Key Insights

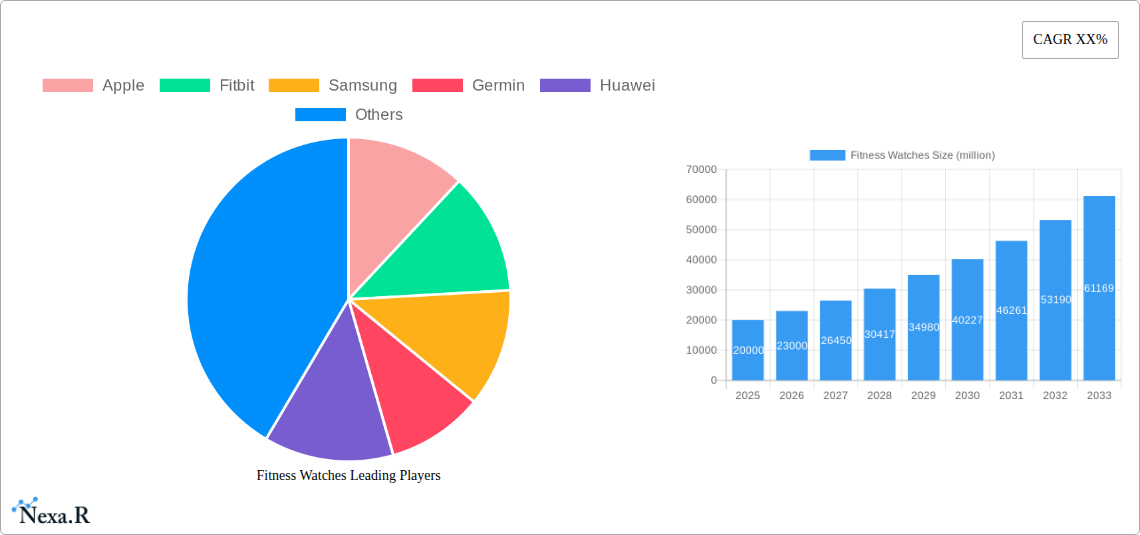

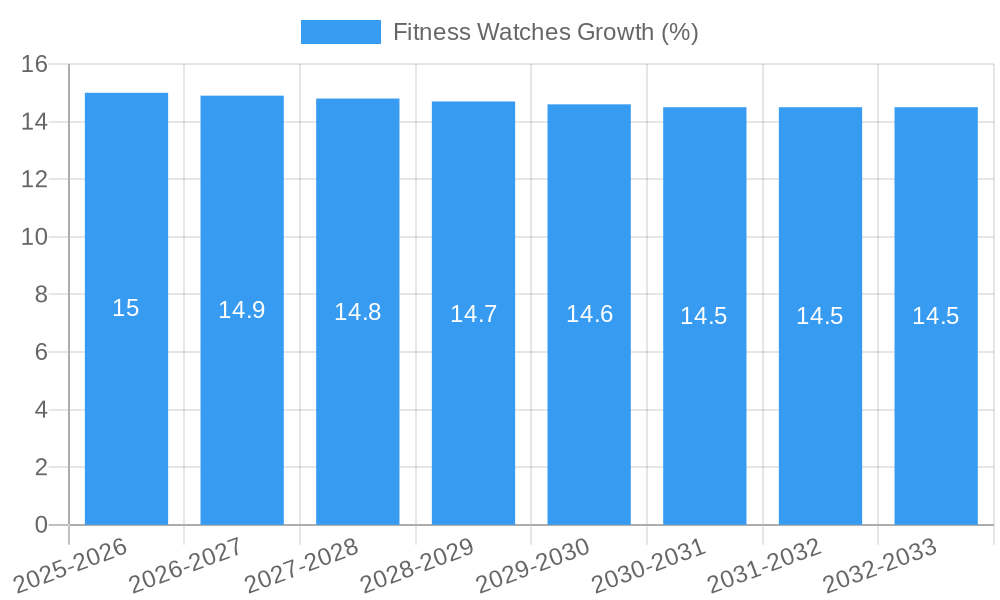

The global fitness watch market is projected for substantial growth, estimated at a robust market size of approximately $20,000 million in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 15% over the forecast period of 2025-2033. This expansion is primarily driven by the increasing health consciousness among consumers worldwide and the rising adoption of sedentary lifestyles necessitating proactive health monitoring. Key growth drivers include the escalating demand for advanced health tracking features like continuous heart rate monitoring, blood oxygen saturation (SpO2) measurement, and sleep pattern analysis, all of which are becoming standard in modern fitness watches. The proliferation of online retail channels, coupled with innovative product launches by leading brands, further fuels market penetration. The market is segmented into various types, including pedometer watches, GPS watches, heart rate watches, and advanced GPS + HRM watches, catering to a diverse range of consumer needs from basic step counting to professional athletic performance tracking.

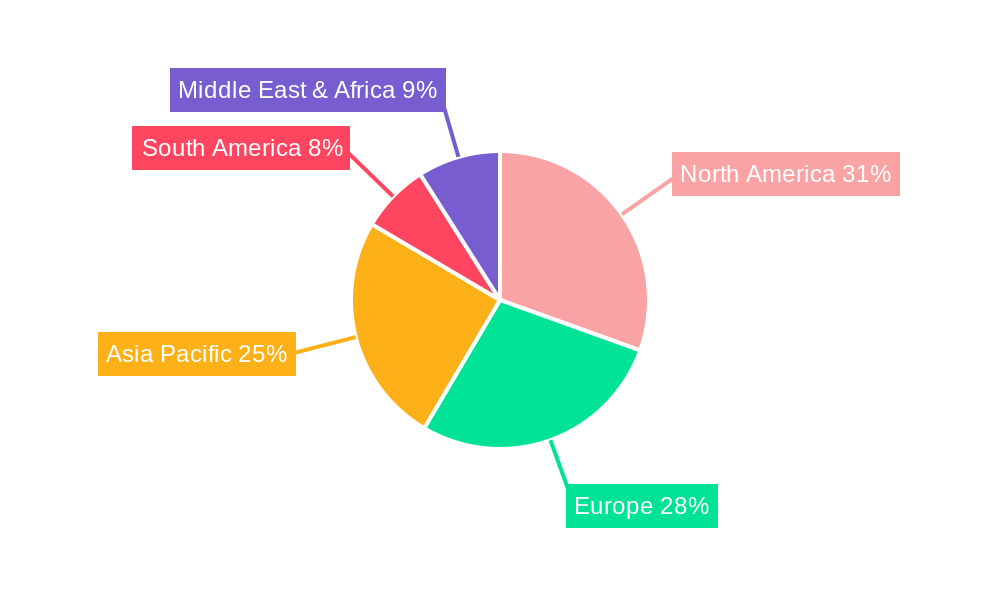

The fitness watch market is characterized by intense competition among established players such as Apple, Fitbit, Samsung, Garmin, and Huawei, alongside emerging brands like Xiaomi and Polar. These companies are continuously innovating, introducing smart features, enhanced durability, and improved battery life to capture market share. Restraints such as the premium pricing of high-end devices and concerns over data privacy for some consumers do exist but are largely offset by the growing availability of more affordable options and increasing trust in data security protocols. The market's expansion is particularly strong in the Asia Pacific region, driven by a burgeoning middle class and a growing awareness of wellness, alongside continued robust performance in North America and Europe, where the adoption of wearable technology is already widespread. The integration of fitness watches into broader digital health ecosystems, offering seamless data synchronization with smartphones and other health devices, will be a critical trend shaping the market's future trajectory.

Here's the SEO-optimized report description for Fitness Watches, designed for maximum visibility and engagement with industry professionals:

Fitness Watches Market Dynamics & Structure

The global fitness watch market is characterized by dynamic competition and rapid technological evolution, catering to both the broad consumer market and specialized niche segments. Market concentration is moderate, with key players like Apple, Fitbit, Samsung, Garmin, and Xiaomi holding significant shares but facing consistent innovation from emerging brands. Technological innovation is a primary driver, with advancements in sensor accuracy, battery life, AI-powered analytics, and seamless integration with health ecosystems propelling market growth. Regulatory frameworks, particularly concerning data privacy and health claims, are becoming increasingly influential, shaping product development and market access. Competitive product substitutes include basic digital watches, advanced smartwatches with limited fitness features, and dedicated sports tracking devices. End-user demographics span a wide spectrum, from health-conscious millennials and Gen Z to active seniors and elite athletes, each with distinct needs and purchasing behaviors. Mergers and acquisitions (M&A) activity, though not consistently high, is strategic, focusing on acquiring complementary technologies or expanding market reach. For instance, several smaller sensor technology companies have been acquired by major wearable manufacturers in the past five years to enhance product capabilities.

- Market Concentration: Moderate, with top 5 players holding an estimated 65% of the global market share.

- Technological Innovation Drivers: Enhanced sensor accuracy (e.g., SpO2, ECG), extended battery life (average 7-10 days), AI-driven personalized insights, seamless app integration, advanced sleep tracking, and stress management features.

- Regulatory Frameworks: Growing emphasis on data privacy (GDPR, CCPA) and health claim validation for advanced health monitoring features.

- Competitive Product Substitutes: Basic digital watches, feature-rich smartwatches, dedicated GPS sports watches.

- End-User Demographics: Broad, from casual fitness enthusiasts to elite athletes and health-conscious individuals of all ages.

- M&A Trends: Strategic acquisitions focused on technology integration and market expansion. Estimated deal volume of 3-5 significant M&A events annually over the historical period.

Fitness Watches Growth Trends & Insights

The fitness watch market has witnessed substantial growth and is poised for continued expansion, driven by escalating health awareness, technological advancements, and evolving consumer lifestyles. The market size is projected to reach approximately $75,000 million by 2033, with a Compound Annual Growth Rate (CAGR) of an estimated 12.5% from 2025 to 2033. This robust growth is fueled by increasing adoption rates across diverse demographics, particularly among younger generations who are more attuned to wearable technology for health and fitness tracking. Technological disruptions have been pivotal, with the integration of advanced sensors for comprehensive health monitoring, including ECG, blood oxygen (SpO2) tracking, and continuous heart rate monitoring, becoming standard in many mid-to-high-end devices. The shift towards personalized health and wellness is a major consumer behavior shift, with individuals seeking data-driven insights to optimize their fitness routines, manage chronic conditions, and improve overall well-being. The "quantified self" movement continues to gain momentum, encouraging users to track and analyze their activity, sleep, and physiological metrics. Furthermore, the growing popularity of remote health monitoring and telehealth services, especially post-pandemic, has further propelled the demand for fitness watches as integral personal health management tools. The market's resilience is underscored by its ability to adapt to changing consumer preferences, offering a spectrum of devices from basic pedometer watches to sophisticated GPS + HRM watches catering to specific athletic needs. The estimated market penetration of fitness watches in developed economies is expected to exceed 60% by 2033, indicating significant room for further growth globally.

- Market Size Evolution: Projected to grow from an estimated $38,000 million in 2025 to $75,000 million by 2033.

- Adoption Rates: Steadily increasing, with particularly strong uptake among millennials and Gen Z. Estimated global adoption rate of 45% in 2025, rising to 60% by 2033.

- Technological Disruptions: Integration of advanced health sensors (ECG, SpO2), AI-powered coaching, contactless payments, and extended battery life.

- Consumer Behavior Shifts: Growing demand for personalized health insights, preventative healthcare solutions, and seamless integration with digital wellness platforms. The "quantified self" trend continues to drive engagement.

- CAGR: Estimated 12.5% for the forecast period 2025-2033.

- Market Penetration: Expected to exceed 60% in developed economies by 2033.

Dominant Regions, Countries, or Segments in Fitness Watches

North America, particularly the United States, stands as the dominant region in the global fitness watches market, driven by a confluence of factors including high disposable incomes, a strong emphasis on health and wellness, widespread adoption of wearable technology, and robust retail infrastructure. The United States accounts for an estimated 35% of the global market share in the base year 2025. This dominance is further amplified by a consumer base that readily embraces new technologies and actively participates in fitness activities. Leading countries within North America are characterized by their advanced technological ecosystems and a significant presence of key industry players like Apple, Fitbit, and Garmin, who have established strong brand loyalty and distribution networks. The application segment of Online Retail is emerging as a significant growth driver, projected to capture approximately 60% of the total market by 2033. This surge in online sales is facilitated by e-commerce giants and direct-to-consumer (DTC) strategies employed by manufacturers, offering convenience, wider product selection, and competitive pricing. The GPS + HRM Watches segment is another critical driver, representing a substantial portion of the market value due to its appeal to serious athletes and fitness enthusiasts who require precise tracking of performance metrics. This segment is expected to account for over 40% of the total market revenue by 2033. Economic policies supportive of innovation and consumer spending, coupled with a well-developed digital infrastructure, enable the seamless integration of these devices into daily life. The presence of major tech hubs also fosters continuous research and development, pushing the boundaries of what fitness watches can offer. The market's growth potential in North America is also linked to the increasing prevalence of lifestyle-related diseases, prompting a proactive approach to health management among its population.

- Dominant Region: North America.

- Dominant Country: United States (estimated 35% market share in 2025).

- Key Drivers in North America: High disposable income, strong health and wellness culture, advanced technological adoption, robust retail infrastructure, and presence of major industry players.

- Dominant Application Segment: Online Retail (projected 60% market share by 2033).

- Dominant Type Segment: GPS + HRM Watches (projected over 40% market share by 2033).

- Growth Potential Factors: Increasing health awareness, proactive health management, supportive economic policies, and advanced digital infrastructure.

Fitness Watches Product Landscape

The fitness watches product landscape is characterized by rapid innovation, offering a diverse range of devices with increasingly sophisticated functionalities. Core product innovations focus on enhanced sensor technology for more accurate tracking of vital signs like heart rate, SpO2, and sleep patterns, alongside advanced GPS capabilities for precise route mapping and performance analysis. Unique selling propositions often lie in personalized coaching algorithms, AI-driven insights into health and fitness trends, and seamless integration with broader health and wellness ecosystems. Technological advancements are also seen in battery longevity, durability, and the introduction of new form factors catering to specific sports and activities. Brands are increasingly emphasizing features like ECG, stress monitoring, and fall detection, blurring the lines between fitness trackers and medical-grade devices.

Key Drivers, Barriers & Challenges in Fitness Watches

The fitness watches market is propelled by several key drivers, including the escalating global focus on preventative healthcare and personal well-being, leading to a surge in demand for self-monitoring devices. Technological advancements in sensor accuracy, AI-powered analytics, and battery efficiency are continuously enhancing product appeal. Furthermore, the increasing affordability and accessibility of fitness watches, coupled with growing consumer awareness of their benefits, are significant growth catalysts.

- Key Drivers: Rising health consciousness, advanced sensor technology, AI-driven personalized insights, improved battery life, increased product affordability, and robust marketing efforts by manufacturers.

However, the market faces notable barriers and challenges. Data privacy concerns and the security of sensitive health information remain a significant hurdle for some consumers. Intense competition and rapid product obsolescence necessitate continuous investment in R&D, posing financial challenges for smaller players. Supply chain disruptions, as experienced in recent years, can impact production and lead times. Additionally, the regulatory landscape, particularly regarding health claims, can be complex and vary by region, requiring significant compliance efforts.

- Key Barriers & Challenges: Data privacy and security concerns, intense market competition, rapid product lifecycle, supply chain vulnerabilities, and evolving regulatory frameworks for health claims.

Emerging Opportunities in Fitness Watches

Emerging opportunities in the fitness watches sector lie in the expansion of personalized wellness and preventative healthcare solutions. The integration of advanced AI for real-time health coaching and predictive diagnostics presents a significant avenue for growth. Untapped markets in developing economies, where health awareness is rising and disposable incomes are increasing, offer substantial potential. The development of specialized fitness watches for niche sports or medical conditions (e.g., diabetes management, cardiac rehabilitation) also represents a promising area. Furthermore, the increasing convergence of fitness watches with mental wellness tracking and stress management features is aligning with evolving consumer preferences.

Growth Accelerators in the Fitness Watches Industry

Long-term growth in the fitness watches industry will be significantly accelerated by ongoing technological breakthroughs, particularly in areas like non-invasive glucose monitoring, advanced sleep staging analysis, and more sophisticated stress detection capabilities. Strategic partnerships between wearable manufacturers, healthcare providers, and insurance companies are expected to foster greater adoption for remote patient monitoring and wellness programs. Market expansion strategies, including the development of more affordable entry-level devices and the penetration into emerging markets, will also serve as crucial growth accelerators. The increasing integration of fitness watches into broader smart home and digital health ecosystems will further enhance their value proposition and drive sustained demand.

Key Players Shaping the Fitness Watches Market

- Apple

- Fitbit

- Samsung

- Garmin

- Huawei

- Xiaomi

- Polar

- Casio

- ToTonsom

- Motorola/Lenovo

- Timex

- Suunto

- Withings

- Soleus

Notable Milestones in Fitness Watches Sector

- 2019/August: Fitbit launches its first ECG app, enabling users to screen for atrial fibrillation.

- 2020/March: Apple Watch Series 5 introduces always-on display and advanced health features.

- 2020/September: Samsung Galaxy Watch 3 launches with advanced health tracking and rotating bezel.

- 2021/January: Garmin announces integration with Strava and other popular fitness platforms, enhancing data connectivity.

- 2021/June: Huawei launches the Watch GT 3 series with extended battery life and advanced health monitoring.

- 2022/February: Xiaomi expands its Mi Watch lineup with enhanced GPS and blood oxygen tracking.

- 2022/October: Polar introduces advanced recovery insights and training load analysis in its latest models.

- 2023/April: Casio releases rugged fitness watches designed for extreme sports enthusiasts.

- 2023/July: ToTonsom enters the market with budget-friendly smartwatches featuring comprehensive health tracking.

- 2023/November: Motorola/Lenovo enhances its smartwatch offerings with improved app ecosystems.

- 2024/January: Timex strengthens its fitness watch portfolio with focus on durability and style.

- 2024/March: Suunto introduces advanced navigation features and mapping capabilities in its new outdoor watches.

- 2024/May: Withings showcases advancements in sleep tracking and overall wellness monitoring.

In-Depth Fitness Watches Market Outlook

The fitness watches market is projected for sustained and robust growth, driven by an unwavering focus on personal health and wellness, coupled with continuous technological innovation. Future market potential lies in the deeper integration of these devices into personalized preventative healthcare ecosystems, offering predictive analytics for chronic disease management and real-time health interventions. Strategic opportunities include the expansion into underserved emerging markets, the development of highly specialized devices for specific medical needs, and the creation of more intuitive user experiences. The increasing demand for comprehensive, data-driven insights into both physical and mental well-being will further solidify the fitness watch's position as an indispensable tool for modern health management.

Fitness Watches Segmentation

-

1. Application

- 1.1. Online Retail

- 1.2. Offline Retail

-

2. Types

- 2.1. Pedometer Watches

- 2.2. GPS Watches

- 2.3. Heart Rate Watches

- 2.4. GPS +HRM Watches

Fitness Watches Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fitness Watches REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fitness Watches Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Retail

- 5.1.2. Offline Retail

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Pedometer Watches

- 5.2.2. GPS Watches

- 5.2.3. Heart Rate Watches

- 5.2.4. GPS +HRM Watches

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Fitness Watches Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Retail

- 6.1.2. Offline Retail

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Pedometer Watches

- 6.2.2. GPS Watches

- 6.2.3. Heart Rate Watches

- 6.2.4. GPS +HRM Watches

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Fitness Watches Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Retail

- 7.1.2. Offline Retail

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Pedometer Watches

- 7.2.2. GPS Watches

- 7.2.3. Heart Rate Watches

- 7.2.4. GPS +HRM Watches

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Fitness Watches Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Retail

- 8.1.2. Offline Retail

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Pedometer Watches

- 8.2.2. GPS Watches

- 8.2.3. Heart Rate Watches

- 8.2.4. GPS +HRM Watches

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Fitness Watches Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Retail

- 9.1.2. Offline Retail

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Pedometer Watches

- 9.2.2. GPS Watches

- 9.2.3. Heart Rate Watches

- 9.2.4. GPS +HRM Watches

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Fitness Watches Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Retail

- 10.1.2. Offline Retail

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Pedometer Watches

- 10.2.2. GPS Watches

- 10.2.3. Heart Rate Watches

- 10.2.4. GPS +HRM Watches

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Apple

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Fitbit

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Samsung

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Germin

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Huawei

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Xiaomi

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Polar

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Casio

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ToTonsom

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Motorola/Lenovo

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Timex

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Suunto

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Withings

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Soleus

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Apple

List of Figures

- Figure 1: Global Fitness Watches Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Fitness Watches Revenue (million), by Application 2024 & 2032

- Figure 3: North America Fitness Watches Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Fitness Watches Revenue (million), by Types 2024 & 2032

- Figure 5: North America Fitness Watches Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Fitness Watches Revenue (million), by Country 2024 & 2032

- Figure 7: North America Fitness Watches Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Fitness Watches Revenue (million), by Application 2024 & 2032

- Figure 9: South America Fitness Watches Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Fitness Watches Revenue (million), by Types 2024 & 2032

- Figure 11: South America Fitness Watches Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Fitness Watches Revenue (million), by Country 2024 & 2032

- Figure 13: South America Fitness Watches Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Fitness Watches Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Fitness Watches Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Fitness Watches Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Fitness Watches Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Fitness Watches Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Fitness Watches Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Fitness Watches Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Fitness Watches Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Fitness Watches Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Fitness Watches Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Fitness Watches Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Fitness Watches Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Fitness Watches Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Fitness Watches Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Fitness Watches Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Fitness Watches Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Fitness Watches Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Fitness Watches Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fitness Watches Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Fitness Watches Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Fitness Watches Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Fitness Watches Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Fitness Watches Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Fitness Watches Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Fitness Watches Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Fitness Watches Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Fitness Watches Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Fitness Watches Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Fitness Watches Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Fitness Watches Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Fitness Watches Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Fitness Watches Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Fitness Watches Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Fitness Watches Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Fitness Watches Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Fitness Watches Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Fitness Watches Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Fitness Watches Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fitness Watches?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Fitness Watches?

Key companies in the market include Apple, Fitbit, Samsung, Germin, Huawei, Xiaomi, Polar, Casio, ToTonsom, Motorola/Lenovo, Timex, Suunto, Withings, Soleus.

3. What are the main segments of the Fitness Watches?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fitness Watches," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fitness Watches report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fitness Watches?

To stay informed about further developments, trends, and reports in the Fitness Watches, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence