Key Insights

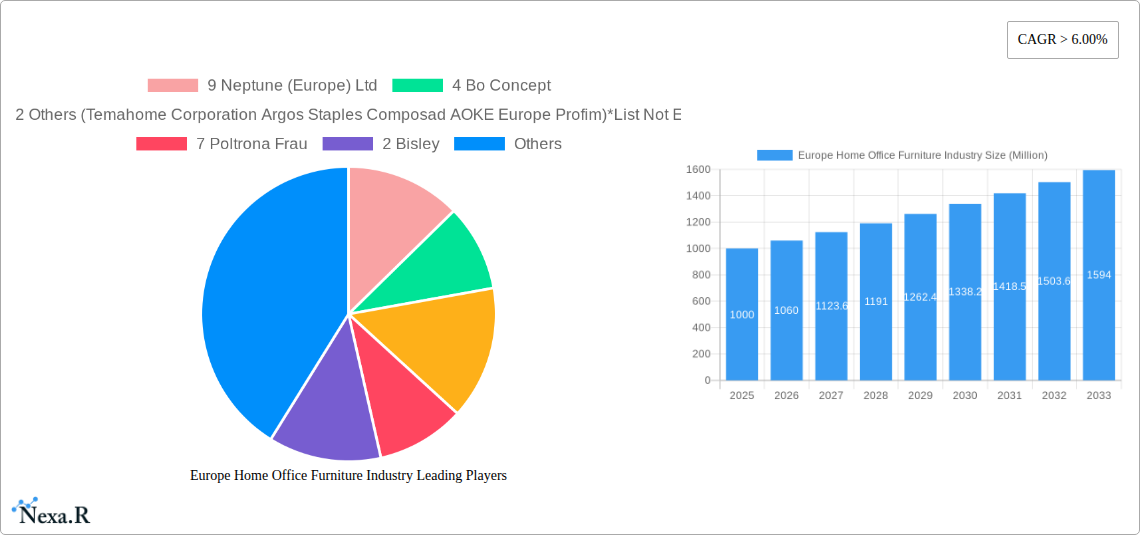

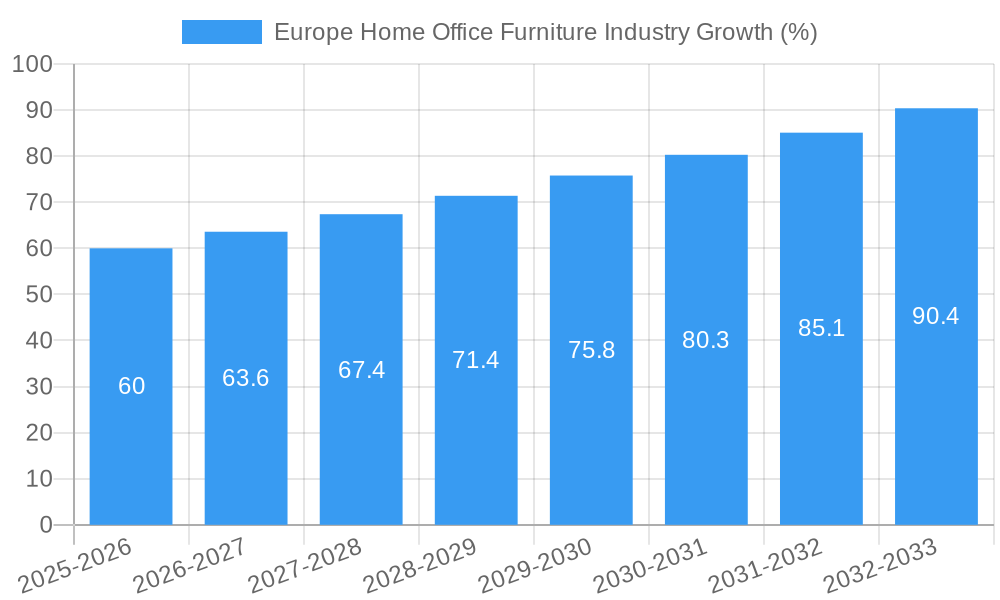

The European home office furniture market, valued at approximately €[Estimate based on market size XX and value unit Million. Let's assume XX = 1000 for this example, resulting in a 2025 market size of €1000 million] million in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 6% through 2033. This expansion is fueled by several key drivers. The enduring trend of remote and hybrid work models, accelerated by the recent pandemic, continues to stimulate demand for functional and aesthetically pleasing home office setups. Technological advancements, such as ergonomic chair designs and smart storage solutions, are also enhancing market appeal. Furthermore, increasing disposable incomes across several European nations, coupled with a growing emphasis on creating comfortable and productive home workspaces, contribute significantly to market growth. The market is segmented by product type (seating, tables & desks, storage, other furniture), distribution channels (flagship stores, specialty stores, online, others), and geography, with Germany, the UK, France, and Italy representing the largest national markets. Competitive pressures stem from established industry giants like IKEA and established players like Vitra and Knoll, alongside a growing number of specialized online retailers offering unique and customizable options. Challenges include fluctuating raw material costs and supply chain disruptions, potentially impacting pricing and delivery times. However, the long-term outlook remains positive, driven by sustained demand and ongoing innovation within the sector.

The leading companies in this dynamic market include IKEA, Vitra International AG, Knoll, and others such as Neptune (Europe) Ltd, Bo Concept, and Poltrona Frau. These companies leverage their brand recognition, design expertise, and distribution networks to capture significant market share. However, smaller, niche players offering specialized designs and customization options also carve out successful niches. The future of the European home office furniture market depends on adapting to evolving consumer preferences for sustainability, ergonomic design, and personalized workspace solutions. Companies that invest in research and development, efficient supply chains, and innovative e-commerce strategies are likely to see the most success in this competitive yet expanding sector.

Europe Home Office Furniture Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the Europe home office furniture industry, covering the period 2019-2033. It offers in-depth insights into market dynamics, growth trends, key players, and future opportunities, equipping industry professionals with the knowledge needed to navigate this evolving landscape. The report utilizes data from the base year 2025, with estimations for 2025 and forecasts extending to 2033. Market values are presented in million units.

Europe Home Office Furniture Industry Market Dynamics & Structure

The European home office furniture market is characterized by a moderately concentrated structure, with key players like IKEA, Vitra, and Knoll holding significant market share. However, a large number of smaller companies and regional players contribute significantly to the overall market volume. Technological innovation, particularly in ergonomic design and smart furniture, is a key driver. Stringent environmental regulations influence material sourcing and manufacturing processes, while competitive pressures from substitute products, such as adaptable shared workspaces, present a continuous challenge. Consumer demographics, especially the rise of remote work and the increasing importance of home office functionality, shape market demand. M&A activity within the sector has been moderate over the historical period (2019-2024), with xx deals recorded, primarily focused on expanding product portfolios and geographic reach.

- Market Concentration: Moderately concentrated, with top 10 players holding xx% market share in 2025.

- Technological Innovation: Focus on ergonomics, smart features, and sustainable materials.

- Regulatory Framework: Emphasis on sustainability and safety standards.

- Competitive Substitutes: Shared workspaces, co-working facilities.

- End-User Demographics: Growing remote work population, increasing demand for home office functionality.

- M&A Trends: Moderate activity, xx deals from 2019-2024, focusing on expansion and diversification.

Europe Home Office Furniture Industry Growth Trends & Insights

The European home office furniture market experienced significant growth during the historical period (2019-2024), driven by the accelerating adoption of remote work and flexible work arrangements. This trend is expected to continue throughout the forecast period (2025-2033), with a projected CAGR of xx%. The market size in 2025 is estimated at xx million units, and is forecast to reach xx million units by 2033. This growth is being fueled by technological advancements leading to innovative product designs, improved ergonomics, and increased functionality. Changes in consumer behavior, such as a preference for personalized and aesthetically pleasing home office spaces, also contribute to market expansion. Market penetration in terms of households with dedicated home office setups is currently at xx% and is projected to increase to xx% by 2033.

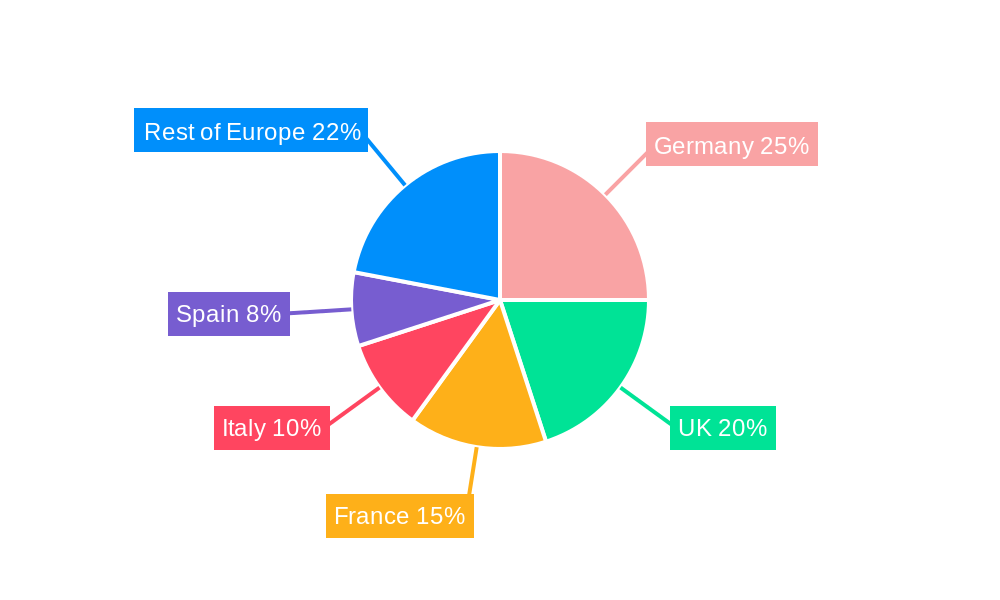

Dominant Regions, Countries, or Segments in Europe Home Office Furniture Industry

The United Kingdom, Germany, and France represent the largest national markets within Europe, driving a significant portion of the overall growth. Within product segments, seating (chairs and desks) and tables and desks command the highest market share, reflecting the core needs of a home office setup. Online distribution channels are experiencing rapid growth, driven by consumer convenience and enhanced e-commerce capabilities.

- By Country: United Kingdom, Germany, and France are the leading markets, driven by strong economies and high adoption rates of remote work.

- By Product: Seating and Tables & Desks segments dominate, accounting for xx% of the market in 2025.

- By Distribution Channel: Online channels are experiencing rapid growth, with xx% market share in 2025.

Europe Home Office Furniture Industry Product Landscape

The home office furniture market showcases a wide range of products, from traditional desks and chairs to sophisticated, ergonomically designed seating with adjustable features and smart desks incorporating technology integrations. Unique selling propositions often center around design aesthetics, sustainability certifications, and smart functionalities, including cable management systems and integrated power solutions. Technological advancements have led to materials that are more durable, adaptable, and sustainable.

Key Drivers, Barriers & Challenges in Europe Home Office Furniture Industry

Key Drivers: The increasing prevalence of remote work, coupled with heightened focus on creating ergonomic and productive home office environments, fuels market growth. Government incentives promoting work-from-home initiatives and technological advancements in furniture design further contribute.

Key Challenges: Supply chain disruptions, rising raw material costs, and intense competition from both established players and emerging brands pose significant challenges. Furthermore, fluctuations in economic conditions can impact consumer spending on non-essential home improvement items like premium office furniture.

Emerging Opportunities in Europe Home Office Furniture Industry

Untapped markets in Southern and Eastern Europe present significant growth opportunities. There is potential for expansion into niche segments like sustainable or customizable furniture, catering to the growing environmentally conscious consumer base. Furthermore, developing smart home integration capabilities and offering subscription-based furniture rental services can create new revenue streams.

Growth Accelerators in the Europe Home Office Furniture Industry

Strategic partnerships with technology companies to integrate smart features into furniture, coupled with expansion into underserved markets, will drive long-term growth. Focusing on sustainable and ethically sourced materials can attract environmentally conscious consumers. Continuous product innovation and diversification across design styles can broaden customer appeal and enhance market competitiveness.

Key Players Shaping the Europe Home Office Furniture Industry Market

- Actona Company A/S

- IKEA

- Bo Concept

- Bisley

- Knoll

- Vitra International Ag

- Poltrona Frau

- Laporta

- Royal Ahrend

- Nowy Styl

- 9 Neptune (Europe) Ltd

- Others (Temahome Corporation, Argos, Staples, Composad, AOKE Europe, Profim) List Not Exhaustive

Notable Milestones in Europe Home Office Furniture Industry Sector

- 2020: Increased demand for home office furniture due to COVID-19 lockdowns.

- 2021: Several key players launched new lines of ergonomic and sustainable furniture.

- 2022: Supply chain disruptions impacted production and delivery times.

- 2023: Increased focus on integrating technology into furniture.

- 2024: Several mergers and acquisitions took place within the industry.

In-Depth Europe Home Office Furniture Industry Market Outlook

The future of the European home office furniture market is bright, propelled by sustained growth in remote work, technological advancements, and evolving consumer preferences. Strategic investments in sustainable practices, smart home integration, and innovative product design will be crucial for companies to maintain a competitive edge and capitalize on emerging opportunities. The market is poised for continuous expansion, driven by a growing need for functional and aesthetically pleasing home office spaces.

Europe Home Office Furniture Industry Segmentation

-

1. Product

- 1.1. Seating

- 1.2. Tables and Desks

- 1.3. Storage Units

- 1.4. Other Home Office Furniture

-

2. Distribution Channel

- 2.1. Flagship Stores

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Europe Home Office Furniture Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Home Office Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The integration of technology into home office furniture is a significant driver. Desks and chairs with built-in technology

- 3.2.2 such as integrated power outlets

- 3.2.3 cable management systems

- 3.2.4 and connectivity features

- 3.2.5 are becoming more popular as they enhance the functionality of home office setups

- 3.3. Market Restrains

- 3.3.1 The home office furniture market is highly competitive

- 3.3.2 with numerous local and international brands vying for market share. Price sensitivity among consumers can put pressure on manufacturers and retailers to offer competitive pricing

- 3.3.3 potentially impacting profit margins.

- 3.4. Market Trends

- 3.4.1. The demand for flexible and adaptable furniture solutions is growing. Consumers are looking for home office furniture that can be easily adjusted or reconfigured to suit different work needs and spaces. Multi-functional furniture that serves various purposes is particularly popular

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Home Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Seating

- 5.1.2. Tables and Desks

- 5.1.3. Storage Units

- 5.1.4. Other Home Office Furniture

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Flagship Stores

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Germany Europe Home Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Home Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Home Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Home Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Home Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Home Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Home Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 9 Neptune (Europe) Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 4 Bo Concept

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 12 Others (Temahome Corporation Argos Staples Composad AOKE Europe Profim)*List Not Exhaustive

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 7 Poltrona Frau

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 2 Bisley

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 6 Vitra International Ag

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 11 Nowy Styl

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 8 Laporta

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 10 Royal Ahrend

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 5 Knoll

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 1 Actona Company A/S

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 3 IKEA

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 9 Neptune (Europe) Ltd

List of Figures

- Figure 1: Europe Home Office Furniture Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Home Office Furniture Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Home Office Furniture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Home Office Furniture Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Europe Home Office Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Europe Home Office Furniture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Home Office Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Home Office Furniture Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Europe Home Office Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Europe Home Office Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Home Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Home Office Furniture Industry?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Europe Home Office Furniture Industry?

Key companies in the market include 9 Neptune (Europe) Ltd, 4 Bo Concept, 12 Others (Temahome Corporation Argos Staples Composad AOKE Europe Profim)*List Not Exhaustive, 7 Poltrona Frau, 2 Bisley, 6 Vitra International Ag, 11 Nowy Styl, 8 Laporta, 10 Royal Ahrend, 5 Knoll, 1 Actona Company A/S, 3 IKEA.

3. What are the main segments of the Europe Home Office Furniture Industry?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The integration of technology into home office furniture is a significant driver. Desks and chairs with built-in technology. such as integrated power outlets. cable management systems. and connectivity features. are becoming more popular as they enhance the functionality of home office setups.

6. What are the notable trends driving market growth?

The demand for flexible and adaptable furniture solutions is growing. Consumers are looking for home office furniture that can be easily adjusted or reconfigured to suit different work needs and spaces. Multi-functional furniture that serves various purposes is particularly popular.

7. Are there any restraints impacting market growth?

The home office furniture market is highly competitive. with numerous local and international brands vying for market share. Price sensitivity among consumers can put pressure on manufacturers and retailers to offer competitive pricing. potentially impacting profit margins..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Home Office Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Home Office Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Home Office Furniture Industry?

To stay informed about further developments, trends, and reports in the Europe Home Office Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence