Key Insights

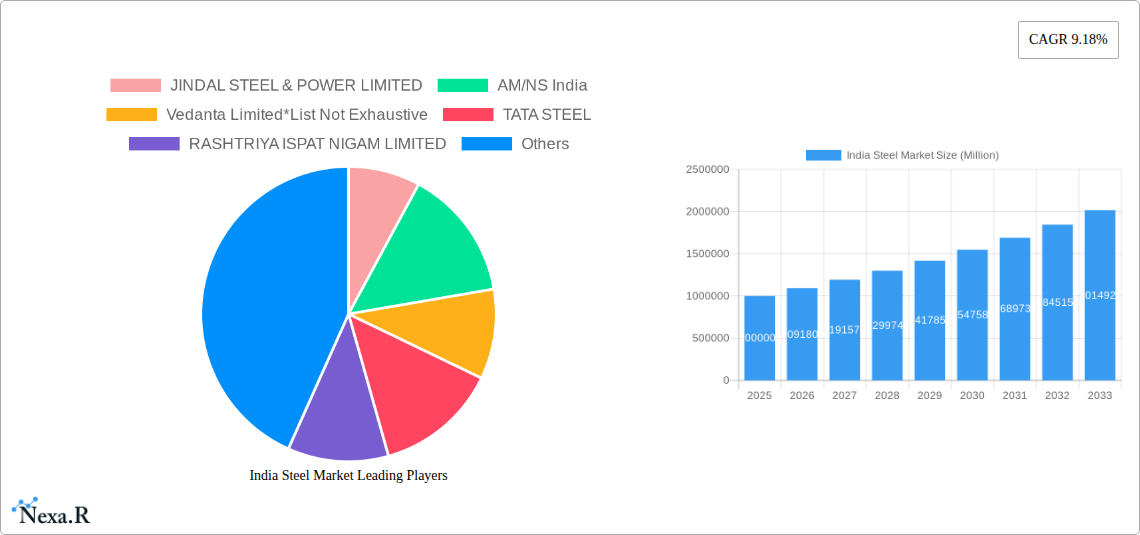

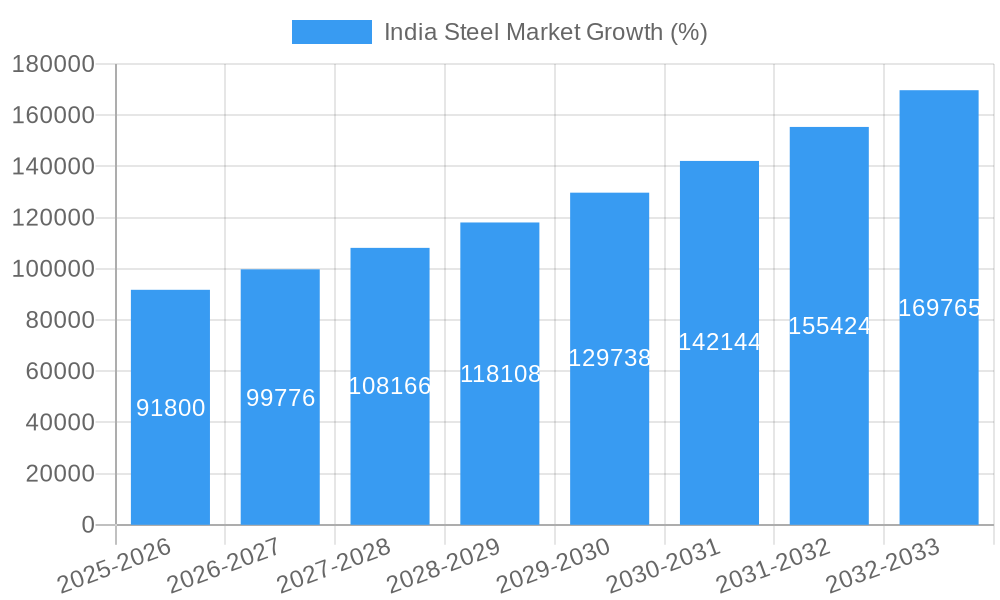

The India steel market, valued at approximately ₹1000 billion (estimated based on a CAGR of 9.18% and available market size data, this value is an approximation) in 2025, is poised for robust growth, projected to reach ₹2000 billion by 2033. This expansion is fueled by several key drivers. The burgeoning construction sector, driven by rapid urbanization and infrastructure development projects like the Bharatmala program, represents a significant demand source. Similarly, the automotive and transportation sectors, experiencing steady growth, contribute substantially to steel consumption. Furthermore, government initiatives promoting industrial growth and "Make in India" initiatives are stimulating domestic steel production. Technological advancements, particularly the increased adoption of Electric Arc Furnaces (EAFs) for their greater energy efficiency and reduced carbon emissions, are shaping the market landscape. However, challenges remain. Fluctuations in global iron ore prices, environmental regulations concerning emissions, and the increasing competition from imported steel products present potential restraints. The market segmentation reveals a significant share held by finished steel products, catering to diverse end-user industries. While the BF-BOF technology remains dominant, EAFs are witnessing accelerated adoption due to their advantages. Key players, such as JSW Steel, Tata Steel, and SAIL, are strategically positioned to capitalize on the market's growth trajectory, but they face competition from both domestic and international players.

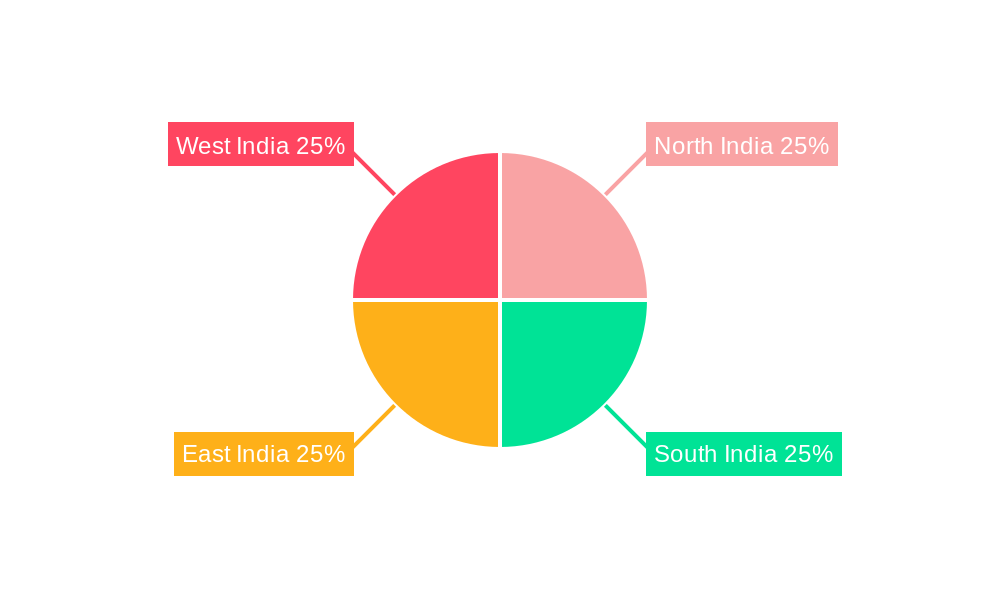

The regional breakdown suggests a relatively even distribution of steel consumption across North, South, East, and West India, reflecting the widespread industrial activity and infrastructure development across the country. The forecast period (2025-2033) is expected to witness a significant shift towards more sustainable steel production methods, with a focus on reducing carbon footprints. This shift will likely influence technological adoption and investment patterns within the industry. Further government policies aimed at supporting domestic steel producers and promoting steel recycling will be crucial in shaping the market's future. Continuous monitoring of global steel prices and the availability of raw materials will also be vital for industry stakeholders. The overall outlook suggests considerable potential for the India steel market, with continued growth expected, driven by both domestic demand and evolving technological landscapes.

India Steel Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India steel market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is invaluable for industry professionals, investors, and strategists seeking a thorough understanding of this dynamic sector. The report covers both parent market (Steel) and child markets including Crude Steel, Finished Steel, and various end-use industries.

India Steel Market Dynamics & Structure

The Indian steel market, valued at xx million units in 2024, exhibits a moderately concentrated structure. Major players like JSW Steel Limited, Tata Steel, and SAIL hold significant market share, while smaller players compete fiercely. Technological innovation, particularly in electric arc furnace (EAF) technology, is driving efficiency gains and shaping the competitive landscape. Stringent environmental regulations are influencing production methods and prompting investments in cleaner technologies. The market faces competitive pressure from substitute materials like aluminum and composites, particularly in specific end-use sectors. M&A activity, such as AM/NS India's acquisition of Indian Steel Corporation, indicates ongoing consolidation and expansion efforts.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Shift towards EAF technologies for improved efficiency and reduced carbon footprint.

- Regulatory Framework: Stringent environmental regulations driving adoption of cleaner technologies and sustainable practices.

- Competitive Substitutes: Aluminum and composites posing challenges in certain end-use segments.

- M&A Trends: Consolidation through acquisitions and mergers to enhance market share and downstream capabilities.

India Steel Market Growth Trends & Insights

The Indian steel market has witnessed significant growth during the historical period (2019-2024), driven by robust infrastructure development, industrialization, and rising consumer demand. The market size expanded from xx million units in 2019 to xx million units in 2024, registering a CAGR of xx%. This growth trajectory is expected to continue in the forecast period (2025-2033), propelled by government initiatives like "Make in India" and increasing urbanization. Technological advancements, such as the adoption of advanced steelmaking technologies, are enhancing productivity and product quality. However, global economic uncertainties and fluctuations in raw material prices pose potential challenges. Consumer behavior is shifting towards higher-value, specialized steel products, demanding greater innovation and customization from producers.

Dominant Regions, Countries, or Segments in India Steel Market

The building and construction sector remains the largest end-user segment, contributing xx% to overall steel consumption in 2024. This segment is fueled by ongoing infrastructure development projects across the nation. The automotive and transportation sector also exhibits significant growth potential, driven by the rising vehicle production and sales. Geographically, western and southern India are leading regions in terms of steel production and consumption, driven by industrial hubs and significant infrastructure investments. The BF-BOF technology remains dominant, albeit with increasing adoption of EAF technologies in smaller-scale operations.

- Key Drivers:

- Robust infrastructure development (roads, railways, buildings).

- Rising urbanization and industrialization.

- Government initiatives promoting domestic steel production.

- Dominant Segments: Building & Construction, Automotive & Transportation.

- Leading Regions: Western and Southern India.

India Steel Market Product Landscape

The Indian steel market offers a wide range of products, from basic forms like crude steel to finished steel products like sheets, plates, and bars. Innovation focuses on developing high-strength, lightweight steels for automotive applications and corrosion-resistant steels for infrastructure projects. Product differentiation is achieved through advanced alloying, surface treatments, and precise dimensional control. Key performance metrics include tensile strength, yield strength, elongation, and corrosion resistance.

Key Drivers, Barriers & Challenges in India Steel Market

Key Drivers: Government infrastructure spending, industrial growth, rising urbanization, and increasing demand for steel in various end-user industries.

Challenges: Fluctuations in iron ore prices, competition from imported steel, environmental regulations, and the need for continuous technology upgrades to improve efficiency and sustainability. Supply chain disruptions can significantly impact production and delivery timelines, leading to increased costs and potential delays in project completion. Regulatory hurdles and inconsistent policy implementation can create uncertainty and hinder investment decisions.

Emerging Opportunities in India Steel Market

Emerging opportunities include the growing demand for specialized steel products in renewable energy, aerospace, and healthcare sectors. Sustainable steel production practices, focused on reducing carbon emissions, present significant market opportunities. Expansion into rural and underserved markets offers further potential for growth. The increasing adoption of advanced manufacturing techniques, like 3D printing and additive manufacturing, could lead to new applications and revenue streams.

Growth Accelerators in the India Steel Market Industry

Long-term growth in the Indian steel market is supported by technological advancements leading to higher efficiency and productivity, strategic partnerships between steel manufacturers and end-user industries to create customized solutions, and aggressive expansion into new markets, particularly those with robust infrastructure development projects.

Key Players Shaping the India Steel Market Market

- JINDAL STEEL & POWER LIMITED

- AM/NS India

- Vedanta Limited

- TATA STEEL

- RASHTRIYA ISPAT NIGAM LIMITED

- NMDC Steel Limited

- JSW STEEL LIMITED

- Steel Authority of India Limited (SAIL)

- Jindal Stainless LIMITED

Notable Milestones in India Steel Market Sector

- November 2022: JSW Group announced a INR 1 trillion (USD 12.08 billion) investment in its Karnataka operations, significantly boosting its steel production capacity.

- April 2023: AM/NS India's acquisition of Indian Steel Corporation strengthened its downstream capabilities and product portfolio.

In-Depth India Steel Market Market Outlook

The future of the Indian steel market is promising, driven by sustained infrastructure development, rising industrial output, and government initiatives promoting economic growth. Strategic partnerships, technological advancements, and market expansion will play key roles in shaping the industry's trajectory. The focus on sustainable practices and product innovation will be crucial for long-term success in this dynamic and competitive market.

India Steel Market Segmentation

-

1. Basic Form

- 1.1. Crude Steel

-

2. Final Form

- 2.1. Finished Steel

-

3. Technology

- 3.1. Blast Furnace-basic Oxygen Furnace (BF-BOF)

- 3.2. Electric Arc Furnace (EAF)

- 3.3. Other Technologies

-

4. End User Industry

- 4.1. Automotive and Transportation

- 4.2. Building and Construction

- 4.3. Tools and Machinery

- 4.4. Energy

- 4.5. Consumer Goods

- 4.6. Other En

India Steel Market Segmentation By Geography

- 1. India

India Steel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.18% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Policy Support by the Indian Government; Strong Influx of Investments in the Steel Sector; Increasing Urbanization and Increased Spending on Construction and Infrastructure Projects

- 3.3. Market Restrains

- 3.3.1. Low Percapita Steel Consumption; High Production Costs

- 3.4. Market Trends

- 3.4.1. Blast Furnace-Basic Oxygen Furnace (BF-BOF) Technology to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Steel Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Basic Form

- 5.1.1. Crude Steel

- 5.2. Market Analysis, Insights and Forecast - by Final Form

- 5.2.1. Finished Steel

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Blast Furnace-basic Oxygen Furnace (BF-BOF)

- 5.3.2. Electric Arc Furnace (EAF)

- 5.3.3. Other Technologies

- 5.4. Market Analysis, Insights and Forecast - by End User Industry

- 5.4.1. Automotive and Transportation

- 5.4.2. Building and Construction

- 5.4.3. Tools and Machinery

- 5.4.4. Energy

- 5.4.5. Consumer Goods

- 5.4.6. Other En

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Basic Form

- 6. North India India Steel Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Steel Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Steel Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Steel Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 JINDAL STEEL & POWER LIMITED

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 AM/NS India

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Vedanta Limited*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 TATA STEEL

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 RASHTRIYA ISPAT NIGAM LIMITED

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 NMDC Steel Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 JSW STEEL LIMITED

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Steel Authority of India Limited (SAIL)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Jindal Stainless LIMITED

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 JINDAL STEEL & POWER LIMITED

List of Figures

- Figure 1: India Steel Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Steel Market Share (%) by Company 2024

List of Tables

- Table 1: India Steel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Steel Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: India Steel Market Revenue Million Forecast, by Basic Form 2019 & 2032

- Table 4: India Steel Market Volume Million Forecast, by Basic Form 2019 & 2032

- Table 5: India Steel Market Revenue Million Forecast, by Final Form 2019 & 2032

- Table 6: India Steel Market Volume Million Forecast, by Final Form 2019 & 2032

- Table 7: India Steel Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 8: India Steel Market Volume Million Forecast, by Technology 2019 & 2032

- Table 9: India Steel Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 10: India Steel Market Volume Million Forecast, by End User Industry 2019 & 2032

- Table 11: India Steel Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: India Steel Market Volume Million Forecast, by Region 2019 & 2032

- Table 13: India Steel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: India Steel Market Volume Million Forecast, by Country 2019 & 2032

- Table 15: North India India Steel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: North India India Steel Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 17: South India India Steel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South India India Steel Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: East India India Steel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: East India India Steel Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: West India India Steel Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: West India India Steel Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: India Steel Market Revenue Million Forecast, by Basic Form 2019 & 2032

- Table 24: India Steel Market Volume Million Forecast, by Basic Form 2019 & 2032

- Table 25: India Steel Market Revenue Million Forecast, by Final Form 2019 & 2032

- Table 26: India Steel Market Volume Million Forecast, by Final Form 2019 & 2032

- Table 27: India Steel Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 28: India Steel Market Volume Million Forecast, by Technology 2019 & 2032

- Table 29: India Steel Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 30: India Steel Market Volume Million Forecast, by End User Industry 2019 & 2032

- Table 31: India Steel Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: India Steel Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Steel Market?

The projected CAGR is approximately 9.18%.

2. Which companies are prominent players in the India Steel Market?

Key companies in the market include JINDAL STEEL & POWER LIMITED, AM/NS India, Vedanta Limited*List Not Exhaustive, TATA STEEL, RASHTRIYA ISPAT NIGAM LIMITED, NMDC Steel Limited, JSW STEEL LIMITED, Steel Authority of India Limited (SAIL), Jindal Stainless LIMITED.

3. What are the main segments of the India Steel Market?

The market segments include Basic Form, Final Form , Technology , End User Industry .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Strong Policy Support by the Indian Government; Strong Influx of Investments in the Steel Sector; Increasing Urbanization and Increased Spending on Construction and Infrastructure Projects.

6. What are the notable trends driving market growth?

Blast Furnace-Basic Oxygen Furnace (BF-BOF) Technology to Dominate the Market.

7. Are there any restraints impacting market growth?

Low Percapita Steel Consumption; High Production Costs.

8. Can you provide examples of recent developments in the market?

April 2023: AM/NS India received approval from India’s regulatory body (NCLT) to buy Indian Steel Corporation to enhance its downstream capabilities and broaden its product portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Steel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Steel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Steel Market?

To stay informed about further developments, trends, and reports in the India Steel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence