Key Insights

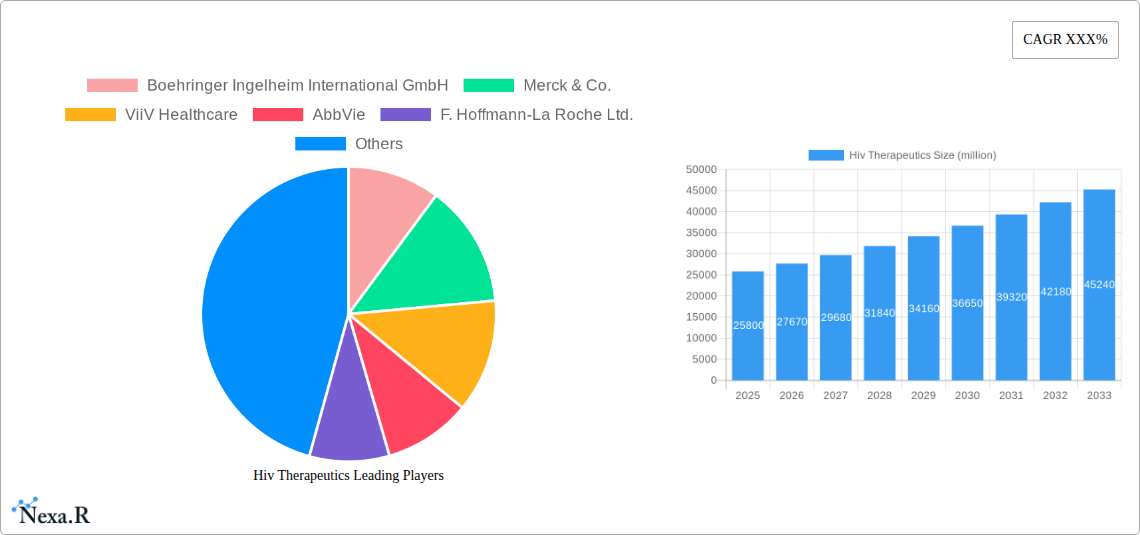

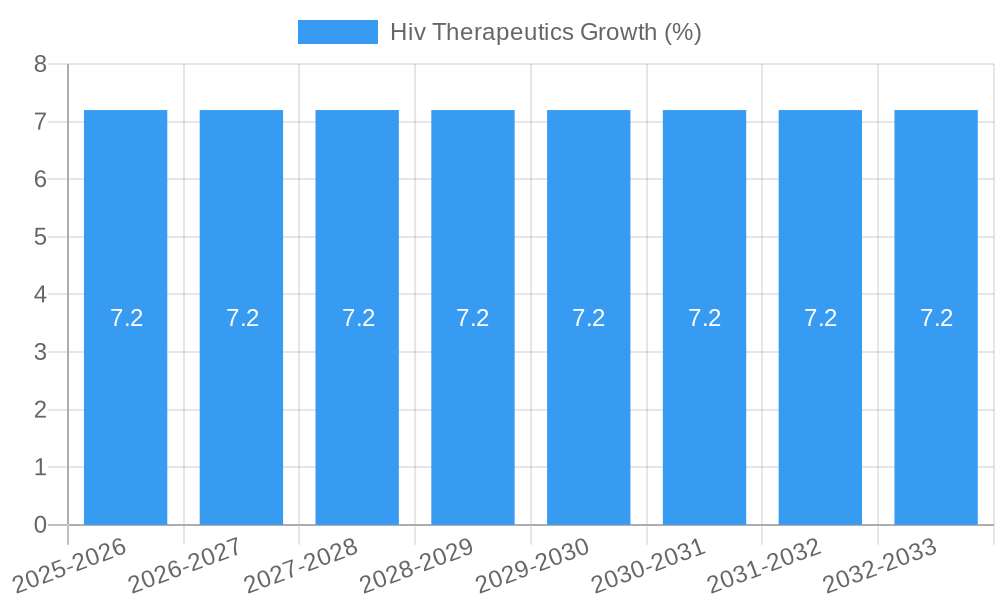

The global HIV therapeutics market is poised for significant expansion, projected to reach an estimated USD 25,800 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.2% throughout the forecast period (2025-2033). This growth is primarily fueled by advancements in drug development, leading to more effective and tolerable treatment regimens. The increasing prevalence of HIV, coupled with a growing awareness and accessibility of diagnostic and treatment services, are further bolstering market expansion. Key market drivers include the development of long-acting injectables, novel drug combinations that combat drug resistance, and a greater focus on preventing mother-to-child transmission (PMTCT). The rising demand for personalized medicine approaches, tailoring treatments to individual patient profiles, is also a significant trend shaping the therapeutic landscape.

The market is segmented across various applications, with Hospitals representing a substantial share due to the complexity of HIV management and the need for specialized care. Other key segments include Clinics and Labs. By type, Protease Inhibitors (PIs) and Integrase Inhibitors are dominating the market due to their high efficacy and improved safety profiles. However, Nucleoside-Analog Reverse Transcriptase Inhibitors (NRTIs) and Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs) continue to hold a significant market presence as foundational components of many treatment regimens. Restraints to market growth include the high cost of novel therapies, the persistent challenge of drug resistance, and disparities in access to treatment in low-income regions. Nevertheless, the increasing government initiatives and global health organizations' efforts to provide affordable access are expected to mitigate these challenges, paving the way for sustained market growth in the coming years.

This in-depth market research report provides a comprehensive analysis of the global HIV therapeutics market, encompassing its current landscape, historical trends, and future projections. Designed for industry professionals, investors, and stakeholders, this report offers actionable insights into market dynamics, growth drivers, challenges, and opportunities within the parent and child market segments.

HIV Therapeutics Market Dynamics & Structure

The global HIV therapeutics market is characterized by a moderately concentrated structure, with a few key players holding significant market share. Technological innovation is a primary driver, fueled by ongoing research and development into novel drug formulations, combination therapies, and long-acting injectables aimed at improving patient adherence and reducing viral load more effectively. Regulatory frameworks, including stringent approval processes by agencies like the FDA and EMA, play a crucial role in shaping market entry and product lifecycles. Competitive product substitutes are abundant, with continuous advancements in drug efficacy and safety profiles intensifying competition. End-user demographics, primarily HIV-infected individuals requiring lifelong treatment, represent a stable demand base. Mergers and acquisitions (M&A) are a notable trend, as larger pharmaceutical companies seek to consolidate their portfolios, acquire innovative pipelines, and expand their global reach. For instance, recent M&A activity has seen significant deal volumes in the range of $500 million to $2 billion. Barriers to innovation include high R&D costs, lengthy clinical trial durations, and the threat of generic competition upon patent expiry.

- Market Concentration: Moderately concentrated, with a significant presence of multinational pharmaceutical giants.

- Technological Innovation: Driven by advancements in antiretroviral drug classes, drug delivery systems, and cure research.

- Regulatory Frameworks: Strict yet supportive, balancing patient safety with timely access to innovative treatments.

- Competitive Landscape: Intense, with a focus on therapeutic efficacy, patient convenience, and managing drug resistance.

- End-User Demographics: Stable and growing, with increasing life expectancy for people living with HIV.

- M&A Trends: Ongoing consolidation and strategic acquisitions to bolster portfolios and market presence, with an estimated deal volume of $700 million in the last fiscal year.

- Innovation Barriers: High R&D investment, extended clinical trials, and pricing pressures.

HIV Therapeutics Growth Trends & Insights

The HIV therapeutics market has witnessed consistent growth over the historical period (2019-2024), driven by increasing global prevalence of HIV, improved diagnostics, and widespread access to antiretroviral therapy (ART). The market size, estimated at approximately $35,000 million in 2024, is projected to expand at a Compound Annual Growth Rate (CAGR) of around 4.5% during the forecast period (2025-2033). Adoption rates of newer, more effective, and less toxic drug regimens have been steadily rising, contributing to improved patient outcomes and quality of life. Technological disruptions are predominantly observed in the development of long-acting injectables and novel drug combinations that simplify treatment protocols. For example, the introduction of single-tablet regimens has significantly improved patient adherence, a critical factor in managing the chronic nature of HIV. Consumer behavior shifts are also influencing the market, with patients increasingly seeking personalized treatment options and greater involvement in their healthcare decisions. The growing awareness campaigns and government initiatives aimed at increasing HIV testing and treatment access in low- and middle-income countries are also substantial growth accelerators. Furthermore, research into pre-exposure prophylaxis (PrEP) and post-exposure prophylaxis (PEP) continues to expand the prophylactic applications of HIV therapeutics, albeit with distinct market dynamics. The base year market size in 2025 is projected to be $36,800 million.

- Market Size Evolution: From an estimated $35,000 million in 2024 to an anticipated $50,000 million by 2033.

- CAGR: Projected at 4.5% between 2025 and 2033.

- Adoption Rates: Increasing for single-tablet regimens and long-acting injectables.

- Technological Disruptions: Focus on reducing pill burden and improving patient convenience.

- Consumer Behavior Shifts: Demand for personalized medicine and greater patient empowerment.

- Market Penetration: High in developed economies, with significant growth potential in emerging markets.

- Historical Performance: Consistent year-over-year growth driven by evolving treatment paradigms.

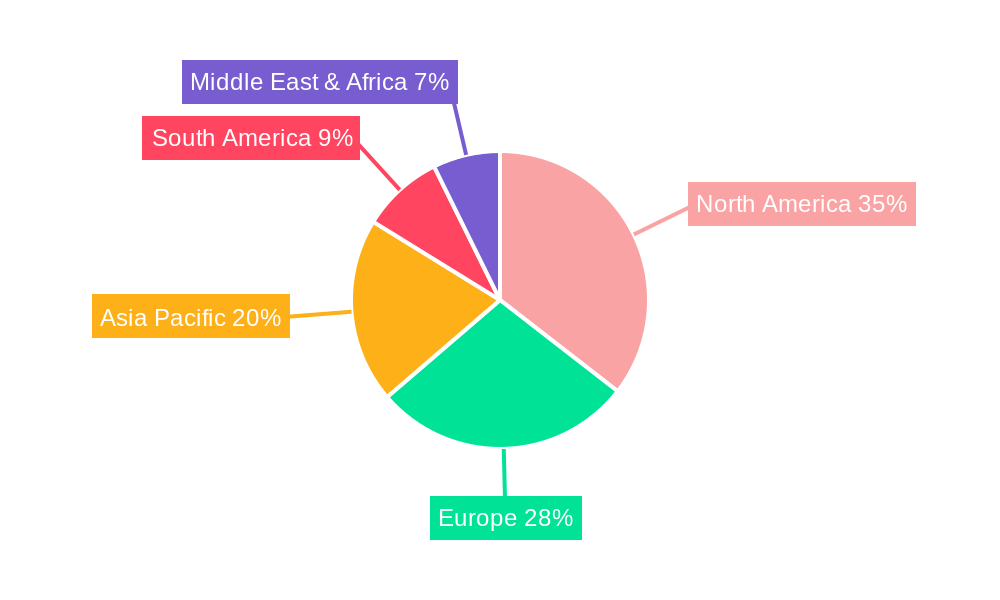

Dominant Regions, Countries, or Segments in HIV Therapeutics

North America, particularly the United States, is a dominant region in the HIV therapeutics market, driven by a robust healthcare infrastructure, high disposable income, advanced research capabilities, and strong government funding for HIV/AIDS research and treatment programs. The region's market share is estimated to be around 35% in 2025. The country's well-established pharmaceutical industry, coupled with a high prevalence of HIV and comprehensive patient registries, further solidifies its leading position. Within the therapeutic types, Integrase Inhibitors are currently a dominant segment, accounting for approximately 40% of the market revenue in 2025. This dominance is attributed to their high efficacy, favorable safety profiles, and effectiveness in initial treatment regimens, often as part of combination therapies. The application segment of Hospitals is also a significant contributor, as these institutions are central to diagnosis, treatment initiation, and management of complex HIV cases, representing an estimated 45% of the application market share.

Key drivers for North America's dominance include:

- Economic Policies: Favorable reimbursement policies and private health insurance coverage.

- Infrastructure: Advanced healthcare facilities and widespread availability of specialized HIV clinics.

- Research & Development: Significant investment in pharmaceutical R&D and a strong pipeline of innovative drugs.

- Awareness and Education: High public awareness and effective public health campaigns.

- Regulatory Environment: Streamlined approval processes for innovative therapies.

In terms of therapeutic types, the rapid uptake of integrase inhibitor-based regimens, such as dolutegravir and bictegravir, has propelled this segment to the forefront. Their role in preventing viral replication and offering high barrier to resistance makes them a cornerstone of modern HIV treatment. The application in Hospitals is crucial due to the specialized care required for managing HIV patients, including complex co-infections, adherence monitoring, and adverse event management. This necessitates integrated healthcare settings that offer comprehensive services. The market size for Integrase Inhibitors is projected to reach $18,000 million in 2025.

HIV Therapeutics Product Landscape

The HIV therapeutics product landscape is characterized by a dynamic pipeline of innovative drugs and evolving treatment regimens. Key product innovations include the development of long-acting injectable antiretrovirals, offering monthly or bi-monthly dosing options that significantly improve patient adherence and quality of life compared to daily oral regimens. Combination therapies, often in the form of single-tablet regimens (STRs), continue to be a cornerstone, simplifying treatment by consolidating multiple active pharmaceutical ingredients into one pill. These products offer enhanced efficacy, reduced pill burden, and improved safety profiles. Prominent examples of next-generation therapies are exploring novel mechanisms of action, aiming to overcome drug resistance and potentially offer a cure for HIV. The market also sees ongoing development in nucleoside-analog reverse transcriptase inhibitors (NRTIs) and non-nucleoside reverse transcriptase inhibitors (NNRTIs) with improved resistance profiles and better tolerability.

Key Drivers, Barriers & Challenges in HIV Therapeutics

The HIV therapeutics market is propelled by several key drivers. Technological advancements in drug discovery and development, leading to more effective and safer antiretroviral drugs, are paramount. Increasing global awareness and improved diagnostic capabilities contribute to higher diagnosis rates and, consequently, greater demand for treatment. Government initiatives and funding for HIV/AIDS prevention and treatment programs, particularly in developing nations, are crucial growth accelerators. The development of long-acting injectables is revolutionizing patient adherence and convenience.

- Key Drivers:

- Continuous innovation in antiretroviral drug development.

- Growing global prevalence and improved diagnostics.

- Government and non-governmental organization support.

- Shift towards patient-centric treatment models (e.g., long-acting injectables).

Conversely, significant barriers and challenges exist. High research and development costs associated with new drug discovery and clinical trials represent a substantial hurdle. The threat of drug resistance necessitates ongoing development of new agents and management strategies. Regulatory complexities and lengthy approval processes can delay market entry. Furthermore, pricing pressures, particularly in resource-limited settings, and the eventual emergence of generic alternatives can impact market revenue for innovator drugs. Supply chain disruptions can also pose a challenge, especially for specialized formulations.

- Barriers & Challenges:

- High R&D expenses and lengthy clinical trial durations.

- Emergence and management of drug resistance.

- Stringent and complex regulatory approval pathways.

- Pricing sensitivities and access issues in lower-income countries.

- Supply chain vulnerabilities and manufacturing complexities.

Emerging Opportunities in HIV Therapeutics

Emerging opportunities in the HIV therapeutics market lie in the development of novel cure strategies, including therapeutic vaccines and gene therapy approaches, which hold the potential to significantly alter the treatment paradigm. The expansion of pre-exposure prophylaxis (PrEP) and post-exposure prophylaxis (PEP) markets, particularly with the advent of long-acting formulations, presents a substantial growth avenue for preventing new infections. Furthermore, there is an unmet need for effective treatments in specific patient populations, such as those with multi-drug resistance or co-infections, creating opportunities for specialized therapeutic development. Untapped geographical markets in regions with high HIV burdens but limited access to advanced treatments also offer significant expansion potential for affordable and accessible HIV therapies.

Growth Accelerators in the HIV Therapeutics Industry

Long-term growth in the HIV therapeutics industry is significantly accelerated by breakthroughs in understanding HIV latency and developing strategies to eradicate the virus. Strategic partnerships between pharmaceutical companies, research institutions, and public health organizations are crucial for fostering innovation and facilitating the efficient development and distribution of new therapies. The increasing focus on patient-centered care, leading to the development of user-friendly treatment options like long-acting injectables, will continue to drive market expansion. Furthermore, market expansion strategies targeting underserved populations and geographical regions, coupled with robust global health initiatives, will play a pivotal role in sustaining industry growth.

Key Players Shaping the Hiv Therapeutics Market

- Boehringer Ingelheim International GmbH

- Merck & Co.

- ViiV Healthcare

- AbbVie

- F. Hoffmann-La Roche Ltd.

- Teva Pharmaceutical Industries Ltd.

- Bristol-Myers Squibb

- Gilead Sciences

- Johnson & Johnson

- Cipla Limited

Notable Milestones in Hiv Therapeutics Sector

- 2019 Q3: Launch of a new integrase inhibitor combination therapy with improved resistance profiles.

- 2020 Q1: Approval of the first long-acting injectable antiretroviral therapy for HIV treatment.

- 2021 Q4: Significant clinical trial results indicating potential for HIV remission in a subset of patients.

- 2022 Q2: Major pharmaceutical company acquires a biotech firm with a promising HIV cure research pipeline.

- 2023 Q1: Expansion of PrEP guidelines to include wider demographic groups.

- 2024 Q3: Regulatory approval for a novel HIV preventative vaccine candidate.

In-Depth HIV Therapeutics Market Outlook

The future outlook for the HIV therapeutics market remains robust, driven by sustained innovation in drug development and an increasing global focus on HIV eradication. Growth accelerators, including the maturation of the long-acting injectable market and progress in functional cure research, will significantly shape the therapeutic landscape. Strategic partnerships and global health initiatives will continue to be instrumental in ensuring broader access to life-saving treatments. The market is poised for further expansion, with ongoing research into novel therapeutic targets and a commitment to developing comprehensive HIV management solutions, offering significant opportunities for pharmaceutical companies and a brighter future for individuals living with HIV. The projected market size for 2033 is estimated to be $50,000 million.

Hiv Therapeutics Segmentation

-

1. Application

- 1.1. Hospitals

- 1.2. Clinics

- 1.3. Labs

-

2. Type

- 2.1. Nucleoside-Analog Reverse Transcriptase Inhibitors (NRTIs)

- 2.2. Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs)

- 2.3. Entry and Fusion Inhibitors

- 2.4. Protease Inhibitors (PIs)

- 2.5. Integrase Inhibitors

- 2.6. Coreceptor Antagonists

Hiv Therapeutics Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hiv Therapeutics REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hiv Therapeutics Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospitals

- 5.1.2. Clinics

- 5.1.3. Labs

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Nucleoside-Analog Reverse Transcriptase Inhibitors (NRTIs)

- 5.2.2. Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs)

- 5.2.3. Entry and Fusion Inhibitors

- 5.2.4. Protease Inhibitors (PIs)

- 5.2.5. Integrase Inhibitors

- 5.2.6. Coreceptor Antagonists

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Hiv Therapeutics Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospitals

- 6.1.2. Clinics

- 6.1.3. Labs

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Nucleoside-Analog Reverse Transcriptase Inhibitors (NRTIs)

- 6.2.2. Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs)

- 6.2.3. Entry and Fusion Inhibitors

- 6.2.4. Protease Inhibitors (PIs)

- 6.2.5. Integrase Inhibitors

- 6.2.6. Coreceptor Antagonists

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Hiv Therapeutics Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospitals

- 7.1.2. Clinics

- 7.1.3. Labs

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Nucleoside-Analog Reverse Transcriptase Inhibitors (NRTIs)

- 7.2.2. Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs)

- 7.2.3. Entry and Fusion Inhibitors

- 7.2.4. Protease Inhibitors (PIs)

- 7.2.5. Integrase Inhibitors

- 7.2.6. Coreceptor Antagonists

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Hiv Therapeutics Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospitals

- 8.1.2. Clinics

- 8.1.3. Labs

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Nucleoside-Analog Reverse Transcriptase Inhibitors (NRTIs)

- 8.2.2. Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs)

- 8.2.3. Entry and Fusion Inhibitors

- 8.2.4. Protease Inhibitors (PIs)

- 8.2.5. Integrase Inhibitors

- 8.2.6. Coreceptor Antagonists

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Hiv Therapeutics Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospitals

- 9.1.2. Clinics

- 9.1.3. Labs

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Nucleoside-Analog Reverse Transcriptase Inhibitors (NRTIs)

- 9.2.2. Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs)

- 9.2.3. Entry and Fusion Inhibitors

- 9.2.4. Protease Inhibitors (PIs)

- 9.2.5. Integrase Inhibitors

- 9.2.6. Coreceptor Antagonists

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Hiv Therapeutics Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospitals

- 10.1.2. Clinics

- 10.1.3. Labs

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Nucleoside-Analog Reverse Transcriptase Inhibitors (NRTIs)

- 10.2.2. Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs)

- 10.2.3. Entry and Fusion Inhibitors

- 10.2.4. Protease Inhibitors (PIs)

- 10.2.5. Integrase Inhibitors

- 10.2.6. Coreceptor Antagonists

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Boehringer Ingelheim International GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Merck & Co.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ViiV Healthcare

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 AbbVie

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 F. Hoffmann-La Roche Ltd.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Teva Pharmaceutical Industries Ltd.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bristol-Myers Squibb

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gilead Sciences

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Johnson & Johnson

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cipla Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Boehringer Ingelheim International GmbH

List of Figures

- Figure 1: Global Hiv Therapeutics Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Hiv Therapeutics Revenue (million), by Application 2024 & 2032

- Figure 3: North America Hiv Therapeutics Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Hiv Therapeutics Revenue (million), by Type 2024 & 2032

- Figure 5: North America Hiv Therapeutics Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Hiv Therapeutics Revenue (million), by Country 2024 & 2032

- Figure 7: North America Hiv Therapeutics Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Hiv Therapeutics Revenue (million), by Application 2024 & 2032

- Figure 9: South America Hiv Therapeutics Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Hiv Therapeutics Revenue (million), by Type 2024 & 2032

- Figure 11: South America Hiv Therapeutics Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Hiv Therapeutics Revenue (million), by Country 2024 & 2032

- Figure 13: South America Hiv Therapeutics Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Hiv Therapeutics Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Hiv Therapeutics Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Hiv Therapeutics Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Hiv Therapeutics Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Hiv Therapeutics Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Hiv Therapeutics Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Hiv Therapeutics Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Hiv Therapeutics Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Hiv Therapeutics Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Hiv Therapeutics Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Hiv Therapeutics Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Hiv Therapeutics Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Hiv Therapeutics Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Hiv Therapeutics Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Hiv Therapeutics Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Hiv Therapeutics Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Hiv Therapeutics Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Hiv Therapeutics Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Hiv Therapeutics Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Hiv Therapeutics Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Hiv Therapeutics Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Hiv Therapeutics Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Hiv Therapeutics Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Hiv Therapeutics Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Hiv Therapeutics Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Hiv Therapeutics Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Hiv Therapeutics Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Hiv Therapeutics Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Hiv Therapeutics Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Hiv Therapeutics Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Hiv Therapeutics Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Hiv Therapeutics Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Hiv Therapeutics Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Hiv Therapeutics Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Hiv Therapeutics Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Hiv Therapeutics Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Hiv Therapeutics Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Hiv Therapeutics Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hiv Therapeutics?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Hiv Therapeutics?

Key companies in the market include Boehringer Ingelheim International GmbH, Merck & Co., ViiV Healthcare, AbbVie, F. Hoffmann-La Roche Ltd., Teva Pharmaceutical Industries Ltd., Bristol-Myers Squibb, Gilead Sciences, Johnson & Johnson, Cipla Limited.

3. What are the main segments of the Hiv Therapeutics?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hiv Therapeutics," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hiv Therapeutics report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hiv Therapeutics?

To stay informed about further developments, trends, and reports in the Hiv Therapeutics, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence