Key Insights

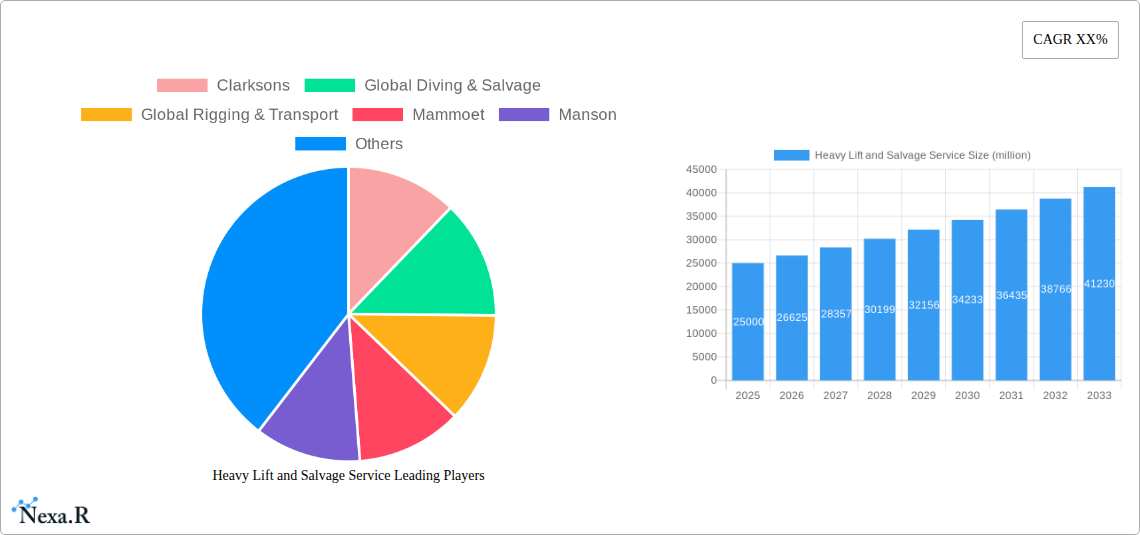

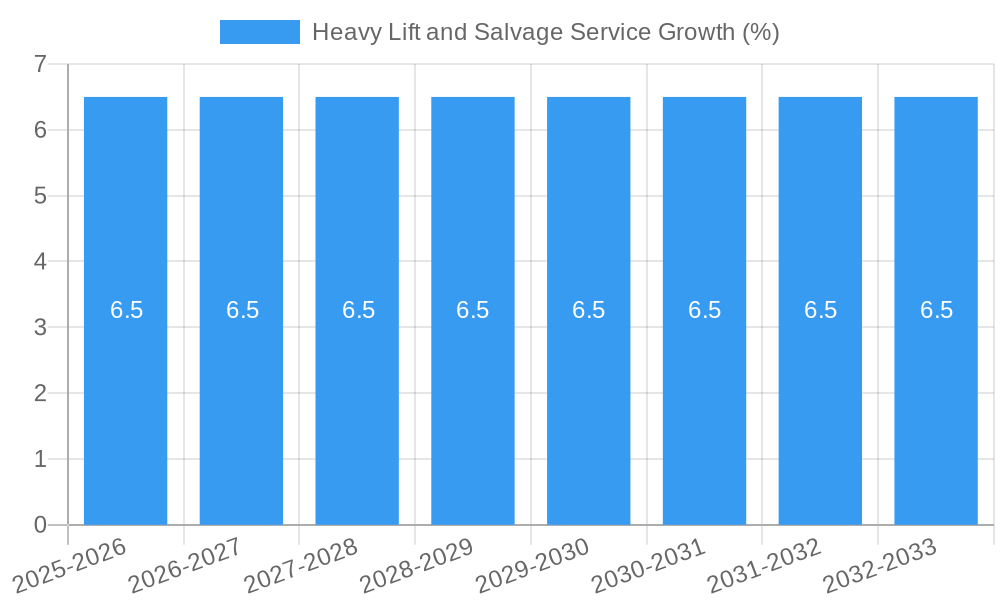

The global Heavy Lift and Salvage Service market is poised for robust expansion, projected to reach approximately $25,000 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This growth is primarily propelled by escalating activities in the offshore oil and gas sector, necessitating specialized heavy lift and salvage operations for exploration, production, and decommissioning. The increasing complexity of offshore infrastructure, coupled with a surge in international transport projects requiring the movement of oversized and heavy cargo, further fuels market demand. Moreover, the imperative for prompt and effective salvage operations following maritime incidents underscores the essential role of these services, contributing to the overall market value and expansion.

The market segmentation reveals a strong emphasis on the Offshore Heavy Lift and Salvage Service segment, which is expected to dominate due to the continuous investment in and maintenance of offshore assets. The "Oil and Gas" application segment stands out as a significant revenue generator, driven by both new project developments and the decommissioning of aging platforms. While the market enjoys substantial growth drivers, certain restraints, such as high operational costs associated with specialized equipment and personnel, and stringent regulatory frameworks governing salvage and environmental protection, could temper the pace of expansion. However, ongoing technological advancements in lifting, towing, and underwater intervention capabilities, alongside increased global maritime trade, are expected to mitigate these challenges and ensure sustained market growth. Leading companies like SMIT Salvage, Mammoet, and Clarksons are strategically positioned to capitalize on these opportunities.

Here is the SEO-optimized report description for Heavy Lift and Salvage Service, designed for maximum visibility and engagement.

Heavy Lift and Salvage Service Market Dynamics & Structure

The global Heavy Lift and Salvage Service market is characterized by a moderately concentrated structure, with key players like Mammoet, SCALDIS, SMIT Salvage, and Global Diving & Salvage holding significant market shares. Technological innovation is a primary driver, with advancements in specialized vessels, lifting equipment, and subsea robotics enhancing operational efficiency and safety. Regulatory frameworks, particularly concerning environmental protection and maritime safety, play a crucial role in shaping operational standards and investment decisions. Competitive product substitutes are limited, given the highly specialized nature of heavy lift and salvage operations. End-user demographics are dominated by the Oil and Gas and Offshore Infrastructure sectors, necessitating tailored solutions for complex projects. Mergers and acquisitions (M&A) trends are evident, driven by the pursuit of enhanced capabilities, expanded geographic reach, and economies of scale.

- Market Concentration: Moderate to high in specialized segments.

- Technological Innovation Drivers: Advanced lifting technologies, automation, subsea engineering, real-time monitoring.

- Regulatory Frameworks: IMO regulations, environmental protection acts, national maritime laws.

- Competitive Product Substitutes: Minimal, due to unique service requirements.

- End-User Demographics: Primarily Oil & Gas, Offshore Infrastructure, International Transport.

- M&A Trends: Strategic acquisitions for capability enhancement and market consolidation.

Heavy Lift and Salvage Service Growth Trends & Insights

The Heavy Lift and Salvage Service market is poised for robust growth, projected to expand significantly throughout the forecast period (2025–2033). The global market size for Heavy Lift and Salvage Services is anticipated to reach approximately $15,000 million by the end of 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 5.8% from the base year of 2025. This expansion is fueled by increasing investments in offshore oil and gas exploration and production, the development of offshore wind farms, and the growing demand for complex international transport of oversized cargo. Adoption rates for specialized heavy lift and salvage solutions are steadily increasing as industries recognize the critical need for efficient and safe handling of large-scale assets. Technological disruptions, such as the deployment of larger and more sophisticated crane vessels, autonomous underwater vehicles (AUVs) for subsea inspection and recovery, and advanced predictive maintenance systems, are transforming operational capabilities and creating new service avenues. Consumer behavior shifts are also contributing, with a greater emphasis on project reliability, environmental responsibility, and integrated service offerings. The parent market, encompassing all maritime logistics and heavy transportation, is estimated at $55,000 million in 2025, with the Heavy Lift and Salvage Service segment representing a substantial and growing portion.

The child market for specialized heavy lift and salvage operations is experiencing direct benefits from these overarching trends. For instance, the Offshore Infrastructure segment alone is projected to contribute over $6,000 million by 2033, driven by the construction of new offshore wind farms, subsea pipelines, and platforms. The Oil and Gas application continues to be a cornerstone, with ongoing decommissioning projects and new exploration initiatives requiring sophisticated heavy lift and salvage capabilities, estimated at approximately $5,000 million by 2033. International Transport, while subject to project-specific demands, is also a vital contributor, expected to reach around $3,000 million. The inherent complexity and high-risk nature of these operations necessitate specialized expertise and equipment, a demand that the leading service providers are increasingly fulfilling. Market penetration for advanced salvage techniques is rising, as evidenced by the increasing adoption of sophisticated dynamic positioning systems and remote operated vehicles (ROVs) that enhance precision and safety during critical operations. Furthermore, the growing global focus on sustainable maritime practices is influencing the development of more environmentally conscious salvage and heavy lift methods, adding another layer of innovation and demand. The historical period (2019–2024) has laid the groundwork for this accelerated growth, with steady project pipelines and continuous technological refinement.

Dominant Regions, Countries, or Segments in Heavy Lift and Salvage Service

The Offshore Infrastructure segment, particularly the burgeoning offshore wind energy sector, is emerging as a dominant force driving market growth within the Heavy Lift and Salvage Service industry. This segment is projected to contribute approximately $6,000 million to the global market by 2033. The exponential growth of offshore wind farms across Europe, North America, and Asia-Pacific necessitates the installation of massive wind turbine components, including foundations, towers, nacelles, and blades, all of which require specialized heavy lift capabilities. Furthermore, the expansion of existing wind farms and the development of new projects create a continuous demand for installation, maintenance, and, in some cases, salvage operations related to critical infrastructure.

- Key Drivers for Offshore Infrastructure Dominance:

- Global Renewable Energy Mandates: Governments worldwide are accelerating their transition to renewable energy sources, with offshore wind being a key pillar.

- Technological Advancements in Turbine Size: The increasing size and weight of offshore wind turbines demand increasingly powerful and specialized heavy lift vessels and equipment.

- Strategic Location of Wind Farms: These farms are often located in challenging marine environments, requiring robust salvage and heavy lift solutions for installation and emergency response.

- Government Incentives and Subsidies: Favorable policies and financial support are spurring investment in offshore wind projects.

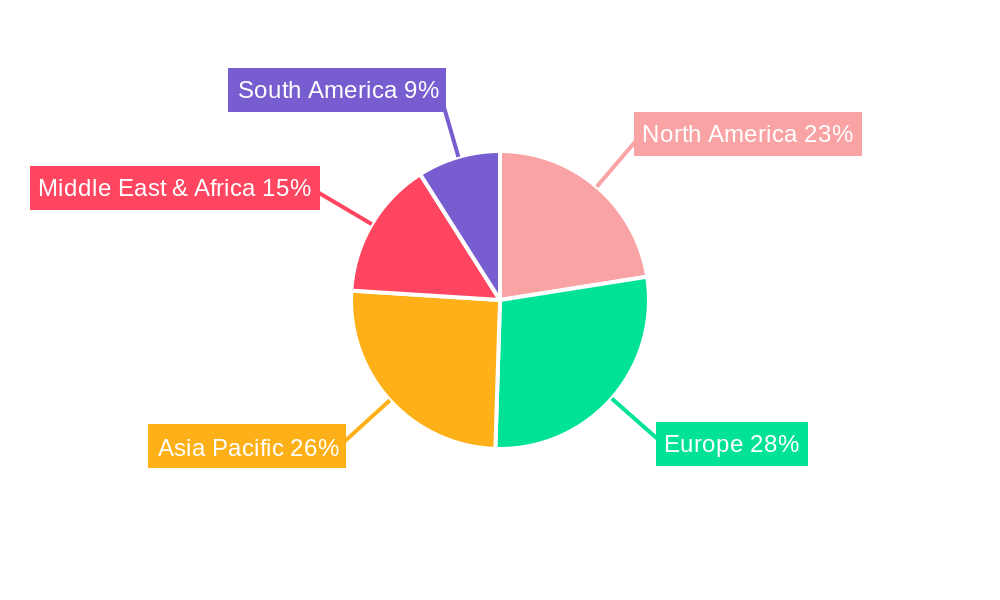

Geographically, Europe continues to be a leading region due to its established offshore wind market and extensive coastline. Countries like the United Kingdom, Germany, Denmark, and the Netherlands are at the forefront of offshore wind development, creating a substantial pipeline of projects requiring heavy lift and salvage services. North America, particularly the United States with its growing offshore wind ambitions, and Asia-Pacific, with countries like China and South Korea investing heavily in offshore energy, are also exhibiting significant growth potential, with market shares projected to increase substantially.

The Ocean Heavy Lift and Salvage Service type is intrinsically linked to the dominance of offshore infrastructure and oil and gas activities, representing a significant portion of the market, estimated at around $7,000 million by 2033. This encompasses the deployment of heavy lift vessels for offshore construction, the transportation of large modules and structures, and emergency salvage operations in deep-sea environments. The sheer scale of components for offshore energy projects, along with the logistical complexities of international transport of oversized cargo, further solidifies the importance of ocean-based heavy lift and salvage. While the Oil and Gas application remains a strong contributor, its growth trajectory is influenced by fluctuating energy prices and the ongoing shift towards renewables. However, decommissioning activities in mature oil and gas fields still present substantial opportunities for salvage and heavy lift services. The overall market dominance is a synergistic interplay between the demand for specialized infrastructure, the inherent need for maritime logistics, and the continuous evolution of technology in challenging marine environments.

Heavy Lift and Salvage Service Product Landscape

The Heavy Lift and Salvage Service product landscape is defined by an array of highly specialized vessels and advanced equipment designed for unparalleled lifting capacities and intricate salvage operations. Innovations focus on increasing lifting capabilities, enhancing precision, and improving operational safety in challenging marine environments. Key product advancements include the development of ultra-large sheerleg crane vessels and semi-submersible heavy lift vessels capable of handling payloads exceeding 15,000 metric tons. Furthermore, the integration of state-of-the-art dynamic positioning systems, advanced subsea robotics, and real-time operational monitoring technologies are transforming the efficiency and safety of complex offshore installations and salvage missions.

Key Drivers, Barriers & Challenges in Heavy Lift and Salvage Service

Key Drivers:

- Growth in Offshore Energy: Expansion of oil and gas exploration and production, coupled with the rapid growth of offshore wind farms, drives demand for heavy lift and salvage.

- Infrastructure Development: Increasing global investments in large-scale maritime infrastructure, such as ports, bridges, and subsea pipelines, require specialized lifting capabilities.

- Technological Advancements: Innovations in crane vessels, subsea technology, and automation enhance operational efficiency and enable more complex projects.

- Decommissioning Activities: The aging offshore infrastructure requires safe and efficient decommissioning, creating salvage and heavy lift opportunities.

Key Barriers & Challenges:

- High Capital Investment: The acquisition and maintenance of specialized heavy lift vessels and equipment require substantial capital outlay.

- Stringent Regulatory Requirements: Navigating complex international and national regulations for safety, environmental protection, and operational permits can be challenging.

- Geopolitical and Economic Volatility: Fluctuations in energy prices, global economic downturns, and geopolitical instability can impact project pipelines and investment.

- Skilled Workforce Shortage: The industry faces a challenge in recruiting and retaining a skilled workforce capable of operating advanced equipment and managing complex operations.

- Environmental Risks: The nature of salvage operations inherently involves environmental risks, requiring robust contingency planning and compliance.

Emerging Opportunities in Heavy Lift and Salvage Service

Emerging opportunities in the Heavy Lift and Salvage Service market are significantly driven by the increasing demand for offshore renewable energy infrastructure, particularly the development of larger and more complex offshore wind farms. Untapped markets in regions with developing offshore wind potential, such as parts of Asia and South America, present considerable growth avenues. Innovative applications are also emerging in the decommissioning of aging offshore platforms and the installation of subsea interconnectors and carbon capture and storage (CCS) infrastructure. Evolving consumer preferences for integrated service solutions, encompassing the entire lifecycle from installation to decommissioning, are creating demand for comprehensive heavy lift and salvage providers.

Growth Accelerators in the Heavy Lift and Salvage Service Industry

The growth accelerators in the Heavy Lift and Salvage Service industry are primarily fueled by continuous technological breakthroughs, strategic partnerships, and ambitious market expansion strategies. The development of larger, more powerful, and more efficient crane vessels, alongside advancements in underwater robotics and autonomous systems, are key technological catalysts. Strategic partnerships between heavy lift operators, offshore engineering firms, and renewable energy developers are crucial for securing large-scale projects and sharing expertise. Market expansion strategies, including geographical diversification and the acquisition of complementary service providers, are vital for sustained long-term growth, enabling companies to tap into new project pipelines and enhance their service portfolios.

Key Players Shaping the Heavy Lift and Salvage Service Market

- Clarksons

- Global Diving & Salvage

- Global Rigging & Transport

- Mammoet

- Manson

- McKINNEY SALVAGE

- Mer-Terre

- Randive

- SCALDIS

- SMIT Salvage

- Stevens Towing

- Wagenborg Towage

Notable Milestones in Heavy Lift and Salvage Service Sector

- 2021: Mammoet's successful installation of the world's largest offshore wind turbine foundations.

- 2022: SCALDIS completes the complex lifting and installation of XXL monopiles for the Dogger Bank Wind Farm.

- 2023: SMIT Salvage demonstrates advanced capabilities in a major complex vessel recovery operation.

- 2023: Global Diving & Salvage awarded significant contracts for offshore infrastructure development in North America.

- 2024: Development and deployment of new ultra-heavy lift vessels by key market players to meet growing offshore wind demands.

In-Depth Heavy Lift and Salvage Service Market Outlook

The future outlook for the Heavy Lift and Salvage Service market is exceptionally strong, driven by a confluence of accelerating growth factors. The sustained global push towards renewable energy, particularly the expansion of offshore wind farms, will continue to be a primary engine of demand for specialized lifting and installation services. Coupled with ongoing investment in offshore oil and gas infrastructure and critical decommissioning projects, the market is set for consistent expansion. Technological innovation, including the deployment of next-generation heavy lift vessels and advanced subsea intervention tools, will unlock new operational efficiencies and enable the execution of increasingly complex projects. Strategic collaborations and the consolidation of service providers are expected to further shape the market, leading to more integrated and comprehensive offerings. The industry's ability to adapt to evolving regulatory landscapes and embrace sustainable practices will be crucial for long-term success and continued growth.

Heavy Lift and Salvage Service Segmentation

-

1. Application

- 1.1. Oil and Gas

- 1.2. Offshore Infrastructure

- 1.3. International Transport

- 1.4. Others

-

2. Types

- 2.1. Offshore Heavy Lift and Salvage Service

- 2.2. Ocean Heavy Lift and Salvage Service

Heavy Lift and Salvage Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Heavy Lift and Salvage Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Heavy Lift and Salvage Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Oil and Gas

- 5.1.2. Offshore Infrastructure

- 5.1.3. International Transport

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Offshore Heavy Lift and Salvage Service

- 5.2.2. Ocean Heavy Lift and Salvage Service

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Heavy Lift and Salvage Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Oil and Gas

- 6.1.2. Offshore Infrastructure

- 6.1.3. International Transport

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Offshore Heavy Lift and Salvage Service

- 6.2.2. Ocean Heavy Lift and Salvage Service

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Heavy Lift and Salvage Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Oil and Gas

- 7.1.2. Offshore Infrastructure

- 7.1.3. International Transport

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Offshore Heavy Lift and Salvage Service

- 7.2.2. Ocean Heavy Lift and Salvage Service

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Heavy Lift and Salvage Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Oil and Gas

- 8.1.2. Offshore Infrastructure

- 8.1.3. International Transport

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Offshore Heavy Lift and Salvage Service

- 8.2.2. Ocean Heavy Lift and Salvage Service

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Heavy Lift and Salvage Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Oil and Gas

- 9.1.2. Offshore Infrastructure

- 9.1.3. International Transport

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Offshore Heavy Lift and Salvage Service

- 9.2.2. Ocean Heavy Lift and Salvage Service

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Heavy Lift and Salvage Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Oil and Gas

- 10.1.2. Offshore Infrastructure

- 10.1.3. International Transport

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Offshore Heavy Lift and Salvage Service

- 10.2.2. Ocean Heavy Lift and Salvage Service

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Clarksons

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Global Diving & Salvage

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Global Rigging & Transport

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mammoet

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Manson

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 McKINNEY SALVAGE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mer-Terre

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Randive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SCALDIS

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SMIT Salvage

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Stevens Towing

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Wagenborg Towage

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Clarksons

List of Figures

- Figure 1: Global Heavy Lift and Salvage Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Heavy Lift and Salvage Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Heavy Lift and Salvage Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Heavy Lift and Salvage Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Heavy Lift and Salvage Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Heavy Lift and Salvage Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Heavy Lift and Salvage Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Heavy Lift and Salvage Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Heavy Lift and Salvage Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Heavy Lift and Salvage Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Heavy Lift and Salvage Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Heavy Lift and Salvage Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Heavy Lift and Salvage Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Heavy Lift and Salvage Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Heavy Lift and Salvage Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Heavy Lift and Salvage Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Heavy Lift and Salvage Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Heavy Lift and Salvage Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Heavy Lift and Salvage Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Heavy Lift and Salvage Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Heavy Lift and Salvage Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Heavy Lift and Salvage Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Heavy Lift and Salvage Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Heavy Lift and Salvage Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Heavy Lift and Salvage Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Heavy Lift and Salvage Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Heavy Lift and Salvage Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Heavy Lift and Salvage Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Heavy Lift and Salvage Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Heavy Lift and Salvage Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Heavy Lift and Salvage Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Heavy Lift and Salvage Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Heavy Lift and Salvage Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Heavy Lift and Salvage Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Heavy Lift and Salvage Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Heavy Lift and Salvage Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Heavy Lift and Salvage Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Heavy Lift and Salvage Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Heavy Lift and Salvage Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Heavy Lift and Salvage Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Heavy Lift and Salvage Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Heavy Lift and Salvage Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Heavy Lift and Salvage Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Heavy Lift and Salvage Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Heavy Lift and Salvage Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Heavy Lift and Salvage Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Heavy Lift and Salvage Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Heavy Lift and Salvage Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Heavy Lift and Salvage Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Heavy Lift and Salvage Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Heavy Lift and Salvage Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Heavy Lift and Salvage Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Heavy Lift and Salvage Service?

Key companies in the market include Clarksons, Global Diving & Salvage, Global Rigging & Transport, Mammoet, Manson, McKINNEY SALVAGE, Mer-Terre, Randive, SCALDIS, SMIT Salvage, Stevens Towing, Wagenborg Towage.

3. What are the main segments of the Heavy Lift and Salvage Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Heavy Lift and Salvage Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Heavy Lift and Salvage Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Heavy Lift and Salvage Service?

To stay informed about further developments, trends, and reports in the Heavy Lift and Salvage Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence