Key Insights

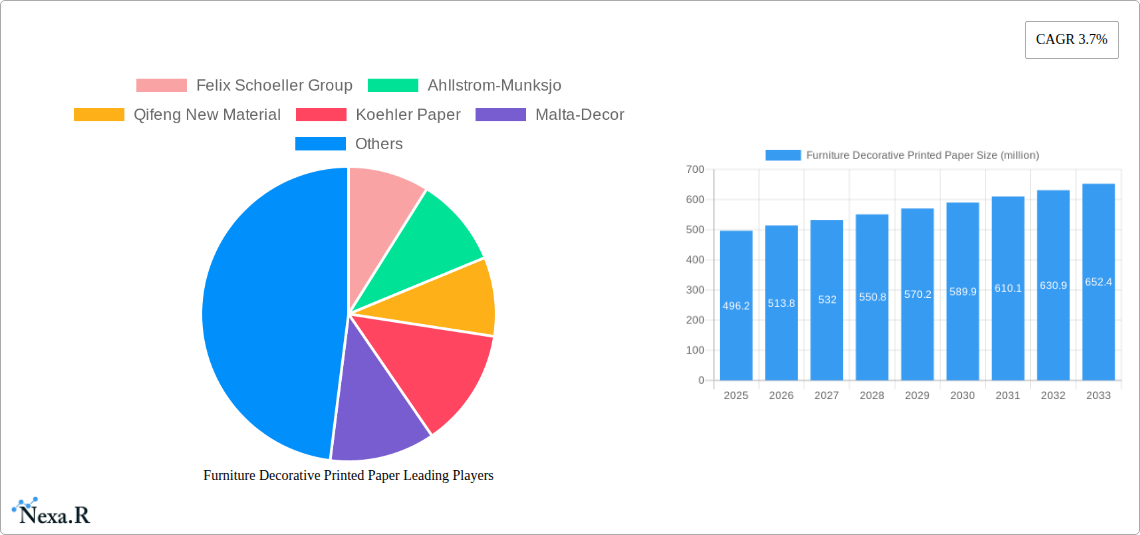

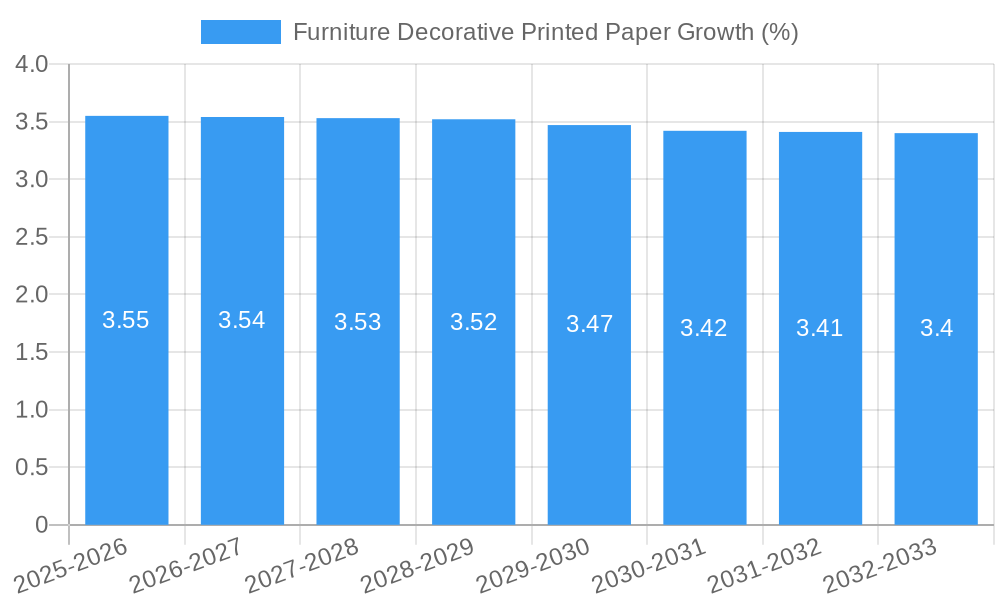

The global Furniture Decorative Printed Paper market is poised for steady growth, projected to reach approximately $496.2 million in value by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 3.7% through 2033. This consistent upward trajectory is primarily fueled by an increasing demand for aesthetically pleasing and customizable furniture, driven by evolving consumer preferences and the burgeoning interior design industry. The market's expansion is further bolstered by advancements in printing technology, allowing for more intricate designs, vibrant colors, and diverse textures, thereby enhancing the appeal of decorative papers for a wide range of furniture applications. The growing trend of personalized living spaces and the rising disposable incomes in emerging economies are significant contributors to this market's positive outlook, as consumers increasingly invest in furniture that reflects their individual style.

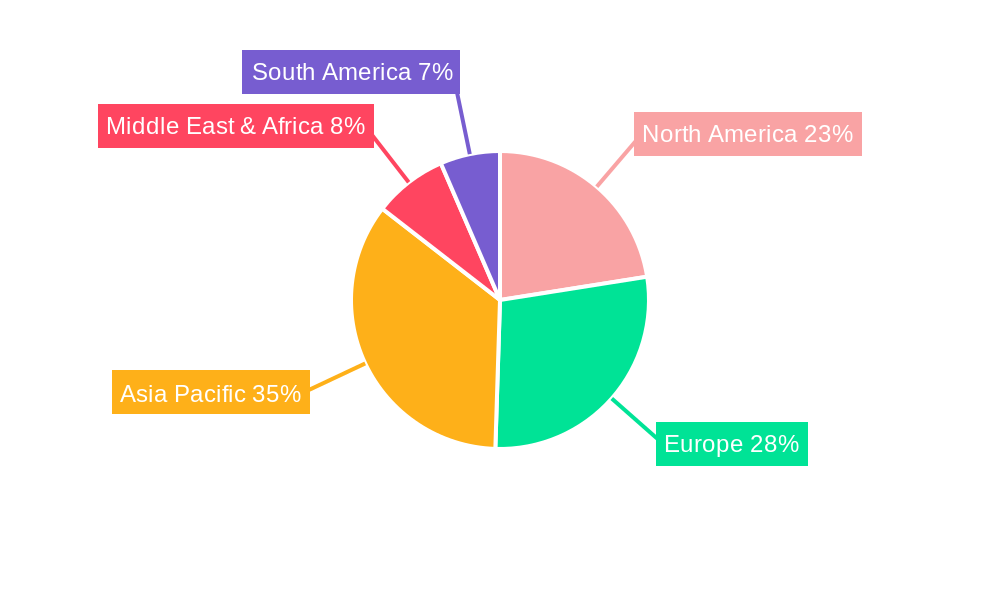

The market is segmented into key applications including Low Pressure Laminates (LPL), High Pressure Laminates (HPL), and Edge Banding, each contributing to the overall market dynamics. The demand for LPL and HPL is particularly strong, driven by their widespread use in furniture manufacturing for surfaces that require durability and visual appeal. In terms of types, papers with weights of 70GSM and 80GSM represent significant market segments, catering to different functional and aesthetic requirements in furniture production. Geographically, Asia Pacific is expected to lead market growth, owing to rapid urbanization, a burgeoning furniture manufacturing sector, and increasing consumer spending power. North America and Europe also represent substantial markets, characterized by a mature furniture industry and a strong demand for high-quality decorative finishes. Key players such as Felix Schoeller Group, Ahlstrom-Munksjo, and Qifeng New Material are actively innovating and expanding their product portfolios to capture market share.

Here is the SEO-optimized report description for Furniture Decorative Printed Paper, designed for maximum visibility and engagement:

Furniture Decorative Printed Paper Market Dynamics & Structure

The global Furniture Decorative Printed Paper market is characterized by a moderately concentrated structure, with key players like Felix Schoeller Group, Ahlstrom-Munksjö, and Qifeng New Material holding significant sway. Technological innovation remains a primary driver, fueled by advancements in printing techniques and substrate development, leading to enhanced aesthetics and durability. Regulatory frameworks, particularly concerning environmental standards and material safety, are increasingly influencing product development and market entry. Competitive product substitutes, such as vinyl films and digital printing directly onto panels, present a constant challenge, necessitating continuous innovation in decorative paper to maintain market share. End-user demographics, leaning towards sustainability and personalized aesthetics, are shaping demand patterns. Mergers and acquisitions (M&A) are a notable trend, with companies consolidating to achieve economies of scale and expand their geographical reach. For instance, the historical period (2019-2024) saw an estimated 15 M&A deals globally, aimed at bolstering technological capabilities and market access. Innovation barriers include the high cost of developing new, eco-friendly inks and resins, alongside stringent quality control requirements for consistent print quality across large production runs.

Furniture Decorative Printed Paper Growth Trends & Insights

The Furniture Decorative Printed Paper market is poised for robust expansion, with a projected market size of $10,500 million units by 2033. Driven by a compound annual growth rate (CAGR) of 5.2% from 2025 to 2033, the industry will witness a significant uplift in demand. The base year of 2025 estimates the market at $7,000 million units. This growth trajectory is underpinned by evolving consumer preferences for aesthetically pleasing, customizable, and sustainable interior design solutions. The adoption rate of decorative printed paper is steadily increasing across both residential and commercial sectors, as manufacturers seek cost-effective alternatives to traditional veneers and solid wood. Technological disruptions, particularly in digital printing technologies and sustainable paper production, are enabling manufacturers to offer a wider array of designs, textures, and finishes, catering to niche market demands and premium segments. Consumer behavior shifts towards greater emphasis on home decor, accelerated by increased remote work and a focus on personal living spaces, are further fueling market penetration. The market penetration rate is anticipated to reach 35% by 2033, signifying its growing importance in furniture manufacturing. The increasing demand for durable, scratch-resistant, and easy-to-maintain surfaces for furniture applications is a critical factor influencing market dynamics. The integration of advanced finishing techniques, such as UV curing and embossed textures, is enhancing the perceived value and performance of decorative printed papers, driving their adoption in high-traffic furniture applications. The ongoing development of eco-friendly and biodegradable decorative papers is also gaining traction, aligning with the growing global consciousness towards environmental sustainability and responsible consumption. This aligns with the broader trend of green manufacturing and circular economy principles within the furniture industry.

Dominant Regions, Countries, or Segments in Furniture Decorative Printed Paper

The Asia-Pacific region is emerging as the undisputed leader in the Furniture Decorative Printed Paper market, driven by a confluence of factors. Its dominance is propelled by robust economic growth, significant infrastructure development, and a burgeoning middle-class with increasing disposable income, leading to heightened demand for aesthetically appealing furniture. China, a pivotal country within this region, plays a crucial role, housing a substantial portion of global furniture manufacturing output and a vast domestic market. Government policies supporting manufacturing and export, coupled with competitive production costs, have further solidified Asia-Pacific's position. The Low Pressure Laminates (LPL) segment is a significant growth driver within the application domain, accounting for an estimated 45% of the total market share in 2025. LPLs, widely used in furniture for their affordability and versatility, directly benefit from the demand for mass-produced, aesthetically diverse furniture. In terms of types, the 80GSM decorative paper segment is expected to lead, representing approximately 40% of the market share in 2025. This weight offers an optimal balance of printability, durability, and cost-effectiveness for a broad range of furniture applications. The growing emphasis on sustainable materials and interior design trends, particularly in emerging economies, further fuels the demand for decorative printed papers in these regions. The concentration of furniture manufacturing hubs in countries like China, Vietnam, and Indonesia within Asia-Pacific provides a ready market for these specialized papers. Furthermore, the increasing adoption of modern interior design aesthetics, emphasizing visual appeal and functional elegance, is directly translating into higher consumption of decorative printed papers for furniture. The region's commitment to technological advancements in printing and paper production further enhances its competitive edge.

Furniture Decorative Printed Paper Product Landscape

The product landscape for Furniture Decorative Printed Paper is dynamic, marked by a steady stream of innovations aimed at enhancing aesthetic appeal and functional performance. Key advancements include the development of high-fidelity printing technologies capable of replicating natural materials like wood grains and stone textures with exceptional realism. Specialized coatings are being integrated to provide superior scratch resistance, UV protection, and moisture repellency, crucial for furniture longevity in diverse environments. Unique selling propositions often revolve around the introduction of novel surface finishes, such as matte, high-gloss, and textured effects that mimic natural materials. The growing demand for eco-friendly products is driving the development of papers made from recycled content and printed with low-VOC (Volatile Organic Compound) inks, appealing to environmentally conscious consumers and manufacturers.

Key Drivers, Barriers & Challenges in Furniture Decorative Printed Paper

The Furniture Decorative Printed Paper market is propelled by several key drivers. Technological advancements in digital printing and gravure printing offer enhanced design flexibility and faster turnaround times. The growing global demand for interior design and home renovation, particularly in emerging economies, directly fuels furniture production and, consequently, decorative paper consumption. The affordability and versatility of decorative papers as an alternative to natural veneers and solid wood also serve as a significant driver.

Key challenges include the volatility of raw material prices, particularly pulp and ink, impacting production costs. Stringent environmental regulations regarding emissions and waste disposal can increase compliance costs for manufacturers. Furthermore, the competitive pressure from alternative materials like vinyl films and direct digital printing on panels necessitates continuous innovation to maintain market relevance. Supply chain disruptions, as experienced in recent years, can also pose a significant challenge to consistent production and delivery.

Emerging Opportunities in Furniture Decorative Printed Paper

Emerging opportunities lie in the development of smart decorative papers that incorporate functional properties, such as anti-microbial or self-healing surfaces. The burgeoning demand for personalized and customizable furniture presents a significant avenue for digital printing technologies that can produce unique designs on-demand. Untapped markets in developing regions with a growing middle class and increasing urbanization offer substantial growth potential. Furthermore, the trend towards sustainable living is creating opportunities for biodegradable and recyclable decorative papers made from responsibly sourced materials.

Growth Accelerators in the Furniture Decorative Printed Paper Industry

Catalysts driving long-term growth in the Furniture Decorative Printed Paper industry are multifaceted. Continued investment in research and development for advanced printing technologies, including 3D texture simulation and augmented reality-compatible designs, will be crucial. Strategic partnerships between paper manufacturers, furniture designers, and interior decorators can foster collaborative innovation and wider market penetration. Expansion into emerging markets with developing furniture industries, coupled with tailored product offerings, will unlock new revenue streams. The ongoing shift towards a circular economy model, promoting the use of recycled content and end-of-life recyclability for decorative papers, will also act as a significant growth accelerator.

Key Players Shaping the Furniture Decorative Printed Paper Market

- Felix Schoeller Group

- Ahlstrom-Munksjö

- Qifeng New Material

- Koehler Paper

- Malta-Decor

- Surteco

- Shandong Lunan New Materials

- Impress Surfaces

- KAMMERER

- Zhejiang Dilong New Material

- SHENGLONG SPLENDECOR

- Onyx Specialty Papers

- PAPCEL

- KJ Specialty Paper

- Pudumjee Paper Products

Notable Milestones in Furniture Decorative Printed Paper Sector

- 2019: Felix Schoeller Group expands its decorative paper portfolio with new eco-friendly product lines.

- 2020: Ahlstrom-Munksjö announces strategic acquisitions to bolster its specialty paper offerings.

- 2021: Qifeng New Material invests heavily in advanced gravure printing technology to enhance design capabilities.

- 2022: Malta-Decor introduces a new range of embossed decorative papers simulating natural wood textures.

- 2023: Surteco enhances its digital printing capabilities for customized furniture solutions.

- 2024: Shandong Lunan New Materials focuses on increasing production capacity for high-demand 80GSM decorative papers.

In-Depth Furniture Decorative Printed Paper Market Outlook

The future outlook for the Furniture Decorative Printed Paper market is exceptionally promising, driven by sustained demand for aesthetically pleasing and cost-effective furniture solutions. Growth accelerators such as ongoing technological innovation in printing and finishing, coupled with the increasing global emphasis on sustainable materials, will continue to shape the industry. Strategic market expansion into rapidly developing economies and the continuous introduction of value-added products that cater to evolving consumer preferences for personalization and enhanced durability will fuel robust growth. The industry is well-positioned to leverage emerging trends and capitalize on opportunities for innovation and market penetration in the coming years, with an estimated market value of $10,500 million units by 2033.

Furniture Decorative Printed Paper Segmentation

-

1. Application

- 1.1. Low Pressure Laminates

- 1.2. High Pressure Laminates

- 1.3. Edge Banding

-

2. Types

- 2.1. 70GSM

- 2.2. 80GSM

Furniture Decorative Printed Paper Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Furniture Decorative Printed Paper REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.7% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Furniture Decorative Printed Paper Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Low Pressure Laminates

- 5.1.2. High Pressure Laminates

- 5.1.3. Edge Banding

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 70GSM

- 5.2.2. 80GSM

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Furniture Decorative Printed Paper Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Low Pressure Laminates

- 6.1.2. High Pressure Laminates

- 6.1.3. Edge Banding

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 70GSM

- 6.2.2. 80GSM

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Furniture Decorative Printed Paper Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Low Pressure Laminates

- 7.1.2. High Pressure Laminates

- 7.1.3. Edge Banding

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 70GSM

- 7.2.2. 80GSM

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Furniture Decorative Printed Paper Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Low Pressure Laminates

- 8.1.2. High Pressure Laminates

- 8.1.3. Edge Banding

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 70GSM

- 8.2.2. 80GSM

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Furniture Decorative Printed Paper Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Low Pressure Laminates

- 9.1.2. High Pressure Laminates

- 9.1.3. Edge Banding

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 70GSM

- 9.2.2. 80GSM

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Furniture Decorative Printed Paper Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Low Pressure Laminates

- 10.1.2. High Pressure Laminates

- 10.1.3. Edge Banding

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 70GSM

- 10.2.2. 80GSM

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Felix Schoeller Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AhIlstrom-Munksjo

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Qifeng New Material

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Koehler Paper

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Malta-Decor

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Surteco

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shandong Lunan New Materials

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 lmpress Surfaces

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 KAMMERER

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Zhejiang Dilong New Material

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SHENGLONG SPLENDECOR

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Onyx Specialty Papers

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 PAPCEL

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 KJSpecialty Paper

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Pudumjee Paper Products

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Felix Schoeller Group

List of Figures

- Figure 1: Global Furniture Decorative Printed Paper Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Furniture Decorative Printed Paper Revenue (million), by Application 2024 & 2032

- Figure 3: North America Furniture Decorative Printed Paper Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Furniture Decorative Printed Paper Revenue (million), by Types 2024 & 2032

- Figure 5: North America Furniture Decorative Printed Paper Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Furniture Decorative Printed Paper Revenue (million), by Country 2024 & 2032

- Figure 7: North America Furniture Decorative Printed Paper Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Furniture Decorative Printed Paper Revenue (million), by Application 2024 & 2032

- Figure 9: South America Furniture Decorative Printed Paper Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Furniture Decorative Printed Paper Revenue (million), by Types 2024 & 2032

- Figure 11: South America Furniture Decorative Printed Paper Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Furniture Decorative Printed Paper Revenue (million), by Country 2024 & 2032

- Figure 13: South America Furniture Decorative Printed Paper Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Furniture Decorative Printed Paper Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Furniture Decorative Printed Paper Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Furniture Decorative Printed Paper Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Furniture Decorative Printed Paper Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Furniture Decorative Printed Paper Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Furniture Decorative Printed Paper Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Furniture Decorative Printed Paper Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Furniture Decorative Printed Paper Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Furniture Decorative Printed Paper Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Furniture Decorative Printed Paper Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Furniture Decorative Printed Paper Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Furniture Decorative Printed Paper Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Furniture Decorative Printed Paper Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Furniture Decorative Printed Paper Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Furniture Decorative Printed Paper Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Furniture Decorative Printed Paper Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Furniture Decorative Printed Paper Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Furniture Decorative Printed Paper Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Furniture Decorative Printed Paper Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Furniture Decorative Printed Paper Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Furniture Decorative Printed Paper Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Furniture Decorative Printed Paper Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Furniture Decorative Printed Paper Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Furniture Decorative Printed Paper Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Furniture Decorative Printed Paper Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Furniture Decorative Printed Paper Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Furniture Decorative Printed Paper Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Furniture Decorative Printed Paper Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Furniture Decorative Printed Paper Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Furniture Decorative Printed Paper Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Furniture Decorative Printed Paper Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Furniture Decorative Printed Paper Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Furniture Decorative Printed Paper Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Furniture Decorative Printed Paper Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Furniture Decorative Printed Paper Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Furniture Decorative Printed Paper Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Furniture Decorative Printed Paper Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Furniture Decorative Printed Paper Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Furniture Decorative Printed Paper?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Furniture Decorative Printed Paper?

Key companies in the market include Felix Schoeller Group, AhIlstrom-Munksjo, Qifeng New Material, Koehler Paper, Malta-Decor, Surteco, Shandong Lunan New Materials, lmpress Surfaces, KAMMERER, Zhejiang Dilong New Material, SHENGLONG SPLENDECOR, Onyx Specialty Papers, PAPCEL, KJSpecialty Paper, Pudumjee Paper Products.

3. What are the main segments of the Furniture Decorative Printed Paper?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 496.2 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Furniture Decorative Printed Paper," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Furniture Decorative Printed Paper report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Furniture Decorative Printed Paper?

To stay informed about further developments, trends, and reports in the Furniture Decorative Printed Paper, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence