Key Insights

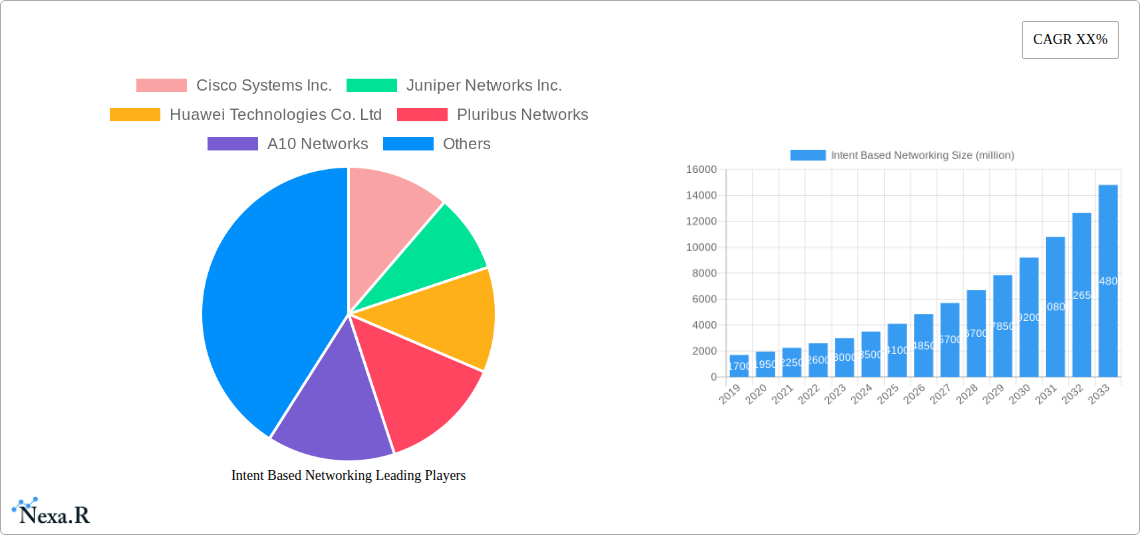

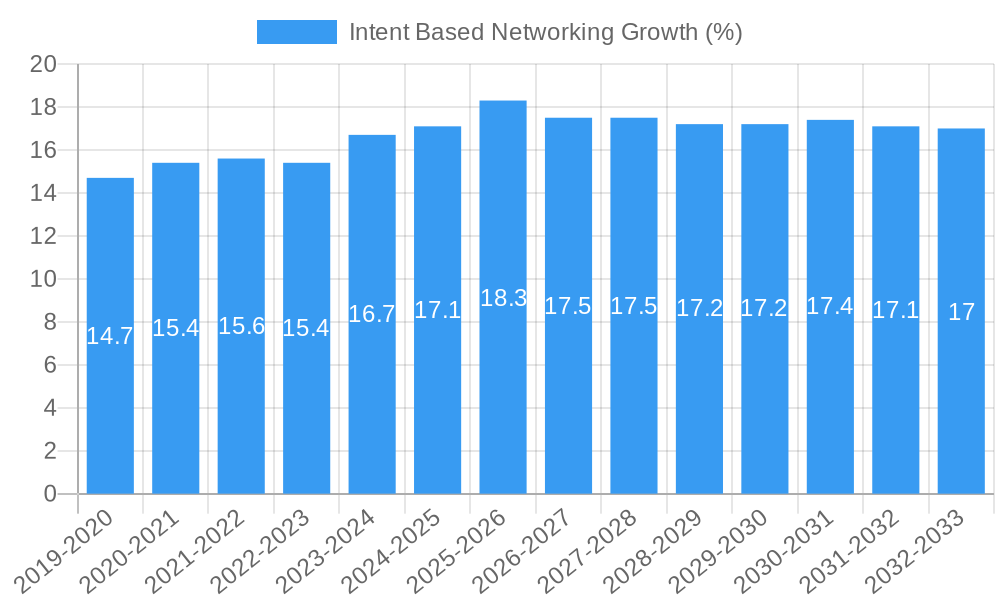

The Intent-Based Networking (IBN) market is poised for significant expansion, projected to reach a substantial market size of approximately $5.2 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 18.5% expected to drive its valuation to over $15 billion by 2033. This surge is primarily fueled by the increasing demand for automated network operations and enhanced security postures across both civil and military applications. Enterprises are recognizing the limitations of traditional, manual network management, which is often complex, error-prone, and hinders agility. IBN's ability to translate business intent into network policies, automate configuration, and provide continuous validation offers a transformative solution, enabling organizations to adapt swiftly to evolving digital landscapes and stringent compliance requirements. The adoption of advanced networking types such as Wide Area Networks (WAN), Metropolitan Area Networks (MAN), Local Area Networks (LAN), and Personal Area Networks (PAN) is further amplifying the market's growth as IBN solutions are integrated across diverse network infrastructures.

Key drivers of this market growth include the escalating complexity of network environments, the imperative for greater operational efficiency, and the critical need for proactive security threat mitigation. The proliferation of connected devices and the rise of sophisticated cybersecurity attacks necessitate intelligent network solutions that can anticipate and respond to potential disruptions. Furthermore, the ongoing digital transformation initiatives across industries, coupled with the expanding adoption of cloud computing and edge computing, are creating a fertile ground for IBN. However, challenges such as the initial investment costs, the need for skilled personnel to implement and manage IBN systems, and interoperability concerns with legacy infrastructure may present some restraints. Nevertheless, the overwhelming benefits in terms of reduced downtime, improved network performance, and enhanced security are expected to outweigh these hurdles, paving the way for widespread IBN adoption. The market is characterized by intense competition among established players like Cisco Systems Inc. and Juniper Networks Inc., alongside innovative startups, all vying to capture market share through advanced feature development and strategic partnerships.

Intent Based Networking Market Dynamics & Structure

The Intent Based Networking (IBN) market is characterized by a moderately concentrated landscape, with key players like Cisco Systems Inc., Juniper Networks Inc., and Huawei Technologies Co. Ltd holding significant sway. Technological innovation is a primary driver, fueled by the escalating demand for network automation, simplified management, and enhanced security. Regulatory frameworks, particularly those emphasizing data privacy and network resilience, are increasingly influencing IBN adoption, especially within the Civil application segment. Competitive product substitutes, such as traditional network management tools and increasingly sophisticated SDN solutions, are present but are progressively being outmaneuvered by the comprehensive automation capabilities of IBN. End-user demographics are shifting towards enterprises and service providers seeking agile, programmable networks to support digital transformation initiatives. Mergers and acquisitions (M&A) are a notable trend, with xx M&A deals valued at approximately $xxx million observed during the historical period (2019-2024), indicating consolidation and strategic partnerships aimed at expanding market reach and technological portfolios. Innovation barriers include the complexity of integrating IBN solutions with legacy infrastructure and the need for skilled personnel to manage these advanced systems.

- Market Concentration: Moderately concentrated with leading vendors.

- Technological Drivers: Network automation, simplified management, enhanced security, digital transformation.

- Regulatory Influence: Data privacy, network resilience mandates.

- Competitive Landscape: Traditional management tools, SDN solutions.

- End-User Demographics: Enterprises, service providers, government agencies.

- M&A Trends: Strategic acquisitions for technology and market expansion.

- Innovation Barriers: Legacy integration, talent shortage.

Intent Based Networking Growth Trends & Insights

The Intent Based Networking market is poised for robust expansion, driven by the inherent need for intelligent, automated network operations across diverse industries. The global IBN market size was estimated at $xxx million in 2024 and is projected to reach a significant $xxx million by 2033, exhibiting a compound annual growth rate (CAGR) of xx% during the forecast period of 2025–2033. This impressive growth trajectory is underpinned by increasing adoption rates of IBN solutions across WAN, MAN, and LAN environments, as organizations seek to optimize performance, reduce operational costs, and improve agility. Technological disruptions, such as the evolution of AI and machine learning within network management, are further accelerating this trend. Consumer behavior shifts are also playing a crucial role; businesses are no longer content with reactive network management but are actively seeking proactive, intent-driven solutions that align network behavior directly with business objectives. This paradigm shift translates into a growing demand for IBN platforms that can translate high-level business intents into concrete network configurations and policies. The penetration of IBN solutions is expected to deepen significantly as organizations realize the tangible benefits of reduced downtime, faster service deployment, and enhanced security posture. The study period of 2019–2033, with a base year of 2025, allows for a comprehensive analysis of both historical adoption patterns and future market potential, revealing a consistent upward trend in market size evolution and a growing reliance on IBN for mission-critical operations. The transition from manual configuration to automated policy enforcement is a fundamental change that will continue to drive market growth throughout the forecast period. As networks become more complex and dynamic, the ability of IBN to manage this complexity through intent-driven automation becomes indispensable. This leads to a sustained increase in market penetration as more organizations across various segments, including the Civil and Military applications, recognize the strategic advantages of adopting IBN. The forecast period is anticipated to witness significant technological advancements within IBN platforms, further solidifying their position as a critical component of modern network infrastructure.

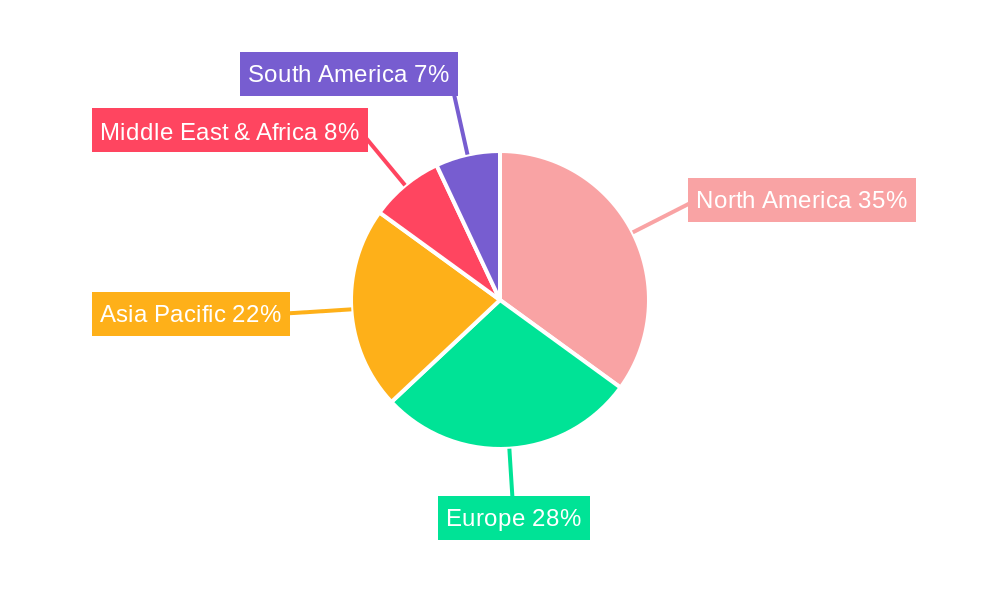

Dominant Regions, Countries, or Segments in Intent Based Networking

The Civil application segment, particularly within North America, is emerging as the dominant force driving growth in the Intent Based Networking (IBN) market. This dominance is fueled by a confluence of factors including robust digital transformation initiatives across enterprises, significant investments in advanced IT infrastructure, and a proactive regulatory environment that encourages the adoption of secure and efficient networking solutions. The sheer scale of the enterprise market in North America, coupled with a high concentration of leading technology companies, creates a fertile ground for IBN adoption. Furthermore, the demand for enhanced network agility and automation to support cloud computing, IoT deployments, and Big Data analytics is particularly acute in this region, making IBN a strategic imperative rather than a luxury. The WAN type of network infrastructure within this segment is experiencing substantial growth due to the increasing complexity of distributed enterprise networks and the need for seamless connectivity across multiple sites.

- Dominant Region: North America, driven by technological maturity and enterprise adoption.

- Dominant Country: United States, leading in IBN research, development, and deployment.

- Dominant Application: Civil, due to its widespread use in enterprise and government networks.

- Dominant Network Type: WAN, as organizations increasingly adopt distributed and cloud-centric architectures.

- Key Drivers: Digital transformation, cloud adoption, IoT expansion, Big Data analytics, stringent security requirements, and demand for network agility.

- Market Share: North America is estimated to hold approximately xx% of the global IBN market share in 2025.

- Growth Potential: Projected to maintain a CAGR of xx% through 2033, outpacing other regions.

- Economic Policies: Government initiatives supporting technological innovation and digital infrastructure development further bolster IBN adoption.

- Infrastructure: Advanced telecommunications infrastructure in North America provides a strong foundation for IBN deployment.

- Competitive Landscape: A mature competitive environment with significant presence of key IBN vendors, fostering innovation and driving market expansion.

Intent Based Networking Product Landscape

The Intent Based Networking product landscape is characterized by sophisticated platforms offering a unified approach to network design, provisioning, validation, and operations. These solutions translate high-level business policies into automated network configurations, significantly reducing manual intervention and potential errors. Key product innovations include advanced AI and machine learning algorithms for predictive analytics and anomaly detection, enabling proactive issue resolution and self-healing networks. Performance metrics are dramatically improved through optimized resource utilization and faster service deployment cycles. Unique selling propositions lie in the end-to-end automation capabilities, end-to-end network visibility, and adherence to business intent throughout the network lifecycle, from LAN to WAN environments.

Key Drivers, Barriers & Challenges in Intent Based Networking

The Intent Based Networking (IBN) market is propelled by significant drivers including the escalating complexity of modern networks, the imperative for enhanced agility and automation, and the critical need for improved cybersecurity. The drive towards digital transformation across industries necessitates networks that can rapidly adapt to changing business requirements, a capability that IBN excels at. Furthermore, the potential for substantial operational cost savings through automation and reduced human error serves as a major catalyst.

Conversely, key challenges include the substantial initial investment required for IBN solutions, the complexity of integrating these systems with existing legacy infrastructure, and the shortage of skilled IT professionals capable of managing and operating IBN environments. Resistance to change within IT departments and concerns regarding vendor lock-in also pose significant hurdles.

- Key Drivers: Network complexity, digital transformation, operational cost reduction, cybersecurity enhancement, increased agility.

- Key Barriers & Challenges: High initial investment, legacy system integration, talent shortage, resistance to change, vendor lock-in concerns, security validation complexity.

Emerging Opportunities in Intent Based Networking

Emerging opportunities in the Intent Based Networking sector are abundant, driven by the increasing adoption of 5G, edge computing, and the proliferation of IoT devices. The demand for highly automated and secure networks to manage the massive influx of data generated by these technologies presents a significant growth avenue. Untapped markets in specific verticals, such as healthcare and manufacturing, are ripe for IBN adoption to streamline operations and enhance patient care or production efficiency. Furthermore, the evolution of IBN towards more sophisticated predictive maintenance and autonomous network operations promises to unlock new levels of efficiency and reliability, creating a substantial market for advanced IBN capabilities.

Growth Accelerators in the Intent Based Networking Industry

The Intent Based Networking industry is experiencing accelerated growth fueled by key catalysts. Technological breakthroughs in AI and machine learning are enhancing the intelligence and predictive capabilities of IBN platforms, making them more indispensable. Strategic partnerships between network hardware vendors, software providers, and cloud service providers are creating integrated ecosystems, simplifying adoption and expanding market reach. Furthermore, aggressive market expansion strategies by leading players, including targeted outreach to underserved verticals and regions, are driving widespread adoption. The increasing standardization of IBN protocols and APIs is also fostering interoperability and reducing integration complexities, acting as a significant growth accelerator.

Key Players Shaping the Intent Based Networking Market

- Cisco Systems Inc.

- Juniper Networks Inc.

- Huawei Technologies Co. Ltd

- Pluribus Networks

- A10 Networks

- FireMon LLC

- Cerium Networks

- Veriflow Systems

- Fortinet Inc.

- Indeni Ltd.

- Forward Networks Inc.

- Anuta Networks

- Apstra Inc.

Notable Milestones in Intent Based Networking Sector

- 2019: Increased adoption of AI/ML in network automation tools, enhancing IBN capabilities.

- 2020: Major cloud providers begin integrating IBN principles into their managed network services.

- 2021: Significant advancements in network telemetry and real-time analytics for IBN.

- 2022: Growing emphasis on security automation within IBN frameworks, addressing evolving cyber threats.

- 2023: Expansion of IBN solutions to support multi-cloud and hybrid cloud environments.

- 2024: Release of next-generation IBN platforms with enhanced intent translation and closed-loop automation.

In-Depth Intent Based Networking Market Outlook

The Intent Based Networking market outlook is exceptionally positive, driven by the sustained acceleration in digital transformation and the increasing demand for agile, automated, and secure network infrastructures. Growth accelerators, including advancements in AI/ML, strategic partnerships, and market expansion initiatives, will continue to propel the industry forward. The future market potential lies in the widespread adoption of autonomous networking, where IBN solutions will not only manage but also proactively optimize network performance based on evolving business needs. Strategic opportunities abound in tailoring IBN solutions for emerging technologies like IoT and edge computing, as well as in providing comprehensive IBN services to industries with critical network dependency. The overall trajectory indicates a robust and sustained period of growth for the IBN market.

Intent Based Networking Segmentation

-

1. Application

- 1.1. Civil

- 1.2. Military

-

2. Types

- 2.1. WAN

- 2.2. MAN

- 2.3. LAN

- 2.4. PAN

Intent Based Networking Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Intent Based Networking REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Intent Based Networking Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Civil

- 5.1.2. Military

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. WAN

- 5.2.2. MAN

- 5.2.3. LAN

- 5.2.4. PAN

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Intent Based Networking Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Civil

- 6.1.2. Military

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. WAN

- 6.2.2. MAN

- 6.2.3. LAN

- 6.2.4. PAN

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Intent Based Networking Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Civil

- 7.1.2. Military

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. WAN

- 7.2.2. MAN

- 7.2.3. LAN

- 7.2.4. PAN

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Intent Based Networking Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Civil

- 8.1.2. Military

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. WAN

- 8.2.2. MAN

- 8.2.3. LAN

- 8.2.4. PAN

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Intent Based Networking Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Civil

- 9.1.2. Military

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. WAN

- 9.2.2. MAN

- 9.2.3. LAN

- 9.2.4. PAN

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Intent Based Networking Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Civil

- 10.1.2. Military

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. WAN

- 10.2.2. MAN

- 10.2.3. LAN

- 10.2.4. PAN

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Cisco Systems Inc.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Juniper Networks Inc.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Huawei Technologies Co. Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pluribus Networks

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 A10 Networks

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FireMon LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cerium Networks

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Veriflow Systems

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fortinet Inc.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Indeni Ltd.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Forward Networks Inc.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Anuta Networks

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Apstra Inc.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Cisco Systems Inc.

List of Figures

- Figure 1: Global Intent Based Networking Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Intent Based Networking Revenue (million), by Application 2024 & 2032

- Figure 3: North America Intent Based Networking Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Intent Based Networking Revenue (million), by Types 2024 & 2032

- Figure 5: North America Intent Based Networking Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Intent Based Networking Revenue (million), by Country 2024 & 2032

- Figure 7: North America Intent Based Networking Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Intent Based Networking Revenue (million), by Application 2024 & 2032

- Figure 9: South America Intent Based Networking Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Intent Based Networking Revenue (million), by Types 2024 & 2032

- Figure 11: South America Intent Based Networking Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Intent Based Networking Revenue (million), by Country 2024 & 2032

- Figure 13: South America Intent Based Networking Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Intent Based Networking Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Intent Based Networking Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Intent Based Networking Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Intent Based Networking Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Intent Based Networking Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Intent Based Networking Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Intent Based Networking Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Intent Based Networking Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Intent Based Networking Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Intent Based Networking Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Intent Based Networking Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Intent Based Networking Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Intent Based Networking Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Intent Based Networking Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Intent Based Networking Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Intent Based Networking Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Intent Based Networking Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Intent Based Networking Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Intent Based Networking Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Intent Based Networking Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Intent Based Networking Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Intent Based Networking Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Intent Based Networking Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Intent Based Networking Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Intent Based Networking Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Intent Based Networking Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Intent Based Networking Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Intent Based Networking Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Intent Based Networking Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Intent Based Networking Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Intent Based Networking Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Intent Based Networking Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Intent Based Networking Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Intent Based Networking Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Intent Based Networking Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Intent Based Networking Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Intent Based Networking Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Intent Based Networking Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Intent Based Networking?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Intent Based Networking?

Key companies in the market include Cisco Systems Inc., Juniper Networks Inc., Huawei Technologies Co. Ltd, Pluribus Networks, A10 Networks, FireMon LLC, Cerium Networks, Veriflow Systems, Fortinet Inc., Indeni Ltd., Forward Networks Inc., Anuta Networks, Apstra Inc..

3. What are the main segments of the Intent Based Networking?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Intent Based Networking," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Intent Based Networking report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Intent Based Networking?

To stay informed about further developments, trends, and reports in the Intent Based Networking, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence