Key Insights

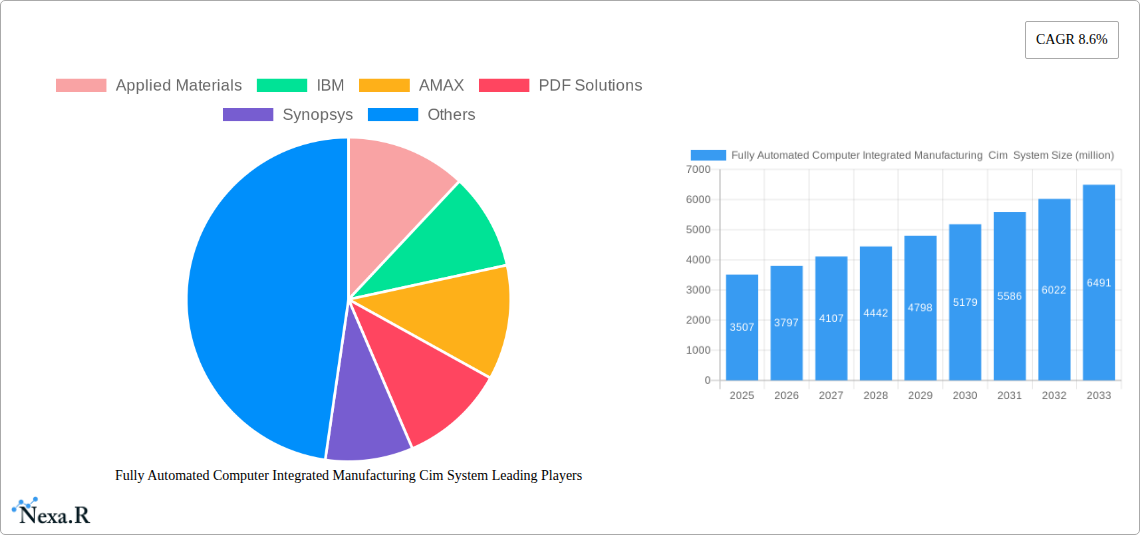

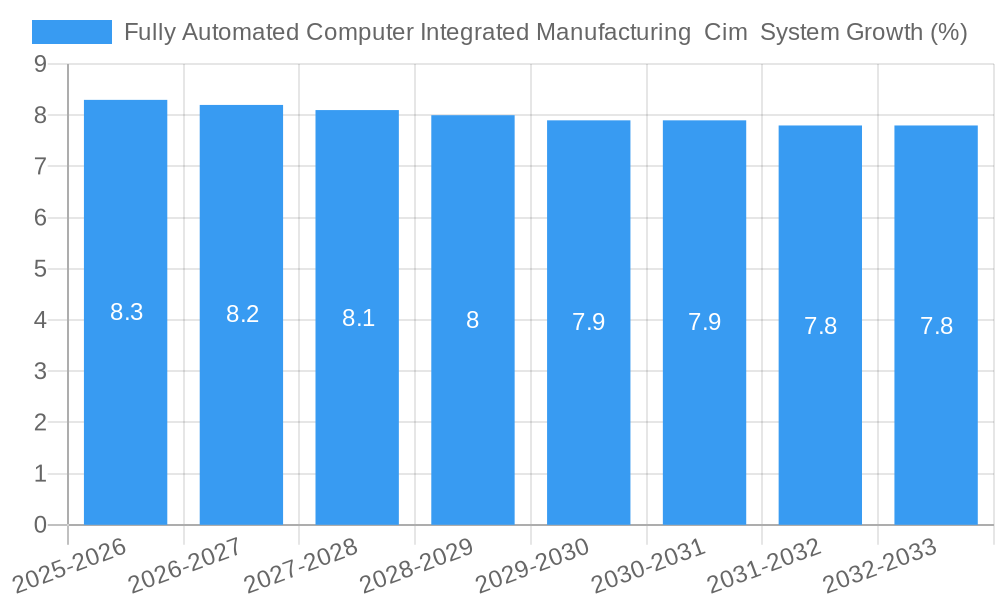

The Fully Automated Computer Integrated Manufacturing (CIM) System market is poised for significant expansion, projected to reach an impressive market size of $3507 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 8.6% from 2019 to 2033. This substantial growth is primarily propelled by the increasing demand for enhanced operational efficiency, reduced manufacturing costs, and improved product quality across various industries. Key drivers include the relentless pursuit of Industry 4.0 adoption, the necessity for real-time data analytics for informed decision-making, and the growing integration of advanced technologies like AI and IoT within manufacturing environments. These systems are crucial for bridging the gap between design, production, and management, creating a seamless flow of information and operations. The market segmentation clearly indicates a strong emphasis on the Foundry and IDM applications, with Manufacture Execution Systems (MES), Equipment Automation Programs (EAP), and Material Control Systems (MCS/MCO) emerging as vital components driving this technological evolution.

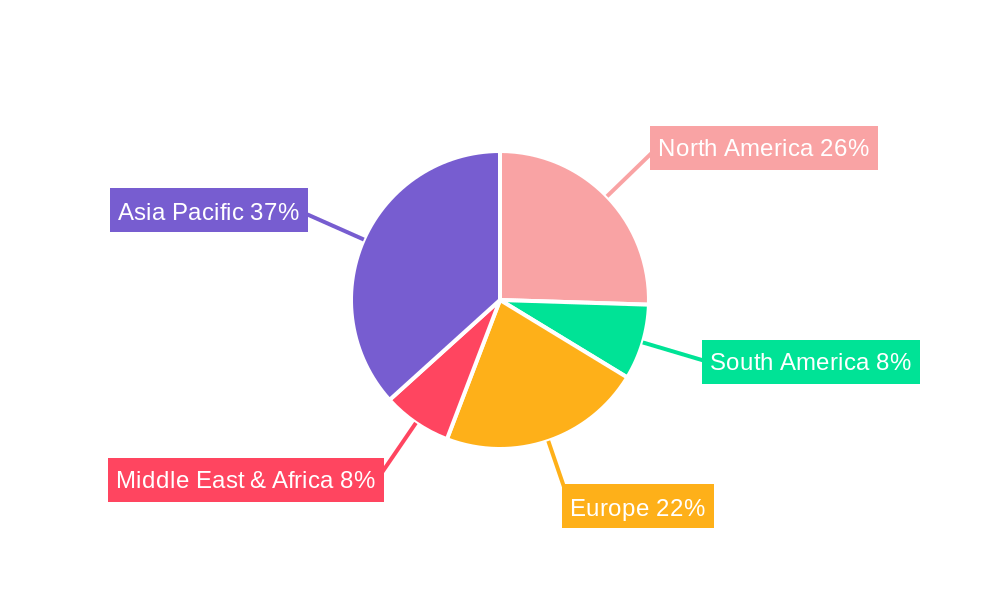

The competitive landscape features a blend of established technology giants and specialized automation providers, including Applied Materials, IBM, Synopsys, and Critical Manufacturing (ASMPT), all vying to capture market share through innovation and strategic partnerships. The increasing complexity of semiconductor manufacturing and the need for stringent quality control further fuel the adoption of these sophisticated CIM systems. While the market benefits from strong growth drivers, potential restraints such as high initial investment costs and the need for skilled personnel for implementation and maintenance could pose challenges. However, the long-term benefits of increased productivity, reduced waste, and enhanced agility are expected to outweigh these concerns, ensuring sustained market growth. Geographically, Asia Pacific, driven by strong manufacturing bases in China and India, is anticipated to be a dominant region, followed by North America and Europe, as these regions embrace advanced manufacturing technologies to maintain their competitive edge.

Fully Automated Computer Integrated Manufacturing Cim System Market Dynamics & Structure

The global Fully Automated Computer Integrated Manufacturing (CIM) system market is characterized by a moderately concentrated structure, driven by significant technological innovation and substantial R&D investments. Leading players are continuously pushing the boundaries of automation, Industry 4.0 integration, and AI-powered manufacturing processes. Regulatory frameworks, while evolving to support digitalization, also present compliance challenges for system integrators and end-users. The presence of competitive product substitutes, such as standalone automation solutions and advanced SCADA systems, necessitates a strong value proposition from CIM providers. End-user demographics are increasingly sophisticated, demanding seamless integration, real-time data analytics, and enhanced cybersecurity. Mergers and acquisitions (M&A) trends are prominent, with larger entities acquiring smaller, innovative firms to expand their technological portfolios and market reach.

- Market Concentration: Moderately concentrated, with key players holding substantial market share.

- Technological Innovation Drivers: AI, IoT, Big Data Analytics, Robotics, 5G integration.

- Regulatory Frameworks: Focus on data security, interoperability standards, and smart factory compliance.

- Competitive Product Substitutes: Advanced SCADA, standalone automation modules, specialized software solutions.

- End-User Demographics: Semiconductor, automotive, aerospace, and electronics manufacturing sectors with a high demand for efficiency and precision.

- M&A Trends: Strategic acquisitions to gain access to niche technologies and expand market footprint.

Fully Automated Computer Integrated Manufacturing Cim System Growth Trends & Insights

The Fully Automated Computer Integrated Manufacturing (CIM) system market is poised for robust expansion, driven by the relentless pursuit of operational excellence and enhanced productivity across various manufacturing sectors. The global market size is projected to witness a significant upward trajectory, fueled by increasing adoption rates of smart factory technologies and the broader Industry 4.0 revolution. Technological disruptions, including the proliferation of AI-driven predictive maintenance, sophisticated robotic integration, and advanced data analytics platforms, are fundamentally reshaping manufacturing paradigms. Consumer behavior shifts towards demand for highly customized products with shorter lead times are compelling manufacturers to invest in agile and automated production environments. The market penetration of CIM systems is steadily increasing, moving beyond traditional high-volume manufacturing to encompass more specialized and complex production processes. The compound annual growth rate (CAGR) is expected to remain strong throughout the forecast period. For instance, the increasing demand for sophisticated manufacturing in the semiconductor industry, driven by the need for miniaturization and advanced chip designs, directly translates to a higher demand for fully automated CIM solutions. The adoption of digital twin technology within CIM environments is also accelerating, allowing for real-time monitoring, simulation, and optimization of production lines. This enhanced visibility and control are crucial for manufacturers to adapt to dynamic market demands and maintain a competitive edge. Furthermore, the growing emphasis on supply chain resilience and transparency is another key factor pushing the adoption of integrated manufacturing systems like CIM. By providing end-to-end visibility and control, CIM systems enable manufacturers to better manage their supply chains, mitigate risks, and respond effectively to disruptions. The integration of edge computing with CIM platforms is further enhancing real-time data processing and decision-making capabilities, reducing latency and improving overall system responsiveness. This trend is particularly critical in industries where microseconds matter, such as in the production of high-frequency electronic components. The forecast period of 2025-2033 will likely see a significant leap in the sophistication and interconnectedness of CIM systems, making them indispensable for modern manufacturing operations. The market is moving towards a future where fully automated CIM systems are not just an option but a necessity for survival and growth.

Dominant Regions, Countries, or Segments in Fully Automated Computer Integrated Manufacturing Cim System

The Foundry segment, within the Application category, is a dominant force driving growth in the Fully Automated Computer Integrated Manufacturing (CIM) system market. This dominance is particularly pronounced in regions with a strong presence of advanced semiconductor manufacturing facilities, such as Asia Pacific and North America. The inherent complexity and precision required in foundry operations, from wafer fabrication to assembly and testing, necessitate sophisticated automation and integration provided by CIM systems.

Key Drivers for Foundry Dominance:

- Technological Advancement in Semiconductors: The insatiable demand for advanced microprocessors, AI chips, and cutting-edge memory devices requires extremely precise and highly automated manufacturing processes. CIM systems are crucial for managing these complex workflows.

- High Capital Investment: Foundries involve significant capital expenditure, with manufacturers willing to invest in state-of-the-art automation to maximize yield, reduce defects, and ensure product quality.

- Stringent Quality Control: The microscopic nature of semiconductor defects demands unparalleled control and traceability, which CIM systems excel at providing.

- Escalating Production Volumes: To meet global demand, foundries operate at massive scales, requiring efficient, integrated systems to manage high throughput without compromising quality.

- Industry 4.0 Adoption: The semiconductor industry has been at the forefront of adopting Industry 4.0 principles, with CIM systems serving as the backbone for smart factory initiatives.

Market Share and Growth Potential:

The Foundry segment is expected to command the largest market share within the CIM system landscape. Countries like South Korea, Taiwan, the United States, and China are key contributors to this dominance due to their extensive foundry infrastructure and continuous investment in upgrading manufacturing capabilities. The growth potential is substantial, driven by the ongoing innovation in semiconductor technology, the increasing demand for advanced electronics in various applications, and the global push for semiconductor self-sufficiency. For instance, the increasing complexity of chip architectures and the transition to smaller process nodes (e.g., 3nm, 2nm) directly translate to a need for more sophisticated CIM solutions capable of handling intricate process flows and real-time monitoring. The integration of AI and machine learning within CIM systems for process optimization and yield improvement is a critical factor contributing to the segment's rapid growth. Moreover, the growing trend of fabless semiconductor companies outsourcing their manufacturing to foundries further amplifies the demand for robust and scalable CIM solutions.

Beyond the Foundry application, Manufacturing Execution System (MES) within the Type category also plays a pivotal role, often acting as a core component of a comprehensive CIM system. MES provides real-time production tracking, scheduling, and shop floor control, making it indispensable for achieving the full automation envisioned by CIM.

Fully Automated Computer Integrated Manufacturing Cim System Product Landscape

The Fully Automated Computer Integrated Manufacturing (CIM) system product landscape is defined by increasingly intelligent and interconnected solutions. Key product innovations focus on enhanced data analytics, real-time process control, and seamless integration across the entire manufacturing value chain. These systems offer advanced functionalities for predictive maintenance, quality assurance, and resource optimization. Performance metrics are measured by improvements in Overall Equipment Effectiveness (OEE), reduction in cycle times, minimization of waste, and increased production throughput. Unique selling propositions revolve around modularity, scalability, and the ability to adapt to diverse manufacturing environments. Technological advancements are driven by the integration of AI and machine learning for intelligent decision-making, the adoption of IIoT for real-time data acquisition, and the development of robust cybersecurity features to protect sensitive manufacturing data.

Key Drivers, Barriers & Challenges in Fully Automated Computer Integrated Manufacturing Cim System

Key Drivers:

The Fully Automated Computer Integrated Manufacturing (CIM) system market is propelled by several critical drivers. The relentless pursuit of increased operational efficiency and productivity in manufacturing is a primary motivator. Technological advancements, particularly in AI, IoT, and robotics, are making fully automated systems more feasible and cost-effective. The growing demand for mass customization and shorter product lifecycles necessitates agile and integrated manufacturing capabilities. Furthermore, stringent quality control requirements in industries like automotive and aerospace are pushing manufacturers towards automated solutions for consistent output. Government initiatives promoting Industry 4.0 adoption and smart manufacturing also play a significant role in market expansion.

Key Barriers & Challenges:

Despite the strong drivers, the market faces considerable barriers and challenges. The substantial upfront investment required for implementing fully automated CIM systems can be a deterrent for small and medium-sized enterprises (SMEs). Integration complexities with legacy systems and the need for skilled personnel to manage and maintain these advanced technologies pose significant hurdles. Cybersecurity threats and the risk of data breaches are also major concerns for manufacturers entrusting their operations to interconnected systems. Supply chain disruptions, leading to shortages of critical components for automation hardware, can impact implementation timelines and costs. Finally, resistance to change from the workforce and the need for extensive training can slow down adoption rates.

Emerging Opportunities in Fully Automated Computer Integrated Manufacturing Cim System

Emerging opportunities in the Fully Automated Computer Integrated Manufacturing (CIM) system sector lie in the expansion of its application into niche manufacturing segments and the development of more specialized AI-driven functionalities. The increasing adoption of Industry 5.0 concepts, emphasizing human-robot collaboration and sustainability, presents an opportunity for CIM systems to become more adaptable and environmentally conscious. Untapped markets in developing economies, as these regions accelerate their industrialization efforts, offer significant growth potential. Innovative applications in areas like additive manufacturing (3D printing) integration and advanced materials processing are also creating new avenues for CIM system development. Furthermore, the growing demand for data-driven insights and predictive analytics within CIM is fostering opportunities for advanced software solutions and cloud-based platforms.

Growth Accelerators in the Fully Automated Computer Integrated Manufacturing Cim System Industry

Several catalysts are accelerating growth in the Fully Automated Computer Integrated Manufacturing (CIM) system industry. The continuous technological breakthroughs in artificial intelligence and machine learning are enabling more sophisticated automation, optimization, and predictive capabilities within CIM. Strategic partnerships between technology providers, system integrators, and end-users are fostering collaborative innovation and accelerating the deployment of comprehensive CIM solutions. The ongoing globalization of supply chains and the increasing complexity of product development are driving the need for integrated and transparent manufacturing processes, which CIM systems effectively address. Furthermore, market expansion strategies targeting emerging economies and the development of modular, scalable CIM solutions tailored to different industry needs are acting as significant growth accelerators.

Key Players Shaping the Fully Automated Computer Integrated Manufacturing Cim System Market

- Applied Materials

- IBM

- AMAX

- PDF Solutions

- Synopsys

- Critical Manufacturing (ASMPT)

- AIM Systems

- Miracom Inc

- SEMES Co. Ltd.

Notable Milestones in Fully Automated Computer Integrated Manufacturing Cim System Sector

- 2019: Increased adoption of AI-driven predictive maintenance algorithms within MES components of CIM systems.

- 2020: Accelerated integration of Industrial IoT (IIoT) platforms to enhance real-time data collection and system connectivity.

- 2021: Significant advancements in robotic automation and collaborative robot (cobot) integration within CIM environments.

- 2022: Growing focus on cybersecurity solutions to protect highly integrated manufacturing networks.

- 2023: Rise in demand for cloud-based CIM solutions offering greater scalability and accessibility.

- 2024: Emergence of digital twin technologies as a key component for simulation and optimization within CIM.

- 2025: Increased investment in 5G infrastructure to support low-latency, high-bandwidth communication for advanced CIM applications.

- 2026: Further integration of advanced analytics for real-time decision-making and process optimization.

- 2027: Expansion of CIM solutions to support Industry 5.0 principles of sustainability and human-centric manufacturing.

- 2028: Maturation of AI-powered quality control systems, significantly reducing defects.

- 2029: Wider adoption of CIM systems in emerging manufacturing sectors like biotechnology and advanced materials.

- 2030: Enhanced interoperability standards leading to more seamless integration between different CIM modules and enterprise systems.

- 2031: Development of highly autonomous manufacturing cells managed by sophisticated CIM platforms.

- 2032: Increased focus on ethical AI and data privacy within CIM system development and deployment.

- 2033: Widespread implementation of hyper-connected factories powered by advanced CIM, realizing the full potential of Industry 4.0.

In-Depth Fully Automated Computer Integrated Manufacturing Cim System Market Outlook

The future outlook for the Fully Automated Computer Integrated Manufacturing (CIM) system market is exceptionally positive, driven by the accelerating digital transformation of manufacturing. Key growth accelerators, including breakthroughs in AI and machine learning, strategic partnerships, and market expansion into emerging economies, will continue to fuel demand. The ongoing evolution towards hyper-connected factories and the increasing adoption of Industry 5.0 principles will necessitate more intelligent, sustainable, and human-centric CIM solutions. Strategic opportunities lie in developing modular, scalable, and secure CIM platforms that can adapt to diverse industry needs and support the growing trend of mass customization and on-demand production. The market is on track to become an indispensable cornerstone of modern manufacturing, enabling unprecedented levels of efficiency, agility, and innovation.

Fully Automated Computer Integrated Manufacturing Cim System Segmentation

-

1. Application

- 1.1. Foundry

- 1.2. IDM

-

2. Type

- 2.1. Manufacture Execution System (MES)

- 2.2. Equipment Automation Program (EAP)

- 2.3. Material Control System (MCS/MCO)

- 2.4. Others

Fully Automated Computer Integrated Manufacturing Cim System Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fully Automated Computer Integrated Manufacturing Cim System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fully Automated Computer Integrated Manufacturing Cim System Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Foundry

- 5.1.2. IDM

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Manufacture Execution System (MES)

- 5.2.2. Equipment Automation Program (EAP)

- 5.2.3. Material Control System (MCS/MCO)

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Fully Automated Computer Integrated Manufacturing Cim System Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Foundry

- 6.1.2. IDM

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Manufacture Execution System (MES)

- 6.2.2. Equipment Automation Program (EAP)

- 6.2.3. Material Control System (MCS/MCO)

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Fully Automated Computer Integrated Manufacturing Cim System Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Foundry

- 7.1.2. IDM

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Manufacture Execution System (MES)

- 7.2.2. Equipment Automation Program (EAP)

- 7.2.3. Material Control System (MCS/MCO)

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Fully Automated Computer Integrated Manufacturing Cim System Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Foundry

- 8.1.2. IDM

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Manufacture Execution System (MES)

- 8.2.2. Equipment Automation Program (EAP)

- 8.2.3. Material Control System (MCS/MCO)

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Fully Automated Computer Integrated Manufacturing Cim System Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Foundry

- 9.1.2. IDM

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Manufacture Execution System (MES)

- 9.2.2. Equipment Automation Program (EAP)

- 9.2.3. Material Control System (MCS/MCO)

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Fully Automated Computer Integrated Manufacturing Cim System Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Foundry

- 10.1.2. IDM

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Manufacture Execution System (MES)

- 10.2.2. Equipment Automation Program (EAP)

- 10.2.3. Material Control System (MCS/MCO)

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Applied Materials

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AMAX

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PDF Solutions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Synopsys

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Critical Manufacturing (ASMPT)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AIM Systems

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Miracom Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SEMES Co. Ltd.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Applied Materials

List of Figures

- Figure 1: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Fully Automated Computer Integrated Manufacturing Cim System Revenue (million), by Application 2024 & 2032

- Figure 3: North America Fully Automated Computer Integrated Manufacturing Cim System Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Fully Automated Computer Integrated Manufacturing Cim System Revenue (million), by Type 2024 & 2032

- Figure 5: North America Fully Automated Computer Integrated Manufacturing Cim System Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Fully Automated Computer Integrated Manufacturing Cim System Revenue (million), by Country 2024 & 2032

- Figure 7: North America Fully Automated Computer Integrated Manufacturing Cim System Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Fully Automated Computer Integrated Manufacturing Cim System Revenue (million), by Application 2024 & 2032

- Figure 9: South America Fully Automated Computer Integrated Manufacturing Cim System Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Fully Automated Computer Integrated Manufacturing Cim System Revenue (million), by Type 2024 & 2032

- Figure 11: South America Fully Automated Computer Integrated Manufacturing Cim System Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Fully Automated Computer Integrated Manufacturing Cim System Revenue (million), by Country 2024 & 2032

- Figure 13: South America Fully Automated Computer Integrated Manufacturing Cim System Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Fully Automated Computer Integrated Manufacturing Cim System Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Fully Automated Computer Integrated Manufacturing Cim System Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Fully Automated Computer Integrated Manufacturing Cim System Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Fully Automated Computer Integrated Manufacturing Cim System Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Fully Automated Computer Integrated Manufacturing Cim System Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Fully Automated Computer Integrated Manufacturing Cim System Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Fully Automated Computer Integrated Manufacturing Cim System Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Fully Automated Computer Integrated Manufacturing Cim System Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Fully Automated Computer Integrated Manufacturing Cim System Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Fully Automated Computer Integrated Manufacturing Cim System Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Fully Automated Computer Integrated Manufacturing Cim System Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Fully Automated Computer Integrated Manufacturing Cim System Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Fully Automated Computer Integrated Manufacturing Cim System Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Fully Automated Computer Integrated Manufacturing Cim System Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Fully Automated Computer Integrated Manufacturing Cim System Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Fully Automated Computer Integrated Manufacturing Cim System Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Fully Automated Computer Integrated Manufacturing Cim System Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Fully Automated Computer Integrated Manufacturing Cim System Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Fully Automated Computer Integrated Manufacturing Cim System Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Fully Automated Computer Integrated Manufacturing Cim System Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fully Automated Computer Integrated Manufacturing Cim System?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the Fully Automated Computer Integrated Manufacturing Cim System?

Key companies in the market include Applied Materials, IBM, AMAX, PDF Solutions, Synopsys, Critical Manufacturing (ASMPT), AIM Systems, Miracom Inc, SEMES Co. Ltd..

3. What are the main segments of the Fully Automated Computer Integrated Manufacturing Cim System?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3507 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fully Automated Computer Integrated Manufacturing Cim System," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fully Automated Computer Integrated Manufacturing Cim System report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fully Automated Computer Integrated Manufacturing Cim System?

To stay informed about further developments, trends, and reports in the Fully Automated Computer Integrated Manufacturing Cim System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence