Key Insights

The Italy Automotive OEM Coatings Market is poised for steady growth, with a projected Compound Annual Growth Rate (CAGR) of over 3.50% from 2025 to 2033. This growth is driven by increasing demand for advanced and sustainable coating solutions in the automotive sector. The market size in 2025 is estimated at around $500 million, reflecting the robust demand from both passenger cars and commercial vehicles segments. Key drivers include the rising production of vehicles and the shift towards environmentally friendly technologies such as waterborne coatings. Trends in the market are leaning towards the adoption of high-performance resins like acrylic and polyurethane, which offer enhanced durability and aesthetic appeal to automotive finishes.

Segmentation of the market by resin type, application, and technology provides a detailed view of the industry landscape. Acrylic and polyurethane resins dominate due to their superior performance characteristics. The application segment is led by passenger cars, followed by commercial vehicles and agricultural, construction, and earth-moving (ACE) equipment. In terms of technology, waterborne coatings are gaining traction due to stringent environmental regulations and the push for sustainability. However, challenges such as fluctuating raw material prices and the need for continuous innovation to meet evolving consumer demands restrain market growth. Leading companies like Axalta Coatings Systems, PPG Industries Inc, and BASF SE are at the forefront, driving innovation and maintaining a competitive edge through strategic investments and partnerships.

Italy Automotive OEM Coatings Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Italy Automotive OEM Coatings market, encompassing market dynamics, growth trends, dominant segments, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base year and forecast period extending to 2033. The report segments the market by Resin type (Acrylic, Epoxy, Alkyd, Polyurethane, Polyester, Other Resins), Application (Passenger Cars, Commercial Vehicles, ACE – Automotive Component Equipment), and Technology (Waterborne, Solvent-borne, Other Technologies). The total market size is projected to reach xx Million units by 2033.

Keywords: Italy Automotive OEM Coatings Market, Automotive Coatings, OEM Coatings, Italy Automotive Market, Passenger Car Coatings, Commercial Vehicle Coatings, Acrylic Resin, Epoxy Resin, Polyurethane Coatings, Waterborne Coatings, Solventborne Coatings, BASF, PPG Industries, Axalta, AkzoNobel, Market Size, Market Share, Market Growth, Market Trends, Market Analysis, Italy Automotive Industry.

Italy Automotive OEM Coatings Market Market Dynamics & Structure

The Italian automotive OEM coatings market presents a moderately concentrated landscape, with several key international and regional players commanding substantial market share. A pivotal dynamic is the relentless pursuit of technological innovation, fueled by the escalating demand for sustainable and high-performance coatings. Italy's stringent environmental regulations are significantly shaping the market trajectory, compelling manufacturers to embrace eco-friendly solutions such as waterborne coatings. The market faces competitive pressure from alternative coating technologies and materials. Furthermore, evolving end-user demographics, notably the surge in electric vehicle adoption, are significantly impacting coating demand. Finally, the market structure is influenced by mergers and acquisitions (M&A) activity, as evidenced by recent significant acquisitions, contributing to market consolidation and strategic expansion.

- Market Concentration: Moderately concentrated, with the top 5 players holding an estimated xx% market share in 2024. Further analysis reveals a detailed breakdown of market share among key players and their respective strategies.

- Technological Innovation: A strong emphasis on waterborne and high-performance coatings is evident, driven by the dual pressures of stringent environmental regulations and the need for enhanced coating performance. Specific examples of innovative coating technologies gaining traction in the Italian market should be included here.

- Regulatory Framework: Stringent environmental regulations are acting as a catalyst for the adoption of sustainable coating technologies, driving innovation and shaping the competitive landscape. A discussion of specific Italian environmental regulations and their impact on the market would strengthen this point.

- Competitive Substitutes: Alternative materials and coating technologies pose a moderate but growing threat. This section should elaborate on specific alternative technologies and their market penetration.

- End-User Demographics: The growing popularity of electric vehicles is significantly influencing coating needs, demanding specialized coatings to address the unique requirements of EV battery packs and other components. Further analysis of EV market trends in Italy is warranted.

- M&A Trends: Recent acquisitions, such as PPG's acquisition of Arsonisi (and others if applicable), illustrate strategic expansion and consolidation within the market. A quantitative analysis of M&A activity during the period 2019-2024, including the number of deals and their total value, would provide valuable insights.

Italy Automotive OEM Coatings Market Growth Trends & Insights

The Italian automotive OEM coatings market exhibited a xx% CAGR during the historical period (2019-2024), propelled by factors such as increased automotive production and the widespread adoption of advanced coating technologies. The market is projected to maintain its growth trajectory in the forecast period (2025-2033), although at a slightly moderated pace, primarily due to economic fluctuations and potential technological saturation in certain segments. The penetration of waterborne coatings is anticipated to rise significantly, driven by environmental regulations and the inherent advantages of this environmentally friendly technology. Furthermore, consumer preferences for aesthetically pleasing and durable finishes will continue to shape market growth.

- Market Size Evolution: The market expanded from xx Million units in 2019 to xx Million units in 2024. A detailed breakdown of market size by segment (e.g., passenger cars, commercial vehicles) would enrich this analysis.

- Adoption Rates: Waterborne coatings adoption is steadily increasing, with projections reaching xx% by 2033. This should include a discussion of factors contributing to this adoption rate.

- Technological Disruptions: Advancements in high-performance coatings and sustainable formulations are at the forefront of market innovation. Specific examples of these advancements should be cited.

- Consumer Behavior Shifts: The increasing consumer demand for aesthetically appealing and durable automotive finishes is a key growth driver. A deeper dive into consumer preferences would add context.

Dominant Regions, Countries, or Segments in Italy Automotive OEM Coatings Market

Northern Italy holds a dominant position in the automotive OEM coatings market due to the higher concentration of automotive manufacturing facilities. Within the market segments, the Passenger Car segment commands the largest market share due to the substantially higher volume of passenger car production compared to commercial vehicles. Polyurethane resins demonstrate significant growth potential, attributed to their superior performance characteristics. Concurrently, waterborne technologies are experiencing a rapid surge in adoption, largely driven by increasingly stringent environmental regulations and consumer preference for eco-friendly products.

- Key Drivers: The robust automotive manufacturing base in Northern Italy, coupled with high demand for passenger car coatings and the increasing adoption of waterborne technologies, are primary growth drivers.

- Dominance Factors: High automotive production in Northern Italy, the superior performance characteristics of polyurethane resins, and the escalating pressure from stringent environmental regulations promoting waterborne technology are key factors contributing to market dominance.

- Market Share & Growth Potential: The Passenger Cars segment holds the largest market share (xx%), followed by Commercial Vehicles (xx%). Polyurethane resins are projected to achieve the highest CAGR (xx%) during the forecast period. A detailed analysis of market share by resin type is recommended.

Italy Automotive OEM Coatings Market Product Landscape

The market offers a wide range of coatings, including waterborne and solvent-borne options, with varying performance characteristics like scratch resistance, UV protection, and color retention. Recent innovations focus on sustainable formulations using biomass-based materials and improved durability. Unique selling propositions often center on enhanced performance attributes or reduced environmental impact. Technological advancements focus on improving both performance and sustainability, creating coatings that meet stricter environmental regulations while maintaining high-quality standards.

Key Drivers, Barriers & Challenges in Italy Automotive OEM Coatings Market

Key Drivers:

- Increasing automotive production in Italy.

- Growing demand for high-performance and sustainable coatings.

- Stringent environmental regulations promoting eco-friendly solutions.

Challenges and Restraints:

- Fluctuations in raw material prices impacting profitability.

- Intense competition from established and emerging players.

- Economic downturns affecting automotive production and demand for coatings. This had a quantifiable impact of xx% reduction in demand during the 2020 economic downturn.

Emerging Opportunities in Italy Automotive OEM Coatings Market

- Growing adoption of electric vehicles and associated coating requirements.

- Increased demand for lightweight and fuel-efficient vehicles necessitating specialized coatings.

- Rising consumer preference for customized finishes and colors.

Growth Accelerators in the Italy Automotive OEM Coatings Market Industry

The sustained long-term growth of the Italian automotive OEM coatings market is propelled by ongoing technological advancements in sustainable and high-performance coatings. Strategic partnerships and collaborations between OEMs and coating manufacturers are facilitating the development of innovative coating solutions tailored to meet the specific requirements of different vehicle types and applications. Expansion into rapidly growing niche markets, such as electric vehicles and lightweight materials, will also significantly contribute to market expansion.

Key Players Shaping the Italy Automotive OEM Coatings Market Market

- Axalta Coatings Systems

- ANGUS

- RPM International Inc

- PPG Industries Inc

- Mader

- Beckers Group

- Nippon Paint Holdings Co Ltd

- BASF SE

- Mankiewicz

- AkzoNobel NV

- Merck Group

- Armorthane

- The Sherwin Williams Company

- Specialty Coatings Systems Inc

Notable Milestones in Italy Automotive OEM Coatings Market Sector

- May 2022: BASF launched ColorBrite Airspace Blue ReSource basecoat, a sustainable automotive coating based on biomass, expanding its sustainable product portfolio in Europe.

- March 2022: PPG acquired Arsonisi powder coatings manufacturing facility in Milan, Italy, boosting its powder coatings product portfolio and development in Europe.

In-Depth Italy Automotive OEM Coatings Market Market Outlook

The Italian automotive OEM coatings market presents significant growth opportunities, particularly in sustainable and high-performance coatings. Strategic collaborations, technological advancements, and the expanding electric vehicle market will further drive market expansion. Companies focused on innovation and sustainability are well-positioned to capitalize on the growth potential of this dynamic market.

Italy Automotive OEM Coatings Market Segmentation

-

1. Application

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

- 1.3. ACE

-

2. Technology

- 2.1. Waterborne

- 2.2. Solvent-borne

- 2.3. Other Technologies

-

3. Resin

- 3.1. Acrylic

- 3.2. Epoxy

- 3.3. Alkyd

- 3.4. Polyurethane

- 3.5. Polyester

- 3.6. Other Resins

Italy Automotive OEM Coatings Market Segmentation By Geography

- 1. Italy

Italy Automotive OEM Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Preferences; Government Involvement Boosting Market Growth; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Shortage of semiconductors; Price Hikes of Raw Materials; Other Restraints

- 3.4. Market Trends

- 3.4.1. Government Involvement to Boost Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Automotive OEM Coatings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.1.3. ACE

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Waterborne

- 5.2.2. Solvent-borne

- 5.2.3. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Resin

- 5.3.1. Acrylic

- 5.3.2. Epoxy

- 5.3.3. Alkyd

- 5.3.4. Polyurethane

- 5.3.5. Polyester

- 5.3.6. Other Resins

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Axalta Coatings Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ANGUS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RPM International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PPG Industries Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mader

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Beckers Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nippon Paint Holdings Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BASF SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mankiewicz

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AkzoNobel NV

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Merck Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Armorthane

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 The Sherwin Williams Company*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Specialty Coating Systems Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Axalta Coatings Systems

List of Figures

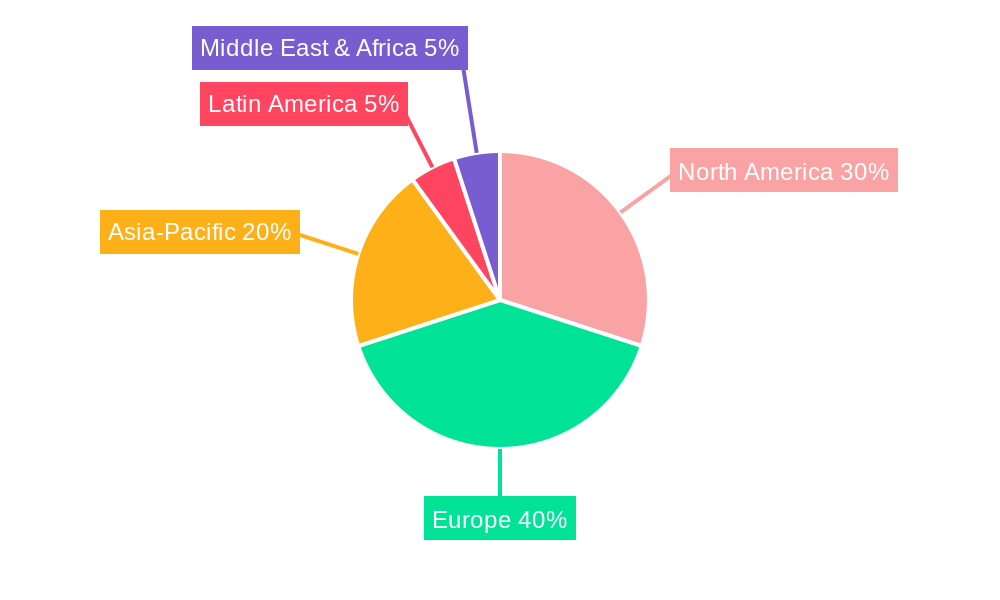

- Figure 1: Italy Automotive OEM Coatings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Automotive OEM Coatings Market Share (%) by Company 2024

List of Tables

- Table 1: Italy Automotive OEM Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Automotive OEM Coatings Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Italy Automotive OEM Coatings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Italy Automotive OEM Coatings Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 5: Italy Automotive OEM Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: Italy Automotive OEM Coatings Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 7: Italy Automotive OEM Coatings Market Revenue Million Forecast, by Resin 2019 & 2032

- Table 8: Italy Automotive OEM Coatings Market Volume K Tons Forecast, by Resin 2019 & 2032

- Table 9: Italy Automotive OEM Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Italy Automotive OEM Coatings Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: Italy Automotive OEM Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Italy Automotive OEM Coatings Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: Italy Automotive OEM Coatings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Italy Automotive OEM Coatings Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 15: Italy Automotive OEM Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: Italy Automotive OEM Coatings Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 17: Italy Automotive OEM Coatings Market Revenue Million Forecast, by Resin 2019 & 2032

- Table 18: Italy Automotive OEM Coatings Market Volume K Tons Forecast, by Resin 2019 & 2032

- Table 19: Italy Automotive OEM Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Italy Automotive OEM Coatings Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Automotive OEM Coatings Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Italy Automotive OEM Coatings Market?

Key companies in the market include Axalta Coatings Systems, ANGUS, RPM International Inc, PPG Industries Inc, Mader, Beckers Group, Nippon Paint Holdings Co Ltd, BASF SE, Mankiewicz, AkzoNobel NV, Merck Group, Armorthane, The Sherwin Williams Company*List Not Exhaustive, Specialty Coating Systems Inc.

3. What are the main segments of the Italy Automotive OEM Coatings Market?

The market segments include Application, Technology, Resin.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Preferences; Government Involvement Boosting Market Growth; Other Drivers.

6. What are the notable trends driving market growth?

Government Involvement to Boost Market Growth.

7. Are there any restraints impacting market growth?

Shortage of semiconductors; Price Hikes of Raw Materials; Other Restraints.

8. Can you provide examples of recent developments in the market?

May 2022: BASF has launched new automotive coatings ColorBrite Airspace Blue ReSource basecoat based on biomass. The company is aiming to increase its sustainable product portfolio in European Region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Automotive OEM Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Automotive OEM Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Automotive OEM Coatings Market?

To stay informed about further developments, trends, and reports in the Italy Automotive OEM Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence