Key Insights

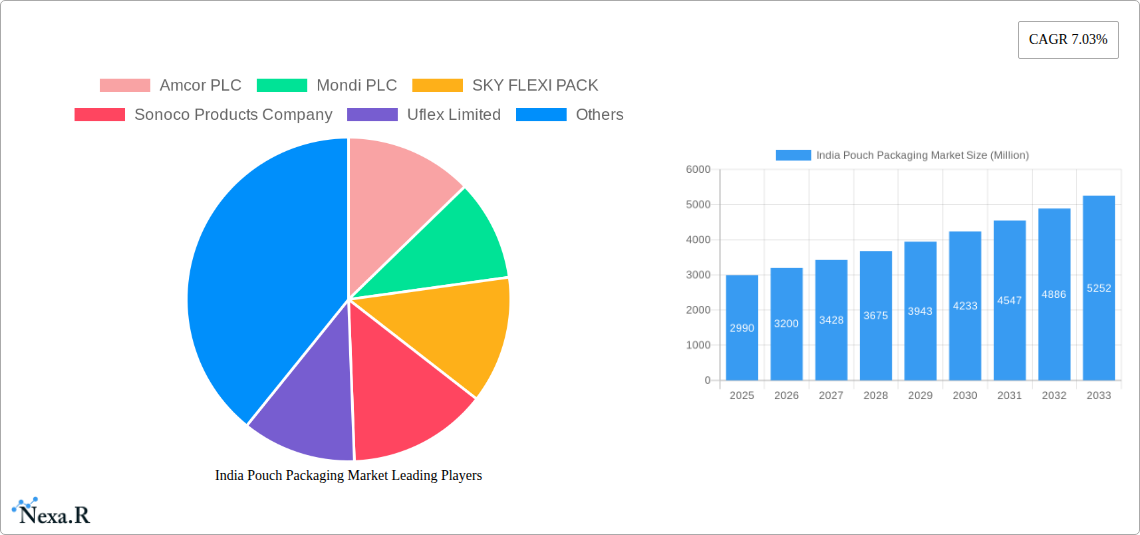

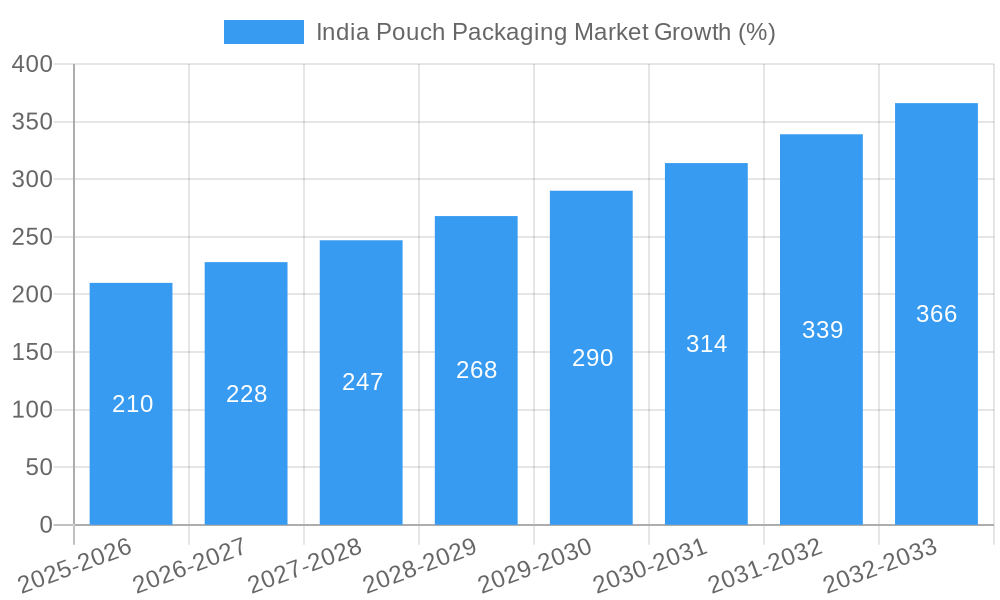

The India pouch packaging market is experiencing robust growth, projected to reach a market size of $2.99 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 7.03%. This expansion is fueled by several key factors. The rising demand for convenient and portable food products, particularly in urban areas, is a significant driver. Increased consumer preference for flexible packaging due to its cost-effectiveness and reduced environmental impact compared to rigid alternatives further boosts market growth. Moreover, advancements in packaging technology, such as the introduction of stand-up pouches with improved barrier properties and resealable features, are enhancing the appeal of pouch packaging among both manufacturers and consumers. The growth is further supported by the expanding e-commerce sector and the increasing adoption of ready-to-eat meals and snacks. Major players like Amcor PLC, Mondi PLC, and Uflex Limited are actively shaping the market through innovation and strategic expansions.

However, certain challenges exist. Fluctuations in raw material prices, particularly polymers, can impact profitability. The stringent regulatory environment surrounding food safety and packaging materials necessitates compliance costs for manufacturers. Furthermore, concerns regarding plastic waste and the need for sustainable packaging solutions are prompting the industry to adopt eco-friendly materials and recycling initiatives. Despite these restraints, the overall market outlook remains positive, driven by continued economic growth, evolving consumer preferences, and ongoing technological advancements in flexible packaging materials and design. The market is segmented by material type (e.g., plastic, paper, foil), packaging type (e.g., stand-up pouches, three-side seal pouches), and application (e.g., food, beverages, personal care). Competitive landscape analysis reveals a mix of established multinational corporations and emerging domestic players vying for market share.

India Pouch Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Pouch Packaging Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report leverages extensive data analysis to provide actionable insights for industry professionals, investors, and stakeholders. Market values are presented in million units.

India Pouch Packaging Market Dynamics & Structure

The Indian pouch packaging market is characterized by a moderately concentrated landscape with both established multinational corporations and emerging domestic players. Technological innovation, driven by increasing demand for sustainable and flexible packaging solutions, is a key growth driver. Stringent regulatory frameworks concerning food safety and environmental regulations influence market dynamics. The market faces competition from alternative packaging formats, such as rigid containers. Growing urbanization and evolving consumer preferences towards convenience and portability fuel market expansion. The market has also witnessed several M&A activities, driving consolidation and innovation.

- Market Concentration: xx% (top 5 players), indicating a moderately concentrated market.

- Technological Innovation: Focus on sustainable materials (e.g., biodegradable polymers) and advanced printing techniques.

- Regulatory Landscape: Stringent food safety standards and environmental regulations drive the adoption of eco-friendly packaging.

- Competitive Substitutes: Rigid containers and other packaging formats pose competitive pressure.

- End-User Demographics: Growing middle class and increasing disposable incomes drive demand for packaged goods.

- M&A Activity: xx number of M&A deals in the past 5 years, driving market consolidation and technological advancements. (e.g., Amcor's acquisition of Phoenix Flexibles).

India Pouch Packaging Market Growth Trends & Insights

The India Pouch Packaging Market exhibits robust growth, driven by rising consumer demand for packaged food, beverages, and personal care products. The market size has witnessed significant expansion over the historical period (2019-2024), exhibiting a CAGR of xx%. Technological disruptions, such as the increasing adoption of automated packaging machinery and the development of innovative materials, are accelerating market growth. Shifting consumer preferences towards convenience, portability, and sustainability further bolster market expansion. Market penetration for pouch packaging continues to increase across various segments, reflecting its widespread adoption.

- Market Size: xx Million units in 2024, projected to reach xx Million units by 2033.

- CAGR (2025-2033): xx%

- Market Penetration: xx% in 2024, expected to reach xx% by 2033.

- Technological Disruptions: Increased adoption of sustainable materials and advanced printing technologies.

- Consumer Behavior: Growing preference for convenience, portability, and eco-friendly packaging.

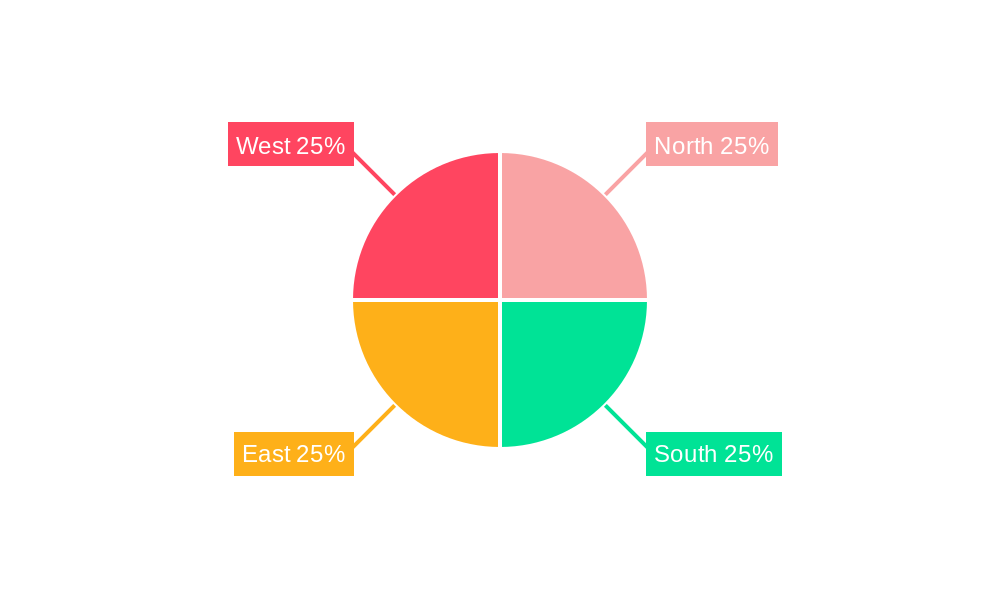

Dominant Regions, Countries, or Segments in India Pouch Packaging Market

The Indian pouch packaging market exhibits varied regional growth, with urban areas and economically developed states displaying higher adoption rates. Strong economic growth, expanding infrastructure, and a burgeoning FMCG sector drive market expansion in these regions. Factors such as favorable government policies promoting industrial growth, readily available raw materials, and a skilled labor pool further enhance the dominance of these regions. The food and beverage segment emerges as the leading application area, accounting for a significant market share, owing to the growing demand for packaged food products.

- Leading Region: Urban centers in states like Maharashtra, Gujarat, and Tamil Nadu.

- Key Drivers: Strong economic growth, expanding infrastructure, favorable government policies, and a large consumer base.

- Market Share: xx% (Food & Beverage Segment), xx% (Personal Care Segment), xx% (Pharmaceutical Segment).

- Growth Potential: High growth potential in rural areas with increasing disposable incomes.

India Pouch Packaging Market Product Landscape

The Indian pouch packaging market encompasses a diverse range of products, including stand-up pouches, spouted pouches, and flat pouches. These products are characterized by varied functionalities and barrier properties, catering to a diverse range of applications. Technological advancements focus on enhanced barrier properties, improved printability, and the incorporation of sustainable materials like biodegradable polymers and recycled content. Unique selling propositions (USPs) include enhanced shelf life, improved product protection, and eye-catching designs.

Key Drivers, Barriers & Challenges in India Pouch Packaging Market

Key Drivers:

- Growing demand for packaged food and beverages.

- Increasing consumer preference for convenience and portability.

- Technological advancements in pouch packaging materials and machinery.

- Favorable government policies promoting the growth of the food processing industry.

Challenges:

- Fluctuations in raw material prices, especially for polymers.

- Stringent regulatory compliance requirements related to food safety and environmental standards.

- Intense competition from established and emerging players.

- Supply chain disruptions impacting raw material availability and timely delivery.

Emerging Opportunities in India Pouch Packaging Market

- E-commerce growth: Increased demand for convenient and tamper-evident packaging for online deliveries.

- Sustainable packaging: Growing consumer demand for eco-friendly and biodegradable options.

- Specialized pouches: Development of pouches for specific product categories, like retort pouches for food preservation.

- Expansion into rural markets: Reaching untapped consumer segments with increased affordability and accessibility.

Growth Accelerators in the India Pouch Packaging Market Industry

Technological advancements, strategic partnerships, and market expansion into new geographical areas and product segments will significantly contribute to long-term market growth. Innovative product development, coupled with the adoption of automation and sustainability initiatives, will create greater efficiency and attract customers. The increasing adoption of e-commerce and the growth of organized retail will further accelerate market expansion.

Key Players Shaping the India Pouch Packaging Market Market

- Amcor PLC https://www.amcor.com/

- Mondi PLC https://www.mondigroup.com/

- SKY FLEXI PACK

- Sonoco Products Company https://www.sonoco.com/

- Uflex Limited https://www.uflexltd.com/

- Shako Flexipack Pvt Ltd

- Huhtamaki Oyj https://www.huhtamaki.com/

- Paras Printpack

- Constantia Flexibles GmbH

Notable Milestones in India Pouch Packaging Market Sector

- August 2023: Amcor PLC acquired Phoenix Flexibles, strengthening its position in the Indian market and promoting sustainable packaging solutions.

- June 2024: Mespack launched the RM Series Rotary Machine, showcasing advancements in flexible packaging technology at the Snack & BakeTec Show.

In-Depth India Pouch Packaging Market Market Outlook

The India Pouch Packaging Market is poised for sustained growth, driven by several factors including rising consumer demand, technological advancements, and increasing investments in the packaging sector. Strategic partnerships, focus on sustainable materials, and penetration into untapped markets will create substantial long-term opportunities. The market is expected to witness further consolidation, with key players focusing on innovation and expansion to gain a larger market share.

India Pouch Packaging Market Segmentation

-

1. Material

-

1.1. Plastic

- 1.1.1. Polyethylene

- 1.1.2. Polypropylene

- 1.1.3. PET

- 1.1.4. PVC

- 1.1.5. EVOH

- 1.1.6. Other Resins

- 1.2. Paper

- 1.3. Aluminum

-

1.1. Plastic

-

2. Product

- 2.1. Flat (Pillow & Side-Seal)

- 2.2. Stand-up

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

India Pouch Packaging Market Segmentation By Geography

- 1. India

India Pouch Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.03% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Retail and E-commerce Sector; Increased Need for Lighweight and On-the-Go Food Consumption

- 3.3. Market Restrains

- 3.3.1. Rise in Retail and E-commerce Sector; Increased Need for Lighweight and On-the-Go Food Consumption

- 3.4. Market Trends

- 3.4.1. Stand-up Pouches are Expected to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Pouch Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.1.1. Polyethylene

- 5.1.1.2. Polypropylene

- 5.1.1.3. PET

- 5.1.1.4. PVC

- 5.1.1.5. EVOH

- 5.1.1.6. Other Resins

- 5.1.2. Paper

- 5.1.3. Aluminum

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Flat (Pillow & Side-Seal)

- 5.2.2. Stand-up

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Amcor PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mondi PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SKY FLEXI PACK

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sonoco Products Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Uflex Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Shako Flexipack Pvt Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Huhtamaki Oyj

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Paras Printpack

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Constantia Flexibles GmbH*List Not Exhaustive 10 2 Heat Map Analysis10 3 Competitor Analysis - Emerging vs Established Player

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Amcor PLC

List of Figures

- Figure 1: India Pouch Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Pouch Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: India Pouch Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Pouch Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: India Pouch Packaging Market Revenue Million Forecast, by Material 2019 & 2032

- Table 4: India Pouch Packaging Market Volume Billion Forecast, by Material 2019 & 2032

- Table 5: India Pouch Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 6: India Pouch Packaging Market Volume Billion Forecast, by Product 2019 & 2032

- Table 7: India Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 8: India Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 9: India Pouch Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: India Pouch Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: India Pouch Packaging Market Revenue Million Forecast, by Material 2019 & 2032

- Table 12: India Pouch Packaging Market Volume Billion Forecast, by Material 2019 & 2032

- Table 13: India Pouch Packaging Market Revenue Million Forecast, by Product 2019 & 2032

- Table 14: India Pouch Packaging Market Volume Billion Forecast, by Product 2019 & 2032

- Table 15: India Pouch Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 16: India Pouch Packaging Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 17: India Pouch Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: India Pouch Packaging Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Pouch Packaging Market?

The projected CAGR is approximately 7.03%.

2. Which companies are prominent players in the India Pouch Packaging Market?

Key companies in the market include Amcor PLC, Mondi PLC, SKY FLEXI PACK, Sonoco Products Company, Uflex Limited, Shako Flexipack Pvt Ltd, Huhtamaki Oyj, Paras Printpack, Constantia Flexibles GmbH*List Not Exhaustive 10 2 Heat Map Analysis10 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the India Pouch Packaging Market?

The market segments include Material, Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Retail and E-commerce Sector; Increased Need for Lighweight and On-the-Go Food Consumption.

6. What are the notable trends driving market growth?

Stand-up Pouches are Expected to Witness Growth.

7. Are there any restraints impacting market growth?

Rise in Retail and E-commerce Sector; Increased Need for Lighweight and On-the-Go Food Consumption.

8. Can you provide examples of recent developments in the market?

June 2024: Mespack, a prominent player in innovative and eco-friendly flexible packaging solutions, showcased its prowess at the Snack & BakeTec Show at Yashobhoomi (IICC) in Dwarka, New Delhi. Mespack unveiled its latest breakthrough, the RM Series Rotary Machine, a game-changer in the packaging landscape. Mespack solidified its frontrunner position, boasting the market’s most extensive product lineup. Its offerings include horizontal equipment compatible with both roll-stock and premade pouches.August 2023: Amcor PLC, a prominent global entity specializing in sustainable packaging solutions, confirmed its acquisition of Phoenix Flexibles. This strategic move was expected to bolster Amcor's presence in the rapidly expanding Indian market, complementing its existing network of four flexible packaging facilities. The acquisition introduced cutting-edge technology, empowering Amcor to manufacture more sustainable packaging solutions locally. It also equipped Amcor with enhanced capabilities, facilitating an expansion into lucrative, high-value market segments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Pouch Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Pouch Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Pouch Packaging Market?

To stay informed about further developments, trends, and reports in the India Pouch Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence