Key Insights

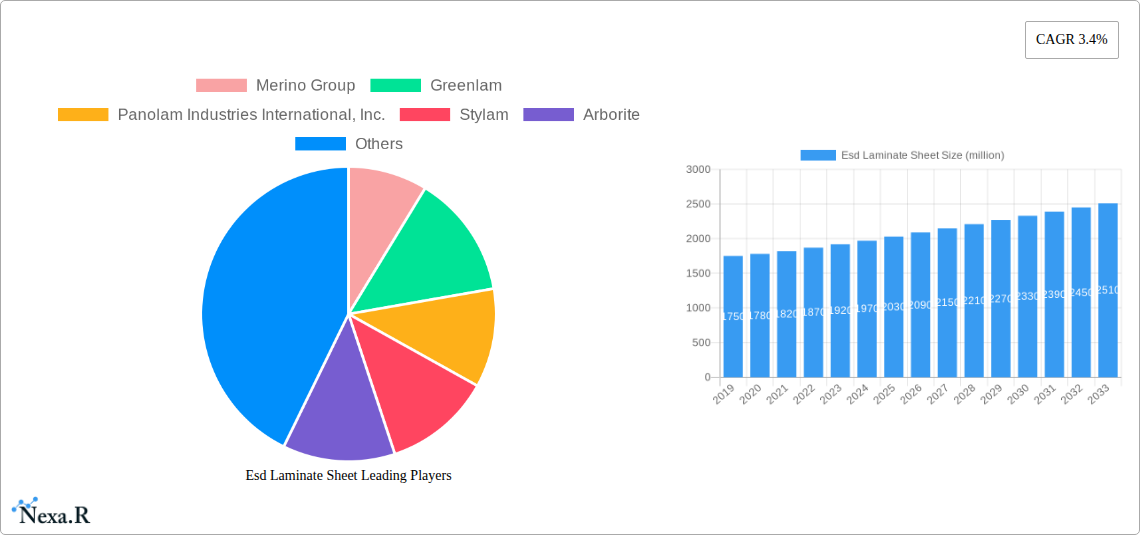

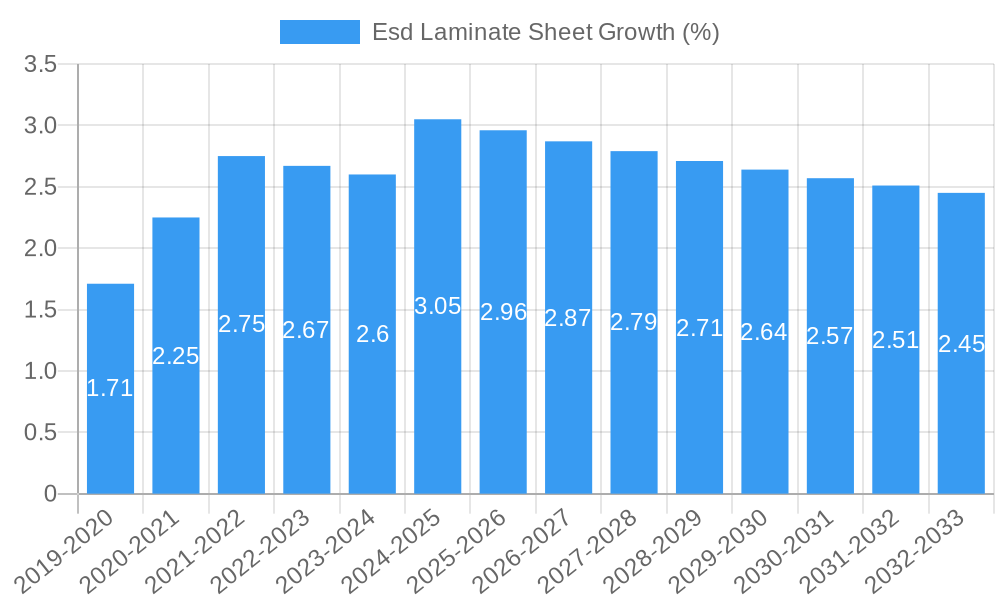

The global ESD laminate sheet market is poised for significant expansion, projected to reach an estimated USD 2110 million by 2025. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 3.4% during the forecast period of 2025-2033. A primary driver for this market's ascendancy is the escalating demand for electrostatic discharge (ESD) protective solutions across a diverse range of industries, most notably electronics manufacturing. As electronic components become increasingly sophisticated and miniaturized, safeguarding them from the detrimental effects of static electricity becomes paramount, driving the adoption of specialized laminate sheets. Furthermore, the burgeoning healthcare sector, with its stringent requirements for sterile and contamination-free environments, also contributes substantially to market growth. Cleanrooms within these facilities rely heavily on ESD-safe materials to prevent equipment malfunction and ensure patient safety.

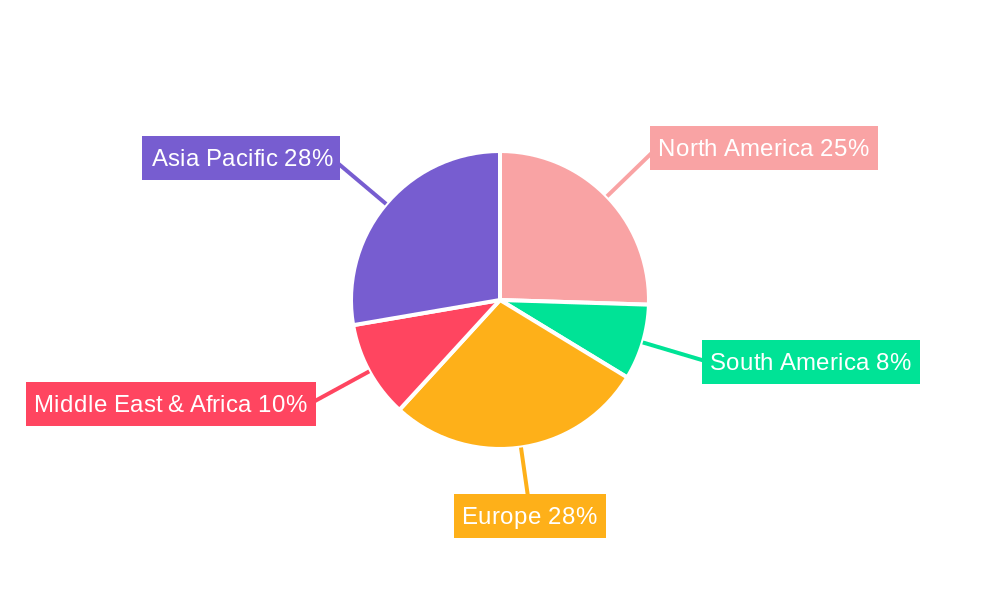

The market segmentation reveals a strong emphasis on the "Electronics Manufacturing Workstations" application, reflecting its critical role in preventing component damage during production and assembly processes. The "Cleanrooms" and "Hospitals" segments also represent substantial avenues for growth, driven by evolving safety and operational standards. In terms of type, the "Square Edge" variant likely holds a dominant share due to its ease of installation and widespread application in workstations and cleanroom environments. Looking ahead, continued innovation in material science, focusing on enhanced ESD performance, durability, and sustainability, will be crucial for market players. Strategic collaborations and product development aimed at addressing specific industry needs, coupled with expanding manufacturing capacities to meet growing global demand, will define the competitive landscape. Emerging economies, particularly in the Asia Pacific region, are expected to present significant opportunities for market expansion due to rapid industrialization and increasing investments in advanced manufacturing infrastructure.

Esd Laminate Sheet Market Dynamics & Structure

The Esd Laminate Sheet market exhibits a moderately concentrated structure, characterized by the presence of both established global players and specialized regional manufacturers. Technological innovation is a primary driver, with continuous advancements in material science and manufacturing processes leading to enhanced electrostatic discharge (ESD) protection capabilities, increased durability, and improved aesthetic options. Regulatory frameworks, particularly those governing electronics manufacturing and healthcare environments, indirectly influence market growth by mandating the use of ESD-safe materials in critical applications. Competitive product substitutes, such as conductive flooring or specialized coatings, pose a threat, but the inherent advantages of laminate sheets – cost-effectiveness, ease of installation, and versatility – maintain their dominance. End-user demographics are increasingly diverse, spanning from high-tech electronics manufacturing firms to research laboratories and healthcare facilities. Mergers and acquisitions (M&A) activity is present, though not overwhelmingly dominant, as companies seek to expand their product portfolios, geographical reach, and technological expertise. For instance, strategic acquisitions can consolidate market share and offer synergistic benefits, contributing to a more robust industry ecosystem. The market share of leading players is estimated to be around xx%, with a xx% increase in M&A deal volume observed in the historical period. Innovation barriers include the high cost of research and development for advanced ESD materials and the stringent testing and certification requirements.

Esd Laminate Sheet Growth Trends & Insights

The global Esd Laminate Sheet market is projected to experience robust growth over the forecast period of 2025–2033. The Compound Annual Growth Rate (CAGR) is estimated at xx%, reflecting a significant expansion in market size. This upward trajectory is fueled by the escalating demand for ESD-protective solutions across a multitude of industries, driven by the increasing complexity and sensitivity of electronic components and the growing emphasis on maintaining pristine environments in sectors like healthcare and cleanrooms. The adoption rates of Esd Laminate Sheets are steadily rising as awareness of static discharge hazards and their potential for equipment damage and data loss becomes more pronounced. Technological disruptions, such as the development of thinner, more flexible, and aesthetically diverse laminate options, are further enhancing their appeal. Moreover, a noticeable shift in consumer behavior, characterized by a greater preference for integrated ESD solutions that offer both functional protection and appealing aesthetics, is influencing product development and market strategies. The market penetration of Esd Laminate Sheets in its core applications, such as electronics manufacturing workstations, is already high and is expected to see further growth, while the penetration in emerging applications like advanced laboratories and specialized industrial settings is poised for accelerated expansion. The overall market size is predicted to reach US$ xx million by 2033, a substantial increase from an estimated US$ xx million in the base year of 2025. This growth is underpinned by ongoing investments in research and development, leading to innovative product offerings that cater to evolving industry needs and stringent performance requirements.

Dominant Regions, Countries, or Segments in Esd Laminate Sheet

The Electronics Manufacturing Workstations segment emerges as a dominant force driving market growth for Esd Laminate Sheets, propelled by the relentless expansion of the global electronics industry. Countries with a strong manufacturing base for semiconductors, consumer electronics, and telecommunications equipment, such as Taiwan, South Korea, China, and the United States, are key geographical hubs for this segment's dominance. The increasing miniaturization and complexity of electronic components necessitate stringent ESD control measures to prevent costly damage and ensure product reliability. Esd Laminate Sheets are indispensable in providing a safe and controlled environment for assembly, testing, and handling of these sensitive devices.

Key Drivers in Electronics Manufacturing Workstations:

- Rapid Technological Advancements: The continuous innovation in electronic devices, including 5G infrastructure, AI hardware, and IoT devices, fuels the demand for advanced ESD protection.

- Outsourcing and Global Supply Chains: The intricate global supply chains in electronics manufacturing necessitate consistent ESD standards across all production facilities, driving demand for standardized laminate solutions.

- Government Initiatives and R&D Investments: Supportive government policies and substantial R&D investments in the electronics sector in key regions further bolster the demand for high-performance ESD materials.

- Market Share: This segment is estimated to hold approximately xx% of the total Esd Laminate Sheet market share in the base year 2025.

Dominance Factors:

- The sheer volume of electronic devices produced globally makes this application segment a foundational market for Esd Laminate Sheets.

- The high cost of potential ESD damage to sophisticated electronic components incentivizes significant investment in protective measures, making laminate sheets a cost-effective solution compared to the potential losses.

- The growth potential remains substantial as emerging technologies continue to integrate more sensitive and powerful electronic components.

While the Electronics Manufacturing Workstations segment leads, other applications like Cleanrooms and Hospitals are experiencing significant growth due to the increasing stringency of contamination and ESD control requirements in these sensitive environments. The Square Edge type of Esd Laminate Sheet also commands a significant market share due to its ease of installation and seamless integration in various workstation designs, making it a preferred choice in many critical applications. The market share of the Square Edge type is estimated at xx%.

Esd Laminate Sheet Product Landscape

The Esd Laminate Sheet product landscape is characterized by ongoing innovation focused on enhanced ESD dissipation, superior durability, and aesthetic versatility. Manufacturers are developing advanced formulations that offer consistent and reliable electrostatic discharge protection, meeting stringent industry standards. Innovations include improved surface resistivity, excellent abrasion and chemical resistance for demanding environments, and the introduction of a wider range of aesthetic finishes, including wood grains, solid colors, and abstract patterns, allowing for seamless integration into modern workspace designs. Unique selling propositions often revolve around specialized formulations for specific applications, such as high-traffic areas or environments with extreme temperature variations, alongside advanced anti-microbial properties for healthcare settings. Technological advancements are also geared towards ease of maintenance and long-term performance, ensuring that Esd Laminate Sheets remain a preferred choice for critical applications where static control is paramount.

Key Drivers, Barriers & Challenges in Esd Laminate Sheet

Key Drivers:

The Esd Laminate Sheet market is primarily propelled by the ever-increasing sensitivity of electronic components and the growing adoption of advanced manufacturing technologies. Stringent regulatory requirements in sectors like electronics and healthcare mandating ESD control further accelerate demand. The miniaturization trend in electronics, leading to more delicate and susceptible components, necessitates robust static protection. Furthermore, the expanding global electronics manufacturing sector, particularly in emerging economies, creates a substantial market for ESD-safe materials. Technological advancements in laminate formulations, offering improved dissipation properties and durability, also act as key drivers.

Barriers & Challenges:

One of the primary barriers is the initial investment cost for high-performance Esd Laminate Sheets, which can be a concern for smaller enterprises. Supply chain disruptions, as witnessed in recent global events, can impact raw material availability and lead times, posing a significant challenge. Intense competition from alternative ESD solutions, such as conductive flooring and specialized coatings, necessitates continuous innovation and competitive pricing. Stringent certification processes for ESD compliance can also be time-consuming and costly for manufacturers. The lack of uniform global standards for ESD protection can create confusion and add complexity for businesses operating internationally. The estimated impact of supply chain disruptions on market growth is xx%.

Emerging Opportunities in Esd Laminate Sheet

Emerging opportunities in the Esd Laminate Sheet industry lie in the expanding applications within the rapidly growing Internet of Things (IoT) ecosystem, where numerous interconnected devices require reliable ESD protection. The increasing sophistication of medical devices and the expansion of healthcare facilities, especially in developing regions, present a significant untapped market for Esd Laminate Sheets in operating rooms and laboratories. Furthermore, the development of environmentally sustainable Esd Laminate Sheet formulations using recycled materials or bio-based resins caters to the growing demand for eco-friendly solutions. Opportunities also exist in the automotive electronics sector, as vehicles become increasingly reliant on sensitive electronic components. The development of aesthetically appealing and highly functional Esd Laminate Sheets for high-end residential and commercial smart home installations also represents an evolving consumer preference.

Growth Accelerators in the Esd Laminate Sheet Industry

Key catalysts driving long-term growth in the Esd Laminate Sheet industry include significant technological breakthroughs in material science, leading to enhanced ESD performance and extended product lifespans. Strategic partnerships between laminate manufacturers and electronics component suppliers are accelerating product development and market penetration by ensuring integrated ESD solutions. Market expansion strategies, particularly focusing on emerging economies with burgeoning electronics manufacturing sectors, are crucial growth accelerators. The continuous investment in research and development to create more cost-effective and versatile Esd Laminate Sheet options will also significantly fuel industry growth. Furthermore, the growing awareness and regulatory enforcement of ESD protection standards globally act as a powerful growth accelerator, compelling industries to adopt these essential materials.

Key Players Shaping the Esd Laminate Sheet Market

- Merino Group

- Greenlam

- Panolam Industries International, Inc.

- Stylam

- Arborite

- ELS Panels

- Northern Lam

- Desco Industries Inc.

- Workspaces And Storage

- WB Manufacturing

- Transforming Technologies

- R&R Lotion

- Norva Plastics

Notable Milestones in Esd Laminate Sheet Sector

- 2019: Introduction of advanced multi-layer Esd Laminate Sheets with enhanced wear resistance.

- 2020: Increased focus on sustainable manufacturing practices and the development of bio-based laminate options.

- 2021: Major players expand their product portfolios to include aesthetically diverse Esd Laminate Sheets for non-traditional applications.

- 2022: Rise in strategic collaborations to develop integrated ESD solutions for emerging technologies like AI hardware.

- 2023: Significant investment in R&D for thinner and more flexible Esd Laminate Sheet materials.

- 2024: Growing demand for Esd Laminate Sheets with enhanced chemical resistance for specialized industrial environments.

In-Depth Esd Laminate Sheet Market Outlook

The Esd Laminate Sheet market is poised for continued expansion, driven by robust technological advancements and an expanding range of applications. Growth accelerators, including the relentless evolution of electronics, stricter regulatory frameworks, and strategic market expansion, will underpin this positive outlook. Future growth will be significantly influenced by the industry's ability to innovate towards more sustainable and cost-effective solutions. Strategic opportunities lie in tapping into emerging markets, developing specialized laminate formulations for nascent industries, and catering to the increasing demand for aesthetically integrated ESD protection. The market's resilience and adaptability to evolving technological landscapes suggest a promising future with sustained demand and innovation.

Esd Laminate Sheet Segmentation

-

1. Application

- 1.1. Electronics Manufacturing Workstations

- 1.2. Cleanrooms

- 1.3. Hospitals

- 1.4. Others

-

2. Type

- 2.1. Square Edge

- 2.2. Bullnose

- 2.3. Other

Esd Laminate Sheet Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Esd Laminate Sheet REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Esd Laminate Sheet Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Electronics Manufacturing Workstations

- 5.1.2. Cleanrooms

- 5.1.3. Hospitals

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Square Edge

- 5.2.2. Bullnose

- 5.2.3. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Esd Laminate Sheet Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Electronics Manufacturing Workstations

- 6.1.2. Cleanrooms

- 6.1.3. Hospitals

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Square Edge

- 6.2.2. Bullnose

- 6.2.3. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Esd Laminate Sheet Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Electronics Manufacturing Workstations

- 7.1.2. Cleanrooms

- 7.1.3. Hospitals

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Square Edge

- 7.2.2. Bullnose

- 7.2.3. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Esd Laminate Sheet Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Electronics Manufacturing Workstations

- 8.1.2. Cleanrooms

- 8.1.3. Hospitals

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Square Edge

- 8.2.2. Bullnose

- 8.2.3. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Esd Laminate Sheet Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Electronics Manufacturing Workstations

- 9.1.2. Cleanrooms

- 9.1.3. Hospitals

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Square Edge

- 9.2.2. Bullnose

- 9.2.3. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Esd Laminate Sheet Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Electronics Manufacturing Workstations

- 10.1.2. Cleanrooms

- 10.1.3. Hospitals

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Square Edge

- 10.2.2. Bullnose

- 10.2.3. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Merino Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Greenlam

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Panolam Industries International Inc.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Stylam

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Arborite

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ELS Panels

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Northern Lam

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Desco Industries Inc.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Workspaces And Storage

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 WB Manufacturing

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Transforming Technologies

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 R&R Lotion

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Norva Plastics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Merino Group

List of Figures

- Figure 1: Global Esd Laminate Sheet Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Esd Laminate Sheet Revenue (million), by Application 2024 & 2032

- Figure 3: North America Esd Laminate Sheet Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Esd Laminate Sheet Revenue (million), by Type 2024 & 2032

- Figure 5: North America Esd Laminate Sheet Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Esd Laminate Sheet Revenue (million), by Country 2024 & 2032

- Figure 7: North America Esd Laminate Sheet Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Esd Laminate Sheet Revenue (million), by Application 2024 & 2032

- Figure 9: South America Esd Laminate Sheet Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Esd Laminate Sheet Revenue (million), by Type 2024 & 2032

- Figure 11: South America Esd Laminate Sheet Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Esd Laminate Sheet Revenue (million), by Country 2024 & 2032

- Figure 13: South America Esd Laminate Sheet Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Esd Laminate Sheet Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Esd Laminate Sheet Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Esd Laminate Sheet Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Esd Laminate Sheet Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Esd Laminate Sheet Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Esd Laminate Sheet Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Esd Laminate Sheet Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Esd Laminate Sheet Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Esd Laminate Sheet Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Esd Laminate Sheet Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Esd Laminate Sheet Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Esd Laminate Sheet Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Esd Laminate Sheet Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Esd Laminate Sheet Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Esd Laminate Sheet Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Esd Laminate Sheet Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Esd Laminate Sheet Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Esd Laminate Sheet Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Esd Laminate Sheet Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Esd Laminate Sheet Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Esd Laminate Sheet Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Esd Laminate Sheet Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Esd Laminate Sheet Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Esd Laminate Sheet Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Esd Laminate Sheet Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Esd Laminate Sheet Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Esd Laminate Sheet Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Esd Laminate Sheet Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Esd Laminate Sheet Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Esd Laminate Sheet Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Esd Laminate Sheet Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Esd Laminate Sheet Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Esd Laminate Sheet Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Esd Laminate Sheet Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Esd Laminate Sheet Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Esd Laminate Sheet Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Esd Laminate Sheet Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Esd Laminate Sheet Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Esd Laminate Sheet?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the Esd Laminate Sheet?

Key companies in the market include Merino Group, Greenlam, Panolam Industries International, Inc., Stylam, Arborite, ELS Panels, Northern Lam, Desco Industries Inc., Workspaces And Storage, WB Manufacturing, Transforming Technologies, R&R Lotion, Norva Plastics.

3. What are the main segments of the Esd Laminate Sheet?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2110 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Esd Laminate Sheet," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Esd Laminate Sheet report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Esd Laminate Sheet?

To stay informed about further developments, trends, and reports in the Esd Laminate Sheet, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence