Key Insights

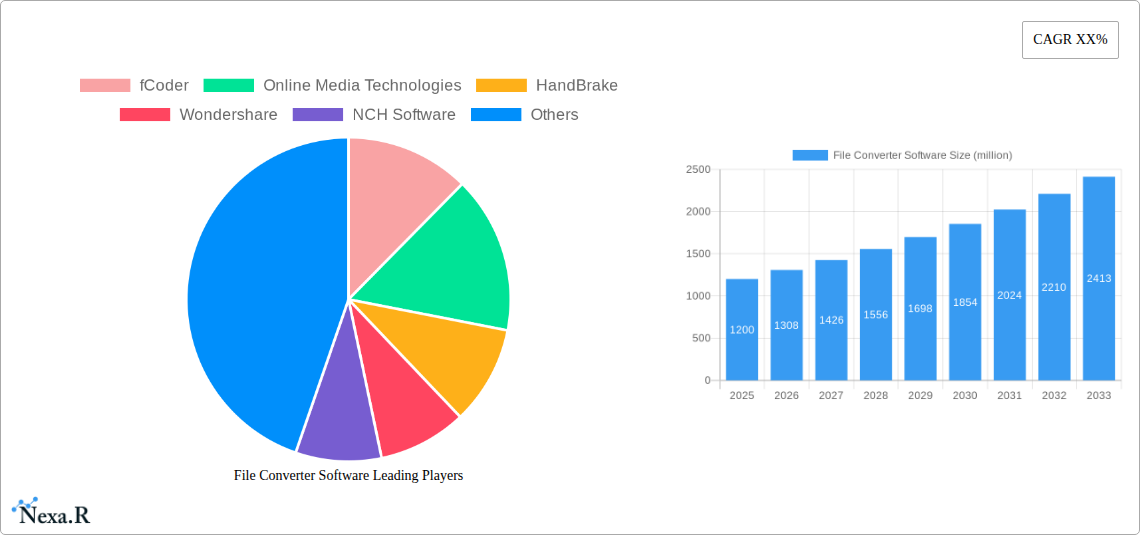

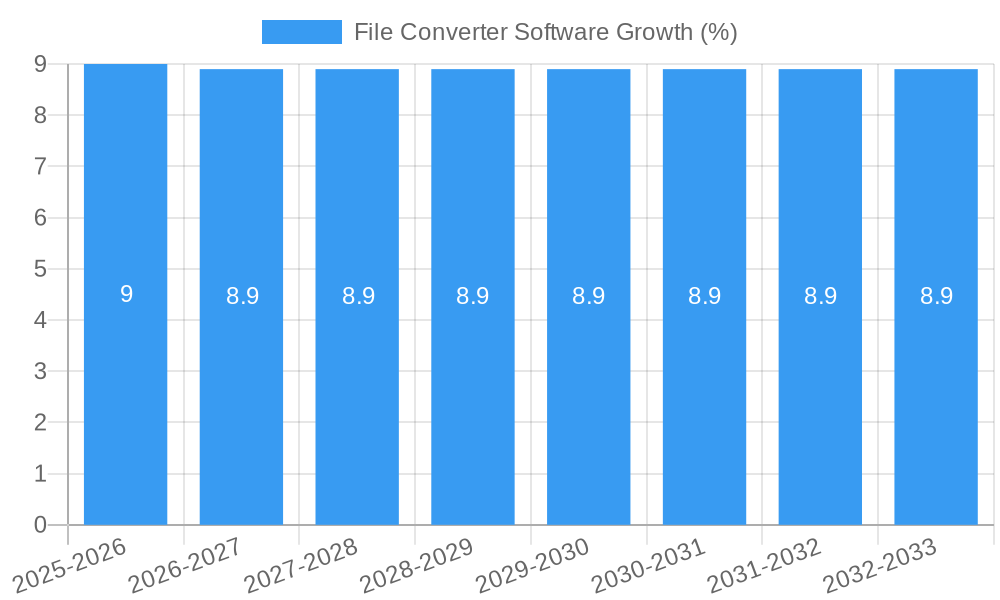

The global File Converter Software market is poised for significant expansion, projected to reach approximately $1,200 million by 2025, with a compelling compound annual growth rate (CAGR) of around 9%. This robust growth trajectory is fueled by the escalating demand for seamless data interoperability across diverse platforms and file formats. Individuals and enterprises alike are increasingly reliant on efficient tools to convert documents, images, audio, and video files, driving the adoption of both on-premise and cloud-based solutions. The proliferation of digital content creation and the continuous evolution of file standards necessitate sophisticated conversion capabilities, making file converter software an indispensable utility in today's digital landscape. The market's dynamism is further underscored by the continuous innovation from key players, offering enhanced features such as batch conversion, OCR integration, and specialized format support.

The market's expansion is strategically driven by the increasing digital transformation initiatives across industries, necessitating the handling and manipulation of a wide array of file types. Businesses are actively seeking solutions that can streamline workflows, improve collaboration, and ensure data accessibility across different applications and operating systems. This trend is particularly evident in sectors like media and entertainment, education, and software development, where cross-format compatibility is paramount. While the market exhibits strong growth potential, certain restraints, such as the complexity of handling highly specialized or proprietary file formats and the emergence of universal file standards that might reduce the need for conversion in some niche areas, warrant careful consideration. Nevertheless, the overarching trend towards a more interconnected digital ecosystem, coupled with the ongoing need for data portability and integration, strongly supports sustained market growth for file converter software.

File Converter Software Market Dynamics & Structure

The global file converter software market is characterized by a moderate to high concentration, with several key players like Wondershare, NCH Software, and Apowersoft holding significant market share. Technological innovation is a primary driver, with continuous advancements in supporting a wider range of file formats, improving conversion speeds, and enhancing data integrity. Regulatory frameworks are largely supportive, focusing on data privacy and security, which are critical considerations for enterprise adoption. Competitive product substitutes include integrated features within operating systems and other productivity suites, though dedicated file converter software offers specialized functionalities.

- Market Concentration: Estimated at 65% by the top 5 vendors in the Base Year 2025.

- Technological Innovation Drivers: Demand for cross-platform compatibility, AI-powered conversion enhancements, and cloud integration.

- Regulatory Frameworks: Primarily focused on data protection (e.g., GDPR, CCPA) influencing feature development.

- Competitive Product Substitutes: Built-in OS tools, document editors with export functions, and online conversion websites.

- End-User Demographics: Split between individual users seeking convenience and enterprises requiring bulk processing and integration.

- M&A Trends: Expected to see strategic acquisitions of niche technology providers and consolidation for expanded market reach. The volume of M&A deals is projected to be around 3-5 major transactions annually during the forecast period, with deal values varying significantly based on target company size and technological IP.

File Converter Software Growth Trends & Insights

The file converter software market is poised for robust growth, driven by the ever-expanding digital content landscape and the increasing need for seamless inter-application file compatibility. In the Base Year 2025, the global market size is projected to reach approximately \$2,500 million units, with an anticipated Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period of 2025–2033. This expansion is fueled by a rising adoption rate across both individual and enterprise segments, as users encounter a growing diversity of file formats in their daily workflows. Technological disruptions, such as the integration of AI and machine learning for intelligent format detection and optimized conversion, are further enhancing the appeal and functionality of these tools.

Consumer behavior shifts also play a crucial role. The proliferation of mobile devices and cloud-based storage solutions necessitates software that can effortlessly bridge format gaps between different platforms and services. For instance, individuals frequently need to convert documents for sharing across iOS and Android devices, or images for social media platforms. Enterprises, on the other hand, are increasingly relying on file converters for streamlining document management, ensuring interoperability between disparate software systems, and facilitating efficient data migration. This broad applicability and the continuous evolution of digital content creation are the bedrock of the market's upward trajectory. The market penetration for dedicated file converter software, currently estimated at 35% of potential users in 2025, is expected to climb to over 50% by the end of the forecast period. This growth is further augmented by the increasing complexity of proprietary file formats that require specialized conversion solutions. The demand for high-fidelity conversions, preserving original formatting and data integrity, is also a significant driver.

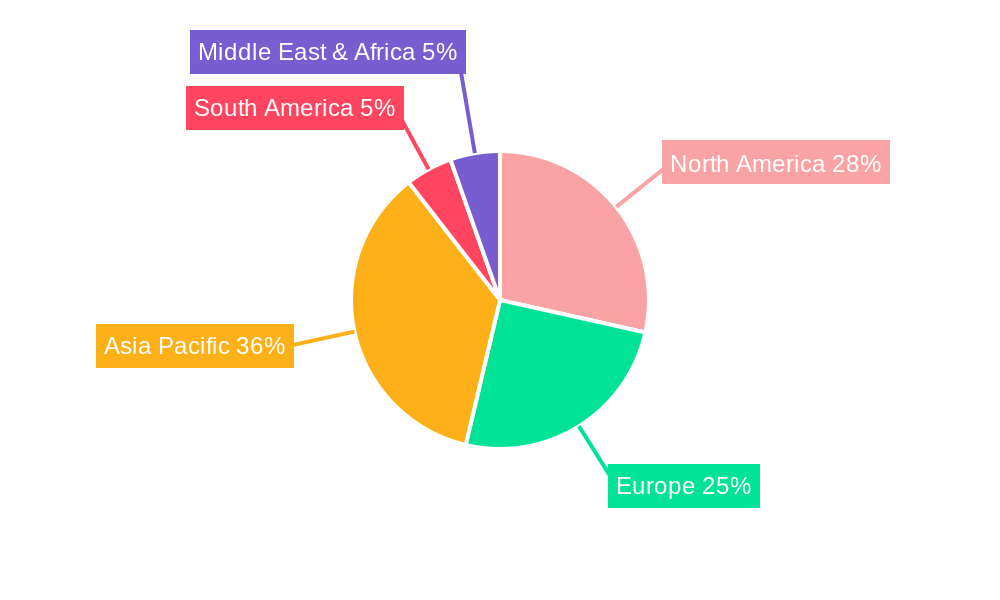

Dominant Regions, Countries, or Segments in File Converter Software

The North America region is projected to be a dominant force in the global file converter software market, driven by a confluence of factors including its robust technological infrastructure, a high concentration of enterprises across various sectors, and a significant individual user base embracing digital workflows. In the Base Year 2025, North America is expected to command approximately 38% of the global market share. The United States, in particular, leads this dominance due to its strong economy, widespread adoption of cloud-based solutions, and a culture of innovation that encourages the development and utilization of advanced software tools. The presence of major technology companies and a significant demand for productivity enhancement tools contribute to the substantial market penetration of file converter software within this region.

- North America's Dominance: Expected to hold around 38% of the global market share in 2025.

- Key Drivers: High internet penetration, strong enterprise adoption of cloud services, and a large individual user base.

- Economic Policies: Favorable business environment and investment in technology development.

- Infrastructure: Advanced digital infrastructure supporting seamless software deployment and usage.

- Enterprise Segment Growth: The enterprise segment within North America is a major contributor, driven by the need for efficient document management, workflow automation, and data interoperability across diverse business applications. Companies are increasingly investing in solutions that can handle bulk conversions, integrate with existing enterprise resource planning (ERP) and customer relationship management (CRM) systems, and ensure data security during conversion processes. The market size for enterprise file converter solutions in North America is estimated to be \$1,200 million units in 2025.

- Cloud-Based Type Adoption: The preference for cloud-based file converter software is accelerating in North America. This is attributed to its scalability, accessibility from any device with an internet connection, and reduced IT overhead for businesses. The market for cloud-based solutions is expected to grow at a CAGR of 15% during the forecast period, outperforming on-premise solutions. This trend is further supported by the increasing adoption of Software-as-a-Service (SaaS) models for business applications.

- Individual User Segment: The individual user segment also contributes significantly, driven by the widespread use of personal computers and smartphones for various tasks, from academic work to personal projects. The ease of use and affordability of many file converter applications cater to this demographic. The individual segment in North America is estimated at \$700 million units in 2025.

File Converter Software Product Landscape

The file converter software landscape is dynamic, marked by continuous product innovation and a widening array of applications. Companies are focusing on developing solutions that offer high-fidelity conversions, preserving the original formatting and data integrity across a vast spectrum of file types, including documents, images, audio, and video. Key technological advancements include the integration of Artificial Intelligence for smarter format recognition and optimization, enhanced batch processing capabilities for enterprise users, and seamless cloud synchronization for accessibility. Unique selling propositions often revolve around conversion speed, user-friendliness, comprehensive format support, and robust security features, particularly for sensitive enterprise data. The performance metrics of these software solutions are increasingly judged by their accuracy, efficiency, and compatibility with both legacy and emerging file formats.

Key Drivers, Barriers & Challenges in File Converter Software

The file converter software market is propelled by several key drivers, including the relentless growth of digital content, the increasing demand for cross-platform compatibility, and the need for streamlined document management in both personal and professional spheres. Technological advancements, such as AI integration for improved conversion accuracy and speed, also act as significant growth accelerators.

- Key Drivers:

- Explosion of digital content creation and consumption.

- Need for seamless interoperability between diverse devices and applications.

- Enterprise requirements for efficient data management and workflow automation.

- Advancements in AI and cloud computing enhancing conversion capabilities.

Conversely, the market faces barriers and challenges such as the complexity of supporting an ever-growing number of obscure file formats, the risk of data corruption or loss during conversion, and the increasing prevalence of free online converters that may lack advanced features or security. Security and privacy concerns, especially for enterprises handling sensitive data, also present a significant hurdle.

- Key Barriers & Challenges:

- Maintaining compatibility with an expanding universe of file formats.

- Ensuring data integrity and preventing corruption during conversion.

- Security and privacy concerns related to sensitive data processing.

- Competition from free online conversion tools and integrated OS features.

- Potential for outdated or unoptimized conversion algorithms.

Emerging Opportunities in File Converter Software

Emerging opportunities in the file converter software sector lie in the development of specialized AI-powered converters capable of understanding and transforming complex design files and engineering blueprints with high precision. The growing demand for secure, end-to-end encrypted conversion services for sensitive legal and medical documents presents a significant untapped market. Furthermore, integrating file conversion capabilities directly into collaboration platforms and project management tools offers a chance to embed these functionalities seamlessly into existing workflows, enhancing user productivity. The expansion into emerging economies with rapidly digitizing populations also presents substantial growth potential.

Growth Accelerators in the File Converter Software Industry

The file converter software industry is witnessing growth acceleration driven by strategic partnerships between software developers and hardware manufacturers to ensure native support for new file formats. The increasing adoption of cloud-native architectures and the subsequent demand for cloud-to-cloud file format conversion are also significant catalysts. Furthermore, advancements in multimodal AI are enabling more intelligent and context-aware conversions, reducing the need for manual intervention and improving user experience. The market expansion into niche industries requiring specialized file format conversions, such as scientific research and media production, is also contributing to sustained growth.

Key Players Shaping the File Converter Software Market

- fCoder

- Online Media Technologies

- HandBrake

- Wondershare

- NCH Software

- deskUNPDF

- MasterSoft

- Apowersoft

- Doc Converter Pro

- CloudConvert

- DataNumen

- FileStar

- Recovery Toolbox

- Officewise

- PowerMockup

Notable Milestones in File Converter Software Sector

- 2021 January: Wondershare releases a significant update to PDFelement, enhancing its PDF to Office conversion capabilities with improved layout preservation.

- 2022 March: CloudConvert introduces advanced API features, enabling developers to integrate robust file conversion into their applications more seamlessly.

- 2022 October: NCH Software launches a new suite of document conversion tools with enhanced support for enterprise-level batch processing.

- 2023 April: Apowersoft integrates AI-driven OCR technology into its file converter, improving text recognition accuracy for scanned documents.

- 2023 December: HandBrake releases version 1.6, focusing on improved video encoding performance and broader codec support.

- 2024 May: DataNumen releases a specialized converter for Outlook PST files, addressing a critical need for data recovery and migration.

In-Depth File Converter Software Market Outlook

The future market outlook for file converter software remains exceptionally bright, with sustained growth anticipated throughout the forecast period. The increasing digitization of all aspects of life and business, coupled with the ongoing evolution of digital formats, ensures a perpetual demand for efficient and reliable conversion tools. The strategic focus on integrating AI for smarter, more accurate conversions, alongside robust security protocols, will be crucial for capturing enterprise market share. The expansion into niche applications and emerging markets, driven by the inherent need for seamless data exchange, will further accelerate industry growth. Companies that prioritize user experience, comprehensive format support, and adaptability to new technological paradigms are best positioned for long-term success in this dynamic sector.

File Converter Software Segmentation

-

1. Application

- 1.1. Individuals

- 1.2. Enterprises

-

2. Types

- 2.1. On-Premise

- 2.2. Cloud-Based

File Converter Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

File Converter Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global File Converter Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Individuals

- 5.1.2. Enterprises

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. On-Premise

- 5.2.2. Cloud-Based

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America File Converter Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Individuals

- 6.1.2. Enterprises

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. On-Premise

- 6.2.2. Cloud-Based

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America File Converter Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Individuals

- 7.1.2. Enterprises

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. On-Premise

- 7.2.2. Cloud-Based

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe File Converter Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Individuals

- 8.1.2. Enterprises

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. On-Premise

- 8.2.2. Cloud-Based

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa File Converter Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Individuals

- 9.1.2. Enterprises

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. On-Premise

- 9.2.2. Cloud-Based

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific File Converter Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Individuals

- 10.1.2. Enterprises

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. On-Premise

- 10.2.2. Cloud-Based

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 fCoder

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Online Media Technologies

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HandBrake

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Wondershare

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 NCH Software

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 deskUNPDF

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MasterSoft

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Apowersoft

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Doc Converter Pro

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CloudConvert

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 DataNumen

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 FileStar

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Recovery Toolbox

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Officewise

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 PowerMockup

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 fCoder

List of Figures

- Figure 1: Global File Converter Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America File Converter Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America File Converter Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America File Converter Software Revenue (million), by Types 2024 & 2032

- Figure 5: North America File Converter Software Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America File Converter Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America File Converter Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America File Converter Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America File Converter Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America File Converter Software Revenue (million), by Types 2024 & 2032

- Figure 11: South America File Converter Software Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America File Converter Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America File Converter Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe File Converter Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe File Converter Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe File Converter Software Revenue (million), by Types 2024 & 2032

- Figure 17: Europe File Converter Software Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe File Converter Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe File Converter Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa File Converter Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa File Converter Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa File Converter Software Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa File Converter Software Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa File Converter Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa File Converter Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific File Converter Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific File Converter Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific File Converter Software Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific File Converter Software Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific File Converter Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific File Converter Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global File Converter Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global File Converter Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global File Converter Software Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global File Converter Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global File Converter Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global File Converter Software Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global File Converter Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global File Converter Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global File Converter Software Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global File Converter Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global File Converter Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global File Converter Software Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global File Converter Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global File Converter Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global File Converter Software Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global File Converter Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global File Converter Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global File Converter Software Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global File Converter Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific File Converter Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the File Converter Software?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the File Converter Software?

Key companies in the market include fCoder, Online Media Technologies, HandBrake, Wondershare, NCH Software, deskUNPDF, MasterSoft, Apowersoft, Doc Converter Pro, CloudConvert, DataNumen, FileStar, Recovery Toolbox, Officewise, PowerMockup.

3. What are the main segments of the File Converter Software?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "File Converter Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the File Converter Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the File Converter Software?

To stay informed about further developments, trends, and reports in the File Converter Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence