Key Insights

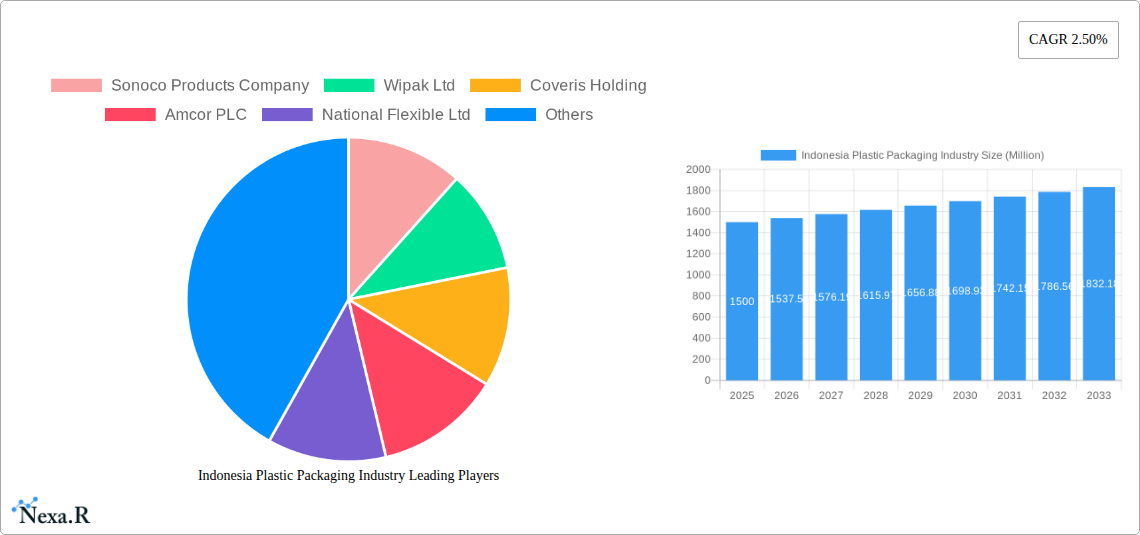

The Indonesian plastic packaging market, valued at approximately $X million in 2025 (assuming a logical extrapolation based on the provided CAGR of 2.5% and market size "XX" which will be replaced with a realistic figure based on industry research for Indonesia), is projected to experience steady growth throughout the forecast period (2025-2033). This growth is primarily fueled by the expanding consumer goods sector, particularly in food and beverage, personal care, and pharmaceuticals. Rising disposable incomes and a burgeoning middle class are driving increased consumption, thereby boosting demand for plastic packaging solutions. Furthermore, advancements in packaging technology, including the development of sustainable and eco-friendly options like biodegradable plastics and improved recycling infrastructure, are shaping the market's trajectory. The market segmentation reveals a strong preference for compartment and slide blister packs, highlighting the importance of convenience and product protection. Key players such as Sonoco Products Company, Amcor PLC, and Berry Global Inc. are leveraging their technological capabilities and established distribution networks to cater to this rising demand.

However, the market faces challenges. Stringent government regulations aimed at curbing plastic pollution, including bans on certain types of plastic packaging and increased recycling mandates, pose significant constraints. The Indonesian government's commitment to reducing environmental impact presents both an opportunity (for eco-friendly packaging) and a challenge (for traditional players). Companies are actively responding by investing in research and development of sustainable alternatives and improving their recycling processes. The competition in this market is fierce, with both domestic and international players vying for market share. This competitive landscape encourages innovation and drives down costs, benefiting consumers in the long run. The future growth of the Indonesian plastic packaging market hinges on a delicate balance between meeting the needs of a growing economy and addressing the urgent concerns about environmental sustainability. Specific growth projections for individual segments will depend on consumer preferences, technological advancements, and governmental regulations implemented over the coming years.

Indonesia Plastic Packaging Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Indonesia plastic packaging industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and businesses seeking to understand and capitalize on the opportunities within this dynamic market. The Indonesian plastic packaging market, a significant sub-segment of the broader Southeast Asian packaging landscape, is ripe for analysis given its substantial growth potential and evolving regulatory landscape.

Indonesia Plastic Packaging Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, and regulatory influences shaping the Indonesian plastic packaging market. We delve into market concentration, identifying major players and their market shares (e.g., Amcor PLC holding xx%, Berry Global Inc holding xx%, etc.), and explore the impact of mergers and acquisitions (M&A) activity. The report also examines the influence of government regulations, including policies promoting sustainability and recyclability, and explores the availability of substitute packaging materials, such as biodegradable alternatives. End-user demographics are analyzed to identify key consumption patterns across various sectors.

- Market Concentration: Highly fragmented market with a few dominant players holding xx% combined market share.

- Technological Innovation: Focus on lightweighting, improved barrier properties, and sustainable materials (e.g., recycled content, bioplastics). Innovation barriers include high R&D costs and limited access to advanced technologies.

- Regulatory Framework: Growing emphasis on environmental regulations, including extended producer responsibility (EPR) schemes and plastic waste management initiatives.

- Competitive Substitutes: Increased competition from alternative packaging materials, such as paperboard, glass, and biodegradable plastics.

- End-User Demographics: Significant growth driven by the rising population, increasing disposable incomes, and expanding e-commerce sector.

- M&A Trends: Moderate M&A activity, with strategic acquisitions aimed at expanding market reach and product portfolios. XX M&A deals recorded during the historical period (2019-2024).

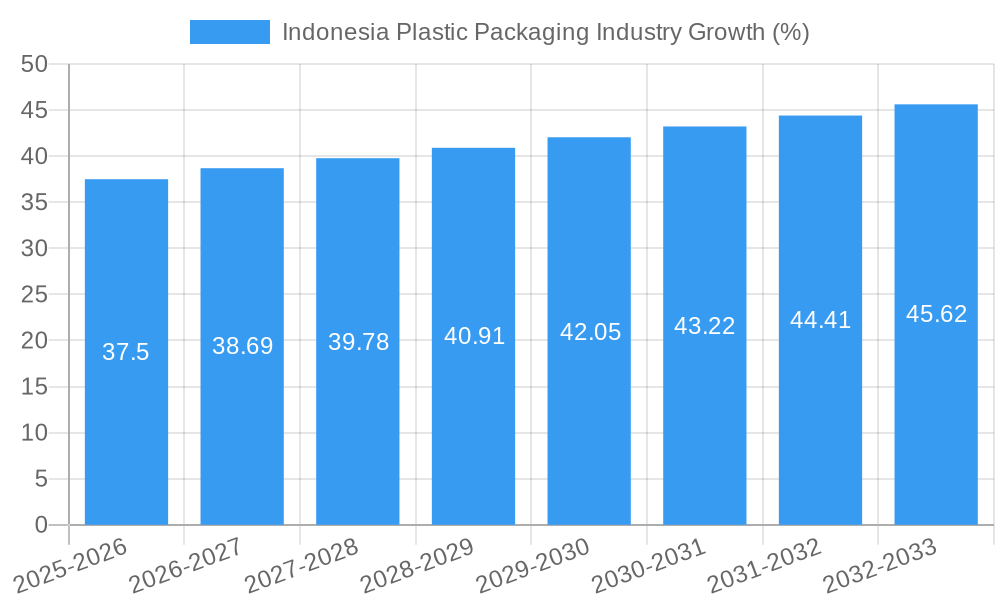

Indonesia Plastic Packaging Industry Growth Trends & Insights

This section offers a detailed examination of the Indonesian plastic packaging market's historical and projected growth trajectory. We analyze market size evolution (in million units), penetration rates, and the impact of technological disruptions, consumer behavior shifts, and economic factors. Specific metrics such as the Compound Annual Growth Rate (CAGR) and market penetration rates across different segments are provided, highlighting growth potential within specific product types (e.g., compartment blister packs, films) and end-use applications (e.g., food, beverages, pharmaceuticals).

Dominant Regions, Countries, or Segments in Indonesia Plastic Packaging Industry

This section identifies the leading regions, countries, or segments within Indonesia's plastic packaging market driving overall growth. We analyze the dominance of specific types (Compartment Blister Packs, Slide Blister Packs, Other Blister Packs) and components (Films, Lidding Materials, Secondary Containers, Packaging Accessories) based on market share and growth potential. Key factors influencing regional or segment dominance are explored, including economic policies, infrastructure development, and consumer preferences.

- Dominant Segment (by type): Films (XX million units), driven by the high demand for flexible packaging in the food and beverage industry.

- Dominant Segment (by component): Films (XX million units), due to widespread use across various packaging applications.

- Key Drivers: Strong economic growth, expanding consumer base, urbanization, and increasing demand for packaged goods.

- Regional Variations: Java Island dominates due to higher population density and industrial activity.

Indonesia Plastic Packaging Industry Product Landscape

The Indonesian plastic packaging industry offers a wide array of products catering to diverse end-use applications. This section details product innovations, including advancements in materials science (e.g., lightweighting, barrier enhancements), design, and functionality. The focus is on highlighting unique selling propositions (USPs) and performance metrics that make certain products stand out in the competitive market. Technological advancements driving product innovation, such as the integration of smart packaging features and sustainable solutions, are also discussed.

Key Drivers, Barriers & Challenges in Indonesia Plastic Packaging Industry

This section identifies both the forces propelling the growth of the Indonesian plastic packaging market and the obstacles hindering its progress. Key drivers include rising consumer demand, industrial expansion, and supportive government policies. On the other hand, challenges include environmental concerns, stringent regulations on plastic waste, and the increasing adoption of sustainable alternatives.

Key Drivers:

- Expanding FMCG sector

- Growth of e-commerce

- Increased disposable incomes

Key Challenges:

- Environmental regulations & waste management

- Competition from sustainable packaging alternatives

- Supply chain disruptions

Emerging Opportunities in Indonesia Plastic Packaging Industry

Despite the challenges, the Indonesian plastic packaging market presents several exciting opportunities. This section highlights emerging trends and prospects, focusing on untapped markets, such as specialized packaging for the healthcare and pharmaceutical industries. The growing demand for sustainable and eco-friendly packaging materials creates a significant opportunity for businesses to develop and market innovative solutions.

Growth Accelerators in the Indonesia Plastic Packaging Industry Industry

Several factors contribute to the long-term growth prospects of the Indonesian plastic packaging market. These include technological advancements that lead to more efficient and sustainable packaging solutions, strategic collaborations between packaging manufacturers and brands, and the expansion of market reach into new regions and customer segments. The increasing awareness of sustainability and the growing adoption of circular economy practices present significant opportunities for growth.

Key Players Shaping the Indonesia Plastic Packaging Industry Market

The Indonesian plastic packaging market is characterized by the presence of both domestic and international players. This section profiles prominent companies, highlighting their market share, product portfolios, and strategic initiatives.

- Sonoco Products Company

- Wipak Ltd

- Coveris Holding

- Amcor PLC

- National Flexible Ltd

- Constantia Flexibles Group

- Silgan Holdings

- Berry Global Inc

- Sealed Air Corporation

- Tetra Laval Group

Notable Milestones in Indonesia Plastic Packaging Industry Sector

This section details significant developments that have shaped the Indonesian plastic packaging market, focusing on their impact on market dynamics.

- July 2022: Coca-Cola Euro-Pacific Partners (CCEP) builds Indonesia's first food-grade PET plastic recycling facility.

- November 2022: CMA CGM Group launches EASY RECYCLING, a pilot program for sustainable packaging disposal in Jakarta.

In-Depth Indonesia Plastic Packaging Industry Market Outlook

The Indonesian plastic packaging market is poised for continued growth, driven by economic expansion, increasing consumer demand, and technological innovation. The market's future potential lies in the adoption of sustainable packaging solutions and the development of circular economy models. Opportunities exist for companies that can effectively navigate the regulatory landscape, meet the growing demand for sustainable options, and adapt to evolving consumer preferences.

Indonesia Plastic Packaging Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Plastic Packaging Industry Segmentation By Geography

- 1. Indonesia

Indonesia Plastic Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Lightweight Packaging Methods; Increased Eco-friendly Packaging and Recycled Plastic

- 3.3. Market Restrains

- 3.3.1. Shift from Conventional Materials to New Recyclable Materials

- 3.4. Market Trends

- 3.4.1. Skincare Segment is Observing Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Plastic Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sonoco Products Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wipak Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coveris Holding

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amcor PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 National Flexible Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Constantia Flexibles Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Silgan Holdings*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Berry Global Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sealed Air Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tetra Laval Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sonoco Products Company

List of Figures

- Figure 1: Indonesia Plastic Packaging Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Plastic Packaging Industry Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Indonesia Plastic Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Plastic Packaging Industry?

The projected CAGR is approximately 2.50%.

2. Which companies are prominent players in the Indonesia Plastic Packaging Industry?

Key companies in the market include Sonoco Products Company, Wipak Ltd, Coveris Holding, Amcor PLC, National Flexible Ltd, Constantia Flexibles Group, Silgan Holdings*List Not Exhaustive, Berry Global Inc, Sealed Air Corporation, Tetra Laval Group.

3. What are the main segments of the Indonesia Plastic Packaging Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Lightweight Packaging Methods; Increased Eco-friendly Packaging and Recycled Plastic.

6. What are the notable trends driving market growth?

Skincare Segment is Observing Significant Growth.

7. Are there any restraints impacting market growth?

Shift from Conventional Materials to New Recyclable Materials.

8. Can you provide examples of recent developments in the market?

November 2022: The CMA CGM Group, a global player in sea, land, and air logistics, introduced EASY RECYCLING, an innovative recycling solution, to enable its customers with shipments to Jakarta, Indonesia, to dispose of used paper and plastic packaging. In Jakarta, only CMA CGM customers will have access to EASY RECYCLING as part of a pilot that aims to eventually bring the service to other Asian nations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Plastic Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Plastic Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Plastic Packaging Industry?

To stay informed about further developments, trends, and reports in the Indonesia Plastic Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence