Key Insights

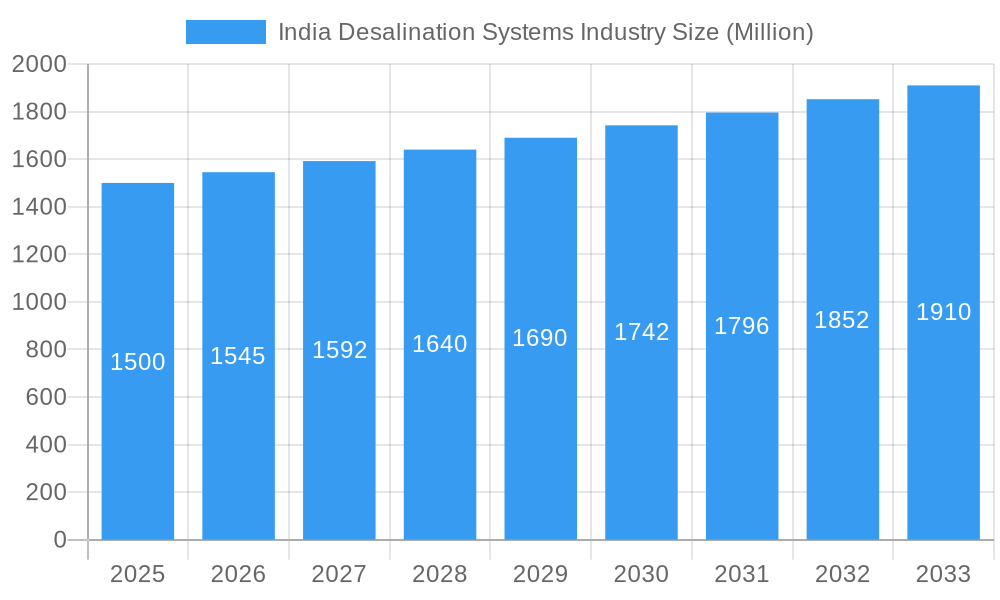

The India desalination systems market is experiencing robust growth, driven by increasing water scarcity, particularly in coastal regions and arid zones. A compound annual growth rate (CAGR) exceeding 3% from 2019 to 2033 indicates a significant expansion of this sector. This growth is fueled by rising industrial water demands, growing urban populations, and the escalating need for reliable water sources in agriculture. Technological advancements in desalination, including more energy-efficient thermal and membrane technologies, are further propelling market expansion. The market is segmented by technology (thermal, vapor compression distillation, membrane) and application (municipal, industrial), with membrane technology likely holding a larger share due to its lower energy consumption and cost-effectiveness for certain applications. Significant regional variations exist across India, with coastal states like Gujarat, Maharashtra, and Tamil Nadu likely dominating the market due to their higher water stress and proximity to the sea. However, inland regions are also expected to see increasing adoption as technology improves and water scarcity intensifies. Key players such as IEI, Thermax Limited, and Suez SA are actively shaping the market landscape through technological innovation and strategic partnerships. The industry also faces certain challenges, including high initial investment costs for desalination plants and the need for efficient energy management to reduce operational expenses. Overcoming these hurdles through government incentives, public-private partnerships, and technological innovation will be crucial to realizing the full potential of this vital sector.

India Desalination Systems Industry Market Size (In Billion)

Government initiatives promoting water conservation and infrastructure development are creating a positive environment for desalination plant deployment. The increasing focus on sustainable water management practices, coupled with the growing awareness of water scarcity's impact on the economy and public health, is further driving market growth. The forecast period (2025-2033) will see continued expansion, with membrane-based desalination likely gaining significant traction due to its energy efficiency and scalability. However, regulatory frameworks concerning environmental impact and water pricing strategies will need careful consideration to ensure responsible growth and equitable access to desalinated water. The continued technological advancements in desalination technologies, coupled with supportive government policies, are poised to drive significant expansion in the coming years.

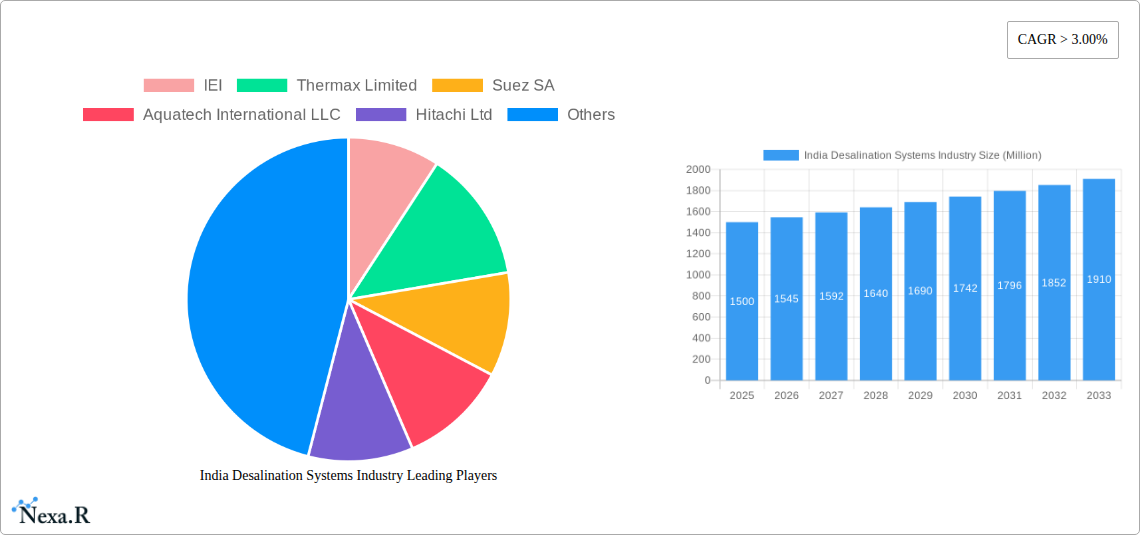

India Desalination Systems Industry Company Market Share

India Desalination Systems Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India desalination systems market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with 2025 as the base year and forecasts extending to 2033. The study examines both parent markets (water treatment) and child markets (thermal and membrane-based desalination technologies for municipal and industrial applications) to deliver a holistic view of this crucial sector. The market size is presented in Million units.

India Desalination Systems Industry Market Dynamics & Structure

The Indian desalination systems market is characterized by a moderately concentrated landscape with both domestic and international players vying for market share. Key players include IEI, Thermax Limited, Suez SA, Aquatech International LLC, Hitachi Ltd, Evoqua Water Technologies, Abengoa, DuPont, VA Tech Wabag Ltd, Veolia Environnement SA, IDE Technologies Ltd, and others. Technological innovation, driven by the need for efficient and cost-effective desalination solutions, is a major growth driver. Stringent government regulations regarding water quality and conservation further propel market expansion. The market faces competition from alternative water sources such as rainwater harvesting and treated wastewater, but the growing water scarcity necessitates the adoption of desalination technologies. Mergers and acquisitions (M&A) activity is significant, as larger players consolidate their position and acquire smaller, specialized companies. For example, Suez SA's acquisition of Sentinel Monitoring Systems significantly strengthened its technological capabilities.

- Market Concentration: Moderately concentrated, with a few major players dominating. XX% market share held by top 5 players in 2024 (estimated).

- Technological Innovation: Significant advancements in membrane technology and energy-efficient desalination processes are driving growth. Barriers include high initial investment costs and energy consumption.

- Regulatory Framework: Government initiatives promoting water conservation and desalination projects are positive drivers. However, regulatory complexities can pose challenges.

- Competitive Substitutes: Rainwater harvesting, treated wastewater reuse, and other water conservation methods pose competition.

- End-User Demographics: Municipal and industrial sectors are the primary end-users, with growing demand from both.

- M&A Trends: Significant M&A activity, with larger players acquiring smaller companies to expand their technology portfolio and market presence. XX M&A deals recorded in 2019-2024 (estimated).

India Desalination Systems Industry Growth Trends & Insights

The Indian desalination systems market has witnessed significant growth over the historical period (2019-2024), driven by factors such as increasing water scarcity, rising industrialization, and government support for water infrastructure development. The market size experienced a CAGR of xx% during 2019-2024, reaching xx Million units in 2024. This growth trajectory is projected to continue in the forecast period (2025-2033), with a projected CAGR of xx%. Technological advancements such as the introduction of more efficient reverse osmosis (RO) systems and energy-efficient thermal technologies are further boosting market adoption. Consumer behavior is shifting towards greater awareness of water conservation and sustainability, which is positively impacting the demand for desalination systems. Market penetration is increasing, particularly in coastal regions and arid areas facing severe water stress. The introduction of innovative technologies like Veolia’s Barrel RO system is expected to accelerate market growth.

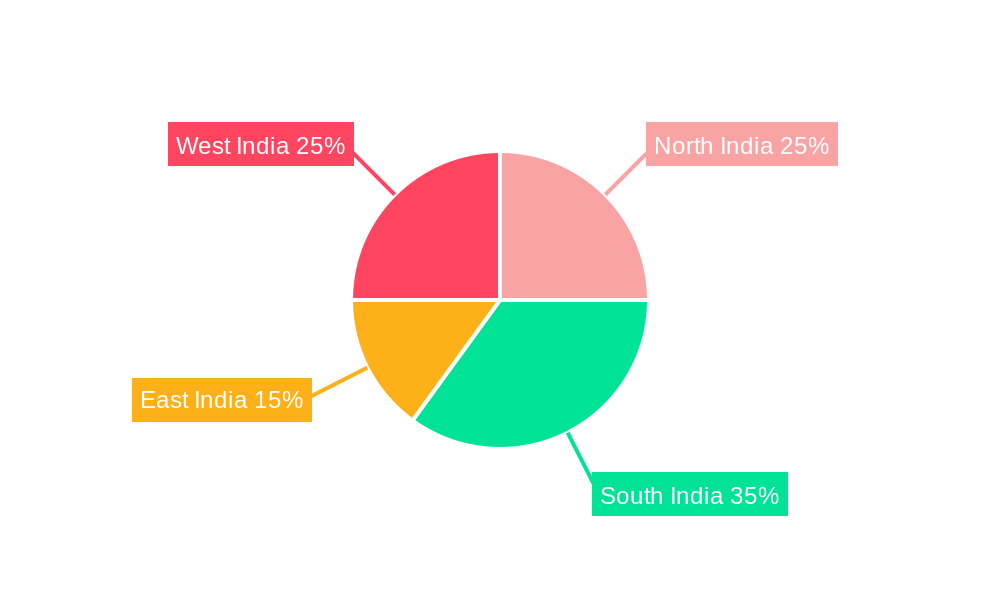

Dominant Regions, Countries, or Segments in India Desalination Systems Industry

Coastal states facing acute water scarcity, such as Gujarat, Tamil Nadu, and Maharashtra, are currently dominant regions for desalination systems. The industrial sector is a key driver, with significant demand from power generation, chemical manufacturing, and other water-intensive industries. Membrane technology (specifically RO) dominates the technology segment due to its relative efficiency and lower energy consumption compared to thermal technologies.

Key Drivers:

- Water Scarcity: Growing water stress in coastal regions and arid areas is driving demand.

- Government Initiatives: Government policies promoting water conservation and desalination projects.

- Industrialization: Rising industrialization, especially in water-intensive sectors, is creating a strong demand for industrial desalination.

- Technological Advancements: Innovations in membrane technology are making desalination more cost-effective and energy-efficient.

Dominance Factors:

- High Water Stress: Coastal areas facing severe water scarcity are witnessing rapid adoption.

- Favorable Government Policies: Subsidies and incentives for desalination projects are driving growth.

- Strong Industrial Base: High demand from various industries, particularly power and chemicals, is fueling market expansion.

Growth Potential:

- Untapped Markets: Significant growth potential exists in inland regions with increasing water scarcity.

- Technological Innovations: Continuous advancements in desalination technologies will open new market opportunities.

India Desalination Systems Industry Product Landscape

The Indian desalination systems market offers a diverse range of products, encompassing various thermal technologies (multi-stage flash distillation, multi-effect distillation) and membrane technologies (reverse osmosis, electrodialysis). Recent product innovations focus on improving energy efficiency, reducing operational costs, and enhancing water quality. Key features include automated control systems, improved pre-treatment methods, and advanced membrane materials. Unique selling propositions often include reduced energy consumption, compact designs for space-constrained areas, and customized solutions tailored to specific water quality needs.

Key Drivers, Barriers & Challenges in India Desalination Systems Industry

Key Drivers: Increasing water scarcity, rising industrialization, government support for water infrastructure projects, and technological advancements in desalination technologies are the key drivers. Government initiatives like the Jal Jeevan Mission aim to improve water access and promote water conservation, indirectly boosting the desalination market.

Key Challenges: High capital costs associated with desalination plants, energy consumption, brine disposal, environmental concerns about the impact of desalination on marine life, and complex regulatory processes hinder widespread adoption. Supply chain disruptions and a shortage of skilled labor can also impact project implementation. The market faces competition from other water sources and technologies. These challenges can lead to delays in project implementation and increased project costs. Estimates suggest that xx% of desalination projects faced delays due to regulatory hurdles in 2024 (estimated).

Emerging Opportunities in India Desalination Systems Industry

Emerging opportunities exist in untapped inland markets facing water scarcity, the development of decentralized desalination systems for smaller communities, and the integration of renewable energy sources to reduce reliance on fossil fuels. Furthermore, the use of desalination for agricultural purposes and industrial applications holds significant potential. Increased focus on water reuse and the development of hybrid desalination systems, combining different technologies, also present promising opportunities.

Growth Accelerators in the India Desalination Systems Industry

Technological advancements, especially in membrane technology and energy recovery systems, are key growth catalysts. Strategic partnerships between technology providers, EPC contractors, and investors can expedite project development. Government policies promoting public-private partnerships (PPPs) and financial incentives for desalination projects are crucial growth accelerators. Expansion into new geographical areas and diversifying applications (agricultural and industrial) are key strategies for future growth.

Key Players Shaping the India Desalination Systems Industry Market

- IEI

- Thermax Limited

- Suez SA

- Aquatech International LLC

- Hitachi Ltd

- Evoqua Water Technologies

- Abengoa

- DuPont

- VA Tech Wabag Ltd

- Veolia Environnement SA

- IDE Technologies Ltd

Notable Milestones in India Desalination Systems Industry Sector

- January 2022: SUEZ acquired Sentinel Monitoring Systems, enhancing its real-time microbial monitoring capabilities.

- April 2022: Veolia launched its Barrel RO technology in Asia Pacific, providing a plug-and-play desalination solution.

- June 2022: ENOWA, ITOCHU, and Veolia signed an MoU to develop a 100% renewable energy-powered desalination plant in NEOM, showcasing a significant shift towards sustainable desalination practices.

In-Depth India Desalination Systems Industry Market Outlook

The Indian desalination systems market is poised for significant growth, driven by increasing water scarcity, technological advancements, and supportive government policies. The focus on sustainable solutions, incorporating renewable energy and water reuse strategies, will be crucial for long-term success. Strategic partnerships and investments in research and development will be key to unlocking the full potential of this vital sector. The market's future trajectory is strongly linked to the effective implementation of large-scale desalination projects and the continued technological innovation that makes these projects more efficient and sustainable.

India Desalination Systems Industry Segmentation

-

1. Technology

-

1.1. Thermal Technology

- 1.1.1. Multi-stage Flash Distillation (MSF)

- 1.1.2. Multi-effect Distillation (MED)

- 1.1.3. Vapor Compression Distillation

-

1.2. Membrane Technology

- 1.2.1. Electrodialysis (ED)

- 1.2.2. Electrodialysis Reversal (EDR)

- 1.2.3. Reverse Osmosis (RO)

- 1.2.4. Other Me

-

1.1. Thermal Technology

-

2. Application

- 2.1. Municipal

- 2.2. Industrial

India Desalination Systems Industry Segmentation By Geography

- 1. India

India Desalination Systems Industry Regional Market Share

Geographic Coverage of India Desalination Systems Industry

India Desalination Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Gap Between Water Supply and Demand; Lack of Existence of Water Infrastructure

- 3.3. Market Restrains

- 3.3.1. High Cost Compared to Water Treatment Plant; Other Restraints

- 3.4. Market Trends

- 3.4.1. Rising Demand from the Municipal Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Desalination Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Thermal Technology

- 5.1.1.1. Multi-stage Flash Distillation (MSF)

- 5.1.1.2. Multi-effect Distillation (MED)

- 5.1.1.3. Vapor Compression Distillation

- 5.1.2. Membrane Technology

- 5.1.2.1. Electrodialysis (ED)

- 5.1.2.2. Electrodialysis Reversal (EDR)

- 5.1.2.3. Reverse Osmosis (RO)

- 5.1.2.4. Other Me

- 5.1.1. Thermal Technology

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Municipal

- 5.2.2. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IEI

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Thermax Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Suez SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aquatech International LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hitachi Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Evoqua Water Technologies

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Abengoa

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DuPont

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 VA Tech Wabag Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Veolia Environnement SA*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 IDE Technologies Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 IEI

List of Figures

- Figure 1: India Desalination Systems Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Desalination Systems Industry Share (%) by Company 2025

List of Tables

- Table 1: India Desalination Systems Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: India Desalination Systems Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: India Desalination Systems Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: India Desalination Systems Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 5: India Desalination Systems Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: India Desalination Systems Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Desalination Systems Industry?

The projected CAGR is approximately 9.6%.

2. Which companies are prominent players in the India Desalination Systems Industry?

Key companies in the market include IEI, Thermax Limited, Suez SA, Aquatech International LLC, Hitachi Ltd, Evoqua Water Technologies, Abengoa, DuPont, VA Tech Wabag Ltd, Veolia Environnement SA*List Not Exhaustive, IDE Technologies Ltd.

3. What are the main segments of the India Desalination Systems Industry?

The market segments include Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Gap Between Water Supply and Demand; Lack of Existence of Water Infrastructure.

6. What are the notable trends driving market growth?

Rising Demand from the Municipal Segment.

7. Are there any restraints impacting market growth?

High Cost Compared to Water Treatment Plant; Other Restraints.

8. Can you provide examples of recent developments in the market?

June 2022: ENOWA, the energy, water, and hydrogen subsidiary of NEOM, signed a Memorandum of Understanding (MoU) with ITOCHU and Veolia. As part of the MoU, the companies have agreed to collaborate to develop a first-of-its-kind selective desalination plant powered by 100% renewable energy in Oxagon, NEOM's advanced manufacturing and innovation city.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Desalination Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Desalination Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Desalination Systems Industry?

To stay informed about further developments, trends, and reports in the India Desalination Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence