Key Insights

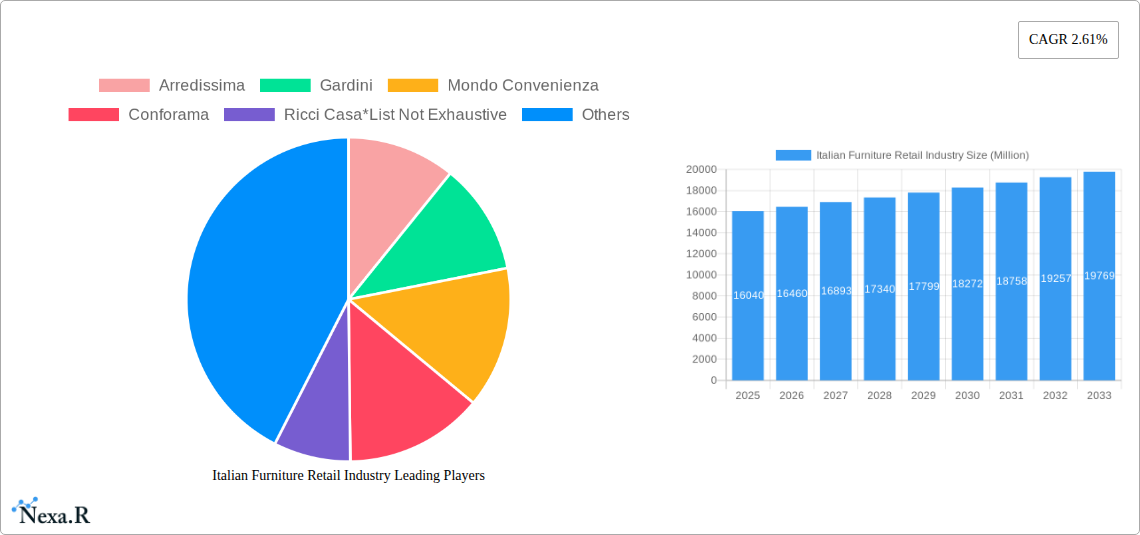

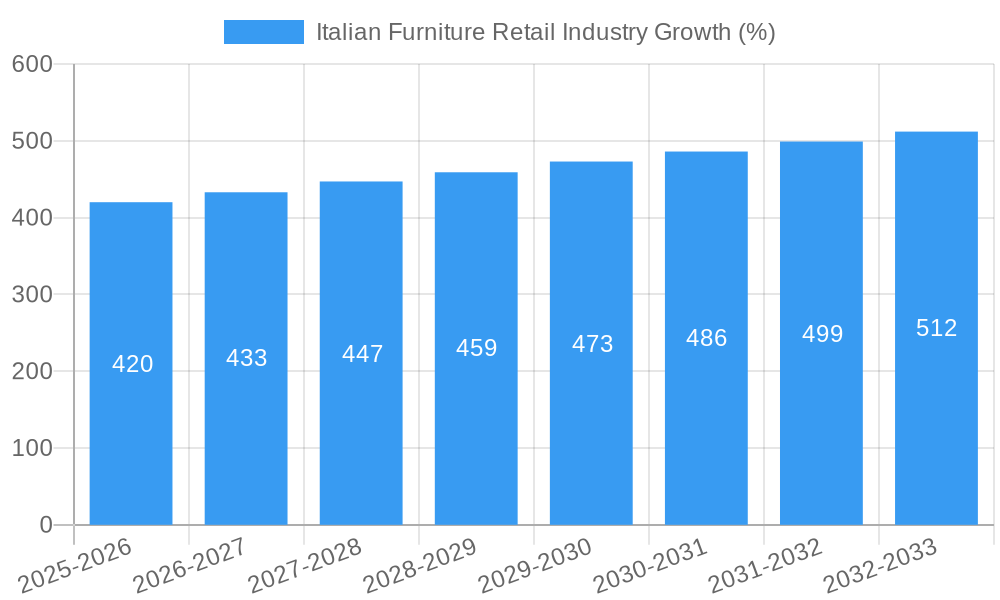

The Italian furniture retail industry, valued at €16.04 billion in 2025, exhibits a steady growth trajectory, projected at a CAGR of 2.61% from 2025 to 2033. This growth is fueled by several key factors. Firstly, a rising middle class with increased disposable income is driving demand for higher-quality, stylish furniture, particularly within the organized retail sector. Secondly, evolving consumer preferences towards sustainable and eco-friendly furniture are impacting product design and material choices. Furthermore, the integration of e-commerce and omnichannel strategies is revolutionizing the distribution landscape, enhancing customer experience and reaching wider audiences. Key players such as IKEA, Poltronesofa, and established Italian brands like Arredissima and Mondo Convenienza are strategically adapting their offerings and marketing to capitalize on these trends. Competition within the market is robust, with both large multinational corporations and smaller, specialized retailers vying for market share. The unorganized sector still holds a significant portion of the market but faces pressure from the increasingly organized segment.

However, the industry faces challenges. Fluctuating raw material prices and supply chain disruptions pose significant threats to profitability and timely delivery. Moreover, intense competition and the need for constant innovation to stay relevant in a dynamic market environment require significant investments in research and development. While the domestic market remains the primary focus, opportunities exist for Italian furniture manufacturers to expand their global presence, leveraging their reputation for high-quality craftsmanship and design. The segment-wise breakdown, though incomplete, shows a strong demand across various furniture types, reflecting the broad appeal of Italian design. The ongoing expansion of online channels alongside traditional brick-and-mortar stores suggests a balanced approach is necessary for sustained success in this market.

Italian Furniture Retail Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Italian furniture retail industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period encompasses 2019-2024. The report segments the market by room furniture type (bedroom, kitchen, living/dining room, outdoor, other), distribution channel (online, offline), and market type (organized, unorganized). Key players analyzed include Arredissima, Gardini, Mondo Convenienza, Conforama, Ricci Casa, IKEA, Canfalone, Dotolo Mobili, Poltronesofa, and JYSK (list not exhaustive). The total market size is projected to reach xx Million by 2033.

Italian Furniture Retail Industry Market Dynamics & Structure

The Italian furniture retail market exhibits a dynamic interplay of factors influencing its structure and growth. Market concentration is moderate, with a few large players alongside numerous smaller, specialized retailers. Technological innovation, particularly in e-commerce and smart home integration, is a key driver, although adoption varies across segments. Regulatory frameworks, including those concerning product safety and environmental standards, significantly impact operations. Competitive substitutes, such as second-hand furniture and DIY solutions, exert pressure on margins. The end-user demographic is diverse, ranging from young professionals to families and senior citizens, with preferences varying across age groups and income levels. M&A activity has been relatively moderate in recent years, with a focus on strategic acquisitions to expand market reach or product portfolios. The number of M&A deals in the sector from 2019-2024 is estimated at xx.

- Market Concentration: Moderate, with a mix of large chains and smaller businesses.

- Technological Innovation: Significant influence from e-commerce, smart home technology, and sustainable materials.

- Regulatory Framework: Stringent regulations impact product safety, labeling, and environmental compliance.

- Competitive Substitutes: Second-hand furniture and DIY options offer affordability but lower quality.

- End-User Demographics: Diverse needs and preferences based on age, income, and lifestyle.

- M&A Trends: Moderate activity focused on strategic acquisitions for market expansion and product diversification.

Italian Furniture Retail Industry Growth Trends & Insights

The Italian furniture retail market has demonstrated consistent growth in recent years, driven by factors such as rising disposable incomes, increasing urbanization, and a growing preference for home improvement and interior design. However, economic fluctuations and shifts in consumer spending patterns have influenced growth rates. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to achieve a CAGR of xx% during the forecast period (2025-2033). This growth is expected to be influenced by several factors, including increasing disposable incomes, shifting consumer preferences, and the growth of e-commerce. Technological disruptions, particularly the rise of online retail and the integration of smart home technologies into furniture, are reshaping consumer behavior and expectations. Consumers are increasingly demanding personalized experiences, sustainable products, and seamless omnichannel shopping.

Dominant Regions, Countries, or Segments in Italian Furniture Retail Industry

The Northern regions of Italy, particularly Lombardy and Veneto, are the most dominant areas in the Italian furniture retail market, benefiting from a higher concentration of affluent consumers and established manufacturing clusters. Within the product segments, Living Room and Dining Room Furniture holds the largest market share, followed by Bedroom Furniture. The organized retail segment is experiencing faster growth than its unorganized counterpart due to greater access to capital, superior inventory management, and established branding. The online distribution channel is rapidly gaining traction, although offline stores still dominate overall sales volume.

- Key Drivers for Northern Regions: High disposable incomes, established manufacturing clusters, and strong consumer demand.

- Dominant Product Segment: Living Room and Dining Room Furniture, driven by high consumer preference and diverse product offerings.

- Fastest-Growing Segment: Organized retail, benefiting from better supply chain management, marketing capabilities, and brand recognition.

- Growing Distribution Channel: Online retail is growing rapidly, leveraging convenience and wider reach.

Italian Furniture Retail Industry Product Landscape

Product innovation in the Italian furniture retail industry focuses on improving functionality, aesthetics, and sustainability. Smart furniture incorporating technology for lighting, sound, and climate control is gaining popularity. Manufacturers are emphasizing sustainable materials and eco-friendly production processes to cater to environmentally conscious consumers. Unique selling propositions often center on superior craftsmanship, design, and durability. Technological advancements include the use of 3D printing for bespoke furniture and virtual reality for enhancing customer experiences.

Key Drivers, Barriers & Challenges in Italian Furniture Retail Industry

Key Drivers:

- Rising disposable incomes and increasing urbanization.

- Growing interest in home improvement and interior design.

- Technological advancements in furniture design and manufacturing.

- Evolving consumer preferences towards sustainability and personalization.

Key Challenges & Restraints:

- Economic fluctuations impacting consumer spending.

- Intense competition among retailers and rising import pressures.

- Supply chain disruptions and increased raw material costs resulting in a 15% increase in production costs.

- Regulatory compliance and labor costs.

Emerging Opportunities in Italian Furniture Retail Industry

- Expansion into untapped markets in Southern Italy.

- Development of personalized and customizable furniture solutions.

- Integration of augmented reality (AR) and virtual reality (VR) technologies in the customer experience.

- Increased focus on sustainable and eco-friendly products.

Growth Accelerators in the Italian Furniture Retail Industry

Long-term growth will be driven by strategic partnerships between manufacturers and retailers to streamline supply chains and optimize marketing efforts. Investing in technological advancements, including the use of automation, robotics, and AI in manufacturing and logistics, will improve efficiency and reduce costs. Expansion into international markets and the development of niche product categories will provide additional growth opportunities.

Key Players Shaping the Italian Furniture Retail Industry Market

- Arredissima

- Gardini

- Mondo Convenienza

- Conforama

- Ricci Casa

- IKEA

- Canfalone

- Dotolo Mobili

- Poltronesofa

- JYSK

Notable Milestones in Italian Furniture Retail Industry Sector

- September 2021: IKEA and Sonos launch a new version of the SYMFONISK table lamp speaker.

- April 2021: PayGlobe and Ingenico partner to improve payment solutions for Mondo Convenienza.

In-Depth Italian Furniture Retail Industry Market Outlook

The Italian furniture retail market is poised for continued growth, driven by technological innovation, evolving consumer preferences, and strategic market expansions. The focus on sustainability and personalization will shape future product development and marketing strategies. Companies that effectively leverage e-commerce, enhance customer experiences, and adapt to changing market conditions will be best positioned for success. The market's future is promising, with opportunities for both established players and new entrants.

Italian Furniture Retail Industry Segmentation

-

1. Room Furniture Type

- 1.1. Bedroom Furniture

- 1.2. Kitchen Furniture

- 1.3. Living Room and Dining Room Furniture

- 1.4. Outdoor Furniture and Other Furniture

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

-

3. Type of Market

- 3.1. Organized

- 3.2. Unorganized

Italian Furniture Retail Industry Segmentation By Geography

- 1. Italia

Italian Furniture Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Urbanization and Housing Sector; Home Improvement and Renovation Project

- 3.3. Market Restrains

- 3.3.1. High Competitive Market; Fluctuating Raw Material Cost

- 3.4. Market Trends

- 3.4.1. Growing E-commerce Penetration is Driving the Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italian Furniture Retail Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Room Furniture Type

- 5.1.1. Bedroom Furniture

- 5.1.2. Kitchen Furniture

- 5.1.3. Living Room and Dining Room Furniture

- 5.1.4. Outdoor Furniture and Other Furniture

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Type of Market

- 5.3.1. Organized

- 5.3.2. Unorganized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italia

- 5.1. Market Analysis, Insights and Forecast - by Room Furniture Type

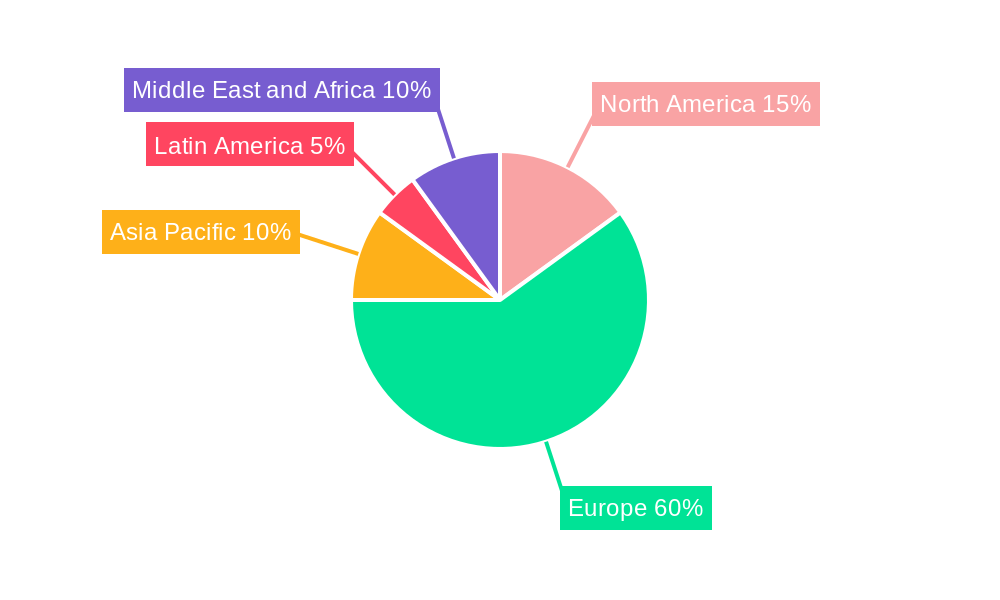

- 6. North America Italian Furniture Retail Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe Italian Furniture Retail Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific Italian Furniture Retail Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America Italian Furniture Retail Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East and Africa Italian Furniture Retail Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Arredissima

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Gardini

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mondo Convenienza

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Conforama

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ricci Casa*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IKEA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Canfalone

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dotolo Mobili

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Poltronesofa

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 JYSK

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Arredissima

List of Figures

- Figure 1: Italian Furniture Retail Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italian Furniture Retail Industry Share (%) by Company 2024

List of Tables

- Table 1: Italian Furniture Retail Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italian Furniture Retail Industry Revenue Million Forecast, by Room Furniture Type 2019 & 2032

- Table 3: Italian Furniture Retail Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Italian Furniture Retail Industry Revenue Million Forecast, by Type of Market 2019 & 2032

- Table 5: Italian Furniture Retail Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Italian Furniture Retail Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Italian Furniture Retail Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italian Furniture Retail Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Italian Furniture Retail Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Italian Furniture Retail Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Italian Furniture Retail Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italian Furniture Retail Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Italian Furniture Retail Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italian Furniture Retail Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Italian Furniture Retail Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italian Furniture Retail Industry Revenue Million Forecast, by Room Furniture Type 2019 & 2032

- Table 17: Italian Furniture Retail Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 18: Italian Furniture Retail Industry Revenue Million Forecast, by Type of Market 2019 & 2032

- Table 19: Italian Furniture Retail Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italian Furniture Retail Industry?

The projected CAGR is approximately 2.61%.

2. Which companies are prominent players in the Italian Furniture Retail Industry?

Key companies in the market include Arredissima, Gardini, Mondo Convenienza, Conforama, Ricci Casa*List Not Exhaustive, IKEA, Canfalone, Dotolo Mobili, Poltronesofa, JYSK.

3. What are the main segments of the Italian Furniture Retail Industry?

The market segments include Room Furniture Type, Distribution Channel, Type of Market.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Urbanization and Housing Sector; Home Improvement and Renovation Project.

6. What are the notable trends driving market growth?

Growing E-commerce Penetration is Driving the Market..

7. Are there any restraints impacting market growth?

High Competitive Market; Fluctuating Raw Material Cost.

8. Can you provide examples of recent developments in the market?

September 2021- IKEA and Sonos are launching a new version of the SYMFONISK table lamp speaker, with a better sound experience and updated, customizable designs. The original SYMFONISK table lamp speaker debuted in 2019, marking the first product developed by IKEA and Sonos.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italian Furniture Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italian Furniture Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italian Furniture Retail Industry?

To stay informed about further developments, trends, and reports in the Italian Furniture Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence