Key Insights

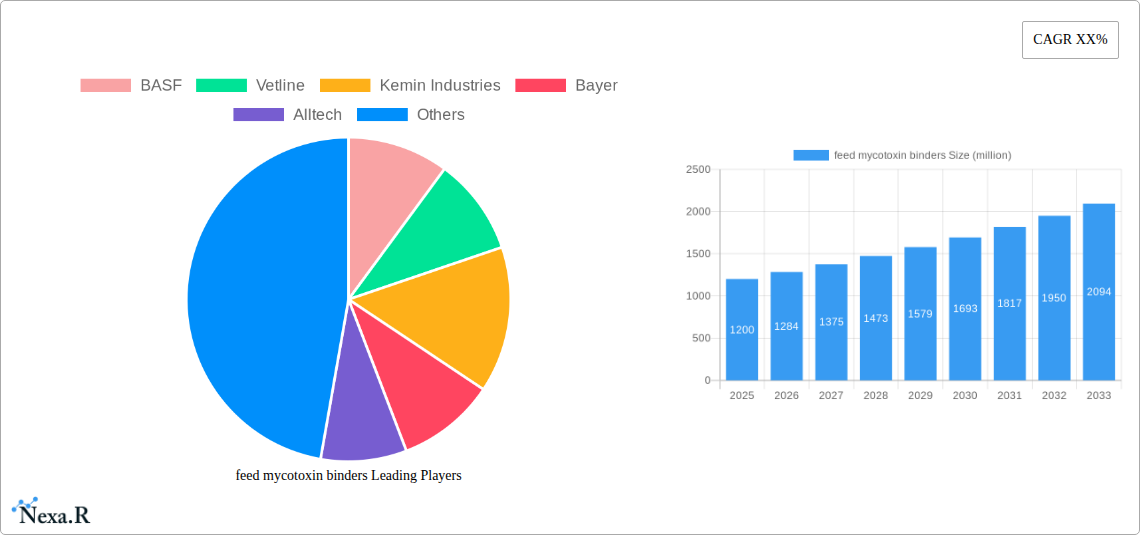

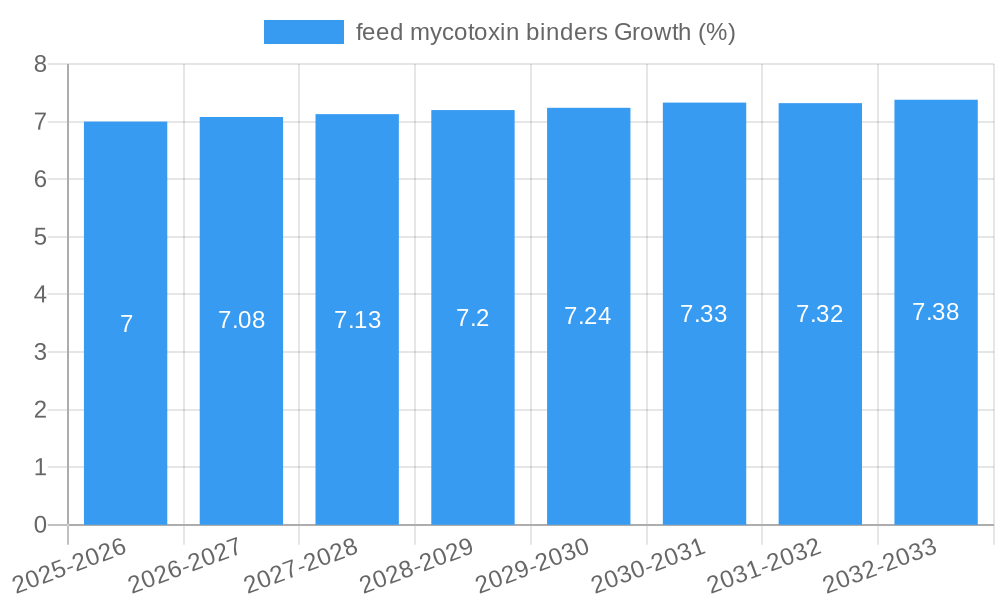

The global feed mycotoxin binders market is experiencing robust growth, projected to reach a substantial market size of approximately $1,200 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 7.5% during the forecast period of 2025-2033. This expansion is primarily driven by the escalating demand for animal protein, necessitating larger and more efficient livestock operations. The increasing awareness among feed producers and farmers about the detrimental effects of mycotoxins on animal health, productivity, and food safety further fuels market demand. Mycotoxins, produced by fungi, can contaminate animal feed, leading to significant economic losses through reduced feed intake, impaired growth, compromised immune systems, and potential residues in animal products. Consequently, the adoption of mycotoxin binders as a critical feed additive is becoming a standard practice to mitigate these risks.

The market is characterized by a diverse range of applications, with poultry and livestock segments holding the largest share due to their extensive production volumes. Aquaculture is also emerging as a significant growth area, driven by the increasing global consumption of fish and seafood. On the supply side, HSCAS (Hydrated Sodium Calcium Aluminosilicates) and Bentonite dominate the market due to their efficacy and cost-effectiveness in adsorbing a broad spectrum of mycotoxins. Emerging trends include the development of multi-functional binders with enhanced adsorption capabilities and synergistic effects with other feed additives, as well as a growing interest in natural and sustainable binder solutions. However, challenges such as stringent regulatory requirements for feed additives, the complexity of mycotoxin analysis, and the fluctuating prices of raw materials can pose restraints to market expansion. Key players are actively engaged in research and development, strategic collaborations, and market expansion initiatives to capitalize on the burgeoning opportunities within this vital sector of the animal feed industry.

Feed Mycotoxin Binders Market Dynamics & Structure

The global feed mycotoxin binders market is characterized by a moderately concentrated structure, with key players like BASF, Kemin Industries, Alltech, and Biomin holding significant market shares. Technological innovation is primarily driven by the demand for more effective and broad-spectrum mycotoxin control solutions, leading to advancements in binder formulations and delivery systems. Regulatory frameworks, particularly in major livestock-producing regions, play a crucial role in shaping market access and product efficacy standards. The competitive landscape includes both established chemical additive manufacturers and emerging players focusing on natural and sustainable binder options. End-user demographics are dominated by large-scale animal feed producers and integrated livestock operations seeking to minimize economic losses due to mycotoxin contamination. Mergers and acquisitions (M&A) activity is moderate, often focused on acquiring specialized technologies or expanding geographical reach.

- Market Concentration: Moderately concentrated, with top players dominating revenue.

- Technological Innovation Drivers: Need for broader spectrum efficacy, reduced anti-nutritional effects, and natural alternatives.

- Regulatory Frameworks: Strict quality control and approval processes in key livestock markets.

- Competitive Product Substitutes: Other feed additives, improved farming practices, and mycotoxin testing services.

- End-User Demographics: Primarily large-scale animal agriculture operations.

- M&A Trends: Strategic acquisitions to enhance product portfolios and market access.

Feed Mycotoxin Binders Growth Trends & Insights

The feed mycotoxin binders market is poised for robust growth, projected to reach approximately USD 1,350 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 5.2% during the forecast period of 2025–2033. The base year of 2025 sees the market valued at an estimated USD 1,020 million. This expansion is fueled by increasing awareness among livestock producers regarding the detrimental impact of mycotoxins on animal health, performance, and product quality. As global meat and dairy consumption rises, so does the demand for high-quality animal feed, further accentuating the need for effective mycotoxin mitigation strategies. Technological disruptions are continuously enhancing the efficacy and specificity of mycotoxin binders. The development of novel adsorbent materials, such as encapsulated binders and multi-component formulations, offers improved binding capacities and reduced interference with nutrient absorption.

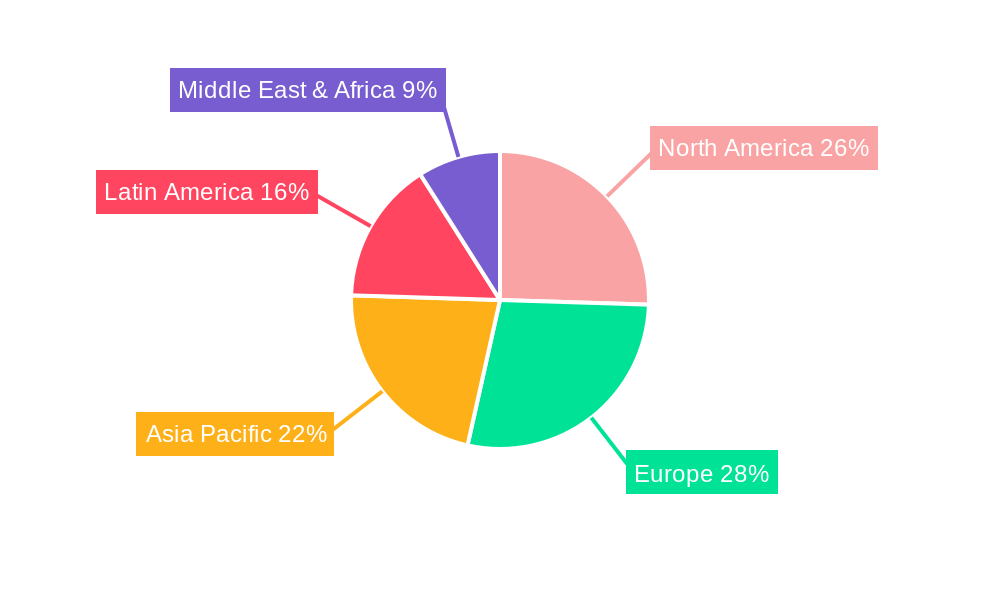

Furthermore, shifts in consumer preferences towards safer and more sustainably produced animal products are indirectly driving the adoption of advanced feed additives like mycotoxin binders. Stringent regulations regarding mycotoxin limits in feed and animal products in various regions, including North America and Europe, are compelling feed manufacturers to invest in these solutions. The parent market for animal feed additives, encompassing a broader range of nutritional and functional ingredients, provides a strong foundation and significant market penetration opportunities for specialized products like mycotoxin binders. The child market, focusing on specific animal species or mycotoxin types, offers niche growth avenues.

Adoption rates are accelerating due to the proven economic benefits of mycotoxin binder inclusion, which outweigh their costs by preventing performance losses, improving feed conversion ratios, and reducing veterinary expenses. The increasing prevalence of mycotoxin contamination in grains and agricultural commodities, exacerbated by climate change and unpredictable weather patterns, underscores the continuous need for these preventative measures. Consumer behavior is increasingly influenced by the perceived safety and quality of animal protein, pushing the industry towards proactive disease and contamination prevention. The estimated market size in the base year of 2025, around USD 1,020 million, signifies a substantial existing market that is set to expand considerably. The forecast period of 2025–2033 anticipates sustained growth, with the market reaching approximately USD 1,350 million, a testament to the enduring demand and innovation within this critical segment of animal nutrition.

Dominant Regions, Countries, or Segments in Feed Mycotoxin Binders

The Poultry segment is the dominant force driving growth in the global feed mycotoxin binders market. This dominance is rooted in several key factors that make poultry production particularly susceptible to mycotoxin contamination and highly sensitive to its detrimental effects. The rapid growth cycles and high-density housing common in poultry operations amplify the potential for widespread mycotoxin exposure and subsequent economic losses. The inherent physiological characteristics of poultry, such as their high feed intake relative to body weight and efficient digestive systems, mean that even low levels of mycotoxins can have a significant impact on growth, immunity, and reproductive performance.

Key Drivers in the Poultry Segment:

- High Feed Consumption: Poultry consume large quantities of feed, increasing their exposure risk.

- Sensitivity to Mycotoxins: Reduced feed intake, impaired growth, compromised immune systems, and decreased egg production are critical concerns.

- Economic Impact: Mycotoxin contamination directly affects profitability through reduced weight gain, increased mortality, and poor feed conversion ratios.

- Global Importance of Poultry: Poultry is a major source of animal protein worldwide, leading to large-scale production and high demand for feed additives.

- Technological Advancements in Binder Efficacy: Development of binders specifically tailored to bind common poultry mycotoxins like aflatoxins and fumonisins.

Geographically, North America and Europe currently represent the leading regions, driven by advanced animal husbandry practices, stringent regulatory oversight, and substantial investments in research and development by key players. The substantial volume of poultry production in countries like the United States, Brazil, and in European Union member states contributes significantly to regional market share. Asia-Pacific, however, is emerging as a high-growth region, propelled by the rapidly expanding poultry sector in countries such as China and India, coupled with increasing awareness of mycotoxin risks and the adoption of modern farming techniques.

In terms of Types of mycotoxin binders, HSCAS (Hydrated Sodium Calcium Aluminosilicate) and Bentonite clays have historically dominated the market due to their cost-effectiveness and broad-spectrum binding capabilities for certain mycotoxins. However, there is a growing trend towards specialized binders like Polysaccharides and Zeolites, particularly for targeting specific mycotoxins or offering improved efficacy in challenging conditions. The market share for Bentonite is estimated to be around 35% in 2025, with HSCAS at 30%. Polysaccharide-based binders are expected to grow at a CAGR of 6.5% during the forecast period, driven by demand for natural and highly effective solutions. The overall market for mycotoxin binders is projected to reach USD 1,350 million by 2033, with the poultry segment accounting for an estimated 45% of this value.

Feed Mycotoxin Binders Product Landscape

The feed mycotoxin binders market is experiencing continuous product innovation focused on enhancing binding efficacy, expanding the spectrum of mycotoxins targeted, and improving the overall nutritional profile of animal feed. Key developments include the introduction of multi-component binders that synergistically address a wider range of mycotoxins, such as HSCAS combined with yeast cell wall extracts or specific organic acids. Advanced formulations leverage nanotechnological approaches to increase surface area and binding sites, leading to superior mycotoxin sequestration. Furthermore, there is a significant push towards naturally derived binders, including specific types of clays, algal extracts, and activated charcoal, catering to the growing demand for sustainable and "clean label" feed solutions. Performance metrics are increasingly emphasizing not only the percentage of mycotoxin binding but also the reduction in anti-nutritional effects and the positive impact on animal health and performance indicators.

Key Drivers, Barriers & Challenges in Feed Mycotoxin Binders

Key Drivers:

- Increasing Mycotoxin Contamination: Climate change and agricultural practices lead to higher incidences of mycotoxin presence in feed ingredients, necessitating preventative measures.

- Growing Global Demand for Animal Protein: Expanded livestock and aquaculture production directly translates to increased demand for safe and effective feed solutions.

- Awareness of Economic Losses: Producers recognize the significant financial impact of mycotoxins on animal health, productivity, and product quality, driving investment in mitigation strategies.

- Stringent Food Safety Regulations: Government regulations worldwide mandate strict limits for mycotoxins in animal feed and products, compelling industry compliance.

- Technological Advancements: Continuous innovation in binder formulations, including natural and broad-spectrum options, enhances market attractiveness.

Key Barriers & Challenges:

- Cost-Effectiveness Concerns: The price of high-efficacy binders can be a deterrent for some producers, especially in price-sensitive markets.

- Variability in Mycotoxin Types and Levels: The diverse nature of mycotoxins and their fluctuating concentrations in feed ingredients require flexible and broad-spectrum solutions.

- Competition from Alternative Solutions: Other feed additives and farm management practices can be perceived as substitutes.

- Limited Efficacy Against All Mycotoxins: Some binders are highly specific and may not effectively bind all prevalent mycotoxins.

- Supply Chain Volatility: Dependence on specific raw materials and potential disruptions can impact availability and pricing.

Emerging Opportunities in Feed Mycotoxin Binders

Emerging opportunities in the feed mycotoxin binders market are centered around the development and adoption of highly specific and synergistic binder formulations that target emerging mycotoxins and their combinations. The increasing consumer demand for naturally sourced and sustainable animal products is driving the growth of "green" binders derived from algae, fungi, and specialized plant extracts. Untapped markets in developing regions with rapidly growing animal agriculture sectors, such as Southeast Asia and parts of Africa, present significant growth potential as awareness and investment in animal health increase. Furthermore, the integration of advanced diagnostic tools for precise mycotoxin profiling in feed ingredients offers opportunities for personalized binder solutions, optimizing efficacy and cost-effectiveness for individual farm operations.

Growth Accelerators in the Feed Mycotoxin Binders Industry

Several factors are accelerating growth in the feed mycotoxin binders industry. Technological breakthroughs in biotechnology and material science are leading to the development of novel adsorbent materials with superior binding capacities and specificities. Strategic partnerships between feed additive manufacturers and academic institutions are fostering innovation and the rapid translation of research into commercial products. Market expansion strategies by key players into rapidly developing agricultural economies are tapping into new customer bases. The growing emphasis on animal welfare and antibiotic-free production systems also indirectly boosts the demand for mycotoxin binders as a means to support robust immune systems and overall animal health, thereby reducing the reliance on therapeutic interventions.

Key Players Shaping the Feed Mycotoxin Binders Market

- BASF

- Vetline

- Kemin Industries

- Bayer

- Alltech

- Virbac Group

- Novus International

- Selko

- Anfotel Nutrition

- Biomin

- FF Chemicals

- Bentoli

- VisscherHolland

- VL Vipro

- Amlan International

- Impextraco NV

- Feed Industryrvice

Notable Milestones in Feed Mycotoxin Binders Sector

- 2019: Launch of novel polysaccharide-based binders with enhanced efficacy against multiple mycotoxins.

- 2020: Increased regulatory scrutiny and updated mycotoxin limits in key markets, driving demand for advanced solutions.

- 2021: Significant investment in R&D for natural and sustainable mycotoxin binder alternatives.

- 2022: Several mergers and acquisitions aimed at consolidating market share and expanding product portfolios.

- 2023: Introduction of precision farming integration, allowing for tailored mycotoxin binder application based on feed analysis.

- 2024: Growing focus on mycotoxin combinations and their synergistic toxic effects, leading to the development of multi-target binders.

In-Depth Feed Mycotoxin Binders Market Outlook

The feed mycotoxin binders market outlook is exceptionally positive, driven by sustained demand for animal protein and an increasing understanding of the pervasive threat of mycotoxin contamination. Growth accelerators, including cutting-edge technological innovations in binder formulations and strategic global market expansion by leading companies, are set to propel the industry forward. The shift towards natural and sustainable feed additives, coupled with stringent regulatory environments and growing consumer awareness regarding food safety, creates a fertile ground for continued innovation and market penetration. The estimated market value of USD 1,350 million by 2033 underscores the critical role these products play in ensuring animal health, farm profitability, and the safety of the global food supply chain. Strategic opportunities lie in addressing emerging mycotoxins and their combinations, as well as in catering to the unique needs of rapidly developing agricultural economies.

feed mycotoxin binders Segmentation

-

1. Application

- 1.1. Poultry

- 1.2. Livestock

- 1.3. Ruminant

- 1.4. Aquaculture

- 1.5. Others

-

2. Types

- 2.1. HSCAS

- 2.2. Bentonite

- 2.3. Zeolites

- 2.4. Polysaccharide

- 2.5. Others

feed mycotoxin binders Segmentation By Geography

- 1. CA

feed mycotoxin binders REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. feed mycotoxin binders Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Poultry

- 5.1.2. Livestock

- 5.1.3. Ruminant

- 5.1.4. Aquaculture

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. HSCAS

- 5.2.2. Bentonite

- 5.2.3. Zeolites

- 5.2.4. Polysaccharide

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. CA

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 BASF

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vetline

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kemin Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayer

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alltech

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Virbac Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Novus International

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Selko

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Anfotel Nutrition

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Biomin

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 FF Chemicals

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Bentoli

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 VisscherHolland

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 VL Vipro

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Amlan International

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Impextraco NV

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Feed Industryrvice

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 BASF

List of Figures

- Figure 1: feed mycotoxin binders Revenue Breakdown (million, %) by Product 2024 & 2032

- Figure 2: feed mycotoxin binders Share (%) by Company 2024

List of Tables

- Table 1: feed mycotoxin binders Revenue million Forecast, by Region 2019 & 2032

- Table 2: feed mycotoxin binders Revenue million Forecast, by Application 2019 & 2032

- Table 3: feed mycotoxin binders Revenue million Forecast, by Types 2019 & 2032

- Table 4: feed mycotoxin binders Revenue million Forecast, by Region 2019 & 2032

- Table 5: feed mycotoxin binders Revenue million Forecast, by Application 2019 & 2032

- Table 6: feed mycotoxin binders Revenue million Forecast, by Types 2019 & 2032

- Table 7: feed mycotoxin binders Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the feed mycotoxin binders?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the feed mycotoxin binders?

Key companies in the market include BASF, Vetline, Kemin Industries, Bayer, Alltech, Virbac Group, Novus International, Selko, Anfotel Nutrition, Biomin, FF Chemicals, Bentoli, VisscherHolland, VL Vipro, Amlan International, Impextraco NV, Feed Industryrvice.

3. What are the main segments of the feed mycotoxin binders?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3400.00, USD 5100.00, and USD 6800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "feed mycotoxin binders," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the feed mycotoxin binders report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the feed mycotoxin binders?

To stay informed about further developments, trends, and reports in the feed mycotoxin binders, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence