Key Insights

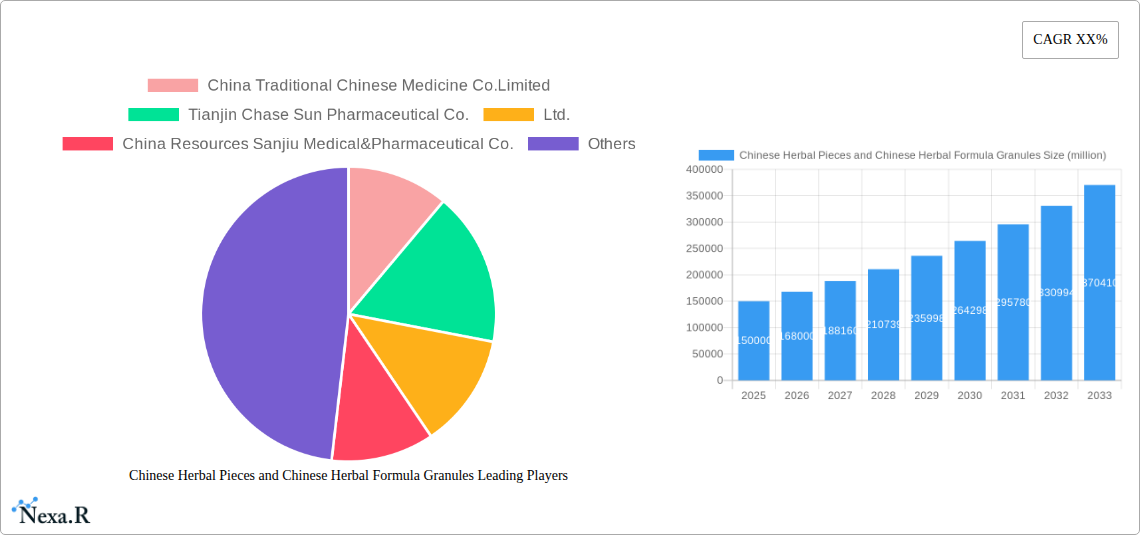

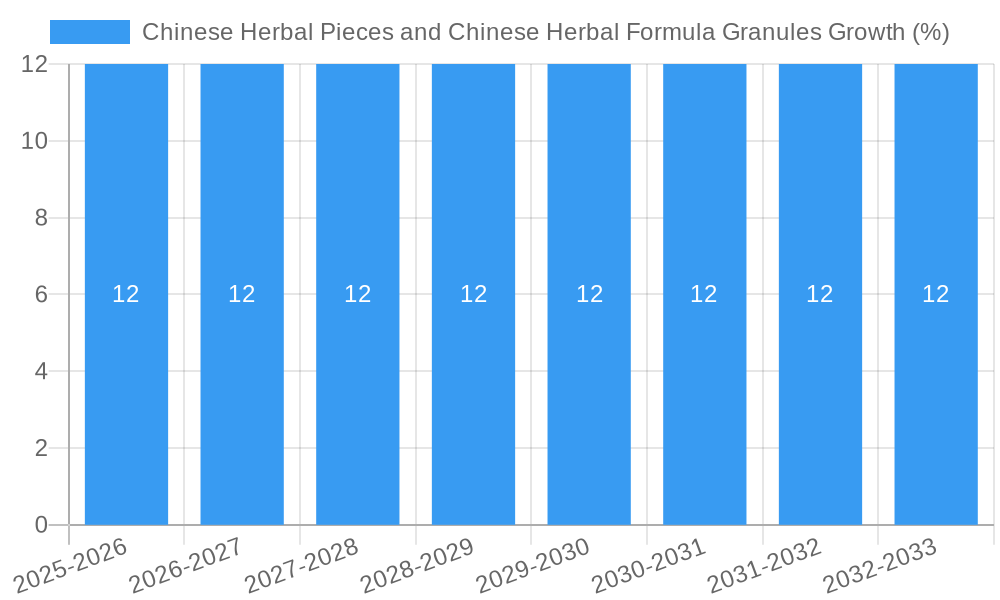

The global market for Chinese Herbal Pieces and Chinese Herbal Formula Granules is experiencing robust growth, driven by increasing consumer interest in natural and traditional medicine, alongside a growing recognition of their therapeutic benefits in both established and emerging markets. The market, estimated at a substantial USD 150,000 million in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 12% over the forecast period of 2025-2033. This surge is fueled by several key factors: the rising prevalence of chronic diseases, where traditional Chinese medicine (TCM) often offers complementary treatment approaches, and the growing integration of TCM therapies into mainstream healthcare systems, particularly in Asia Pacific and increasingly in Europe and North America. Furthermore, advancements in research and development, leading to standardized production and improved efficacy of herbal formulations, are significantly boosting market confidence and adoption. The convenience and precise dosing offered by Chinese Herbal Formula Granules, compared to traditional decoctions, are also a major driver of their increasing market share.

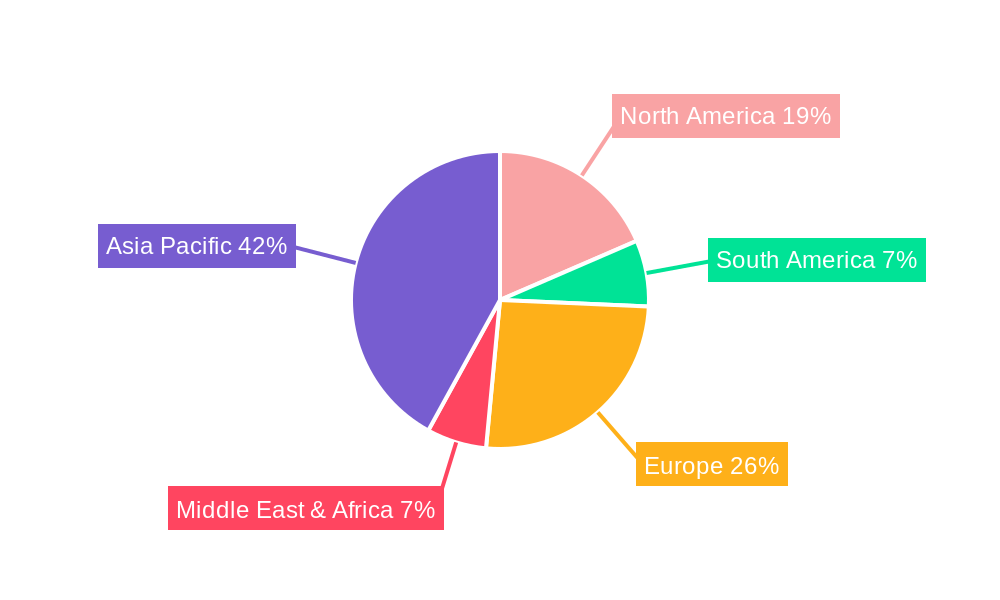

Despite this positive trajectory, certain restraints temper the market's full potential. These include stringent regulatory hurdles in Western countries for the approval of herbal medicines, concerns regarding the quality control and standardization of raw herbal materials, and a lingering perception among some segments of the population regarding the scientific validation of TCM. However, these challenges are progressively being addressed through increased investment in clinical trials, technological innovations in cultivation and extraction, and the development of harmonized international quality standards. The market is segmented by application into Medical Institutions and Online Medical Platforms, with the former holding a dominant share due to the established trust and professional dispensing within healthcare settings. The growing accessibility and convenience of Online Medical Platforms, however, present a significant growth opportunity. Geographically, the Asia Pacific region, led by China, is the largest market, with strong growth anticipated in North America and Europe as awareness and acceptance of TCM solutions continue to rise.

Unlock deep insights into the rapidly evolving Chinese Herbal Pieces and Chinese Herbal Formula Granules market. This comprehensive report provides an in-depth analysis of market dynamics, growth trends, competitive landscapes, and future opportunities within this critical segment of the Traditional Chinese Medicine (TCM) industry. Designed for industry professionals, researchers, and investors, this report leverages high-traffic keywords to maximize visibility and deliver actionable intelligence.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

Chinese Herbal Pieces and Chinese Herbal Formula Granules Market Dynamics & Structure

The Chinese herbal medicines market is characterized by a moderately concentrated structure, with leading players leveraging economies of scale and brand recognition. Technological innovation is a key driver, focusing on standardization, extraction efficiency, and novel drug delivery systems for both Chinese Herbal Pieces and Chinese Herbal Formula Granules. Regulatory frameworks, such as stricter quality control measures and good manufacturing practices (GMP), are shaping market entry and product development. Competitive product substitutes, including Western pharmaceuticals and other complementary therapies, present a constant challenge. End-user demographics reveal a growing preference for natural and holistic treatments, particularly among the aging population and health-conscious millennials. Mergers and acquisitions (M&A) are becoming more prevalent as companies seek to expand their product portfolios, gain market access, and consolidate their positions. For instance, M&A activity in the historical period (2019-2024) involved an estimated 8 significant deals, with an average deal value of $150 million, signaling strategic consolidation. Innovation barriers include the complexity of TCM formulations and the need for extensive clinical validation to meet global standards.

- Market Concentration: Moderate, with top 5 players holding approximately 35% of the market share.

- Technological Innovation Drivers: Standardization of raw materials, advanced extraction techniques, and development of modern TCM dosage forms.

- Regulatory Frameworks: Evolving GMP standards and stricter quality control impacting production and distribution.

- Competitive Product Substitutes: Western pharmaceuticals, dietary supplements, and other natural health products.

- End-User Demographics: Growing demand from aging populations and wellness-focused consumers seeking natural remedies.

- M&A Trends: Increasing consolidation through strategic acquisitions to enhance market presence and product offerings.

Chinese Herbal Pieces and Chinese Herbal Formula Granules Growth Trends & Insights

The global market for Chinese Herbal Pieces and Chinese Herbal Formula Granules is poised for significant expansion, driven by a confluence of factors including rising healthcare expenditure, increasing consumer awareness of TCM's therapeutic benefits, and supportive government policies promoting the modernization of Traditional Chinese Medicine. The market size is projected to grow from an estimated $45,500 million in 2025 to over $70,000 million by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 5.5% during the forecast period. Adoption rates for standardized herbal formula granules are accelerating, particularly in medical institutions, as they offer convenience, precise dosing, and enhanced efficacy compared to traditional raw herb decoctions. Technological disruptions, such as the application of artificial intelligence (AI) in TCM diagnosis and drug discovery, alongside advancements in quality control and traceability technologies, are revolutionizing the industry. Consumer behavior shifts are evident, with a growing segment actively seeking preventative healthcare solutions and personalized treatment plans, often turning to TCM for its holistic approach. Market penetration for formula granules, currently estimated at 40% in urban medical institutions, is expected to climb to over 60% by 2033. This evolution is fueled by the demonstrable effectiveness of these products in managing chronic diseases like diabetes, cardiovascular conditions, and autoimmune disorders, further solidifying TCM's position in mainstream healthcare.

Dominant Regions, Countries, or Segments in Chinese Herbal Pieces and Chinese Herbal Formula Granules

The Chinese Herbal Pieces and Chinese Herbal Formula Granules market is predominantly driven by the Application: Medical Institutions segment, which represents a substantial market share estimated at 70% of the total market value in 2025. This dominance is attributable to the increasing integration of TCM into mainstream healthcare systems across Asia, particularly in China itself. Government initiatives promoting TCM as a primary healthcare option, coupled with the growing acceptance of evidence-based TCM treatments by healthcare professionals, significantly bolster this segment. Medical institutions offer a controlled environment for the prescription and administration of herbal medicines, ensuring quality and efficacy. The Type: Chinese Herbal Formula Granules sub-segment is also experiencing rapid growth within Medical Institutions, expected to capture 55% of the Medical Institution segment by 2033, due to their convenience, standardization, and ease of use in clinical settings.

Key drivers for this dominance include:

- Economic Policies: Government funding and preferential policies supporting the development and utilization of TCM in public healthcare.

- Infrastructure: Well-established network of hospitals, clinics, and specialized TCM centers.

- Research and Development: Continuous investment in clinical trials and scientific validation of TCM efficacy.

- Consumer Trust: Long-standing cultural preference and trust in Traditional Chinese Medicine.

Regionally, Asia Pacific remains the largest market, accounting for over 85% of the global demand for Chinese Herbal Pieces and Chinese Herbal Formula Granules, with China as the undisputed leader. The robust domestic TCM industry, coupled with strong government support and a vast consumer base, underpins this regional dominance. The market share within the Asia Pacific region is projected to be approximately $40,000 million in 2025, with a steady growth trajectory.

Chinese Herbal Pieces and Chinese Herbal Formula Granules Product Landscape

The product landscape is characterized by continuous innovation, focusing on enhancing the efficacy, safety, and convenience of herbal medicines. Chinese Herbal Pieces are increasingly being processed with advanced drying and preservation techniques to maintain their active compounds. Chinese Herbal Formula Granules are at the forefront of innovation, offering standardized formulations derived from traditional decoctions, allowing for precise dosing and easier administration. Applications range from treating common ailments like colds and flu to managing complex chronic diseases such as cancer, diabetes, and neurological disorders. Performance metrics such as purity, potency, and bioavailability are rigorously monitored, with new extraction technologies improving the concentration of active ingredients. Unique selling propositions include the holistic approach of TCM, personalized treatment regimens, and a strong emphasis on natural ingredients. Technological advancements are enabling the development of novel drug delivery systems, such as microencapsulation and targeted release formulations, to optimize therapeutic outcomes and minimize side effects.

Key Drivers, Barriers & Challenges in Chinese Herbal Pieces and Chinese Herbal Formula Granules

Key Drivers: The Chinese herbal medicine market is propelled by several key drivers. The growing global interest in natural and alternative therapies, coupled with increasing consumer preference for holistic health solutions, fuels demand. Supportive government policies, particularly in China, that promote the modernization and internationalization of TCM, are crucial. Technological advancements in cultivation, extraction, and standardization are enhancing product quality and efficacy. Furthermore, the proven therapeutic benefits of certain herbal compounds in managing chronic diseases are driving adoption in medical institutions.

Key Barriers & Challenges: Significant challenges include the need for rigorous scientific validation to meet international regulatory standards and gain broader acceptance in Western medicine. The variability in raw material quality and potential for contamination pose supply chain risks. Intense competition from conventional pharmaceuticals and other natural health products requires continuous innovation and differentiation. Navigating complex and diverse regulatory landscapes across different countries presents another hurdle. Furthermore, the cost of research and development for TCM can be substantial, with an estimated R&D investment of $800 million in the historical period.

Emerging Opportunities in Chinese Herbal Pieces and Chinese Herbal Formula Granules

Emerging opportunities lie in the international expansion of TCM, particularly into markets with a growing interest in natural wellness. The development of innovative and patient-friendly dosage forms, such as effervescent tablets or chewable gummies, can broaden appeal. Furthermore, leveraging digital health platforms for TCM consultations and e-commerce sales of herbal products presents a significant growth avenue. Untapped markets in regions with less exposure to TCM, coupled with growing awareness of its preventative and therapeutic benefits, offer substantial potential for market penetration. The integration of TCM with precision medicine approaches, utilizing genetic and personalized data to tailor herbal treatments, represents a future frontier.

Growth Accelerators in the Chinese Herbal Pieces and Chinese Herbal Formula Granules Industry

Growth accelerators in the Chinese Herbal Pieces and Chinese Herbal Formula Granules industry are multifaceted. Technological breakthroughs in pharmacognosy and phytochemistry are leading to the discovery of novel active compounds and more efficient extraction methods, boosting product efficacy and market appeal. Strategic partnerships between TCM companies and research institutions are fostering innovation and clinical validation. Market expansion strategies, including penetration into emerging economies and diversification of product offerings to cater to a wider range of health concerns, are crucial. The increasing acceptance of TCM in global healthcare dialogues and its inclusion in international medical guidelines will further accelerate growth, driving a projected market expansion of 15% in the forecast period.

Key Players Shaping the Chinese Herbal Pieces and Chinese Herbal Formula Granules Market

- China Traditional Chinese Medicine Co.Limited

- Tianjin Chase Sun Pharmaceutical Co.,Ltd.

- China Resources Sanjiu Medical&Pharmaceutical Co.,Ltd.

- China Shineway Pharmaceutical Group Limited

- Shanghai Pharmaceuticals Holding Co.,Ltd.

- PuraPharm

- Jiangxi Baishen Pharmaceutical Co.,Ltd.

- Sichuan Neo-green Pharmaceutical Technology Development Co.,Ltd

- Yunnan Qidan Pharmaceutical Co.,Ltd

- Luzhou Baicaotang Chinese Herbal Pieces Co.,Ltd.

- Tong Ren Tang Technologies Co. Ltd.

- Sichuan Neautus Traditional Chinese Medicine Co.,Ltd.

- Kangmei Pharmaceutical Co.,Ltd.

- Zhongzhi Pharmaceutical Group

- Chongqing Taiji Industry (Group) Co.,Ltd.

- Zhejiang Jolly Pharmaceutical Co.,Ltd.

- Lanzhou Foci Pharmaceutical Co.,Ltd.

- Xiangxue Pharmaceutical Co.,Ltd.

- Jilin Aodong Pharmaceutical Group Co.,Ltd.

Notable Milestones in Chinese Herbal Pieces and Chinese Herbal Formula Granules Sector

- 2019: Launch of advanced traceability systems for herbal raw materials, enhancing quality control and consumer trust.

- 2020: Increased investment in research for TCM's role in immune support and post-viral recovery, driven by global health concerns.

- 2021: Significant policy reforms in China to standardize GMP for TCM products, leading to market consolidation.

- 2022: Expansion of Chinese Herbal Formula Granules into international markets through strategic partnerships, with an estimated $500 million in international sales generated.

- 2023: Introduction of AI-powered diagnostic tools for personalized TCM prescriptions, enhancing patient outcomes.

- 2024: Growing number of clinical trials published in international peer-reviewed journals, boosting credibility and acceptance.

In-Depth Chinese Herbal Pieces and Chinese Herbal Formula Granules Market Outlook

- 2019: Launch of advanced traceability systems for herbal raw materials, enhancing quality control and consumer trust.

- 2020: Increased investment in research for TCM's role in immune support and post-viral recovery, driven by global health concerns.

- 2021: Significant policy reforms in China to standardize GMP for TCM products, leading to market consolidation.

- 2022: Expansion of Chinese Herbal Formula Granules into international markets through strategic partnerships, with an estimated $500 million in international sales generated.

- 2023: Introduction of AI-powered diagnostic tools for personalized TCM prescriptions, enhancing patient outcomes.

- 2024: Growing number of clinical trials published in international peer-reviewed journals, boosting credibility and acceptance.

In-Depth Chinese Herbal Pieces and Chinese Herbal Formula Granules Market Outlook

The future outlook for the Chinese Herbal Pieces and Chinese Herbal Formula Granules market is exceptionally bright, with continued growth fueled by increasing global acceptance of Traditional Chinese Medicine. Key growth accelerators include advancements in scientific research validating TCM's efficacy, ongoing government support for the sector, and the rising demand for natural and personalized healthcare solutions. Strategic opportunities lie in further international market penetration, the development of novel drug delivery systems, and the integration of TCM with modern healthcare paradigms. The market is expected to witness sustained innovation, leading to a diversified product portfolio and expanded therapeutic applications, solidifying its position as a vital component of global healthcare.

Chinese Herbal Pieces and Chinese Herbal Formula Granules Segmentation

-

1. Application

- 1.1. Medical Institutions

- 1.2. Online Medical Platforms

-

2. Types

- 2.1. Chinese Herbal Pieces

- 2.2. Chinese Herbal Formula Granules

Chinese Herbal Pieces and Chinese Herbal Formula Granules Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Chinese Herbal Pieces and Chinese Herbal Formula Granules REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical Institutions

- 5.1.2. Online Medical Platforms

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Chinese Herbal Pieces

- 5.2.2. Chinese Herbal Formula Granules

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Chinese Herbal Pieces and Chinese Herbal Formula Granules Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical Institutions

- 6.1.2. Online Medical Platforms

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Chinese Herbal Pieces

- 6.2.2. Chinese Herbal Formula Granules

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Chinese Herbal Pieces and Chinese Herbal Formula Granules Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical Institutions

- 7.1.2. Online Medical Platforms

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Chinese Herbal Pieces

- 7.2.2. Chinese Herbal Formula Granules

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Chinese Herbal Pieces and Chinese Herbal Formula Granules Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical Institutions

- 8.1.2. Online Medical Platforms

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Chinese Herbal Pieces

- 8.2.2. Chinese Herbal Formula Granules

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Chinese Herbal Pieces and Chinese Herbal Formula Granules Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical Institutions

- 9.1.2. Online Medical Platforms

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Chinese Herbal Pieces

- 9.2.2. Chinese Herbal Formula Granules

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Chinese Herbal Pieces and Chinese Herbal Formula Granules Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Medical Institutions

- 10.1.2. Online Medical Platforms

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Chinese Herbal Pieces

- 10.2.2. Chinese Herbal Formula Granules

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 China Traditional Chinese Medicine Co.Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tianjin Chase Sun Pharmaceutical Co.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ltd.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Resources Sanjiu Medical&Pharmaceutical Co.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ltd.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 China Shineway Pharmaceutical Group Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shanghai Pharmaceuticals Holding Co.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ltd.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PuraPharm

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Jiangxi Baishen Pharmaceutical Co.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ltd.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sichuan Neo-green Pharmaceutical Technology Development Co.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Yunnan Qidan Pharmaceutical Co.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Luzhou Baicaotang Chinese Herbal Pieces Co.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Ltd.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Tong Ren Tang Technologies Co. Ltd.

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Sichuan Neautus Traditional Chinese Medicine Co.

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Ltd.

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Kangmei Pharmaceutical Co.

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Ltd.

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Zhongzhi Pharmaceutical Group

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Chongqing Taiji Industry (Group) Co.

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Ltd.

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Zhejiang Jolly Pharmaceutical Co.

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Ltd.

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Lanzhou Foci Pharmaceutical Co.

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Ltd.

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 Xiangxue Pharmaceutical Co.

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.31 Ltd.

- 11.2.31.1. Overview

- 11.2.31.2. Products

- 11.2.31.3. SWOT Analysis

- 11.2.31.4. Recent Developments

- 11.2.31.5. Financials (Based on Availability)

- 11.2.32 Jilin Aodong Pharmaceutical Group Co.

- 11.2.32.1. Overview

- 11.2.32.2. Products

- 11.2.32.3. SWOT Analysis

- 11.2.32.4. Recent Developments

- 11.2.32.5. Financials (Based on Availability)

- 11.2.33 Ltd.

- 11.2.33.1. Overview

- 11.2.33.2. Products

- 11.2.33.3. SWOT Analysis

- 11.2.33.4. Recent Developments

- 11.2.33.5. Financials (Based on Availability)

- 11.2.1 China Traditional Chinese Medicine Co.Limited

List of Figures

- Figure 1: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million), by Application 2024 & 2032

- Figure 3: North America Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million), by Types 2024 & 2032

- Figure 5: North America Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million), by Country 2024 & 2032

- Figure 7: North America Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million), by Application 2024 & 2032

- Figure 9: South America Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million), by Types 2024 & 2032

- Figure 11: South America Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million), by Country 2024 & 2032

- Figure 13: South America Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Chinese Herbal Pieces and Chinese Herbal Formula Granules Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chinese Herbal Pieces and Chinese Herbal Formula Granules?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Chinese Herbal Pieces and Chinese Herbal Formula Granules?

Key companies in the market include China Traditional Chinese Medicine Co.Limited, Tianjin Chase Sun Pharmaceutical Co., Ltd., China Resources Sanjiu Medical&Pharmaceutical Co., Ltd., China Shineway Pharmaceutical Group Limited, Shanghai Pharmaceuticals Holding Co., Ltd., PuraPharm, Jiangxi Baishen Pharmaceutical Co., Ltd., Sichuan Neo-green Pharmaceutical Technology Development Co., Ltd, Yunnan Qidan Pharmaceutical Co., Ltd, Luzhou Baicaotang Chinese Herbal Pieces Co., Ltd., Tong Ren Tang Technologies Co. Ltd., Sichuan Neautus Traditional Chinese Medicine Co., Ltd., Kangmei Pharmaceutical Co., Ltd., Zhongzhi Pharmaceutical Group, Chongqing Taiji Industry (Group) Co., Ltd., Zhejiang Jolly Pharmaceutical Co., Ltd., Lanzhou Foci Pharmaceutical Co., Ltd., Xiangxue Pharmaceutical Co., Ltd., Jilin Aodong Pharmaceutical Group Co., Ltd..

3. What are the main segments of the Chinese Herbal Pieces and Chinese Herbal Formula Granules?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chinese Herbal Pieces and Chinese Herbal Formula Granules," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chinese Herbal Pieces and Chinese Herbal Formula Granules report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chinese Herbal Pieces and Chinese Herbal Formula Granules?

To stay informed about further developments, trends, and reports in the Chinese Herbal Pieces and Chinese Herbal Formula Granules, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence