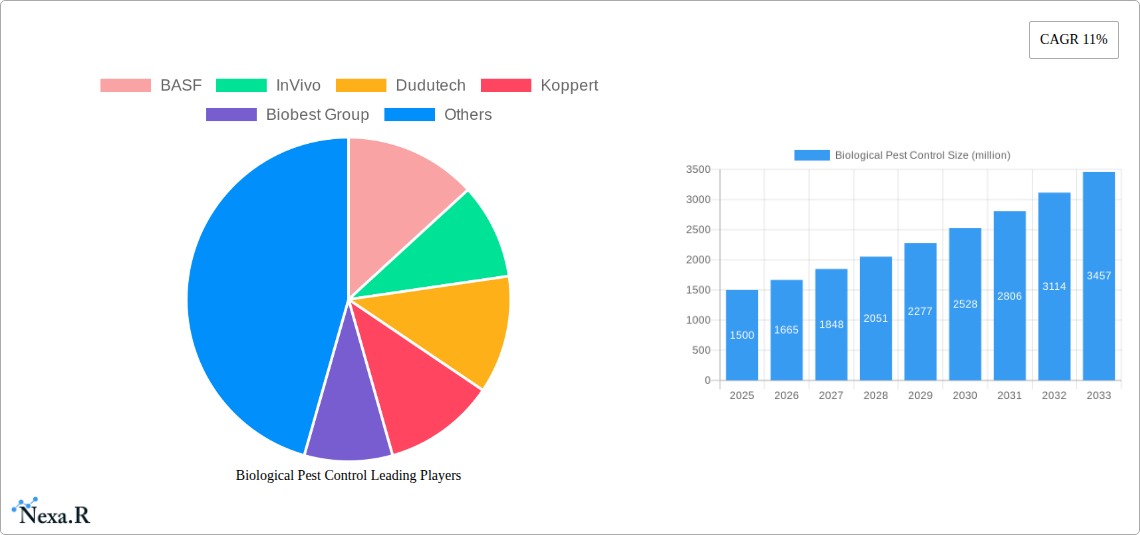

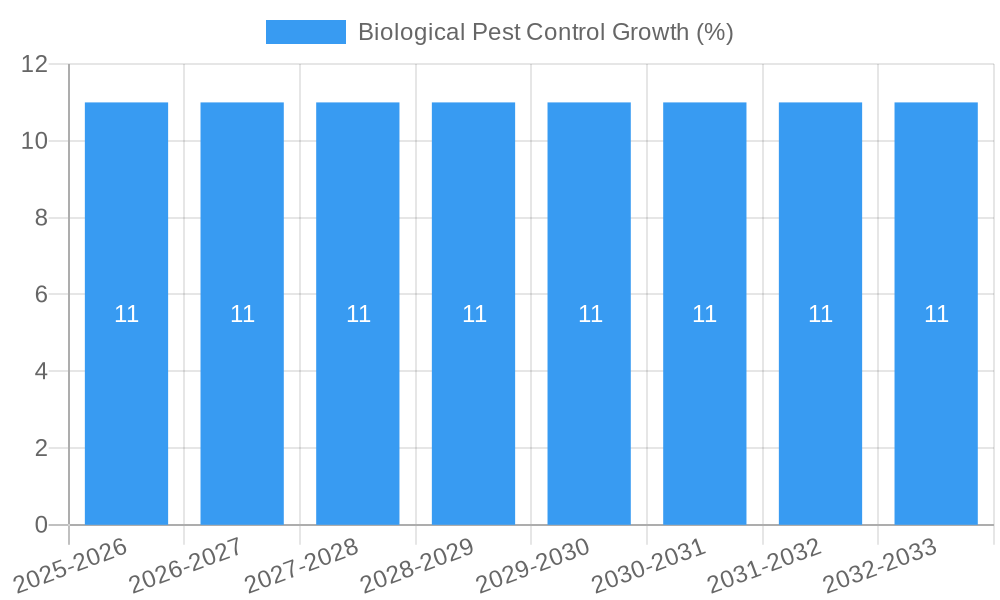

The Biological Pest Control market is poised for significant expansion, driven by a growing global demand for sustainable agricultural practices and a reduction in reliance on synthetic chemicals. With a historical market size in 1947 estimated to have been around $194.7 million (assuming a conservative initial market size based on the CAGR), the sector has witnessed a remarkable evolution. The projected Compound Annual Growth Rate (CAGR) of 11% underscores this robust growth trajectory, indicating a market that is not only expanding but also gaining substantial traction. This expansion is fueled by increasing consumer awareness regarding the health and environmental impacts of traditional pesticides, alongside stringent government regulations promoting eco-friendly alternatives. The market's value unit is in millions of dollars, reflecting the substantial economic activity within this sector. Key applications, including Vegetables & Fruits, Turf and Gardening, and Crop protection, are all contributing to this upward trend, highlighting the versatility and widespread adoption of biological pest control solutions.

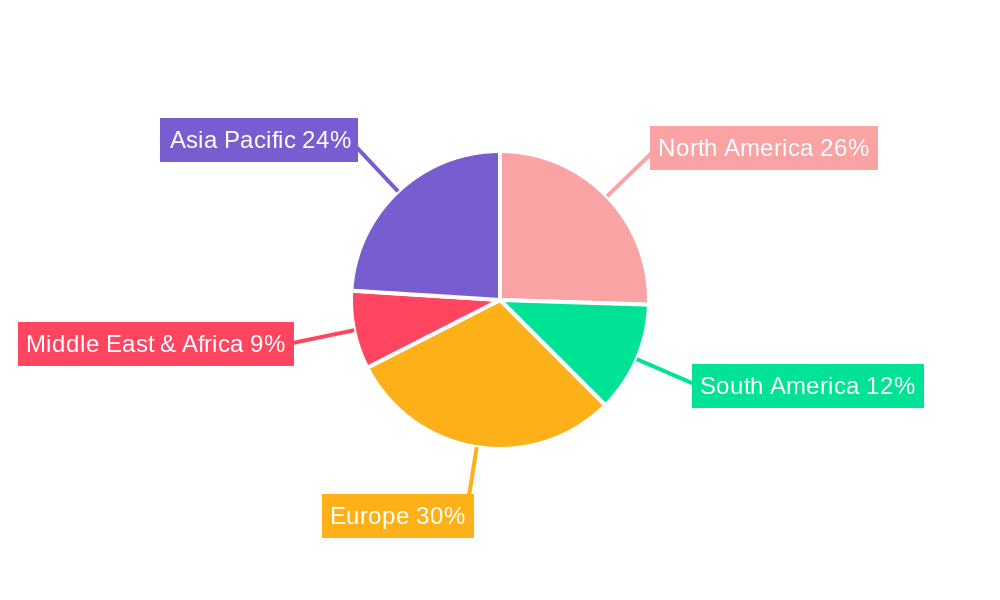

The biological pest control market is characterized by a diverse range of products, prominently featuring Predatory Mites, Insects, and Nematodes, alongside the rapidly growing segment of Bioinsecticides. These biological agents offer targeted pest management, minimizing harm to beneficial organisms and the environment. Emerging trends include advancements in research and development, leading to more effective and stable biological control agents, as well as integrated pest management (IPM) strategies that combine biological methods with other control techniques. Despite the strong growth outlook, the market faces certain restraints, such as the sometimes higher upfront cost compared to conventional pesticides, limited shelf life of certain biological agents, and the need for specialized knowledge for effective application. However, ongoing innovation and increasing farmer education are steadily mitigating these challenges. Key players like BASF, Koppert, and Valent BioSciences are investing heavily in R&D and expanding their product portfolios, further solidifying the market's growth potential across regions like North America, Europe, and Asia Pacific.

Biological Pest Control Market: Sustainable Solutions for a Growing World

This comprehensive report provides an in-depth analysis of the global Biological Pest Control market, projecting a robust CAGR of xx% from 2025 to 2033. The market, valued at an estimated $xx million in 2025, is driven by increasing demand for sustainable agriculture, stringent regulations on synthetic pesticides, and a growing consumer preference for organically grown produce. The report examines the parent market's influence and the child market's specific growth trajectories, offering critical insights for stakeholders navigating this dynamic landscape.

Biological Pest Control Market Dynamics & Structure

The Biological Pest Control market is characterized by moderate concentration, with key players actively investing in research and development to introduce novel bio-pesticide formulations and biological control agents. Technological innovation is primarily driven by advancements in microbial fermentation, genetic engineering for enhanced efficacy, and precision application technologies. Regulatory frameworks globally are increasingly favoring biological solutions over synthetic chemicals, creating a fertile ground for market expansion. However, the higher initial cost of biological control agents and the need for specialized knowledge in their application present significant competitive product substitutes and adoption barriers. End-user demographics are shifting towards younger, environmentally conscious farmers and horticulturalists who are seeking long-term, sustainable pest management strategies. Merger and acquisition (M&A) trends are on the rise as larger agrochemical companies seek to integrate biological solutions into their portfolios and smaller, innovative firms aim for broader market reach. The M&A deal volume for biological pest control solutions saw an increase of xx% from 2019 to 2024.

- Market Concentration: Moderate, with a mix of large corporations and specialized SMEs.

- Technological Innovation Drivers: Microbial fermentation, genetic engineering, precision application, and integrated pest management (IPM) integration.

- Regulatory Frameworks: Growing favorability towards biologicals, leading to increased market access.

- Competitive Product Substitutes: While synthetic pesticides remain prevalent, the efficacy and safety profile of biologicals are increasingly recognized.

- End-User Demographics: Farmers, horticulturalists, and governments prioritizing sustainable practices.

- M&A Trends: Active consolidation to enhance product portfolios and market penetration.

Biological Pest Control Growth Trends & Insights

The global Biological Pest Control market is poised for significant expansion, driven by a confluence of economic, environmental, and social factors. The market size evolution from a historical $xx million in 2019 to an estimated $xx million in 2025 highlights a consistent upward trajectory. This growth is further underscored by the projected CAGR of xx% during the forecast period of 2025–2033. Adoption rates of biological pest control methods are steadily increasing, particularly in regions with strong organic farming initiatives and stringent regulations on conventional pesticides. Technological disruptions are emerging in the form of advanced formulation techniques that improve the shelf-life and efficacy of bio-pesticides, as well as the development of novel biocontrol agents targeting specific pests. Consumer behavior shifts are a crucial catalyst, with a burgeoning demand for pesticide-free food products influencing farming practices and subsequently, the adoption of biological pest control. Market penetration of biologicals, while still lower than synthetics, is projected to reach xx% by 2033. The increasing awareness of the negative environmental and health impacts of synthetic pesticides is a powerful driver pushing farmers towards safer and more sustainable alternatives. Furthermore, government initiatives promoting integrated pest management (IPM) strategies, which often incorporate biological control, are significantly boosting market growth. The development of more targeted and cost-effective biological solutions is also a key factor in overcoming initial farmer resistance. The parent market, encompassing the broader agricultural chemicals sector, is witnessing a significant investment shift towards sustainable solutions, with biologicals emerging as a key growth engine. The child market, specifically focusing on biological pest control agents and bio-insecticides, is benefiting from this overarching trend, experiencing rapid innovation and market expansion.

Dominant Regions, Countries, or Segments in Biological Pest Control

The Vegetables & Fruits segment, within the Application category, is currently the dominant force driving growth in the global Biological Pest Control market. This dominance is attributed to several interconnected factors, including the high value of these crops, their susceptibility to a wide range of pests, and the stringent residue limits imposed by importing nations, which encourage the adoption of biological pest control solutions. The Type segment of Predatory Mites is also exhibiting remarkable growth, owing to their high efficacy in controlling common agricultural pests and their compatibility with organic farming practices.

Key Drivers for Dominance in Vegetables & Fruits:

- High Crop Value and Vulnerability: Vegetables and fruits often command higher market prices, making investment in effective pest management crucial. Their tender nature makes them susceptible to a broad spectrum of pests.

- Stringent Residue Regulations: Major importing countries enforce strict limits on pesticide residues, pushing producers towards biological alternatives to ensure market access.

- Consumer Demand for Organic Produce: A growing global consumer base actively seeks organically grown vegetables and fruits, directly influencing farming practices and the adoption of biological pest control.

- Versatility of Biological Agents: Biological control agents can be effectively deployed in diverse farming systems, from open fields to greenhouses, catering to the varied cultivation methods for vegetables and fruits.

- Integrated Pest Management (IPM) Integration: Vegetables and fruits are ideal candidates for comprehensive IPM programs, where biological agents play a pivotal role in sustainable pest management.

Market Share and Growth Potential:

The Vegetables & Fruits segment is estimated to hold a market share of xx% in 2025, with a projected CAGR of xx% during the forecast period. This segment's growth is further propelled by the increasing global population and the corresponding rise in demand for fresh produce.

Dominance Factors in Predatory Mites:

- Targeted Efficacy: Predatory mites are highly effective against specific, problematic pests such as spider mites and thrips, offering a precise and sustainable solution.

- Environmentally Benign: They pose no threat to beneficial insects, humans, or the environment, aligning with the principles of sustainable agriculture.

- Adaptability: Predatory mites can be deployed in a variety of settings, including greenhouses and open fields, making them a versatile option.

- Commercially Available Formulations: The availability of well-researched and commercially viable formulations of predatory mites further supports their widespread adoption.

Biological Pest Control Product Landscape

The Biological Pest Control product landscape is witnessing an influx of innovative solutions, including advanced formulations of bio-insecticides derived from naturally occurring microorganisms, enhanced strains of predatory insects and mites with improved efficacy and persistence, and novel bio-nematicides offering targeted control of soil-borne pests. Product performance metrics are increasingly focused on specificity, reduced environmental impact, and compatibility with integrated pest management (IPM) programs. Unique selling propositions revolve around their safety profile for non-target organisms, contribution to soil health, and the absence of harvest intervals compared to many synthetic pesticides. Technological advancements are enabling the development of bio-control agents with extended shelf-life and improved delivery mechanisms, making them more practical and cost-effective for end-users.

Key Drivers, Barriers & Challenges in Biological Pest Control

Key Drivers:

- Growing demand for sustainable agriculture and organic produce.

- Increasingly stringent regulations on synthetic pesticides globally.

- Rising consumer awareness regarding health and environmental impacts of conventional pesticides.

- Government initiatives and subsidies promoting Integrated Pest Management (IPM).

- Technological advancements leading to more effective and cost-efficient biological solutions.

Barriers & Challenges:

- Higher initial cost compared to some conventional pesticides.

- Need for specialized knowledge for optimal application and integration into farming practices.

- Shorter shelf-life for some biological control agents, requiring careful storage and timely application.

- Variability in efficacy based on environmental conditions (temperature, humidity).

- Supply chain complexities and the need for specialized cold-chain logistics for certain products.

- Resistance from some traditional farming communities due to unfamiliarity and perceived risks.

Emerging Opportunities in Biological Pest Control

Emerging opportunities in the Biological Pest Control market lie in the development of microbial consortia offering broad-spectrum pest control, advanced formulation technologies for enhanced UV stability and persistence of bio-pesticides, and the application of RNA interference (RNAi) technology for highly targeted pest suppression. Untapped markets include developing economies where the adoption of sustainable agriculture is gaining momentum and the expansion of biologicals into urban and peri-urban gardening sectors. Evolving consumer preferences for transparent and sustainable food production are creating demand for traceable and verifiable biological pest management solutions. The integration of biologicals with digital farming technologies, such as AI-driven pest monitoring and application recommendations, presents a significant growth avenue.

Growth Accelerators in the Biological Pest Control Industry

Catalysts driving long-term growth in the Biological Pest Control industry include significant investments in research and development for novel bio-control agents and bio-stimulants, strategic partnerships between agrochemical giants and specialized biotech firms to leverage complementary expertise, and market expansion strategies targeting regions with nascent but rapidly growing sustainable agriculture sectors. The continuous refinement of production processes, leading to economies of scale and reduced costs, will further accelerate adoption. The development of more robust and resilient biological control agents capable of withstanding a wider range of environmental conditions will also be a key growth accelerator.

Key Players Shaping the Biological Pest Control Market

- BASF

- InVivo

- Dudutech

- Koppert

- Biobest Group

- Arbico

- Applied Bio-nomics

- ENTOCARE

- BioBee

- Anatis Bioprotection

- Rentokil

- Beneficial insectary

- F.A.R

- Kenya Biologics Ltd.

- Xilema

- SDS Biotech

- Fujian Yan Xuan Biological Control Technology

- Henan Jiyuan Baiyun Industry

- E-nema GmbH

- Biohelp

- Envu

- Valent BioSciences

- Certis USA

Notable Milestones in Biological Pest Control Sector

- 2019: Launch of novel bio-insecticide formulations with extended shelf-life by major players, improving market accessibility.

- 2020: Increased regulatory approvals for biological pest control agents in key agricultural markets, boosting market entry.

- 2021: Significant investment in R&D for RNAi-based pest control technologies, promising highly targeted solutions.

- 2022: Strategic acquisitions of smaller biotech firms by leading agrochemical companies to bolster their biological portfolios.

- 2023: Introduction of advanced delivery systems for beneficial insects and mites, enhancing their survival and efficacy in diverse field conditions.

- 2024: Growing adoption of biologicals in greenhouse cultivation for high-value crops, demonstrating efficacy in controlled environments.

In-Depth Biological Pest Control Market Outlook

The future of the Biological Pest Control market is exceptionally promising, driven by sustained innovation and an unwavering global commitment to sustainable agricultural practices. Growth accelerators, including ongoing advancements in microbial technology, the development of sophisticated IPM-compatible solutions, and increasing consumer demand for organic and residue-free produce, will propel the market forward. Strategic collaborations and market expansion into emerging economies offer significant potential for widespread adoption. The continued support from regulatory bodies and increasing farmer education on the benefits of biologicals will further solidify its position as a cornerstone of modern, sustainable agriculture. The market is poised to become a dominant force in global pest management solutions by 2033.

Biological Pest Control Segmentation

-

1. Application

- 1.1. Vegetables & Fruits

- 1.2. Turf and Gardening

- 1.3. Crop

-

2. Type

- 2.1. Predatory Mites

- 2.2. Insects

- 2.3. Nematodes

- 2.4. Bioinsecticides

Biological Pest Control Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Biological Pest Control REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Biological Pest Control Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Vegetables & Fruits

- 5.1.2. Turf and Gardening

- 5.1.3. Crop

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Predatory Mites

- 5.2.2. Insects

- 5.2.3. Nematodes

- 5.2.4. Bioinsecticides

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Biological Pest Control Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Vegetables & Fruits

- 6.1.2. Turf and Gardening

- 6.1.3. Crop

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Predatory Mites

- 6.2.2. Insects

- 6.2.3. Nematodes

- 6.2.4. Bioinsecticides

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Biological Pest Control Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Vegetables & Fruits

- 7.1.2. Turf and Gardening

- 7.1.3. Crop

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Predatory Mites

- 7.2.2. Insects

- 7.2.3. Nematodes

- 7.2.4. Bioinsecticides

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Biological Pest Control Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Vegetables & Fruits

- 8.1.2. Turf and Gardening

- 8.1.3. Crop

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Predatory Mites

- 8.2.2. Insects

- 8.2.3. Nematodes

- 8.2.4. Bioinsecticides

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Biological Pest Control Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Vegetables & Fruits

- 9.1.2. Turf and Gardening

- 9.1.3. Crop

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Predatory Mites

- 9.2.2. Insects

- 9.2.3. Nematodes

- 9.2.4. Bioinsecticides

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Biological Pest Control Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Vegetables & Fruits

- 10.1.2. Turf and Gardening

- 10.1.3. Crop

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Predatory Mites

- 10.2.2. Insects

- 10.2.3. Nematodes

- 10.2.4. Bioinsecticides

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BASF

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 InVivo

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dudutech

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Koppert

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Biobest Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Arbico

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Applied Bio-nomics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ENTOCARE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BioBee

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Anatis Bioprotection

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rentokil

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Beneficial insectary

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 F.A.R

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Kenya Biologics Ltd.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Xilema

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 SDS Biotech

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Fujian Yan Xuan Biological Control Technology

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Henan Jiyuan Baiyun Industry

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 E-nema GmbH

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Biohelp

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Envu

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Valent BioSciences

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Certis USA

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.1 BASF

List of Figures

- Figure 1: Global Biological Pest Control Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Biological Pest Control Revenue (million), by Application 2024 & 2032

- Figure 3: North America Biological Pest Control Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Biological Pest Control Revenue (million), by Type 2024 & 2032

- Figure 5: North America Biological Pest Control Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Biological Pest Control Revenue (million), by Country 2024 & 2032

- Figure 7: North America Biological Pest Control Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Biological Pest Control Revenue (million), by Application 2024 & 2032

- Figure 9: South America Biological Pest Control Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Biological Pest Control Revenue (million), by Type 2024 & 2032

- Figure 11: South America Biological Pest Control Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Biological Pest Control Revenue (million), by Country 2024 & 2032

- Figure 13: South America Biological Pest Control Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Biological Pest Control Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Biological Pest Control Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Biological Pest Control Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Biological Pest Control Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Biological Pest Control Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Biological Pest Control Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Biological Pest Control Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Biological Pest Control Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Biological Pest Control Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Biological Pest Control Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Biological Pest Control Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Biological Pest Control Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Biological Pest Control Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Biological Pest Control Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Biological Pest Control Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Biological Pest Control Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Biological Pest Control Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Biological Pest Control Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Biological Pest Control Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Biological Pest Control Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Biological Pest Control Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Biological Pest Control Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Biological Pest Control Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Biological Pest Control Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Biological Pest Control Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Biological Pest Control Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Biological Pest Control Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Biological Pest Control Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Biological Pest Control Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Biological Pest Control Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Biological Pest Control Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Biological Pest Control Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Biological Pest Control Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Biological Pest Control Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Biological Pest Control Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Biological Pest Control Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Biological Pest Control Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Biological Pest Control Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Biological Pest Control?

The projected CAGR is approximately 11%.

2. Which companies are prominent players in the Biological Pest Control?

Key companies in the market include BASF, InVivo, Dudutech, Koppert, Biobest Group, Arbico, Applied Bio-nomics, ENTOCARE, BioBee, Anatis Bioprotection, Rentokil, Beneficial insectary, F.A.R, Kenya Biologics Ltd., Xilema, SDS Biotech, Fujian Yan Xuan Biological Control Technology, Henan Jiyuan Baiyun Industry, E-nema GmbH, Biohelp, Envu, Valent BioSciences, Certis USA.

3. What are the main segments of the Biological Pest Control?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1947 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5900.00, USD 8850.00, and USD 11800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Biological Pest Control," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Biological Pest Control report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Biological Pest Control?

To stay informed about further developments, trends, and reports in the Biological Pest Control, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence