Key Insights

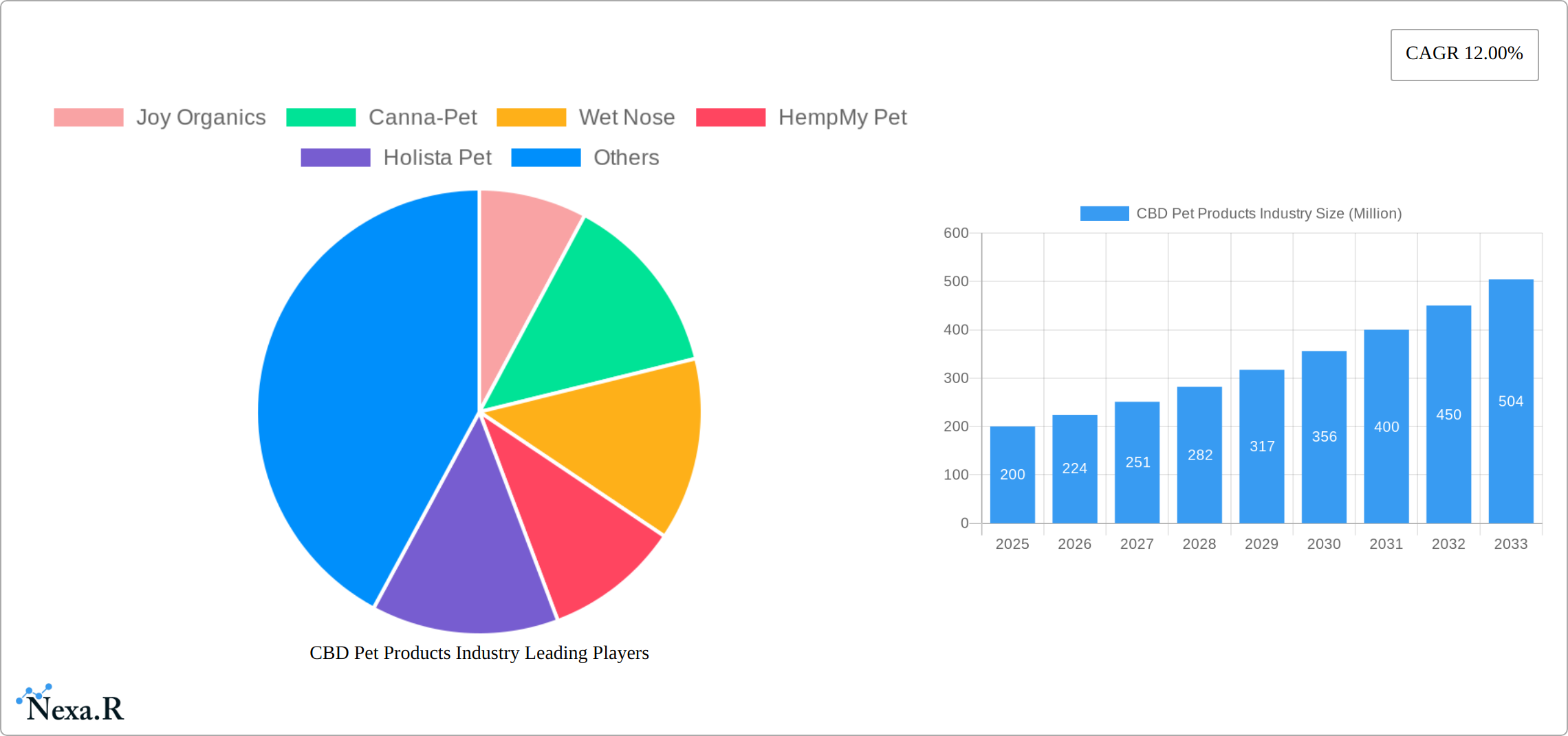

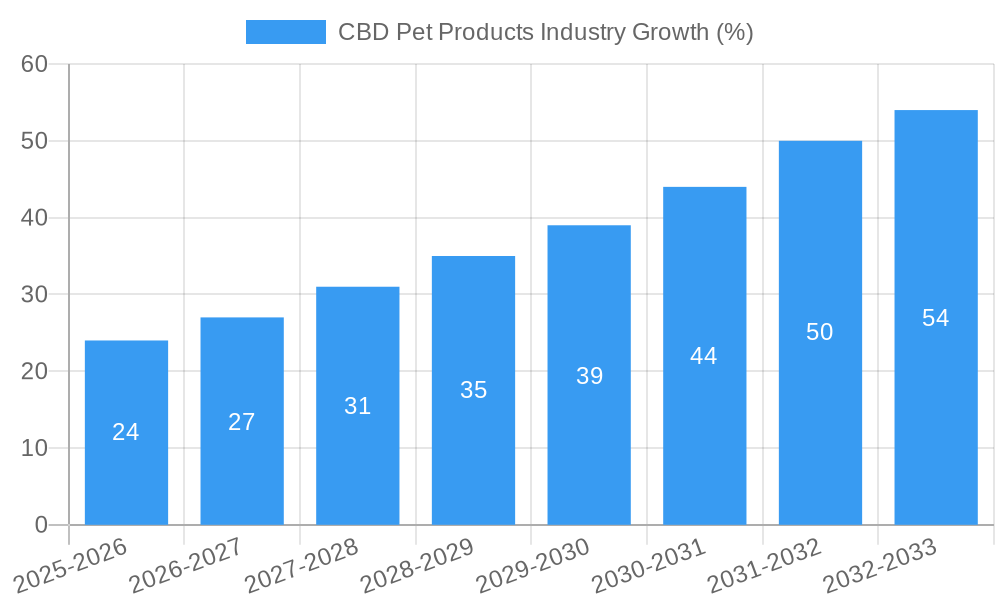

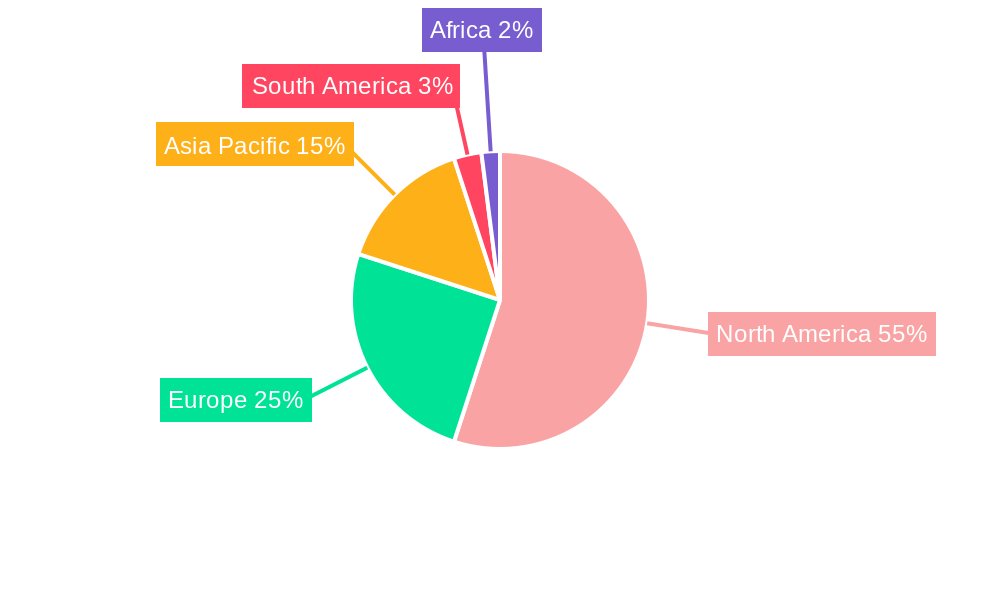

The global CBD pet products market is experiencing robust growth, driven by increasing pet owner awareness of CBD's potential health benefits for animals and a rising trend towards holistic pet care. The market, valued at approximately $XX million in 2025, is projected to exhibit a compound annual growth rate (CAGR) of 12% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, a growing body of anecdotal evidence and preliminary research suggests CBD's efficacy in managing anxiety, pain, inflammation, and other conditions common in pets. Secondly, the increasing availability of CBD pet products through various distribution channels—online retail, veterinary clinics, and retail pharmacies—is expanding market reach and accessibility. The food-grade segment currently dominates, reflecting the preference for incorporating CBD into everyday pet food and treats. However, the therapeutic-grade segment is poised for significant growth as scientific understanding of CBD's therapeutic applications in veterinary medicine advances. Leading companies like Joy Organics, Canna-Pet, and others are instrumental in shaping market trends through product innovation and branding strategies. Regional variations exist, with North America, particularly the United States, currently holding the largest market share due to high pet ownership rates and early adoption of CBD products. However, Europe and Asia-Pacific are expected to witness significant growth in the coming years driven by increased consumer awareness and regulatory changes. Despite the positive outlook, regulatory uncertainties and varying legal frameworks across different regions remain a key restraint to market expansion.

The competitive landscape is dynamic, characterized by both established brands and emerging players. Successful companies are focusing on product quality, transparency in sourcing and manufacturing, and strong marketing strategies to build consumer trust. Further growth will depend on continued research validating CBD's efficacy in pets, stronger regulatory frameworks that ensure product safety and quality, and effective consumer education campaigns addressing common misconceptions about CBD. The increasing integration of CBD into preventative care regimens for pets, rather than solely treatment-focused applications, presents a considerable opportunity for future market expansion. Segmentation by pet type (dogs, cats, etc.) and specific health conditions will also drive further product specialization and market growth. Overall, the CBD pet products market presents a compelling investment opportunity with considerable potential for future growth, provided regulatory challenges are addressed and consumer confidence continues to rise.

CBD Pet Products Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the CBD pet products market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report analyzes both the parent market (pet products) and the child market (CBD pet products), offering granular insights for industry professionals and investors. Market values are presented in million units.

CBD Pet Products Industry Market Dynamics & Structure

The CBD pet products market presents a moderately fragmented landscape, with numerous players competing for market share. Growth is significantly driven by technological advancements, particularly in product formulation and delivery methods encompassing treats, topicals, oils, and other innovative formats. Regulatory landscapes, however, vary considerably across different regions, simultaneously posing challenges and creating opportunities that influence market access and product development strategies. Established competitors include traditional pet health supplements and pharmaceuticals, creating a dynamic competitive environment. The primary end-users are pet owners prioritizing their animals' health and well-being, with a demonstrably increasing segment favoring natural and holistic approaches. While mergers and acquisitions (M&A) activity has been relatively subdued in the period from 2019-2024 (with xx deals recorded), the potential for future consolidation remains significant, especially as larger players seek to establish greater market dominance.

- Market Concentration: Moderately fragmented, with the top 5 players holding an estimated xx% market share (2024). This indicates ample opportunity for smaller players to carve out niche markets.

- Technological Innovation: A strong focus on enhancing bioavailability, developing sophisticated targeted delivery systems, and creating novel product formats to cater to diverse pet needs and preferences.

- Regulatory Framework: The inconsistent regulatory landscape across different global regions presents challenges for standardization and consistent market access. Companies must navigate diverse legal requirements on a region-by-region basis.

- Competitive Substitutes: Traditional pet health supplements and pharmaceuticals represent major competitive alternatives, necessitating clear product differentiation and value proposition.

- End-User Demographics: The core customer base comprises pet owners actively seeking natural and holistic health solutions for their companion animals, reflecting a broader trend towards natural pet care.

- M&A Activity: Relatively low historical activity suggests potential for future consolidation as larger companies strategically acquire smaller, innovative players or expand their product portfolios.

CBD Pet Products Industry Growth Trends & Insights

The global CBD pet products market experienced significant growth during the historical period (2019-2024), driven by increasing pet owner awareness of CBD's potential benefits and a rising demand for natural pet health solutions. Market size expanded from xx million in 2019 to xx million in 2024, registering a CAGR of xx%. Adoption rates are increasing steadily, particularly among younger and affluent pet owners. Technological disruptions, such as advancements in CBD extraction and formulation techniques, are contributing to product improvement and market expansion. Consumer behavior shifts towards more holistic and preventative pet care further fuel market growth. We project continued expansion, with the market reaching xx million by 2025 and xx million by 2033, achieving a forecast period CAGR of xx%. Market penetration remains relatively low, suggesting substantial untapped potential.

Dominant Regions, Countries, or Segments in CBD Pet Products Industry

The North American market currently dominates the CBD pet products industry, driven by high pet ownership rates, early adoption of CBD products, and a relatively favorable regulatory environment. Within North America, the United States holds the largest market share, followed by Canada. Europe is experiencing substantial growth, albeit at a slower pace compared to North America. In terms of product segments, the food-grade CBD products segment holds the largest market share, while therapeutic-grade products are showing faster growth. The online retail channel is the dominant distribution channel, leveraging ease of access and broader reach. However, retail pharmacies and veterinary clinics are emerging as significant distribution channels, offering credibility and professional guidance.

- Key Drivers (North America): High pet ownership, early adoption of CBD, relatively favorable regulations.

- Key Drivers (Europe): Growing pet ownership, increasing awareness of CBD benefits, evolving regulatory landscape.

- Dominant Product Segment: Food-grade CBD products (xx% market share in 2024)

- Fastest Growing Segment: Therapeutic-grade CBD products

- Dominant Distribution Channel: Online retail channel

CBD Pet Products Industry Product Landscape

The CBD pet products market boasts a diverse array of offerings, including CBD-infused treats, oils, topicals, and supplements meticulously formulated to address various pet health concerns such as anxiety, pain management, and dermatological issues. Product innovation is relentless, concentrating on improving bioavailability through enhanced absorption and targeted delivery systems. Furthermore, formulations are constantly refined to enhance palatability, ensuring better compliance from pets. Many products emphasize broad-spectrum formulations that preserve the synergistic "entourage effect" while minimizing THC content. Key differentiators frequently include the use of organic ingredients, rigorous third-party lab testing to guarantee product purity and potency, and specialized formulations catering to the unique needs of different pet breeds and specific health conditions. Continuous advancements in extraction methods and formulation techniques consistently contribute to the creation of higher-quality, more effective, and safer products.

Key Drivers, Barriers & Challenges in CBD Pet Products Industry

Key Drivers:

- The escalating awareness among pet owners regarding the potential health benefits of CBD for their animals is a powerful growth driver.

- A pronounced and growing preference for natural and holistic pet care solutions fuels demand for CBD products.

- Continuous technological advancements in CBD extraction and formulation processes result in improved product quality and efficacy.

- The increasing regulatory acceptance of CBD in specific regions is opening up new market opportunities.

Key Challenges:

- Regulatory uncertainty and inconsistencies across different global regions represent substantial barriers to market entry and expansion. Supply chain complexities, coupled with inconsistencies in product quality across various manufacturers, demand vigilant quality control. The fiercely competitive landscape necessitates strong product differentiation to stand out amongst established pet health product manufacturers. Effective consumer education and building trust are paramount to achieving broader market acceptance. The limitations of existing scientific research on CBD's efficacy in animals continues to present a challenge in widespread adoption.

Emerging Opportunities in CBD Pet Products Industry

Emerging opportunities lie in expanding into untapped international markets, particularly in Asia and Latin America, where pet ownership is growing. Further innovation in product formats, such as customized formulations for specific breeds or health conditions, presents exciting possibilities. Developing targeted marketing strategies focusing on specific pet health concerns and leveraging social media influencers to reach a broader audience can drive market growth. Collaborating with veterinary professionals to increase credibility and provide professional recommendations can be extremely beneficial. Finally, focusing on sustainability and ethically sourced ingredients can resonate with increasingly conscious consumers.

Growth Accelerators in the CBD Pet Products Industry

Sustained long-term growth will hinge on continued advancements in CBD extraction and formulation technologies, leading to the development of even more potent and bioavailable products. Strategic collaborations between CBD manufacturers and veterinary clinics or pet retailers are crucial for amplifying product reach and establishing greater credibility within the veterinary community. Expanding into new geographical markets, particularly those experiencing growth in pet ownership, is paramount for sustained growth. Finally, fostering greater consumer trust through transparent labeling practices, independent third-party testing, and a commitment to robust scientific research will be pivotal in driving wider market acceptance and adoption of CBD pet products.

Key Players Shaping the CBD Pet Products Market

- Joy Organics

- Canna-Pet

- Wet Nose

- HempMy Pet

- Holista Pet

- NaturVet

- Honest Paws

- Fomo Bones

Notable Milestones in CBD Pet Products Industry Sector

- March 2022: Healthy TOKYO successfully launched its pioneering CBD pet product line in the Japanese market.

- August 2022: Pet Releaf expanded its offerings with a new line of CBD-infused grooming products specifically designed for dogs.

- November 2022: Sky Wellness revitalized its D Oh Gee brand, re-launching its CBD dog products with improved formulations and marketing.

In-Depth CBD Pet Products Industry Market Outlook

The CBD pet products market is poised for significant long-term growth, driven by continuous product innovation, expanding regulatory acceptance, and rising consumer demand for natural pet health solutions. Strategic partnerships, targeted marketing, and expansion into new markets will be key to realizing the market's substantial untapped potential. Continued research and development, focusing on efficacy and safety, will build consumer confidence and foster further market expansion. The long-term outlook is positive, with considerable potential for market expansion and further product diversification.

CBD Pet Products Industry Segmentation

-

1. Type

- 1.1. Food-grade

- 1.2. Therapeutic-grade

-

2. Distribution Channel

- 2.1. Online Retail Channel

- 2.2. Retail Pharmacies

- 2.3. Veterinary Clinics

- 2.4. Other Distribution Channels

CBD Pet Products Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Australia

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Africa

- 5.1. South Africa

- 5.2. Rest of Africa

CBD Pet Products Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Fish Meal and Fish Oil Production; Demand for Quality Animal Feed

- 3.3. Market Restrains

- 3.3.1. High Prices of Fish Meal and Fish Oil Products; Threat to Fish Reserves

- 3.4. Market Trends

- 3.4.1. Increase in the Number of Pet Owners and Increased Spending on Pets

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global CBD Pet Products Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Food-grade

- 5.1.2. Therapeutic-grade

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online Retail Channel

- 5.2.2. Retail Pharmacies

- 5.2.3. Veterinary Clinics

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America CBD Pet Products Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Food-grade

- 6.1.2. Therapeutic-grade

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Online Retail Channel

- 6.2.2. Retail Pharmacies

- 6.2.3. Veterinary Clinics

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe CBD Pet Products Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Food-grade

- 7.1.2. Therapeutic-grade

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Online Retail Channel

- 7.2.2. Retail Pharmacies

- 7.2.3. Veterinary Clinics

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific CBD Pet Products Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Food-grade

- 8.1.2. Therapeutic-grade

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Online Retail Channel

- 8.2.2. Retail Pharmacies

- 8.2.3. Veterinary Clinics

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America CBD Pet Products Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Food-grade

- 9.1.2. Therapeutic-grade

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Online Retail Channel

- 9.2.2. Retail Pharmacies

- 9.2.3. Veterinary Clinics

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Africa CBD Pet Products Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Food-grade

- 10.1.2. Therapeutic-grade

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Online Retail Channel

- 10.2.2. Retail Pharmacies

- 10.2.3. Veterinary Clinics

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America CBD Pet Products Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe CBD Pet Products Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Rest of Europe

- 13. Asia Pacific CBD Pet Products Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Australia

- 13.1.4 Rest of Asia Pacific

- 14. South America CBD Pet Products Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Africa CBD Pet Products Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 Rest of Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Joy Organics

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Canna-Pet

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Wet Nose

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 HempMy Pet

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Holista Pet

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 NaturVet

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Honest Paws

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Fomo Bones

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.1 Joy Organics

List of Figures

- Figure 1: Global CBD Pet Products Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America CBD Pet Products Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America CBD Pet Products Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe CBD Pet Products Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe CBD Pet Products Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific CBD Pet Products Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific CBD Pet Products Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America CBD Pet Products Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America CBD Pet Products Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Africa CBD Pet Products Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Africa CBD Pet Products Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America CBD Pet Products Industry Revenue (Million), by Type 2024 & 2032

- Figure 13: North America CBD Pet Products Industry Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America CBD Pet Products Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 15: North America CBD Pet Products Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 16: North America CBD Pet Products Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America CBD Pet Products Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe CBD Pet Products Industry Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe CBD Pet Products Industry Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe CBD Pet Products Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 21: Europe CBD Pet Products Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 22: Europe CBD Pet Products Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe CBD Pet Products Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific CBD Pet Products Industry Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific CBD Pet Products Industry Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific CBD Pet Products Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 27: Asia Pacific CBD Pet Products Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 28: Asia Pacific CBD Pet Products Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific CBD Pet Products Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America CBD Pet Products Industry Revenue (Million), by Type 2024 & 2032

- Figure 31: South America CBD Pet Products Industry Revenue Share (%), by Type 2024 & 2032

- Figure 32: South America CBD Pet Products Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: South America CBD Pet Products Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: South America CBD Pet Products Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: South America CBD Pet Products Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Africa CBD Pet Products Industry Revenue (Million), by Type 2024 & 2032

- Figure 37: Africa CBD Pet Products Industry Revenue Share (%), by Type 2024 & 2032

- Figure 38: Africa CBD Pet Products Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 39: Africa CBD Pet Products Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 40: Africa CBD Pet Products Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Africa CBD Pet Products Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global CBD Pet Products Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global CBD Pet Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global CBD Pet Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global CBD Pet Products Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global CBD Pet Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global CBD Pet Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global CBD Pet Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: China CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Australia CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Asia Pacific CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global CBD Pet Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Argentina CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of South America CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global CBD Pet Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: South Africa CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Africa CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global CBD Pet Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 29: Global CBD Pet Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 30: Global CBD Pet Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 31: United States CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Mexico CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of North America CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global CBD Pet Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Global CBD Pet Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 37: Global CBD Pet Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Germany CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: United Kingdom CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: France CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Spain CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global CBD Pet Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Global CBD Pet Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 45: Global CBD Pet Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: China CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: India CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Australia CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Asia Pacific CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global CBD Pet Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 51: Global CBD Pet Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 52: Global CBD Pet Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Brazil CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Argentina CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of South America CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global CBD Pet Products Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 57: Global CBD Pet Products Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 58: Global CBD Pet Products Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 59: South Africa CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Africa CBD Pet Products Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the CBD Pet Products Industry?

The projected CAGR is approximately 12.00%.

2. Which companies are prominent players in the CBD Pet Products Industry?

Key companies in the market include Joy Organics, Canna-Pet, Wet Nose, HempMy Pet, Holista Pet, NaturVet, Honest Paws, Fomo Bones.

3. What are the main segments of the CBD Pet Products Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Fish Meal and Fish Oil Production; Demand for Quality Animal Feed.

6. What are the notable trends driving market growth?

Increase in the Number of Pet Owners and Increased Spending on Pets.

7. Are there any restraints impacting market growth?

High Prices of Fish Meal and Fish Oil Products; Threat to Fish Reserves.

8. Can you provide examples of recent developments in the market?

November 2022: Sky Wellness, a company providing people and animals with CBD, relaunched its CBD wellness collection for dogs under its D Oh Gee brand. The collection includes three broad-spectrum, THC-free CBD products formulated to support joint health and mobility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "CBD Pet Products Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the CBD Pet Products Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the CBD Pet Products Industry?

To stay informed about further developments, trends, and reports in the CBD Pet Products Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence