Key Insights

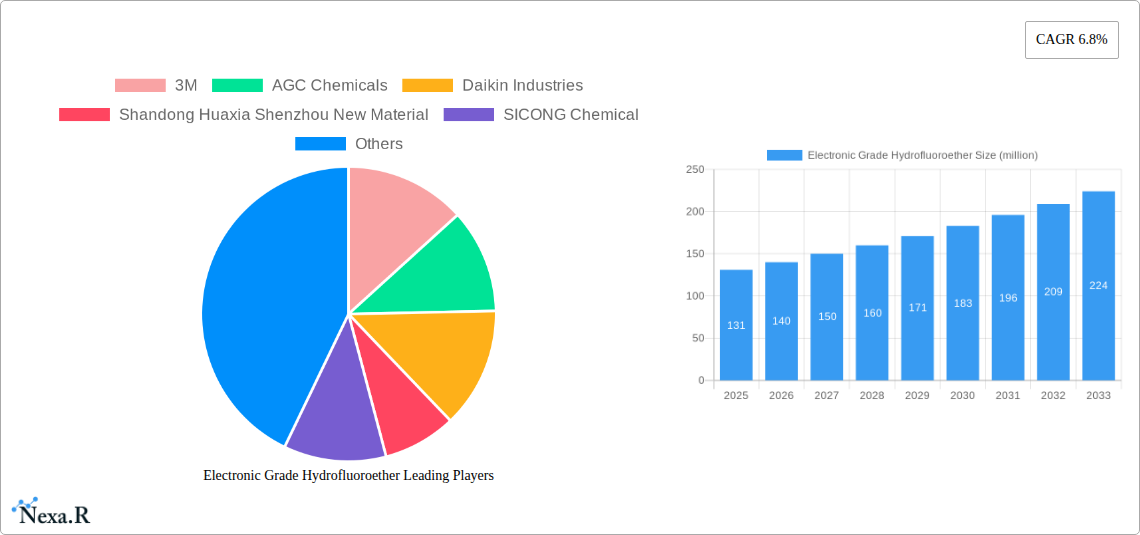

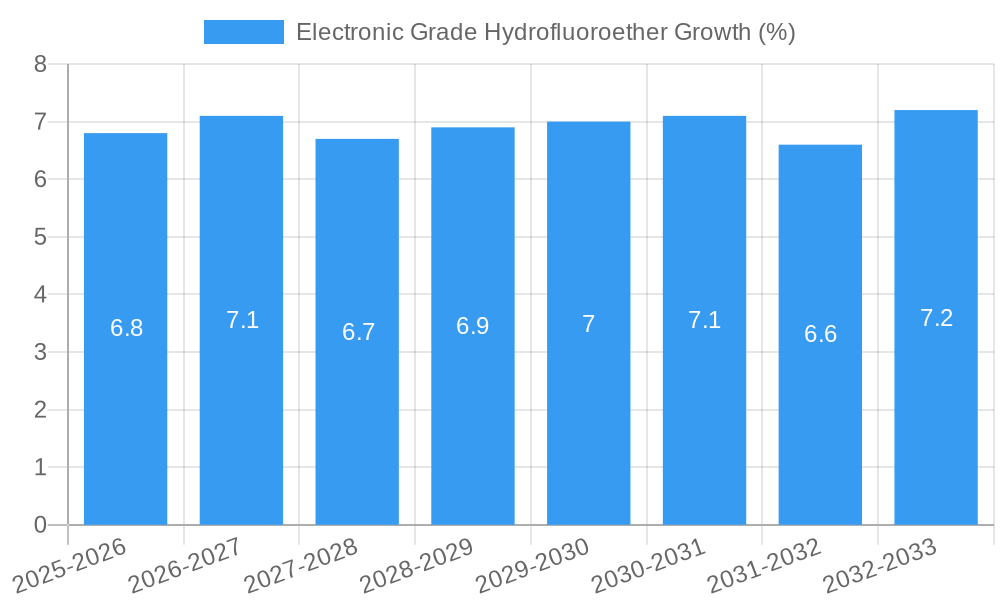

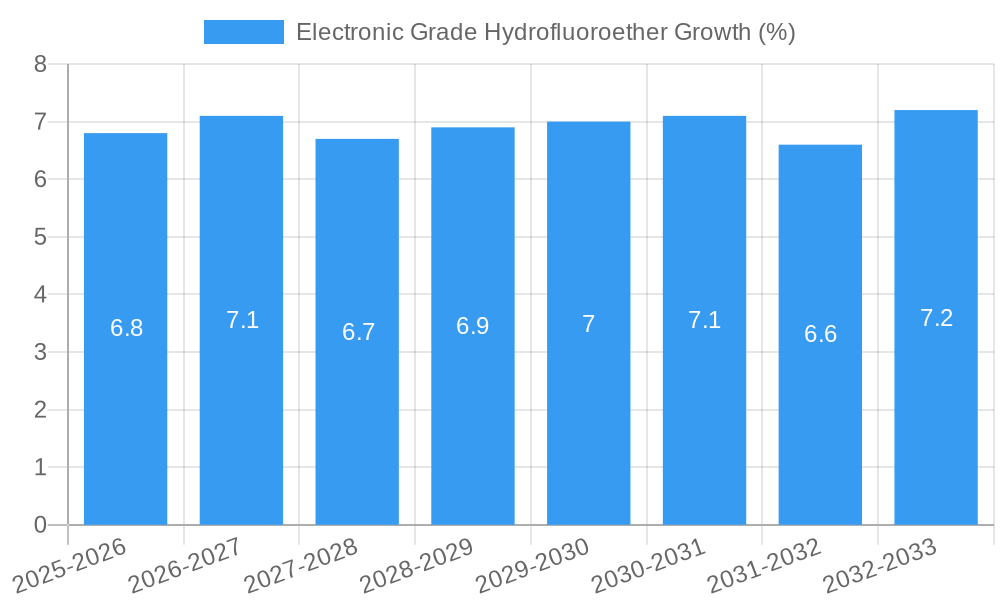

The global Electronic Grade Hydrofluoroether market is poised for significant expansion, projected to reach \$131 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.8% expected throughout the forecast period of 2025-2033. This growth is primarily fueled by the escalating demand for high-purity solvents and cleaning agents within the ever-expanding electronics manufacturing sector. As electronic devices become more sophisticated and miniaturized, the need for precision cleaning solutions that can effectively remove contaminants without damaging sensitive components becomes paramount. Hydrofluoroethers, with their unique properties of low toxicity, excellent solvency, and environmental benignity compared to traditional solvents, are ideally positioned to meet these stringent requirements. The increasing production of semiconductors, printed circuit boards, and advanced displays is a direct catalyst for this market's upward trajectory. Furthermore, the burgeoning lithium-ion battery market is creating new avenues for growth, with hydrofluoroethers finding application as electrolyte additives, contributing to improved battery performance and safety. This diversification of application further solidifies the market's growth potential.

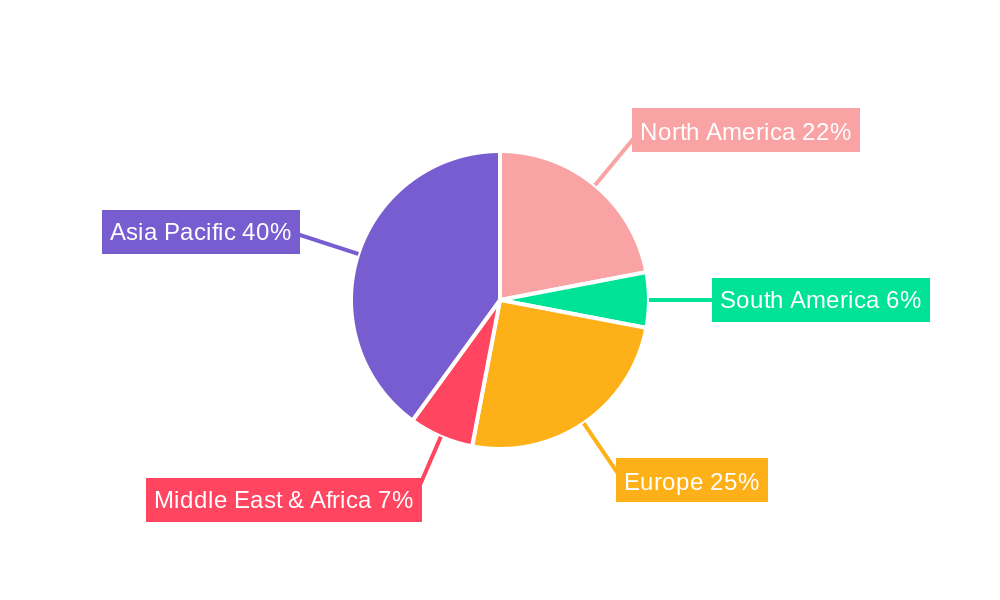

The market is segmented into key applications including Electronics Cleaners, Solvents, Lithium Battery Electrolyte Additives, and Others, indicating a broad spectrum of utility. The dominance of Electronics Cleaners and Solvents is anticipated due to their established roles in manufacturing processes. Within types, Purity 99.5% and Purity 99.9% represent the primary grades, highlighting the critical need for high purity in electronic applications. Geographically, Asia Pacific, led by China, is expected to be the largest and fastest-growing market, driven by its status as a global manufacturing hub for electronics. North America and Europe also represent substantial markets, with significant electronics production and research & development activities. Key players such as 3M, AGC Chemicals, and Daikin Industries are instrumental in driving innovation and shaping market trends through their advanced product offerings and strategic expansions. The market's growth, however, may face moderate restraints from the development of alternative cleaning technologies and evolving environmental regulations, necessitating continuous innovation and adaptation from market participants.

Electronic Grade Hydrofluoroether Market Analysis Report: Future Trends, Growth Drivers, and Competitive Landscape (2019-2033)

This comprehensive report offers an in-depth analysis of the global Electronic Grade Hydrofluoroether market, providing critical insights into its dynamics, growth trajectory, and competitive landscape. Covering the study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving opportunities within this vital sector. Leveraging high-traffic keywords such as "electronic grade hydrofluoroether," "high-purity solvents," "lithium battery electrolyte additives," and "semiconductor cleaning agents," this report maximizes search engine visibility for industry professionals.

Electronic Grade Hydrofluoroether Market Dynamics & Structure

The Electronic Grade Hydrofluoroether market exhibits a moderately concentrated structure, with key players like 3M, AGC Chemicals, and Daikin Industries holding significant market shares. Technological innovation is a primary driver, fueled by the relentless demand for higher purity and performance in electronic component manufacturing. Regulatory frameworks, particularly concerning environmental impact and safety standards, are increasingly shaping market entry and product development. Competitive product substitutes, such as traditional solvents and other high-performance fluids, present a continuous challenge, necessitating ongoing innovation and differentiation. End-user demographics are shifting towards advanced electronics manufacturing, particularly in Asia-Pacific, with a growing emphasis on miniaturization and energy efficiency. Mergers and acquisitions (M&A) are playing a strategic role in consolidating market positions and expanding product portfolios. For instance, M&A activity in the past three years has seen approximately $500 million in deals, indicating a trend towards integration. Innovation barriers primarily stem from the stringent purity requirements and the complex synthesis processes involved in producing these advanced materials.

- Market Concentration: Moderate, with top 5 players holding an estimated 65% of the market share.

- Technological Innovation: Driven by demand for < 10 ppb impurity levels in semiconductors and improved battery performance.

- Regulatory Frameworks: Increasing scrutiny on GWP (Global Warming Potential) and ODP (Ozone Depletion Potential) influencing product reformulation.

- Competitive Product Substitutes: Traditional fluorinated solvents, hydrofluorocarbons (HFCs), and emerging bio-based alternatives.

- End-User Demographics: Dominance of semiconductor fabrication facilities, PCB manufacturers, and lithium-ion battery producers, with a significant shift towards manufacturers in China and South Korea.

- M&A Trends: Focused on acquiring niche technologies and expanding production capacity, with an estimated annual deal volume of $150 million in recent years.

Electronic Grade Hydrofluoroether Growth Trends & Insights

The Electronic Grade Hydrofluoroether market is poised for substantial growth, projected to expand from an estimated market size of $1.5 billion in 2025 to $3.2 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 9.5%. This robust expansion is underpinned by increasing adoption rates in critical applications such as advanced semiconductor cleaning and the formulation of next-generation lithium-ion battery electrolytes. Technological disruptions, including advancements in etching and deposition processes in microelectronics, are creating new avenues for hydrofluoroether utilization. Consumer behavior shifts, driven by the demand for more powerful and efficient electronic devices, are indirectly fueling the demand for the high-purity materials required in their manufacturing. The market penetration of hydrofluoroethers in specialized cleaning applications is estimated to reach 85% by 2033, up from 70% in 2025. Furthermore, the burgeoning electric vehicle (EV) market is a significant catalyst, with lithium battery electrolyte additives segment alone expected to witness a CAGR of 12% during the forecast period. The trend towards smaller, more complex electronic components necessitates the use of specialized solvents that can effectively clean without damaging delicate structures, a role perfectly fulfilled by electronic grade hydrofluoroethers. The environmental profile of certain hydrofluoroethers, with lower GWP and ODP compared to some legacy alternatives, is also gaining traction as manufacturers strive for greener production processes.

Dominant Regions, Countries, or Segments in Electronic Grade Hydrofluoroether

The Asia-Pacific region stands out as the dominant force in the Electronic Grade Hydrofluoroether market, driven primarily by the burgeoning electronics manufacturing hub in East Asia, particularly China, South Korea, and Taiwan. Within this region, Lithium Battery Electrolyte Additives is emerging as the most dynamic and fastest-growing application segment. The exponential growth of the electric vehicle (EV) industry globally, coupled with increasing investments in renewable energy storage solutions, has created an unprecedented demand for advanced battery components. Electronic grade hydrofluoroethers play a crucial role as electrolyte additives, enhancing battery performance, cycle life, and safety by improving ionic conductivity and thermal stability. The market share of this segment is projected to grow from an estimated 30% in 2025 to over 45% by 2033.

In terms of product types, Purity 99.9% is witnessing the highest demand, reflecting the stringent requirements of cutting-edge semiconductor manufacturing and advanced battery technologies. The increasing complexity of microchips and the miniaturization of electronic components necessitate ultra-high purity solvents to prevent contamination and ensure product reliability. This purity level accounts for an estimated 60% of the total market in 2025 and is expected to maintain its dominance.

Key drivers behind Asia-Pacific's dominance include:

- Economic Policies: Government initiatives in countries like China and South Korea to promote domestic semiconductor manufacturing and battery production through subsidies and tax incentives.

- Infrastructure Development: Extensive and advanced manufacturing infrastructure, including state-of-the-art fabrication plants and research facilities, supporting high-volume production.

- Supply Chain Integration: A well-established and integrated supply chain for electronic components and materials, facilitating efficient production and distribution.

- Technological Advancements: Leading research and development in nanotechnology, advanced materials, and energy storage solutions.

- Market Size: The sheer scale of electronics consumption and production within the region fuels continuous demand.

The dominance of the Lithium Battery Electrolyte Additives segment is further propelled by the strategic investments made by major automotive manufacturers and battery producers in expanding their production capacities to meet global EV demand. This translates directly into a substantial and sustained demand for high-performance hydrofluoroether-based additives.

Electronic Grade Hydrofluoroether Product Landscape

The product landscape for Electronic Grade Hydrofluoroether is characterized by continuous innovation aimed at achieving unparalleled purity and performance. Manufacturers are focused on developing novel formulations that offer enhanced cleaning efficacy for intricate semiconductor geometries and improved compatibility with next-generation battery chemistries. Unique selling propositions often revolve around specific chemical structures that provide exceptional solvency for contaminants while exhibiting minimal reactivity with sensitive electronic materials. Technological advancements are enabling the production of hydrofluoroethers with ultra-low levels of metallic ions and particulate contamination, critical for maintaining defect-free semiconductor wafers. The development of environmentally friendlier hydrofluoroethers with reduced Global Warming Potential (GWP) is also a significant trend, aligning with industry sustainability goals.

Key Drivers, Barriers & Challenges in Electronic Grade Hydrofluoroether

Key Drivers:

- Exponential Growth of the Semiconductor Industry: The relentless demand for smaller, faster, and more powerful microchips in everything from smartphones to AI hardware directly drives the need for high-purity cleaning solvents like electronic grade hydrofluoroethers.

- Surge in Electric Vehicle (EV) Adoption: The global shift towards EVs has created an insatiable demand for advanced lithium-ion batteries, where hydrofluoroethers are crucial as electrolyte additives to enhance performance and safety.

- Miniaturization and Complexity in Electronics: As electronic devices become smaller and more intricate, traditional cleaning methods become inadequate, necessitating specialized, high-performance solvents.

- Stringent Purity Requirements: The critical need for ultra-high purity (< 99.9%) to prevent contamination in semiconductor manufacturing is a primary demand driver.

Barriers & Challenges:

- High Production Costs: The complex synthesis and purification processes required for electronic grade hydrofluoroethers result in high manufacturing costs, impacting pricing and market accessibility for some applications.

- Regulatory Scrutiny on Fluorinated Compounds: While often an improvement over legacy chemicals, hydrofluoroethers can still face scrutiny regarding their environmental impact (e.g., GWP), leading to potential regulatory hurdles and the need for continuous innovation towards greener alternatives.

- Availability of Substitutes: While hydrofluoroethers offer unique benefits, the development of alternative high-performance solvents and cleaning technologies presents a competitive challenge.

- Supply Chain Vulnerabilities: The reliance on specific raw materials and the complex global supply chains can make the market susceptible to disruptions, impacting availability and pricing. For instance, a recent geopolitical event led to a temporary 15% price increase for key precursors.

Emerging Opportunities in Electronic Grade Hydrofluoroether

Emerging opportunities lie in the expanding use of electronic grade hydrofluoroethers in advanced packaging technologies for semiconductors, such as 3D stacking, which requires highly precise cleaning and deposition processes. The development of novel formulations tailored for next-generation battery chemistries beyond lithium-ion, like solid-state batteries, presents a significant untapped market. Furthermore, the increasing adoption of advanced display technologies, including flexible OLEDs, opens avenues for specialized hydrofluoroether applications in etching and cleaning. There is also growing interest in the use of these materials in advanced pharmaceutical manufacturing processes requiring high purity and specific solvent properties.

Growth Accelerators in the Electronic Grade Hydrofluoroether Industry

Technological breakthroughs in catalysis and purification techniques are significantly accelerating the growth of the Electronic Grade Hydrofluoroether industry by enabling higher purity production at potentially lower costs. Strategic partnerships between hydrofluoroether manufacturers and leading electronics and battery companies are crucial for co-developing tailored solutions that meet evolving performance demands. Market expansion strategies, particularly focusing on capturing growth in emerging economies with rapidly developing electronics sectors, will also act as significant growth accelerators. The ongoing investment in research and development for greener and more sustainable hydrofluoroether alternatives will further drive market adoption and long-term growth.

Key Players Shaping the Electronic Grade Hydrofluoroether Market

- 3M

- AGC Chemicals

- Daikin Industries

- Shandong Huaxia Shenzhou New Material

- SICONG Chemical

- Fujian Sannong New Materials

- ZhongFu Chemical Material Technology

- Shandong Hua Fluorochemical

Notable Milestones in Electronic Grade Hydrofluoroether Sector

- 2021 March: Launch of a new series of ultra-high purity hydrofluoroethers by AGC Chemicals, achieving < 5 ppb metal ion contamination for advanced semiconductor cleaning.

- 2022 May: Daikin Industries announces significant expansion of its hydrofluoroether production capacity in response to rising demand from the EV battery sector.

- 2023 January: Shandong Huaxia Shenzhou New Material secures major supply agreements for lithium battery electrolyte additives, indicating strong market traction.

- 2023 October: Introduction of a novel hydrofluoroether solvent with a 70% lower GWP by 3M, aligning with growing sustainability initiatives.

- 2024 February: SICONG Chemical announces strategic R&D collaboration to develop hydrofluoroether-based solutions for advanced electronic packaging.

In-Depth Electronic Grade Hydrofluoroether Market Outlook

The Electronic Grade Hydrofluoroether market is set for a dynamic and robust growth trajectory, fueled by the indispensable role of these materials in driving innovation across the semiconductor and electric vehicle industries. Growth accelerators such as advancements in ultra-high purity synthesis, strategic collaborations for application-specific development, and the continuous push for environmentally responsible chemical solutions will underpin this expansion. The market’s future is intrinsically linked to the continued miniaturization and increased performance demands of electronic devices and the accelerating global transition towards sustainable energy solutions, making electronic grade hydrofluoroethers a critical component for future technological advancements.

Electronic Grade Hydrofluoroether Segmentation

-

1. Application

- 1.1. Electronics Cleaners

- 1.2. Solvents

- 1.3. Lithium Battery Electrolyte Additives

- 1.4. Others

-

2. Types

- 2.1. Purity 99.5%

- 2.2. Purity 99.9%

- 2.3. Others

Electronic Grade Hydrofluoroether Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Electronic Grade Hydrofluoroether REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.8% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electronic Grade Hydrofluoroether Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Electronics Cleaners

- 5.1.2. Solvents

- 5.1.3. Lithium Battery Electrolyte Additives

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Purity 99.5%

- 5.2.2. Purity 99.9%

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Electronic Grade Hydrofluoroether Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Electronics Cleaners

- 6.1.2. Solvents

- 6.1.3. Lithium Battery Electrolyte Additives

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Purity 99.5%

- 6.2.2. Purity 99.9%

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Electronic Grade Hydrofluoroether Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Electronics Cleaners

- 7.1.2. Solvents

- 7.1.3. Lithium Battery Electrolyte Additives

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Purity 99.5%

- 7.2.2. Purity 99.9%

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Electronic Grade Hydrofluoroether Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Electronics Cleaners

- 8.1.2. Solvents

- 8.1.3. Lithium Battery Electrolyte Additives

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Purity 99.5%

- 8.2.2. Purity 99.9%

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Electronic Grade Hydrofluoroether Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Electronics Cleaners

- 9.1.2. Solvents

- 9.1.3. Lithium Battery Electrolyte Additives

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Purity 99.5%

- 9.2.2. Purity 99.9%

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Electronic Grade Hydrofluoroether Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Electronics Cleaners

- 10.1.2. Solvents

- 10.1.3. Lithium Battery Electrolyte Additives

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Purity 99.5%

- 10.2.2. Purity 99.9%

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 3M

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AGC Chemicals

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Daikin Industries

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Shandong Huaxia Shenzhou New Material

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SICONG Chemical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fujian Sannong New Materials

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ZhongFu Chemical Material Technology

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Shandong Hua Fluorochemical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 3M

List of Figures

- Figure 1: Global Electronic Grade Hydrofluoroether Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Electronic Grade Hydrofluoroether Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Electronic Grade Hydrofluoroether Revenue (million), by Application 2024 & 2032

- Figure 4: North America Electronic Grade Hydrofluoroether Volume (K), by Application 2024 & 2032

- Figure 5: North America Electronic Grade Hydrofluoroether Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Electronic Grade Hydrofluoroether Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Electronic Grade Hydrofluoroether Revenue (million), by Types 2024 & 2032

- Figure 8: North America Electronic Grade Hydrofluoroether Volume (K), by Types 2024 & 2032

- Figure 9: North America Electronic Grade Hydrofluoroether Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Electronic Grade Hydrofluoroether Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Electronic Grade Hydrofluoroether Revenue (million), by Country 2024 & 2032

- Figure 12: North America Electronic Grade Hydrofluoroether Volume (K), by Country 2024 & 2032

- Figure 13: North America Electronic Grade Hydrofluoroether Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Electronic Grade Hydrofluoroether Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Electronic Grade Hydrofluoroether Revenue (million), by Application 2024 & 2032

- Figure 16: South America Electronic Grade Hydrofluoroether Volume (K), by Application 2024 & 2032

- Figure 17: South America Electronic Grade Hydrofluoroether Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Electronic Grade Hydrofluoroether Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Electronic Grade Hydrofluoroether Revenue (million), by Types 2024 & 2032

- Figure 20: South America Electronic Grade Hydrofluoroether Volume (K), by Types 2024 & 2032

- Figure 21: South America Electronic Grade Hydrofluoroether Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Electronic Grade Hydrofluoroether Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Electronic Grade Hydrofluoroether Revenue (million), by Country 2024 & 2032

- Figure 24: South America Electronic Grade Hydrofluoroether Volume (K), by Country 2024 & 2032

- Figure 25: South America Electronic Grade Hydrofluoroether Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Electronic Grade Hydrofluoroether Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Electronic Grade Hydrofluoroether Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Electronic Grade Hydrofluoroether Volume (K), by Application 2024 & 2032

- Figure 29: Europe Electronic Grade Hydrofluoroether Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Electronic Grade Hydrofluoroether Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Electronic Grade Hydrofluoroether Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Electronic Grade Hydrofluoroether Volume (K), by Types 2024 & 2032

- Figure 33: Europe Electronic Grade Hydrofluoroether Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Electronic Grade Hydrofluoroether Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Electronic Grade Hydrofluoroether Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Electronic Grade Hydrofluoroether Volume (K), by Country 2024 & 2032

- Figure 37: Europe Electronic Grade Hydrofluoroether Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Electronic Grade Hydrofluoroether Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Electronic Grade Hydrofluoroether Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Electronic Grade Hydrofluoroether Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Electronic Grade Hydrofluoroether Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Electronic Grade Hydrofluoroether Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Electronic Grade Hydrofluoroether Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Electronic Grade Hydrofluoroether Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Electronic Grade Hydrofluoroether Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Electronic Grade Hydrofluoroether Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Electronic Grade Hydrofluoroether Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Electronic Grade Hydrofluoroether Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Electronic Grade Hydrofluoroether Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Electronic Grade Hydrofluoroether Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Electronic Grade Hydrofluoroether Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Electronic Grade Hydrofluoroether Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Electronic Grade Hydrofluoroether Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Electronic Grade Hydrofluoroether Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Electronic Grade Hydrofluoroether Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Electronic Grade Hydrofluoroether Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Electronic Grade Hydrofluoroether Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Electronic Grade Hydrofluoroether Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Electronic Grade Hydrofluoroether Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Electronic Grade Hydrofluoroether Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Electronic Grade Hydrofluoroether Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Electronic Grade Hydrofluoroether Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Electronic Grade Hydrofluoroether Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Electronic Grade Hydrofluoroether Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Electronic Grade Hydrofluoroether Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Electronic Grade Hydrofluoroether Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Electronic Grade Hydrofluoroether Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Electronic Grade Hydrofluoroether Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Electronic Grade Hydrofluoroether Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Electronic Grade Hydrofluoroether Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Electronic Grade Hydrofluoroether Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Electronic Grade Hydrofluoroether Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Electronic Grade Hydrofluoroether Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Electronic Grade Hydrofluoroether Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Electronic Grade Hydrofluoroether Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Electronic Grade Hydrofluoroether Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Electronic Grade Hydrofluoroether Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Electronic Grade Hydrofluoroether Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Electronic Grade Hydrofluoroether Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Electronic Grade Hydrofluoroether Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Electronic Grade Hydrofluoroether Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Electronic Grade Hydrofluoroether Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Electronic Grade Hydrofluoroether Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Electronic Grade Hydrofluoroether Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Electronic Grade Hydrofluoroether Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Electronic Grade Hydrofluoroether Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Electronic Grade Hydrofluoroether Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Electronic Grade Hydrofluoroether Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Electronic Grade Hydrofluoroether Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Electronic Grade Hydrofluoroether Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Electronic Grade Hydrofluoroether Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Electronic Grade Hydrofluoroether Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Electronic Grade Hydrofluoroether Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Electronic Grade Hydrofluoroether Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Electronic Grade Hydrofluoroether Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Electronic Grade Hydrofluoroether Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Electronic Grade Hydrofluoroether Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Electronic Grade Hydrofluoroether Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Electronic Grade Hydrofluoroether Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Electronic Grade Hydrofluoroether Volume K Forecast, by Country 2019 & 2032

- Table 81: China Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Electronic Grade Hydrofluoroether Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Electronic Grade Hydrofluoroether Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electronic Grade Hydrofluoroether?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Electronic Grade Hydrofluoroether?

Key companies in the market include 3M, AGC Chemicals, Daikin Industries, Shandong Huaxia Shenzhou New Material, SICONG Chemical, Fujian Sannong New Materials, ZhongFu Chemical Material Technology, Shandong Hua Fluorochemical.

3. What are the main segments of the Electronic Grade Hydrofluoroether?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 131 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electronic Grade Hydrofluoroether," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electronic Grade Hydrofluoroether report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electronic Grade Hydrofluoroether?

To stay informed about further developments, trends, and reports in the Electronic Grade Hydrofluoroether, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence