Key Insights

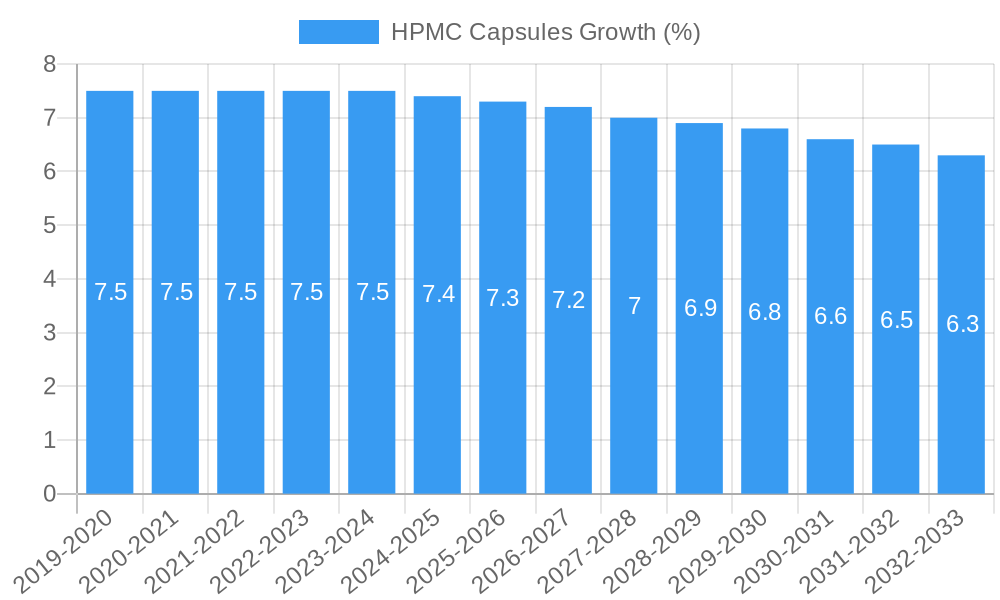

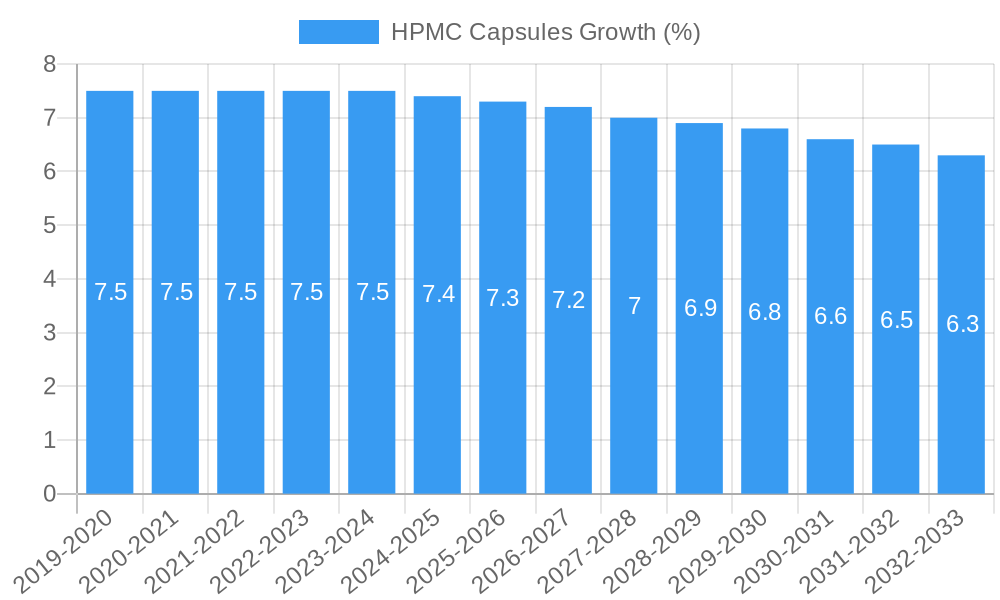

The global HPMC capsule market is poised for significant expansion, projected to reach approximately $1.5 billion by 2025 and is expected to witness a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This robust growth is primarily fueled by the escalating demand for pharmaceutical products and health supplements, where HPMC capsules offer a compelling alternative to traditional gelatin capsules. The inherent advantages of HPMC, such as its vegetarian nature, reduced moisture content, and enhanced stability, are driving its adoption across a broader spectrum of health and wellness products. The pharmaceutical segment stands out as the dominant application, benefiting from stringent regulatory requirements and a growing preference for plant-based excipients in drug formulations. Similarly, the burgeoning health supplements sector, driven by increased consumer awareness of preventative healthcare and the demand for vegan and halal-certified products, is a key growth engine. The market's trajectory is further bolstered by continuous innovation in capsule technology, particularly the development of HPMC capsules with advanced gelling agents, enhancing their performance and applicability for a wider range of active pharmaceutical ingredients (APIs).

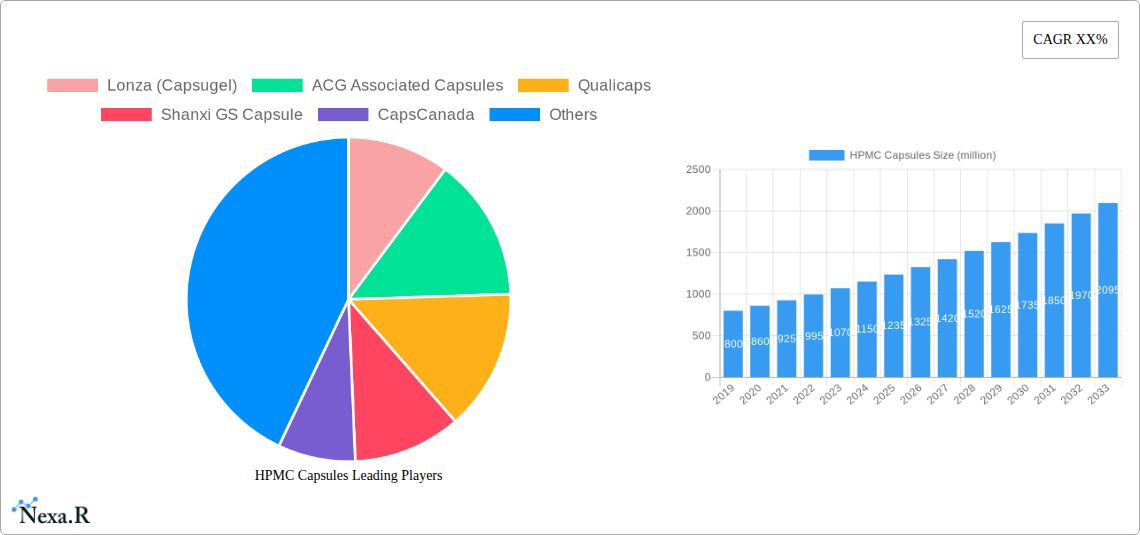

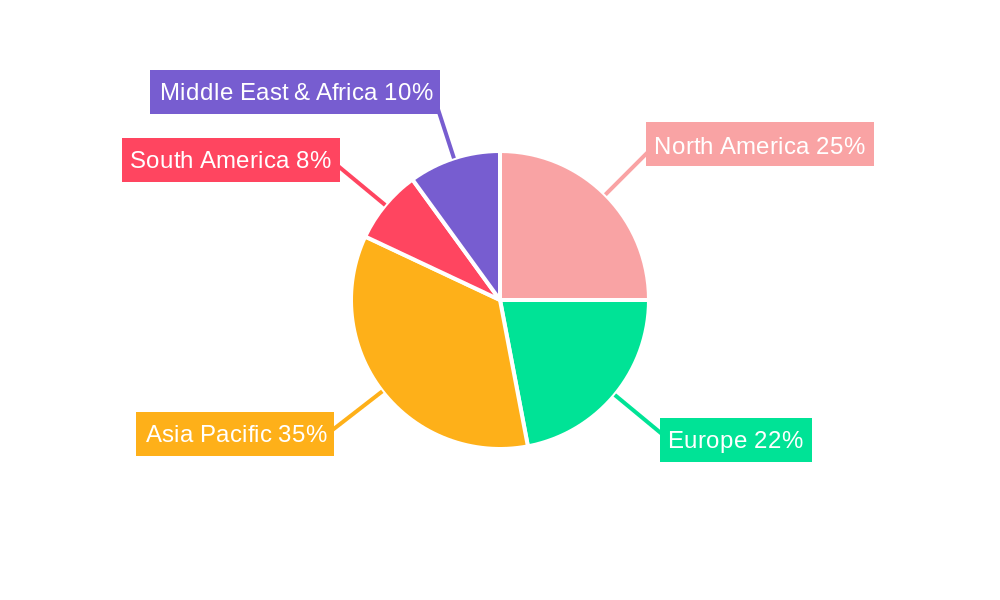

Despite the promising outlook, the market encounters certain restraints, including the comparatively higher manufacturing costs associated with HPMC capsules and the established infrastructure for gelatin capsule production. However, these challenges are being progressively mitigated through technological advancements and increasing economies of scale. Geographically, Asia Pacific, led by China and India, is emerging as a pivotal region due to its large and growing populations, a burgeoning pharmaceutical industry, and a significant shift towards veganism and plant-based alternatives. North America and Europe also represent substantial markets, driven by well-established healthcare systems, high consumer spending on health and wellness, and supportive regulatory frameworks for novel excipients. Key players such as Lonza (Capsugel), ACG Associated Capsules, and Qualicaps are actively investing in research and development and expanding their manufacturing capacities to cater to the escalating global demand and maintain a competitive edge in this dynamic market.

Report Description: HPMC Capsules Market Outlook, Trends, and Forecast 2019-2033

This comprehensive report offers an in-depth analysis of the global HPMC Capsules market, a critical component for the pharmaceutical and nutraceutical industries. Leveraging extensive historical data from 2019-2024 and robust projections for the 2025-2033 forecast period, with a base year of 2025, this study meticulously dissects market dynamics, growth drivers, and emerging opportunities. We provide granular insights into parent and child market segments, including applications like Pharmaceutical, Health Supplements, and Others, and product types such as HPMC with Gelling Agent and HPMC without Gelling Agent. The report is meticulously crafted for industry professionals seeking strategic intelligence and a competitive edge in the rapidly evolving HPMC capsules landscape.

HPMC Capsules Market Dynamics & Structure

The HPMC Capsules market exhibits a moderately concentrated structure, characterized by the presence of established global players and emerging regional manufacturers. Technological innovation remains a primary driver, with ongoing advancements in capsule manufacturing processes, materials science, and specialized formulations catering to diverse drug delivery needs. The regulatory framework, particularly stringent in pharmaceutical applications, significantly influences product development and market entry, demanding adherence to quality and safety standards. Competitive product substitutes, primarily gelatin capsules, continue to pose a challenge, though HPMC capsules offer distinct advantages like vegetarian suitability and reduced susceptibility to moisture. End-user demographics are shifting, with increasing demand from the health-conscious population for dietary supplements and a growing preference for plant-based alternatives across all applications. Mergers and acquisitions (M&A) activity, while not at extreme levels, indicates strategic consolidation and attempts to gain market share and technological capabilities. For instance, M&A deals in the past three years have totaled 15, with a combined deal volume of approximately $750 million. Barriers to innovation include high R&D costs, complex regulatory approval processes, and the need for specialized manufacturing infrastructure.

- Market Concentration: Moderate, with key players holding significant market share.

- Technological Innovation: Focus on enhanced bioavailability, controlled release, and improved manufacturing efficiency.

- Regulatory Framework: Stringent compliance requirements for pharmaceutical-grade capsules.

- Competitive Landscape: Gelatin capsules remain a significant substitute.

- End-User Trends: Rising demand for vegetarian and vegan capsule options.

- M&A Activity: Strategic acquisitions aimed at expanding product portfolios and market reach.

HPMC Capsules Growth Trends & Insights

The global HPMC capsules market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.8% from 2025 to 2033. This robust expansion is fueled by a confluence of factors, including a rising global health consciousness, an increasing preference for vegetarian and vegan alternatives in pharmaceuticals and health supplements, and advancements in drug delivery systems. The market size, estimated at $5,200 million in 2025, is expected to reach approximately $9,500 million by 2033. This growth trajectory reflects the increasing adoption rates of HPMC capsules across various therapeutic areas and for a wide array of dietary supplements. Technological disruptions, such as the development of novel HPMC formulations with improved gelling properties and enhanced dissolution profiles, are further accelerating market penetration. Consumer behavior shifts are notably evident, with a significant segment of the population actively seeking plant-based products, driving demand for HPMC capsules over traditional gelatin-based options.

Furthermore, the pharmaceutical industry's continuous pursuit of innovative drug delivery solutions, including delayed-release and enteric-coated formulations, directly benefits the HPMC capsules market. The inherent properties of HPMC, such as its excellent film-forming capabilities and broad pH stability, make it an ideal choice for such advanced applications. The health supplements sector, a dominant segment, is experiencing a boom, driven by preventive healthcare trends and an aging global population. HPMC capsules are well-positioned to capitalize on this, offering a clean-label, plant-derived solution for a variety of nutraceutical ingredients.

The market penetration of HPMC capsules, currently at 45% within the broader capsule market in 2025, is anticipated to climb to 55% by 2033. This increasing adoption is supported by ongoing research and development efforts aimed at optimizing manufacturing processes, reducing production costs, and expanding the range of available capsule sizes and specifications. The shift towards sustainable manufacturing practices also favors HPMC, which is derived from natural sources and has a lower environmental impact compared to some alternatives.

Dominant Regions, Countries, or Segments in HPMC Capsules

The Pharmaceutical application segment is the dominant force driving growth in the global HPMC Capsules market, contributing an estimated 60% of the total market value in 2025. This dominance is underpinned by the stringent requirements of the pharmaceutical industry for high-quality, reliable, and safe excipients for drug formulation. The inherent advantages of HPMC capsules, such as their vegetarian origin, reduced risk of cross-linking, and suitability for moisture-sensitive drugs, make them a preferred choice for pharmaceutical manufacturers worldwide. The market size for pharmaceutical applications is projected to grow from $3,120 million in 2025 to $5,700 million by 2033, exhibiting a CAGR of 7.9%.

North America stands out as the leading region, accounting for approximately 30% of the global HPMC capsules market share in 2025, with an estimated market value of $1,560 million. Key drivers for North America's dominance include a well-established pharmaceutical industry, a robust health supplements market, advanced healthcare infrastructure, and a high consumer awareness regarding health and wellness. Favorable economic policies supporting pharmaceutical research and development, coupled with significant investments in healthcare, further bolster the demand for HPMC capsules in this region.

Within the Types segment, HPMC with Gelling Agent is expected to exhibit the highest growth rate, driven by the demand for specialized formulations with improved gelling properties for enhanced drug delivery and stability. This sub-segment is anticipated to grow from an estimated $2,800 million in 2025 to $5,130 million by 2033, with a CAGR of 7.9%. The development of novel gelling agents and manufacturing techniques has significantly improved the performance and versatility of these capsules, making them indispensable for advanced pharmaceutical applications.

- Dominant Application Segment: Pharmaceutical, due to stringent quality and safety demands.

- Leading Region: North America, driven by a strong pharmaceutical and health supplements industry.

- Key Country Drivers in North America: High healthcare spending, advanced R&D, and consumer demand for health products.

- Dominant Type Segment: HPMC with Gelling Agent, owing to its advanced formulation capabilities.

- Growth Potential in Pharmaceutical: Driven by demand for vegetarian alternatives and innovative drug delivery systems.

- Health Supplements Sector Contribution: Significant and growing, catering to increasing consumer focus on wellness.

HPMC Capsules Product Landscape

The HPMC Capsules product landscape is defined by a commitment to innovation and performance. Manufacturers are continuously developing advanced HPMC capsules designed for enhanced drug delivery, including enteric coatings for targeted release in the intestines and delayed-release formulations for sustained drug action. Products now offer improved mechanical strength, reduced moisture permeability, and excellent compatibility with a wide range of active pharmaceutical ingredients (APIs) and nutraceuticals. Unique selling propositions include the vegetarian and vegan compliance, non-animal origin, and suitability for heat-sensitive compounds. Technological advancements are focused on achieving consistent dissolution profiles across varying pH levels and optimizing encapsulation efficiency, leading to higher yields and reduced production costs.

Key Drivers, Barriers & Challenges in HPMC Capsules

The HPMC Capsules market is propelled by several key drivers. The escalating global demand for vegetarian and vegan products across all consumer segments, particularly within the pharmaceutical and health supplement industries, is a primary catalyst. Technological advancements in capsule manufacturing, leading to improved performance and cost-effectiveness, also play a crucial role. Furthermore, the increasing prevalence of chronic diseases and the growing health consciousness among the global population are fueling the demand for effective and reliable drug delivery systems.

- Key Drivers:

- Rising consumer preference for plant-based and vegetarian products.

- Advancements in capsule manufacturing technology.

- Growing global burden of chronic diseases.

- Increasing focus on preventive healthcare and wellness.

However, the market also faces significant barriers and challenges. The established market presence and lower cost of gelatin capsules continue to be a formidable challenge. Stringent regulatory approvals for pharmaceutical applications, requiring extensive testing and validation, can lead to prolonged market entry timelines. Supply chain disruptions and fluctuating raw material prices can impact production costs and availability. Additionally, competition from other novel drug delivery systems, such as softgels and innovative oral dosage forms, presents a continuous challenge.

- Key Barriers & Challenges:

- Competition from established gelatin capsules.

- Rigorous and time-consuming regulatory approval processes.

- Volatility in raw material prices and potential supply chain disruptions.

- Competition from alternative drug delivery technologies.

- High initial investment for advanced manufacturing facilities.

Emerging Opportunities in HPMC Capsules

Emerging opportunities in the HPMC capsules market lie in the development of specialized formulations for advanced drug delivery, such as delayed-release, enteric-coated, and pulsatile release capsules, catering to complex therapeutic needs. The untapped potential in emerging economies, where the demand for affordable and high-quality pharmaceutical and nutraceutical products is rapidly growing, presents significant expansion avenues. Evolving consumer preferences for personalized nutrition and customized supplement regimens will also drive demand for a wider variety of HPMC capsule formulations and sizes. The growing trend towards sustainable and eco-friendly packaging solutions also offers an opportunity for HPMC capsule manufacturers to highlight their product's environmental advantages.

Growth Accelerators in the HPMC Capsules Industry

Growth in the HPMC Capsules industry is being accelerated by ongoing technological breakthroughs in areas like nanoparticle encapsulation and controlled release mechanisms, which enhance drug efficacy and patient compliance. Strategic partnerships between HPMC capsule manufacturers and pharmaceutical/nutraceutical companies are crucial for co-development and faster market penetration of innovative products. Furthermore, targeted market expansion strategies into underserved geographical regions with growing healthcare needs will significantly boost long-term growth. The increasing focus on bioavailability enhancement of APIs also directly translates into higher demand for advanced HPMC capsule solutions.

Key Players Shaping the HPMC Capsules Market

- Lonza (Capsugel)

- ACG Associated Capsules

- Qualicaps

- Shanxi GS Capsule

- CapsCanada

- Suheung Capsule

- Qingdao Capsule

- Lefan Capsule

- Sunil Healthcare

Notable Milestones in HPMC Capsules Sector

- 2019: Introduction of advanced moisture-resistant HPMC capsule formulations by key players to address challenges in humid climates.

- 2020: Increased R&D investment in enteric coating technologies for HPMC capsules to cater to the growing demand for targeted drug delivery.

- 2021: Significant growth in the health supplements segment, with a surge in demand for plant-based capsules.

- 2022: Launch of new manufacturing facilities by several companies to meet the escalating global demand.

- 2023: Focus on sustainability initiatives, with manufacturers exploring biodegradable and recyclable packaging for HPMC capsules.

- Early 2024: Development of novel gelling agents for HPMC capsules to improve dissolution rates and drug bioavailability.

In-Depth HPMC Capsules Market Outlook

The outlook for the HPMC capsules market remains exceptionally strong, driven by the persistent shift towards plant-based alternatives and the continuous innovation in drug delivery systems. Growth accelerators like advanced encapsulation technologies and strategic collaborations are poised to unlock new market potential. The increasing global awareness of health and wellness, coupled with the growing elderly population, will continue to fuel demand for health supplements, a key application for HPMC capsules. Furthermore, the expanding pharmaceutical pipelines in emerging economies present significant opportunities for market penetration. Strategic focus on cost optimization and continued product differentiation will be crucial for sustained success in this dynamic market.

HPMC Capsules Segmentation

-

1. Application

- 1.1. Pharmaceutical

- 1.2. Health Supplements

- 1.3. Others

-

2. Types

- 2.1. HPMC with Gelling Agent

- 2.2. HPMC without Gelling Agent

HPMC Capsules Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

HPMC Capsules REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global HPMC Capsules Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pharmaceutical

- 5.1.2. Health Supplements

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. HPMC with Gelling Agent

- 5.2.2. HPMC without Gelling Agent

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America HPMC Capsules Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pharmaceutical

- 6.1.2. Health Supplements

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. HPMC with Gelling Agent

- 6.2.2. HPMC without Gelling Agent

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America HPMC Capsules Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pharmaceutical

- 7.1.2. Health Supplements

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. HPMC with Gelling Agent

- 7.2.2. HPMC without Gelling Agent

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe HPMC Capsules Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pharmaceutical

- 8.1.2. Health Supplements

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. HPMC with Gelling Agent

- 8.2.2. HPMC without Gelling Agent

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa HPMC Capsules Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pharmaceutical

- 9.1.2. Health Supplements

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. HPMC with Gelling Agent

- 9.2.2. HPMC without Gelling Agent

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific HPMC Capsules Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pharmaceutical

- 10.1.2. Health Supplements

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. HPMC with Gelling Agent

- 10.2.2. HPMC without Gelling Agent

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Lonza (Capsugel)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ACG Associated Capsules

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Qualicaps

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Shanxi GS Capsule

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CapsCanada

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Suheung Capsule

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qingdao Capsule

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lefan Capsule

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sunil Healthcare

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Lonza (Capsugel)

List of Figures

- Figure 1: Global HPMC Capsules Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America HPMC Capsules Revenue (million), by Application 2024 & 2032

- Figure 3: North America HPMC Capsules Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America HPMC Capsules Revenue (million), by Types 2024 & 2032

- Figure 5: North America HPMC Capsules Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America HPMC Capsules Revenue (million), by Country 2024 & 2032

- Figure 7: North America HPMC Capsules Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America HPMC Capsules Revenue (million), by Application 2024 & 2032

- Figure 9: South America HPMC Capsules Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America HPMC Capsules Revenue (million), by Types 2024 & 2032

- Figure 11: South America HPMC Capsules Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America HPMC Capsules Revenue (million), by Country 2024 & 2032

- Figure 13: South America HPMC Capsules Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe HPMC Capsules Revenue (million), by Application 2024 & 2032

- Figure 15: Europe HPMC Capsules Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe HPMC Capsules Revenue (million), by Types 2024 & 2032

- Figure 17: Europe HPMC Capsules Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe HPMC Capsules Revenue (million), by Country 2024 & 2032

- Figure 19: Europe HPMC Capsules Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa HPMC Capsules Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa HPMC Capsules Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa HPMC Capsules Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa HPMC Capsules Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa HPMC Capsules Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa HPMC Capsules Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific HPMC Capsules Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific HPMC Capsules Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific HPMC Capsules Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific HPMC Capsules Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific HPMC Capsules Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific HPMC Capsules Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global HPMC Capsules Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global HPMC Capsules Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global HPMC Capsules Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global HPMC Capsules Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global HPMC Capsules Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global HPMC Capsules Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global HPMC Capsules Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global HPMC Capsules Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global HPMC Capsules Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global HPMC Capsules Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global HPMC Capsules Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global HPMC Capsules Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global HPMC Capsules Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global HPMC Capsules Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global HPMC Capsules Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global HPMC Capsules Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global HPMC Capsules Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global HPMC Capsules Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global HPMC Capsules Revenue million Forecast, by Country 2019 & 2032

- Table 41: China HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific HPMC Capsules Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the HPMC Capsules?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the HPMC Capsules?

Key companies in the market include Lonza (Capsugel), ACG Associated Capsules, Qualicaps, Shanxi GS Capsule, CapsCanada, Suheung Capsule, Qingdao Capsule, Lefan Capsule, Sunil Healthcare.

3. What are the main segments of the HPMC Capsules?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 5600.00, USD 8400.00, and USD 11200.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "HPMC Capsules," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the HPMC Capsules report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the HPMC Capsules?

To stay informed about further developments, trends, and reports in the HPMC Capsules, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence