Key Insights

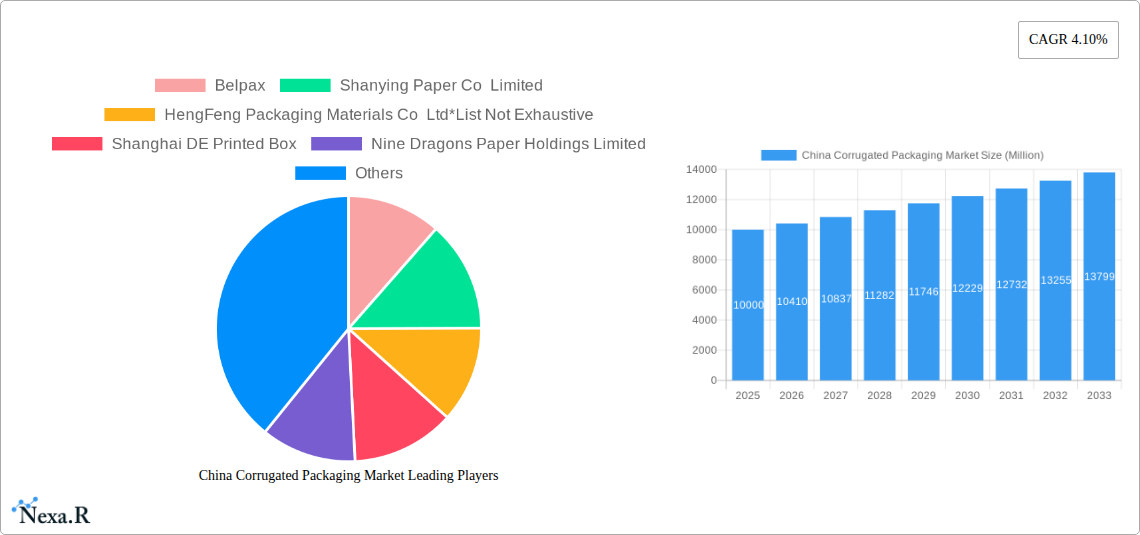

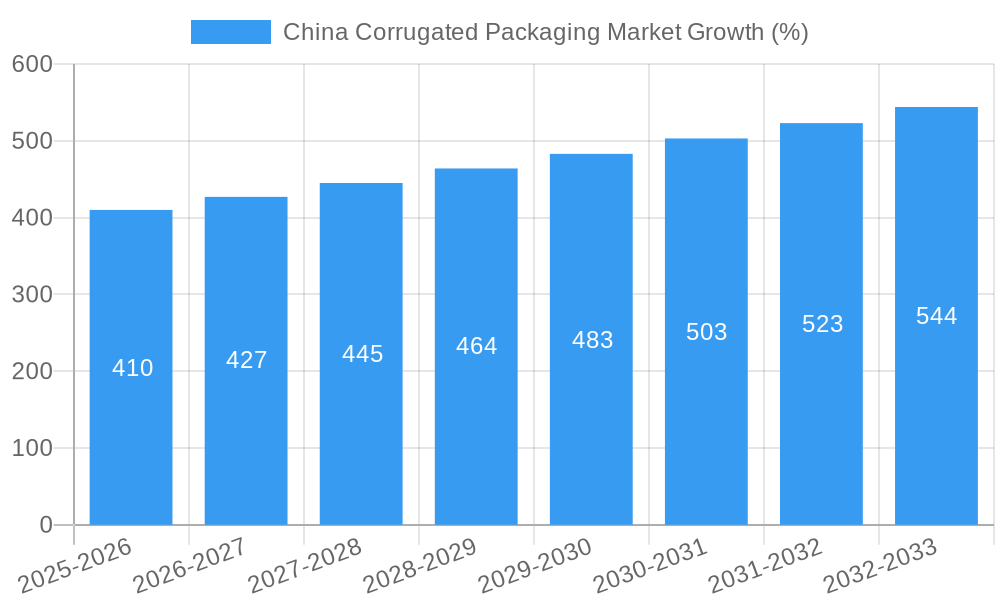

The China corrugated packaging market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.10% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning e-commerce sector in China necessitates significant packaging solutions for efficient and safe delivery of goods, significantly boosting demand for corrugated boxes. Furthermore, the rising preference for convenient and sustainable packaging materials, coupled with increasing consumer goods production, particularly within the food and beverage industries, further propels market growth. Government initiatives promoting sustainable packaging practices and reducing plastic waste are also contributing positively to market expansion. While increased raw material costs and fluctuating paper prices pose challenges, the overall market outlook remains optimistic due to the strong underlying growth drivers.

The market segmentation reveals a strong presence across various end-user industries. The food and beverage sector represents a significant portion of the market, followed by electrical goods and household items. The "Other End-user Industries" segment, encompassing industrial and stationary applications, also contributes substantially to the overall demand. Key players such as Belpax, Shanying Paper Co Limited, and Nine Dragons Paper Holdings Limited compete in this dynamic market, employing strategies focused on innovation, capacity expansion, and strategic partnerships to gain a competitive edge. The forecast period of 2025-2033 presents lucrative opportunities for existing and new players looking to capitalize on the continued expansion of this crucial sector within the Chinese economy. Regional analysis primarily focuses on China, given the data provided, highlighting the dominance of this market within the broader Asia-Pacific region.

China Corrugated Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the China corrugated packaging market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report segments the market by end-user industry (Food, Beverages, Electrical goods, Household, Other End-user Industries) providing granular data and projections in million units.

China Corrugated Packaging Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, and regulatory influences shaping the China corrugated packaging market. We delve into market concentration, examining the market share held by major players and identifying potential merger and acquisition (M&A) activities. The report explores the impact of technological innovation, including automation and sustainable packaging solutions, and assesses the influence of government regulations on market growth. Furthermore, it examines the availability of substitute products and their influence on market dynamics.

- Market Concentration: The market exhibits a [xx]% concentration ratio (CRx), indicating [Describe the level of concentration: e.g., a moderately consolidated market with a few dominant players].

- Technological Innovation: Key drivers include advancements in printing techniques (e.g., digital printing), automation of production lines, and the development of eco-friendly materials. Barriers include high initial investment costs for new technologies and a lack of skilled labor in certain regions.

- Regulatory Framework: Government regulations focused on environmental sustainability and food safety are significantly impacting packaging choices, driving demand for recyclable and compostable materials.

- Competitive Product Substitutes: The main substitutes are plastic packaging and other forms of rigid and flexible packaging. Their market share is estimated to be [xx]% in 2025.

- End-User Demographics: The growing middle class and increasing disposable incomes are major contributors to rising demand for packaged goods, particularly in urban areas.

- M&A Trends: The number of M&A deals in the sector averaged [xx] per year during 2019-2024, driven by [explain reasons for M&A, e.g., expansion into new markets and consolidation of market share].

China Corrugated Packaging Market Growth Trends & Insights

This section provides a detailed analysis of the China corrugated packaging market's evolution, examining market size, growth rate, and key factors driving expansion. We analyze adoption rates of new technologies and materials, consumer behavior shifts towards sustainable packaging, and the impact of technological disruptions on market dynamics. Quantitative insights, including the Compound Annual Growth Rate (CAGR) and market penetration rates, are provided.

(Note: This section requires XXX to be defined to deliver a 600-word analysis. Please provide the necessary data or methodology.)

Dominant Regions, Countries, or Segments in China Corrugated Packaging Market

This section pinpoints the leading region(s) or segment(s) within the China corrugated packaging market driving its expansion. We analyze the factors contributing to this dominance, including economic policies, infrastructure development, and consumer preferences, using both quantitative and qualitative data. Market share and growth potential are assessed for each segment.

- Leading Segment: The [Food/Beverages/Electrical Goods/Household/Other - Choose the leading segment] segment is projected to dominate the market, with a [xx]% market share in 2025 and a projected CAGR of [xx]% during the forecast period.

- Key Drivers:

- Rapid growth of the [relevant end-user industry, e.g., food processing industry]

- Expansion of e-commerce and online retail driving demand for efficient packaging solutions.

- Government initiatives supporting infrastructure development and logistics.

- Dominance Factors: [Detailed explanation of why this segment is dominant, including specific market share data and growth projections.]

China Corrugated Packaging Market Product Landscape

The China corrugated packaging market offers a diverse range of products, showcasing continuous innovation in materials, designs, and functionalities. These innovations encompass advancements in printing technologies, resulting in high-quality graphics and improved brand visibility. Furthermore, there's a growing emphasis on eco-friendly materials and sustainable packaging solutions to cater to the increasing environmental consciousness among consumers and regulatory pressures. The focus is shifting towards enhanced product protection and cost-effective packaging options tailored to meet specific industry needs.

Key Drivers, Barriers & Challenges in China Corrugated Packaging Market

Key Drivers:

- The booming e-commerce sector is fueling demand for cost-effective and efficient packaging solutions.

- Increasing consumer awareness of sustainability is driving adoption of eco-friendly packaging.

- Government regulations promoting sustainable practices are pushing for innovation in recyclable materials.

Key Challenges & Restraints:

- Fluctuations in raw material prices, particularly pulp and paper, impact production costs. [Quantifiable impact: e.g., A 10% increase in pulp prices can lead to a [x]% increase in production costs.]

- Intense competition among domestic and international players is pressuring profit margins.

- Stringent environmental regulations may require costly upgrades to production processes.

Emerging Opportunities in China Corrugated Packaging Market

- Growing demand for customized and personalized packaging solutions, particularly in luxury goods and e-commerce.

- Increased adoption of smart packaging incorporating technologies like RFID for improved supply chain management.

- Expansion into niche markets like pharmaceuticals and healthcare, requiring specialized packaging solutions.

Growth Accelerators in the China Corrugated Packaging Market Industry

Technological advancements, particularly in automation and sustainable materials, are key growth catalysts. Strategic partnerships between packaging manufacturers and brand owners are driving innovation and efficiency gains. Market expansion strategies targeting underserved regions and consumer segments present significant growth opportunities.

Key Players Shaping the China Corrugated Packaging Market Market

- Belpax

- Shanying Paper Co Limited

- HengFeng Packaging Materials Co Ltd

- Shanghai DE Printed Box

- Nine Dragons Paper Holdings Limited

- Hung Hing Printing Group Limited

- List Not Exhaustive

Notable Milestones in China Corrugated Packaging Market Sector

- November 2022: Ningbo Unico Packing Co., Ltd. invested in a fully-automatic packaging machine, boosting its monthly production capacity of rigid gift boxes to 300,000 units. This signifies an investment in advanced technology and increased capacity within the market.

In-Depth China Corrugated Packaging Market Outlook

The China corrugated packaging market exhibits strong growth potential, driven by ongoing industrialization, expansion of e-commerce, and a growing emphasis on sustainable packaging solutions. Strategic investments in automation and innovative materials, coupled with expansion into niche markets, will shape the future of the industry. Companies focusing on sustainable practices and efficient supply chain management are poised to capture significant market share in the coming years.

China Corrugated Packaging Market Segmentation

-

1. End-user Industry

- 1.1. Food

- 1.2. Beverages

- 1.3. Electrical goods

- 1.4. Household

- 1.5. Other En

China Corrugated Packaging Market Segmentation By Geography

- 1. China

China Corrugated Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Environmental Awareness by Urban Populations; Growing Demand for Sustainable Packaging; Strong Demand from the E-commerce Sector

- 3.3. Market Restrains

- 3.3.1. High Competition from Substitute Packaging Solutions; Improved Technology Offering Better Solutions

- 3.4. Market Trends

- 3.4.1. Strong Demand from the E-commerce Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Corrugated Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Food

- 5.1.2. Beverages

- 5.1.3. Electrical goods

- 5.1.4. Household

- 5.1.5. Other En

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Belpax

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shanying Paper Co Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HengFeng Packaging Materials Co Ltd*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shanghai DE Printed Box

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nine Dragons Paper Holdings Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hung Hing Printing Group Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Belpax

List of Figures

- Figure 1: China Corrugated Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Corrugated Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: China Corrugated Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Corrugated Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 3: China Corrugated Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: China Corrugated Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Corrugated Packaging Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: China Corrugated Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Corrugated Packaging Market?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the China Corrugated Packaging Market?

Key companies in the market include Belpax, Shanying Paper Co Limited, HengFeng Packaging Materials Co Ltd*List Not Exhaustive, Shanghai DE Printed Box, Nine Dragons Paper Holdings Limited, Hung Hing Printing Group Limited.

3. What are the main segments of the China Corrugated Packaging Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Environmental Awareness by Urban Populations; Growing Demand for Sustainable Packaging; Strong Demand from the E-commerce Sector.

6. What are the notable trends driving market growth?

Strong Demand from the E-commerce Sector.

7. Are there any restraints impacting market growth?

High Competition from Substitute Packaging Solutions; Improved Technology Offering Better Solutions.

8. Can you provide examples of recent developments in the market?

November 2022: Ningbo Unico Packing Co., Ltd. purchased a fully-automatic packaging machine and successfully set up the full production line for all kinds of custom cardboard rigid gift boxes. The company's production capacity has now increased to 300,000 pieces of rigid gift boxes per month. The machine takes all work from box printing, mold setting up, lamination, and surface add-ons to final assembling.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Corrugated Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Corrugated Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Corrugated Packaging Market?

To stay informed about further developments, trends, and reports in the China Corrugated Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence