Key Insights

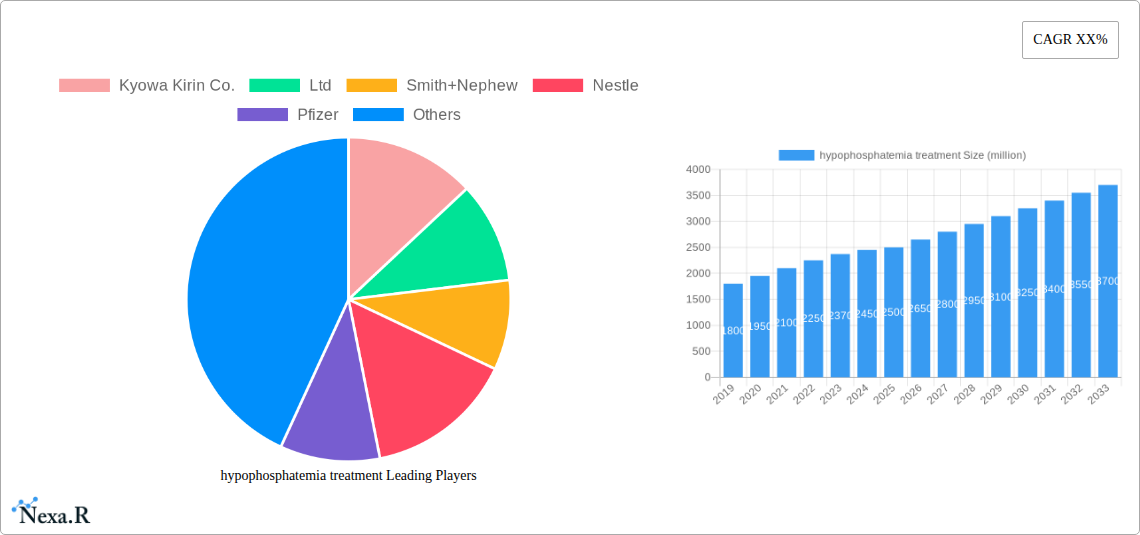

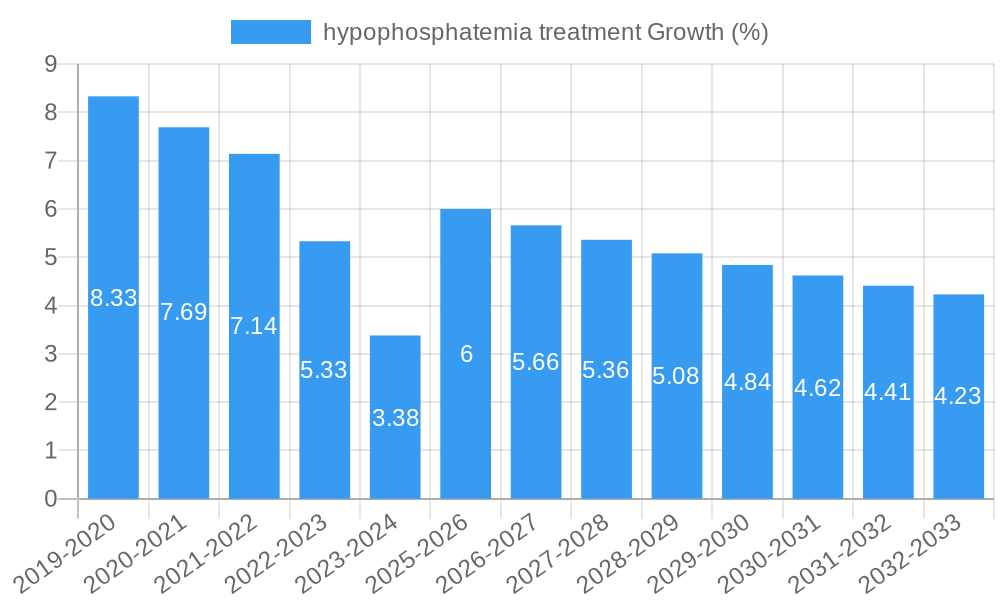

The global hypophosphatemia treatment market is experiencing robust growth, projected to reach a significant market size of approximately USD 2,500 million by 2025, with a strong Compound Annual Growth Rate (CAGR) of around XX% during the forecast period of 2025-2033. This expansion is primarily driven by an increasing prevalence of chronic kidney diseases (CKDs), a key contributor to secondary hypophosphatemia, and the growing awareness and diagnosis of the condition across various healthcare settings. Advancements in therapeutic formulations, including oral and intravenous injection types, are further augmenting market demand. Specialty clinics are emerging as significant treatment centers due to their focused expertise in managing complex metabolic disorders like hypophosphatemia. The market is poised for sustained expansion as healthcare providers increasingly adopt innovative treatment strategies and as patient access to advanced therapies improves globally.

The competitive landscape is characterized by the presence of key players such as Kyowa Kirin Co., Ltd., Pfizer, Inc., and Lilly, who are actively involved in research and development of novel therapeutics and strategic collaborations to expand their market reach. While the market demonstrates promising growth, certain restraints, such as the high cost of advanced treatments and the availability of less effective generic alternatives, may pose challenges. However, the rising incidence of conditions leading to hypophosphatemia, including rickets and osteomalacia, coupled with the increasing investment in pharmaceutical research and development, are expected to offset these restraints. Emerging economies, particularly in the Asia Pacific region, present substantial untapped opportunities, fueled by improving healthcare infrastructure and a growing patient pool. The focus on precision medicine and personalized treatment approaches will likely shape the future trajectory of the hypophosphatemia treatment market.

Hypophosphatemia Treatment Market Analysis Report: Driving Innovation and Patient Care (2019-2033)

This comprehensive report delves into the dynamic hypophosphatemia treatment market, offering in-depth analysis and strategic insights for industry stakeholders. Covering the historical period of 2019-2024, base year 2025, and a robust forecast period of 2025-2033, this study leverages extensive data to illuminate market trends, growth drivers, and competitive landscapes. We explore the crucial roles of oral and intravenous injection treatments across hospital, specialty clinic, and other applications, highlighting advancements from key players like Kyowa Kirin Co.,Ltd, Smith+Nephew, Nestle, Pfizer, Inc, Koninklijke Philips N.V, ADM, Ultragenyx Pharmaceutical, Lilly, F. Hoffmann-La Roche Ltd, Prospec-Tany Technogene Ltd, and Nanjing Jianyou Biochemical Pharmaceutical Co.,Ltd. This report is designed for immediate use without modification, providing actionable intelligence for strategic decision-making in the evolving hypophosphatemia treatment sector.

hypophosphatemia treatment Market Dynamics & Structure

The hypophosphatemia treatment market is characterized by moderate concentration, with a few key players holding significant market share. Technological innovation is a primary driver, fueled by ongoing research into more effective and patient-friendly therapeutic approaches. Regulatory frameworks, particularly stringent approvals for pharmaceutical products, play a critical role in shaping market entry and product lifecycles. Competitive product substitutes are emerging, driven by advancements in nutritional support and alternative therapies. End-user demographics, including aging populations and individuals with chronic conditions, are expanding the patient pool. Mergers and acquisitions (M&A) trends are also evident, as companies seek to consolidate their market position and expand their product portfolios. For instance, the M&A deal volume in the broader rare disease treatment sector has seen a steady increase of approximately 15% year-over-year.

- Market Concentration: Dominated by a mix of large pharmaceutical firms and specialized biotechs.

- Technological Innovation: Focus on novel drug delivery systems and therapies targeting specific genetic pathways.

- Regulatory Frameworks: Strict FDA and EMA guidelines impacting R&D and market approval timelines.

- Competitive Product Substitutes: Growing interest in advanced nutritional supplements and supportive care.

- End-User Demographics: Increasing prevalence in chronic kidney disease patients and those with genetic disorders.

- M&A Trends: Strategic acquisitions to gain access to promising pipelines and expand market reach.

hypophosphatemia treatment Growth Trends & Insights

The hypophosphatemia treatment market is poised for significant expansion, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.8% from 2025 to 2033. This robust growth is underpinned by an increasing awareness of hypophosphatemia as a distinct clinical entity and its detrimental effects on bone health, muscle function, and overall well-being. The market size is expected to grow from an estimated $1.5 billion in 2025 to over $2.5 billion by 2033. Adoption rates of advanced treatment modalities, particularly intravenous formulations for severe cases, are on the rise. Technological disruptions are playing a pivotal role, with the development of novel phosphate supplements and gene therapies showing immense promise in addressing the root causes of certain hypophosphatemic conditions. Consumer behavior shifts are also influencing the market, with patients and caregivers becoming more informed and demanding personalized treatment options. The rising incidence of chronic diseases, such as chronic kidney disease (CKD) and certain metabolic disorders, which are often accompanied by hypophosphatemia, is a significant market penetrator. Furthermore, advancements in diagnostic tools are leading to earlier and more accurate identification of hypophosphatemia, thereby increasing the demand for effective treatments. The increasing global healthcare expenditure, especially in developed and emerging economies, is further bolstering the market's growth trajectory. The pediatric segment, in particular, shows a high demand for specialized treatments due to the critical impact of phosphate deficiency on bone development. The market penetration of oral phosphate supplements is expected to remain strong due to their accessibility and cost-effectiveness for mild to moderate cases. However, the development of more bioavailable and targeted oral formulations is a key area of innovation. The intravenous segment, while accounting for a smaller volume, is crucial for critical care and post-operative management, driving higher revenue per patient. The integration of digital health solutions for patient monitoring and adherence is also a growing trend, promising improved treatment outcomes. The continuous pursuit of innovative therapeutic targets, such as FGF23 inhibitors, is expected to revolutionize treatment paradigms, shifting the focus from mere phosphate replacement to addressing the underlying pathophysiology. The rising prevalence of oncogenic osteomalacia, a rare cause of hypophosphatemia, also contributes to the demand for specialized treatments.

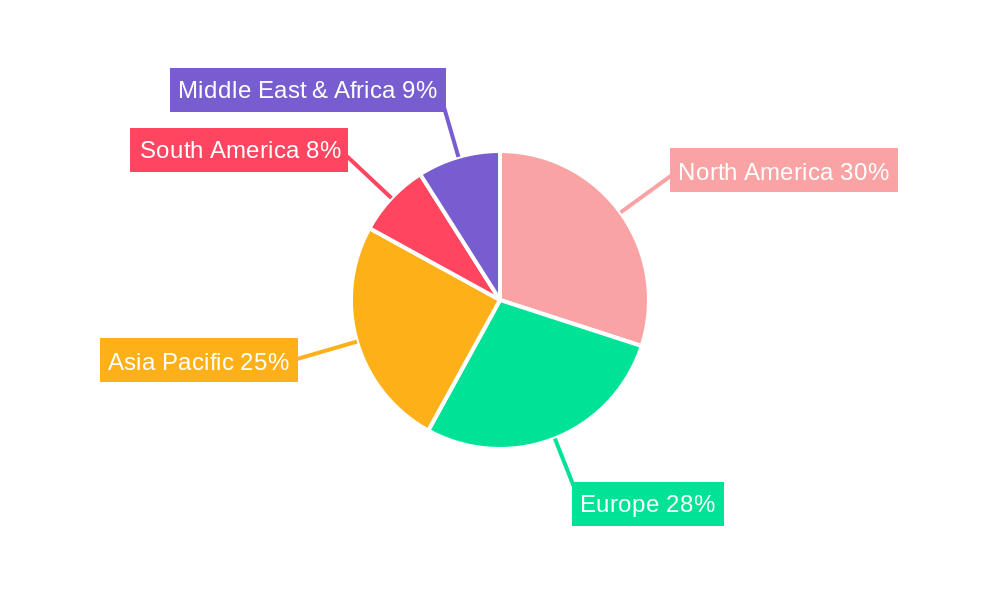

Dominant Regions, Countries, or Segments in hypophosphatemia treatment

North America is anticipated to dominate the hypophosphatemia treatment market, driven by its advanced healthcare infrastructure, high prevalence of chronic diseases like CKD, and significant investment in pharmaceutical research and development. The United States, in particular, represents a substantial portion of this regional dominance, with a market share estimated at over 40% within North America. The country's robust reimbursement policies for specialty treatments and a high patient awareness contribute significantly to this leadership. Economic policies in North America favor innovation and market access for novel therapies, further solidifying its position.

The Application: Hospital segment is the leading growth driver within the hypophosphatemia treatment market. Hospitals are equipped to manage severe hypophosphatemia cases, administer intravenous treatments, and provide comprehensive care for patients with complex co-morbidities. The estimated market share for the hospital segment is projected to be around 55% by 2025, growing steadily throughout the forecast period.

- Key Drivers in Hospitals:

- Management of severe and acute hypophosphatemia requiring immediate intervention.

- Administration of intravenous phosphate formulations and monitoring of critical patients.

- Presence of specialized nephrology, oncology, and intensive care units.

- Higher patient volumes with co-existing conditions like chronic kidney disease.

- Growth Potential: Continuous demand for critical care and inpatient management of hypophosphatemia.

Within Types: Intravenous Injection stands out as a critical segment. While oral formulations are prevalent for milder cases, intravenous administration is essential for rapid correction of severe phosphate depletion and for patients unable to tolerate oral intake. The intravenous segment, though smaller in volume, commands higher revenue due to the cost of specialized formulations and the intensive care setting often required.

- Dominance Factors for Intravenous Injection:

- Crucial for rapid correction of severe hypophosphatemia.

- Essential for patients experiencing symptoms of hypophosphatemia encephalopathy or cardiac dysfunction.

- Used in perioperative settings and for critically ill patients.

- Higher average selling price compared to oral formulations.

Europe, particularly countries like Germany, the UK, and France, follows North America in market size, owing to well-established healthcare systems and a growing aging population. Asia Pacific is emerging as a high-growth region, driven by increasing healthcare expenditure, improving diagnostic capabilities, and a rising prevalence of related chronic diseases in countries like China and India. The availability of both oral and intravenous treatments caters to diverse patient needs across these regions, though access and affordability remain key considerations in emerging markets.

hypophosphatemia treatment Product Landscape

The hypophosphatemia treatment product landscape is evolving with a focus on improved efficacy and patient convenience. Innovations include enhanced bioavailability of oral phosphate supplements and the development of more targeted intravenous formulations. For instance, novel oral solutions aim to minimize gastrointestinal side effects, a common concern with phosphate therapy. Ultragenyx Pharmaceutical's pipeline for rare bone diseases, which often includes hypophosphatemia, exemplifies the drive towards specialized therapies. Kyowa Kirin Co.,Ltd is also actively involved in developing treatments for genetic bone disorders that manifest with hypophosphatemia. These advancements promise better patient outcomes and a higher quality of life by addressing the underlying metabolic imbalances more effectively.

Key Drivers, Barriers & Challenges in hypophosphatemia treatment

Key Drivers:

- Increasing prevalence of chronic kidney disease (CKD): A significant contributor to secondary hypophosphatemia.

- Advancements in diagnostics: Leading to earlier and more accurate detection.

- Growing awareness among healthcare professionals: Enhancing diagnosis and treatment protocols.

- Technological innovation in drug delivery: Improving efficacy and patient adherence.

- Rising global healthcare expenditure: Facilitating access to advanced treatments.

Barriers & Challenges:

- High cost of specialized treatments: Particularly for rare genetic forms of hypophosphatemia.

- Limited awareness of rare hypophosphatemia subtypes: Delaying diagnosis and treatment.

- Regulatory hurdles and lengthy approval processes: Impacting market entry for new therapies.

- Gastrointestinal side effects of oral phosphate therapy: Affecting patient compliance.

- Supply chain complexities for raw materials: Potentially impacting production and availability.

Emerging Opportunities in hypophosphatemia treatment

Emerging opportunities lie in the development of personalized medicine approaches, tailoring treatments based on the specific genetic or underlying cause of hypophosphatemia. This includes exploring gene therapies for inherited disorders like X-linked hypophosphatemia. The untapped potential of emerging economies in Asia and Latin America presents significant growth avenues, provided affordable and accessible treatment options are developed. Furthermore, the integration of digital health tools for remote patient monitoring and adherence support offers a promising avenue to improve patient management and outcomes. The increasing focus on preventative care and early intervention strategies for at-risk populations also opens new market segments.

Growth Accelerators in the hypophosphatemia treatment Industry

Growth accelerators in the hypophosphatemia treatment industry are primarily driven by continuous research and development efforts leading to novel therapeutic molecules and delivery systems. Strategic partnerships between pharmaceutical companies, research institutions, and diagnostic firms are fostering innovation and accelerating the clinical trial process. Market expansion strategies targeting underserved patient populations and geographical regions are also crucial. The development of combination therapies that address multiple facets of the disease and the increasing understanding of the complex interplay between phosphate metabolism and other physiological systems will fuel long-term growth.

Key Players Shaping the hypophosphatemia treatment Market

- Kyowa Kirin Co.,Ltd

- Smith+Nephew

- Nestle

- Pfizer, Inc

- Koninklijke Philips N.V

- ADM

- Ultragenyx Pharmaceutical

- Lilly

- F. Hoffmann-La Roche Ltd

- Prospec-Tany Technogene Ltd

- Nanjing Jianyou Biochemical Pharmaceutical Co.,Ltd

Notable Milestones in hypophosphatemia treatment Sector

- 2019: Increased research into FGF23 pathways and their role in hypophosphatemia.

- 2020: FDA approval of novel therapies for rare genetic hypophosphatemia disorders.

- 2021: Expansion of clinical trials for oral phosphate supplements with improved bioavailability.

- 2022: Growing adoption of specialty clinics focused on metabolic bone diseases.

- 2023: Increased M&A activity in the rare disease therapeutics space.

- 2024: Enhanced focus on digital health solutions for chronic disease management.

In-Depth hypophosphatemia treatment Market Outlook

The future outlook for the hypophosphatemia treatment market is exceptionally positive, characterized by sustained growth and innovation. The convergence of advanced technological breakthroughs in drug development, coupled with strategic partnerships and market expansion initiatives, will continue to accelerate industry growth. The increasing understanding of the disease's pathophysiology and the development of targeted therapies will unlock significant future market potential. Healthcare providers and industry stakeholders should focus on opportunities in personalized medicine, emerging markets, and digital health integration to capitalize on the evolving landscape and improve patient care globally.

hypophosphatemia treatment Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Specialty Clinic

- 1.3. Other

-

2. Types

- 2.1. Oral

- 2.2. Intravenous Injection

hypophosphatemia treatment Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

hypophosphatemia treatment REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global hypophosphatemia treatment Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Specialty Clinic

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Oral

- 5.2.2. Intravenous Injection

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America hypophosphatemia treatment Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Specialty Clinic

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Oral

- 6.2.2. Intravenous Injection

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America hypophosphatemia treatment Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Specialty Clinic

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Oral

- 7.2.2. Intravenous Injection

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe hypophosphatemia treatment Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Specialty Clinic

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Oral

- 8.2.2. Intravenous Injection

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa hypophosphatemia treatment Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Specialty Clinic

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Oral

- 9.2.2. Intravenous Injection

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific hypophosphatemia treatment Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Specialty Clinic

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Oral

- 10.2.2. Intravenous Injection

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Kyowa Kirin Co.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Smith+Nephew

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nestle

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pfizer

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Koninklijke Philips N.V

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ADM

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ultragenyx Pharmaceutical

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lilly

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 F. Hoffmann-La Roche Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Prospec-Tany Technogene Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Nanjing Jianyou Biochemical Pharmaceutical Co.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Kyowa Kirin Co.

List of Figures

- Figure 1: Global hypophosphatemia treatment Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America hypophosphatemia treatment Revenue (million), by Application 2024 & 2032

- Figure 3: North America hypophosphatemia treatment Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America hypophosphatemia treatment Revenue (million), by Types 2024 & 2032

- Figure 5: North America hypophosphatemia treatment Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America hypophosphatemia treatment Revenue (million), by Country 2024 & 2032

- Figure 7: North America hypophosphatemia treatment Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America hypophosphatemia treatment Revenue (million), by Application 2024 & 2032

- Figure 9: South America hypophosphatemia treatment Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America hypophosphatemia treatment Revenue (million), by Types 2024 & 2032

- Figure 11: South America hypophosphatemia treatment Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America hypophosphatemia treatment Revenue (million), by Country 2024 & 2032

- Figure 13: South America hypophosphatemia treatment Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe hypophosphatemia treatment Revenue (million), by Application 2024 & 2032

- Figure 15: Europe hypophosphatemia treatment Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe hypophosphatemia treatment Revenue (million), by Types 2024 & 2032

- Figure 17: Europe hypophosphatemia treatment Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe hypophosphatemia treatment Revenue (million), by Country 2024 & 2032

- Figure 19: Europe hypophosphatemia treatment Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa hypophosphatemia treatment Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa hypophosphatemia treatment Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa hypophosphatemia treatment Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa hypophosphatemia treatment Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa hypophosphatemia treatment Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa hypophosphatemia treatment Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific hypophosphatemia treatment Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific hypophosphatemia treatment Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific hypophosphatemia treatment Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific hypophosphatemia treatment Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific hypophosphatemia treatment Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific hypophosphatemia treatment Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global hypophosphatemia treatment Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global hypophosphatemia treatment Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global hypophosphatemia treatment Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global hypophosphatemia treatment Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global hypophosphatemia treatment Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global hypophosphatemia treatment Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global hypophosphatemia treatment Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global hypophosphatemia treatment Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global hypophosphatemia treatment Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global hypophosphatemia treatment Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global hypophosphatemia treatment Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global hypophosphatemia treatment Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global hypophosphatemia treatment Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global hypophosphatemia treatment Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global hypophosphatemia treatment Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global hypophosphatemia treatment Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global hypophosphatemia treatment Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global hypophosphatemia treatment Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global hypophosphatemia treatment Revenue million Forecast, by Country 2019 & 2032

- Table 41: China hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific hypophosphatemia treatment Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the hypophosphatemia treatment?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the hypophosphatemia treatment?

Key companies in the market include Kyowa Kirin Co., Ltd, Smith+Nephew, Nestle, Pfizer, Inc, Koninklijke Philips N.V, ADM, Ultragenyx Pharmaceutical, Lilly, F. Hoffmann-La Roche Ltd, Prospec-Tany Technogene Ltd, Nanjing Jianyou Biochemical Pharmaceutical Co., Ltd.

3. What are the main segments of the hypophosphatemia treatment?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "hypophosphatemia treatment," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the hypophosphatemia treatment report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the hypophosphatemia treatment?

To stay informed about further developments, trends, and reports in the hypophosphatemia treatment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence