Key Insights

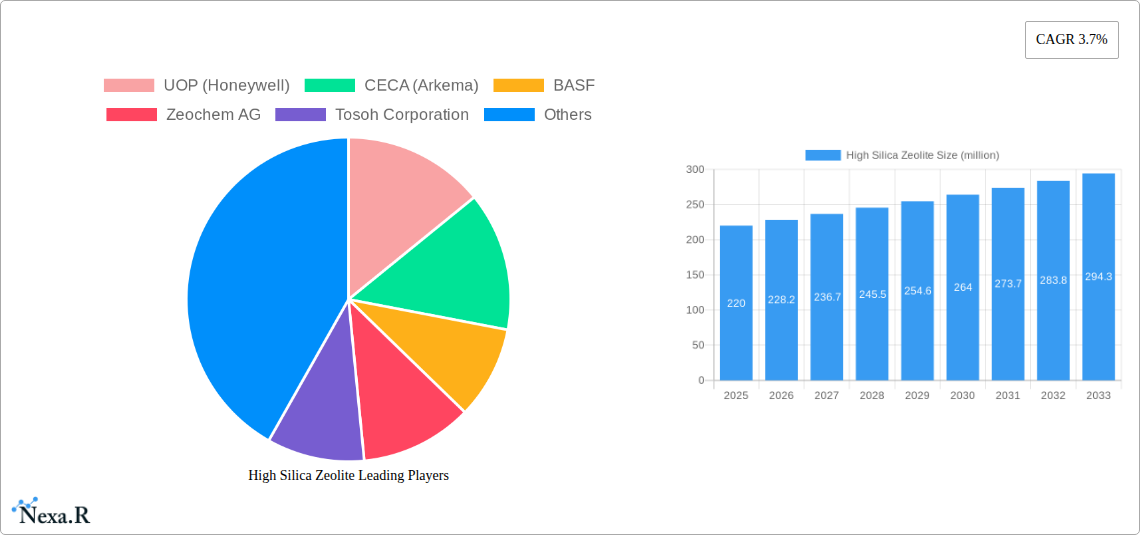

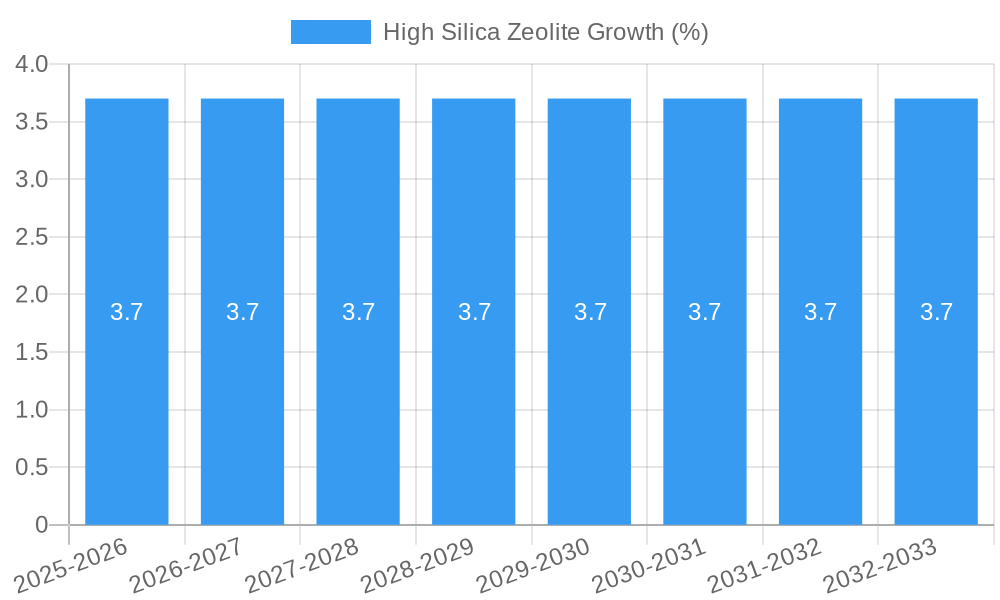

The global High Silica Zeolite market is poised for robust expansion, estimated at USD 220 million in 2025 and projected to witness a Compound Annual Growth Rate (CAGR) of 3.7% through 2033. This steady growth is primarily fueled by the escalating demand for advanced catalysts in the petroleum refining and petrochemical industries, critical for optimizing production efficiency and meeting stringent environmental regulations. High silica zeolites, with their superior thermal stability and selectivity, are becoming indispensable in processes like fluid catalytic cracking (FCC), isomerization, and selective hydrogenation. Emerging applications in areas such as industrial adsorbents, membranes for gas separation, and catalytic converters further bolster market prospects, indicating a diversification of demand beyond traditional core segments. The market's trajectory is also influenced by ongoing research and development efforts focused on creating novel zeolite structures with enhanced catalytic properties and improved sustainability profiles.

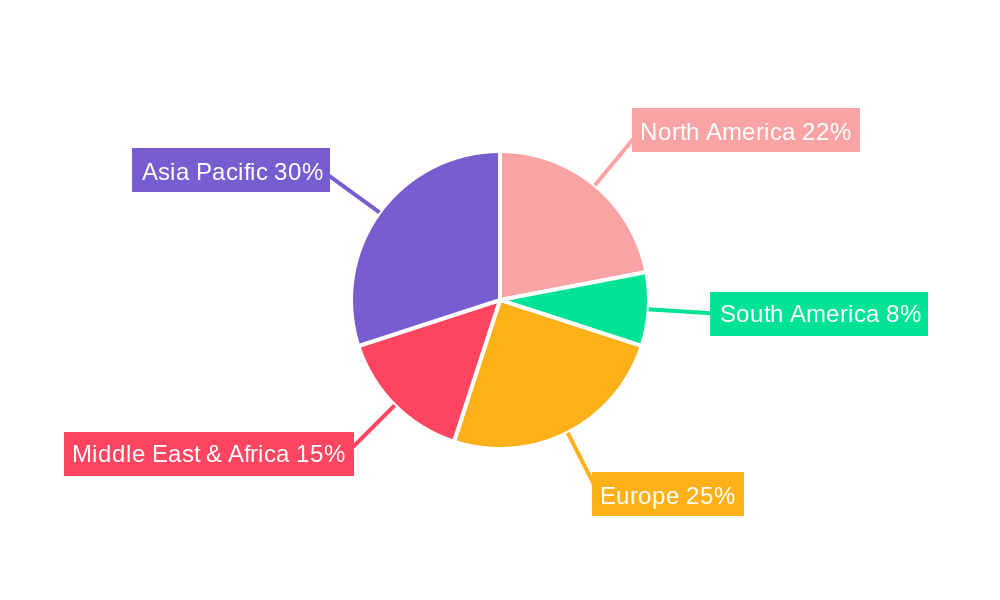

The market is segmented by application into Petroleum Refining Catalysts, Petrochemical Catalysts, and Others, with the former two segments expected to dominate owing to their established and growing usage in crucial industrial processes. By type, ZSM-5, USY, and Beta zeolites are anticipated to hold significant market shares, driven by their specific catalytic functionalities and widespread adoption. Geographically, the Asia Pacific region, led by China and India, is projected to be a key growth engine, propelled by rapid industrialization, increasing petrochemical production, and substantial investments in refining capacity. North America and Europe will continue to be significant markets, characterized by mature refining sectors and a strong emphasis on upgrading existing facilities and adopting cleaner technologies. Restraints, such as the high cost of production and the availability of alternative catalytic materials, are expected to be mitigated by technological advancements and the inherent performance advantages of high silica zeolites in demanding applications.

Unlock unparalleled insights into the High Silica Zeolite market with this comprehensive, SEO-optimized report. Delve into critical market dynamics, growth trajectories, and strategic opportunities across the petroleum refining, petrochemical, and other key application segments. This report is meticulously designed for industry professionals seeking data-driven intelligence on a market projected to reach xx million units by 2033.

High Silica Zeolite Market Dynamics & Structure

The High Silica Zeolite market is characterized by a moderate concentration, with a few prominent players holding significant market share. Technological innovation remains a key driver, propelled by the demand for more efficient and selective catalysts in the petroleum refining and petrochemical industries. Regulatory frameworks, particularly concerning environmental emissions and catalyst performance standards, are increasingly influencing market trends. Competitive product substitutes, such as amorphous silica and alumina, pose a moderate threat, but the unique properties of high silica zeolites continue to provide a competitive edge. End-user demographics are shifting towards industries with growing demands for advanced materials and cleaner processing techniques. Mergers and acquisitions (M&A) activity, while not extremely high, has been observed as companies seek to expand their product portfolios and geographical reach.

- Market Concentration: Moderately concentrated, with key players like UOP (Honeywell), CECA (Arkema), BASF, and W. R. Grace dominating market share.

- Technological Innovation Drivers: Increased demand for fuel efficiency, stricter environmental regulations, and the development of novel catalytic processes.

- Regulatory Frameworks: Growing emphasis on catalyst longevity, reduced emissions, and adherence to international environmental standards.

- Competitive Product Substitutes: Amorphous silica, alumina, and other molecular sieve materials present alternative solutions, though often with lower selectivity and activity.

- End-User Demographics: Primarily driven by the oil and gas sector, followed by the chemical manufacturing and environmental control industries.

- M&A Trends: Strategic acquisitions aimed at gaining access to new technologies, expanding production capacity, and strengthening market presence.

High Silica Zeolite Growth Trends & Insights

The global High Silica Zeolite market is poised for robust expansion, driven by escalating demand from the petroleum refining and petrochemical sectors. The study period of 2019–2033, with 2025 as the base year, highlights a sustained growth trajectory, with the forecast period of 2025–2033 expected to witness significant market penetration. This expansion is fueled by the inherent advantages of high silica zeolites, including their superior thermal stability, shape selectivity, and acidity, which are critical for optimizing various catalytic processes. For instance, in petroleum refining, these zeolites are indispensable for fluid catalytic cracking (FCC) operations, enhancing gasoline yields and improving octane numbers. Their role in isomerization, alkylation, and dewaxing processes further underscores their importance in producing cleaner fuels and meeting stringent environmental mandates.

In the petrochemical industry, high silica zeolites are instrumental in the production of high-value chemicals. Their applications in xylene isomerization, ethylene to propylene (ETP) conversion, and methanol-to-olefins (MTO) processes are critical for the synthesis of plastics, polymers, and other essential chemical intermediates. The increasing global demand for these end products directly translates into a higher demand for high silica zeolite catalysts. Furthermore, the "Others" application segment, encompassing environmental remediation, gas separation, and adsorption technologies, is also contributing to market growth. As environmental consciousness rises and industries seek sustainable solutions, the use of high silica zeolites in areas like NOx reduction and volatile organic compound (VOC) removal is gaining traction.

Technological disruptions, such as the development of hierarchical zeolites with improved diffusion properties and modified framework structures for enhanced catalytic activity, are also shaping market dynamics. These advancements are leading to the creation of more efficient and durable catalysts, thereby driving adoption rates. Consumer behavior shifts, in this context, refer to the evolving preferences of end-users for catalysts that offer longer service life, reduced regeneration cycles, and lower operational costs. The market is also witnessing a growing emphasis on customized zeolite solutions tailored to specific process requirements, further stimulating innovation and market expansion. The CAGR for the High Silica Zeolite market is projected to be substantial, indicating a healthy growth outlook.

Dominant Regions, Countries, or Segments in High Silica Zeolite

The global High Silica Zeolite market's dominance is significantly influenced by key regions and their respective contributions across various application and type segments. Asia Pacific consistently emerges as the leading region, driven by its robust petroleum refining and petrochemical industries, particularly in countries like China and India. These nations are characterized by rapid industrialization, increasing fuel consumption, and substantial investments in expanding refining capacity and petrochemical production. The sheer scale of operations in these sectors necessitates a continuous supply of high-performance catalysts like high silica zeolites.

Within the application segments, Petroleum Refining Catalysts represent a dominant force, accounting for a substantial market share. The ongoing demand for cleaner fuels, coupled with the need to optimize yields from crude oil, makes this segment a perpetual growth engine. Similarly, Petrochemical Catalysts are crucial for meeting the escalating global demand for plastics, polymers, and various chemical intermediates. The burgeoning automotive, packaging, and construction industries in emerging economies directly fuel the demand for these petrochemical products and, consequently, the catalysts used in their production.

By Type, the ZSM-5 Type zeolites often lead in market dominance due to their widespread application in a variety of catalytic processes, including FCC additive, methanol-to-gasoline conversion, and xylene isomerization. Their unique pore structure and high silica content provide excellent shape selectivity and catalytic activity for these critical reactions. USY Type zeolites also hold significant market share, particularly in FCC applications, where they contribute to improved gasoline yields and reduced SOx emissions. Beta Type zeolites, while perhaps not as dominant as ZSM-5 or USY, are carving out their niche in specialized catalytic applications requiring strong acidity and pore structure.

Key drivers for this regional and segmental dominance include favorable government policies supporting industrial growth, substantial foreign and domestic investment in infrastructure, and a large, growing consumer base for refined petroleum products and petrochemical derivatives. The presence of major refining and petrochemical hubs, coupled with the implementation of advanced technologies, further solidifies the dominance of these segments and regions. For instance, ongoing refinery upgrades and expansions in Asia Pacific, aimed at meeting higher fuel quality standards, are directly contributing to the demand for high silica zeolites.

High Silica Zeolite Product Landscape

The High Silica Zeolite product landscape is defined by continuous innovation aimed at enhancing catalytic performance and expanding application versatility. Key product developments focus on tailoring pore structures, framework compositions, and acidity to meet the specific demands of various industrial processes. For Petroleum Refining Catalysts, innovations include advanced zeolites that boost gasoline octane, improve diesel quality, and enable deeper conversion of heavier crude fractions. In Petrochemical Catalysts, new formulations offer superior selectivity for valuable chemical intermediates like olefins and aromatics, while also reducing byproduct formation. The ZSM-5 Type, USY Type, and Beta Type zeolites are continually being refined for improved thermal stability, hydrothermal resistance, and longer catalyst lifespans. Unique selling propositions often revolve around enhanced catalytic activity, increased selectivity, reduced regeneration frequency, and lower environmental impact.

Key Drivers, Barriers & Challenges in High Silica Zeolite

The High Silica Zeolite market is propelled by several key drivers. Technological advancements in catalyst synthesis leading to improved selectivity and activity are paramount. The increasing global demand for cleaner fuels and petrochemicals, driven by stricter environmental regulations and growing consumer awareness, further fuels market growth. Investment in new refining capacities and petrochemical plants, particularly in emerging economies, also acts as a significant growth accelerator.

Conversely, the market faces certain barriers and challenges. High research and development costs associated with novel zeolite synthesis can be a restraint. Volatility in crude oil prices can impact the economics of refining operations, indirectly affecting catalyst demand. Stringent environmental regulations, while driving demand for cleaner processes, also necessitate continuous adaptation and innovation, posing a challenge for manufacturers. Supply chain disruptions and the availability of key raw materials can also pose significant hurdles.

Emerging Opportunities in High Silica Zeolite

Emerging opportunities in the High Silica Zeolite sector lie in the growing demand for sustainable and green technologies. The development of zeolites for CO2 capture and conversion, for instance, presents a significant untapped market. Furthermore, their application in advanced separation processes for pharmaceuticals and fine chemicals, as well as in catalysis for biomass conversion, offers considerable growth potential. Evolving consumer preferences for environmentally friendly products are also creating opportunities for catalysts that enable more sustainable chemical production.

Growth Accelerators in the High Silica Zeolite Industry

Long-term growth in the High Silica Zeolite industry is being accelerated by breakthroughs in materials science, leading to the design of zeolites with tailored properties for highly specific catalytic reactions. Strategic partnerships between catalyst manufacturers and end-users are crucial for co-developing optimized solutions that address evolving process needs. Market expansion strategies, including the penetration of new geographical regions with developing refining and petrochemical infrastructure, are also significant growth catalysts. The increasing focus on circular economy principles is driving research into catalysts that facilitate the recycling and upcycling of materials.

Key Players Shaping the High Silica Zeolite Market

- UOP (Honeywell)

- CECA (Arkema)

- BASF

- Zeochem AG

- Tosoh Corporation

- W. R. Grace

- Zeolyst International

- Clariant

- CWK Chemiewerk Bad Köstritz GmbH

- KNT Group

- Zeolites & Allied Products

Notable Milestones in High Silica Zeolite Sector

- 2019: Introduction of novel ZSM-5 variants with enhanced hydrothermal stability for FCC applications.

- 2020: Major petrochemical company announces significant investment in MTO technology utilizing advanced high silica zeolites.

- 2021: CECA (Arkema) expands its production capacity for specialty zeolites to meet growing demand.

- 2022: UOP (Honeywell) launches a new generation of FCC catalysts with improved heavy oil conversion capabilities.

- 2023: BASF announces a new research initiative focused on zeolites for CO2 capture and utilization.

- 2024: Zeolyst International secures a major supply contract for USY-type zeolites for a new refinery project.

In-Depth High Silica Zeolite Market Outlook

- 2019: Introduction of novel ZSM-5 variants with enhanced hydrothermal stability for FCC applications.

- 2020: Major petrochemical company announces significant investment in MTO technology utilizing advanced high silica zeolites.

- 2021: CECA (Arkema) expands its production capacity for specialty zeolites to meet growing demand.

- 2022: UOP (Honeywell) launches a new generation of FCC catalysts with improved heavy oil conversion capabilities.

- 2023: BASF announces a new research initiative focused on zeolites for CO2 capture and utilization.

- 2024: Zeolyst International secures a major supply contract for USY-type zeolites for a new refinery project.

In-Depth High Silica Zeolite Market Outlook

The future outlook for the High Silica Zeolite market is exceptionally promising, driven by a confluence of technological advancements and escalating global demand for efficient and sustainable chemical processes. Growth accelerators, including ongoing R&D into novel zeolite structures for emerging applications like carbon capture and green chemistry, will be instrumental. Strategic partnerships between key players and end-users will foster tailored catalyst development, ensuring alignment with industry needs. Furthermore, the expanding petrochemical and refining landscape in developing regions presents significant untapped market potential, promising sustained growth throughout the forecast period.

High Silica Zeolite Segmentation

-

1. Application

- 1.1. Petroleum Refining Catalysts

- 1.2. Petrochemical Catalysts

- 1.3. Others

-

2. Type

- 2.1. ZSM-5 Type

- 2.2. USY Type

- 2.3. Beta Type

- 2.4. Others

High Silica Zeolite Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

High Silica Zeolite REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.7% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Silica Zeolite Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Petroleum Refining Catalysts

- 5.1.2. Petrochemical Catalysts

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. ZSM-5 Type

- 5.2.2. USY Type

- 5.2.3. Beta Type

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America High Silica Zeolite Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Petroleum Refining Catalysts

- 6.1.2. Petrochemical Catalysts

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. ZSM-5 Type

- 6.2.2. USY Type

- 6.2.3. Beta Type

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America High Silica Zeolite Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Petroleum Refining Catalysts

- 7.1.2. Petrochemical Catalysts

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. ZSM-5 Type

- 7.2.2. USY Type

- 7.2.3. Beta Type

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe High Silica Zeolite Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Petroleum Refining Catalysts

- 8.1.2. Petrochemical Catalysts

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. ZSM-5 Type

- 8.2.2. USY Type

- 8.2.3. Beta Type

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa High Silica Zeolite Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Petroleum Refining Catalysts

- 9.1.2. Petrochemical Catalysts

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. ZSM-5 Type

- 9.2.2. USY Type

- 9.2.3. Beta Type

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific High Silica Zeolite Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Petroleum Refining Catalysts

- 10.1.2. Petrochemical Catalysts

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. ZSM-5 Type

- 10.2.2. USY Type

- 10.2.3. Beta Type

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 UOP (Honeywell)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CECA (Arkema)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BASF

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Zeochem AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tosoh Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 W. R. Grace

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zeolyst International

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Clariant

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CWK Chemiewerk Bad Köstritz GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 KNT Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zeolites & Allied Products

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 UOP (Honeywell)

List of Figures

- Figure 1: Global High Silica Zeolite Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America High Silica Zeolite Revenue (million), by Application 2024 & 2032

- Figure 3: North America High Silica Zeolite Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America High Silica Zeolite Revenue (million), by Type 2024 & 2032

- Figure 5: North America High Silica Zeolite Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America High Silica Zeolite Revenue (million), by Country 2024 & 2032

- Figure 7: North America High Silica Zeolite Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America High Silica Zeolite Revenue (million), by Application 2024 & 2032

- Figure 9: South America High Silica Zeolite Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America High Silica Zeolite Revenue (million), by Type 2024 & 2032

- Figure 11: South America High Silica Zeolite Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America High Silica Zeolite Revenue (million), by Country 2024 & 2032

- Figure 13: South America High Silica Zeolite Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe High Silica Zeolite Revenue (million), by Application 2024 & 2032

- Figure 15: Europe High Silica Zeolite Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe High Silica Zeolite Revenue (million), by Type 2024 & 2032

- Figure 17: Europe High Silica Zeolite Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe High Silica Zeolite Revenue (million), by Country 2024 & 2032

- Figure 19: Europe High Silica Zeolite Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa High Silica Zeolite Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa High Silica Zeolite Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa High Silica Zeolite Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa High Silica Zeolite Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa High Silica Zeolite Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa High Silica Zeolite Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific High Silica Zeolite Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific High Silica Zeolite Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific High Silica Zeolite Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific High Silica Zeolite Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific High Silica Zeolite Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific High Silica Zeolite Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global High Silica Zeolite Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global High Silica Zeolite Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global High Silica Zeolite Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global High Silica Zeolite Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global High Silica Zeolite Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global High Silica Zeolite Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global High Silica Zeolite Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global High Silica Zeolite Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global High Silica Zeolite Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global High Silica Zeolite Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global High Silica Zeolite Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global High Silica Zeolite Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global High Silica Zeolite Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global High Silica Zeolite Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global High Silica Zeolite Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global High Silica Zeolite Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global High Silica Zeolite Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global High Silica Zeolite Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global High Silica Zeolite Revenue million Forecast, by Country 2019 & 2032

- Table 41: China High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific High Silica Zeolite Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Silica Zeolite?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the High Silica Zeolite?

Key companies in the market include UOP (Honeywell), CECA (Arkema), BASF, Zeochem AG, Tosoh Corporation, W. R. Grace, Zeolyst International, Clariant, CWK Chemiewerk Bad Köstritz GmbH, KNT Group, Zeolites & Allied Products.

3. What are the main segments of the High Silica Zeolite?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 220 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Silica Zeolite," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Silica Zeolite report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Silica Zeolite?

To stay informed about further developments, trends, and reports in the High Silica Zeolite, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence