Key Insights

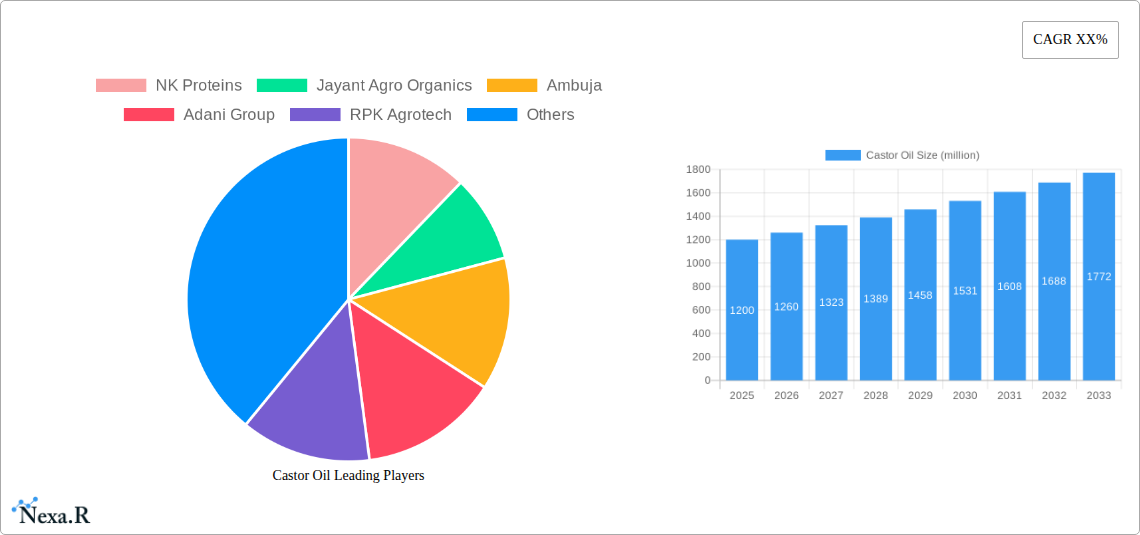

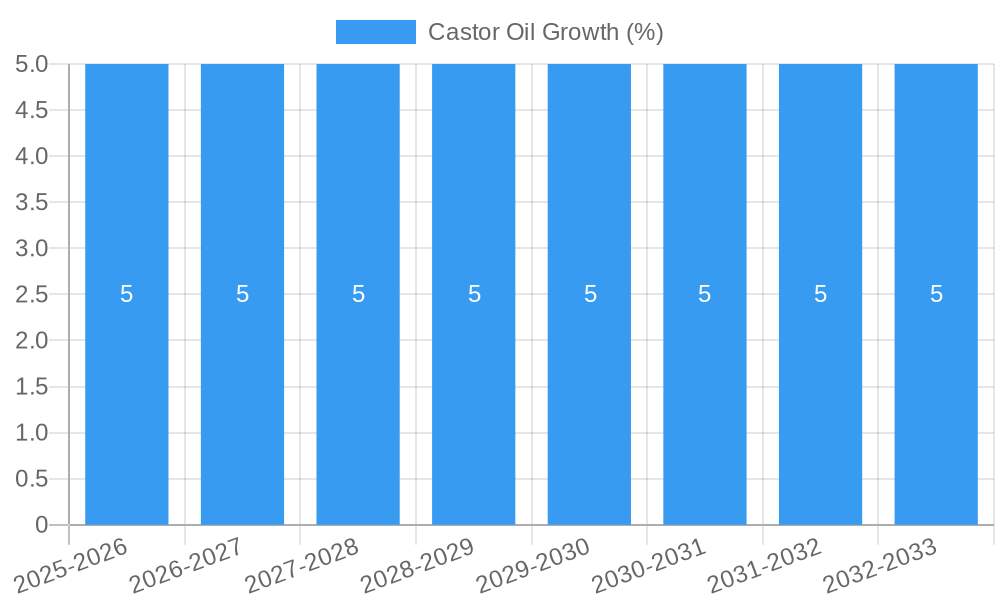

The global castor oil market is projected for robust expansion, driven by its diverse and expanding applications across key industries. With an estimated market size of approximately $1.2 billion in 2025 and a Compound Annual Growth Rate (CAGR) of around 5.5%, the market is expected to reach nearly $2 billion by 2033. This growth is significantly fueled by the increasing demand for bio-based and sustainable products. The food industry leverages castor oil for its emulsifying and lubricating properties, while the pharmaceutical and cosmetics sectors utilize its moisturizing and anti-inflammatory benefits in a wide array of products, from skincare to pharmaceutical formulations. Industrial applications, including the production of lubricants, paints, coatings, and polymers, also contribute substantially to market expansion, particularly as industries seek greener alternatives to petroleum-based products.

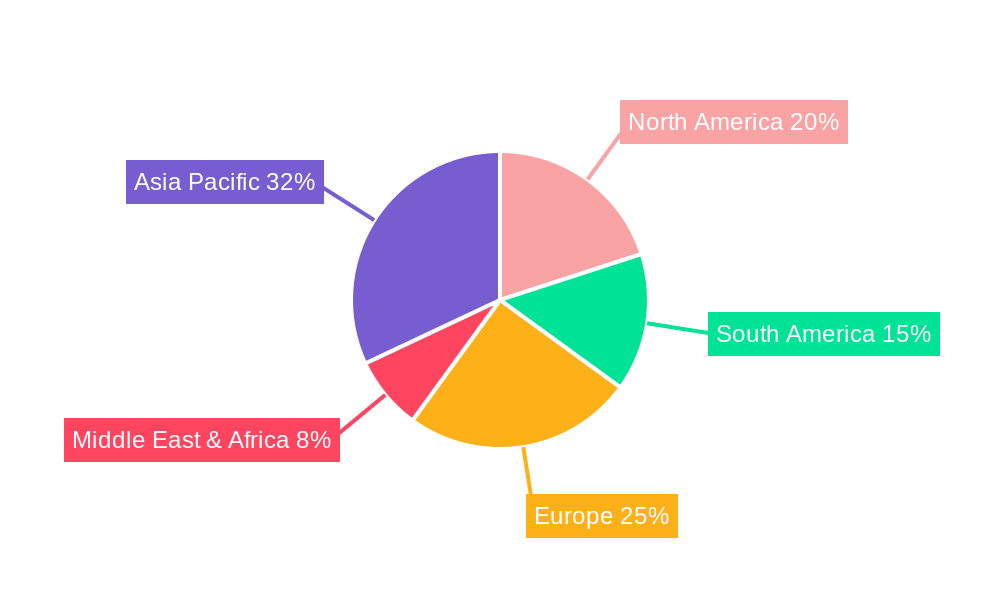

The market is segmented into Food Grade, Pharmaceutical/Cosmetic Grade, and Industry Grade, with each segment exhibiting its own growth trajectory based on specific end-user demands. Geographically, the Asia Pacific region, led by China and India, is anticipated to dominate the market, owing to its strong agricultural base for castor bean cultivation and a rapidly growing industrial and consumer goods sector. North America and Europe are also significant markets, driven by high consumer awareness of natural ingredients and stringent environmental regulations promoting the use of bio-based chemicals. Restraints, such as fluctuating raw material prices and the availability of synthetic alternatives in certain niche applications, are present, but the overarching trend towards sustainability and the versatile nature of castor oil are expected to outweigh these challenges. Leading companies like NK Proteins, Jayant Agro Organics, and Adani Group are strategically positioned to capitalize on these market dynamics through innovation and capacity expansion.

Castor Oil Market Dynamics & Structure

The global castor oil market exhibits a moderately concentrated structure, with leading players like Jayant Agro Organics, NK Proteins, and Ambuja holding significant market share. Technological innovation is a key driver, particularly in developing specialized castor oil derivatives with enhanced properties for niche applications. Regulatory frameworks, while generally supportive of natural and sustainable ingredients, can introduce complexities, especially concerning food-grade and pharmaceutical-grade standards across different regions. Competitive product substitutes, such as petroleum-based emollients and alternative vegetable oils in certain industrial applications, pose a constant challenge, necessitating continuous product development and differentiation. End-user demographics are increasingly favoring natural, bio-based products, particularly in the cosmetics and personal care sectors. Mergers and acquisitions (M&A) activity remains a strategic tool for market consolidation and expansion, with recent deals focusing on enhancing production capacity and diversifying product portfolios.

- Market Concentration: Dominated by a few key players, but with significant presence of regional manufacturers.

- Technological Innovation Drivers: Development of oleochemicals, bio-lubricants, and specialty cosmetic ingredients.

- Regulatory Frameworks: Stringent quality control for food and pharmaceutical grades; varying international standards.

- Competitive Product Substitutes: Petrochemical-based oils, palm oil derivatives, soybean oil.

- End-User Demographics: Growing demand from millennials and Gen Z for natural and sustainable products.

- M&A Trends: Focus on vertical integration and acquisition of innovative technology providers.

Castor Oil Growth Trends & Insights

The global castor oil market has witnessed consistent and robust growth throughout the historical period of 2019–2024, driven by escalating demand across its diverse applications. The market size, valued at an estimated $700 million in 2024, is projected to expand significantly, reaching approximately $1,100 million by 2025 and continuing on a strong upward trajectory through 2033. This growth is underpinned by increasing adoption rates of castor oil and its derivatives in the pharmaceuticals and cosmetics industries, where its emollient, moisturizing, and anti-inflammatory properties are highly valued. Furthermore, the industrial segment, encompassing lubricants, paints, coatings, and biofuels, is a substantial contributor to market expansion, benefiting from the push towards bio-based and renewable resources.

Technological disruptions are playing a pivotal role in unlocking new applications and enhancing the performance of existing ones. Innovations in processing techniques have led to the development of higher purity grades and specialized derivatives, such as hydrogenated castor oil and undecylenic acid, catering to specific industry needs. Consumer behavior shifts are also profoundly influencing market dynamics. A growing awareness and preference for natural, sustainable, and ethically sourced ingredients in personal care products and cosmetics are directly boosting the demand for castor oil. This trend is further amplified by stringent regulations in some regions promoting the use of bio-based alternatives to synthetic chemicals.

The projected Compound Annual Growth Rate (CAGR) for the castor oil market is estimated to be around 7.5% to 8.0% for the forecast period of 2025–2033. This healthy growth rate is indicative of the market's resilience and its ability to adapt to evolving industrial requirements and consumer demands. Market penetration is expected to deepen, especially in emerging economies where the adoption of bio-based materials is gaining momentum. The pharmaceutical sector's reliance on castor oil for various drug formulations and excipients, coupled with the burgeoning demand for organic and natural cosmetics, will continue to be key market drivers. The industrial applications, particularly in the renewable energy sector (biofuels) and as a sustainable alternative in plasticizers and lubricants, are also poised for substantial growth, contributing to the overall positive market outlook.

Dominant Regions, Countries, or Segments in Castor Oil

The global castor oil market is experiencing dynamic shifts in regional dominance and segment penetration, with significant growth engines emerging across various geographical landscapes and application areas. India stands out as the undisputed leader, consistently dominating both production and exports of castor oil, driven by favorable agro-climatic conditions, extensive cultivation, and established processing infrastructure. The country's substantial contribution to the global supply chain makes it a critical hub for both raw material sourcing and manufacturing of castor oil derivatives.

Within the application segments, the Pharmaceuticals and Cosmetics Industry is emerging as the fastest-growing and highest-value segment. This dominance is fueled by a global surge in consumer demand for natural, organic, and sustainable ingredients in skincare, haircare, and personal care products. The inherent emollient, moisturizing, and therapeutic properties of castor oil make it an indispensable component in a wide array of cosmetic formulations, from lip balms and moisturizers to anti-aging serums. The pharmaceutical industry further bolsters this segment's growth through its use as a laxative, a key ingredient in certain drug delivery systems, and as a precursor for various active pharmaceutical ingredients.

Geographically, Asia Pacific continues to be the largest and most rapidly expanding market for castor oil. This growth is not only attributed to India's production prowess but also to the increasing consumption in countries like China, Japan, and Southeast Asian nations, where the personal care and pharmaceutical sectors are experiencing significant expansion. North America and Europe, with their mature cosmetic and pharmaceutical markets and strong emphasis on sustainable and natural ingredients, also represent substantial and stable demand centers for castor oil.

In terms of product types, Pharmaceutical/Cosmetic Grade castor oil commands the highest market share and growth potential, mirroring the demand trends in its primary end-use industries. Food-grade castor oil, while significant, faces more direct competition from other edible oils, though its use in specific food additives and flavorings contributes to its market presence. Industrial Grade castor oil, though a larger volume segment historically, is witnessing evolving demand dynamics. While its applications in lubricants, paints, and biofuels remain crucial, the growth in this segment is increasingly tied to the development of advanced oleochemicals and bio-based materials that offer superior performance and sustainability.

Key drivers for this segment dominance include supportive government policies promoting agricultural exports and chemical manufacturing in countries like India, along with stringent regulations in developed nations that favor natural and biodegradable ingredients. The rising disposable incomes in emerging economies also play a crucial role, enabling a larger consumer base to opt for premium cosmetic and pharmaceutical products that utilize castor oil.

Castor Oil Product Landscape

The castor oil product landscape is characterized by a diverse range of grades and specialized derivatives, meticulously engineered to meet the exacting demands of various industries. Beyond the standard Food Grade, Pharmaceutical/Cosmetic Grade, and Industry Grade, manufacturers are actively innovating to produce refined grades with specific fatty acid profiles and enhanced purity. Key product innovations include the development of high-purity hydrogenated castor oil (HCO) for lubricants and cosmetics, and undecylenic acid derivatives for pharmaceuticals and polymers. These advancements ensure superior performance metrics, such as increased thermal stability, improved lubricity, and enhanced biodegradability, making castor oil an increasingly attractive bio-based alternative.

Key Drivers, Barriers & Challenges in Castor Oil

Key Drivers:

- Growing Demand for Natural and Sustainable Products: Escalating consumer preference for bio-based ingredients in cosmetics, personal care, and pharmaceuticals.

- Versatile Applications: Wide-ranging utility across industries including pharmaceuticals, cosmetics, lubricants, paints, coatings, and biofuels.

- Technological Advancements: Development of specialized castor oil derivatives with improved performance characteristics.

- Government Initiatives: Supportive policies for agricultural production and promotion of bio-based materials in several key regions.

- Renewable Resource: Castor bean's sustainability as a non-edible oilseed crop.

Barriers & Challenges:

- Price Volatility: Fluctuations in castor bean prices due to weather conditions, crop yields, and global supply-demand dynamics.

- Supply Chain Disruptions: Vulnerability to agricultural risks and geopolitical factors affecting raw material availability and logistics.

- Competition from Substitutes: Presence of alternative vegetable oils and petrochemical-based products in certain industrial applications.

- Regulatory Hurdles: Varying quality standards and registration requirements for different grades and applications across international markets.

- Limited Geographic Concentration of Production: Over-reliance on a few key producing regions can lead to supply vulnerabilities.

Emerging Opportunities in Castor Oil

Emerging opportunities in the castor oil market lie in the development of novel high-value derivatives for advanced materials and specialty chemicals. The increasing focus on the circular economy and bio-plastics presents a significant avenue for castor oil-based polyols and polymers. Furthermore, untapped markets in niche cosmetic formulations, such as sunscreens and specialized skincare for sensitive skin, offer substantial growth potential. The ongoing research into castor oil's medicinal properties for novel pharmaceutical applications also holds promise for future market expansion. Exploring sustainable agricultural practices and traceability initiatives can also unlock premium market segments.

Growth Accelerators in the Castor Oil Industry

Several key catalysts are accelerating the growth of the castor oil industry. Technological breakthroughs in enzymatic conversion and refining processes are enabling the production of highly purified and functionalized castor oil derivatives at competitive costs. Strategic partnerships between castor oil producers, chemical manufacturers, and end-user industries are fostering innovation and driving the adoption of castor oil-based solutions in new applications. Market expansion strategies, particularly targeting emerging economies with growing middle classes and increasing environmental awareness, are crucial for long-term growth. The continuous R&D investment in unlocking new therapeutic and industrial applications further fuels this growth trajectory.

Key Players Shaping the Castor Oil Market

- NK Proteins

- Jayant Agro Organics

- Ambuja

- Adani Group

- RPK Agrotech

- Gokul Overseas

- Kanak

- Adya Oil

- Taj Agro Products

- Girnar Industries

- Bom Brazil

- Kisan

- Thai Castor Oil

- ITOH Oil Chemicals

- Tongliao TongHua

- Tongliao Weiyu

- Tianxing

- Kanghui

- Huanghe Youzhi

- Xingtai Lantian

- Hewei

Notable Milestones in Castor Oil Sector

- 2019: Significant advancements in enzymatic processing of castor oil to produce bio-surfactants.

- 2020: Launch of new bio-lubricant formulations utilizing castor oil derivatives, gaining traction in the automotive sector.

- 2021: Increased investment in R&D for castor oil-based biodegradable plastics and polymers.

- 2022: Growing number of cosmetic brands highlighting "natural" and "organic" castor oil in their product lines.

- 2023: Several strategic acquisitions and mergers aimed at consolidating market share and expanding production capacities.

- 2024: Emerging research on the anti-inflammatory and analgesic properties of castor oil showing promising pharmaceutical applications.

In-Depth Castor Oil Market Outlook

The castor oil market is poised for sustained and robust growth, driven by an intensifying global demand for sustainable and high-performance ingredients. Growth accelerators like technological advancements in oleochemicals and bio-based materials, coupled with expanding applications in pharmaceuticals, cosmetics, and industrial sectors, will continue to propel the market forward. The strategic importance of castor oil as a renewable resource in an increasingly environmentally conscious world positions it for significant future potential. Companies that focus on innovation, vertical integration, and sustainable sourcing will be well-positioned to capitalize on emerging opportunities and secure a dominant share in the evolving global castor oil landscape.

Castor Oil Segmentation

-

1. Application

- 1.1. Food Industry

- 1.2. Pharmaceuticals and Cosmetics Industry

- 1.3. Industrial

-

2. Types

- 2.1. Food Grade

- 2.2. Pharmaceutical/Cosmetic Grade

- 2.3. Industry Grade

Castor Oil Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Castor Oil REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Castor Oil Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food Industry

- 5.1.2. Pharmaceuticals and Cosmetics Industry

- 5.1.3. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Food Grade

- 5.2.2. Pharmaceutical/Cosmetic Grade

- 5.2.3. Industry Grade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Castor Oil Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food Industry

- 6.1.2. Pharmaceuticals and Cosmetics Industry

- 6.1.3. Industrial

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Food Grade

- 6.2.2. Pharmaceutical/Cosmetic Grade

- 6.2.3. Industry Grade

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Castor Oil Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food Industry

- 7.1.2. Pharmaceuticals and Cosmetics Industry

- 7.1.3. Industrial

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Food Grade

- 7.2.2. Pharmaceutical/Cosmetic Grade

- 7.2.3. Industry Grade

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Castor Oil Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food Industry

- 8.1.2. Pharmaceuticals and Cosmetics Industry

- 8.1.3. Industrial

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Food Grade

- 8.2.2. Pharmaceutical/Cosmetic Grade

- 8.2.3. Industry Grade

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Castor Oil Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food Industry

- 9.1.2. Pharmaceuticals and Cosmetics Industry

- 9.1.3. Industrial

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Food Grade

- 9.2.2. Pharmaceutical/Cosmetic Grade

- 9.2.3. Industry Grade

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Castor Oil Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food Industry

- 10.1.2. Pharmaceuticals and Cosmetics Industry

- 10.1.3. Industrial

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Food Grade

- 10.2.2. Pharmaceutical/Cosmetic Grade

- 10.2.3. Industry Grade

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 NK Proteins

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jayant Agro Organics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ambuja

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Adani Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 RPK Agrotech

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Gokul Overseas

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kanak

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Adya Oil

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Taj Agro Products

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Girnar Industries

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bom Brazil

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Kisan

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Thai Castor Oil

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ITOH Oil Chemicals

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Tongliao TongHua

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Tongliao Weiyu

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Tianxing

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Kanghui

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Huanghe Youzhi

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Xingtai Lantian

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Hewei

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 NK Proteins

List of Figures

- Figure 1: Global Castor Oil Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Castor Oil Revenue (million), by Application 2024 & 2032

- Figure 3: North America Castor Oil Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Castor Oil Revenue (million), by Types 2024 & 2032

- Figure 5: North America Castor Oil Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Castor Oil Revenue (million), by Country 2024 & 2032

- Figure 7: North America Castor Oil Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Castor Oil Revenue (million), by Application 2024 & 2032

- Figure 9: South America Castor Oil Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Castor Oil Revenue (million), by Types 2024 & 2032

- Figure 11: South America Castor Oil Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Castor Oil Revenue (million), by Country 2024 & 2032

- Figure 13: South America Castor Oil Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Castor Oil Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Castor Oil Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Castor Oil Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Castor Oil Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Castor Oil Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Castor Oil Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Castor Oil Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Castor Oil Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Castor Oil Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Castor Oil Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Castor Oil Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Castor Oil Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Castor Oil Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Castor Oil Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Castor Oil Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Castor Oil Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Castor Oil Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Castor Oil Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Castor Oil Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Castor Oil Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Castor Oil Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Castor Oil Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Castor Oil Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Castor Oil Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Castor Oil Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Castor Oil Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Castor Oil Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Castor Oil Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Castor Oil Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Castor Oil Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Castor Oil Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Castor Oil Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Castor Oil Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Castor Oil Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Castor Oil Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Castor Oil Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Castor Oil Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Castor Oil Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Castor Oil?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Castor Oil?

Key companies in the market include NK Proteins, Jayant Agro Organics, Ambuja, Adani Group, RPK Agrotech, Gokul Overseas, Kanak, Adya Oil, Taj Agro Products, Girnar Industries, Bom Brazil, Kisan, Thai Castor Oil, ITOH Oil Chemicals, Tongliao TongHua, Tongliao Weiyu, Tianxing, Kanghui, Huanghe Youzhi, Xingtai Lantian, Hewei.

3. What are the main segments of the Castor Oil?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5600.00, USD 8400.00, and USD 11200.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Castor Oil," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Castor Oil report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Castor Oil?

To stay informed about further developments, trends, and reports in the Castor Oil, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence