Key Insights

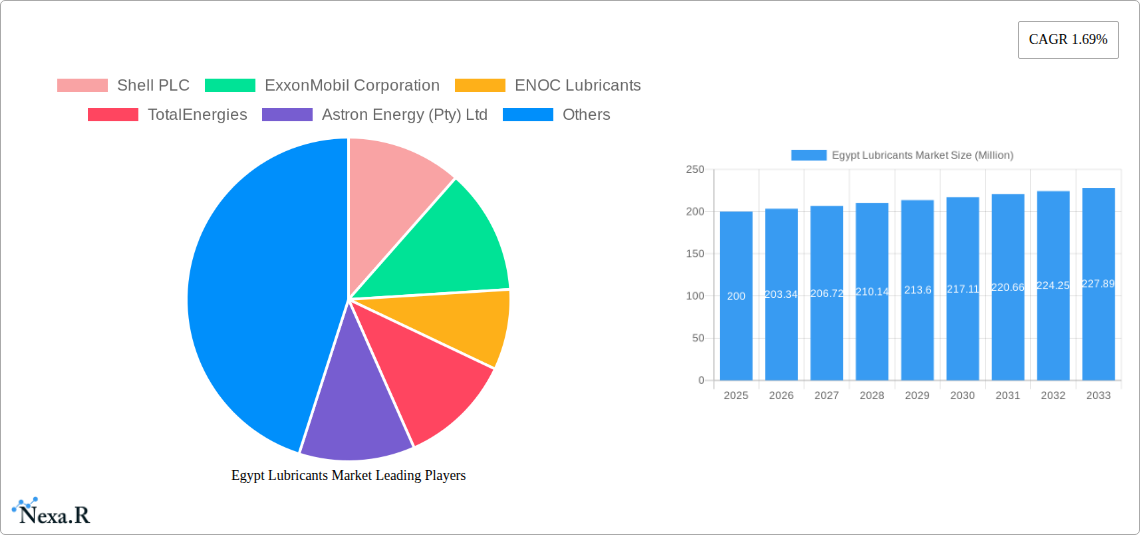

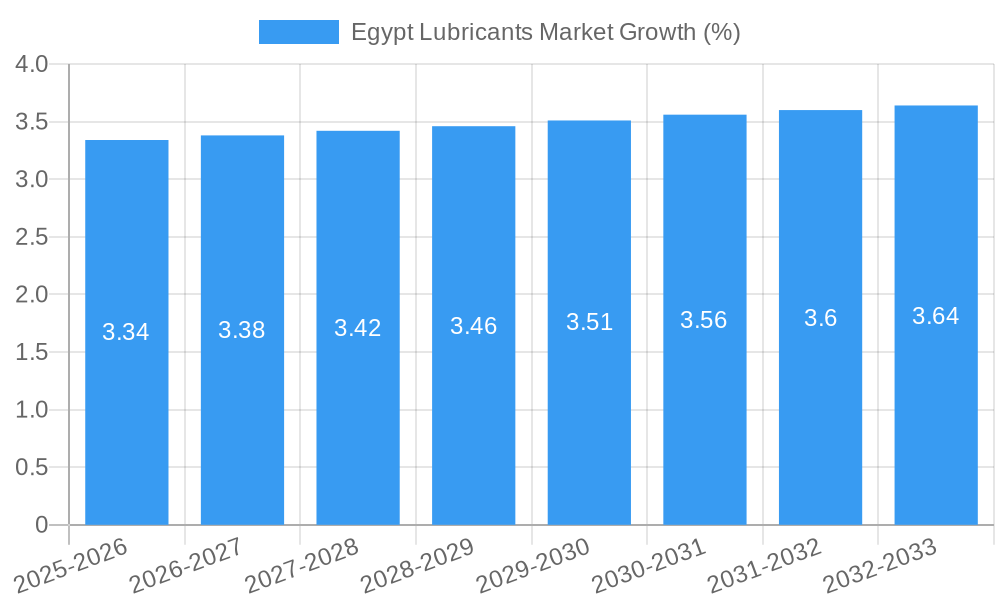

The Egypt lubricants market, valued at approximately $XXX million in 2025, is projected to experience steady growth, driven by a CAGR of 1.69% from 2025 to 2033. This growth is fueled by several key factors. The expanding automotive sector, particularly commercial vehicles and passenger cars, is a major contributor, demanding increased quantities of engine oils, transmission fluids, and greases. Furthermore, the development of infrastructure projects and industrial activities, including power generation and heavy equipment operations, contribute significantly to the demand for industrial lubricants. The food and beverage industry also plays a role, albeit smaller, requiring specialized lubricants for its machinery. Competition within the market is intense, with major international players like Shell, ExxonMobil, and TotalEnergies alongside regional companies such as ENOC Lubricants and Misr Petroleum Company vying for market share. This competitive landscape encourages innovation and the introduction of advanced lubricant technologies, such as those focusing on improved fuel efficiency and reduced environmental impact.

However, the market's growth is not without challenges. Economic fluctuations and potential instability within Egypt could affect investment in new infrastructure and industrial projects, thereby impacting lubricant demand. Fluctuations in global crude oil prices, a key input in lubricant manufacturing, also pose a risk to profitability and pricing strategies. Furthermore, stringent environmental regulations and a growing emphasis on sustainable practices within the industry may necessitate investments in greener, more environmentally friendly lubricant formulations. This necessitates manufacturers to adapt their product offerings and invest in R&D to maintain competitiveness. The segment breakdown indicates significant contribution from Engine Oil, followed by Transmission and Hydraulic Fluid, with Automotive and Other Transportation being the dominant end-user industry. Growth in these segments will be key to the overall success of the market.

Egypt Lubricants Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Egypt lubricants market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is invaluable for industry professionals, investors, and strategic decision-makers seeking a deep understanding of this dynamic market. This report covers a parent market of Industrial Lubricants and child market of Egypt Lubricants. The market size is presented in million units.

Egypt Lubricants Market Dynamics & Structure

The Egyptian lubricants market is characterized by a moderately concentrated structure with both international and domestic players vying for market share. Technological innovation, particularly in the development of energy-efficient and environmentally friendly lubricants, is a key driver. Stringent government regulations regarding environmental protection and product quality influence market dynamics. The market faces competitive pressure from substitute products, such as biodegradable lubricants. Demographic shifts, primarily driven by economic growth and urbanization, are altering end-user consumption patterns. While M&A activity has been moderate in recent years, consolidation amongst key players is anticipated as the market continues to mature.

- Market Concentration: xx% dominated by top 5 players (2024).

- Technological Innovation: Focus on bio-lubricants and enhanced performance additives.

- Regulatory Framework: Compliance with environmental standards and product specifications.

- Competitive Substitutes: Growth of biodegradable and sustainable alternatives.

- End-User Demographics: Increasing demand from automotive and industrial sectors.

- M&A Trends: xx number of significant M&A deals recorded between 2019-2024.

Egypt Lubricants Market Growth Trends & Insights

The Egyptian lubricants market exhibited a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by expanding industrialization, rising vehicle ownership, and increased government spending on infrastructure projects. The market penetration of high-performance lubricants is steadily increasing, driven by a growing awareness of their benefits in terms of fuel efficiency and extended equipment lifespan. Technological disruptions, such as the adoption of advanced lubricant formulations and improved analytical techniques, are also impacting market growth. Consumer behavior is shifting towards higher-quality, environmentally conscious lubricants. Market size is projected to reach xx million units by 2033.

Dominant Regions, Countries, or Segments in Egypt Lubricants Market

The Automotive and Other Transportation segment is currently the dominant end-user industry, followed by the Heavy Equipment sector. Within product types, Engine Oil holds the largest market share, followed by Gear Oil and Grease. The greater Cairo region and other major urban centers exhibit the highest consumption rates, driven by higher population density and industrial activity.

- Key Drivers:

- Government investment in infrastructure projects.

- Rapid urbanization and industrialization.

- Growing automotive sector.

- Increased adoption of high-performance lubricants.

- Dominance Factors:

- High vehicle ownership in urban areas.

- Significant industrial activity and construction projects.

- Growing demand for heavy-duty lubricants in the construction sector.

Egypt Lubricants Market Product Landscape

The market offers a diverse range of lubricant products, including engine oils tailored for various vehicle types, advanced transmission and hydraulic fluids for improved efficiency, and specialized industrial lubricants for diverse applications. Continuous innovation focuses on improving energy efficiency, extending equipment life, and reducing environmental impact through the use of biodegradable and synthetic base oils. Unique selling propositions center on enhanced performance characteristics, extended drain intervals, and superior protection against wear and tear.

Key Drivers, Barriers & Challenges in Egypt Lubricants Market

Key Drivers:

- Rising industrial activity and infrastructure development.

- Expanding automotive sector and vehicle ownership.

- Growing government investments in energy and transportation.

Key Challenges:

- Fluctuations in crude oil prices impacting lubricant production costs.

- Stringent environmental regulations demanding compliance with stringent emission norms.

- Intense competition among numerous domestic and international players.

Emerging Opportunities in Egypt Lubricants Market

- Growing demand for eco-friendly lubricants.

- Increased use of lubricants in renewable energy sectors.

- Potential for market expansion into less-developed regions.

Growth Accelerators in the Egypt Lubricants Market Industry

Technological advancements in lubricant formulations are a significant growth accelerator. Strategic partnerships between lubricant manufacturers and equipment original equipment manufacturers (OEMs) are driving product innovation and market penetration. Expansion into new end-user industries and geographic regions represents significant opportunities for growth.

Key Players Shaping the Egypt Lubricants Market Market

- Shell PLC

- ExxonMobil Corporation

- ENOC Lubricants

- TotalEnergies

- Astron Energy (Pty) Ltd

- LUKOIL

- Pakelo Motor Oil S r l

- FUCHS

- Castrol Limited

- EOG

- Misr Petroleum Company

Notable Milestones in Egypt Lubricants Market Sector

- October 2023: ExxonMobil announced the expansion of its operations in Egypt.

- December 2023: Lukoil announced a USD 73 million investment in Egypt’s West Esh El Mallaha Oil Field.

In-Depth Egypt Lubricants Market Market Outlook

The Egyptian lubricants market is poised for sustained growth, driven by ongoing infrastructure development, expanding industrial activities, and the burgeoning automotive sector. Strategic partnerships, technological innovations, and the increasing demand for high-performance, environmentally friendly lubricants present significant opportunities for market players. The market’s long-term potential is substantial, promising attractive returns for investors and businesses operating in this dynamic sector.

Egypt Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oil

- 1.2. Transmission and Hydraulic Fluid

- 1.3. General Industrial Oil

- 1.4. Gear Oil

- 1.5. Grease

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Power Generation

- 2.2. Automotive and Other Transportation

- 2.3. Heavy Equipment

- 2.4. Food and Beverage

- 2.5. Other End-user Industries

Egypt Lubricants Market Segmentation By Geography

- 1. Egypt

Egypt Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.69% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Construction Sector; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Volatility in Crude Oil Prices; Increasing Counterfit Products

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Engine Oil

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oil

- 5.1.2. Transmission and Hydraulic Fluid

- 5.1.3. General Industrial Oil

- 5.1.4. Gear Oil

- 5.1.5. Grease

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power Generation

- 5.2.2. Automotive and Other Transportation

- 5.2.3. Heavy Equipment

- 5.2.4. Food and Beverage

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Shell PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ExxonMobil Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ENOC Lubricants

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TotalEnergies

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Astron Energy (Pty) Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LUKOIL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pakelo Motor Oil S r l

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FUCHS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Castrol Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 EOG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Misr Petroleum Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Shell PLC

List of Figures

- Figure 1: Egypt Lubricants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Egypt Lubricants Market Share (%) by Company 2024

List of Tables

- Table 1: Egypt Lubricants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Egypt Lubricants Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Egypt Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Egypt Lubricants Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 5: Egypt Lubricants Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: Egypt Lubricants Market Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 7: Egypt Lubricants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Egypt Lubricants Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Egypt Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Egypt Lubricants Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Egypt Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: Egypt Lubricants Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 13: Egypt Lubricants Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: Egypt Lubricants Market Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 15: Egypt Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Egypt Lubricants Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Lubricants Market?

The projected CAGR is approximately 1.69%.

2. Which companies are prominent players in the Egypt Lubricants Market?

Key companies in the market include Shell PLC, ExxonMobil Corporation, ENOC Lubricants, TotalEnergies, Astron Energy (Pty) Ltd, LUKOIL, Pakelo Motor Oil S r l, FUCHS, Castrol Limited, EOG, Misr Petroleum Company.

3. What are the main segments of the Egypt Lubricants Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Construction Sector; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand for Engine Oil.

7. Are there any restraints impacting market growth?

Volatility in Crude Oil Prices; Increasing Counterfit Products.

8. Can you provide examples of recent developments in the market?

December 2023: Lukoil announced the USD 73 million investment in Egypt’s West Esh El Mallaha Oil Field to enhance oil reserves and increase production capacity, supporting the Egyptian economy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Lubricants Market?

To stay informed about further developments, trends, and reports in the Egypt Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence