Key Insights

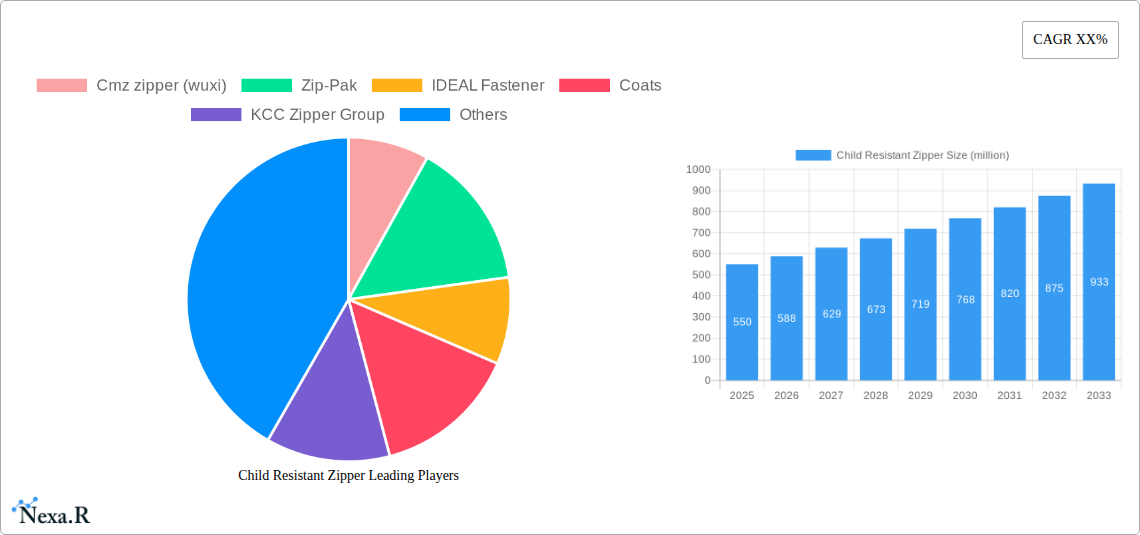

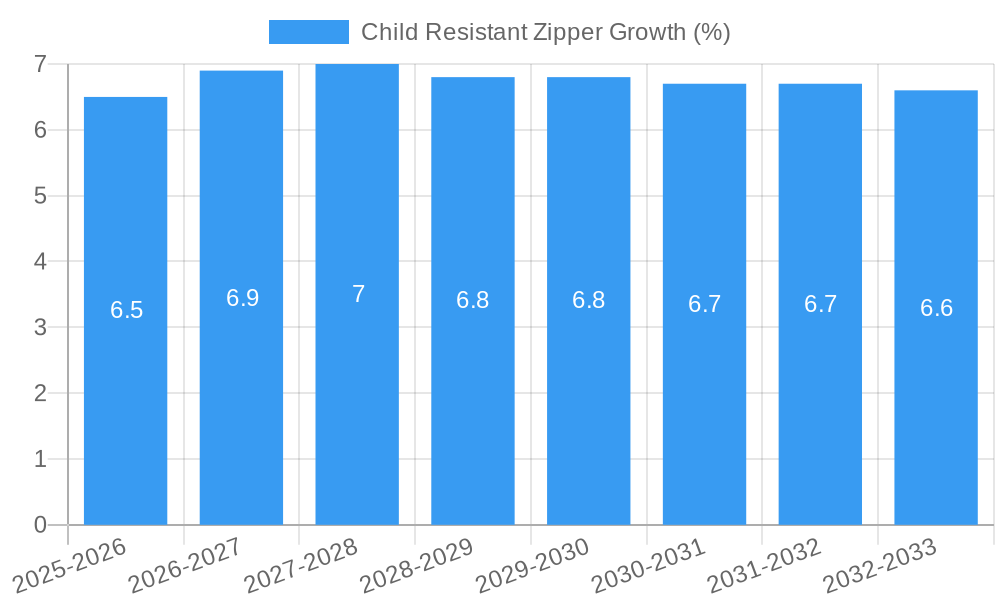

The global Child Resistant Zipper market is poised for significant expansion, projected to reach an estimated USD 550 million by 2025 and grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% through 2033. This robust growth is primarily fueled by the escalating demand from the Cosmetics and Personal Care Industry, driven by stringent safety regulations and increasing consumer awareness regarding child safety. The Food and Beverage Industry also represents a substantial segment, particularly for products requiring secure packaging to prevent accidental ingestion by children. Innovations in zipper technology, such as enhanced child-resistance mechanisms and improved material durability, are further propelling market adoption. The market is segmented by type into Close End Child Resistant Zipper and Open End Child Resistant Zipper, with both categories witnessing steady demand. The "Close End" variant is likely to dominate due to its comprehensive sealing capabilities, crucial for pharmaceuticals and certain food items. Leading companies like Cmz zipper (wuxi), Zip-Pak, IDEAL Fastener, Coats, and KCC Zipper Group are actively investing in research and development to introduce advanced, user-friendly, and cost-effective solutions, contributing to market dynamism.

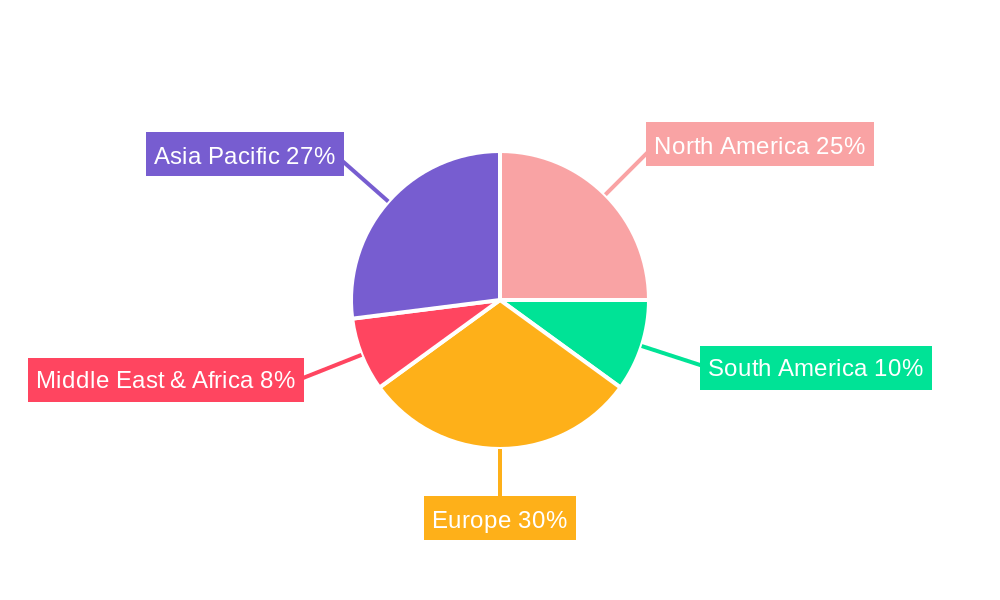

Geographically, the Asia Pacific region, led by China and India, is expected to emerge as the fastest-growing market for child-resistant zippers, owing to a burgeoning consumer base, rising disposable incomes, and evolving regulatory landscapes that prioritize child safety in packaging. North America and Europe are established markets with a consistent demand for these safety features, driven by well-entrenched regulatory frameworks and a mature consumer products sector. The Middle East & Africa and South America also present considerable growth opportunities as awareness and regulatory enforcement increase. Key market restraints include the higher cost of manufacturing compared to standard zippers and the potential for counterfeiting of certified products. However, the ongoing emphasis on childproofing packaging across various consumer goods sectors, coupled with advancements in material science and manufacturing processes, are expected to outweigh these challenges, ensuring sustained market growth and innovation in the child-resistant zipper sector over the forecast period.

Child Resistant Zipper Market Analysis Report: 2019-2033

Unlock critical insights into the burgeoning Child Resistant Zipper market. This comprehensive report forecasts explosive growth driven by stringent safety regulations and increasing consumer demand for secure packaging solutions across the Cosmetics and Personal Care Industry, Food and Beverage Industry, and beyond. Explore market dynamics, dominant regions, product innovations, key players, and emerging opportunities that will shape the future of this vital sector.

Child Resistant Zipper Market Dynamics & Structure

The Child Resistant Zipper market is characterized by a moderate to high concentration, with a few key players dominating a significant portion of the global market share. Technological innovation remains a primary driver, focusing on enhanced child-proofing mechanisms that are intuitive for adults while robust against young children. Regulatory frameworks, particularly in North America and Europe, mandate the adoption of child-resistant packaging for various products, fueling market expansion. Competitive product substitutes, such as snap closures and specialized locking mechanisms, exist but often lack the convenience and reusability offered by zippers. End-user demographics highlight increasing awareness among parents regarding product safety, particularly for ingestible items, medications, and potent household products. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios, gain market access, and achieve economies of scale.

- Market Concentration: Dominated by a mix of established zipper manufacturers and specialized packaging solution providers.

- Technological Innovation: Driven by the pursuit of advanced locking mechanisms, material science for durability, and ease-of-use for adults.

- Regulatory Frameworks: Stringent safety standards (e.g., CPSC in the US, relevant EU directives) are a major growth catalyst.

- Competitive Product Substitutes: While present, zippers offer a balance of safety, functionality, and aesthetics.

- End-User Demographics: Growing parental concern for product safety, especially for children.

- M&A Trends: Consolidation to enhance market reach and technological capabilities.

Child Resistant Zipper Growth Trends & Insights

The global Child Resistant Zipper market is poised for substantial growth, projected to expand from an estimated market size of $1,200 million units in 2025 to $2,500 million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 9.5% during the forecast period. Historical data from 2019 to 2024 indicates a steady upward trajectory, driven by increasing awareness of child safety and evolving regulatory mandates across various industries. The adoption rates for child-resistant packaging are accelerating, particularly in the Food and Beverage Industry, where snacks, confectionery, and household cleaning products are increasingly incorporating these features.

Technological disruptions are playing a pivotal role, with advancements in material science leading to more durable, aesthetically pleasing, and cost-effective child-resistant zipper solutions. Innovations such as multi-step locking mechanisms, tactile indicators, and integrated tamper-evident features are gaining traction. Consumer behavior shifts are also a significant influencer; parents are actively seeking out products with enhanced safety features, viewing them as a premium indicator of brand responsibility and care. This rising consumer preference, coupled with proactive industry initiatives and stricter government oversight, is creating a fertile ground for sustained market expansion. The Cosmetics and Personal Care Industry is also witnessing a surge in demand for child-resistant zippers, especially for products containing potentially harmful ingredients or those attractive to children, such as nail polish removers and certain grooming products. The broader "Others" segment, encompassing pharmaceuticals, household chemicals, and even recreational products, is a significant contributor to the market's growth trajectory, reflecting the ubiquitous need for child safety across a diverse range of applications.

Dominant Regions, Countries, or Segments in Child Resistant Zipper

The Child Resistant Zipper market's dominance is multifaceted, with significant growth driven by key regions and specific application segments. North America, particularly the United States, stands out as a leading region, propelled by robust regulatory frameworks and high consumer awareness regarding child safety. The Food and Beverage Industry in this region is a primary consumer of child-resistant zippers, accounting for an estimated 45% of the total market share in 2025, driven by the widespread adoption for snack packaging, confectionery, and dietary supplements. The Cosmetics and Personal Care Industry follows closely, representing approximately 30% of the market, with increasing demand for child-resistant closures on products like essential oils, skincare formulations, and potent cosmetic treatments.

Europe is another dominant region, with countries like Germany, the UK, and France enforcing strict safety standards that necessitate the use of child-resistant packaging. The combined market share of these European nations is projected to reach 25% by 2033. In terms of product types, the Close End Child Resistant Zipper segment is currently the largest, holding an estimated 60% of the market share in 2025. This is attributed to its widespread use in pre-made pouches and packaging for food items, pharmaceuticals, and personal care products. The Open End Child Resistant Zipper segment, though smaller, is expected to witness significant growth, particularly in applications where re-closability is paramount, such as in bulk food packaging and specialized apparel.

Key drivers for regional dominance include:

- North America: Stringent CPSC regulations, high consumer disposable income, and a proactive approach to product safety.

- Europe: Harmonized safety directives, strong consumer advocacy groups, and a focus on premium packaging solutions.

- Asia-Pacific: Emerging market with rapidly growing awareness and increasing regulatory implementation, particularly in China and India.

The dominance of the Food and Beverage Industry is fueled by the sheer volume of packaged goods and the direct impact on household safety. The Cosmetics and Personal Care Industry's growth is tied to product formulation complexities and the aesthetic appeal of safe packaging. The preference for Close End Child Resistant Zippers is a reflection of their versatility and established use in flexible packaging, while the rise of Open End Child Resistant Zippers signals innovation in functionality and reusability for diverse applications.

Child Resistant Zipper Product Landscape

The Child Resistant Zipper product landscape is characterized by continuous innovation focused on balancing robust child-proofing with user-friendliness. Products range from sophisticated multi-step locking mechanisms requiring specific hand movements to simpler, yet effective, designs that integrate tactile cues for adult operation. Key applications include flexible packaging for edibles, pharmaceuticals, cosmetics, and household chemicals, ensuring product integrity and preventing accidental ingestion or exposure by children. Performance metrics are increasingly centered on durability, tear resistance, tamper evidence, and ease of opening and closing for adults, all while adhering to strict international safety standards. Unique selling propositions often lie in proprietary locking technologies, advanced material compositions offering superior barrier properties, and integrated branding or design elements.

Key Drivers, Barriers & Challenges in Child Resistant Zipper

The Child Resistant Zipper market is primarily propelled by the unwavering demand for enhanced child safety, mandated by stringent government regulations across numerous countries. Technological advancements in material science and design engineering are creating more effective and user-friendly locking mechanisms. Furthermore, growing consumer awareness and parental concern about accidental ingestion or exposure to hazardous substances are significant market drivers. The expanding scope of applications, from pharmaceuticals to pet food, also contributes to sustained growth.

- Key Drivers:

- Mandatory child-resistant packaging regulations.

- Increasing consumer awareness of product safety.

- Innovations in zipper technology and materials.

- Expansion of end-use industries requiring child safety.

However, the market faces notable barriers and challenges. The cost of implementing child-resistant features can be higher compared to standard zippers, impacting pricing for end-products. Ensuring compliance with diverse and evolving international regulations presents a hurdle for manufacturers. Supply chain disruptions and raw material price volatility can affect production and availability. Moreover, the need for user-friendly designs that are intuitive for adults but difficult for children requires careful engineering and testing, posing an ongoing challenge.

- Key Barriers & Challenges:

- Higher manufacturing costs associated with safety features.

- Navigating complex and evolving global regulatory landscapes.

- Supply chain vulnerabilities and raw material cost fluctuations.

- Balancing stringent child-proofing with adult usability.

- Competition from alternative child-resistant closure systems.

Emerging Opportunities in Child Resistant Zipper

Emerging opportunities in the Child Resistant Zipper market are deeply intertwined with evolving consumer lifestyles and technological advancements. The growing legalization of cannabis and associated products in various regions presents a significant untapped market for child-resistant packaging solutions, demanding innovative and discreet designs. Furthermore, the increasing focus on sustainable packaging is creating opportunities for eco-friendly child-resistant zippers made from recycled or biodegradable materials. The expansion of e-commerce for sensitive products like pharmaceuticals and certain chemicals necessitates robust child-resistant shipping solutions, offering another avenue for growth.

- Untapped Markets: Legalized cannabis and cannabinoid product packaging.

- Innovative Applications: Sustainable and biodegradable child-resistant zipper solutions.

- Evolving Consumer Preferences: Enhanced child safety for e-commerce and subscription box services.

Growth Accelerators in the Child Resistant Zipper Industry

Several catalysts are accelerating the growth of the Child Resistant Zipper industry. Foremost among these are proactive government initiatives and evolving safety standards that compel manufacturers to integrate child-resistant features into their packaging. Continuous technological breakthroughs, such as the development of novel locking mechanisms and the use of advanced materials that enhance both safety and durability, are significantly boosting product development and adoption. Strategic partnerships between zipper manufacturers and packaging converters are streamlining the integration process and expanding market reach. Additionally, the increasing global demand for consumer goods that prioritize child safety is creating a strong pull for these specialized zippers, further solidifying their market presence and driving long-term growth.

Key Players Shaping the Child Resistant Zipper Market

- Cmz zipper (wuxi)

- Zip-Pak

- IDEAL Fastener

- Coats

- KCC Zipper Group

Notable Milestones in Child Resistant Zipper Sector

- 2019: Increased regulatory scrutiny and adoption of enhanced child-resistant standards in key markets.

- 2020: Introduction of new sustainable material options for child-resistant zippers.

- 2021: Significant growth in the demand for child-resistant packaging for cannabis-related products.

- 2022: Advancements in tactile and visual indicators for improved adult usability.

- 2023: Expansion of child-resistant zipper applications into the pharmaceutical delivery systems.

- 2024: Focus on cost-optimization and scalability for widespread adoption across industries.

In-Depth Child Resistant Zipper Market Outlook

The future outlook for the Child Resistant Zipper market is exceptionally promising, fueled by a confluence of sustained regulatory pressures, escalating consumer demand for safety, and continuous technological innovation. Growth accelerators such as advancements in biomaterials for sustainable options and the burgeoning legalized cannabis sector will further expand market penetration. Strategic collaborations between material science experts and zipper manufacturers will unlock novel functionalities and cost efficiencies. The market is poised for substantial expansion as companies across the Cosmetics and Personal Care Industry, Food and Beverage Industry, and pharmaceutical sectors prioritize child safety as a core packaging attribute, ensuring robust and enduring growth throughout the forecast period.

Child Resistant Zipper Segmentation

-

1. Application

- 1.1. Cosmetics and Personal Care Industry

- 1.2. Food and Beverage Industry

- 1.3. Others

-

2. Types

- 2.1. Close End Child Resistant Zipper

- 2.2. Open End Child Resistant Zipper

Child Resistant Zipper Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Child Resistant Zipper REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Child Resistant Zipper Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cosmetics and Personal Care Industry

- 5.1.2. Food and Beverage Industry

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Close End Child Resistant Zipper

- 5.2.2. Open End Child Resistant Zipper

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Child Resistant Zipper Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cosmetics and Personal Care Industry

- 6.1.2. Food and Beverage Industry

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Close End Child Resistant Zipper

- 6.2.2. Open End Child Resistant Zipper

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Child Resistant Zipper Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cosmetics and Personal Care Industry

- 7.1.2. Food and Beverage Industry

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Close End Child Resistant Zipper

- 7.2.2. Open End Child Resistant Zipper

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Child Resistant Zipper Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cosmetics and Personal Care Industry

- 8.1.2. Food and Beverage Industry

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Close End Child Resistant Zipper

- 8.2.2. Open End Child Resistant Zipper

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Child Resistant Zipper Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cosmetics and Personal Care Industry

- 9.1.2. Food and Beverage Industry

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Close End Child Resistant Zipper

- 9.2.2. Open End Child Resistant Zipper

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Child Resistant Zipper Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Cosmetics and Personal Care Industry

- 10.1.2. Food and Beverage Industry

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Close End Child Resistant Zipper

- 10.2.2. Open End Child Resistant Zipper

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Cmz zipper (wuxi)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zip-Pak

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IDEAL Fastener

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Coats

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 KCC Zipper Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 Cmz zipper (wuxi)

List of Figures

- Figure 1: Global Child Resistant Zipper Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Child Resistant Zipper Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Child Resistant Zipper Revenue (million), by Application 2024 & 2032

- Figure 4: North America Child Resistant Zipper Volume (K), by Application 2024 & 2032

- Figure 5: North America Child Resistant Zipper Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Child Resistant Zipper Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Child Resistant Zipper Revenue (million), by Types 2024 & 2032

- Figure 8: North America Child Resistant Zipper Volume (K), by Types 2024 & 2032

- Figure 9: North America Child Resistant Zipper Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Child Resistant Zipper Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Child Resistant Zipper Revenue (million), by Country 2024 & 2032

- Figure 12: North America Child Resistant Zipper Volume (K), by Country 2024 & 2032

- Figure 13: North America Child Resistant Zipper Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Child Resistant Zipper Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Child Resistant Zipper Revenue (million), by Application 2024 & 2032

- Figure 16: South America Child Resistant Zipper Volume (K), by Application 2024 & 2032

- Figure 17: South America Child Resistant Zipper Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Child Resistant Zipper Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Child Resistant Zipper Revenue (million), by Types 2024 & 2032

- Figure 20: South America Child Resistant Zipper Volume (K), by Types 2024 & 2032

- Figure 21: South America Child Resistant Zipper Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Child Resistant Zipper Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Child Resistant Zipper Revenue (million), by Country 2024 & 2032

- Figure 24: South America Child Resistant Zipper Volume (K), by Country 2024 & 2032

- Figure 25: South America Child Resistant Zipper Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Child Resistant Zipper Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Child Resistant Zipper Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Child Resistant Zipper Volume (K), by Application 2024 & 2032

- Figure 29: Europe Child Resistant Zipper Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Child Resistant Zipper Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Child Resistant Zipper Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Child Resistant Zipper Volume (K), by Types 2024 & 2032

- Figure 33: Europe Child Resistant Zipper Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Child Resistant Zipper Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Child Resistant Zipper Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Child Resistant Zipper Volume (K), by Country 2024 & 2032

- Figure 37: Europe Child Resistant Zipper Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Child Resistant Zipper Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Child Resistant Zipper Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Child Resistant Zipper Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Child Resistant Zipper Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Child Resistant Zipper Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Child Resistant Zipper Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Child Resistant Zipper Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Child Resistant Zipper Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Child Resistant Zipper Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Child Resistant Zipper Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Child Resistant Zipper Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Child Resistant Zipper Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Child Resistant Zipper Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Child Resistant Zipper Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Child Resistant Zipper Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Child Resistant Zipper Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Child Resistant Zipper Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Child Resistant Zipper Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Child Resistant Zipper Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Child Resistant Zipper Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Child Resistant Zipper Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Child Resistant Zipper Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Child Resistant Zipper Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Child Resistant Zipper Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Child Resistant Zipper Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Child Resistant Zipper Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Child Resistant Zipper Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Child Resistant Zipper Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Child Resistant Zipper Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Child Resistant Zipper Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Child Resistant Zipper Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Child Resistant Zipper Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Child Resistant Zipper Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Child Resistant Zipper Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Child Resistant Zipper Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Child Resistant Zipper Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Child Resistant Zipper Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Child Resistant Zipper Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Child Resistant Zipper Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Child Resistant Zipper Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Child Resistant Zipper Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Child Resistant Zipper Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Child Resistant Zipper Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Child Resistant Zipper Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Child Resistant Zipper Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Child Resistant Zipper Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Child Resistant Zipper Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Child Resistant Zipper Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Child Resistant Zipper Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Child Resistant Zipper Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Child Resistant Zipper Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Child Resistant Zipper Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Child Resistant Zipper Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Child Resistant Zipper Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Child Resistant Zipper Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Child Resistant Zipper Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Child Resistant Zipper Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Child Resistant Zipper Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Child Resistant Zipper Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Child Resistant Zipper Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Child Resistant Zipper Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Child Resistant Zipper Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Child Resistant Zipper Volume K Forecast, by Country 2019 & 2032

- Table 81: China Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Child Resistant Zipper Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Child Resistant Zipper Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Child Resistant Zipper?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Child Resistant Zipper?

Key companies in the market include Cmz zipper (wuxi), Zip-Pak, IDEAL Fastener, Coats, KCC Zipper Group.

3. What are the main segments of the Child Resistant Zipper?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Child Resistant Zipper," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Child Resistant Zipper report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Child Resistant Zipper?

To stay informed about further developments, trends, and reports in the Child Resistant Zipper, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence