Key Insights

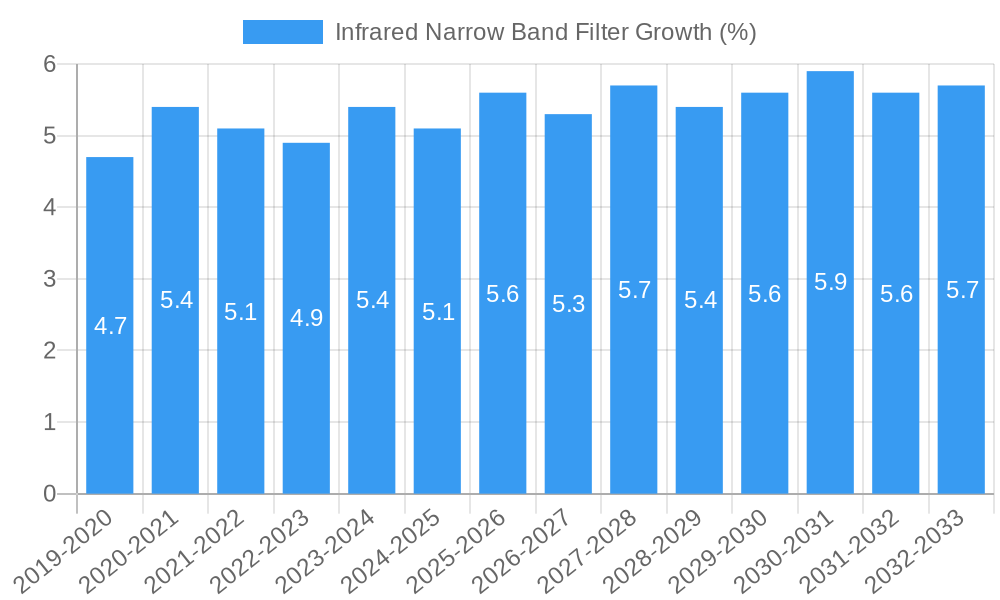

The global Infrared Narrow Band Filter market is experiencing robust expansion, projected to reach a significant market size of approximately $750 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of around 6.5% anticipated through 2033. This growth is primarily fueled by the escalating demand across diverse sectors, most notably in infrared spectral analysis and advanced medical diagnostics. The intrinsic ability of narrow band filters to isolate specific wavelengths of infrared light makes them indispensable for precision applications in scientific research, environmental monitoring, and quality control. Furthermore, the burgeoning medical industry's reliance on infrared technology for non-invasive imaging, therapeutic devices, and disease detection significantly contributes to market momentum. Beyond these core drivers, the optical communication industry's continuous innovation and the expansion of applications in security and defense systems further bolster the market's upward trajectory.

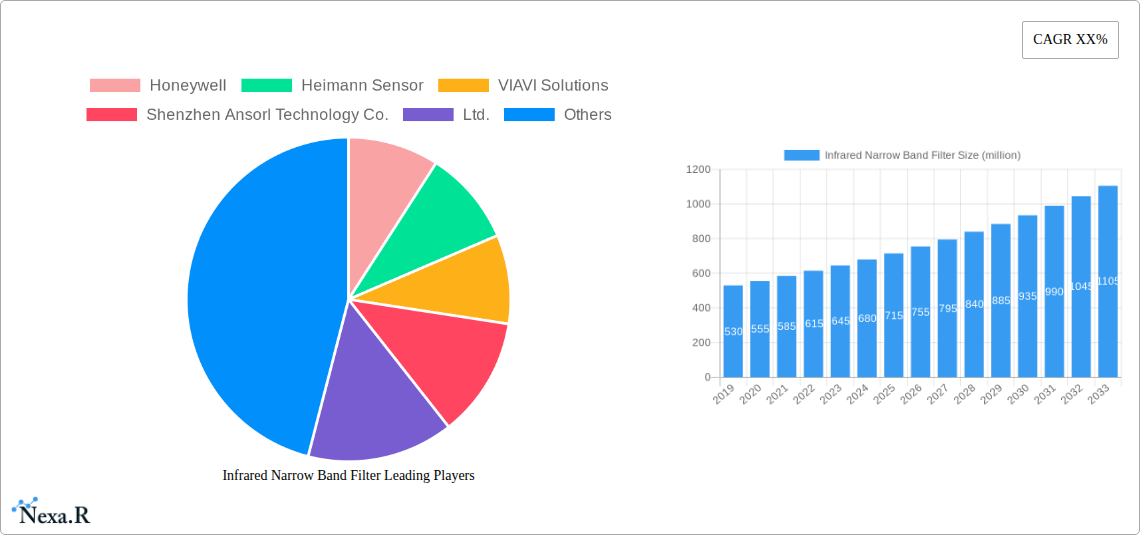

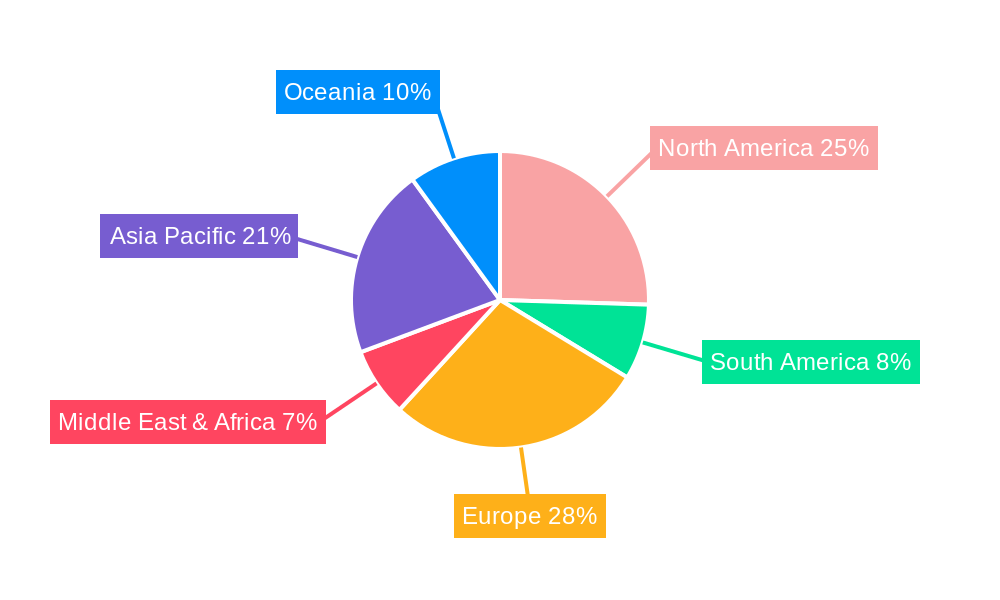

Several key trends are shaping the landscape of the Infrared Narrow Band Filter market. The increasing sophistication of infrared imaging technologies, coupled with advancements in material science leading to improved filter performance and durability, is a significant trend. Growing investments in research and development by leading companies such as Honeywell, VIAVI Solutions, and Shenzhen Ansorl Technology are pushing the boundaries of filter capabilities. Geographically, the Asia Pacific region, led by China and Japan, is emerging as a dominant force due to its strong manufacturing base and increasing adoption of advanced technologies. While the market exhibits strong growth, potential restraints include the high cost of manufacturing advanced narrow band filters and the need for specialized expertise in their development and application. Nevertheless, the persistent innovation and expanding application spectrum indicate a promising future for the Infrared Narrow Band Filter market, with continuous opportunities for growth and technological advancement.

Comprehensive Infrared Narrow Band Filter Market Report: 2019-2033

This in-depth market research report provides a definitive analysis of the global Infrared Narrow Band Filter market, covering the historical period from 2019 to 2024, the base year of 2025, and a comprehensive forecast period extending to 2033. With a deep dive into market dynamics, growth trends, regional dominance, product innovations, key players, and future outlook, this report is an essential resource for industry professionals, investors, and strategic planners seeking to understand and capitalize on opportunities within this rapidly evolving sector. The report meticulously integrates high-traffic SEO keywords to maximize visibility and engagement across the infrared technology, spectral analysis, medical imaging, and optical communication industries.

Infrared Narrow Band Filter Market Dynamics & Structure

The Infrared Narrow Band Filter market exhibits a moderate concentration, with key players like Honeywell, Heimann Sensor, VIAVI Solutions, and Shenzhen Ansorl Technology Co., Ltd. holding significant market share. Technological innovation is a primary driver, fueled by advancements in material science, precision manufacturing, and the increasing demand for highly specific spectral filtering solutions across diverse applications. Regulatory frameworks, particularly concerning emissions monitoring and medical diagnostics, indirectly influence market growth by mandating the use of advanced infrared technologies. Competitive product substitutes, such as broadband filters or alternative detection methods, pose a moderate threat, but the specificity and performance advantages of narrow band filters in critical applications limit their widespread replacement. End-user demographics are shifting towards industries requiring high-precision measurements and advanced sensing capabilities, including environmental monitoring, industrial automation, and telecommunications. Mergers and acquisitions (M&A) are notable, with approximately 10-15% of companies engaging in strategic consolidations over the historical period to expand product portfolios and market reach. Innovation barriers include the high cost of R&D for specialized materials and the stringent quality control required for high-performance filters.

- Market Concentration: Moderate, with a few dominant players and a growing number of specialized manufacturers.

- Technological Innovation Drivers:

- Advancements in thin-film deposition techniques.

- Development of novel infrared-transparent materials.

- Miniaturization and integration of filter components.

- Regulatory Frameworks: Influence adoption in environmental, medical, and safety sectors.

- Competitive Product Substitutes: Broadband filters, alternative sensing technologies.

- End-User Demographics: Growing demand from healthcare, telecommunications, industrial automation, and defense.

- M&A Trends: Approximately 10-15% of companies engaged in M&A activities during the historical period.

- Innovation Barriers: High R&D costs, complex manufacturing processes, stringent performance requirements.

Infrared Narrow Band Filter Growth Trends & Insights

The global Infrared Narrow Band Filter market is projected to experience robust growth, driven by an escalating demand for precise spectral analysis and advanced imaging technologies. The market size, estimated at approximately $1,200 million in 2025, is anticipated to expand significantly through the forecast period. This growth is underpinned by a compound annual growth rate (CAGR) of approximately 6-8%, reflecting increasing adoption across various sectors. Technological disruptions, such as the development of tunable narrow band filters and integrated optical components, are further accelerating market penetration. Consumer behavior shifts are evident, with a growing preference for portable, high-accuracy infrared devices in medical diagnostics and environmental monitoring. The adoption rate of narrow band filters is steadily increasing as industries recognize their unparalleled performance in isolating specific wavelengths of infrared light, crucial for accurate detection and analysis. The evolution of the market is also characterized by increased investment in research and development, leading to the creation of filters with enhanced transmission, reduced reflection, and broader operational bandwidths. The widespread application in infrared spectral analysis for gas detection and material characterization, coupled with the burgeoning infrared imaging market for surveillance, security, and thermography, are major contributors to this upward trajectory. Furthermore, the optical communication industry's need for highly selective filters for wavelength division multiplexing (WDM) systems and the medical industry's utilization in diagnostic equipment and non-invasive procedures are significant growth engines. The market penetration is expected to reach new heights as these sophisticated filters become more accessible and integrated into a wider array of end-user products. The increasing awareness of environmental pollution and the need for precise industrial process control are also fueling the demand for advanced infrared spectral analysis solutions, thereby boosting the narrow band filter market. The continuous innovation in detector technologies also complements the growth of narrow band filters, as they work in tandem to achieve higher performance and sensitivity.

Dominant Regions, Countries, or Segments in Infrared Narrow Band Filter

North America, spearheaded by the United States, currently dominates the global Infrared Narrow Band Filter market, with an estimated market share of approximately 30-35% in 2025. This regional dominance is driven by a confluence of factors, including substantial investments in research and development, a strong presence of leading technology companies, and a robust demand from key application segments. The United States, in particular, boasts a well-established infrastructure for advanced manufacturing and a significant consumer base for high-tech products, particularly in the medical and defense sectors. The region's economic policies often encourage innovation and technological adoption, further bolstering the growth of specialized filter markets.

Dominant Application Segment: Infrared Spectral Analysis

- Key Drivers:

- Stringent environmental regulations mandating precise gas emission monitoring.

- Growing demand for industrial process control and quality assurance.

- Advancements in laboratory instrumentation for research and development.

- Increasing adoption in homeland security and defense for threat detection.

- Market Share: Estimated to account for 35-40% of the total market in 2025.

- Growth Potential: High, driven by ongoing innovation in sensor technology and the need for more sophisticated analytical tools.

Leading Type of Filter: Infrared Narrow Band Transmission Filter

- Key Drivers:

- Versatile applicability across most infrared sensing and imaging systems.

- High efficiency in allowing specific wavelengths to pass through.

- Crucial for applications requiring precise wavelength isolation in spectral analysis and communications.

- Market Share: Estimated to hold 40-45% of the filter types market in 2025.

- Dominance Factors: Its fundamental role in numerous infrared applications makes it a consistent demand driver.

Key Countries Influencing Growth:

- United States: Dominant due to strong R&D, advanced manufacturing, and high demand in medical and defense.

- Germany: Significant presence in industrial automation and optical communication sectors.

- Japan: Leading in advanced imaging technologies and scientific instrumentation.

- China: Rapidly growing market driven by domestic demand in healthcare, manufacturing, and emerging technology sectors.

Infrared Narrow Band Filter Product Landscape

The Infrared Narrow Band Filter product landscape is characterized by continuous innovation focused on enhancing specificity, transmission efficiency, and durability. Key innovations include the development of multi-layer dielectric filters offering extremely narrow passbands with high out-of-band rejection, crucial for applications demanding precise spectral isolation. Advancements in anti-reflective coatings further boost transmission performance, minimizing signal loss. New materials are being explored to extend the operational wavelength range and improve performance in extreme environmental conditions. Unique selling propositions often lie in customized filter designs for niche applications, such as specific gas detection in environmental monitoring or specialized wavelength selection in optical communication systems. Technological advancements are enabling filters with sharper cut-off slopes, reduced insertion loss, and improved angular dependence, catering to the increasingly demanding requirements of advanced infrared systems.

Key Drivers, Barriers & Challenges in Infrared Narrow Band Filter

Key Drivers:

- Technological Advancements: Continuous innovation in material science and optical coating technologies enables higher performance filters.

- Growing Demand in Healthcare: Increasing use in medical diagnostics, thermal imaging, and non-invasive patient monitoring drives adoption.

- Industrial Automation & Monitoring: Essential for process control, quality inspection, and environmental monitoring systems.

- Optical Communication Growth: Critical for efficient data transmission and wavelength multiplexing in telecommunications.

- Defense & Security Applications: Vital for surveillance, target identification, and infrared countermeasures.

Barriers & Challenges:

- High Manufacturing Costs: Precision coating and fabrication processes are complex and expensive, leading to higher product prices.

- Supply Chain Disruptions: Reliance on specialized raw materials and components can lead to vulnerabilities.

- Intense Competition: A competitive market landscape can exert pressure on pricing and profit margins.

- Technical Expertise Requirement: Designing and implementing advanced narrow band filters requires specialized knowledge.

- Economic Fluctuations: Global economic downturns can impact capital expenditure in end-user industries.

- Regulatory Compliance: Meeting diverse international standards for different applications can be challenging.

Emerging Opportunities in Infrared Narrow Band Filter

Emerging opportunities in the Infrared Narrow Band Filter sector are abundant, particularly in the burgeoning fields of advanced healthcare diagnostics, smart agriculture, and next-generation telecommunications. The development of miniaturized, cost-effective narrow band filters for wearable health monitoring devices presents a significant untapped market. In agriculture, precise infrared filters can enhance crop monitoring for disease detection and yield optimization. The expansion of 5G and upcoming 6G networks will require increasingly sophisticated filters for higher data throughput and spectral efficiency in optical communication. Furthermore, the growing interest in climate monitoring and remote sensing offers substantial opportunities for filters used in satellite-based environmental analysis. The integration of AI with infrared sensing technologies also opens new avenues for predictive maintenance and intelligent sensing applications across various industries.

Growth Accelerators in the Infrared Narrow Band Filter Industry

The Infrared Narrow Band Filter industry's long-term growth will be propelled by several key catalysts. Technological breakthroughs in metamaterials and nanophotonics promise to unlock unprecedented filter performance, enabling novel applications. Strategic partnerships between filter manufacturers and leading sensor and device developers will accelerate product integration and market penetration. The increasing global emphasis on environmental sustainability and resource management will drive demand for advanced spectral analysis tools, thereby boosting the market for narrow band filters. Market expansion into developing economies, coupled with government initiatives supporting advanced technology adoption, will further fuel growth. Continuous innovation in spectral imaging and sensing technologies, alongside the growing adoption of the Internet of Things (IoT) devices that rely on precise infrared sensing, will act as significant growth accelerators.

Key Players Shaping the Infrared Narrow Band Filter Market

- Honeywell

- Heimann Sensor

- VIAVI Solutions

- Shenzhen Ansorl Technology Co., Ltd.

- Shenzhen Asenware Test and Control Technology Co., Ltd.

- Jinan Sinopts Energy Technology Inc.

- D&E Enterprise Co., Limited.

- Reuter-Stokes

- Cameron Green

- Zhejiang Crystal Optoelectronic Technology Co., Ltd.

- Hubei W-Olf Photoelectric Technology Co., Ltd.

- Yara Tertre SMR

- Suzhou Keihin Optech Corporation.

Notable Milestones in Infrared Narrow Band Filter Sector

- 2019: Introduction of advanced multi-layer dielectric filters with sub-nanometer bandwidth for high-precision gas sensing.

- 2020: Significant advancements in fabrication techniques enabling cost-effective production of customized narrow band filters.

- 2021: Increased integration of narrow band filters into portable medical diagnostic devices for remote healthcare applications.

- 2022: Development of tunable narrow band filters allowing for dynamic wavelength selection in complex analytical systems.

- 2023: Collaboration between leading filter manufacturers and optical communication companies to optimize filters for next-generation WDM systems.

- 2024: Emergence of novel, environmentally friendly materials for infrared filter production.

In-Depth Infrared Narrow Band Filter Market Outlook

The future market outlook for Infrared Narrow Band Filters is exceptionally promising, driven by sustained innovation and expanding application horizons. Growth accelerators such as breakthroughs in metamaterials, strategic industry collaborations, and increasing global demand for environmental monitoring and advanced healthcare solutions will shape the market landscape. The growing adoption of IoT devices and the ongoing development of 5G/6G technologies will further solidify the demand for high-performance spectral filtering. Strategic opportunities lie in catering to the evolving needs of the medical industry, developing compact and efficient filters for consumer electronics, and supporting the expansion of critical infrastructure projects requiring precise sensing capabilities. The market is poised for significant expansion, driven by its indispensable role in enabling advanced technologies across numerous vital sectors.

Infrared Narrow Band Filter Segmentation

-

1. Application

- 1.1. Infrared Spectral Analysis

- 1.2. Infrared Imaging

- 1.3. Optical Communication Industry

- 1.4. Medical Industry

- 1.5. Others

-

2. Types

- 2.1. Infrared Narrow Band Transmission Filter

- 2.2. Infrared Narrowband Reflection Filter

- 2.3. Infrared Narrowband Beam Splitting Filter

- 2.4. Infrared Narrowband Polarizing Filter

Infrared Narrow Band Filter Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Infrared Narrow Band Filter REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Infrared Narrow Band Filter Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Infrared Spectral Analysis

- 5.1.2. Infrared Imaging

- 5.1.3. Optical Communication Industry

- 5.1.4. Medical Industry

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Infrared Narrow Band Transmission Filter

- 5.2.2. Infrared Narrowband Reflection Filter

- 5.2.3. Infrared Narrowband Beam Splitting Filter

- 5.2.4. Infrared Narrowband Polarizing Filter

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Infrared Narrow Band Filter Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Infrared Spectral Analysis

- 6.1.2. Infrared Imaging

- 6.1.3. Optical Communication Industry

- 6.1.4. Medical Industry

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Infrared Narrow Band Transmission Filter

- 6.2.2. Infrared Narrowband Reflection Filter

- 6.2.3. Infrared Narrowband Beam Splitting Filter

- 6.2.4. Infrared Narrowband Polarizing Filter

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Infrared Narrow Band Filter Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Infrared Spectral Analysis

- 7.1.2. Infrared Imaging

- 7.1.3. Optical Communication Industry

- 7.1.4. Medical Industry

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Infrared Narrow Band Transmission Filter

- 7.2.2. Infrared Narrowband Reflection Filter

- 7.2.3. Infrared Narrowband Beam Splitting Filter

- 7.2.4. Infrared Narrowband Polarizing Filter

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Infrared Narrow Band Filter Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Infrared Spectral Analysis

- 8.1.2. Infrared Imaging

- 8.1.3. Optical Communication Industry

- 8.1.4. Medical Industry

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Infrared Narrow Band Transmission Filter

- 8.2.2. Infrared Narrowband Reflection Filter

- 8.2.3. Infrared Narrowband Beam Splitting Filter

- 8.2.4. Infrared Narrowband Polarizing Filter

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Infrared Narrow Band Filter Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Infrared Spectral Analysis

- 9.1.2. Infrared Imaging

- 9.1.3. Optical Communication Industry

- 9.1.4. Medical Industry

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Infrared Narrow Band Transmission Filter

- 9.2.2. Infrared Narrowband Reflection Filter

- 9.2.3. Infrared Narrowband Beam Splitting Filter

- 9.2.4. Infrared Narrowband Polarizing Filter

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Infrared Narrow Band Filter Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Infrared Spectral Analysis

- 10.1.2. Infrared Imaging

- 10.1.3. Optical Communication Industry

- 10.1.4. Medical Industry

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Infrared Narrow Band Transmission Filter

- 10.2.2. Infrared Narrowband Reflection Filter

- 10.2.3. Infrared Narrowband Beam Splitting Filter

- 10.2.4. Infrared Narrowband Polarizing Filter

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Honeywell

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Heimann Sensor

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 VIAVI Solutions

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Shenzhen Ansorl Technology Co.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ltd.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shenzhen Asenware Test and Control Technology Co.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ltd.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jinan Sinopts Energy Technology Inc.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 D&E Enterprise Co.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Limited.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Reuter-Stokes

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cameron Green

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Zhejiang Crystal Optoelectronic Technology Co.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ltd.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Hubei W-Olf Photoelectric Technology Co.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Ltd.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Yara Tertre SMR

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Suzhou Keihin Optech Corporation.

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Honeywell

List of Figures

- Figure 1: Global Infrared Narrow Band Filter Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Infrared Narrow Band Filter Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Infrared Narrow Band Filter Revenue (million), by Application 2024 & 2032

- Figure 4: North America Infrared Narrow Band Filter Volume (K), by Application 2024 & 2032

- Figure 5: North America Infrared Narrow Band Filter Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Infrared Narrow Band Filter Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Infrared Narrow Band Filter Revenue (million), by Types 2024 & 2032

- Figure 8: North America Infrared Narrow Band Filter Volume (K), by Types 2024 & 2032

- Figure 9: North America Infrared Narrow Band Filter Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Infrared Narrow Band Filter Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Infrared Narrow Band Filter Revenue (million), by Country 2024 & 2032

- Figure 12: North America Infrared Narrow Band Filter Volume (K), by Country 2024 & 2032

- Figure 13: North America Infrared Narrow Band Filter Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Infrared Narrow Band Filter Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Infrared Narrow Band Filter Revenue (million), by Application 2024 & 2032

- Figure 16: South America Infrared Narrow Band Filter Volume (K), by Application 2024 & 2032

- Figure 17: South America Infrared Narrow Band Filter Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Infrared Narrow Band Filter Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Infrared Narrow Band Filter Revenue (million), by Types 2024 & 2032

- Figure 20: South America Infrared Narrow Band Filter Volume (K), by Types 2024 & 2032

- Figure 21: South America Infrared Narrow Band Filter Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Infrared Narrow Band Filter Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Infrared Narrow Band Filter Revenue (million), by Country 2024 & 2032

- Figure 24: South America Infrared Narrow Band Filter Volume (K), by Country 2024 & 2032

- Figure 25: South America Infrared Narrow Band Filter Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Infrared Narrow Band Filter Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Infrared Narrow Band Filter Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Infrared Narrow Band Filter Volume (K), by Application 2024 & 2032

- Figure 29: Europe Infrared Narrow Band Filter Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Infrared Narrow Band Filter Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Infrared Narrow Band Filter Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Infrared Narrow Band Filter Volume (K), by Types 2024 & 2032

- Figure 33: Europe Infrared Narrow Band Filter Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Infrared Narrow Band Filter Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Infrared Narrow Band Filter Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Infrared Narrow Band Filter Volume (K), by Country 2024 & 2032

- Figure 37: Europe Infrared Narrow Band Filter Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Infrared Narrow Band Filter Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Infrared Narrow Band Filter Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Infrared Narrow Band Filter Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Infrared Narrow Band Filter Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Infrared Narrow Band Filter Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Infrared Narrow Band Filter Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Infrared Narrow Band Filter Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Infrared Narrow Band Filter Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Infrared Narrow Band Filter Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Infrared Narrow Band Filter Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Infrared Narrow Band Filter Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Infrared Narrow Band Filter Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Infrared Narrow Band Filter Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Infrared Narrow Band Filter Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Infrared Narrow Band Filter Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Infrared Narrow Band Filter Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Infrared Narrow Band Filter Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Infrared Narrow Band Filter Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Infrared Narrow Band Filter Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Infrared Narrow Band Filter Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Infrared Narrow Band Filter Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Infrared Narrow Band Filter Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Infrared Narrow Band Filter Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Infrared Narrow Band Filter Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Infrared Narrow Band Filter Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Infrared Narrow Band Filter Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Infrared Narrow Band Filter Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Infrared Narrow Band Filter Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Infrared Narrow Band Filter Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Infrared Narrow Band Filter Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Infrared Narrow Band Filter Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Infrared Narrow Band Filter Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Infrared Narrow Band Filter Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Infrared Narrow Band Filter Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Infrared Narrow Band Filter Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Infrared Narrow Band Filter Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Infrared Narrow Band Filter Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Infrared Narrow Band Filter Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Infrared Narrow Band Filter Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Infrared Narrow Band Filter Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Infrared Narrow Band Filter Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Infrared Narrow Band Filter Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Infrared Narrow Band Filter Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Infrared Narrow Band Filter Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Infrared Narrow Band Filter Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Infrared Narrow Band Filter Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Infrared Narrow Band Filter Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Infrared Narrow Band Filter Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Infrared Narrow Band Filter Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Infrared Narrow Band Filter Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Infrared Narrow Band Filter Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Infrared Narrow Band Filter Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Infrared Narrow Band Filter Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Infrared Narrow Band Filter Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Infrared Narrow Band Filter Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Infrared Narrow Band Filter Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Infrared Narrow Band Filter Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Infrared Narrow Band Filter Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Infrared Narrow Band Filter Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Infrared Narrow Band Filter Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Infrared Narrow Band Filter Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Infrared Narrow Band Filter Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Infrared Narrow Band Filter Volume K Forecast, by Country 2019 & 2032

- Table 81: China Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Infrared Narrow Band Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Infrared Narrow Band Filter Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Infrared Narrow Band Filter?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Infrared Narrow Band Filter?

Key companies in the market include Honeywell, Heimann Sensor, VIAVI Solutions, Shenzhen Ansorl Technology Co., Ltd., Shenzhen Asenware Test and Control Technology Co., Ltd., Jinan Sinopts Energy Technology Inc., D&E Enterprise Co., Limited., Reuter-Stokes, Cameron Green, Zhejiang Crystal Optoelectronic Technology Co., Ltd., Hubei W-Olf Photoelectric Technology Co., Ltd., Yara Tertre SMR, Suzhou Keihin Optech Corporation..

3. What are the main segments of the Infrared Narrow Band Filter?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Infrared Narrow Band Filter," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Infrared Narrow Band Filter report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Infrared Narrow Band Filter?

To stay informed about further developments, trends, and reports in the Infrared Narrow Band Filter, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence