Key Insights

The global K9 first aid kits market is poised for robust growth, projected to reach an estimated market size of over USD 500 million by 2025 and expand significantly through 2033. This expansion is driven by a confluence of factors, including increasing government and private sector investments in canine units for law enforcement and military operations, alongside a heightened awareness among pet owners and animal welfare organizations regarding the importance of immediate medical care for dogs. The demand for specialized K9 first aid kits, designed to address the unique physiological needs of working dogs, is escalating. These kits are becoming indispensable for police K9s involved in high-risk situations, military working dogs deployed in demanding environments, and even service animals requiring prompt attention. The market is witnessing a surge in innovation, with manufacturers developing more comprehensive, portable, and specialized kits tailored for various applications and canine roles.

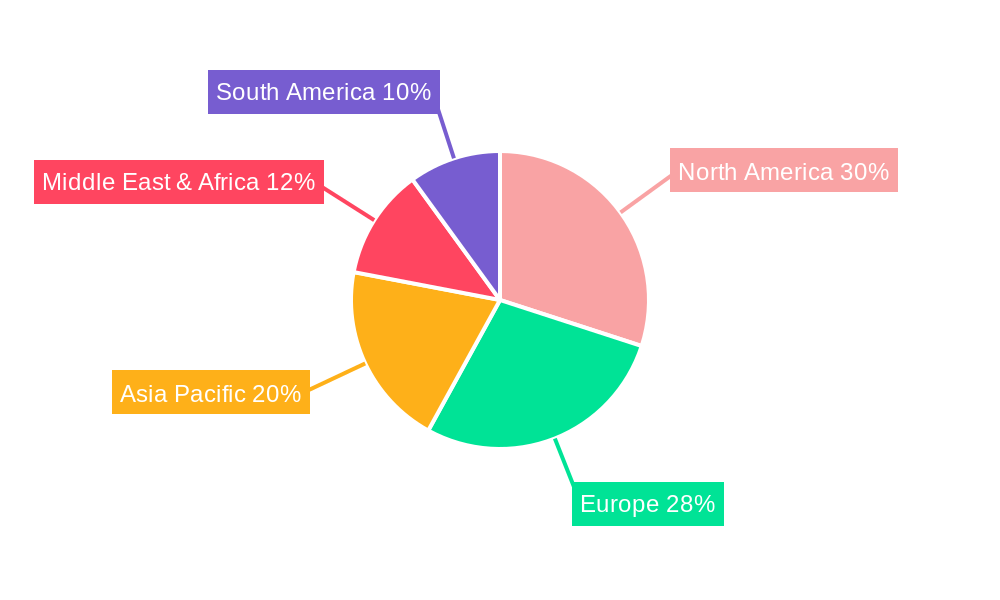

The market's trajectory is further bolstered by emerging trends such as the integration of advanced medical supplies, including trauma dressings, hemostatic agents, and canine-specific medications, into these kits. The rising adoption of portable K9 first aid kits, offering agility and ease of deployment in the field, is a significant growth contributor. While the market is largely optimistic, certain restraints, such as the cost of specialized equipment and the need for standardized training protocols for handling K9 medical emergencies, could temper growth to some extent. However, the overwhelming need for preparedness and rapid response in critical situations involving canine units is expected to outweigh these challenges, fostering sustained market expansion across key regions like North America, Europe, and Asia Pacific, with significant contributions from countries with advanced K9 programs.

K9 First Aid Kits Market Dynamics & Structure

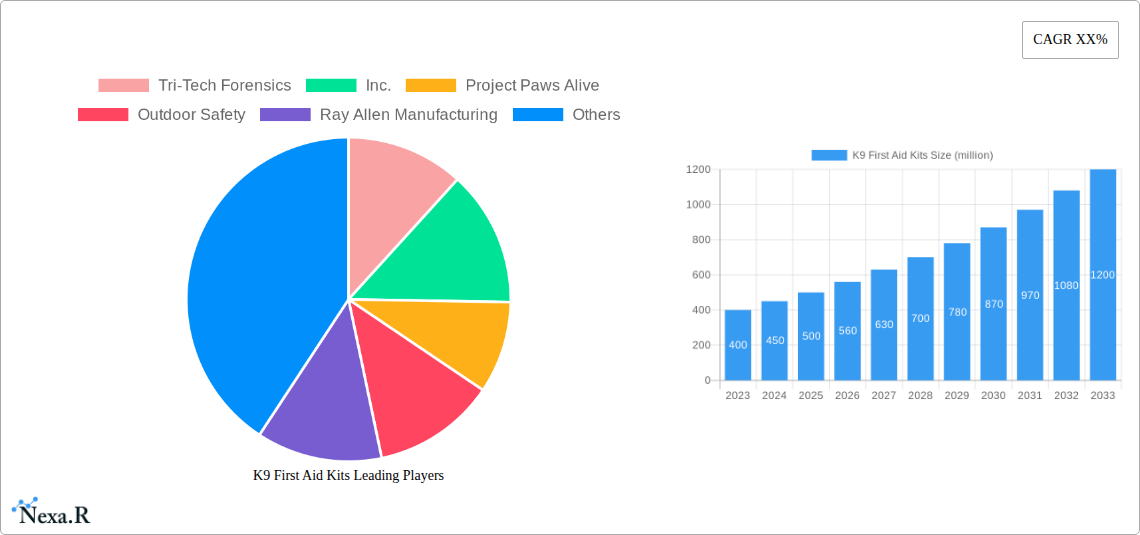

The K9 First Aid Kits market, a critical niche within both the parent pet care industry and the child market of specialized emergency response equipment, is characterized by a moderate concentration. Leading players such as Tri-Tech Forensics, Inc., Project Paws Alive, and Outdoor Safety are vying for market share, supported by specialized manufacturers like Ray Allen Manufacturing and MAI Animal Health. Technological innovation is a significant driver, with advancements in materials science and kit contents enabling more effective battlefield and on-scene treatment for canine companions. Regulatory frameworks, though less stringent than human-first aid, are evolving, particularly in military and law enforcement applications, demanding standardized and accredited kits. Competitive product substitutes are emerging, ranging from basic DIY kits to advanced trauma response systems designed for working dogs. The end-user demographics are primarily professional, including police K9 units, military working dog handlers, and first responders, with a growing secondary market of civilian pet owners seeking premium emergency preparedness. Mergers and acquisitions (M&A) are anticipated to increase as larger pet care conglomerates or emergency preparedness firms look to consolidate their position in this growing segment. While innovation barriers are relatively low, the cost of specialized veterinary-grade components can be a limiting factor for broader adoption. The market for K9 first aid kits is projected to see steady growth, driven by increasing investment in working dog welfare and a heightened awareness of canine emergency preparedness.

K9 First Aid Kits Growth Trends & Insights

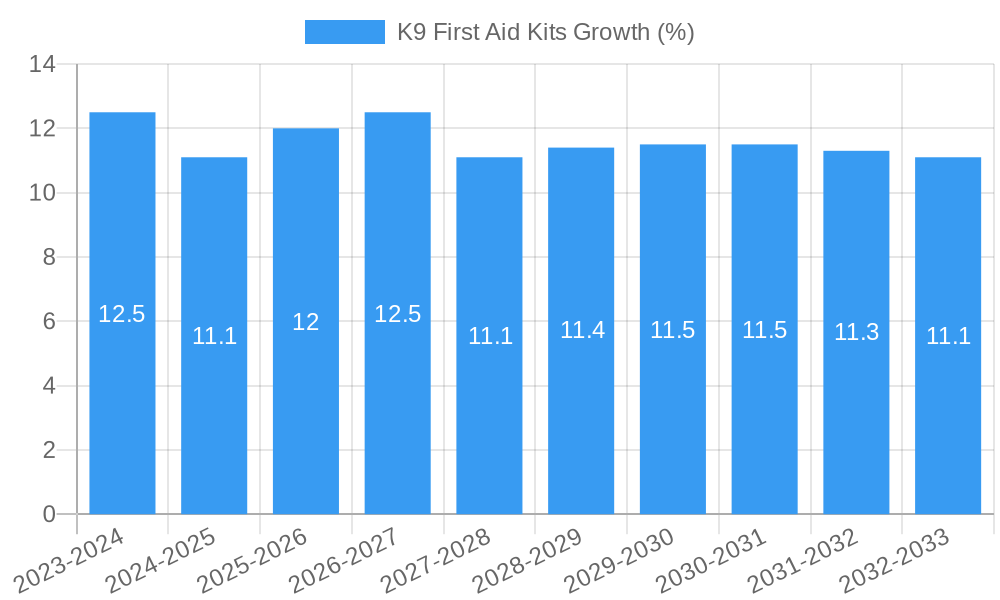

The K9 First Aid Kits market is poised for robust expansion, driven by a confluence of increasing global awareness regarding animal welfare, the escalating deployment of K9 units across law enforcement and military sectors, and a growing trend of pet humanization. During the historical period of 2019–2024, the market witnessed a steady uptake, fueled by heightened demand for specialized equipment for service animals. The base year of 2025 marks a pivotal point, with an estimated market size of $180.5 million units, projected to ascend significantly through the forecast period of 2025–2033. The Compound Annual Growth Rate (CAGR) is anticipated to be in the range of 7.5% to 8.5%, indicating a dynamic and expanding market. Technological disruptions are a key influencer, with innovations focusing on lightweight, portable designs and the inclusion of advanced diagnostic tools and wound care solutions. Consumer behavior is shifting from basic preparedness to proactive investment in high-quality, veterinarian-approved K9 first aid kits. The adoption rates for specialized kits, particularly those designed for trauma and battlefield scenarios, are on the rise. Market penetration is expected to deepen as educational initiatives highlighting the importance of immediate canine care in emergency situations gain traction. The integration of smart technologies for monitoring vital signs or providing guidance on treatment protocols is a nascent but promising trend that will further shape market dynamics. This evolution reflects a broader commitment to ensuring the health and operational readiness of our canine partners.

Dominant Regions, Countries, or Segments in K9 First Aid Kits

The North American region stands as the dominant force in the K9 First Aid Kits market, primarily propelled by the extensive deployment of K9 units within its law enforcement agencies and military branches. The United States, in particular, commands a significant market share, fueled by substantial government funding for police and military operations, which often includes provisions for specialized equipment for working dogs. The application segment of Police K9s is a primary growth driver, given the increasing responsibilities and operational risks faced by these invaluable animals in combating crime and ensuring public safety. The estimated market share for this segment within North America is projected to exceed 40% of the total regional market. Furthermore, the strong emphasis on pet care and the humanization of pets in this region contribute to a growing demand for portable K9 first aid kits among civilian dog owners, adding another layer of market penetration.

In terms of types, Portable K9 First Aid Kits are witnessing exceptional growth, accounting for over 60% of the market within North America. Their versatility and ease of deployment in various field conditions make them indispensable for tactical operations. Key economic policies supporting defense and public safety, coupled with robust infrastructure for distribution and accessibility of specialized pet healthcare products, further solidify North America's leadership.

The Military application segment also plays a crucial role, with significant investments in equipping K9 units deployed in active zones. The demand for rugged, all-weather, and comprehensive trauma kits for these dogs is consistently high. Countries like Canada and Mexico, while smaller markets individually, contribute to the overall regional dominance through their own growing adoption of K9 units and increasing awareness of canine emergency preparedness.

K9 First Aid Kits Product Landscape

The K9 First Aid Kits product landscape is characterized by a focus on practical, durable, and comprehensive solutions designed for immediate veterinary care in critical situations. Innovations include the development of compact, lightweight kits that can be easily attached to tactical vests or vehicles. Key applications range from treating minor wounds and abrasions to managing severe trauma, including bleeding control and stabilizing fractures. Performance metrics emphasize the inclusion of sterile dressings, bandages, antiseptic wipes, and essential tools like trauma shears and gloves. Unique selling propositions often lie in the specificity of the contents, catering to the unique physiological needs of dogs, and the inclusion of detailed, easy-to-follow instruction guides. Technological advancements are driving the integration of more advanced items such as hemostatic agents, specialized wound closure devices, and even basic diagnostic tools for assessing vital signs, enhancing the efficacy of on-site care.

Key Drivers, Barriers & Challenges in K9 First Aid Kits

The K9 First Aid Kits market is propelled by several key drivers. The escalating use of K9 units in law enforcement, military operations, and search and rescue missions directly fuels demand for reliable emergency kits. Growing awareness of animal welfare and the recognition of working dogs as essential partners in public safety contribute significantly. Technological advancements in materials and kit design, leading to more portable and effective solutions, are also major accelerators. Furthermore, the increasing trend of pet humanization means owners are more willing to invest in premium preparedness items.

However, several barriers and challenges exist. The initial cost of high-quality, specialized K9 first aid kits can be a restraint, particularly for smaller departments or individual owners. Regulatory hurdles, while evolving, can sometimes lag behind technological advancements, creating uncertainty for manufacturers. Supply chain disruptions, as seen in recent global events, can impact the availability and cost of essential components. Competitive pressures from lower-cost, less specialized alternatives also pose a challenge.

Emerging Opportunities in K9 First Aid Kits

Emerging opportunities in the K9 First Aid Kits sector lie in the expansion of kits tailored for specific environments and roles. This includes developing advanced trauma kits for extreme environments such as arctic or desert operations, and specialized kits for K9 units involved in hazardous material response. The increasing popularity of canine sports and adventure activities presents an untapped market for robust, portable kits designed for recreational use. Furthermore, the integration of digital components, such as QR codes linking to online training modules or emergency veterinary contact databases, offers a unique value proposition. Evolving consumer preferences are also leaning towards eco-friendly and sustainable packaging and materials, presenting an opportunity for innovative product development.

Growth Accelerators in the K9 First Aid Kits Industry

Long-term growth in the K9 First Aid Kits industry is being catalyzed by several key factors. Technological breakthroughs in wound healing technologies and advanced materials for bandages and dressings are leading to more effective and user-friendly kits. Strategic partnerships between K9 training organizations, veterinary associations, and kit manufacturers are crucial for raising awareness and ensuring product relevance. Furthermore, market expansion strategies targeting developing nations with growing professional K9 programs will unlock significant potential. The increasing emphasis on preventative care and wellness for working animals also drives demand for kits that go beyond basic first aid, incorporating elements for recovery and ongoing health management.

Key Players Shaping the K9 First Aid Kits Market

- Tri-Tech Forensics, Inc.

- Project Paws Alive

- Outdoor Safety

- Ray Allen Manufacturing

- MAI Animal Health

- JS Enterprises

- Modular survival systems

- Double Aero Guides

- CPR Savers & First Aid Supply, LLC

Notable Milestones in K9 First Aid Kits Sector

- 2019: Launch of advanced trauma kits with hemostatic agents for military K9 units.

- 2020: Increased demand for portable K9 first aid kits due to heightened operational deployment of police K9s.

- 2021: Introduction of veterinary-grade wound closure strips in civilian-focused K9 kits.

- 2022: Growing interest in K9 first aid training programs, indirectly boosting kit sales.

- 2023: Several manufacturers began incorporating more modular and customizable kit components.

- 2024: Emergence of smart K9 first aid kits with basic vital sign monitoring capabilities.

In-Depth K9 First Aid Kits Market Outlook

The future outlook for the K9 First Aid Kits market is exceptionally promising, driven by a sustained increase in the operational deployment of working dogs across diverse sectors. Growth accelerators such as continuous technological innovation in veterinary emergency care products and a deepening commitment to animal welfare will fuel market expansion. Strategic partnerships between key industry players and emergency response agencies will further enhance product development and market penetration. The increasing demand for specialized kits for varied environments and applications, coupled with the growing awareness among civilian pet owners, presents significant untapped potential. The market is set to benefit from an ever-increasing recognition of the indispensable role K9s play, ensuring their health and readiness remains a top priority.

K9 First Aid Kits Segmentation

-

1. Application

- 1.1. Police

- 1.2. Military

- 1.3. Fire Fighting

-

2. Types

- 2.1. Portable K9 First Aid Kits

- 2.2. Bag Type K9 First Aid Kits

K9 First Aid Kits Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

K9 First Aid Kits REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global K9 First Aid Kits Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Police

- 5.1.2. Military

- 5.1.3. Fire Fighting

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Portable K9 First Aid Kits

- 5.2.2. Bag Type K9 First Aid Kits

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America K9 First Aid Kits Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Police

- 6.1.2. Military

- 6.1.3. Fire Fighting

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Portable K9 First Aid Kits

- 6.2.2. Bag Type K9 First Aid Kits

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America K9 First Aid Kits Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Police

- 7.1.2. Military

- 7.1.3. Fire Fighting

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Portable K9 First Aid Kits

- 7.2.2. Bag Type K9 First Aid Kits

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe K9 First Aid Kits Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Police

- 8.1.2. Military

- 8.1.3. Fire Fighting

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Portable K9 First Aid Kits

- 8.2.2. Bag Type K9 First Aid Kits

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa K9 First Aid Kits Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Police

- 9.1.2. Military

- 9.1.3. Fire Fighting

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Portable K9 First Aid Kits

- 9.2.2. Bag Type K9 First Aid Kits

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific K9 First Aid Kits Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Police

- 10.1.2. Military

- 10.1.3. Fire Fighting

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Portable K9 First Aid Kits

- 10.2.2. Bag Type K9 First Aid Kits

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Tri-Tech Forensics

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Inc.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Project Paws Alive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Outdoor Safety

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ray Allen Manufacturing

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MAI Animal Health

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 JS Enterprises

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Modular survival systems

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Double Aero Guides

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CPR Savers & First Aid Supply

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Tri-Tech Forensics

List of Figures

- Figure 1: Global K9 First Aid Kits Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global K9 First Aid Kits Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America K9 First Aid Kits Revenue (million), by Application 2024 & 2032

- Figure 4: North America K9 First Aid Kits Volume (K), by Application 2024 & 2032

- Figure 5: North America K9 First Aid Kits Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America K9 First Aid Kits Volume Share (%), by Application 2024 & 2032

- Figure 7: North America K9 First Aid Kits Revenue (million), by Types 2024 & 2032

- Figure 8: North America K9 First Aid Kits Volume (K), by Types 2024 & 2032

- Figure 9: North America K9 First Aid Kits Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America K9 First Aid Kits Volume Share (%), by Types 2024 & 2032

- Figure 11: North America K9 First Aid Kits Revenue (million), by Country 2024 & 2032

- Figure 12: North America K9 First Aid Kits Volume (K), by Country 2024 & 2032

- Figure 13: North America K9 First Aid Kits Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America K9 First Aid Kits Volume Share (%), by Country 2024 & 2032

- Figure 15: South America K9 First Aid Kits Revenue (million), by Application 2024 & 2032

- Figure 16: South America K9 First Aid Kits Volume (K), by Application 2024 & 2032

- Figure 17: South America K9 First Aid Kits Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America K9 First Aid Kits Volume Share (%), by Application 2024 & 2032

- Figure 19: South America K9 First Aid Kits Revenue (million), by Types 2024 & 2032

- Figure 20: South America K9 First Aid Kits Volume (K), by Types 2024 & 2032

- Figure 21: South America K9 First Aid Kits Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America K9 First Aid Kits Volume Share (%), by Types 2024 & 2032

- Figure 23: South America K9 First Aid Kits Revenue (million), by Country 2024 & 2032

- Figure 24: South America K9 First Aid Kits Volume (K), by Country 2024 & 2032

- Figure 25: South America K9 First Aid Kits Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America K9 First Aid Kits Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe K9 First Aid Kits Revenue (million), by Application 2024 & 2032

- Figure 28: Europe K9 First Aid Kits Volume (K), by Application 2024 & 2032

- Figure 29: Europe K9 First Aid Kits Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe K9 First Aid Kits Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe K9 First Aid Kits Revenue (million), by Types 2024 & 2032

- Figure 32: Europe K9 First Aid Kits Volume (K), by Types 2024 & 2032

- Figure 33: Europe K9 First Aid Kits Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe K9 First Aid Kits Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe K9 First Aid Kits Revenue (million), by Country 2024 & 2032

- Figure 36: Europe K9 First Aid Kits Volume (K), by Country 2024 & 2032

- Figure 37: Europe K9 First Aid Kits Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe K9 First Aid Kits Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa K9 First Aid Kits Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa K9 First Aid Kits Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa K9 First Aid Kits Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa K9 First Aid Kits Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa K9 First Aid Kits Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa K9 First Aid Kits Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa K9 First Aid Kits Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa K9 First Aid Kits Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa K9 First Aid Kits Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa K9 First Aid Kits Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa K9 First Aid Kits Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa K9 First Aid Kits Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific K9 First Aid Kits Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific K9 First Aid Kits Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific K9 First Aid Kits Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific K9 First Aid Kits Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific K9 First Aid Kits Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific K9 First Aid Kits Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific K9 First Aid Kits Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific K9 First Aid Kits Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific K9 First Aid Kits Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific K9 First Aid Kits Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific K9 First Aid Kits Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific K9 First Aid Kits Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global K9 First Aid Kits Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global K9 First Aid Kits Volume K Forecast, by Region 2019 & 2032

- Table 3: Global K9 First Aid Kits Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global K9 First Aid Kits Volume K Forecast, by Application 2019 & 2032

- Table 5: Global K9 First Aid Kits Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global K9 First Aid Kits Volume K Forecast, by Types 2019 & 2032

- Table 7: Global K9 First Aid Kits Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global K9 First Aid Kits Volume K Forecast, by Region 2019 & 2032

- Table 9: Global K9 First Aid Kits Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global K9 First Aid Kits Volume K Forecast, by Application 2019 & 2032

- Table 11: Global K9 First Aid Kits Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global K9 First Aid Kits Volume K Forecast, by Types 2019 & 2032

- Table 13: Global K9 First Aid Kits Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global K9 First Aid Kits Volume K Forecast, by Country 2019 & 2032

- Table 15: United States K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global K9 First Aid Kits Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global K9 First Aid Kits Volume K Forecast, by Application 2019 & 2032

- Table 23: Global K9 First Aid Kits Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global K9 First Aid Kits Volume K Forecast, by Types 2019 & 2032

- Table 25: Global K9 First Aid Kits Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global K9 First Aid Kits Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global K9 First Aid Kits Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global K9 First Aid Kits Volume K Forecast, by Application 2019 & 2032

- Table 35: Global K9 First Aid Kits Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global K9 First Aid Kits Volume K Forecast, by Types 2019 & 2032

- Table 37: Global K9 First Aid Kits Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global K9 First Aid Kits Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global K9 First Aid Kits Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global K9 First Aid Kits Volume K Forecast, by Application 2019 & 2032

- Table 59: Global K9 First Aid Kits Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global K9 First Aid Kits Volume K Forecast, by Types 2019 & 2032

- Table 61: Global K9 First Aid Kits Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global K9 First Aid Kits Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global K9 First Aid Kits Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global K9 First Aid Kits Volume K Forecast, by Application 2019 & 2032

- Table 77: Global K9 First Aid Kits Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global K9 First Aid Kits Volume K Forecast, by Types 2019 & 2032

- Table 79: Global K9 First Aid Kits Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global K9 First Aid Kits Volume K Forecast, by Country 2019 & 2032

- Table 81: China K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific K9 First Aid Kits Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific K9 First Aid Kits Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the K9 First Aid Kits?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the K9 First Aid Kits?

Key companies in the market include Tri-Tech Forensics, Inc., Project Paws Alive, Outdoor Safety, Ray Allen Manufacturing, MAI Animal Health, JS Enterprises, Modular survival systems, Double Aero Guides, CPR Savers & First Aid Supply, LLC.

3. What are the main segments of the K9 First Aid Kits?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "K9 First Aid Kits," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the K9 First Aid Kits report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the K9 First Aid Kits?

To stay informed about further developments, trends, and reports in the K9 First Aid Kits, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence