Key Insights

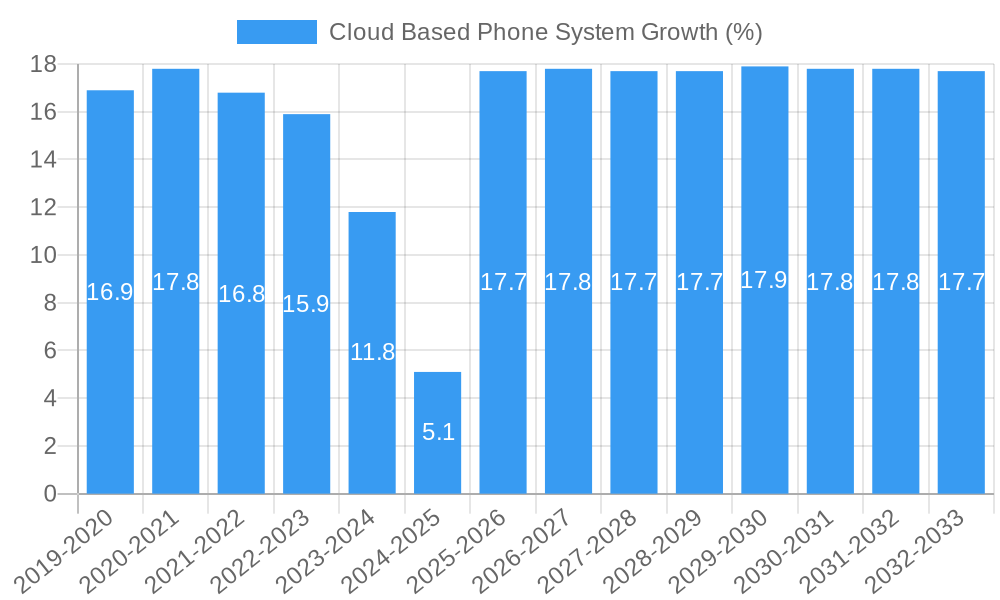

The global Cloud Based Phone System market is experiencing robust growth, projected to reach approximately $55.8 billion by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 18.5% during the forecast period of 2025-2033. This expansion is fueled by the increasing adoption of advanced communication solutions by businesses of all sizes seeking enhanced flexibility, scalability, and cost-efficiency. Small and Medium-sized Enterprises (SMEs) are a significant driver, leveraging cloud-based systems to access enterprise-grade features without substantial upfront infrastructure investment. Large enterprises are also migrating to these solutions to streamline global operations, improve team collaboration, and enhance customer service through features like advanced call routing, unified communications, and integrated CRM capabilities. The shift from traditional on-premise PBX systems to cloud-based alternatives is a dominant trend, driven by the inherent advantages of accessibility from any location with an internet connection, reduced maintenance overhead, and predictable subscription-based pricing models. The market is further propelled by the continuous innovation in unified communications as a service (UCaaS), offering a seamless integration of voice, video, messaging, and conferencing.

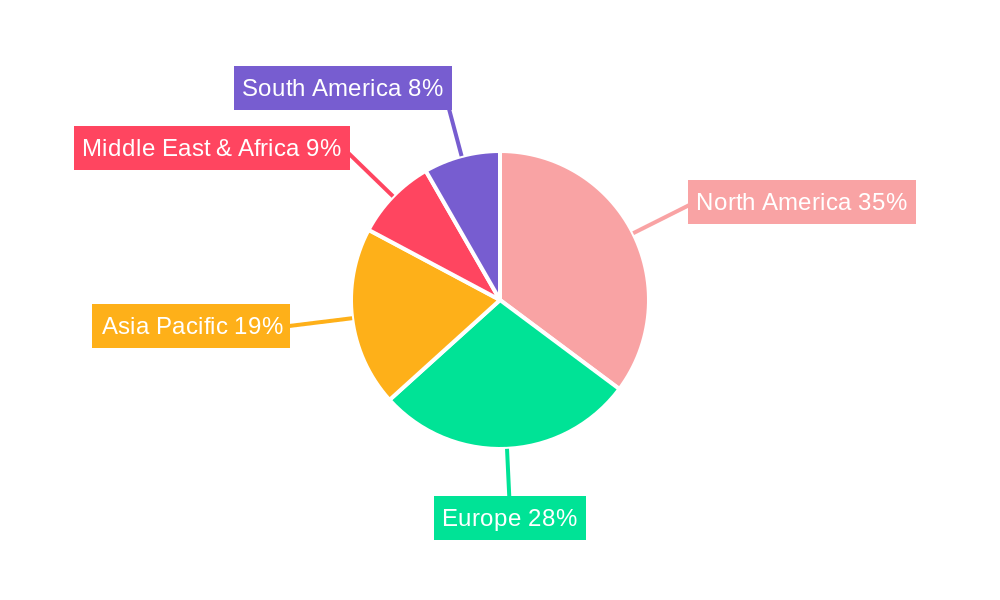

Several factors are contributing to this dynamic market growth. The ongoing digital transformation across industries, accelerated by the necessity for remote and hybrid work models, has made cloud-based phone systems indispensable. Businesses are prioritizing agility and the ability to adapt quickly to changing market demands, which these systems readily provide. The increasing availability of high-speed internet and the proliferation of mobile devices further facilitate the adoption and seamless operation of these solutions. While the market enjoys strong growth, potential restraints include concerns around data security and privacy for some organizations, particularly in highly regulated industries. However, robust security measures and compliance certifications are increasingly addressing these concerns. Competition among key players like Microsoft, Cisco, RingCentral, and 8x8 is intense, driving innovation and competitive pricing, which benefits end-users. The market is segmented by application (SMEs, Large Enterprises) and type (Unlimited Type, Metered Type), with both segments expected to show significant expansion. Geographically, North America and Europe currently dominate the market, driven by early adoption and a strong presence of technology providers, while the Asia Pacific region is poised for substantial growth due to its rapidly expanding economies and increasing digitalization efforts.

Cloud Based Phone System Market Dynamics & Structure

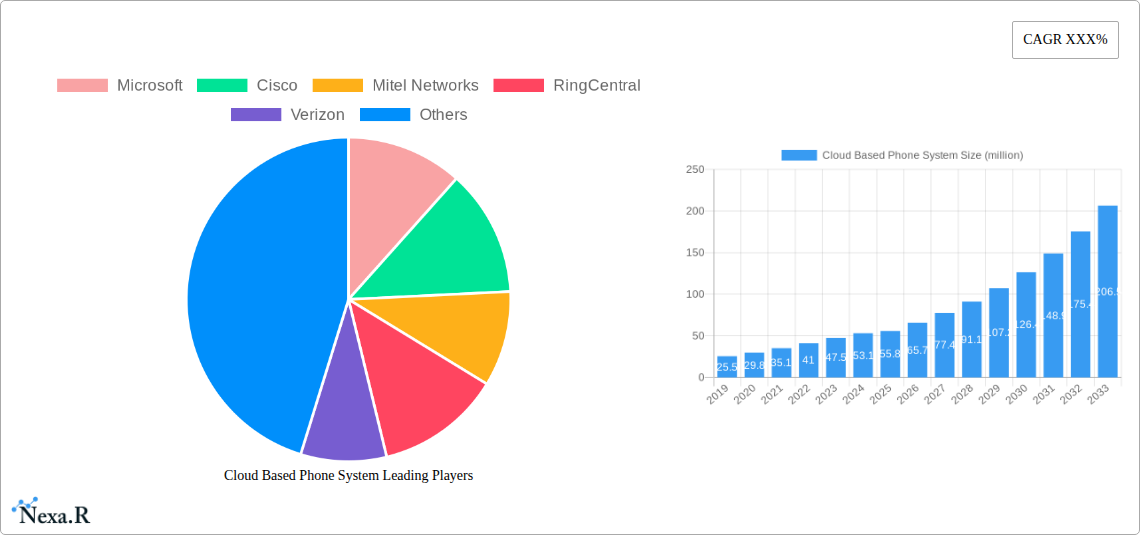

The cloud-based phone system market exhibits a dynamic and evolving structure, characterized by intense competition, rapid technological innovation, and an increasing emphasis on scalability and flexibility. Market concentration is moderate, with a few dominant players like Microsoft, Cisco, and RingCentral holding significant market share, alongside a robust ecosystem of mid-tier and emerging providers such as 3CX, 8x8, and Nextiva. Technological innovation is a primary driver, fueled by advancements in AI-powered features like intelligent call routing, real-time analytics, and unified communications (UCaaS) integration. The increasing adoption of 5G technology further enhances the performance and reliability of cloud-based solutions. Regulatory frameworks, while generally supportive of digital transformation, can introduce complexities related to data privacy and security, particularly in cross-border operations. Competitive product substitutes, including traditional on-premise PBX systems, are steadily being displaced by the superior cost-effectiveness and agility of cloud solutions. End-user demographics are broadening, with Small and Medium-sized Enterprises (SMEs) increasingly recognizing the value proposition of cloud-based systems, alongside continued strong demand from Large Enterprises. Mergers and acquisitions (M&A) trends are active, with larger players acquiring smaller innovators to expand their feature sets and market reach. For instance, recent M&A activities in the UCaaS space have consolidated market positions and spurred further innovation.

- Market Concentration: Moderate, with leading players and a strong competitive fringe.

- Technological Innovation Drivers: AI, 5G integration, UCaaS advancements.

- Regulatory Frameworks: Focus on data privacy, security, and interoperability.

- Competitive Product Substitutes: Declining relevance of traditional PBX systems.

- End-User Demographics: Growing adoption by SMEs and continued dominance in Large Enterprises.

- M&A Trends: Active consolidation and acquisition of innovative technologies.

Cloud Based Phone System Growth Trends & Insights

The global cloud-based phone system market is poised for substantial growth, driven by an escalating demand for flexible, scalable, and cost-effective communication solutions across all business sizes. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period of 2025-2033, expanding from an estimated $XX billion in 2025 to over $XXX billion by 2033. Adoption rates are accelerating, particularly among SMEs, which represent a significant segment of the parent market, previously underserved by expensive on-premise systems. These businesses are recognizing the tangible benefits of cloud-based solutions, including reduced upfront investment, simplified management, and enhanced collaboration capabilities. Large Enterprises, while already substantial users, are further optimizing their existing infrastructure by migrating to more advanced UCaaS platforms, seeking greater integration with their existing CRM and ERP systems.

Technological disruptions are playing a pivotal role in this growth trajectory. The integration of Artificial Intelligence (AI) into cloud phone systems is revolutionizing customer service with features like intelligent chatbots, predictive analytics for call volume, and automated transcription. Advancements in unified communications, enabling seamless integration of voice, video, messaging, and conferencing, are transforming how businesses operate and collaborate. Consumer behavior shifts are also contributing significantly. The rise of remote and hybrid work models has made reliable and accessible communication tools paramount. Employees expect to be able to connect and collaborate effectively from any location, on any device, a demand that cloud-based phone systems are ideally positioned to meet. Furthermore, the increasing reliance on digital channels for customer engagement is driving businesses to adopt sophisticated communication platforms that offer omnichannel support and advanced analytics to understand customer interactions better. The market penetration of cloud-based phone systems, currently at an estimated 65% globally, is expected to climb to over 85% by 2033, indicating a strong future for this technology. The shift is not merely about replacing old technology; it's about enabling new ways of working, fostering agility, and improving overall business productivity and customer satisfaction. The underlying infrastructure supporting these systems, from advanced data centers to robust internet connectivity, continues to mature, further solidifying the foundation for sustained market expansion. The ability of these systems to adapt to fluctuating business needs and to integrate with a growing array of digital tools makes them an indispensable component of modern business operations.

Dominant Regions, Countries, or Segments in Cloud Based Phone System

North America is currently the dominant region in the global cloud-based phone system market, driven by its mature digital infrastructure, high rate of technology adoption, and a strong presence of key industry players. The United States, in particular, accounts for a significant share of this dominance, supported by a robust economy, a large concentration of SMEs, and a proactive business environment that embraces innovation. Government initiatives promoting digital transformation and the widespread availability of high-speed internet further bolster adoption.

From the Application segment perspective, SMEs are emerging as a particularly strong growth engine. The child market segment of SMEs is experiencing a rapid influx of cloud-based phone system adoption due to their cost-effectiveness, scalability, and ease of deployment. Unlike large enterprises with dedicated IT departments and substantial capital for on-premise solutions, SMEs benefit immensely from the pay-as-you-go models and the absence of significant upfront hardware costs. This accessibility democratizes advanced communication capabilities for smaller businesses, enabling them to compete more effectively with larger organizations. The availability of feature-rich, yet affordable, cloud-based solutions has made them an indispensable tool for these businesses to manage customer interactions, enhance internal collaboration, and improve operational efficiency.

Analyzing the Type segment, Unlimited Type plans are driving significant market growth. Businesses are increasingly opting for unlimited calling and feature packages to ensure predictable costs and avoid the complexities of usage-based billing, especially with the rise of global and remote teams. This preference for unlimited services simplifies budgeting and operational management, allowing businesses to focus on their core activities without concerns about exceeding call limits or incurring unexpected charges. The reliability and comprehensive nature of unlimited plans align perfectly with the growing demand for continuous and seamless communication, a critical factor for businesses operating in today's fast-paced global economy. The market share for unlimited type plans is estimated to be around 70% of the total market by 2025, with a projected increase to 78% by 2033.

- Dominant Region: North America (primarily the United States).

- Key Drivers: Mature digital infrastructure, high technology adoption rates, strong economic base, government support for digital transformation, robust internet connectivity.

- Dominant Application Segment: SMEs.

- Dominance Factors: Cost-effectiveness, scalability, ease of deployment, accessibility of advanced features, reduced IT burden, enablement of remote work.

- Growth Potential: High, driven by digitalization efforts across a vast number of small businesses.

- Dominant Type Segment: Unlimited Type.

- Dominance Factors: Predictable costs, simplified budgeting, elimination of usage-based billing complexities, support for global and remote teams, continuous communication needs.

- Market Share: Estimated at 70% in 2025, projected to reach 78% by 2033.

Cloud Based Phone System Product Landscape

The cloud-based phone system product landscape is characterized by continuous innovation and a focus on delivering comprehensive Unified Communications as a Service (UCaaS) solutions. Products are increasingly offering advanced features such as AI-powered virtual assistants, sophisticated call analytics, seamless integration with CRM and productivity suites, and enhanced security protocols. Performance metrics like call quality, uptime reliability (often exceeding 99.99%), and low latency are paramount. Unique selling propositions often revolve around user-friendly interfaces, extensive customization options, and robust support services. Technological advancements are centered on improving interoperability between different communication channels and devices, creating a truly converged communication experience.

Key Drivers, Barriers & Challenges in Cloud Based Phone System

Key Drivers:

- Cost Efficiency: Significant reduction in upfront capital expenditure and ongoing maintenance costs compared to on-premise systems.

- Scalability and Flexibility: Ability to easily scale services up or down based on business needs, accommodating growth or seasonal fluctuations.

- Enhanced Collaboration: Facilitation of remote and hybrid workforces through integrated voice, video, messaging, and conferencing.

- Technological Advancements: Integration of AI, analytics, and advanced UCaaS features improving productivity and customer experience.

- Mobility: Access to communication services from any device, anywhere with an internet connection.

Key Barriers & Challenges:

- Internet Dependency: Reliance on stable and high-speed internet connectivity, which can be a challenge in certain regions.

- Security and Data Privacy Concerns: Although improving, some organizations remain hesitant about entrusting sensitive communication data to third-party providers.

- Integration Complexities: Challenges in integrating cloud-based systems with legacy IT infrastructure or specific business applications.

- Vendor Lock-in: Potential for dependence on a single provider, making future transitions difficult and costly.

- Service Outages: Although rare, the impact of an outage on a business heavily reliant on cloud communication can be significant. The potential financial loss due to an outage is estimated to range from $10,000 to $50,000 per hour for SMEs, and significantly higher for large enterprises.

Emerging Opportunities in Cloud Based Phone System

Emerging opportunities lie in the deeper integration of AI for predictive customer service, enabling proactive issue resolution before customers even contact support. The expansion of IoT device communication through cloud-based platforms presents a new frontier. Furthermore, niche industry-specific solutions, such as those tailored for healthcare with enhanced HIPAA compliance or for retail with integrated POS communication, offer significant untapped potential. The growing demand for specialized analytics dashboards that provide actionable insights into customer engagement patterns and employee productivity also represents a lucrative area for growth.

Growth Accelerators in the Cloud Based Phone System Industry

Growth accelerators are primarily driven by the ongoing digital transformation initiatives across all business sectors, coupled with the increasing necessity for resilient and agile communication infrastructure in the face of evolving work models. Strategic partnerships between cloud providers and technology integrators are expanding market reach and offering bundled solutions. The continuous evolution of 5G technology will unlock new possibilities for mobile communication quality and real-time data processing. Furthermore, the increasing emphasis on customer experience management by businesses of all sizes is a powerful catalyst, pushing adoption of advanced communication tools that enhance customer interactions.

Key Players Shaping the Cloud Based Phone System Market

- Microsoft

- Cisco

- Mitel Networks

- RingCentral

- Verizon

- MegaPath

- Nextiva

- 3CX

- Estech Systems

- 8x8

- Sangoma

- Panasonic

- NetFortris

- TPX Communications

Notable Milestones in Cloud Based Phone System Sector

- 2019: Increased adoption of AI in call routing and virtual assistants.

- 2020: Significant surge in remote work solutions and UCaaS adoption due to global events.

- 2021: Enhanced focus on cybersecurity features and data privacy compliance.

- 2022: Integration of advanced video conferencing and collaboration tools into core platforms.

- 2023: Expansion of omnichannel customer engagement capabilities and analytics.

- 2024: Growing interest in AI-driven customer service automation and predictive analytics.

In-Depth Cloud Based Phone System Market Outlook

The future of the cloud-based phone system market is exceptionally bright, propelled by sustained digital transformation, the imperative for flexible work environments, and relentless technological innovation. The increasing sophistication of AI integration will revolutionize customer interactions, moving beyond basic automation to predictive and personalized experiences. The ongoing expansion of 5G will enhance mobile communication capabilities, further solidifying the role of cloud-based systems in ubiquitous connectivity. Strategic alliances and continued M&A activity will foster a more integrated and feature-rich market. The shift towards experience-centric business operations will ensure that advanced, reliable, and scalable cloud communication solutions remain at the forefront of business strategy, driving sustained growth and market penetration.

Cloud Based Phone System Segmentation

-

1. Application

- 1.1. SMEs

- 1.2. Large Enterprises

-

2. Type

- 2.1. Unlimited Type

- 2.2. Metered Type

Cloud Based Phone System Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cloud Based Phone System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cloud Based Phone System Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. SMEs

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Unlimited Type

- 5.2.2. Metered Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Cloud Based Phone System Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. SMEs

- 6.1.2. Large Enterprises

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Unlimited Type

- 6.2.2. Metered Type

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Cloud Based Phone System Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. SMEs

- 7.1.2. Large Enterprises

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Unlimited Type

- 7.2.2. Metered Type

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Cloud Based Phone System Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. SMEs

- 8.1.2. Large Enterprises

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Unlimited Type

- 8.2.2. Metered Type

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Cloud Based Phone System Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. SMEs

- 9.1.2. Large Enterprises

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Unlimited Type

- 9.2.2. Metered Type

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Cloud Based Phone System Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. SMEs

- 10.1.2. Large Enterprises

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Unlimited Type

- 10.2.2. Metered Type

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Microsoft

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cisco

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mitel Networks

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 RingCentral

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Verizon

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MegaPath

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nextiva

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 3CX

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Estech Systems

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 8x8

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sangoma

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Panasonic

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 NetFortris

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 TPX Communications

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Microsoft

List of Figures

- Figure 1: Global Cloud Based Phone System Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Cloud Based Phone System Revenue (million), by Application 2024 & 2032

- Figure 3: North America Cloud Based Phone System Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Cloud Based Phone System Revenue (million), by Type 2024 & 2032

- Figure 5: North America Cloud Based Phone System Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Cloud Based Phone System Revenue (million), by Country 2024 & 2032

- Figure 7: North America Cloud Based Phone System Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Cloud Based Phone System Revenue (million), by Application 2024 & 2032

- Figure 9: South America Cloud Based Phone System Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Cloud Based Phone System Revenue (million), by Type 2024 & 2032

- Figure 11: South America Cloud Based Phone System Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Cloud Based Phone System Revenue (million), by Country 2024 & 2032

- Figure 13: South America Cloud Based Phone System Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Cloud Based Phone System Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Cloud Based Phone System Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Cloud Based Phone System Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Cloud Based Phone System Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Cloud Based Phone System Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Cloud Based Phone System Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Cloud Based Phone System Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Cloud Based Phone System Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Cloud Based Phone System Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Cloud Based Phone System Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Cloud Based Phone System Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Cloud Based Phone System Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Cloud Based Phone System Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Cloud Based Phone System Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Cloud Based Phone System Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Cloud Based Phone System Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Cloud Based Phone System Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Cloud Based Phone System Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cloud Based Phone System Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Cloud Based Phone System Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Cloud Based Phone System Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Cloud Based Phone System Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Cloud Based Phone System Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Cloud Based Phone System Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Cloud Based Phone System Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Cloud Based Phone System Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Cloud Based Phone System Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Cloud Based Phone System Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Cloud Based Phone System Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Cloud Based Phone System Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Cloud Based Phone System Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Cloud Based Phone System Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Cloud Based Phone System Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Cloud Based Phone System Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Cloud Based Phone System Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Cloud Based Phone System Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Cloud Based Phone System Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Cloud Based Phone System Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cloud Based Phone System?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Cloud Based Phone System?

Key companies in the market include Microsoft, Cisco, Mitel Networks, RingCentral, Verizon, MegaPath, Nextiva, 3CX, Estech Systems, 8x8, Sangoma, Panasonic, NetFortris, TPX Communications.

3. What are the main segments of the Cloud Based Phone System?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cloud Based Phone System," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cloud Based Phone System report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cloud Based Phone System?

To stay informed about further developments, trends, and reports in the Cloud Based Phone System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence