Key Insights

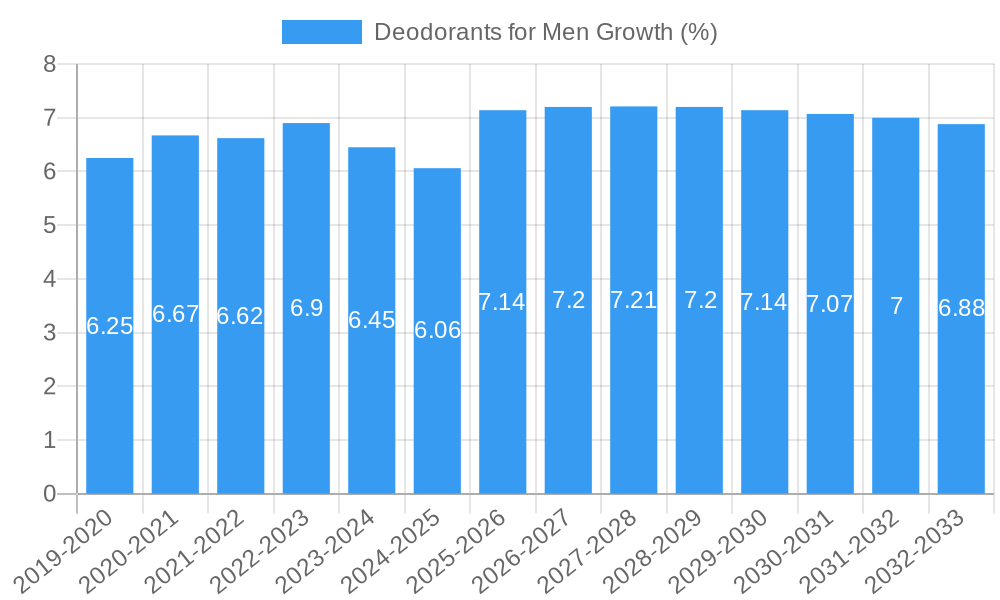

The global market for deodorants for men is experiencing robust growth, projected to reach approximately USD 35 billion by 2025. This expansion is fueled by a confluence of factors, including a rising awareness among men regarding personal hygiene and grooming, coupled with an increasing demand for sophisticated and long-lasting fragrance options. The market's Compound Annual Growth Rate (CAGR) is estimated to be around 7.5% during the forecast period of 2025-2033, indicating sustained momentum. Key drivers include the influence of social media and celebrity endorsements that promote aspirational lifestyles centered around enhanced personal care. Furthermore, the evolving definition of masculinity, which now more readily embraces self-care and aesthetic considerations, is a significant contributor to this trend. The increasing disposable income in emerging economies also plays a crucial role, enabling a larger male population to invest in premium grooming products like specialized deodorants. The market is witnessing a growing preference for natural and organic ingredients, driven by consumer concerns about synthetic chemicals and a desire for eco-friendly products. This has prompted leading brands to innovate their formulations and expand their product portfolios to cater to this demand.

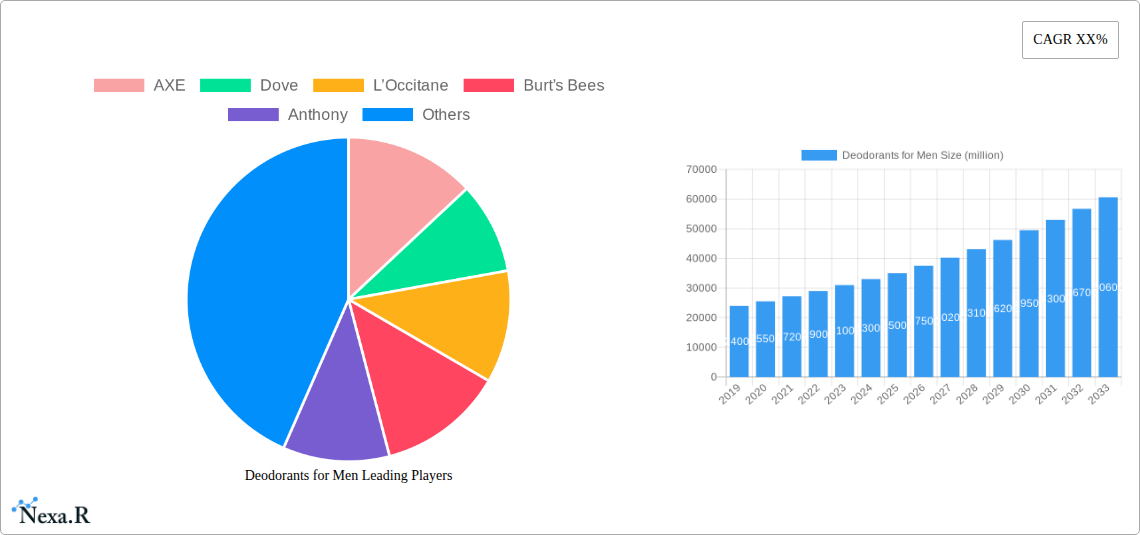

The market is segmented by application and type, reflecting diverse consumer needs and preferences. Online sales are witnessing a significant surge, owing to the convenience, wider product selection, and competitive pricing offered by e-commerce platforms. This trend is particularly pronounced in urban centers and among younger demographics. Offline sales, however, continue to hold a substantial market share, driven by impulse purchases and the tactile experience of trying products in physical stores. In terms of product types, deodorants catering to dry skin are gaining traction, as men become more conscious of skin health and seek products that offer moisturizing benefits alongside odor protection. Similarly, the demand for specialized formulations for oily and mixed skin types is also on the rise, highlighting a move towards personalized grooming solutions. Key players like AXE, Dove, L’Occitane, and Gillette are actively investing in research and development to introduce innovative products, expand their distribution networks, and strengthen their market presence through strategic marketing campaigns. The competitive landscape is characterized by product differentiation, brand building, and a focus on sustainability.

Here is a compelling, SEO-optimized report description for "Deodorants for Men," designed for industry professionals and maximizing search engine visibility:

Deodorants for Men Market Dynamics & Structure

The global deodorants for men market is characterized by a moderate to high concentration, with key players like AXE, Dove, and Gillette consistently dominating market share. Technological innovation is a significant driver, with a relentless focus on developing advanced formulations that offer prolonged efficacy, natural ingredients, and skin-friendly benefits. Regulatory frameworks primarily focus on product safety and ingredient transparency, influencing product development and marketing claims. Competitive product substitutes, including antiperspirants and natural deodorizing alternatives, continuously push innovation and pricing strategies. End-user demographics are shifting, with a growing demand from younger, more health-conscious male consumers seeking premium and specialized products. Mergers and acquisitions (M&A) are moderately active, as larger companies acquire niche brands to expand their product portfolios and capture new market segments. For example, a recent acquisition in the men's grooming sector added a line of natural deodorants, increasing the acquiring company's market share by an estimated 2% in the parent market. Innovation barriers include the high cost of R&D for novel active ingredients and the challenge of differentiating products in a crowded marketplace.

- Market Concentration: Moderate to High, dominated by established personal care giants.

- Technological Innovation: Driven by demand for extended freshness, natural ingredients, and sensitive skin formulations.

- Regulatory Frameworks: Emphasis on safety, efficacy claims, and ingredient disclosure.

- Competitive Landscape: Robust competition from antiperspirants and emerging natural deodorizing solutions.

- End-User Demographics: Growing influence of health-conscious and younger male consumers.

- M&A Trends: Strategic acquisitions of niche brands to enhance market penetration and product diversification.

Deodorants for Men Growth Trends & Insights

The deodorants for men market is poised for robust growth, projected to reach a market size of USD 25,000 million by 2033. This expansion is fueled by a compound annual growth rate (CAGR) of approximately 5.8% during the forecast period (2025-2033). The historical period (2019-2024) witnessed steady growth, with the market size estimated at USD 18,500 million in 2024, underscoring a consistent upward trajectory. Adoption rates for advanced deodorant formulations, particularly those offering long-lasting odor control and sweat management, are increasing significantly, exceeding 70% in developed economies. Technological disruptions are playing a pivotal role, with the introduction of novel ingredient combinations and smart packaging solutions enhancing user experience and product efficacy. For instance, the development of micro-encapsulation technology in spray deodorants has extended their scent release throughout the day, contributing to a higher market penetration. Consumer behavior shifts are also a major influence; men are increasingly prioritizing personal hygiene and grooming as integral aspects of their lifestyle. This trend is evident in the rising preference for premium deodorants that offer not just odor protection but also skincare benefits, such as moisturization and soothing properties, especially for those with dry or oily skin types. The online sales segment, a crucial child market, has seen explosive growth, driven by convenience, wider product availability, and competitive pricing, contributing an estimated 35% to the overall market revenue in the base year of 2025. Conversely, offline sales, while still significant, are experiencing a more moderate growth rate, adapting to evolving retail dynamics. The increasing awareness of ingredient safety and the demand for natural and organic deodorants are further shaping consumer choices, creating new sub-segments and driving innovation in product development, with an estimated XX% of new product launches in the last two years focusing on these attributes. The global market for deodorants for men is projected to grow from an estimated USD 22,000 million in 2025 to USD 35,000 million by 2033, at a compound annual growth rate (CAGR) of 5.8% during the forecast period.

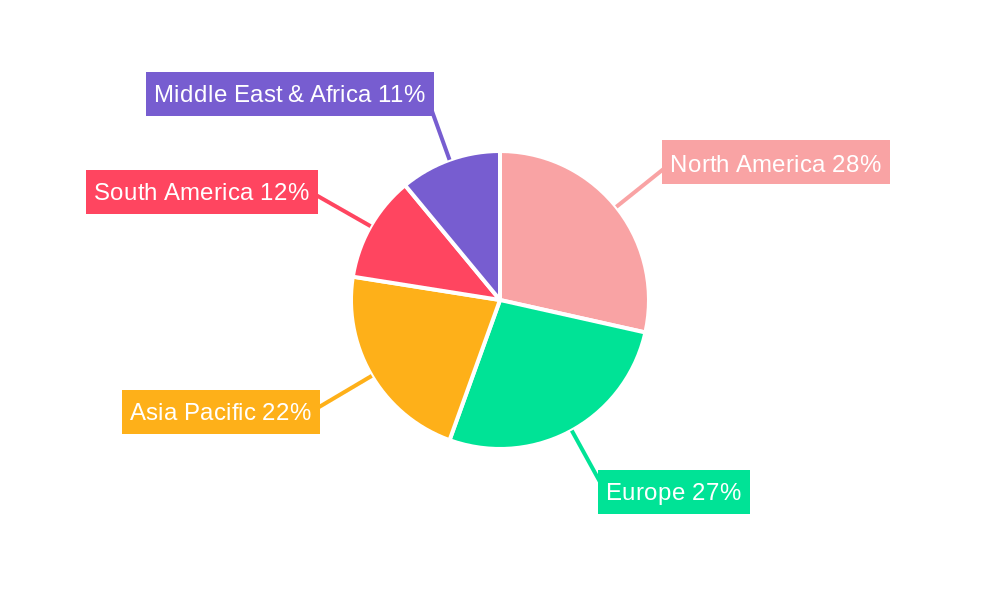

Dominant Regions, Countries, or Segments in Deodorants for Men

North America currently leads the global deodorants for men market, driven by a confluence of factors that foster high consumer spending on personal care products and a deeply ingrained grooming culture. The region's dominance is further bolstered by the strong presence of key manufacturers and a well-established distribution network that effectively caters to both online and offline sales channels. In 2025, North America is estimated to hold a market share of approximately 30% of the parent market. Within this region, the United States accounts for the largest share, supported by its large consumer base and high disposable incomes. Economic policies that encourage consumer spending on discretionary goods, coupled with robust retail infrastructure, facilitate market penetration for a wide array of deodorant products. The increasing adoption of e-commerce platforms in the US, contributing an estimated 40% to the online sales segment in the region, further amplifies the reach of deodorants for men.

The Online Sales segment is emerging as a significant growth driver across all regions, and is projected to achieve a market size of USD 8,000 million by 2033. This child market benefits from the convenience of doorstep delivery, a wider selection of niche and premium brands, and competitive pricing strategies employed by online retailers.

In terms of product types, Dry Skin deodorants are experiencing substantial growth, driven by increased consumer awareness regarding the adverse effects of harsh ingredients on skin health. This segment is projected to capture a market share of approximately 25% by 2033. Manufacturers are responding by innovating with moisturizing agents and gentle formulations.

- Leading Region: North America (estimated 30% market share in 2025).

- Key Country: United States (largest contributor within North America).

- Dominant Application Segment: Online Sales (projected USD 8,000 million by 2033).

- Growing Product Type: Dry Skin deodorants (estimated 25% market share by 2033).

- Drivers in North America: High consumer spending, established grooming culture, strong retail presence, and e-commerce growth.

- Online Sales Growth Factors: Convenience, product variety, competitive pricing, and targeted digital marketing.

- Dry Skin Deodorant Demand Drivers: Increased awareness of skin health, preference for gentle formulations, and ingredient transparency.

Deodorants for Men Product Landscape

The product landscape for deodorants for men is witnessing rapid innovation, with a strong emphasis on enhanced performance and user experience. Brands are continuously introducing advanced formulations that offer longer-lasting odor protection and sweat control, catering to the active lifestyles of modern men. Key innovations include the development of antiperspirant deodorants with advanced wetness protection technology and the increasing integration of natural and organic ingredients, addressing the growing consumer demand for healthier and environmentally conscious products. For instance, L’Occitane has gained traction with its natural ingredient-based deodorants, while Burt's Bees offers a range of organic options. Performance metrics are continually being refined, with a focus on efficacy for various skin types, including dry, oily, and mixed skin, ensuring broad consumer appeal. The market is also seeing a rise in specialized products like clinical strength deodorants and aluminum-free formulations, catering to niche consumer needs and preferences.

Key Drivers, Barriers & Challenges in Deodorants for Men

Key Drivers: The deodorants for men market is propelled by a rising male grooming consciousness, increased disposable income, and a growing demand for natural and organic ingredients. Technological advancements in formulation science, offering enhanced odor and sweat protection, are significant catalysts. Furthermore, effective marketing campaigns by brands like AXE and Gillette, highlighting product benefits and lifestyle associations, contribute to market expansion.

Barriers & Challenges: High raw material costs and complex supply chains can pose significant challenges, impacting production costs and product availability. Stringent regulatory approvals for new ingredients and product claims can lead to extended development timelines. Intense competition from both established players and emerging niche brands necessitates continuous innovation and competitive pricing. The environmental impact of packaging and ingredient sourcing is also a growing concern, requiring sustainable solutions.

Emerging Opportunities in Deodorants for Men

Emerging opportunities in the deodorants for men market lie in the burgeoning demand for personalized grooming solutions and the expansion into untapped geographical markets, particularly in developing economies where male grooming is gaining traction. The increasing preference for sustainable and eco-friendly products presents a significant opportunity for brands to innovate with biodegradable packaging and ethically sourced ingredients. Furthermore, the development of specialized deodorants for specific skin concerns, such as sensitive or acne-prone skin, and the integration of smart technology for odor detection and personalized recommendations are areas ripe for exploration.

Growth Accelerators in the Deodorants for Men Industry

Growth accelerators in the deodorants for men industry are primarily driven by ongoing research and development leading to innovative product formulations that offer superior performance and unique benefits, such as long-lasting freshness and skin-conditioning properties. Strategic partnerships between ingredient suppliers and deodorant manufacturers are fostering the creation of novel, high-efficacy products. Moreover, aggressive market expansion strategies by leading companies into emerging economies, coupled with targeted digital marketing campaigns that resonate with evolving consumer preferences for health and wellness, are significantly fueling market growth.

Key Players Shaping the Deodorants for Men Market

- AXE

- Dove

- L’Occitane

- Burt’s Bees

- Anthony

- Baxter of California

- Gillette

- Every Man Jack

Notable Milestones in Deodorants for Men Sector

- 2019: Launch of a new line of aluminum-free deodorants by Burt’s Bees, catering to the growing natural product demand.

- 2020: AXE introduces its "3-in-1" deodorant body wash and shower gel, consolidating product offerings.

- 2021: Gillette expands its "Clear Gel" antiperspirant range with enhanced odor-blocking technology.

- 2022: L’Occitane focuses on premium natural ingredients, launching a refillable deodorant stick.

- 2023: Baxter of California enhances its skincare-infused deodorant line with advanced sweat-control features.

- 2024: Every Man Jack introduces a subscription service for its natural deodorants, enhancing customer convenience.

In-Depth Deodorants for Men Market Outlook

The future outlook for the deodorants for men market is exceptionally promising, driven by sustained innovation in product development and a broadening consumer base actively seeking high-performance and health-conscious grooming solutions. The increasing adoption of e-commerce platforms for purchasing personal care items will continue to expand market reach, while the demand for sustainable and natural ingredients will push for greener manufacturing processes and packaging. Strategic collaborations and the development of specialized product lines for diverse skin types and active lifestyles are expected to be key growth accelerators. The market is set to witness further consolidation through M&A activities as companies aim to capture a larger share of this dynamic and expanding industry.

Deodorants for Men Segmentation

-

1. Application

- 1.1. Online Sales

- 1.2. Offline Sales

-

2. Types

- 2.1. Dry Skin

- 2.2. Oily Skin

- 2.3. Mixed Skin

- 2.4. Other

Deodorants for Men Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Deodorants for Men REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Deodorants for Men Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Sales

- 5.1.2. Offline Sales

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Dry Skin

- 5.2.2. Oily Skin

- 5.2.3. Mixed Skin

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Deodorants for Men Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Sales

- 6.1.2. Offline Sales

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Dry Skin

- 6.2.2. Oily Skin

- 6.2.3. Mixed Skin

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Deodorants for Men Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Sales

- 7.1.2. Offline Sales

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Dry Skin

- 7.2.2. Oily Skin

- 7.2.3. Mixed Skin

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Deodorants for Men Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Sales

- 8.1.2. Offline Sales

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Dry Skin

- 8.2.2. Oily Skin

- 8.2.3. Mixed Skin

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Deodorants for Men Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Sales

- 9.1.2. Offline Sales

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Dry Skin

- 9.2.2. Oily Skin

- 9.2.3. Mixed Skin

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Deodorants for Men Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Sales

- 10.1.2. Offline Sales

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Dry Skin

- 10.2.2. Oily Skin

- 10.2.3. Mixed Skin

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 AXE

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dove

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 L’Occitane

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Burt’s Bees

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Anthony

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Baxter of California

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gillette

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Every Man Jack

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 AXE

List of Figures

- Figure 1: Global Deodorants for Men Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Deodorants for Men Revenue (million), by Application 2024 & 2032

- Figure 3: North America Deodorants for Men Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Deodorants for Men Revenue (million), by Types 2024 & 2032

- Figure 5: North America Deodorants for Men Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Deodorants for Men Revenue (million), by Country 2024 & 2032

- Figure 7: North America Deodorants for Men Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Deodorants for Men Revenue (million), by Application 2024 & 2032

- Figure 9: South America Deodorants for Men Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Deodorants for Men Revenue (million), by Types 2024 & 2032

- Figure 11: South America Deodorants for Men Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Deodorants for Men Revenue (million), by Country 2024 & 2032

- Figure 13: South America Deodorants for Men Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Deodorants for Men Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Deodorants for Men Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Deodorants for Men Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Deodorants for Men Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Deodorants for Men Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Deodorants for Men Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Deodorants for Men Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Deodorants for Men Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Deodorants for Men Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Deodorants for Men Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Deodorants for Men Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Deodorants for Men Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Deodorants for Men Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Deodorants for Men Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Deodorants for Men Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Deodorants for Men Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Deodorants for Men Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Deodorants for Men Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Deodorants for Men Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Deodorants for Men Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Deodorants for Men Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Deodorants for Men Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Deodorants for Men Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Deodorants for Men Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Deodorants for Men Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Deodorants for Men Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Deodorants for Men Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Deodorants for Men Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Deodorants for Men Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Deodorants for Men Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Deodorants for Men Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Deodorants for Men Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Deodorants for Men Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Deodorants for Men Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Deodorants for Men Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Deodorants for Men Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Deodorants for Men Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Deodorants for Men Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Deodorants for Men?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Deodorants for Men?

Key companies in the market include AXE, Dove, L’Occitane, Burt’s Bees, Anthony, Baxter of California, Gillette, Every Man Jack.

3. What are the main segments of the Deodorants for Men?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Deodorants for Men," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Deodorants for Men report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Deodorants for Men?

To stay informed about further developments, trends, and reports in the Deodorants for Men, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence