Key Insights

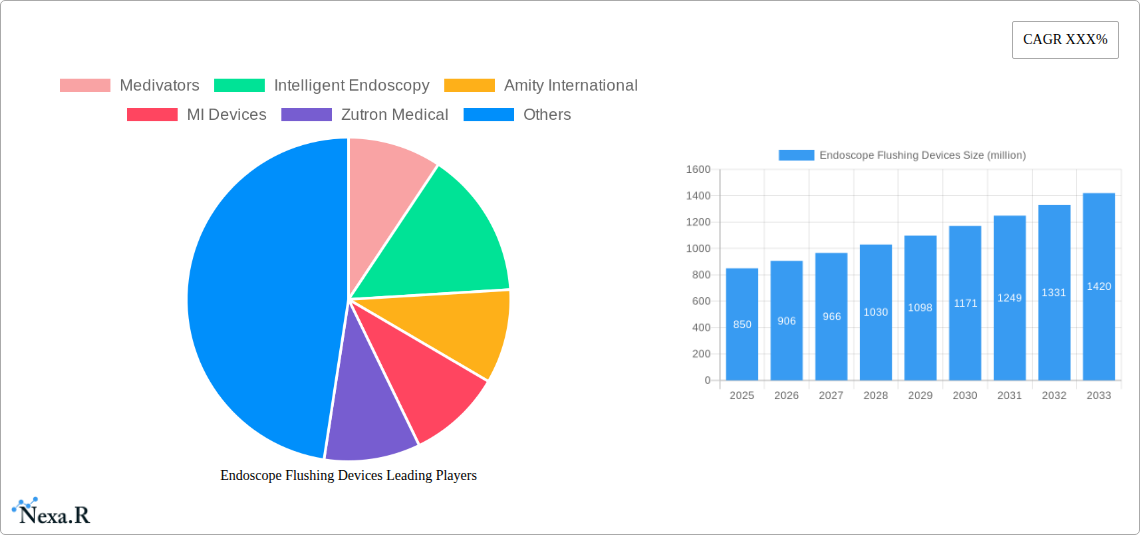

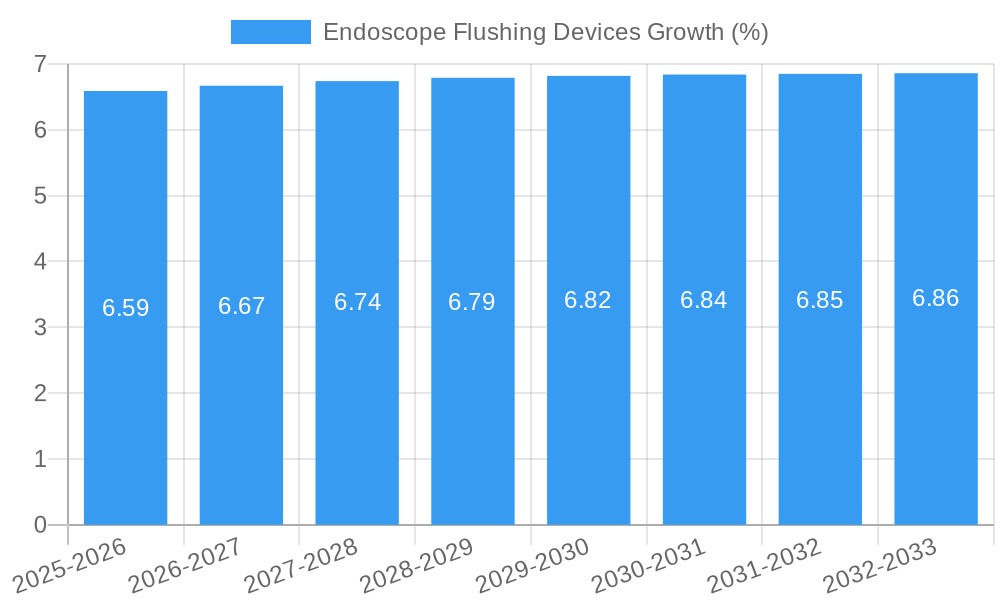

The global Endoscope Flushing Devices market is experiencing robust growth, projected to reach approximately $850 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 6.5% over the forecast period of 2025-2033. This expansion is primarily fueled by the increasing prevalence of gastrointestinal (GI) disorders, a growing demand for minimally invasive diagnostic and therapeutic procedures, and a rising awareness regarding effective infection control in healthcare settings. Hospitals and Ambulatory Surgical Centers (ASCs) represent the largest application segments, driven by the high volume of endoscopic procedures performed and the stringent regulatory requirements for reprocessing endoscopes to prevent patient-to-patient transmission of infections. Technological advancements in flushing devices, including automated and integrated systems, are further stimulating market growth by enhancing efficiency, accuracy, and safety during endoscope reprocessing.

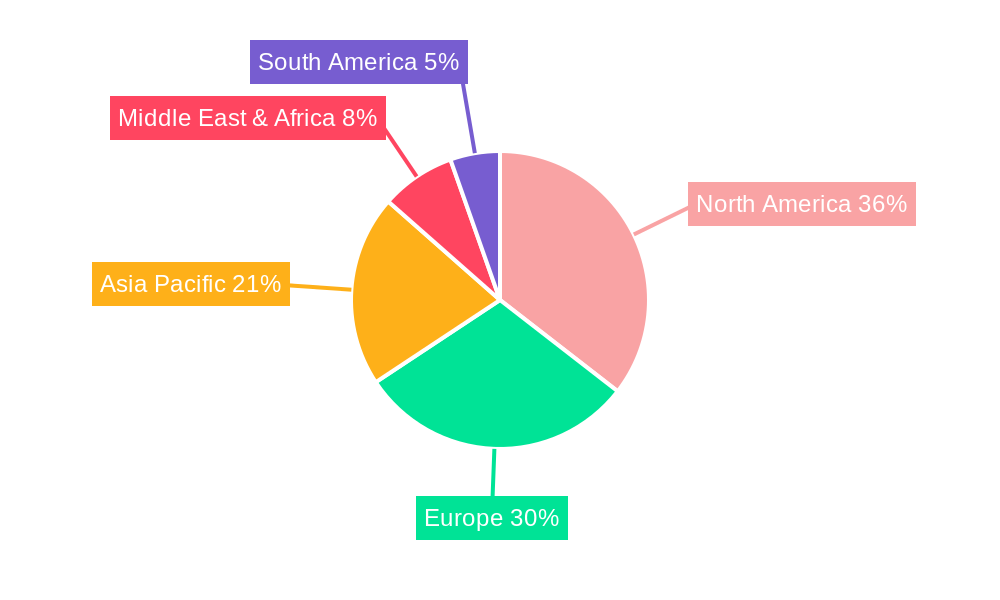

The market's trajectory is significantly influenced by several key drivers. The aging global population, a demographic segment more susceptible to various chronic diseases requiring endoscopic interventions, is a paramount factor. Furthermore, increasing healthcare expenditure, particularly in emerging economies, and the subsequent expansion of healthcare infrastructure are creating new opportunities for market players. However, challenges such as the high initial cost of advanced flushing systems and the need for proper training and maintenance can pose restraints. The market is segmented by type into Device Flushing and Gastrointestinal (GI) Tract Flushing, with GI tract flushing applications dominating due to the widespread use of endoscopies for diagnosing and treating digestive system conditions. Geographically, North America and Europe currently hold the largest market shares, attributed to advanced healthcare infrastructure, high adoption rates of new technologies, and strict regulatory frameworks. The Asia Pacific region is poised for significant growth, driven by increasing healthcare investments, a burgeoning patient pool, and improving access to sophisticated medical devices.

This comprehensive report provides an in-depth analysis of the global Endoscope Flushing Devices market, offering critical insights into market dynamics, growth trends, competitive landscape, and future opportunities. Spanning from 2019 to 2033, with a base year of 2025, this report is an indispensable resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on this rapidly evolving sector.

Endoscope Flushing Devices Market Dynamics & Structure

The Endoscope Flushing Devices market is characterized by a moderate to high concentration, with key players like Medivators, Olympus, and Intelligent Endoscopy holding significant market shares. Technological innovation is a primary driver, with companies continuously investing in R&D to develop more efficient, automated, and user-friendly flushing systems, thereby reducing the risk of cross-contamination and improving patient safety. Regulatory frameworks, particularly those from the FDA and EMA, play a crucial role in setting standards for device efficacy and safety, influencing product development and market entry strategies. Competitive product substitutes, such as manual cleaning methods and alternative sterilization techniques, exist but are increasingly being supplanted by advanced flushing devices due to their superior performance and compliance with stringent infection control guidelines. End-user demographics are primarily driven by the rising prevalence of gastrointestinal (GI) disorders and the increasing demand for minimally invasive procedures. Mergers and acquisitions (M&A) are notable trends, with larger companies acquiring smaller, innovative firms to expand their product portfolios and market reach. For instance, approximately 5-7 significant M&A deals are anticipated within the forecast period. Barriers to innovation include the high cost of advanced technological development and the need for extensive clinical validation.

Endoscope Flushing Devices Growth Trends & Insights

The global Endoscope Flushing Devices market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033. This expansion is underpinned by a significant increase in endoscopic procedures worldwide, driven by aging populations, rising incidence of chronic diseases, and a growing awareness of early disease detection. The adoption rate of automated endoscope reprocessors (AERs) and advanced flushing systems is accelerating, particularly in hospitals and ambulatory surgical centers (ASCs), as they offer enhanced infection control and operational efficiency. Technological disruptions, such as the integration of artificial intelligence for process monitoring and advanced sterilization technologies, are further shaping market dynamics. Consumer behavior shifts, particularly among healthcare providers, are moving towards prioritizing patient safety and infection prevention, making sophisticated flushing devices a critical investment. The market size is estimated to reach USD 2,500 million in 2025, with a projected increase to USD 4,000 million by 2033. Market penetration for advanced flushing devices in developed economies is expected to reach over 70% by 2033, while emerging economies are witnessing a significant ramp-up in adoption. The focus on reducing healthcare-associated infections (HAIs) remains a paramount concern, propelling the demand for effective endoscope cleaning solutions.

Dominant Regions, Countries, or Segments in Endoscope Flushing Devices

North America currently dominates the Endoscope Flushing Devices market, driven by a well-established healthcare infrastructure, high healthcare expenditure, and a strong emphasis on patient safety and infection control. The United States, in particular, is a leading contributor due to the high volume of endoscopic procedures performed annually in hospitals and ASCs. The Application segment of Hospitals is the primary growth engine within North America, accounting for an estimated 55% of the regional market share in 2025. This dominance is attributed to the presence of advanced medical facilities, availability of sophisticated reimbursement policies, and the proactive adoption of cutting-edge medical technologies. The Type segment of Device Flushing is also a significant contributor to regional growth, encompassing a wide range of automated reprocessors and flushing accessories designed for thorough and efficient cleaning.

Key drivers of this dominance include:

- Advanced Healthcare Infrastructure: A high density of hospitals and ASCs equipped with state-of-the-art technology.

- Favorable Reimbursement Policies: Robust insurance coverage for endoscopic procedures and associated cleaning protocols.

- Stringent Regulatory Standards: Strict guidelines from the FDA promoting the use of effective infection control measures.

- High Awareness of HAIs: Proactive efforts by healthcare providers to minimize the risk of healthcare-associated infections.

- Technological Adoption: A willingness to invest in and adopt advanced endoscope flushing devices.

The market share for hospitals in North America is projected to remain substantial throughout the forecast period, with a steady growth potential fueled by increasing procedural volumes and ongoing advancements in flushing technologies.

Endoscope Flushing Devices Product Landscape

The Endoscope Flushing Devices product landscape is characterized by a continuous stream of innovations aimed at enhancing cleaning efficacy, improving workflow efficiency, and ensuring compliance with stringent infection control standards. Automated Endoscope Reprocessors (AERs) represent the forefront of this innovation, offering multi-channel flushing capabilities, advanced disinfection cycles, and integrated data management systems. Key advancements include dual-channel flushing, which allows for simultaneous cleaning of both channels of an endoscope, significantly reducing processing time. Furthermore, the integration of intelligent sensors for real-time monitoring of water temperature, disinfectant concentration, and flow rates ensures optimal cleaning performance. Unique selling propositions often revolve around reduced cycle times, superior lumen cleaning, and user-friendly interfaces. Technological advancements also encompass the development of more environmentally friendly disinfectant solutions and disposable components to minimize manual handling and reduce the risk of contamination.

Key Drivers, Barriers & Challenges in Endoscope Flushing Devices

Key Drivers:

- Rising Incidence of Gastrointestinal Diseases: The increasing prevalence of conditions like colorectal cancer, inflammatory bowel disease, and GERD necessitates more frequent endoscopic procedures, thereby driving the demand for efficient endoscope cleaning.

- Emphasis on Infection Control: Growing concerns about healthcare-associated infections (HAIs) and stringent regulatory mandates for endoscope reprocessing are pushing healthcare facilities to adopt advanced flushing devices.

- Technological Advancements: Innovations in automated flushing systems, including AI integration and improved disinfection technologies, enhance efficacy and user convenience.

- Growth in Ambulatory Surgical Centers (ASCs): The expanding ASC sector, offering cost-effective alternatives to hospitals, contributes to increased procedural volumes and device adoption.

Barriers & Challenges:

- High Initial Investment Cost: Advanced endoscope flushing devices can be expensive, posing a financial barrier for smaller clinics and facilities in developing regions.

- Stringent Regulatory Approvals: Obtaining regulatory clearance for new devices can be a lengthy and complex process, delaying market entry.

- Need for Skilled Personnel: Operating and maintaining sophisticated flushing systems requires trained personnel, which can be a challenge in some healthcare settings.

- Compatibility Issues: Ensuring compatibility of flushing devices with a wide range of endoscope models from different manufacturers can be complex.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability of raw materials and finished products, affecting production and delivery.

Emerging Opportunities in Endoscope Flushing Devices

Emerging opportunities in the Endoscope Flushing Devices market lie in the development of compact, portable, and point-of-care flushing solutions for remote or resource-limited settings. The integration of advanced connectivity features, enabling remote monitoring and data analytics for predictive maintenance and performance optimization, presents a significant untapped market. Furthermore, the increasing demand for single-use components and accessories within flushing systems offers opportunities for manufacturers focused on disposable solutions that enhance convenience and reduce cross-contamination risks. The burgeoning medical tourism sector also presents a niche market for high-quality, reliable endoscope reprocessing technologies in countries experiencing rapid healthcare infrastructure development.

Growth Accelerators in the Endoscope Flushing Devices Industry

Long-term growth in the Endoscope Flushing Devices industry will be significantly accelerated by continued technological breakthroughs in disinfection efficacy and automation. Strategic partnerships between device manufacturers and endoscope producers will streamline compatibility and foster integrated solutions. The growing focus on standardization of reprocessing protocols across different healthcare systems globally will also act as a major catalyst. Furthermore, increasing government initiatives and funding aimed at improving infection control standards in healthcare settings will further bolster market expansion. The development of more sustainable and eco-friendly flushing solutions will also attract a broader customer base.

Key Players Shaping the Endoscope Flushing Devices Market

- Medivators

- Intelligent Endoscopy

- Amity International

- MI Devices

- Zutron Medical

- Olympus

Notable Milestones in Endoscope Flushing Devices Sector

- 2019: Launch of next-generation automated endoscope reprocessors with enhanced disinfection capabilities.

- 2020: Increased regulatory scrutiny on endoscope reprocessing following heightened awareness of infection control during the pandemic.

- 2021: Significant growth in the adoption of dual-channel flushing systems to improve efficiency.

- 2022: Introduction of smart AERs with advanced data logging and connectivity features.

- 2023: Key acquisitions aimed at consolidating market share and expanding product portfolios.

- 2024: Emerging focus on AI-driven process optimization and remote monitoring solutions.

In-Depth Endoscope Flushing Devices Market Outlook

- 2019: Launch of next-generation automated endoscope reprocessors with enhanced disinfection capabilities.

- 2020: Increased regulatory scrutiny on endoscope reprocessing following heightened awareness of infection control during the pandemic.

- 2021: Significant growth in the adoption of dual-channel flushing systems to improve efficiency.

- 2022: Introduction of smart AERs with advanced data logging and connectivity features.

- 2023: Key acquisitions aimed at consolidating market share and expanding product portfolios.

- 2024: Emerging focus on AI-driven process optimization and remote monitoring solutions.

In-Depth Endoscope Flushing Devices Market Outlook

The Endoscope Flushing Devices market is projected for sustained and robust growth, driven by an unwavering global commitment to patient safety and infection prevention. The increasing volume of endoscopic procedures, coupled with the continuous evolution of disinfection technologies, will fuel demand for advanced and automated solutions. Strategic investments in R&D by key players, focusing on intelligent automation and enhanced user experience, will further shape the market. Opportunities in emerging economies and the growing trend towards integrated healthcare solutions present significant potential for market expansion, ensuring a promising future for this vital sector of medical device technology.

Endoscope Flushing Devices Segmentation

-

1. Application

- 1.1. Hospitals

- 1.2. Ambulatory Surgical Centers (ASCs)

- 1.3. Clinics

- 1.4. Others

-

2. Type

- 2.1. Device Flushing

- 2.2. Gastro Intestinal (GI) Tract Flushing

- 2.3. Others

Endoscope Flushing Devices Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Endoscope Flushing Devices REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Endoscope Flushing Devices Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospitals

- 5.1.2. Ambulatory Surgical Centers (ASCs)

- 5.1.3. Clinics

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Device Flushing

- 5.2.2. Gastro Intestinal (GI) Tract Flushing

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Endoscope Flushing Devices Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospitals

- 6.1.2. Ambulatory Surgical Centers (ASCs)

- 6.1.3. Clinics

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Device Flushing

- 6.2.2. Gastro Intestinal (GI) Tract Flushing

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Endoscope Flushing Devices Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospitals

- 7.1.2. Ambulatory Surgical Centers (ASCs)

- 7.1.3. Clinics

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Device Flushing

- 7.2.2. Gastro Intestinal (GI) Tract Flushing

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Endoscope Flushing Devices Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospitals

- 8.1.2. Ambulatory Surgical Centers (ASCs)

- 8.1.3. Clinics

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Device Flushing

- 8.2.2. Gastro Intestinal (GI) Tract Flushing

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Endoscope Flushing Devices Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospitals

- 9.1.2. Ambulatory Surgical Centers (ASCs)

- 9.1.3. Clinics

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Device Flushing

- 9.2.2. Gastro Intestinal (GI) Tract Flushing

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Endoscope Flushing Devices Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospitals

- 10.1.2. Ambulatory Surgical Centers (ASCs)

- 10.1.3. Clinics

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Device Flushing

- 10.2.2. Gastro Intestinal (GI) Tract Flushing

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Medivators

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Intelligent Endoscopy

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amity International

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 MI Devices

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Zutron Medical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Olympus

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Medivators

List of Figures

- Figure 1: Global Endoscope Flushing Devices Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Endoscope Flushing Devices Revenue (million), by Application 2024 & 2032

- Figure 3: North America Endoscope Flushing Devices Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Endoscope Flushing Devices Revenue (million), by Type 2024 & 2032

- Figure 5: North America Endoscope Flushing Devices Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Endoscope Flushing Devices Revenue (million), by Country 2024 & 2032

- Figure 7: North America Endoscope Flushing Devices Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Endoscope Flushing Devices Revenue (million), by Application 2024 & 2032

- Figure 9: South America Endoscope Flushing Devices Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Endoscope Flushing Devices Revenue (million), by Type 2024 & 2032

- Figure 11: South America Endoscope Flushing Devices Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Endoscope Flushing Devices Revenue (million), by Country 2024 & 2032

- Figure 13: South America Endoscope Flushing Devices Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Endoscope Flushing Devices Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Endoscope Flushing Devices Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Endoscope Flushing Devices Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Endoscope Flushing Devices Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Endoscope Flushing Devices Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Endoscope Flushing Devices Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Endoscope Flushing Devices Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Endoscope Flushing Devices Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Endoscope Flushing Devices Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Endoscope Flushing Devices Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Endoscope Flushing Devices Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Endoscope Flushing Devices Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Endoscope Flushing Devices Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Endoscope Flushing Devices Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Endoscope Flushing Devices Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Endoscope Flushing Devices Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Endoscope Flushing Devices Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Endoscope Flushing Devices Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Endoscope Flushing Devices Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Endoscope Flushing Devices Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Endoscope Flushing Devices Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Endoscope Flushing Devices Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Endoscope Flushing Devices Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Endoscope Flushing Devices Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Endoscope Flushing Devices Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Endoscope Flushing Devices Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Endoscope Flushing Devices Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Endoscope Flushing Devices Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Endoscope Flushing Devices Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Endoscope Flushing Devices Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Endoscope Flushing Devices Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Endoscope Flushing Devices Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Endoscope Flushing Devices Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Endoscope Flushing Devices Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Endoscope Flushing Devices Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Endoscope Flushing Devices Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Endoscope Flushing Devices Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Endoscope Flushing Devices Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Endoscope Flushing Devices?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Endoscope Flushing Devices?

Key companies in the market include Medivators, Intelligent Endoscopy, Amity International, MI Devices, Zutron Medical, Olympus.

3. What are the main segments of the Endoscope Flushing Devices?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Endoscope Flushing Devices," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Endoscope Flushing Devices report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Endoscope Flushing Devices?

To stay informed about further developments, trends, and reports in the Endoscope Flushing Devices, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence