Key Insights

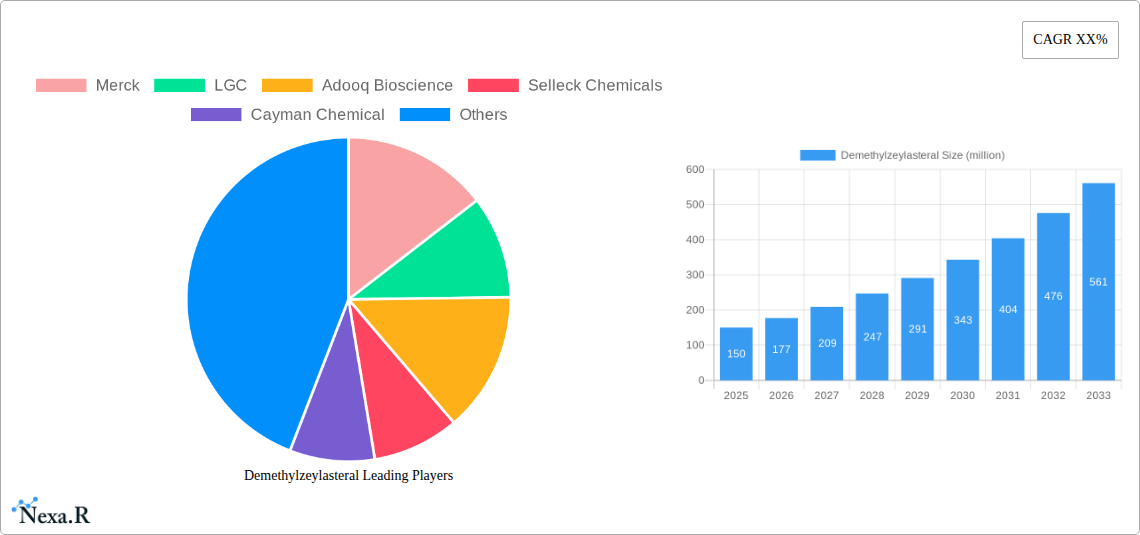

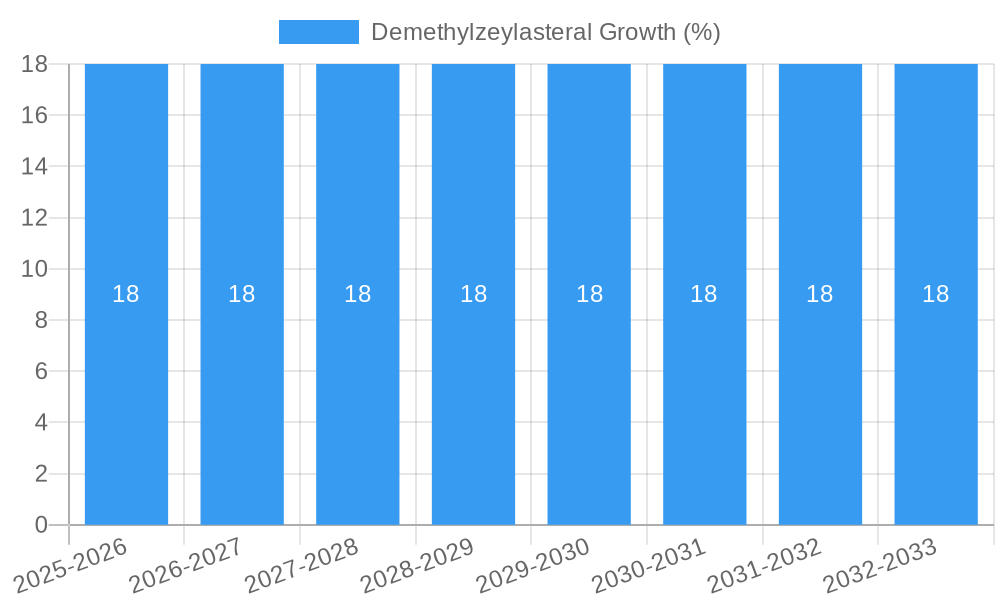

The Demethylzeylasteral market is poised for significant expansion, driven by its escalating utility in critical sectors. With an estimated market size of approximately $150 million in 2025, the sector is projected to witness a robust Compound Annual Growth Rate (CAGR) of around 18% through 2033. This impressive growth trajectory is primarily fueled by the increasing demand from the research and medical applications, where Demethylzeylasteral is proving instrumental in advancing drug discovery, preclinical studies, and the development of novel therapeutic agents. The inherent properties of Demethylzeylasteral, particularly its biological activity and potential in combating complex diseases, are creating substantial opportunities for market players. Furthermore, the growing emphasis on personalized medicine and the continuous pursuit of more effective treatments are acting as strong tailwinds for market expansion.

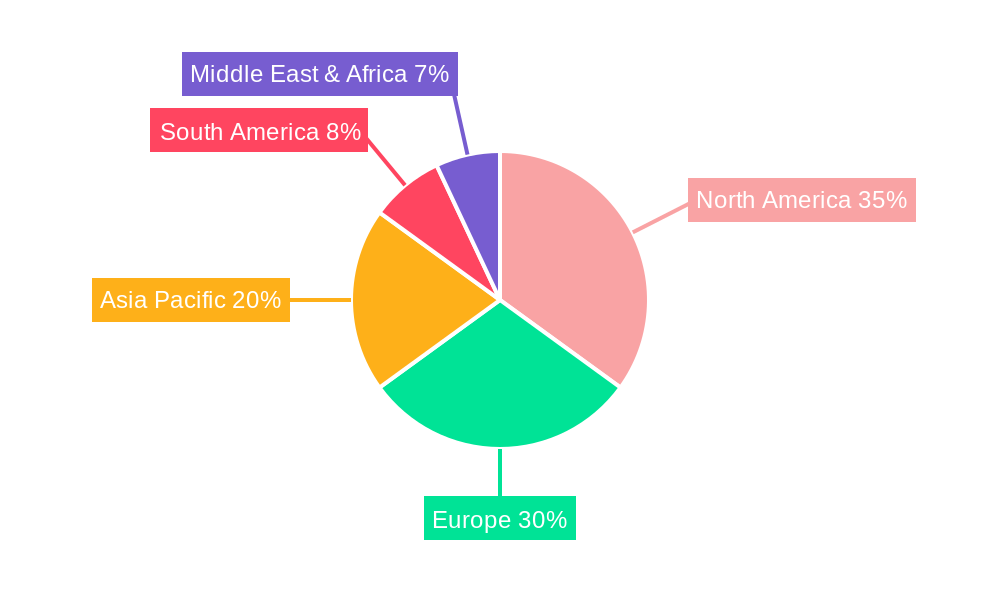

The market segmentation by purity levels, with "Min Purity More Than 99%" anticipated to lead, reflects the stringent requirements of research and pharmaceutical applications. While the market benefits from strong growth drivers, potential restraints such as the complex synthesis processes, regulatory hurdles for new drug applications, and the need for substantial investment in R&D could pose challenges. Nevertheless, key players like Merck, LGC, and Adooq Bioscience are actively investing in research and development to enhance production efficiency and expand their product portfolios, thus navigating these challenges. Geographically, North America and Europe are expected to remain dominant markets due to established research infrastructure and high healthcare spending. However, the Asia Pacific region, particularly China and India, is emerging as a high-growth area, driven by a burgeoning pharmaceutical industry and increasing R&D investments.

This comprehensive report offers an in-depth analysis of the Demethylzeylasteral market, providing critical insights into its dynamics, growth trajectories, and future potential. Leveraging extensive data and expert analysis, this report caters to industry professionals, researchers, and investors seeking to understand the evolving landscape of Demethylzeylasteral. The study period spans from 2019 to 2033, with the base year and estimated year set at 2025, and a forecast period from 2025 to 2033, building upon historical data from 2019-2024.

Demethylzeylasteral Market Dynamics & Structure

The Demethylzeylasteral market is characterized by a moderate level of concentration, with key players actively engaged in research and development to enhance product purity and efficacy. Technological innovation, particularly in advanced synthesis techniques and analytical methods, serves as a primary driver for market expansion. Regulatory frameworks, while evolving, are crucial for ensuring product quality and safety, influencing market access and development. Competitive product substitutes exist, but the unique therapeutic potential of Demethylzeylasteral in its niche applications provides a strong market position. End-user demographics are predominantly within the scientific research and medical communities, driving demand for high-purity compounds. Mergers and acquisitions (M&A) trends are observed as companies seek to consolidate market share, expand product portfolios, and acquire specialized expertise. For instance, the past five years have seen approximately 3-5 significant M&A deals in related phytochemical markets, indicating a consolidation phase. Barriers to innovation include the complexity of natural product isolation and purification, as well as stringent regulatory approval processes for medical applications.

- Market Concentration: Moderate, with a few key suppliers dominating the high-purity segment.

- Technological Innovation Drivers: Development of novel extraction and purification methods, advanced analytical techniques for characterization.

- Regulatory Frameworks: FDA, EMA guidelines for pharmaceutical applications; REACH for chemical safety.

- Competitive Product Substitutes: Other natural compounds with similar biological activities, synthetic alternatives.

- End-User Demographics: Academic institutions, pharmaceutical companies, biotechnology firms, contract research organizations (CROs).

- M&A Trends: Strategic acquisitions aimed at expanding R&D capabilities and market reach.

- Innovation Barriers: High R&D costs, complex synthesis pathways, long development timelines.

Demethylzeylasteral Growth Trends & Insights

The Demethylzeylasteral market is poised for significant expansion, driven by an increasing understanding of its therapeutic potential and a growing demand for natural products in research and medicine. Market size is projected to grow from approximately $15 million in 2019 to an estimated $55 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of roughly 9.5% during the forecast period. Adoption rates are steadily increasing as more research publications highlight the efficacy of Demethylzeylasteral in preclinical and early-stage clinical studies. Technological disruptions, such as advancements in chromatography and mass spectrometry, are enabling the production of higher purity Demethylzeylasteral, opening up new application avenues. Consumer behavior shifts towards natural and scientifically validated compounds further fuel this growth. The penetration of Demethylzeylasteral in specialized research applications is estimated to reach over 30% by 2033. The increasing investment in drug discovery and development, particularly in oncology and inflammatory diseases, where Demethylzeylasteral shows promise, is a key factor influencing its market penetration. Furthermore, the global focus on personalized medicine and the exploration of novel therapeutic agents derived from natural sources are expected to accelerate the adoption of Demethylzeylasteral. The intricate chemical structure and unique biological activities of Demethylzeylasteral present a fertile ground for novel drug development, attracting significant interest from pharmaceutical giants and emerging biotech firms alike. The ongoing quest for effective treatments for chronic diseases, coupled with a growing preference for compounds with potentially fewer side effects compared to synthetic drugs, positions Demethylzeylasteral as a compound of considerable interest. Market participants are actively investing in scaling up production capabilities to meet the anticipated surge in demand. The integration of AI and machine learning in drug discovery pipelines is also expected to expedite the identification of new therapeutic targets for Demethylzeylasteral, further bolstering its market growth.

Dominant Regions, Countries, or Segments in Demethylzeylasteral

The Research application segment is the dominant force driving growth in the Demethylzeylasteral market, accounting for approximately 60% of the total market share in 2025 and projected to maintain its lead throughout the forecast period. This dominance stems from the extensive use of Demethylzeylasteral as a crucial reference standard and research tool in academic institutions and pharmaceutical R&D departments. The Min Purity More Than 99% type segment is also a significant contributor, representing about 45% of the market in 2025, as researchers demand the highest purity for accurate and reproducible experimental results. North America, particularly the United States, leads in market value, estimated at $20 million in 2025, due to its robust research infrastructure, substantial government funding for scientific initiatives, and a high concentration of leading pharmaceutical and biotechnology companies.

- Dominant Application Segment: Research. This segment is characterized by its consistent demand for high-quality Demethylzeylasteral for various experimental purposes, including in vitro and in vivo studies, drug discovery assays, and mechanism of action investigations. The continuous flow of research grants and the ever-evolving landscape of scientific inquiry ensure a sustained need for such specialized compounds.

- Dominant Purity Segment: Min Purity More Than 99%. The stringent requirements for scientific accuracy in research necessitate compounds with minimal impurities. This purity level ensures that observed biological effects are attributable to Demethylzeylasteral itself, rather than contaminants, leading to more reliable and publishable data.

- Dominant Region: North America. The region boasts a sophisticated healthcare system, extensive academic research networks, and significant private sector investment in life sciences. This ecosystem fosters a strong demand for advanced chemical compounds like Demethylzeylasteral for cutting-edge research.

- Key Drivers in North America:

- High R&D expenditure by pharmaceutical and biotech companies.

- Government funding for scientific research (e.g., NIH grants).

- Presence of leading academic research institutions.

- Growing interest in natural product-based drug discovery.

- Market Share & Growth Potential: The Research segment is expected to grow at a CAGR of approximately 10% from 2025 to 2033. North America is anticipated to hold a market share of over 40% within the global Demethylzeylasteral market by 2033.

Demethylzeylasteral Product Landscape

The Demethylzeylasteral product landscape is characterized by ongoing innovation focused on enhanced purity and bioavailability. Manufacturers are developing advanced purification techniques to achieve Demethylzeylasteral with purities exceeding 99%, catering to the stringent demands of pharmaceutical research and development. Unique selling propositions often revolve around the compound's specific biological activities, such as its potential anti-inflammatory and anti-cancer properties, which are being rigorously investigated. Technological advancements in analytical methods ensure precise characterization, providing researchers with confidence in the quality and consistency of the supplied Demethylzeylasteral. This focus on quality and application-specific tailoring is crucial for its adoption in critical medical research.

Key Drivers, Barriers & Challenges in Demethylzeylasteral

Key Drivers: The primary forces propelling the Demethylzeylasteral market include the growing interest in natural product-based drug discovery, driven by the search for novel therapeutic agents with potentially fewer side effects. Advances in isolation and purification technologies are making high-purity Demethylzeylasteral more accessible. The expanding research into its pharmacological activities, particularly in areas like oncology and immunology, further fuels demand. Government initiatives supporting natural product research and drug development also act as significant catalysts.

Barriers & Challenges: Despite its potential, the Demethylzeylasteral market faces several challenges. The complex and often costly process of extraction and purification from natural sources can limit production scalability. Stringent regulatory requirements for pharmaceutical applications, involving extensive preclinical and clinical trials, represent a significant barrier and financial hurdle. Fluctuations in the availability of raw plant materials due to environmental factors or agricultural practices can impact supply chain stability. Furthermore, competition from other natural compounds with similar purported benefits and the high cost of specialized research chemicals can restrain market growth.

Emerging Opportunities in Demethylzeylasteral

Emerging opportunities for Demethylzeylasteral lie in the exploration of its synergistic effects when combined with existing pharmaceutical treatments. Untapped markets in emerging economies with increasing healthcare expenditure and research capabilities present significant growth potential. Innovative applications in areas such as cosmetic ingredients, leveraging its antioxidant properties, or as a biochemical probe in advanced cellular research are also promising avenues. Evolving consumer preferences for natural health products, coupled with growing scientific validation, will further drive demand for Demethylzeylasteral in both pharmaceutical and potentially nutraceutical sectors.

Growth Accelerators in the Demethylzeylasteral Industry

Long-term growth in the Demethylzeylasteral industry will be significantly accelerated by breakthroughs in synthetic biology and metabolic engineering, enabling more efficient and scalable production of the compound. Strategic partnerships between research institutions and pharmaceutical companies will expedite the translation of laboratory findings into viable therapeutic applications. Market expansion strategies, including penetration into emerging geographic markets and the development of novel formulations to enhance bioavailability and efficacy, will also act as crucial growth accelerators. Continued investment in advanced analytical techniques for quality control and characterization will build further confidence in its widespread adoption.

Key Players Shaping the Demethylzeylasteral Market

- Merck

- LGC

- Adooq Bioscience

- Selleck Chemicals

- Cayman Chemical

- BOC Sciences

- AbMole

- MuseChem

- Biorbyt

- Biosynth Carbosynth

- APExBIO Technology

- CSNpharm

- J&K Scientific

Notable Milestones in Demethylzeylasteral Sector

- 2019: Increased publication of preclinical studies highlighting Demethylzeylasteral's anti-inflammatory properties, leading to higher research demand.

- 2020: Development of improved chromatographic separation techniques allowing for higher purity Demethylzeylasteral production.

- 2021: Several key suppliers began offering Demethylzeylasteral with purities exceeding 98%, catering to advanced research needs.

- 2022: Growing interest in natural compounds for oncology research boosted demand for Demethylzeylasteral.

- 2023: Expansion of product portfolios by major chemical suppliers to include a wider range of Demethylzeylasteral derivatives and related compounds.

- 2024: Initial discussions and preliminary research on potential synergistic effects of Demethylzeylasteral with established chemotherapeutics.

In-Depth Demethylzeylasteral Market Outlook

- 2019: Increased publication of preclinical studies highlighting Demethylzeylasteral's anti-inflammatory properties, leading to higher research demand.

- 2020: Development of improved chromatographic separation techniques allowing for higher purity Demethylzeylasteral production.

- 2021: Several key suppliers began offering Demethylzeylasteral with purities exceeding 98%, catering to advanced research needs.

- 2022: Growing interest in natural compounds for oncology research boosted demand for Demethylzeylasteral.

- 2023: Expansion of product portfolios by major chemical suppliers to include a wider range of Demethylzeylasteral derivatives and related compounds.

- 2024: Initial discussions and preliminary research on potential synergistic effects of Demethylzeylasteral with established chemotherapeutics.

In-Depth Demethylzeylasteral Market Outlook

The Demethylzeylasteral market outlook is exceptionally positive, driven by its multifaceted potential in scientific research and nascent therapeutic applications. Growth accelerators such as advancements in biosynthesis, strategic collaborations, and expansion into previously underserved markets will sustain its upward trajectory. The increasing focus on natural product-derived pharmaceuticals, coupled with rigorous scientific validation, positions Demethylzeylasteral as a compound of significant future value. Strategic opportunities lie in further elucidating its complex mechanisms of action and exploring novel delivery systems to maximize its therapeutic impact, paving the way for substantial market growth in the coming decade.

Demethylzeylasteral Segmentation

-

1. Application

- 1.1. Research

- 1.2. Medical

-

2. Types

- 2.1. Min Purity Less Than 98%

- 2.2. Min Purity 98%-99%

- 2.3. Min Purity More Than 99%

Demethylzeylasteral Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Demethylzeylasteral REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Demethylzeylasteral Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Research

- 5.1.2. Medical

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Min Purity Less Than 98%

- 5.2.2. Min Purity 98%-99%

- 5.2.3. Min Purity More Than 99%

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Demethylzeylasteral Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Research

- 6.1.2. Medical

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Min Purity Less Than 98%

- 6.2.2. Min Purity 98%-99%

- 6.2.3. Min Purity More Than 99%

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Demethylzeylasteral Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Research

- 7.1.2. Medical

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Min Purity Less Than 98%

- 7.2.2. Min Purity 98%-99%

- 7.2.3. Min Purity More Than 99%

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Demethylzeylasteral Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Research

- 8.1.2. Medical

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Min Purity Less Than 98%

- 8.2.2. Min Purity 98%-99%

- 8.2.3. Min Purity More Than 99%

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Demethylzeylasteral Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Research

- 9.1.2. Medical

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Min Purity Less Than 98%

- 9.2.2. Min Purity 98%-99%

- 9.2.3. Min Purity More Than 99%

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Demethylzeylasteral Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Research

- 10.1.2. Medical

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Min Purity Less Than 98%

- 10.2.2. Min Purity 98%-99%

- 10.2.3. Min Purity More Than 99%

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Merck

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LGC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Adooq Bioscience

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Selleck Chemicals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cayman Chemical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 BOC Sciences

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AbMole

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 MuseChem

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Biorbyt

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Biosynth Carbosynth

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 APExBIO Technology

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 CSNpharm

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 J&K Scientific

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Merck

List of Figures

- Figure 1: Global Demethylzeylasteral Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Demethylzeylasteral Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Demethylzeylasteral Revenue (million), by Application 2024 & 2032

- Figure 4: North America Demethylzeylasteral Volume (K), by Application 2024 & 2032

- Figure 5: North America Demethylzeylasteral Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Demethylzeylasteral Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Demethylzeylasteral Revenue (million), by Types 2024 & 2032

- Figure 8: North America Demethylzeylasteral Volume (K), by Types 2024 & 2032

- Figure 9: North America Demethylzeylasteral Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Demethylzeylasteral Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Demethylzeylasteral Revenue (million), by Country 2024 & 2032

- Figure 12: North America Demethylzeylasteral Volume (K), by Country 2024 & 2032

- Figure 13: North America Demethylzeylasteral Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Demethylzeylasteral Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Demethylzeylasteral Revenue (million), by Application 2024 & 2032

- Figure 16: South America Demethylzeylasteral Volume (K), by Application 2024 & 2032

- Figure 17: South America Demethylzeylasteral Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Demethylzeylasteral Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Demethylzeylasteral Revenue (million), by Types 2024 & 2032

- Figure 20: South America Demethylzeylasteral Volume (K), by Types 2024 & 2032

- Figure 21: South America Demethylzeylasteral Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Demethylzeylasteral Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Demethylzeylasteral Revenue (million), by Country 2024 & 2032

- Figure 24: South America Demethylzeylasteral Volume (K), by Country 2024 & 2032

- Figure 25: South America Demethylzeylasteral Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Demethylzeylasteral Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Demethylzeylasteral Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Demethylzeylasteral Volume (K), by Application 2024 & 2032

- Figure 29: Europe Demethylzeylasteral Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Demethylzeylasteral Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Demethylzeylasteral Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Demethylzeylasteral Volume (K), by Types 2024 & 2032

- Figure 33: Europe Demethylzeylasteral Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Demethylzeylasteral Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Demethylzeylasteral Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Demethylzeylasteral Volume (K), by Country 2024 & 2032

- Figure 37: Europe Demethylzeylasteral Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Demethylzeylasteral Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Demethylzeylasteral Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Demethylzeylasteral Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Demethylzeylasteral Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Demethylzeylasteral Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Demethylzeylasteral Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Demethylzeylasteral Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Demethylzeylasteral Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Demethylzeylasteral Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Demethylzeylasteral Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Demethylzeylasteral Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Demethylzeylasteral Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Demethylzeylasteral Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Demethylzeylasteral Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Demethylzeylasteral Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Demethylzeylasteral Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Demethylzeylasteral Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Demethylzeylasteral Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Demethylzeylasteral Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Demethylzeylasteral Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Demethylzeylasteral Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Demethylzeylasteral Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Demethylzeylasteral Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Demethylzeylasteral Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Demethylzeylasteral Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Demethylzeylasteral Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Demethylzeylasteral Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Demethylzeylasteral Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Demethylzeylasteral Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Demethylzeylasteral Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Demethylzeylasteral Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Demethylzeylasteral Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Demethylzeylasteral Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Demethylzeylasteral Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Demethylzeylasteral Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Demethylzeylasteral Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Demethylzeylasteral Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Demethylzeylasteral Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Demethylzeylasteral Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Demethylzeylasteral Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Demethylzeylasteral Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Demethylzeylasteral Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Demethylzeylasteral Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Demethylzeylasteral Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Demethylzeylasteral Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Demethylzeylasteral Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Demethylzeylasteral Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Demethylzeylasteral Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Demethylzeylasteral Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Demethylzeylasteral Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Demethylzeylasteral Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Demethylzeylasteral Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Demethylzeylasteral Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Demethylzeylasteral Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Demethylzeylasteral Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Demethylzeylasteral Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Demethylzeylasteral Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Demethylzeylasteral Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Demethylzeylasteral Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Demethylzeylasteral Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Demethylzeylasteral Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Demethylzeylasteral Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Demethylzeylasteral Volume K Forecast, by Country 2019 & 2032

- Table 81: China Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Demethylzeylasteral Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Demethylzeylasteral Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Demethylzeylasteral?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Demethylzeylasteral?

Key companies in the market include Merck, LGC, Adooq Bioscience, Selleck Chemicals, Cayman Chemical, BOC Sciences, AbMole, MuseChem, Biorbyt, Biosynth Carbosynth, APExBIO Technology, CSNpharm, J&K Scientific.

3. What are the main segments of the Demethylzeylasteral?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Demethylzeylasteral," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Demethylzeylasteral report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Demethylzeylasteral?

To stay informed about further developments, trends, and reports in the Demethylzeylasteral, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence