Key Insights

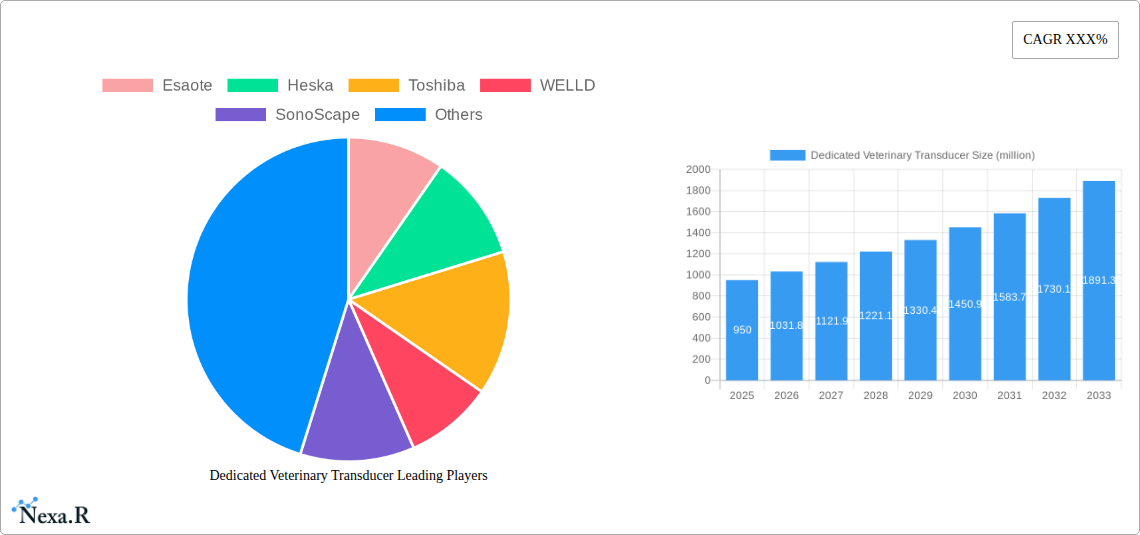

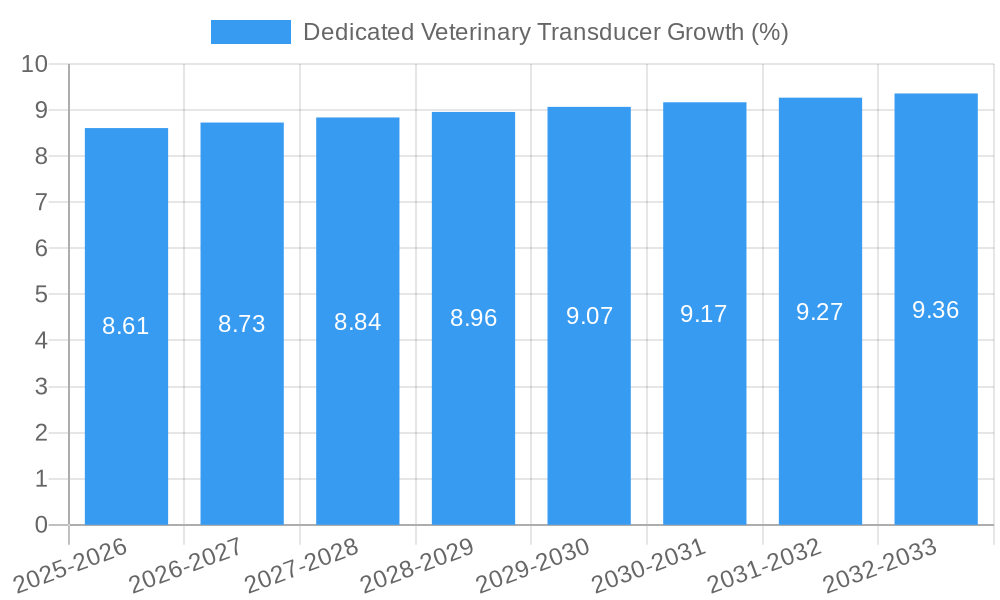

The global Dedicated Veterinary Transducer market is poised for significant expansion, projected to reach an estimated value of \$950 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.5% anticipated through 2033. This impressive growth is primarily propelled by the escalating adoption of advanced veterinary imaging technologies, driven by an increasing awareness of animal health and welfare among pet owners and livestock producers alike. The rising incidence of chronic diseases in animals, coupled with the growing demand for specialized diagnostic tools, further fuels market expansion. Furthermore, the continuous innovation in transducer technology, leading to enhanced image quality, portability, and functionality, is a key driver. The market is segmented across various animal sizes, with Giant Sized Animal applications showing strong potential due to the increasing prevalence of large breed pets and the specialized needs of equine and bovine diagnostics.

The market's trajectory is also influenced by a confluence of favorable trends. The surge in companion animal ownership globally, particularly in developed economies, is a significant contributor. This is augmented by advancements in veterinary medicine, necessitating sophisticated diagnostic equipment like dedicated veterinary transducers for accurate diagnosis and effective treatment planning. While the market enjoys substantial growth, certain restraints such as the high initial cost of advanced veterinary ultrasound equipment and the need for skilled technicians to operate these systems could pose challenges. However, the increasing availability of financing options and ongoing training initiatives are expected to mitigate these limitations. The Asia Pacific region, led by China and India, is emerging as a high-growth market due to rapid advancements in veterinary healthcare infrastructure and a burgeoning pet population.

This in-depth report provides a comprehensive analysis of the global Dedicated Veterinary Transducer market, dissecting its intricate dynamics, growth trajectories, and future potential. Covering a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this research is an indispensable resource for veterinary professionals, ultrasound manufacturers, distributors, and investors seeking to understand the evolving landscape of veterinary diagnostic imaging. The report leverages high-traffic keywords like "veterinary ultrasound probes," "animal imaging transducers," "equine ultrasound," "companion animal diagnostics," and "large animal imaging solutions" to ensure maximum search engine visibility and attract industry-specific engagement. We explore the parent market of medical imaging transducers and the child market of veterinary-specific ultrasound devices to provide a holistic view. All quantitative values are presented in million units for clarity and ease of comparison.

Dedicated Veterinary Transducer Market Dynamics & Structure

The Dedicated Veterinary Transducer market, a critical segment within the broader medical imaging transducer industry, is characterized by a moderately concentrated structure. Key players like Esaote, Heska, Toshiba, WELLD, SonoScape, and Mindray are actively engaged in technological innovation, driving advancements in image quality, portability, and specialized applications. The regulatory framework, primarily governed by veterinary medical device regulations in different regions, influences product development and market access. Competitive product substitutes, while present in the form of general-purpose transducers, are increasingly being outperformed by dedicated veterinary solutions optimized for specific animal anatomies and clinical needs. End-user demographics are diversifying, with an increasing demand from specialized veterinary clinics, research institutions, and expanding rural veterinary practices. Mergers and acquisitions (M&A) trends, while not yet at peak levels, are indicative of consolidation opportunities and strategic partnerships aimed at expanding product portfolios and market reach.

- Market Concentration: Dominated by a few key manufacturers, with strategic partnerships and distribution networks playing a crucial role.

- Technological Innovation Drivers: Focus on higher frequency probes for small animals, lower frequency and deeper penetration probes for large animals, miniaturization, and improved durability.

- Regulatory Frameworks: Adherence to FDA, EMA, and other regional veterinary device approval processes.

- Competitive Product Substitutes: General ultrasound probes, though often less efficient and precise for specific veterinary applications.

- End-User Demographics: Growing demand from companion animal practices, equine specialists, large animal veterinarians, and emerging markets.

- M&A Trends: Opportunities for vertical integration and market expansion through strategic acquisitions of smaller, innovative companies.

Dedicated Veterinary Transducer Growth Trends & Insights

The Dedicated Veterinary Transducer market is poised for robust growth, driven by a confluence of factors including escalating pet ownership, increasing expenditure on animal healthcare, and the growing recognition of ultrasound as a vital diagnostic tool in veterinary medicine. The global market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.2% from 2025 to 2033, reaching an estimated market value of $1,500 million units by 2033. Adoption rates for advanced veterinary ultrasound systems and their associated transducers are steadily increasing across developed and emerging economies. Technological disruptions, such as the development of miniaturized, wireless, and AI-enhanced transducers, are revolutionizing diagnostic capabilities and improving workflow efficiency. Consumer behavior shifts, including a greater willingness among pet owners to invest in advanced diagnostic imaging for their animals, are directly contributing to market expansion. The increasing prevalence of chronic diseases and the need for early detection and monitoring further fuel the demand for sophisticated veterinary ultrasound solutions.

The market penetration of dedicated veterinary transducers is also on an upward trajectory. Historically, from 2019 to 2024, the market experienced steady growth, with an estimated market size of $850 million units in 2024. The increasing integration of portable and handheld ultrasound devices in general veterinary practices, alongside the established presence in specialized imaging centers, highlights a broadening market reach. The demand for higher resolution imaging, enabling the detection of subtle pathological changes, is a significant driver. Furthermore, the development of specialized transducers for specific applications, such as cardiac imaging, abdominal diagnostics, and musculoskeletal assessments in animals, is enhancing the diagnostic utility and market appeal. The rising number of veterinary diagnostic imaging centers and the growing number of veterinary professionals trained in ultrasound interpretation are creating a supportive ecosystem for market expansion.

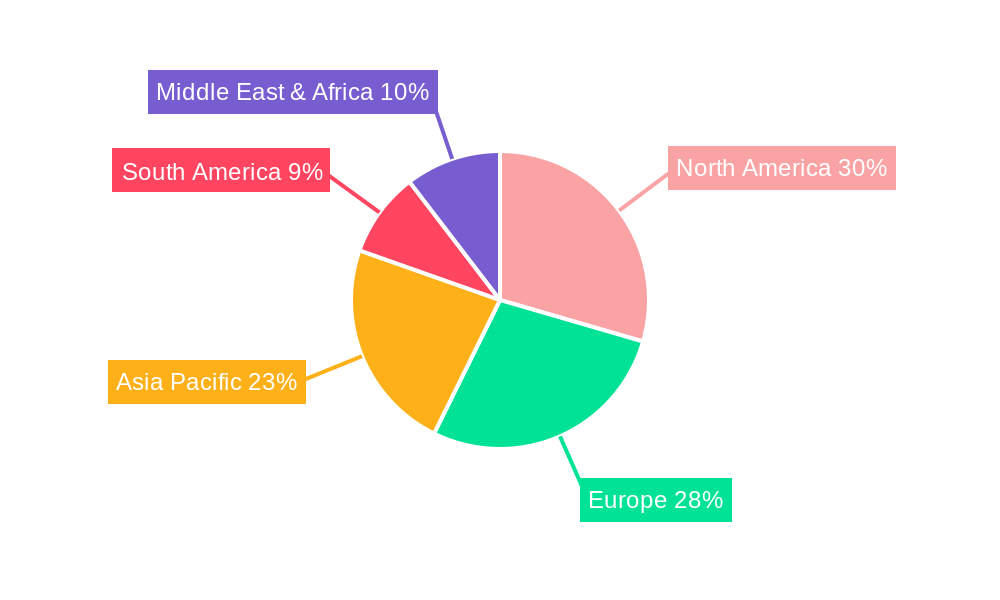

Dominant Regions, Countries, or Segments in Dedicated Veterinary Transducer

North America currently holds a dominant position in the global Dedicated Veterinary Transducer market, driven by its high per capita spending on pet healthcare, a well-established veterinary infrastructure, and a significant concentration of advanced veterinary specialty hospitals. The United States, in particular, is a key contributor, with a large population of companion animals and a strong demand for high-quality diagnostic imaging. The market segment for Medium Sized Animal applications, encompassing dogs and cats, is the largest contributor to the overall market value, estimated at $650 million units in 2025. This dominance is attributed to the vast number of companion animals, the increasing trend of pet humanization, and the continuous innovation in transducers designed for their specific anatomies.

Linear Transducers represent the most significant type segment, accounting for an estimated $500 million units in 2025. Their versatility in imaging superficial structures, such as musculoskeletal tissues, abdominal organs, and the vascular system in animals, makes them indispensable in veterinary diagnostics. The ongoing advancements in linear transducer technology, offering higher frequencies and improved resolution, further solidify their market leadership.

Key Drivers in North America:

- High disposable income and willingness to spend on pet healthcare.

- Advanced veterinary infrastructure and prevalence of specialty clinics.

- Proactive regulatory environment supporting the adoption of advanced veterinary technologies.

- Strong presence of leading market players and research institutions.

Dominance Factors in Medium Sized Animal Segment:

- Largest pet population globally.

- Increasing demand for advanced diagnostics for early disease detection and treatment.

- Ongoing development of specialized transducers optimized for canine and feline anatomy.

Dominance Factors in Linear Transducer Type:

- Broad range of applications in abdominal, musculoskeletal, and vascular imaging.

- Continuous technological advancements leading to improved image quality and diagnostic capabilities.

- Cost-effectiveness and ease of use for various veterinary procedures.

While North America leads, the Asia Pacific region is emerging as a significant growth engine, driven by increasing pet ownership, rising disposable incomes, and government initiatives promoting animal welfare. Europe also presents a substantial market, with strong demand for advanced veterinary imaging solutions and a well-regulated veterinary market.

Dedicated Veterinary Transducer Product Landscape

The dedicated veterinary transducer product landscape is characterized by continuous innovation focused on enhancing diagnostic precision and expanding clinical utility. Manufacturers are developing transducers with specialized frequency ranges, curvilinear and sector arrays optimized for specific animal anatomies, and robust designs capable of withstanding the demanding veterinary environment. Product innovations include miniaturized probes for smaller animal imaging, multi-frequency transducers for versatile use, and advanced materials for improved signal transmission and durability. Applications range from routine abdominal and cardiac imaging in companion animals to advanced orthopedic and reproductive assessments in large animals. Performance metrics such as resolution, penetration depth, and signal-to-noise ratio are continuously being improved, enabling earlier and more accurate diagnoses. Unique selling propositions often lie in the transducer's specific design for species-specific anatomy and its integration with advanced veterinary ultrasound systems.

Key Drivers, Barriers & Challenges in Dedicated Veterinary Transducer

Key Drivers:

- Growing Pet Population and Humanization: An increasing number of pet owners view their animals as family, leading to higher spending on advanced veterinary care, including diagnostic imaging.

- Technological Advancements: Development of higher frequency, higher resolution, and more portable transducers, improving diagnostic accuracy and accessibility.

- Rising Veterinary Healthcare Expenditure: Increased investment in advanced diagnostic equipment by veterinary clinics and hospitals.

- Expanding Applications: Ultrasound's utility extending beyond basic diagnostics to areas like interventional procedures, reproductive health, and anesthesiology.

- Early Disease Detection: The need for non-invasive and early diagnostic tools to manage chronic and acute conditions in animals.

Barriers & Challenges:

- Cost of Advanced Technology: High initial investment for sophisticated veterinary ultrasound systems and transducers can be a barrier for smaller practices.

- Regulatory Hurdles: Navigating complex and varying regulatory approvals for veterinary medical devices across different regions.

- Limited Awareness and Training: In some emerging markets, a lack of awareness about the benefits of advanced ultrasound and insufficient training for veterinary professionals can hinder adoption.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and pricing of critical components for transducer manufacturing.

- Competition from General Imaging: While dedicated transducers offer advantages, competition from more general-purpose ultrasound equipment exists, especially in cost-sensitive markets.

Emerging Opportunities in Dedicated Veterinary Transducer

Emerging opportunities in the Dedicated Veterinary Transducer market lie in the development of AI-integrated transducers that offer automated image optimization and diagnostic assistance, significantly improving efficiency and accuracy. The untapped potential in emerging economies, with their rapidly growing pet populations and increasing healthcare spending, presents a significant growth avenue. Furthermore, the development of specialized transducers for exotic animals and wildlife research offers niche market opportunities. The evolution of point-of-care ultrasound (POCUS) in veterinary medicine, driven by the demand for rapid, on-site diagnostics, is creating a market for highly portable and user-friendly transducer solutions. Innovations in contrast-enhanced ultrasound for veterinary applications are also poised to unlock new diagnostic capabilities.

Growth Accelerators in the Dedicated Veterinary Transducer Industry

Catalysts driving long-term growth in the Dedicated Veterinary Transducer industry include breakthroughs in materials science leading to more durable and high-performance transducers, alongside advancements in miniaturization allowing for more portable and handheld devices. Strategic partnerships between transducer manufacturers and veterinary ultrasound system developers will streamline product integration and accelerate market adoption. Market expansion strategies, particularly focusing on underserved regions and expanding the application scope of veterinary ultrasound, will be critical. The increasing emphasis on preventative healthcare for animals, driven by owner awareness, will further propel the demand for early and accurate diagnostic tools, directly benefiting the transducer market.

Key Players Shaping the Dedicated Veterinary Transducer Market

- Esaote

- Heska

- Toshiba

- WELLD

- SonoScape

- Mindray

Notable Milestones in Dedicated Veterinary Transducer Sector

- 2019: Introduction of higher frequency linear transducers for enhanced small animal musculoskeletal imaging.

- 2020: Development of more robust and sterilizable transducer covers for improved infection control in veterinary surgical settings.

- 2021: Launch of AI-powered image optimization software integrated with new veterinary transducer lines.

- 2022: Increased adoption of wireless transducers for improved portability and reduced cable management complexities.

- 2023: Focus on developing specialized probes for equine reproductive diagnostics and large animal cardiology.

- 2024: Emergence of advanced phased array transducers offering wider field of view for abdominal imaging in larger animals.

In-Depth Dedicated Veterinary Transducer Market Outlook

- 2019: Introduction of higher frequency linear transducers for enhanced small animal musculoskeletal imaging.

- 2020: Development of more robust and sterilizable transducer covers for improved infection control in veterinary surgical settings.

- 2021: Launch of AI-powered image optimization software integrated with new veterinary transducer lines.

- 2022: Increased adoption of wireless transducers for improved portability and reduced cable management complexities.

- 2023: Focus on developing specialized probes for equine reproductive diagnostics and large animal cardiology.

- 2024: Emergence of advanced phased array transducers offering wider field of view for abdominal imaging in larger animals.

In-Depth Dedicated Veterinary Transducer Market Outlook

The future outlook for the Dedicated Veterinary Transducer market is exceptionally promising, fueled by ongoing technological innovations and a steadily expanding customer base. The convergence of artificial intelligence, advanced materials, and miniaturization is set to redefine diagnostic capabilities, making veterinary ultrasound more accessible, accurate, and efficient. Strategic collaborations, expanding into emerging markets, and a continued focus on species-specific applications will be key growth accelerators. The increasing emphasis on animal welfare and preventative healthcare worldwide will solidify the indispensable role of high-quality veterinary diagnostic imaging, ensuring sustained market expansion and innovation in the years to come.

Dedicated Veterinary Transducer Segmentation

-

1. Application

- 1.1. Giant Sized Animal

- 1.2. Medium Sized Animal

- 1.3. Small Sized Animal

-

2. Type

- 2.1. Convex Transducers

- 2.2. Linear Transducers

- 2.3. Phased Transducers

- 2.4. Other

Dedicated Veterinary Transducer Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Dedicated Veterinary Transducer REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dedicated Veterinary Transducer Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Giant Sized Animal

- 5.1.2. Medium Sized Animal

- 5.1.3. Small Sized Animal

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Convex Transducers

- 5.2.2. Linear Transducers

- 5.2.3. Phased Transducers

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Dedicated Veterinary Transducer Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Giant Sized Animal

- 6.1.2. Medium Sized Animal

- 6.1.3. Small Sized Animal

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Convex Transducers

- 6.2.2. Linear Transducers

- 6.2.3. Phased Transducers

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Dedicated Veterinary Transducer Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Giant Sized Animal

- 7.1.2. Medium Sized Animal

- 7.1.3. Small Sized Animal

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Convex Transducers

- 7.2.2. Linear Transducers

- 7.2.3. Phased Transducers

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Dedicated Veterinary Transducer Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Giant Sized Animal

- 8.1.2. Medium Sized Animal

- 8.1.3. Small Sized Animal

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Convex Transducers

- 8.2.2. Linear Transducers

- 8.2.3. Phased Transducers

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Dedicated Veterinary Transducer Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Giant Sized Animal

- 9.1.2. Medium Sized Animal

- 9.1.3. Small Sized Animal

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Convex Transducers

- 9.2.2. Linear Transducers

- 9.2.3. Phased Transducers

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Dedicated Veterinary Transducer Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Giant Sized Animal

- 10.1.2. Medium Sized Animal

- 10.1.3. Small Sized Animal

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Convex Transducers

- 10.2.2. Linear Transducers

- 10.2.3. Phased Transducers

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Esaote

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Heska

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Toshiba

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 WELLD

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SonoScape

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mindray

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Esaote

List of Figures

- Figure 1: Global Dedicated Veterinary Transducer Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Dedicated Veterinary Transducer Revenue (million), by Application 2024 & 2032

- Figure 3: North America Dedicated Veterinary Transducer Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Dedicated Veterinary Transducer Revenue (million), by Type 2024 & 2032

- Figure 5: North America Dedicated Veterinary Transducer Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Dedicated Veterinary Transducer Revenue (million), by Country 2024 & 2032

- Figure 7: North America Dedicated Veterinary Transducer Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Dedicated Veterinary Transducer Revenue (million), by Application 2024 & 2032

- Figure 9: South America Dedicated Veterinary Transducer Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Dedicated Veterinary Transducer Revenue (million), by Type 2024 & 2032

- Figure 11: South America Dedicated Veterinary Transducer Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Dedicated Veterinary Transducer Revenue (million), by Country 2024 & 2032

- Figure 13: South America Dedicated Veterinary Transducer Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Dedicated Veterinary Transducer Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Dedicated Veterinary Transducer Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Dedicated Veterinary Transducer Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Dedicated Veterinary Transducer Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Dedicated Veterinary Transducer Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Dedicated Veterinary Transducer Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Dedicated Veterinary Transducer Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Dedicated Veterinary Transducer Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Dedicated Veterinary Transducer Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Dedicated Veterinary Transducer Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Dedicated Veterinary Transducer Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Dedicated Veterinary Transducer Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Dedicated Veterinary Transducer Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Dedicated Veterinary Transducer Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Dedicated Veterinary Transducer Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Dedicated Veterinary Transducer Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Dedicated Veterinary Transducer Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Dedicated Veterinary Transducer Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Dedicated Veterinary Transducer Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Dedicated Veterinary Transducer Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Dedicated Veterinary Transducer Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Dedicated Veterinary Transducer Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Dedicated Veterinary Transducer Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Dedicated Veterinary Transducer Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Dedicated Veterinary Transducer Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Dedicated Veterinary Transducer Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Dedicated Veterinary Transducer Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Dedicated Veterinary Transducer Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Dedicated Veterinary Transducer Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Dedicated Veterinary Transducer Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Dedicated Veterinary Transducer Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Dedicated Veterinary Transducer Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Dedicated Veterinary Transducer Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Dedicated Veterinary Transducer Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Dedicated Veterinary Transducer Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Dedicated Veterinary Transducer Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Dedicated Veterinary Transducer Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Dedicated Veterinary Transducer Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dedicated Veterinary Transducer?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Dedicated Veterinary Transducer?

Key companies in the market include Esaote, Heska, Toshiba, WELLD, SonoScape, Mindray.

3. What are the main segments of the Dedicated Veterinary Transducer?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dedicated Veterinary Transducer," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dedicated Veterinary Transducer report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dedicated Veterinary Transducer?

To stay informed about further developments, trends, and reports in the Dedicated Veterinary Transducer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence