Key Insights

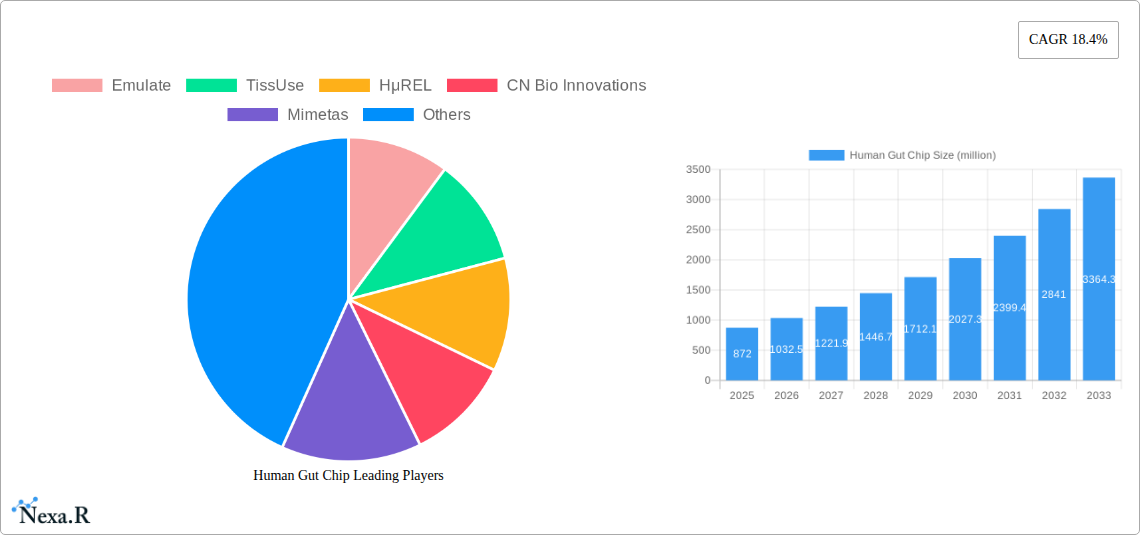

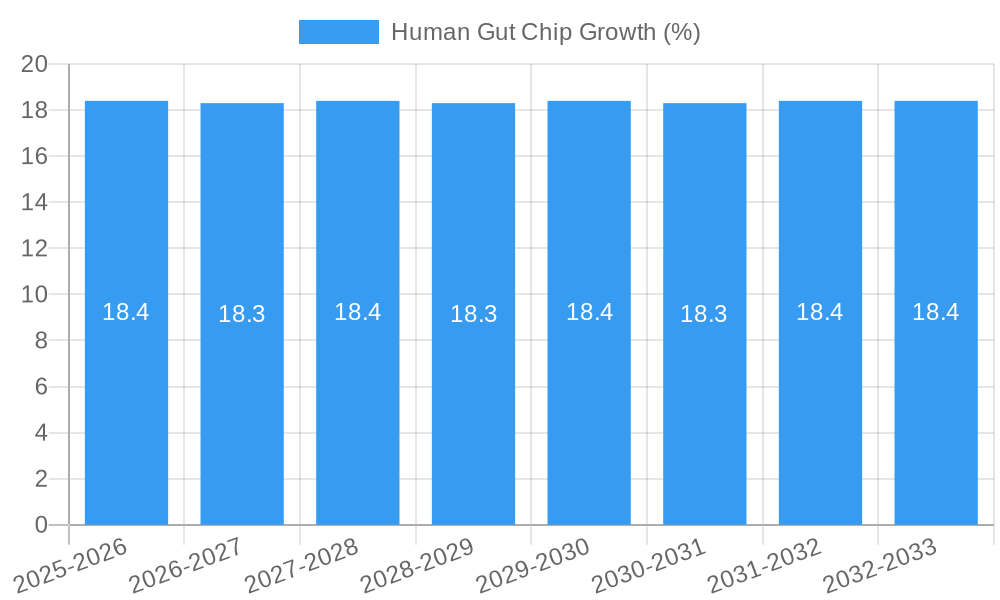

The Human Gut Chip market is poised for exceptional growth, projected to reach \$872 million in 2025 with a remarkable Compound Annual Growth Rate (CAGR) of 18.4% throughout the forecast period extending to 2033. This surge is primarily driven by the increasing demand for advanced preclinical models in drug discovery and development, offering a more physiologically relevant alternative to traditional animal testing. The limitations of current in-vivo models in accurately predicting human responses to therapeutics are compelling researchers and pharmaceutical companies to invest in innovative organ-on-a-chip technologies. The ability of human gut chips to mimic the complex microenvironment, cellular interactions, and physiological functions of the human gut is a key differentiator, enabling more accurate efficacy and toxicity predictions. This leads to reduced late-stage trial failures and accelerated drug development timelines, ultimately translating into significant cost savings for the industry. Furthermore, the growing emphasis on personalized medicine and the understanding of the gut microbiome's role in various diseases are creating new avenues for gut chip applications in diagnostics and novel therapeutic research.

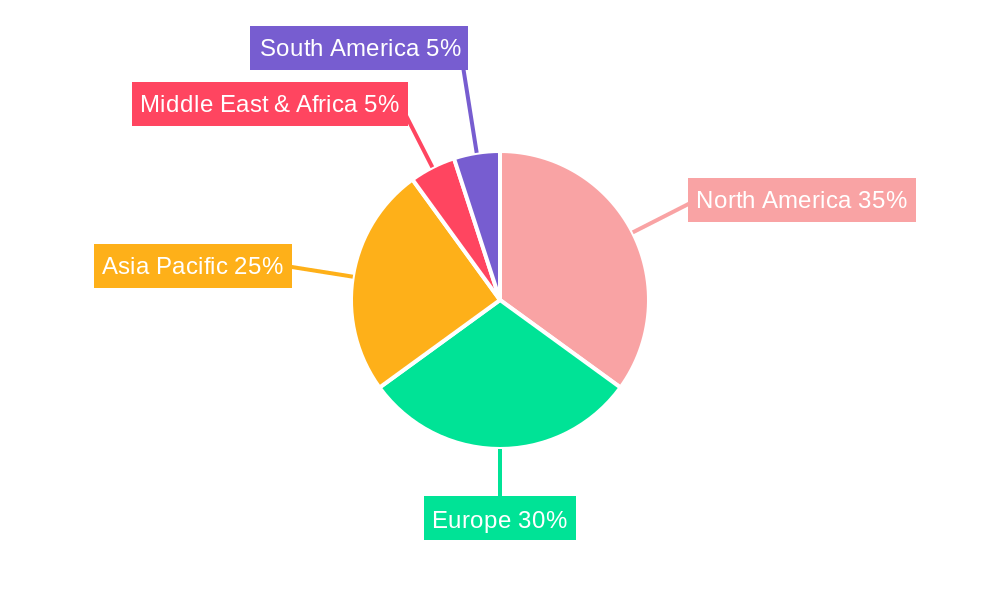

The market segmentation reveals that "Medical Diagnosis" is a crucial application, driven by the potential of gut chips to model disease states and screen for diagnostic markers. In terms of technology, the market is witnessing advancements in both "Static Chip" and "Dynamic Chip" designs, with dynamic chips offering more sophisticated microfluidic control and physiological simulation. Key players like Emulate, TissUse, and CN Bio Innovations are at the forefront of this innovation, continuously developing advanced gut-on-a-chip platforms. Geographically, North America and Europe are expected to lead the market due to robust R&D investments and the presence of leading biotechnology firms. However, the Asia Pacific region, particularly China and India, is anticipated to exhibit the fastest growth, fueled by increasing government support for biotech research and a burgeoning pharmaceutical industry. The market is expected to overcome challenges such as standardization of protocols and regulatory acceptance, as the scientific community increasingly validates the predictive power of these advanced models.

Human Gut Chip Market Dynamics & Structure

The Human Gut Chip market exhibits a moderately concentrated structure, with key players like Emulate, TissUse, HμREL, CN Bio Innovations, Mimetas, Hurel, AxoSim, Nortis, Mucosal Immunology and Biology Research Center, SynVivo, Tara Biosystems, Kugelmeiers, Ascendance Biotechnology, ChipScreen Biosciences, BGI Genomics, Zhejiang Ruiao Biotechnology, WuXi AppTec, and Hurel driving innovation. Technological advancements in microfluidics and biomimicry are paramount, fostering the development of more sophisticated and physiologically relevant gut-on-a-chip models. Regulatory frameworks, particularly those governing preclinical drug testing and medical device development, are evolving to accommodate these novel technologies, offering a pathway for market acceptance. Competitive product substitutes, primarily traditional animal models and in vitro cell cultures, are facing increasing scrutiny due to ethical concerns and their limited predictive power. End-user demographics span pharmaceutical and biotechnology companies, academic research institutions, and contract research organizations (CROs). Mergers and acquisitions (M&A) are becoming more prevalent as larger entities seek to integrate cutting-edge organ-on-a-chip technologies into their drug discovery and development pipelines. For instance, the volume of M&A deals in the broader organ-on-a-chip sector has seen a steady increase from approximately 5 deals in 2019 to an estimated 12 deals by 2024, with an anticipated further rise to 20 deals by 2028. Innovation barriers include the complexity of replicating the intricate human gut microbiome and immune system within a chip format, alongside the high initial investment required for R&D and manufacturing.

- Market Concentration: Moderately concentrated with a few leading innovators.

- Technological Innovation Drivers: Microfluidics, biomimicry, advanced cell culture techniques, microbiome engineering.

- Regulatory Frameworks: Evolving to encompass organ-on-a-chip applications in drug development and diagnostics.

- Competitive Product Substitutes: Traditional animal models, 2D and 3D cell cultures.

- End-User Demographics: Pharmaceutical & Biotech companies, Academic Research, CROs.

- M&A Trends: Increasing as companies seek to consolidate expertise and technology portfolios.

Human Gut Chip Growth Trends & Insights

The Human Gut Chip market is poised for substantial growth, driven by an increasing demand for more predictive and human-relevant preclinical models. The market size, valued at approximately $450 million in 2024, is projected to expand at a Compound Annual Growth Rate (CAGR) of 18.5% from 2025 to 2033, reaching an estimated $1.2 billion by the end of the forecast period. Adoption rates are accelerating, particularly within the pharmaceutical industry, as companies seek to de-risk drug development and improve translational success rates. Technological disruptions are continuously enhancing the functionality of gut chips, enabling the simulation of complex biological processes such as nutrient absorption, immune responses, and microbiome interactions. Consumer behavior shifts, influenced by ethical considerations and a growing awareness of personalized medicine, are further bolstering the demand for alternatives to animal testing. The penetration of gut-on-a-chip technology in preclinical drug screening is still in its nascent stages, with current estimates suggesting it accounts for around 5% of the total preclinical testing market. However, this is expected to grow to over 20% by 2033, indicating a significant market shift. The ability of these chips to model disease states like inflammatory bowel disease (IBD) and colorectal cancer with higher fidelity than traditional methods is a key driver for increased market penetration. Furthermore, the integration of advanced imaging and sensing technologies within gut chip platforms is providing researchers with unprecedented real-time data, further enhancing their value proposition. The evolving landscape of drug discovery, with its increasing focus on targeted therapies and complex biologics, necessitates models that can accurately recapitulate human physiology. Gut chips are emerging as a critical tool in this evolution, offering a more nuanced understanding of drug efficacy and toxicity before human trials. The estimated market size evolution reflects a steady upward trajectory, fueled by ongoing research and development and increasing commercialization efforts by key industry players.

Dominant Regions, Countries, or Segments in Human Gut Chip

The Application segment of New Medical Research is currently the dominant driver of growth in the Human Gut Chip market, with an estimated market share of 55% in 2025. This dominance is propelled by the inherent capabilities of gut-on-a-chip technology to facilitate groundbreaking studies in areas such as microbiome-host interactions, drug metabolism, and the pathogenesis of gastrointestinal diseases. Academic and research institutions, particularly in North America and Europe, are leading this charge, investing heavily in gut chip platforms for fundamental scientific inquiry. The increasing understanding of the gut microbiome's profound impact on overall health and disease is further fueling this segment.

The Types segment of Dynamic Chip is also gaining significant traction, representing approximately 40% of the market in 2025. Dynamic chips, which incorporate fluid flow and shear stress to mimic physiological conditions, offer a more sophisticated and representative model of the gut epithelium compared to static chips. This enhanced realism is critical for accurately assessing drug absorption, permeability, and the dynamic interactions within the gut environment.

Geographically, North America is the leading region, accounting for an estimated 45% of the global Human Gut Chip market in 2025. This leadership is attributed to robust government funding for biomedical research, a high concentration of leading pharmaceutical and biotechnology companies, and a strong ecosystem of academic research centers focused on microfluidics and human biology. The region's proactive stance on adopting novel technologies for drug discovery and development, coupled with favorable economic policies, further bolsters its dominance.

- Dominant Application Segment: New Medical Research (55% market share in 2025)

- Key Drivers: Microbiome research, drug metabolism studies, gastrointestinal disease modeling, academic investment.

- Dominant Type Segment: Dynamic Chip (40% market share in 2025)

- Key Drivers: Mimics physiological flow and shear stress, improved predictive accuracy for drug absorption and permeability.

- Dominant Region: North America (45% market share in 2025)

- Key Drivers: Strong R&D funding, presence of major pharmaceutical companies, advanced academic research infrastructure, supportive economic policies.

- Emerging Regional Strength: Europe is showing significant growth due to increasing R&D investments and stringent regulations favoring human-relevant models.

Human Gut Chip Product Landscape

The Human Gut Chip product landscape is characterized by continuous innovation focused on replicating the complexity of the human gastrointestinal system. Companies are developing chips that integrate multiple cell types, including epithelial cells, immune cells, and even representative microbial communities, to create more physiologically relevant models. Performance metrics are increasingly being standardized, with a focus on parameters like transepithelial electrical resistance (TEER) for barrier function assessment, drug permeability coefficients, and cytokine secretion profiles for immune response evaluation. Unique selling propositions include the ability to model specific diseases like IBD and colorectal cancer with higher accuracy than traditional methods, enabling more effective preclinical drug testing and personalized medicine applications. Technological advancements are enabling real-time monitoring of cellular behavior and microenvironment conditions within the chip.

Key Drivers, Barriers & Challenges in Human Gut Chip

Key Drivers:

- Increasing demand for human-relevant preclinical models: Driven by limitations of animal models and the need for better drug translation.

- Advancements in microfluidics and biomimicry: Enabling the creation of more complex and physiologically accurate gut environments.

- Growing understanding of the gut microbiome's role in health and disease: Opening new avenues for research and therapeutic development.

- Ethical considerations and regulatory pressure: Pushing for alternatives to animal testing.

- Focus on personalized medicine: Requiring models that can predict individual responses to therapies.

Barriers & Challenges:

- High initial R&D and manufacturing costs: Limiting widespread adoption by smaller research entities.

- Standardization and validation of gut chip models: Ensuring reproducibility and comparability across different platforms.

- Complexity of replicating the human gut microbiome: Challenges in accurately culturing and integrating diverse microbial communities.

- Long-term stability and maintenance of gut chip cultures: Requiring specialized expertise and infrastructure.

- Regulatory acceptance and integration into existing drug development workflows: A gradual process requiring extensive validation data.

- Supply chain issues for specialized reagents and components: Potentially impacting production scalability.

Emerging Opportunities in Human Gut Chip

Emerging opportunities lie in the development of advanced multi-organ-on-a-chip systems that integrate the gut chip with other organ models, such as the liver and brain, to study systemic drug effects and complex disease interactions. The untapped potential for using gut chips in personalized nutrition and diagnostics, predicting individual responses to dietary interventions and identifying early biomarkers for gastrointestinal disorders, presents a significant growth avenue. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) for analyzing the vast datasets generated by gut chips promises to unlock new insights into disease mechanisms and drug discovery.

Growth Accelerators in the Human Gut Chip Industry

Technological breakthroughs in creating more stable and scalable gut microbiome simulations, coupled with advancements in multiplexed sensing technologies for real-time monitoring, are key growth accelerators. Strategic partnerships between organ-on-a-chip technology developers and pharmaceutical giants are crucial for funding large-scale validation studies and accelerating market penetration. Furthermore, market expansion strategies targeting emerging economies with growing pharmaceutical R&D investments and increasing adoption of advanced research tools will further fuel long-term growth.

Key Players Shaping the Human Gut Chip Market

- Emulate

- TissUse

- HμREL

- CN Bio Innovations

- Mimetas

- Hurel

- AxoSim

- Nortis

- Mucosal Immunology and Biology Research Center

- SynVivo

- Tara Biosystems

- Kugelmeiers

- Ascendance Biotechnology

- ChipScreen Biosciences

- BGI Genomics

- Zhejiang Ruiao Biotechnology

- WuXi AppTec

Notable Milestones in Human Gut Chip Sector

- 2019: Increased focus on microbiome integration in gut-on-a-chip models, leading to more complex co-culture systems.

- 2020: Emergence of standardized assays for drug permeability and barrier function assessments in gut chips.

- 2021: Significant advancements in developing dynamic flow systems for gut chip applications, enhancing physiological relevance.

- 2022: Growing number of academic publications highlighting the use of gut chips for disease modeling, particularly for IBD.

- 2023: Increased M&A activity and strategic collaborations between technology providers and pharmaceutical companies.

- Early 2024: Development of advanced imaging techniques for real-time monitoring of gut chip dynamics and cellular responses.

- Mid-2024: Growing interest in the application of gut chips for personalized medicine and drug response prediction.

In-Depth Human Gut Chip Market Outlook

The Human Gut Chip market is characterized by a robust outlook, driven by its indispensable role in addressing the limitations of traditional preclinical models and accelerating drug development. The continuous innovation in replicating the intricate gut environment, including its microbial inhabitants and immune components, will unlock new therapeutic avenues. Strategic collaborations and increasing adoption by major pharmaceutical companies are expected to significantly expand market reach. The potential for gut chips to revolutionize areas like personalized nutrition, diagnostics, and the development of novel therapeutics for gastrointestinal diseases presents substantial future growth opportunities.

Human Gut Chip Segmentation

-

1. Application

- 1.1. Medical Diagnosis

- 1.2. New Medical Research

- 1.3. Other

-

2. Types

- 2.1. Static Chip

- 2.2. Dynamic Chip

Human Gut Chip Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Human Gut Chip REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Human Gut Chip Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical Diagnosis

- 5.1.2. New Medical Research

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Static Chip

- 5.2.2. Dynamic Chip

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Human Gut Chip Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical Diagnosis

- 6.1.2. New Medical Research

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Static Chip

- 6.2.2. Dynamic Chip

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Human Gut Chip Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical Diagnosis

- 7.1.2. New Medical Research

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Static Chip

- 7.2.2. Dynamic Chip

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Human Gut Chip Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical Diagnosis

- 8.1.2. New Medical Research

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Static Chip

- 8.2.2. Dynamic Chip

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Human Gut Chip Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical Diagnosis

- 9.1.2. New Medical Research

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Static Chip

- 9.2.2. Dynamic Chip

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Human Gut Chip Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Medical Diagnosis

- 10.1.2. New Medical Research

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Static Chip

- 10.2.2. Dynamic Chip

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Emulate

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TissUse

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HμREL

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CN Bio Innovations

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mimetas

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hurel

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AxoSim

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nortis

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mucosal Immunology and Biology Research Center

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SynVivo

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Tara Biosystems

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Kugelmeiers

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ascendance Biotechnology

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ChipScreen Biosciences

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 BGI Genomics

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Zhejiang Ruiao Biotechnology

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 WuXi AppTec

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Emulate

List of Figures

- Figure 1: Global Human Gut Chip Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Human Gut Chip Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Human Gut Chip Revenue (million), by Application 2024 & 2032

- Figure 4: North America Human Gut Chip Volume (K), by Application 2024 & 2032

- Figure 5: North America Human Gut Chip Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Human Gut Chip Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Human Gut Chip Revenue (million), by Types 2024 & 2032

- Figure 8: North America Human Gut Chip Volume (K), by Types 2024 & 2032

- Figure 9: North America Human Gut Chip Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Human Gut Chip Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Human Gut Chip Revenue (million), by Country 2024 & 2032

- Figure 12: North America Human Gut Chip Volume (K), by Country 2024 & 2032

- Figure 13: North America Human Gut Chip Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Human Gut Chip Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Human Gut Chip Revenue (million), by Application 2024 & 2032

- Figure 16: South America Human Gut Chip Volume (K), by Application 2024 & 2032

- Figure 17: South America Human Gut Chip Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Human Gut Chip Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Human Gut Chip Revenue (million), by Types 2024 & 2032

- Figure 20: South America Human Gut Chip Volume (K), by Types 2024 & 2032

- Figure 21: South America Human Gut Chip Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Human Gut Chip Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Human Gut Chip Revenue (million), by Country 2024 & 2032

- Figure 24: South America Human Gut Chip Volume (K), by Country 2024 & 2032

- Figure 25: South America Human Gut Chip Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Human Gut Chip Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Human Gut Chip Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Human Gut Chip Volume (K), by Application 2024 & 2032

- Figure 29: Europe Human Gut Chip Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Human Gut Chip Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Human Gut Chip Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Human Gut Chip Volume (K), by Types 2024 & 2032

- Figure 33: Europe Human Gut Chip Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Human Gut Chip Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Human Gut Chip Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Human Gut Chip Volume (K), by Country 2024 & 2032

- Figure 37: Europe Human Gut Chip Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Human Gut Chip Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Human Gut Chip Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Human Gut Chip Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Human Gut Chip Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Human Gut Chip Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Human Gut Chip Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Human Gut Chip Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Human Gut Chip Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Human Gut Chip Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Human Gut Chip Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Human Gut Chip Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Human Gut Chip Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Human Gut Chip Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Human Gut Chip Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Human Gut Chip Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Human Gut Chip Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Human Gut Chip Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Human Gut Chip Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Human Gut Chip Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Human Gut Chip Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Human Gut Chip Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Human Gut Chip Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Human Gut Chip Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Human Gut Chip Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Human Gut Chip Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Human Gut Chip Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Human Gut Chip Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Human Gut Chip Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Human Gut Chip Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Human Gut Chip Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Human Gut Chip Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Human Gut Chip Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Human Gut Chip Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Human Gut Chip Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Human Gut Chip Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Human Gut Chip Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Human Gut Chip Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Human Gut Chip Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Human Gut Chip Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Human Gut Chip Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Human Gut Chip Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Human Gut Chip Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Human Gut Chip Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Human Gut Chip Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Human Gut Chip Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Human Gut Chip Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Human Gut Chip Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Human Gut Chip Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Human Gut Chip Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Human Gut Chip Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Human Gut Chip Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Human Gut Chip Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Human Gut Chip Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Human Gut Chip Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Human Gut Chip Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Human Gut Chip Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Human Gut Chip Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Human Gut Chip Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Human Gut Chip Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Human Gut Chip Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Human Gut Chip Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Human Gut Chip Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Human Gut Chip Volume K Forecast, by Country 2019 & 2032

- Table 81: China Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Human Gut Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Human Gut Chip Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Human Gut Chip?

The projected CAGR is approximately 18.4%.

2. Which companies are prominent players in the Human Gut Chip?

Key companies in the market include Emulate, TissUse, HμREL, CN Bio Innovations, Mimetas, Hurel, AxoSim, Nortis, Mucosal Immunology and Biology Research Center, SynVivo, Tara Biosystems, Kugelmeiers, Ascendance Biotechnology, ChipScreen Biosciences, BGI Genomics, Zhejiang Ruiao Biotechnology, WuXi AppTec.

3. What are the main segments of the Human Gut Chip?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 872 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Human Gut Chip," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Human Gut Chip report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Human Gut Chip?

To stay informed about further developments, trends, and reports in the Human Gut Chip, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence