Key Insights

The global Blown Film Grade White Masterbatch market is poised for robust expansion, projected to reach an estimated market size of approximately USD 5,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 5.8% anticipated through 2033. This growth trajectory is primarily propelled by the burgeoning demand for enhanced aesthetic appeal and functional properties in a wide array of plastic film applications. Key drivers include the increasing use of white masterbatch in packaging films, particularly for food and beverage products where opacity and UV protection are crucial, as well as in agricultural films for improved light diffusion and plant growth. The versatility of white masterbatches, offering excellent dispersion and opacity, makes them indispensable for manufacturers seeking to achieve consistent coloration and desired visual effects in their blown films.

The market is segmented by application, with Cast Film and Wrap applications expected to hold significant market share due to their widespread use in industrial and consumer packaging. PE Masterbatch and PP Masterbatch are dominant types, reflecting the extensive use of polyethylene and polypropylene in blown film production. Emerging trends such as the development of high-performance white masterbatches with improved weatherability and non-migratory properties, alongside a growing emphasis on sustainable and eco-friendly formulations, are shaping the market landscape. However, price volatility of raw materials, particularly titanium dioxide, and increasing environmental regulations concerning plastic waste present considerable restraints. Despite these challenges, strategic collaborations, product innovation, and expansion into high-growth regions like Asia Pacific will continue to fuel market advancement in the coming years.

Comprehensive Report on the Blown Film Grade White Masterbatch Market: Dynamics, Trends, and Future Outlook (2019-2033)

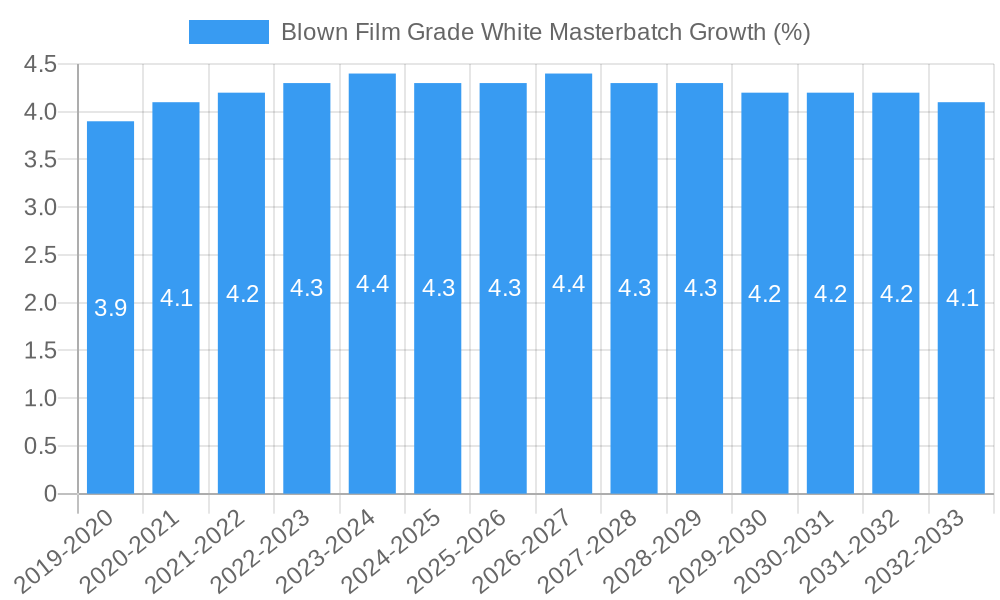

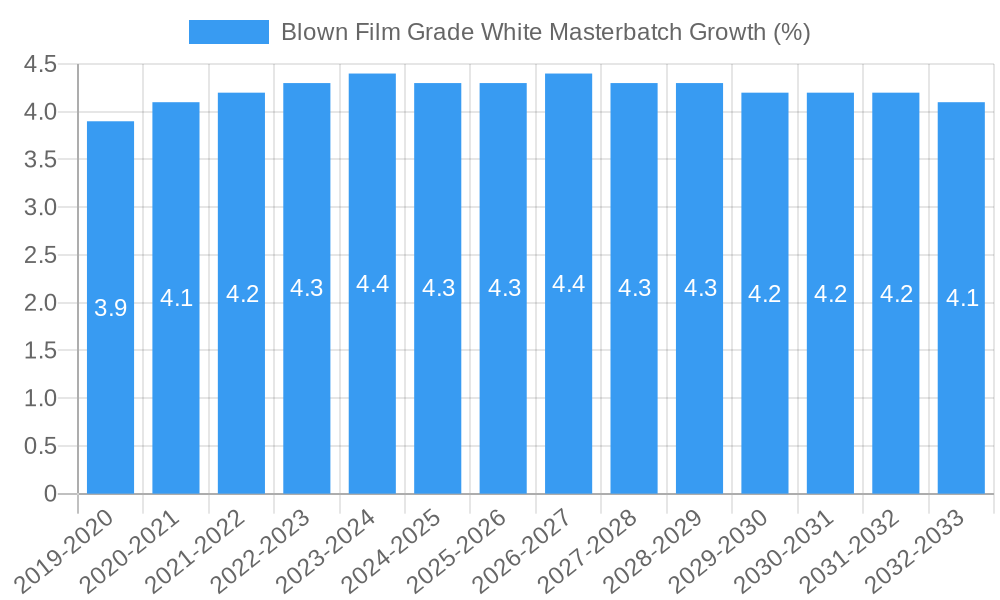

This in-depth report provides a meticulous analysis of the global Blown Film Grade White Masterbatch market, offering critical insights for industry stakeholders. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025 and a forecast period extending from 2025 to 2033, this report details market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, challenges, emerging opportunities, growth accelerators, major players, notable milestones, and a future market outlook. The report is meticulously designed for immediate use, requiring no further modifications, and presents all quantitative data in millions of units.

Blown Film Grade White Masterbatch Market Dynamics & Structure

The Blown Film Grade White Masterbatch market exhibits a moderately consolidated structure, characterized by the presence of both large multinational corporations and specialized regional manufacturers. Technological innovation plays a pivotal role, driven by the continuous demand for enhanced opacity, UV resistance, and processability in masterbatch formulations. Regulatory frameworks, particularly concerning food contact safety and environmental sustainability, are increasingly shaping product development and manufacturing processes. Competitive product substitutes, such as liquid colorants and pre-colored resins, pose a constant challenge, but the cost-effectiveness and ease of use of masterbatches maintain their dominance. End-user demographics are diverse, spanning industries like packaging, agriculture, and construction, with a growing preference for high-performance and eco-friendly solutions. Mergers and acquisitions (M&A) are active, with key players consolidating their market positions and expanding their product portfolios. For instance, in the historical period, there were approximately 12 M&A deals within the broader masterbatch sector, indicating a trend towards integration. Innovation barriers include the significant R&D investment required for novel pigment dispersion and additive incorporation, as well as the stringent quality control necessary for consistent batch production.

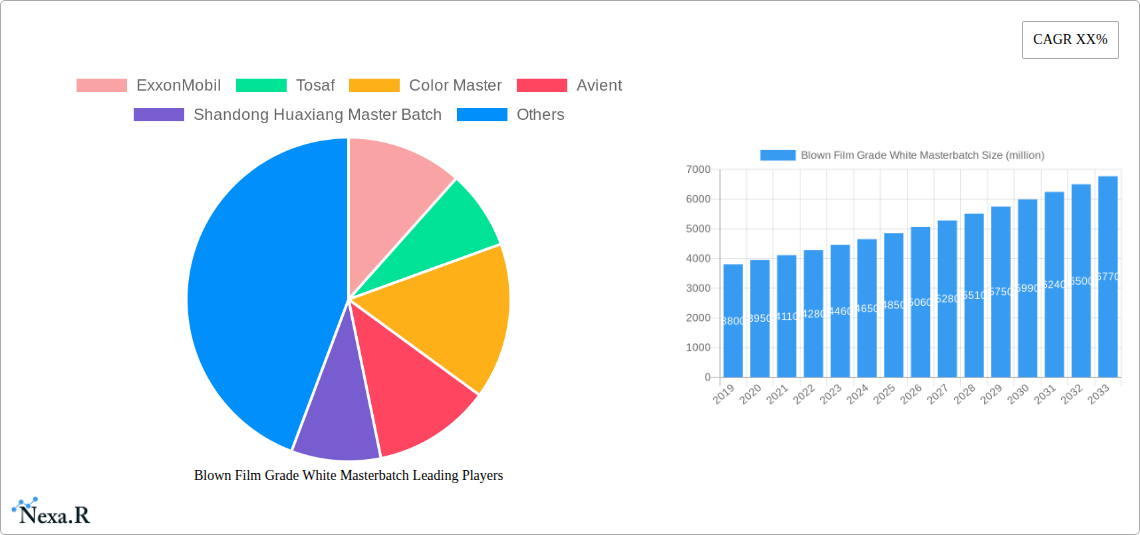

- Market Concentration: Moderately consolidated, with top 5 players holding an estimated 45% of the market share in 2025.

- Technological Innovation Drivers: Enhanced UV stability, improved dispersion, and reduced dusting for processing efficiency.

- Regulatory Frameworks: Growing emphasis on REACH compliance, FDA approvals for food contact applications, and stricter environmental standards.

- Competitive Product Substitutes: Liquid colorants, pre-colored resins, and alternative white pigments.

- End-User Demographics: Primarily packaging (food & beverage, consumer goods), agriculture (films), and construction (pipes, profiles).

- M&A Trends: Strategic acquisitions to gain market access, technology, and product diversification.

Blown Film Grade White Masterbatch Growth Trends & Insights

The Blown Film Grade White Masterbatch market is projected to experience robust growth driven by the burgeoning demand for flexible packaging solutions across various industries. The increasing consumer preference for visually appealing and durable packaging, coupled with the expansion of the e-commerce sector, fuels the consumption of blown films that heavily rely on white masterbatches for opacity and aesthetic appeal. Technological advancements in pigment dispersion and carrier resin technology are leading to the development of higher-performance masterbatches with improved UV resistance, thermal stability, and processing efficiency, further stimulating market adoption.

The market size of the Blown Film Grade White Masterbatch is estimated to reach approximately $3,500 million in 2025 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period (2025-2033), reaching an estimated $5,900 million by 2033. This growth is underpinned by several key trends. Firstly, the increasing adoption of lightweight and sustainable packaging materials is driving the demand for specialized masterbatches that enhance the performance and recyclability of blown films. Secondly, the agricultural sector's reliance on white mulch films for weed control and moisture retention contributes significantly to market expansion. Thirdly, the construction industry's use of white masterbatches in various film applications, such as vapor barriers and protective sheeting, also plays a crucial role.

Consumer behavior shifts towards visually appealing and informative packaging are compelling manufacturers to invest in high-quality white masterbatches that offer superior whiteness, opacity, and printability. The penetration of white masterbatches in blown film applications is estimated to be around 75% in 2025, with a gradual increase expected as new applications emerge and existing ones are optimized. Technological disruptions, such as the development of bio-based and biodegradable masterbatches, are also beginning to influence market dynamics, catering to the growing environmental consciousness among consumers and regulatory bodies. The transition towards more sustainable manufacturing practices and the circular economy are expected to further accelerate the adoption of advanced white masterbatch solutions in the coming years. The global market for white masterbatches in general is a significant parent market, valued at approximately $8,200 million in 2025, with the blown film segment constituting a substantial portion of this value.

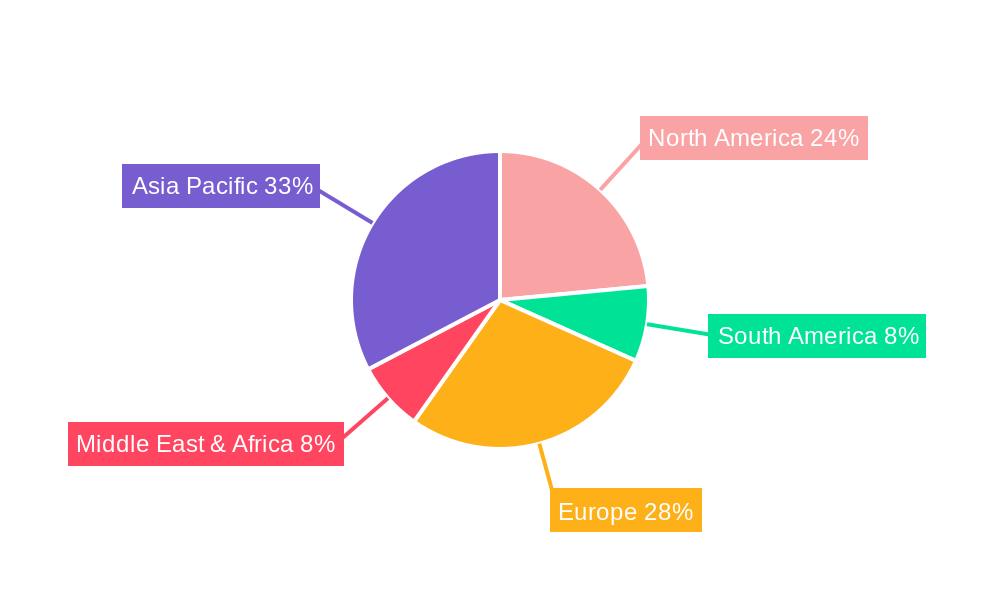

Dominant Regions, Countries, or Segments in Blown Film Grade White Masterbatch

The Asia-Pacific region stands as the dominant force in the global Blown Film Grade White Masterbatch market, exhibiting unparalleled growth potential and consumption. Within this expansive region, China emerges as the leading country, propelled by its massive manufacturing base in packaging, agriculture, and construction. The robust economic development, coupled with significant government initiatives promoting domestic manufacturing and infrastructure development, creates a fertile ground for the widespread adoption of blown films and, consequently, white masterbatches. The packaging segment, particularly Dry Composite Membrane and Cast Film applications, is a primary driver of this dominance. The burgeoning middle class and the expansion of the food and beverage industry in Asia-Pacific necessitate a vast quantity of high-quality flexible packaging, where white masterbatches are crucial for opacity, light protection, and branding.

- Dominant Region: Asia-Pacific, projected to hold 48% of the global market share in 2025.

- Dominant Country: China, expected to account for 60% of the Asia-Pacific market in 2025.

- Dominant Application Segment: Dry Composite Membrane and Cast Film, collectively representing an estimated 55% of the total application market share in 2025.

- Key Drivers in Asia-Pacific: Rapid industrialization, growing consumer demand for packaged goods, increasing agricultural output, and supportive government policies for manufacturing.

- Growth Potential: Asia-Pacific is anticipated to witness a CAGR of 7.5% during the forecast period, outpacing other regions.

The PE Masterbatch type segment also plays a pivotal role in this regional dominance, given the widespread use of polyethylene in blown film extrusion for packaging and agricultural applications. The cost-effectiveness and versatility of PE make it the material of choice, directly translating into high demand for PE-based white masterbatches. Furthermore, the increasing investments in advanced manufacturing technologies within China and other Asian nations are enabling the production of sophisticated white masterbatches that meet stringent international quality standards. The Wrap application, encompassing stretch wrap and shrink wrap, is also a significant contributor to the market growth in this region, driven by the expansion of logistics and supply chain networks. The Black And White Film segment, while smaller, also sees consistent demand for applications requiring distinct visual contrast or specific light-blocking properties.

Blown Film Grade White Masterbatch Product Landscape

The Blown Film Grade White Masterbatch product landscape is characterized by continuous innovation focused on delivering superior whiteness, opacity, and processing performance. Key product advancements include the development of high-dispersion formulations that minimize speckling and ensure uniform color distribution in thin films. Enhanced UV stabilization properties are crucial for agricultural films and outdoor applications, preventing degradation and extending product lifespan. Furthermore, the industry is witnessing a trend towards tailor-made masterbatches, designed to meet specific processing parameters and end-use requirements, such as food-contact compliance and recyclability. The integration of advanced TiO2 grades and synergistic additives contributes to achieving desired optical properties with lower loading levels, enhancing cost-effectiveness.

Key Drivers, Barriers & Challenges in Blown Film Grade White Masterbatch

The Blown Film Grade White Masterbatch market is propelled by several key drivers. The burgeoning global demand for flexible packaging, particularly in the food and beverage and consumer goods sectors, is a primary growth catalyst. The increasing use of white films in agriculture for crop protection and yield enhancement further fuels demand. Technological advancements in pigment dispersion and carrier resins, leading to improved performance and processing efficiency, also contribute significantly.

- Key Drivers:

- Escalating demand for flexible packaging.

- Growth in the agricultural film market.

- Advancements in pigment dispersion technology.

- Increasing preference for visually appealing packaging.

- Expansion of e-commerce logistics.

Conversely, the market faces several barriers and challenges. Volatility in raw material prices, particularly for titanium dioxide, can impact profitability and pricing strategies. Stringent environmental regulations regarding pigment content and waste management can add to production costs and compliance burdens. Intense competition from established players and emerging regional manufacturers can lead to price pressures and market fragmentation. Supply chain disruptions, as witnessed in recent global events, can affect the availability and cost of essential raw materials.

- Key Barriers & Challenges:

- Fluctuations in titanium dioxide prices.

- Stringent environmental and regulatory compliance.

- Intense market competition and price sensitivity.

- Supply chain volatility and raw material availability.

- Need for consistent quality and performance in specialized applications.

Emerging Opportunities in Blown Film Grade White Masterbatch

Emerging opportunities in the Blown Film Grade White Masterbatch market lie in the development of sustainable and high-performance solutions. The growing global emphasis on environmental consciousness presents a significant opportunity for bio-based and recycled-content masterbatches. Innovations in masterbatches that enhance the recyclability of blown films, such as those that are compatibilizers or reduce color impact on recycled streams, are gaining traction. The expanding use of blown films in niche applications, like medical packaging and advanced industrial films, offers avenues for specialized, high-value masterbatch formulations. Furthermore, the increasing demand for aesthetically pleasing and functional packaging in developing economies represents a substantial untapped market for white masterbatches.

Growth Accelerators in the Blown Film Grade White Masterbatch Industry

Long-term growth in the Blown Film Grade White Masterbatch industry will be significantly accelerated by ongoing technological breakthroughs, particularly in the realm of advanced pigment technologies and sustainable carrier resins. Strategic partnerships between masterbatch manufacturers and film producers are becoming crucial for co-developing innovative solutions tailored to specific application needs. The ongoing expansion of manufacturing capacities in emerging economies, coupled with the increasing adoption of high-performance films across diverse sectors, will serve as further catalysts for market expansion. The trend towards a circular economy and the development of masterbatches that facilitate easier recycling of plastic films are expected to be major growth accelerators.

Key Players Shaping the Blown Film Grade White Masterbatch Market

- ExxonMobil

- Tosaf

- Color Master

- Avient

- Shandong Huaxiang Master Batch

- Ningyan Masterbatch

- Qingyun Xinyang New Materials

- Wuhan Jinghong

- Shandong Nuosen Plastic

Notable Milestones in Blown Film Grade White Masterbatch Sector

- 2021/08: Launch of new high-performance TiO2 dispersions by a leading manufacturer, offering superior opacity and UV resistance for agricultural films.

- 2022/03: A major player announces significant investment in R&D for bio-based masterbatch formulations to meet growing sustainability demands.

- 2022/09: Acquisition of a specialized masterbatch producer by a global chemical conglomerate to expand its product portfolio in the packaging sector.

- 2023/01: Introduction of a novel additive package for blown films, enhancing recyclability and reducing carbon footprint.

- 2023/06: Several companies achieve ISO 14001 certification, underscoring a commitment to environmental management in masterbatch production.

- 2024/02: Development of a new generation of dust-free white masterbatch for improved processing safety and efficiency in blown film extrusion.

In-Depth Blown Film Grade White Masterbatch Market Outlook

The Blown Film Grade White Masterbatch market is poised for sustained and significant growth, fueled by its integral role in the expanding global packaging industry and the critical applications in agriculture. Key growth accelerators, including advancements in sustainable material science and the increasing integration of masterbatches that enhance film recyclability, will shape the future landscape. Strategic collaborations and the continuous pursuit of product innovation to meet evolving regulatory demands and consumer preferences will be paramount. The market's outlook is overwhelmingly positive, with ample opportunities for companies to capitalize on the burgeoning demand for high-quality, efficient, and environmentally responsible white masterbatch solutions in the coming years.

Blown Film Grade White Masterbatch Segmentation

-

1. Application

- 1.1. Dry Composite Membrane

- 1.2. Cast Film

- 1.3. Black And White Film

- 1.4. Wrap

-

2. Types

- 2.1. PE Masterbatch

- 2.2. PP Masterbatch

- 2.3. ABS Masterbatch

- 2.4. PVC Masterbatch

- 2.5. Others

Blown Film Grade White Masterbatch Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Blown Film Grade White Masterbatch REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Blown Film Grade White Masterbatch Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Dry Composite Membrane

- 5.1.2. Cast Film

- 5.1.3. Black And White Film

- 5.1.4. Wrap

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. PE Masterbatch

- 5.2.2. PP Masterbatch

- 5.2.3. ABS Masterbatch

- 5.2.4. PVC Masterbatch

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Blown Film Grade White Masterbatch Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Dry Composite Membrane

- 6.1.2. Cast Film

- 6.1.3. Black And White Film

- 6.1.4. Wrap

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. PE Masterbatch

- 6.2.2. PP Masterbatch

- 6.2.3. ABS Masterbatch

- 6.2.4. PVC Masterbatch

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Blown Film Grade White Masterbatch Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Dry Composite Membrane

- 7.1.2. Cast Film

- 7.1.3. Black And White Film

- 7.1.4. Wrap

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. PE Masterbatch

- 7.2.2. PP Masterbatch

- 7.2.3. ABS Masterbatch

- 7.2.4. PVC Masterbatch

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Blown Film Grade White Masterbatch Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Dry Composite Membrane

- 8.1.2. Cast Film

- 8.1.3. Black And White Film

- 8.1.4. Wrap

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. PE Masterbatch

- 8.2.2. PP Masterbatch

- 8.2.3. ABS Masterbatch

- 8.2.4. PVC Masterbatch

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Blown Film Grade White Masterbatch Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Dry Composite Membrane

- 9.1.2. Cast Film

- 9.1.3. Black And White Film

- 9.1.4. Wrap

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. PE Masterbatch

- 9.2.2. PP Masterbatch

- 9.2.3. ABS Masterbatch

- 9.2.4. PVC Masterbatch

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Blown Film Grade White Masterbatch Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Dry Composite Membrane

- 10.1.2. Cast Film

- 10.1.3. Black And White Film

- 10.1.4. Wrap

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. PE Masterbatch

- 10.2.2. PP Masterbatch

- 10.2.3. ABS Masterbatch

- 10.2.4. PVC Masterbatch

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ExxonMobil

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tosaf

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Color Master

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Avient

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shandong Huaxiang Master Batch

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ningyan Masterbatch

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qingyun Xinyang New Materials

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wuhan Jinghong

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shandong Nuosen Plastic

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 ExxonMobil

List of Figures

- Figure 1: Global Blown Film Grade White Masterbatch Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Blown Film Grade White Masterbatch Revenue (million), by Application 2024 & 2032

- Figure 3: North America Blown Film Grade White Masterbatch Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Blown Film Grade White Masterbatch Revenue (million), by Types 2024 & 2032

- Figure 5: North America Blown Film Grade White Masterbatch Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Blown Film Grade White Masterbatch Revenue (million), by Country 2024 & 2032

- Figure 7: North America Blown Film Grade White Masterbatch Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Blown Film Grade White Masterbatch Revenue (million), by Application 2024 & 2032

- Figure 9: South America Blown Film Grade White Masterbatch Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Blown Film Grade White Masterbatch Revenue (million), by Types 2024 & 2032

- Figure 11: South America Blown Film Grade White Masterbatch Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Blown Film Grade White Masterbatch Revenue (million), by Country 2024 & 2032

- Figure 13: South America Blown Film Grade White Masterbatch Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Blown Film Grade White Masterbatch Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Blown Film Grade White Masterbatch Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Blown Film Grade White Masterbatch Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Blown Film Grade White Masterbatch Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Blown Film Grade White Masterbatch Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Blown Film Grade White Masterbatch Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Blown Film Grade White Masterbatch Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Blown Film Grade White Masterbatch Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Blown Film Grade White Masterbatch Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Blown Film Grade White Masterbatch Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Blown Film Grade White Masterbatch Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Blown Film Grade White Masterbatch Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Blown Film Grade White Masterbatch Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Blown Film Grade White Masterbatch Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Blown Film Grade White Masterbatch Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Blown Film Grade White Masterbatch Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Blown Film Grade White Masterbatch Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Blown Film Grade White Masterbatch Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Blown Film Grade White Masterbatch Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Blown Film Grade White Masterbatch Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Blown Film Grade White Masterbatch Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Blown Film Grade White Masterbatch Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Blown Film Grade White Masterbatch Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Blown Film Grade White Masterbatch Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Blown Film Grade White Masterbatch Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Blown Film Grade White Masterbatch Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Blown Film Grade White Masterbatch Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Blown Film Grade White Masterbatch Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Blown Film Grade White Masterbatch Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Blown Film Grade White Masterbatch Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Blown Film Grade White Masterbatch Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Blown Film Grade White Masterbatch Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Blown Film Grade White Masterbatch Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Blown Film Grade White Masterbatch Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Blown Film Grade White Masterbatch Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Blown Film Grade White Masterbatch Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Blown Film Grade White Masterbatch Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Blown Film Grade White Masterbatch Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Blown Film Grade White Masterbatch?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Blown Film Grade White Masterbatch?

Key companies in the market include ExxonMobil, Tosaf, Color Master, Avient, Shandong Huaxiang Master Batch, Ningyan Masterbatch, Qingyun Xinyang New Materials, Wuhan Jinghong, Shandong Nuosen Plastic.

3. What are the main segments of the Blown Film Grade White Masterbatch?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Blown Film Grade White Masterbatch," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Blown Film Grade White Masterbatch report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Blown Film Grade White Masterbatch?

To stay informed about further developments, trends, and reports in the Blown Film Grade White Masterbatch, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence